2018 ANNUAL REPORT for More Information About Nemak, Visit

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Annual Report 2016

Libramiento Arco Vial Km 3.8 García, N.L. 66000 México +52 (81) 8748-5200 www.nemak.com 2016 Annual Report Annual Report 2016 G4-3, G4-9 Nemak is a leading provider of innovative lightweighting solutions for the global Contact automotive industry, specializing in the development and manufacturing of aluminum components for powertrain and body structure applications. As of 2016, the company employed more than 21,000 people at 36 facilities worldwide and generated revenues of US$4.3 billion. For more information about Nemak, visit www.nemak.com For more information visit us at: Investor Relations http://www.nemak.com http://investors.nemak.com [email protected] Libramiento Arco Vial Km 3.8, García N.L., 66000, México /NemakGlobal +52 (81) 874-85107 /Nemak_Global Media Relations [email protected] Libramiento Arco Vial Km 3.8, García N.L., 66000, México +52 (81) 874-85200 Independent Auditor PwC CONTENT PricewaterhouseCoopers Av. Rufino Tamayo 100 piso 2 Valle Oriente Monterrey N.L., 66269, México Nemak at a glance 2 +52 (81) 8152-2000 Product portfolio 4 Financial highlights 5 Stock Exchange and Symbol Letter to shareholders 6 Nemak S.A.B. de C.V. Lightweighting trends 10 trades on the Bolsa Mexicana de Valores (BMV) under the symbol Nemak. Innovation 13 Structural components 14 Powertrain components 17 Talent development 18 Sustainability 21 Operating summary 26 Driving innovation and Board of directors 28 shaping the future of Management team 29 automotive lightweighting Corporate governance 30 Consolidated financial statements 31 Design: signi.com.mx Printing: earthcolor.com at a glance Nemak G4-6, G4-8 CANADA UNITED STATES MEXICO BRAZIL 33% EUROPE 9% REST OF THE WORLD 58% REVENUE NORTH AMERICA BREAKDOWN ARGENTINA 2 CZECH REPUBLIC RUSSIA GERMANY HUNGARY POLAND SLOVAKIA AUSTRIA TURKEY SPAIN CHINA INDIA U.S.A. -

2005-Global Partnerships Final Poster.Qxd 8/17/2005 3:54 PM Page 1

2005-global partnerships final poster.qxd 8/17/2005 3:54 PM Page 1 SPONSORED BY GGuuiiddee ttoo gglloobbaall aauuttoommoottiivvee ppaarrttnneerrsshhiippss FULL OWNERSHIP EQUITY STAKES VEHICLE ASSEMBLY ALLIANCES TECHNICAL/PARTS ALLIANCES BMW AG Owned by: Joint venture: Contract assembly: •DaimlerChrysler - gasoline engines - Brazil •Mini •Quandt family - 46.6% •BMW Brilliance •Magna Steyr, Austria •Land Rover - diesel engines - UK •Rolls-Royce Motor Cars Ltd. •Other shareholders - 53.4% Automotive Co., China •PSA/Peugeot-Citroen - gasoline engines - France & UK •Tritec Motors, Brazil •Toyota -diesel engines DAIMLERCHRYSLER AG Owns: Owned by: Joint venture: Contract assembly: •BMW - gasoline engines - Brazil •Chrysler group •McLaren Group - 40% •Deutsche Bank - 6.9% •Beijing Benz-DaimlerChrysler •Karmann, Germany •GM - hybrid drive system •Mercedes-Benz •Mitsubishi - 12.8% •Kuwait Investments - 7.2% Automotive, China •Magna Steyr, Austria •Hyundai/Mitsubishi - 4-cylinder engines (Mercedes-Benz owns 100% of Maybach and Smart) •Mitsubishi Fuso - 65% •Other shareholders - 85.9% •Fujian Motor Industry Group, China DONGFENG MOTOR CORP. Owns: Owned by: Joint venture: •Dongfeng Yueda Kia Dongfeng Motor Corp. •Dongfeng Liuzhou Motor Co. Ltd. •Dongfeng Automobile Co. - •Chinese central government - •Dongfeng Honda Automobile Co., China 70% 100% Automobile (Wuhan), China •Zhengzhou Nissan •Dongfeng Motor Co., China Automobile Co., China •Dongfeng Peugeot Citroen Automobile Co., China FIAT S.P.A. Owns: Owned by: Joint venture: Contract assembly: •General Motors - powertrains - Poland •Fiat Auto S.p.A. •Ferrari - 50% •Agnelli family - 22% •Nanjing Fiat - China •Pininfarina, Italy •Suzuki - diesel engines - India (Fiat Auto owns 100% of Alfa Romeo, Fiat and Lancia) •Other shareholders - 78% •SEVEL - Italy, France •Suzuki, Hungary •Maserati S.p.A. •Tofas - Turkey •Nissan, South Africa •Iveo Fiat - Brazil •Mekong Corp., Vietnam FIRST AUTOMOBILE WORKS GROUP Owns: Owned by: Joint venture: •FAW-Volkswagen First Automobile (FAW) •FAW Car Co. -

Lüber – Excellent References

Lüber – Excellent references Europe North America Ferromatrix NV Belgium GM Powertrain, Defiance USA Stahlgiesserei State Bulgaria Waupaca Foundry, Waupaca USA Montupet, Russe Bulgaria Ford, Cleveland USA Ferrari, Modena Italy Caterpillar Illinois USA Teksid, Carmagnola Italy Vald Birn, Holstebro Denmark Central America Componenta, Hoensbroek Netherlands Nemak, Monterrey Mexico Componenta, Weert Netherlands Nemak, Saltillo Mexico MGG Giessen, Tegelen Netherlands Volkswagen, Puebla Mexico Nemak, Wernigerode Germany Nemak, Dillingen Germany South America BMW, Landshut Germany GM General Motors, Sao Paulo Brazil Mercedes Benz, Untertürkheim Germany LUK, Sao Paulo Brazil Mercedes Benz, Mannheim Germany New Hübner, Curitiba Brazil Georg Fischer, Mettmann Germany Tupy, Joinville Brazil Georg Fischer, Friedrichshafen Germany Tupy, Sao Paulo Brazil Georg Fischer, Singen Germany Fritz Winter, Stadtallendorf Germany Asia Linde, Weilbach Germany Craftsman, Coimbatore India Volkswagen, Poznan Poland Tata, Pune India Nemak, Bielsko Biala Poland HEI Ltd., Kolkata India Georg Fischer, Herzogenburg Austria Rowshan Sanaat, Karaj Iran Nemak, Linz Austria Chauffagekar, Teheran Iran Avtovaz, Togliatti Russia Daido Castings, Kisho Japan Belniilit, Minsk Belarus FAW, Chan Chun City China Traktor Minsk, Minsk Belarus Jinan Foundry, Shandong China Von Roll, Emmenbrücke Switzerland Mannesmann Rexroth, Xisangi China Beninger Guss, Uzwil Switzerland Hangzhou Gearbox Works, Zhejiang China Nemak, Ziar Slovakia Lingotes, Valladolid Spain Australia Aurrenak, Vitoria -

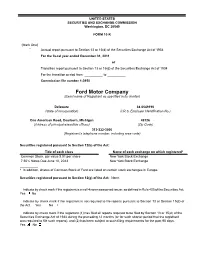

Ford Motor Company (Exact Name of Registrant As Specified in Its Charter)

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, DC 20549 FORM 10-K (Mark One) Annual report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 For the fiscal year ended December 31, 2011 or Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 For the transition period from __________ to __________ Commission file number 1-3950 Ford Motor Company (Exact name of Registrant as specified in its charter) Delaware 38-0549190 (State of incorporation) (I.R.S. Employer Identification No.) One American Road, Dearborn, Michigan 48126 (Address of principal executive offices) (Zip Code) 313-322-3000 (Registrant’s telephone number, including area code) Securities registered pursuant to Section 12(b) of the Act: Title of each class Name of each exchange on which registered* Common Stock, par value $.01 per share New York Stock Exchange 7.50% Notes Due June 10, 2043 New York Stock Exchange __________ * In addition, shares of Common Stock of Ford are listed on certain stock exchanges in Europe. Securities registered pursuant to Section 12(g) of the Act: None. Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes No Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes No Indicate by check mark if the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. -

The Technology Group for Security and Mobility

Rheinmetall Group Corporate Presentation August 2020 Rheinmetall Group Mobility and security form the DNA of the business model RHEINMETALL GROUP INTEGRATED TECHNOLOGY GROUP FOR SECURITY AND MOBILITY Automotive Our heart beats for your engine Defence Force protection is our mission Tier 1 supplier System house for land based operations High-tech products for global markets Leading provider of innovative solutions Model Business Gaining powertrain neutrality Internationalization focused on home markets Megatrend mobility Increasing demand for security Growing demand for clean mobility Geostrategical powershifts Global LV production with growth Constantly changing conflict situations driver Market Market Increased regulation Rising defence/security budgets Corporate Presentation August 2020 2 Rheinmetall Group Highlights Group performance indicator Strategy roadmap Grow sales ~8% op. Organic International around 8% margin RHEINMETALL growth expansion Targeted 2-4% 30-35% GROUP Leading by Targeted Cash on sales payout ratio innovations acquisitions AUTOMOTIVE Our heart beats for your engine 2019 DEFENCE Force protection is our mission Op. margin €2,736m 44% Sales 56% €3,522m Op. margin 6.7% €184m 35% Oper. Result 65% €343m 9.8% *€447m Order backlog €10,399m 11,405 49% Headcount** 51% 12,100 * Short-term; **Headcount at capacities; Corporate Presentation August 2020 3 Rheinmetall Group Financial overview - Growth in all relevant KPI Sales, operating result and operating margin Operating FCF and operating FCF to Sales In €m In €m / in % 4,7% 5,0% 6.500 6.255 12 400 5 6.148 314 10 4 6.000 5.896 300 276 2-4% 5.602 8 161 3 OFCF 5.500 200 5.183 8,0% 8,1% 6 2,9% 2 TARGET 6,3% 6,8% 100 29 5,5% 491 505 4 1 500 287 353 400 0 2 0,6% 0 -0,6% 0 0 -100 -35 -1 2015 2016 2017 2018 2019 Op. -

Anticorruption Policy May 2019 1

NPO-GBL-GOV-03 Rev 1 Published: 06-2016 Scope: Global Policy Anticorruption Policy May 2019 1. Purpose & Scope 1.1. Reaffirm to all employees our commitment to a culture of integrity, honesty, and accountability everywhere we operate and at the same time comply with the international anticorruption laws and policies. 1.2. Establish the basic principles and framework for preventing, detecting, investigating, remedying and, if applicable, apply the corresponding penalties. 1.3. This policy is applicable to: a) All Nemak employees and every individual that either directly or indirectly acts on behalf of the company, such as representatives, agents, consultants, advisors, distributors, etc. b) Suppliers, contractors, subcontractors and individuals that do not represent the company but provide a service to it will be notified of the existence of this Policy and will be encouraged to observe it. 2. Definitions a) Corruption or bribery acts: Offer or promise, pay or receive money or valuables to any individual or entity, to improperly influence their acts or decisions in order to obtain an unfair or unlawful benefit or advantage either as a personal favor or for the company. The mere act of offering or promising any kind of wrongful compensation, even if the act had not been completed, it is itself an act of corruption. b) Valuables: Gifts, invitations to entertainment events, travel expenses, employment opportunities and other perks or benefits. c) Assets: Assets may include, but are not limited to facilities, equipment, phones, smartphones, computers, e-mail, internet software, supplies, documents, money, intellectual property and any other services that help perform work-related duties. -

Nemak Investor Presentation – March 2019

Investor Presentation March 2019 Innovative Lightweighting Forward-looking statement This presentation contains forward-looking information based on numerous variables and assumptions that are inherently uncertain. They involve judgments with respect to, among other things, future economic, competitive and financial market conditions and future business decisions, all of which are difficult or impossible to predict accurately. Accordingly, actual results are likely to vary from those set forth in this presentation. ©Nemak | Internal 2 Nemak Overview ©Nemak | Internal Nemak Today Leading provider of innovative lightweighting solutions 2018 Revenues 2018 EBITDA1 US $4.7 Billion US $734 Million Diversified product portfolio Sole supplier in ~90% of sales Strong customer base Presence in ~650 vehicle platforms 1 in 4 new vehicles sold has a Nemak component (1) = EBITDA = Operating Income + Depreciation, Amortization & other Non-Cash Charges 4 Broad portfolio of automotive lightweighting solutions Cylinder Heads Engine Blocks Longitudinal Members Transmission Cases E-Motor Housings Battery Housings ©Nemak | Internal 5 State-of-the-art facilities in major automotive markets Slovakia Russia 38 Manufacturing facilities 16 Countries Spain ~23K Employees ©Nemak | Internal 6 Solid and long-standing customer relationships 40 years 25 years 20 years 15 years 10 years 35 years 25 years 20 years 15 years 10 years 35 years 20 years 20 years 15 years 10 years 2 years ©Nemak | Internal 7 Strong competitive position Product Customer portfolio Others Cylinder -

Profitable Growth for All Ford Motor Company 2012 Annual Report Operating Highlights

Profitable Growth for All Ford Motor Company 2012 Annual Report Operating Highlights Revenues 2012 2011 Worldwide wholesale unit volumes by automotive segment (in thousands) Ford North America 2,784 2,686 Ford South America 498 506 Ford Europe 1,353 1,602 Ford Asia Pacific Africa 1,033 901 Total 5,668 5,695 Revenues (in millions) Automotive $ 126,567 $ 128,168 Financial Services 7,685 8,096 Total $ 134,252 $ 136,264 Financial Results Income before income taxes (in millions) Automotive $ 6,010 $ 6,250 Financial Services 1,710 2,431 Total $ 7,720 $ 8,681 Amounts Attributable to Ford Motor Company Net income (in millions) $ 5,665 $ 20,213 Diluted net income per share of Common and Class B Stock $ 1.42 $ 4.94 Cash and Spending Automotive capital expenditures Amount (in billions) $ 5.5 $ 4.3 As a percentage of Automotive sales 4.3% 3.3% Automotive cash at year end (in billions) Automotive gross cash (a) $ 24.3 $ 22.9 – Cash net of Automotive debt 10.0 9.8 Shareholder Value Dividends paid per share $ 0.20 $ 0.00 Total shareholder returns % (b) 23% (36)% (a) Automotive gross cash includes cash and cash equivalents and net marketable securities. (b) Source: Standard & Poor’s, a division of the McGraw Hill Companies, Inc. Content On the Cover 1 More Products People Want The One Ford plan enables accelerated development of products 2 A Message from the Executive Chairman that customers truly want and value, resulting in a full-line of cars, 3 A Message from the President and CEO utilities and trucks that meet and exceed owner expectations 7 Board of Directors and Executives across global markets. -

Nemak 2020 Annual Report

2020 ANNUAL REPORT GRI Standards: 102-1, 102-7 Nemak, S.A.B. de C.V. (“Nemak”) is a leading provider of innovative lightweighting solutions for the global automotive industry, specializing in the development and manufacturing of aluminum CONTENT components for powertrain, e-mobility, and structural applications. In 2020, the Company 3 Nemak at a Glance employed approximately 22,000 people at 38 4 Product Portfolio facilities worldwide and generated revenue of 5 Financial Highlights US$3.2 billion. 6 Letter to Shareholders 10 Lightweighting Developments Controladora Nemak, S.A.B. de C.V. (“Controladora 12 Nemak Safe and Strong Nemak”) is the owner of Alfa, S.A.B. de C.V.’s former 15 Sustainability shareholding in Nemak. Since the main asset of 32 Operating Summary Controladora Nemak are shares representing 34 Board of Directors Nemak’s capital, the business of Controladora 35 Management Team Nemak is substantially similar to the business 36 Corporate Governance of Nemak, and therefore is subject to the same 37 Financial Section operating and financial results. The operating and financial results of Nemak that are reported here are therefore also those of Controladora Nemak. For more information about Nemak, visit: www.nemak.com NEMAK AT LETTER TO LIGHTWEIGHTING NEMAK SAFE OPERATING BOARD MANAGEMENT CORPORATE FINANCIAL SUSTAINABILITY A GLANCE SHAREHOLDERS DEVELOPMENTS AND STRONG SUMMARY OF DIRECTORS TEAM GOVERNANCE SECTION Slovakia Germany Poland United States Russia Czech Republic Austria Spain China Mexico Hungary Turkey Brazil India Argentina -

Q3 2018 Nemak SAB De CV Earnings Call on October 16, 2018 / 3:30PM

Client Id: 77 THOMSON REUTERS STREETEVENTS EDITED TRANSCRIPT NEMAKA.MX - Q3 2018 Nemak SAB De CV Earnings Call EVENT DATE/TIME: OCTOBER 16, 2018 / 3:30PM GMT THOMSON REUTERS STREETEVENTS | www.streetevents.com | Contact Us ©2018 Thomson Reuters. All rights reserved. Republication or redistribution of Thomson Reuters content, including by framing or similar means, is prohibited without the prior written consent of Thomson Reuters. 'Thomson Reuters' and the Thomson Reuters logo are registered trademarks of Thomson Reuters and its affiliated companies. Client Id: 77 OCTOBER 16, 2018 / 3:30PM, NEMAKA.MX - Q3 2018 Nemak SAB De CV Earnings Call CORPORATE PARTICIPANTS Adrian Althoff Nemak, S. A. B. de C. V. - IR Officer Alberto Sada Medina Nemak, S. A. B. de C. V. - CFO Armando Tamez Martínez Nemak, S. A. B. de C. V. - CEO CONFERENCE CALL PARTICIPANTS Alejandro Azar Wabi GBM Grupo Bursátil Mexicano, S.A. de C.V. Casa de Bolsa, Research Division - Research Analyst Augusto Akihito Ensiki HSBC, Research Division - Latin America Analyst Jean Baptiste Bruny BBVA Corporate and Investment Bank, Research Division - Chief Analyst Luis Miranda Valenzuela Santander Investment Securities Inc., Research Division - Head of Food and Beverage Marcelo Garaldi Motta JP Morgan Chase & Co, Research Division - Research Analyst Marcelo Inoue Citigroup Inc, Research Division - Research Analyst Mauricio Serna Vega UBS Investment Bank, Research Division - Analyst Vanessa Quiroga Crédit Suisse AG, Research Division - Head of Mexico Equity Research & Co-Head of the Housing & Infrastructure in LatAm excluding Brazil PRESENTATION Operator Good morning, everyone, and welcome to Nemak Third Quarter 2018 Earnings Call. Armando Tamez, Nemak's CEO; Alberto Sada, CFO; and Adrian Althoff, Investor Relations Officer, are here this morning to discuss the company's performance and answer any questions you may have. -

Nemak 2018 Annual Report

2018 ANNUAL REPORT For more information about Nemak, visit www.nemak.com GRI Standards: 102-1, 102-7 Nemak is a leading provider of innovative lightweighting solutions for the global automotive CONTENT industry, specializing in the development and manufacturing of aluminum components for Nemak at a glance 3 powertrain and body structure applications. As of 2018, the company employed more than Product portfolio 4 Financial highlights 5 22,000 people at 38 facilities worldwide and generated revenues of US $4.7 billion. Letter to shareholders 6 Lightweighting developments 9 Sustainability 12 Operating summary 19 Board of directors 21 Management team 22 Corporate governance 23 Consolidated fnancial statements 24 NEMAK 2018 ANNUAL REPORT 2 NEMAK AT LETTER TO LIGHTWEIGHTING OPERATING BOARD MANAGEMENT CORPORATE FINANCIAL A GLANCE SHAREHOLDERS DEVELOPMENTS SUSTAINABILITY SUMMARY OF DIRECTORS TEAM GOVERNANCE SECTION Nemak at a glance GRI Standards: 102-4, 102-6 SLOVAKIA GERMANY POLAND RUSSIA CANADA CZECH REPUBLIC AUSTRIA UNITED STATES SPAIN CHINA MEXICO HUNGARY TURKEY INDIA BRAZIL ARGENTINA 3% 14% HEADS 56% BLOCKS North America 35% SEGMENT REVENUE Europe 49% TRANSMISSIONS AND OTHER REVENUE STRUCTURAL & EV 9% 34% Rest of World NEMAK 2018 ANNUAL REPORT 3 NEMAK AT LETTER TO LIGHTWEIGHTING OPERATING BOARD MANAGEMENT CORPORATE FINANCIAL A GLANCE SHAREHOLDERS DEVELOPMENTS SUSTAINABILITY SUMMARY OF DIRECTORS TEAM GOVERNANCE SECTION GRI Standard: 102-2 Product portfolio POWERTRAIN • Cylinder Heads • Engine Blocks • Transmission Cases VEHICLE STRUCTURES • Longitudinal Members • Shock Towers • Subframes • Other E-MOBILITY COMPONENTS • E-Motor Housings • Battery Housings • Other NEMAK 2018 ANNUAL REPORT 4 NEMAK AT LETTER TO LIGHTWEIGHTING OPERATING BOARD MANAGEMENT CORPORATE FINANCIAL A GLANCE SHAREHOLDERS DEVELOPMENTS SUSTAINABILITY SUMMARY OF DIRECTORS TEAM GOVERNANCE SECTION GRI Standard: 201-1 Volume Financial highlights millions of equivalent units 2015 50.7 2016 50.1 EXPRESSED IN MILLIONS OF U.S. -

NEMAK a Less Challenging Environment Ahead @Analisis Fundam

Equity Research Me xico Company Note September 30, 2020 NEMAK www.banorte.com A less challenging environment ahead @analisis_fundam ▪ After the impact of COVID-19, Nemak’s outlook is poised for Consumer and Telecoms recovery. Meanwhile, the cost and expense reduction strategy implemented should be reflected into better margins Valentín Mendoza Senior Strategist, Equity ▪ Its spin-off from Alfa conglomerate will provide greater independence [email protected] for strategic decision-making. Likewise, when eventually only one Juan Barbier, CFA series of shares remains listed, marketability should improve Analyst [email protected] ▪ Through a discounted cash flow valuation model, we raised our PT2020 to MXN 7.60 vs. the MXN 7.00 previously, representing a 4.8x HOLD FV/EBITDA 2021E multiple. We reiterate our HOLD rating Current Price $6.78 PT 2020 $7.60 Dividend The worst is over now. After the strong impact on Nemak's results from the Dividend Yield (%) OEMs plants closure due to the COVID-19 pandemic, IHS Automotive has Upside Potential 12.1% Max – Min LTM ($) 9.54 – 3.25 revised upwards its vehicle production projections for 2H20 and 2021. This is Market Cap (US$m) 924.2 explained by a faster recovery in China and low inventory levels at the Detroit Shares Outstanding (m) 3,076.6 Float 19.24% 3, yet mainly at General Motors, after production ceased in 2Q20. Thus, IHS Daily Turnover ($m) 10.0 now estimates global vehicle production to sequentially recover to -5% y/y in Valuation metrics TTM FV/EBITDA 7.8x 3Q20 (vs. -43% in the previous quarter), while it is expected to recover 13% in P/E N.A.