3 1 Jan. 2013

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Moldova Mobile ID Case Study, Washington, DC: World Bank License: Creative Commons Attribution 3.0 IGO (CC by 3.0 IGO)

Public Disclosure Authorized Public Disclosure Authorized Moldova Mobile ID Public Disclosure Authorized Case Study id4d.worldbank.org Public Disclosure Authorized 44540_Moldova_CVR.indd 3 5/23/19 10:49 AM © 2018 International Bank for Reconstruction and Development/The World Bank 1818 H Street, NW, Washington, D.C., 20433 Telephone: 202-473-1000; Internet: www.worldbank.org Some Rights Reserved This work is a product of the staff of The World Bank with external contributions. The findings, interpretations, and conclusions expressed in this work do not necessarily reflect the views of The World Bank, its Board of Executive Directors, or the governments they represent. The World Bank does not guarantee the accuracy of the data included in this work. The boundaries, colors, denominations, and other information shown on any map in this work do not imply any judgment on the part of The World Bank concerning the legal status of any territory or the endorsement or acceptance of such boundaries. Nothing herein shall constitute or be considered to be a limitation upon or waiver of the privileges and immunities of The World Bank, or of any participating organization to which such privileges and immunities may apply, all of which are specifically reserved. Rights and Permission This work is available under the Creative Commons Attribution 3.0 IGO license (CC BY 3.0 IGO) http:// creativecommons.org/licenses/by/3.0/igo. Under the Creative Commons Attribution license, you are free to copy, distribute, transmit, and adapt this work, including for commercial purposes, under the following conditions: Attribution—Please cite the work as follows: World Bank. -

Turkcell Annual Report 2010

TURKCELL ANNUAL REPORT 2010 GET MoRE oUT of LIfE WITh TURKCELL CoNTENTS PAGE our Vision / our Values / our Strategic Priorities 4 Turkcell Group in Numbers 6 Turkcell: Leading Communication and Technology Company 8 Letter from the Chairman 10 Board Members 12 Letter from the CEo 14 Executive officers 16 Superior Technologies 22 More Advantages 32 Best Quality Service 40 More Social Responsibility 46 Awards 53 Managers of Turkcell Affiliates 54 Subsidiaries 56 human Resources 62 Mobile Telecommunication Sector 66 International Ratings 72 Investor Relations 74 Corporate Governance 78 Turkcell offices 95 Consolidated financial Statement and Independent Audit Report 96 Dematerialization of The Share Certificates of The Companies That Are Traded on The Stock Exchange 204 The Board’s Dividend Distribution Proposal 205 2 3 oUR VISIoN oUR STRATEGIC PRIoRITIES To ease and enrich the lives of our customers with communication and As a Leading Communication and Technology Company, technology solutions. • to grow in our core mobile communication business through increased use of voice and data, • to grow our existing international subsidiaries with a focus on profitability, oUR VALUES • to grow in the fixed broadband business by creating synergy among Turkcell Group companies through our fiber optic infrastructure, • We believe that customers come first • to grow in the area of mobility, internet and convergence through new • We are an agile team business opportunities, • We promote open communication • to grow in domestic and international markets through communications, • We are passionate about making a difference technology and new business opportunities, • We value people • to develop new service platforms that will enrich our relationship with our customers through our technical capabilities. -

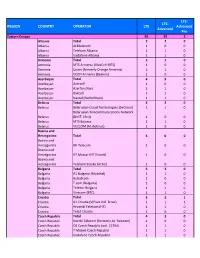

Ready for Upload GCD Wls Networks

LTE‐ Region Country Operator LTE 5G Advanced Eastern Europe 93 60 18 Albania Total 320 Albania ALBtelecom 100 ONE Telecommunications (formerly Albania Telekom Albania) 110 Albania Vodafone Albania 110 Armenia Total 330 Armenia MTS Armenia (Viva‐MTS) 110 Armenia Ucom 110 Armenia VEON Armenia (Beeline) 110 Azerbaijan Total 430 Azerbaijan Azercell 100 Azerbaijan Azerfon (Nar) 110 Azerbaijan Bakcell 110 Azerbaijan Naxtel (Nakhchivan) 110 Belarus Total 431 Belarus A1 Belarus 101 Belarus Belarusian Cloud Technologies (beCloud) 110 Belarusian Telecommunications Network Belarus (BeST, life:)) 110 Belarus MTS Belarus 110 Bosnia‐Herzegovina Total 310 Bosnia‐Herzegovina BH Telecom 110 Bosnia‐Herzegovina HT Mostar (HT Eronet) 100 Bosnia‐Herzegovina Telekom Srpske (m:tel) 100 Bulgaria Total 530 Bulgaria A1 Bulgaria (Mobiltel) 110 Bulgaria Bulsatcom 100 Bulgaria T.com (Bulgaria) 100 Bulgaria Telenor Bulgaria 110 Bulgaria Vivacom (BTC) 110 Croatia Total 331 Croatia A1 Hrvatska (formerly VIPnet/B.net) 110 Croatia Hrvatski Telekom (HT) 111 Croatia Tele2 Croatia 110 Czech Republic Total 433 Czech Republic Nordic Telecom 100 Czech Republic O2 Czech Republic (incl. CETIN) 111 Czech Republic T‐Mobile Czech Republic 111 Czech Republic Vodafone Czech Republic 111 Estonia Total 331 Estonia Elisa Eesti (incl. Starman) 110 Estonia Tele2 Eesti 110 Telia Eesti (formerly Eesti Telekom, EMT, Estonia Elion) 111 Georgia Total 630 Georgia A‐Mobile (Abkhazia) 100 Georgia Aquafon GSM (Abkhazia) 110 Georgia MagtiCom 110 Georgia Ostelecom (MegaFon) (South Ossetia) 100 Georgia -

Turkcell the Digital Operator

Turkcell the Digital Operator Turkcell Annual Report 2018 About Turkcell Turkcell is a digital operator headquartered in Turkey, serving its customers with its unique portfolio of digital services along with voice, messaging, data and IPTV services on its mobile and fixed networks. Turkcell Group companies operate in 5 countries – Turkey, Ukraine, Belarus, Northern Cyprus, Germany. Turkcell launched LTE services in its home country on April 1st, 2016, employing LTE-Advanced and 3 carrier aggregation technologies in 81 cities. Turkcell offers up to 10 Gbps fiber internet speed with its FTTH services. Turkcell Group reported TRY 21.3 billion revenue in FY18 with total assets of TRY 42.8 billion as of December 31, 2018. It has been listed on the NYSE and the BIST since July 2000, and is the only NYSE-listed company in Turkey. Read more at www.turkcell.com.tr/english-support All financial results in this annual report are prepared in accordance with International Financial Reporting Standards (IFRS) and expressed in Turkish Lira (TRY or TL) unless otherwise stated. TABLE OF CONTENTS TRY Turkcell Group 16 Chairman’s Message 21.3 20 Board of Directors 22 Message from the CEO billion 26 Executive Officers 28 Top Management of Subsidiaries REVENUES 30 Turkcell Group 31 Our Vision, Target, Strategy and Approach 32 2018 at a Glance 34 2018 Highlights 36 The World’s 1st Digital Operator Brand: Lifecell 37 Turkcell’s Digital Services 2018 Operations 38 Exemplary Digital Operator 40 Our Superior Technology 41.3% 46 Our Consumer Business EBITDA 52 Our -

2017 Registration Document

2017 Registration document Annual financial report Table of contents 1. Overview of the Group 5. Corporate, social and and of its business environmental responsibility 1.1 Overview 4 5.1 Social commitments 311 1.2 Market and strategy 7 5.2 Employee information 316 1.3 Operating activities 12 5.3 Environmental information 328 1.4 Networks and real- estate 38 5.4 Duty of care 337 1.5 Innovation at Orange 40 5.5 Report by one of the Statutory Auditors 338 1.6 Regulation of telecom activities 43 6. Shareholder Base 2. Risk factors and activity and Shareholders’ Meeting management framework 6.1 Share capital 342 2.1 Risk factors 64 6.2 Major shareholders 343 2.2 Activity and risk management framework 69 6.3 Draft resolutions to be submitted to the Combined Ordinary and Extraordinary Shareholders’ Meeting of May 4, 2018 345 3. Financial report 6.4 Report of the Board of Directors on the resolutions submitted to the Combined Ordinary and 3.1 Analysis of the Group’s financial position and earnings 78 Extraordinary Shareholders’ Meeting of May 4, 2018 350 3.2 Recent events and Outlook 131 6.5 Statutory Auditors’ report on resolutions 3.3 Consolidated financial statements 133 and related party agreements 357 3.4 Annual financial statements Orange SA 240 3.5 Dividend distribution policy 278 7. Additional information 4. Corporate Governance 7.1 Person responsible 362 7.2 Statutory Auditors 362 4.1 Composition of management and supervisory bodies 280 7.3 Statutory information 363 4.2 Functioning of the management 7.4 Factors that may have an impact in the event and supervisory bodies 290 of a public offer 365 4.3 Reference to a Code of Corporate Governance 298 7.5 Regulated agreements and related party transactions 366 4.4 Compensation and benefits paid to Directors, 7.6 Material contracts 366 Officers and Senior Management 298 8. -

Dijital Operatör Vizyonu Ve 1440 Stratejisi Dünyaya Yayılıyor

27.02.2019 3 kıtada 9 operatör müşterilerine Lifecell’in dijital servislerini sunuyor Dijital Operatör vizyonu ve 1440 stratejisi dünyaya yayılıyor Turkcell’in, geçen yıl Mobil Dünya Kongresi’nde duyurduğu dijital ihracat hamlesi bir yıl içerisinde 3 kıtada toplam 9 operatörde karşılık buldu. Lifecell, Türkiye’de Turkcell, KKTC’de Kuzey Kıbrıs Turkcell, Belarus’ta BeST, Ukrayna’da Lifecell, Almanya’da Lifecell Europe ve Moldova’da Moldcell’in ardından şimdi de Arnavutluk’ta ALB Telecom, Nepal’de CG Corp Global, Karayipler, Orta Amerika ve Asya Pasifik’te 31 ülkede faaliyet gösteren Digicel ile toplam 39 ülkede kullanılmaya başlanacak. Yakın zamanda imzalanan anlaşmalarla birlikte BiP, fizy, TV+, Dijital Operatör, Okudo (Dergilik), Lifebox, Yaani, Upcall, GollerCepte, Akademi ve Kopilot gibi onlarca servis toplamda 9 operatör tarafından müşterilerine sunulacak Son iki yıldır %49 gelir büyümesi ile dünyanın en hızlı büyüyen dijital operatörü olmayı başaran Turkcell, geçen yıl Mobil Dünya Kongresi’nde paylaştığı “dijital ihracat hedefi” doğrultusunda attığı önemli adımları, bu yıl yine aynı etkinlikte yaptığı bir basın toplantısıyla açıkladı. OTT ve telekom yeteneklerini başarıyla birleştirerek telekom sektörüne yepyeni bir soluk getiren Turkcell, grup şirketi Lifecell ile Türkiye, Belarus, Ukrayna, KKTC, Moldova ve Almanya’daki müşterileri ile daha güçlü ilişkiler kurmayı sağlayan 1440 stratejisinin yeni işbirlikleriyle birlikte toplam 9 operatör tarafından hayata geçirileceğini açıkladı. Lifecell’in dijital servisleri Türkiye’de Turkcell, KKTC’de Kuzey Kıbrıs Turkcell, Belarus’ta BeST, Ukrayna’da Lifecell, Almanya’da Lifecell Europe ve Moldova’da Moldcell’in ardından Arnavutluk’ta ALB Telecom, Nepal’de CG Corp Global, Karayipler’de ise Digicel ile birlikte toplam 39 ülkede kullanılmaya başlanacak. Hayata geçen işbirlikleri sayesinde Türkiye’nin uygulamaları toplamda yaklaşık 320 milyon kişinin yaşadığı bir pazara açılmış oluyor. -

2012 Electronic Communication Sector Comparative Assessment Moldova – Country Summary

2012 Electronic Communication Sector Comparative Assessment Moldova – Country Summary EBRD 2012 Electronic Communications Sector Comparative Assessment European Bank for Reconstruction and Development (EBRD) 2012 Electronic Communications Sector Comparative Assessment Moldova www.ebrd.com/law 1 EBRD 2012 Electronic Communications Sector Comparative Assessment 0: EXECUTIVE SUMMARY ............................................................................................................................................. 3 1: BACKGROUND AND OBJECTIVES ........................................................................................................................... 4 1.1 Background ................................................................................................................................................................... 4 1.2 Participant countries..................................................................................................................................................... 5 1.3 Objectives of the Assessment ...................................................................................................................................... 5 1.4 The electronic communications sector ........................................................................................................................ 6 2: ASSESSMENT METHODOLOGY .............................................................................................................................. 7 2.1 Taking an investor’s view ............................................................................................................................................ -

Turkcell Iletisim Hizmetleri Fourth Quarter and Full

Fourth Quarter and Full Year 2017 Results TURKCELL ILETISIM HIZMETLERI FOURTH QUARTER AND FULL YEAR 2017 RESULTS “REMARKABLE RESULTS ON THE BACK OF DIGITAL TRANSFORMATION” 1 Fourth Quarter and Full Year 2017 Results Contents HIGHLIGHTS COMMENTS BY KAAN TERZIOGLU, CEO 4 FINANCIAL AND OPERATIONAL REVIEW FINANCIAL REVIEW OF TURKCELL GROUP 6 OPERATIONAL REVIEW OF TURKCELL TURKEY 10 TURKCELL INTERNATIONAL lifecell 11 BeST 12 Kuzey Kıbrıs Turkcell 12 FINTUR 12 TURKCELL GROUP SUBSCRIBERS 13 OVERVIEW OF THE MACROECONOMIC ENVIRONMENT 13 RECONCILIATION OF NON-GAAP FINANCIAL MEASUREMENTS 14 Appendix A – Tables 16 Please note that all financial data is consolidated and comprises that of Turkcell Iletisim Hizmetleri A.S. (the “Company”, or “Turkcell”) and its subsidiaries and associates (together referred to as the “Group”), unless otherwise stated. We have three reporting segments: o "Turkcell Turkey" which comprises all of our telecom related businesses in Turkey (as used in our previous releases, this term covered only the mobile businesses). All non-financial data presented in this press release is unconsolidated and comprises Turkcell Turkey only figures, unless otherwise stated. The terms "we", "us", and "our" in this press release refer only to Turkcell Turkey, except in discussions of financial data, where such terms refer to the Group, and except where context otherwise requires. o “Turkcell International” which comprises all of our telecom related businesses outside of Turkey. o “Other subsidiaries” which is mainly comprised of our information and entertainment services, call center business revenues, financial services revenues and inter-business eliminations. In this press release, a year-on-year comparison of our key indicators is provided and figures in parentheses following the operational and financial results for December 31, 2017 refer to the same item as at December 31, 2016. -

Kcell Is a Market Leader Again Mobile Network Antennas: Myths and Reality Dual Carrier: 3G Evolution in Progress Publisher: Apriori Communications LLP

Specialized telecommunication magazine of Kazakhstan september — november / №3 [27] Kcell is a Market Leader Again Mobile Network Antennas: Myths and Reality Dual Carrier: 3G Evolution in Progress Publisher: Apriori Communications LLP Editor-in-chief: Aida Dossayeva Editorial Director: Natalia Yeskova Director: Dinara Sherieva Design: David Djubayev [www.vkartinke.com] Authors of Publications: Natalya Yeskova Ivan Glushchenko Aisha Arynova Sanzhar Bimamirov Dmitriy Paramonov Photographs: Saken Nigmashev Valeriy Ayapov Translation into the Kazakh and English languages: InterBridge-A Translation Bureau Read VOX.com on your mobile phone Address of the Editorial Office: 118 Makatayev str., 6 apt. 050000, Almaty, Republic of Kazakhstan tel.: 8 [727] 232-71-40 mobile.: +7 701 211 31 77 e-mail: [email protected] Printed in Gerona Print House 30a/3 Satpayev str., office 124 Tel.: 7 (727) 250-47-40, 398-94-59, 398-94-60 The magazine is re-registered with the Ministry of Communications and Information of the RoK as of 19.10.2011 under No.12052-Ж CONTENTS NEWS 4 TeliaSonera News 8 Kcell News ANALYTICS 6 Kcell is a Market Leader Again 22 Mobile Network Antennas: Myths and Reality INTERVIEW 26 The Road Project: What Matters Is There's Almost Always a Connection MARKET 12 Kcell Cloud: Taming Clouds 14 Dual Carrier: 3G Evolution in Progress 16 How to Maximize Your Smartphone's Potential 18 Roaming: Make Yourself At Home! 20 A Pretty Number Is Quick and Convenient 34 Smartphones with Dual Carrier Support PHOTO REPORTAGE 30 TEDxAlmaty. Extra is New Rationality 4 5 news TeliaSonera International the interconnection services. The net sales Net sales in the Eurasian branch of Carrier Presents Anywhereization Trend figures remained stable in the local currency, TeliaSonera (BA Eurasia) increased by 11.1 excluding acquisitions and divestments. -

Telia Company – Annual and Sustainability Report 2019

BRINGING THE WORLD CLOSER ANNUAL AND SUSTAINABILITY REPORT 2019 CONTENT OUR COMPANY Telia Company in one minute ................................................ 4 2019 in brief ............................................................................ 6 How we create value ............................................................. 8 Comments from the CEO ..................................................... 10 Trends and strategy .............................................................. 12 DIRECTORS' REPORT Group development ............................................................. 16 Country development .......................................................... 32 Sustainability ....................................................................... 41 Risks and uncertainties ....................................................... 62 CORPORATE GOVERNANCE Corporate Governance Statement ....................................... 70 Board of Directors ............................................................... 82 Group Executive Management ............................................ 84 FINANCIAL STATEMENTS Consolidated statements of comprehensive income .......... 86 Consolidated statements of financial position .................... 87 Consolidated statements of cash flows .............................. 88 Consolidated statements of changes in equity ................... 89 Notes to consolidated financial statements ........................ 90 Parent company income statements.................................. 182 Parent company -

Prepared for Upload GCD Wls Networks

LTE‐ LTE‐ Region Country Operator LTE Advanced 5G Advanced Pro Eastern Europe 92 57 4 3 Albania Total 32 0 0 Albania ALBtelecom 10 0 0 Albania Telekom Albania 11 0 0 Albania Vodafone Albania 11 0 0 Armenia Total 31 0 0 Armenia MTS Armenia (VivaCell‐MTS) 10 0 0 Armenia Ucom (formerly Orange Armenia) 11 0 0 Armenia VEON Armenia (Beeline) 10 0 0 Azerbaijan Total 43 0 0 Azerbaijan Azercell 10 0 0 Azerbaijan Azerfon (Nar) 11 0 0 Azerbaijan Bakcell 11 0 0 Azerbaijan Naxtel (Nakhchivan) 11 0 0 Belarus Total 42 0 0 Belarus A1 Belarus (formerly VELCOM) 10 0 0 Belarus Belarusian Cloud Technologies (beCloud) 11 0 0 Belarus Belarusian Telecommunications Network (BeST, life:)) 10 0 0 Belarus MTS Belarus 11 0 0 Bosnia and Total Herzegovina 31 0 0 Bosnia and Herzegovina BH Telecom 11 0 0 Bosnia and Herzegovina HT Mostar (HT Eronet) 10 0 0 Bosnia and Herzegovina Telekom Srpske (m:tel) 10 0 0 Bulgaria Total 53 0 0 Bulgaria A1 Bulgaria (Mobiltel) 11 0 0 Bulgaria Bulsatcom 10 0 0 Bulgaria T.com (Bulgaria) 10 0 0 Bulgaria Telenor Bulgaria 11 0 0 Bulgaria Vivacom (BTC) 11 0 0 Croatia Total 33 1 0 Croatia A1 Hrvatska (formerly VIPnet/B.net) 11 1 0 Croatia Hrvatski Telekom (HT) 11 0 0 Croatia Tele2 Croatia 11 0 0 Czechia Total 43 0 0 Czechia Nordic Telecom (formerly Air Telecom) 10 0 0 Czechia O2 Czech Republic (incl. CETIN) 11 0 0 Czechia T‐Mobile Czech Republic 11 0 0 Czechia Vodafone Czech Republic 11 0 0 Estonia Total 33 2 0 Estonia Elisa Eesti (incl. -

Ready for Upload GCD Wls Networks

LTE‐ LTE‐ REGION COUNTRY OPERATOR LTE Advanced Advanced Pro Eastern Europe 92 55 2 Albania Total 320 Albania ALBtelecom 100 Albania Telekom Albania 110 Albania Vodafone Albania 110 Armenia Total 310 Armenia MTS Armenia (VivaCell‐MTS) 100 Armenia Ucom (formerly Orange Armenia) 110 Armenia VEON Armenia (Beeline) 100 Azerbaijan Total 430 Azerbaijan Azercell 100 Azerbaijan Azerfon (Nar) 110 Azerbaijan Bakcell 110 Azerbaijan Naxtel (Nakhchivan) 110 Belarus Total 420 Belarus Belarusian Cloud Technologies (beCloud) 110 Belarusian Telecommunications Network Belarus (BeST, life:)) 100 Belarus MTS Belarus 110 Belarus VELCOM (A1 Belarus) 100 Bosnia and Herzegovina Total 300 Bosnia and Herzegovina BH Telecom 100 Bosnia and Herzegovina HT Mostar (HT Eronet) 100 Bosnia and Herzegovina Telekom Srpske (m:tel) 100 Bulgaria Total 530 Bulgaria A1 Bulgaria (Mobiltel) 110 Bulgaria Bulsatcom 100 Bulgaria T.com (Bulgaria) 100 Bulgaria Telenor Bulgaria 110 Bulgaria Vivacom (BTC) 110 Croatia Total 321 Croatia A1 Croatia (VIPnet incl. B.net) 111 Croatia Hrvatski Telekom (HT) 110 Croatia Tele2 Croatia 100 Czech Republic Total 430 Czech Republic Nordic Telecom (formerly Air Telecom) 100 Czech Republic O2 Czech Republic (incl. CETIN) 110 Czech Republic T‐Mobile Czech Republic 110 Czech Republic Vodafone Czech Republic 110 Estonia Total 330 Estonia Elisa Eesti (incl. Starman) 110 Estonia Tele2 Eesti 110 Telia Eesti (formerly Eesti Telekom, EMT, Estonia Elion) 110 Georgia Total 630 Georgia A‐Mobile (Abkhazia) 100 Georgia Aquafon GSM (Abkhazia) 110 Georgia MagtiCom