Bluefin Building and Bankside 2&3 London

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

71 Fenchurch Street London EC3

71 Fenchurch Street London EC3 73,891 sq ft savills.co.uk Location 71 Fenchurch Street is one of the iconic buildings within the insurance district of the City of London. Accessed via a private courtyard on Fenchurch Street, the building is adjacent to Fenchurch Street mainline station and a few minute walk from Lloyd’s. In addition to Fenchurch Street, numerous other transport hubs are within a short walk; Tower Hill (Docklands Light Railway, District and Circle lines), Aldgate (Circle, Metropolitan and Hammersmith & City lines) and Liverpool Street (mainline, Elizabeth. Central, Circle, Metropolitan and Hammersmith & City lines). Description This landmark 12 storey, Richard Rogers designed building comprises 245,000 sq ft of office space with additional ground floor retail on the Fenchurch Street and Fenchurch Place frontages. The floors are available in a range of conditions from partially fitted-out to full ‘plug-and-play’ options. Specification • Grade A office accommodation VAT • Chilled beam air conditioning • Enhanced raised floors The property has been elected for VAT. • Superb natural light and City skyline views • Cycle spaces, showers and lockers Lease • Reception café • Potential for self-contained entrance off Lloyd’s Avenue A new lease direct from the landlord. • EPC – C (68) Accommodation Quoting rent Floor Area (sq ft) Availability £62.50 per sq ft on Pt 8th floor 11th 4,732 Q3 2021 10th 4,732 Q1 2022 Rates Pt 8th 4,789 Immediate 7th 11,198 Q4 2021 £19.97 per sq ft 6th 11,185 Q3 2021 4th 20,942 Q2 2021 Service Charge LG 16,313 Q3 2021 TBC - strictly by appointment through:- Viewing Josh Lamb Jade Dedman Savills Savills 020 7409 8891 020 7330 8617 [email protected] [email protected] Important Notice: Savills, their clients and any joint agents give notice that: 1.They are not authorised to make or give any representations or warranties in relation to the property either here or elsewhere, either on their own behalf or on behalf of their client or otherwise. -

One Blackfriars in the London Borough of Southwark Planning Application No.12/AP/1784

planning report PDU/2894/01 18 July 2012 One Blackfriars in the London Borough of Southwark planning application no.12/AP/1784 Strategic planning application stage 1 referral (new powers) Town & Country Planning Act 1990 (as amended); Greater London Authority Acts 1999 and 2007; Town & Country Planning (Mayor of London) Order 2008 The proposal The erection of three buildings a tower of 50 storey (containing 274 residential units) plus basement levels, of a maximum height of 170 metres above ordnance datum (AOD), a low rise building of 6 storey “the Rennie Street building”, a low rise 4 storey building “the podium building” which together provide a mixed use development totalling 74,925 sq.m. gross external area comprising: class C1 hotel use, class C3 residential use , Class A1to A5 retail use; and 9,648 sq.m. of basement, ancillary plant, servicing and car parking with associated public open space and landscaping. The applicant The applicant is St George South London Ltd, the architect is Ian Simpson Architects and the agent is CBRE. Strategic issues Strategic issues for consideration are the principle of the proposed development; housing, affordable housing; London’s visitor infrastructure; urban design and inclusive design tall buildings and strategic views; access; Children’s and young people’s play; transport; climate change mitigation and energy; Transport and Community Infrastructure Levy. Recommendation That Southwark Council be advised that while the application is generally acceptable in strategic planning terms the application does not comply with the London Plan, for the reasons set out in paragraph 130 of this report; but that the possible remedies set out in paragraph 132 of this report could address these deficiencies. -

Timetables Content

Timetables Content Page 2 – RB1 Service Weekdays Page 4 – RB1, RB1X & RB5 Service Weekends Page 6 – RB2 Service Page 7 – RB4 Service Page 8 – RB6 Service Page 9 – Route Map thamesclippers.com @thamesclippers /thamesclippers /thamesclippers RB1 Timetable Weekdays Departures every 20 minutes. Travel to and from Westminster to North Greenwich (The O2) and Woolwich (Royal Arsenal) RB1 Westbound - Weekdays (towards Central London) Woolwich (Royal Arsenal) 0600 0630 0650 0710 0730 0750 0810 0830 .... 0850 0920 0942 .... .... .... .... .... .... .... .... .... .... .... .... .... North Greenwich - The O2 0608 0638 0658 0718 0738 0758 0818 0838 .... 0858 0928 0950 1010 1030 1050 1110 1130 1150 1210 1230 1250 1310 1330 1350 1410 Greenwich 0616 0646 0706 0726 0746 0806 0826 0846 .... 0906 0936 0958 1019 1038 1059 1118 1139 1158 1219 1238 1259 1318 1339 1358 1419 Masthouse Terrace 0620 0650 0710 0730 0750 0810 0830 0850 .... 0910 0939 1001 .... 1041 .... 1121 .... 1201 .... 1241 .... 1321 .... 1401 .... Greenland (Surrey Quays) 0624 0654 0714 0734 0754 0814 0834 0854 0904 0914 0942 1004 .... 1044 .... 1124 .... 1204 .... 1244 .... 1324 .... 1404 .... Canary Wharf 0629 0659 0719 0739 0759 0819 0839 0859 0909 0919 0946 1008 1025 1048 1105 1128 1145 1208 1225 1248 1305 1328 1345 1408 1425 Tower 0638 0708 0728 0748 0808 0828 0848 0908 .... 0928 0955 1017 1035 1057 1115 1137 1155 1217 1235 1257 1315 1337 1355 1417 1435 London Bridge City 0642 0712 0732 0752 0812 0832 0852 0912 .... 0932 0959 1021 1040 1101 1120 1141 1200 1221 1240 1301 1320 1341 1400 1421 1440 Bankside 0646 0716 0736 0756 0816 0836 0856 0916 .... 0936 1003 1025 1044 1105 1124 1145 1204 1225 1244 1305 1324 1345 1404 1425 1444 Blackfriars 0649 0719 0739 0759 0819 0839 0859 0919 ... -

22 Bishopsgate London EC2N 4BQ Construction of A

Committee: Date: Planning and Transportation 28 February 2017 Subject: Public 22 Bishopsgate London EC2N 4BQ Construction of a building arranged on three basement floors, ground and 58 upper floors plus mezzanines and plant comprising floorspace for use within Classes A and B1 of the Use Classes Order and a publicly accessible viewing gallery and facilities (sui generis); hard and soft landscaping works; the provision of ancillary servicing and other works incidental to the development. (201,449sq.m. GEA) Ward: Lime Street For Decision Registered No: 16/01150/FULEIA Registered on: 24 November 2016 Conservation Area: St Helen's Place Listed Building: No Summary The planning application relates to the site of the 62 storey tower (294.94m AOD) granted planning permission in June 2016 and which is presently being constructed. The current scheme is for a tower comprising 59 storeys at ground and above (272.32m AOD) with an amended design to the top. The tapering of the upper storeys previously approved has been omitted and replaced by a flat topped lower tower. In other respects the design of the elevations remains as before. The applicants advise that the lowering of the tower in the new proposal is in response to construction management constraints in relation to aviation safeguarding issues. The planning application also incorporates amendments to the base of the building, the public realm and to cycle space provision which were proposed in a S73 amendment application and which your Committee resolved to grant on 28 November 2016, subject to a legal agreement but not yet issued. The building would provide offices, retail at ground level, a viewing gallery with free public access at levels 55 and 56 and a public restaurant and bar at levels 57 and 58. -

861 Sq Ft Headquarters Office Building Your Own Front Door

861 SQ FT HEADQUARTERS OFFICE BUILDING YOUR OWN FRONT DOOR This quite unique property forms part of the building known as Rotherwick House. The Curve comprises a self-contained building, part of which is Grade II Listed, which has been comprehensively refurbished to provide bright contemporary Grade A office space. The property — located immediately to the east of St Katharine’s Dock and adjoining Thomas More Square — benefits from the immediate area which boasts a wide variety of retail and restaurant facilities. SPECIFICATION • Self-contained building • Generous floor to ceiling heights • New fashionable refurbishment • Full-height windows • New air conditioning • Two entrances • Floor boxes • Grade II Listed building • LG7 lighting with indirect LED up-lighting • Fire and security system G R E A ET T THE TEA TRE E D S A BUILDING OL S T E R SHOREDITCH N S HOUSE OLD STREET T R E E T BOX PARK AD L RO NWEL SHOREDITCH CLERKE C I HIGH STREET T Y R G O O A S D W S F H A O E R L U A L R T AD T H I O R T R N A S STEPNEY D’ O O M AL G B N A GREEN P O D E D T H G O T O WHITECHAPEL A N N R R R O D BARBICAN W O CHANCERY E A FARRINGDON T N O LANE D T T E N H A E M C T N O C LBOR A D O HO M A IGH MOORGATE G B O H S R R U TOTTENHAM M L R LIVERPOOL P IC PE T LO E COURT ROAD NDON WA O K A LL R N R H STREET H C L C E E O S A I SPITALFIELDS I IT A A W B N H D L E W STE S R PNEY WAY T O J R U SALESFORCE A E HOLBORN B T D REE TOWER E ST N I D L XFOR E G T O W R E K G ES H ALDGATE I A H E N TE A O M LONDON MET. -

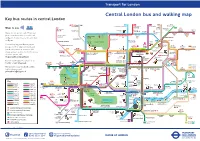

Central London Bus and Walking Map Key Bus Routes in Central London

General A3 Leaflet v2 23/07/2015 10:49 Page 1 Transport for London Central London bus and walking map Key bus routes in central London Stoke West 139 24 C2 390 43 Hampstead to Hampstead Heath to Parliament to Archway to Newington Ways to pay 23 Hill Fields Friern 73 Westbourne Barnet Newington Kentish Green Dalston Clapton Park Abbey Road Camden Lock Pond Market Town York Way Junction The Zoo Agar Grove Caledonian Buses do not accept cash. Please use Road Mildmay Hackney 38 Camden Park Central your contactless debit or credit card Ladbroke Grove ZSL Camden Town Road SainsburyÕs LordÕs Cricket London Ground Zoo Essex Road or Oyster. Contactless is the same fare Lisson Grove Albany Street for The Zoo Mornington 274 Islington Angel as Oyster. Ladbroke Grove Sherlock London Holmes RegentÕs Park Crescent Canal Museum Museum You can top up your Oyster pay as Westbourne Grove Madame St John KingÕs TussaudÕs Street Bethnal 8 to Bow you go credit or buy Travelcards and Euston Cross SadlerÕs Wells Old Street Church 205 Telecom Theatre Green bus & tram passes at around 4,000 Marylebone Tower 14 Charles Dickens Old Ford Paddington Museum shops across London. For the locations Great Warren Street 10 Barbican Shoreditch 453 74 Baker Street and and Euston Square St Pancras Portland International 59 Centre High Street of these, please visit Gloucester Place Street Edgware Road Moorgate 11 PollockÕs 188 TheobaldÕs 23 tfl.gov.uk/ticketstopfinder Toy Museum 159 Russell Road Marble Museum Goodge Street Square For live travel updates, follow us on Arch British -

New Southwark Plan Preferred Option: Area Visions and Site Allocations

NEW SOUTHWARK PLAN PREFERRED OPTION - AREA VISIONS AND SITE ALLOCATIONS February 2017 www.southwark.gov.uk/fairerfuture Foreword 5 1. Purpose of the Plan 6 2. Preparation of the New Southwark Plan 7 3. Southwark Planning Documents 8 4. Introduction to Area Visions and Site Allocations 9 5. Bankside and The Borough 12 5.1. Bankside and The Borough Area Vision 12 5.2. Bankside and the Borough Area Vision Map 13 5.3. Bankside and The Borough Sites 14 6. Bermondsey 36 6.1. Bermondsey Area Vision 36 6.2. Bermondsey Area Vision Map 37 6.3. Bermondsey Sites 38 7. Blackfriars Road 54 7.1. Blackfriars Road Area Vision 54 7.2. Blackfriars Road Area Vision Map 55 7.3. Blackfriars Road Sites 56 8. Camberwell 87 8.1. Camberwell Area Vision 87 8.2. Camberwell Area Vision Map 88 8.3. Camberwell Sites 89 9. Dulwich 126 9.1. Dulwich Area Vision 126 9.2. Dulwich Area Vision Map 127 9.3. Dulwich Sites 128 10. East Dulwich 135 10.1. East Dulwich Area Vision 135 10.2. East Dulwich Area Vision Map 136 10.3. East Dulwich Sites 137 11. Elephant and Castle 150 11.1. Elephant and Castle Area Vision 150 11.2. Elephant and Castle Area Vision Map 151 11.3. Elephant and Castle Sites 152 3 New Southwark Plan Preferred Option 12. Herne Hill and North Dulwich 180 12.1. Herne Hill and North Dulwich Area Vision 180 12.2. Herne Hill and North Dulwich Area Vision Map 181 12.3. Herne Hill and North Dulwich Sites 182 13. -

A Bid for Better Transit Improving Service with Contracted Operations Transitcenter Is a Foundation That Works to Improve Urban Mobility

A Bid for Better Transit Improving service with contracted operations TransitCenter is a foundation that works to improve urban mobility. We believe that fresh thinking can change the transportation landscape and improve the overall livability of cities. We commission and conduct research, convene events, and produce publications that inform and improve public transit and urban transportation. For more information, please visit www.transitcenter.org. The Eno Center for Transportation is an independent, nonpartisan think tank that promotes policy innovation and leads professional development in the transportation industry. As part of its mission, Eno seeks continuous improvement in transportation and its public and private leadership in order to improve the system’s mobility, safety, and sustainability. For more information please visit: www.enotrans.org. TransitCenter Board of Trustees Rosemary Scanlon, Chair Eric S. Lee Darryl Young Emily Youssouf Jennifer Dill Clare Newman Christof Spieler A Bid for Better Transit Improving service with contracted operations TransitCenter + Eno Center for Transportation September 2017 Acknowledgments A Bid for Better Transit was written by Stephanie Lotshaw, Paul Lewis, David Bragdon, and Zak Accuardi. The authors thank Emily Han, Joshua Schank (now at LA Metro), and Rob Puentes of the Eno Center for their contributions to this paper’s research and writing. This report would not be possible without the dozens of case study interviewees who contributed their time and knowledge to the study and reviewed the report’s case studies (see report appendices). The authors are also indebted to Don Cohen, Didier van de Velde, Darnell Grisby, Neil Smith, Kent Woodman, Dottie Watkins, Ed Wytkind, and Jeff Pavlak for their detailed and insightful comments during peer review. -

Title Landsec Sells Its Share of 20 Fenchurch Street, EC3M for £641M and Proposes to Return £475 Million to Shareholders

Title Landsec sells its share of 20 Fenchurch Street, EC3M for £641m and proposes to return £475 million to shareholders From Land Securities Group PLC (“Landsec”) Date 27 July 2017 This announcement contains inside information. Landsec has exchanged contracts to sell its 50% stake in 20 Fenchurch Street, EC3M to LKK Health Products Group Limited (“LKKHPG”) for a headline price of £641.3 million. LKKHPG will also acquire Canary Wharf Group’s 50% stake in the building, bringing the total headline price to £1,282.5 million, reflecting a net initial yield to the purchaser of 3.4%. Completion is expected to take place at the end of August and is unconditional. 20 Fenchurch Street was developed by a joint venture between Landsec and Canary Wharf Group in 2010, completed in 2014 and comprises 671,000 sq ft of office space on 34 floors in the City of London’s insurance district. Its innovative and efficient design makes it an attractive location for insurance companies and brokers alike, and it was fully let just a few months after completion to customers including Markel, RSA and Liberty Mutual. It’s also home to 17,000 sq ft of retail space on the ground floor and within the three-storey Sky Garden, which has spectacular views across London. After costs of sale, the top up of unexpired rent free periods and other commitments, Landsec expects to receive £634.5 million in net proceeds. Landsec intends to return approximately £475 million to shareholders in the form of a payment of 60 pence per share, which would be accompanied by a share consolidation. -

South East London Green Chain Plus Area Framework in 2007, Substantial Progress Has Been Made in the Development of the Open Space Network in the Area

All South East London Green London Chain Plus Green Area Framework Grid 6 Contents 1 Foreword and Introduction 2 All London Green Grid Vision and Methodology 3 ALGG Framework Plan 4 ALGG Area Frameworks 5 ALGG Governance 6 Area Strategy 8 Area Description 9 Strategic Context 10 Vision 12 Objectives 14 Opportunities 16 Project Identification 18 Project Update 20 Clusters 22 Projects Map 24 Rolling Projects List 28 Phase Two Early Delivery 30 Project Details 50 Forward Strategy 52 Gap Analysis 53 Recommendations 56 Appendices 56 Baseline Description 58 ALGG SPG Chapter 5 GGA06 Links 60 Group Membership Note: This area framework should be read in tandem with All London Green Grid SPG Chapter 5 for GGA06 which contains statements in respect of Area Description, Strategic Corridors, Links and Opportunities. The ALGG SPG document is guidance that is supplementary to London Plan policies. While it does not have the same formal development plan status as these policies, it has been formally adopted by the Mayor as supplementary guidance under his powers under the Greater London Authority Act 1999 (as amended). Adoption followed a period of public consultation, and a summary of the comments received and the responses of the Mayor to those comments is available on the Greater London Authority website. It will therefore be a material consideration in drawing up development plan documents and in taking planning decisions. The All London Green Grid SPG was developed in parallel with the area frameworks it can be found at the following link: http://www. london.gov.uk/publication/all-london-green-grid-spg . -

Accommodation List

Accommodation List Bed and Breakfast Accommodation in Private Homes Bed and Breakfast accommodation is provided by local families who have kindly offered this service for visitors to St Christopher’s. Should you need to cancel your accommodation reservation, please do contact the relevant guest house and let them know as they may be able to offer the place to someone else. Please remember that while they are clean and comfortable accommodations they are private homes. Should you wish to stay in a professionally run hotel, there are a number listed on the following pages. When making a reservation please call the host family directly, before 21h30, and advise them that you are attending a St Christopher’s course or conference. The charges are listed on the following pages, and are all per person, per night. Accommodation fees should be paid directly to the host family. Travel instructions are available on request. A reliable minicab service is available from: Clock House Cars +44(0)20 8658 0066 Canon Cars Please email us with queries or visit our website for details of other courses: www.stchristophers.org.uk/education Email: [email protected]+44(0)20 8658 1234 The accommodation list below is within close proximity to St Christopher’s Education Centre Mrs Mariam Bishai £25 pp (2 single bed) £20pp (1 double bed) Tel: 020 8778 5747 25 Princethorpe Road, Sydenham, SE26 4PF. (15 mins walk away) Ms Anastasia Stylianou £30 pp (4 single rooms) Tel: 020 8776 9296 Mob: 07887 983 836 150 Venner Road Email:[email protected] Sydenham, SE26 5JQ. -

Supplement T.O The. London "Gazette, 22 February, 1946 1061

SUPPLEMENT T.O THE. LONDON "GAZETTE, 22 FEBRUARY, 1946 1061 BARCLAYS BANK (DOMINION, COLONIAL AND OVERSEAS). Formerly the Colonial Bank. Incorporated by Royal Charter, 1836. Reincorporated by the Colonial Bank Act, , 1925- Name changed 15th September, 1925. Names of Places where the Business is carried on. Place. County. 54, Lombard Street, London, E.C.3 London 42, Gracechurch Street, E.C.3 London Circus Place, London Wall, E.C.2 London 29, Gracechurch Street, E.C.3 London Oceanic House, i, Cockspur Street, S.W.i London ' 37, King Wiluam Street, E.C.4 London Liverpool: 25, Castle Street Lancashire Manchester : 46, Fountain Street Lancashire THOMAS BARLOW & BRO. Persons of whom the Partnership consists. RESIDENCE. OCCUPATION. Sir John Denman Barlow, Bart. 20, Major Street, Manchester Merchant Banker Thomas Bradwall Barlow 49/51, Eastcheap, London, E.C.3 Merchant Banker Name of Place where the Business is carried on. • Place-. County. 49 & 51, Eastcheap, London, E.C.3 London 20, 'Major Street, Manchester Lancashire B. W. BLYDENSTEIN & CO. Persons of whom the Company or Partnership consists. NAME. RESIDENCE. OCCUPATION. Jurriaan ten Doesschate " The Heights," Kingston Hill, Surrey Banker Willem John Harry Blydenstein Tudor Cottage, looa, Hill Road, Wimbledon, S.W.I9 Banker August Philips 54/55/56, Threadneedle Street, E.C.2 Banker The Twentsche Bank (London) 54/5.5/56, Threadneadle Street, E.C.2 Bankers Limited Name of Place where the Business is carried on. Place.—54/55/56, Threadneedle Street, E.C.2 County.—London WM. BRANDT'S SONS & CO. Persons of whom the Company or Partnership consists.