Koppers Holdings Inc

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

One World the Employees of Koppers Come from Many Nations and Cultures

Koppers Inc. 436 Seventh Avenue Pittsburgh, PA 15219-1800 412 227 2001 www.koppers.com One World The employees of Koppers come from many nations and cultures. Yet we are united in our desire to feel connected to something larger. Offering people a safe, goal-oriented and inclusive workplace is one way Koppers creates that connection around the world. Joining together to achieve a more sustainable way of working is another. Our shared commitment to innovation, compliance and mindful environmental practices that minimize our impact on the Earth has brought the people of Koppers together like no other time in our company’s history. GLOBAL STEWARDSHIP INDIVIDUAL LEADERSHIP KOPPERS Locations Locations of KOPPERS Customers A Message from our President ABOUT KOPPERS and Chief Executive Officer As Koppers continues to evolve as a strong I am proud of the way the loyal, talented Koppers, with our corporate headquarters global company, it is only natural that we and dedicated people of Koppers have and research center in Pittsburgh, Pennsylvania, focus heavily on corporate growth. But in risen to the challenge. We set very aggres- addition to having a clear growth strategy, sive goals for our safety and environmental is a global integrated producer of carbon compounds we also believe it is important to be conscien- performance and, though we don’t always and treated wood products. Including its joint ventures, tious. That is why responsibility plays such achieve those goals, I am gratified to see that a key role in our vision for the future. our employees understand the interrelated Koppers operates facilities in the United States, In short, we believe that working responsibly nature of responsibility, compliance and United Kingdom, Denmark, Australia and China. -

2020 Esg Report Message from Ceo

2020 ESG REPORT MESSAGE FROM CEO At ATI, our core values are the foundation of everything we achieve. The strength of these values – Integrity; Safety & Sustainability; Accountability; Teamwork & Respect; and Innovation – is woven into our corporate mindset, driving us to do the right things in the right way. Our values ensure we keep our people safe, protect the environment while delivering for our customers, create the diverse and inclusive culture we aspire to lead, and support the communities in which we operate. Environmental stewardship, social engagement and strong corporate governance support the growth of shareholder value and are fundamental to the long-term success of ATI. As industry leaders, we’re helping to forge the path forward as environmental, social and corporate governance expectations evolve for our employees, customers and markets. The year 2020 was demanding for ATI, as we and our customers adjusted to meet rapid declines in demand brought on by the pandemic. During this time — as always — the health and safety of our people was our paramount concern. We took immediate and decisive action across our global operations to safeguard the health of our workforce and long- term health of our business. Robert S. Wetherbee President and Chief At the same time, we remained committed to furthering our stated environmental goals, improving the diversity of Executive Officer our workforce, cultivating an inclusive corporate culture focused on talent and career development, continuing to foster local community involvement, and sustaining our long and proud tradition of robust and engaged corporate governance. I am pleased to say that, as detailed in this report, we have continued to advance these priorities and look forward to the future opportunities they present. -

IN the LEADLETOADP 50 Acquisitio Ns Can Really Spik E Revenue Growth

ANNUAL BUSINESS REPORT 2017 EDITION IN TRAN SFORMED FO THER THE FUTURE IN THE LEADLETOADP 50 Acquisitio ns can really spik e revenue growth HE Lead TRANSFORMED FOR THE FUTURE IN T ture BY TERE SA F. LINDE PITTSB MAN URGH POST-G Toby Talb AZETTE He ot/Associated rastruC inz ketchu F Press p. Few Acqu things spike isitions also the revenue were a fact year, even other busi line like acqu compan or for so me of if , as inIth N ness, iring ies rank the ot e case but the new an- ed high on her Firs of Buffalo, N. that Kraft Heinz bers the revenue t Niagara, it Y.-based ba maneuver wi Co. executed , with Nort change num- was only a nk th special gu h Shore memor Se 0.1 percent in By sto last year Matth ial and ca venteen comp crease. merging Pitt . ews Intern sket maker anies saw sburgh’s H. ational’s 28.9 the pr their revenu $10.92 bi J. Heinz Co. second percent incr evious year, es drop from llion in 2014 and its -place rank ease and with Montrea revenues wi ing as well as the bott l-based Bo Foods Gr th Illinois- S&T Ba Indiana, Pa om of the list mbardier at oup in July based Kraft ncorp’s 22.7 .-based with a 9.6 pe 2015, the new percent gain Judged rcent declin jumped to global food tion, both and fourth-p only on tota e. $18.34 billio company made possib lace posi- l revenue fi n in revenues le in part by $18.17 billio gures, Bomb fiscal year — for the most nesses. -

KOPPERS COMPANY, INC. a Delaware Corporation IRS Employer Identification No

SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. 20549 FORM 10-K ANNUAL REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 1987 Commission File Number 1-3224 KOPPERS COMPANY, INC. A Delaware Corporation IRS Employer Identification No. 25.0904665 Koppers Building Pittsburgh, Pennsylvania 15219 (412) 227-2000 Securities registered pursuant to Section 12(b) of the Act: Common Stock Registered: $1.25 Par Value New York Stock Exchange Midwest Stock Exchange Pacific Stock Exchange Cumulative Preferred Stock Registered: 4% Series, $100 Par Value New York Stock Exchange Securities registered pursuant to Section 12(g) of the Act: None Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months, and (2) has been subject to such filing requirements for the past 90 days. Yes X No As of February 29, 1988, 28,122,361 shares of common stock were outstanding, and the aggregate market value of the shares of Koppers common stock (based upon the closing price of these shares on the New York Stock Exchange/composite tape) held by nonaffihiates was approximately $1,123 million. For this computa tion, Koppers has excluded the market value of all common stock beneficially owned by officers and directors of Koppers and their associates as a group. Such exclusion is not to signify in any way that any of such persons are “affiliates” of Koppers. KOPPERS COMPANY, INC. -

Koppers Holdings Inc

SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. 20549 FORM 10-Q x QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15 OF THE SECURITIES EXCHANGE ACT OF 1934 For the Quarterly Period Ended March 31, 2006 ¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the Transition Period From to Commission file number 1-32737 Koppers Holdings Inc. (Exact name of registrant as specified in its charter) Pennsylvania 20-1878963 (State or other jurisdiction of (I.R.S. Employer incorporation or organization) Identification No.) 436 Seventh Avenue Pittsburgh, Pennsylvania 15219 (Address of principal executive offices) (412) 227-2001 (Registrant’s telephone number, including area code) Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter periods that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨ Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one): Large accelerated filer ¨ Accelerated filer ¨ Non-accelerated filer x Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x Common Stock, par value $.01 per share, outstanding at April 30, 2006 amounted to 20,656,383 shares. -

Koppers Holdings Inc

UNITED STATES SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. 20549 FORM 10-Q QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the quarterly period ended September 30, 2019 Commission file number 1-32737 KOPPERS HOLDINGS INC. (Exact name of registrant as specified in its charter) Pennsylvania 20-1878963 (State of incorporation) (IRS Employer Identification No.) 436 Seventh Avenue Pittsburgh, Pennsylvania 15219 (Address of principal executive offices) (412) 227-2001 (Registrant’s telephone number, including area code) Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐ Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐ Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.: Large accelerated filer ☒ Accelerated filer ☐ Non-accelerated filer ☐ Smaller reporting company ☐ Emerging growth company ☐ If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards pursuant to Section 13(a) of the Exchange Act. -

Upcoming Exhibitions Help the History Center Shine

Volume 17 | No. 3 | Spring 2009 makingHISTORYThe Newsletter of the Senator John Heinz History Center Upcoming Exhibitions Help The History Center Shine resh off an exciting Pittsburgh 250 anni- Civil War and the details of Lincoln’s pre-inaugura- History Center By The Numbers versary celebration, the Senator John Heinz tion speech that was intended to soothe the public’s History Center recently announced a com- growing fear over a possible war. Fpelling schedule of upcoming exhibitions that will keep the museum buzzing for years to come. The outstanding lineup features a variety of Discovering the Real George Washington, blockbuster exhibitions that will complement the A View from Mount Vernon Number of 2009 History Maker awardees. History Center’s schedule of upcoming family pro- Feb. 12, 2010 – June 2010 7 Story, page 3. grams, community-based exhibits, and educational outreach. This brand new exhibition features highlights from Mount Vernon’s world-class collection of George Washington items, many of which have never trav- Lincoln: The Constitution and the Civil War eled outside of Virginia. and Lincoln Slept Here The History Center will serve as the first venue Nielsen rating of Pittsburgh’s Hidden Treasures . Presented by: PNC Financial Services Group on a national tour of Discovering the Real George 9.5Story, page 5. May 30, 2009 – February 2010 Washington, which celebrates the remarkable story of the first American hero. As part of Abraham Lincoln’s bicentennial in More than 100 original artifacts owned by, or Lincoln: 2009, the History Center will welcome closely related to, Washington will be on display, in- The Constitution and the Civil War , a 2,500 cluding: square-foot traveling exhibition from The National Constitution Center in Philadelphia. -

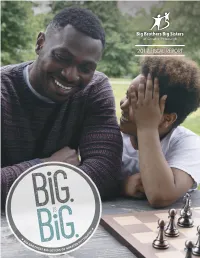

2017 Fiscal Report

2017 FISCAL REPORT 2017 BBBSPGH Fiscal Report | 1 "There Deji was..." Why the need for BBBSPGH? “It feels awesome to have a Big Brother because my father growth did not compromise excellence. We enhanced our wasn’t really there for me. My mom said, ‘Let’s get signed up training to our Bigs so they are better prepared to mentor their Mentors help youth overcome adversity to become productive members of our society— on something.' She looked this up, and there Deji was.” Littles. high school graduates, educated and trained workers, and good, honest community members. “There Deji was.” The Pennsylvania Big Brother and Big Sister of the Year Big Brother Deji and Little Brother Jordan have been are from our Pittsburgh agency. In November, we held our matched for two years. We asked Jordan and Deji to appear on first Match Maker Breakfast, adding an additional 40 donors the KDKA morning show “Pittsburgh Today Live” and they both to our individual giving program. We started a Campus-Based eagerly agreed to the opportunity to talk about BBBS and their Mentoring Program with University of Pittsburgh students on relationship. It can be risky to put a child on live television; just Saturday mornings. Children from the Rankin Christian Center like in “real life,” kids often say the darndest things. However, are transported to Pitt, and each child is assigned a mentor. unscripted, Jordan summed up his experience in these three Many of the mentors are first-generation college students simple words—”there Deji was.” proving to their Little that with perseverance and support, they Although Deji seemed to appear before Jordan like magic, a too can attend a college of their choice. -

Thanks to Our Donors

Celebrating DONORS and volunteer leadership PHOTO: LISA KYLE 2004 Left to right: Dolly Ellenberg, Vice President, Development; Suzy Broadhurst, Chair, Board of Trustees and Interim President; Maxwell King, President, Heinz Endowments; and Janet Sarbaugh, Program Director of the Heinz Endowments Arts & Culture Program 36 CARNEGIE • SUMMER 2005 Traditionally, the role of museums was primarily to preserve the past. Today, museums —particularly the four Carnegie Museums —play a Some of the key people we must thank for helping us reach these much more important role in people’s lives and in the development achievements are: of the communities they serve. Time after time, our museums amaze • Janie Thompson, chair of the Trustee/Board Annual Giving Fund us with the thought-provoking exhibitions, innovative educational and Development Committee. programs, special events, and community partnerships they develop and the impact they have on our region. • Peter Veeder, chair of the Annual Sustaining Fund. • Ray Steeb and Lou Cestello, co-chairs of the Corporate Yet, none of these things would be possible without the generosity of Committee. our many wonderful supporters, some of whom you’ll read about on the following pages. Carnegie Museums has always been inspired to • Debbie Dick, chair of the Individual Gifts Committee. reach out to the region and do great things by the passionate support These individuals give so much of themselves year after year and truly and strong commitment of our donors —and we’ve thrived as a result. lead by example. We are thankful for their support and friendship. Over the years, one of our most remarkable supporters has also We would also like to take this opportunity to recognize three other been one of our most steadfast: The Heinz Endowments. -

Dr. Sharon Feng and Stephen R. Tritch Elected to Koppers Board of Directors

Dr. Sharon Feng and Stephen R. Tritch Elected to Koppers Board of Directors May 6, 2009 PITTSBURGH, PA, May 06, 2009 (MARKETWIRE via COMTEX) -- The shareholders of Koppers Holdings Inc. (NYSE: KOP) have elected Dr. Sharon Feng and Stephen R. Tritch as directors of the company at the Koppers Annual Meeting of Shareholders. In addition, T. Michael Young was reelected as a Director of Koppers. Dr. Feng is currently the Vice President, Industrial and Environmental Affairs/Logistics Management of LANXESS Corporation. Previously, Dr. Feng served as the Vice President of Business Development, Coatings and Adhesives, Asia Pacific Region for Bayer MaterialScience. In this role, Dr. Feng was responsible for the construction of the Polymer Research and Development Center in Shanghai and establishing the technical organization to support Bayer's business in the Asia Pacific region. Dr. Feng was also the Director of Polyurethane Research, North America for Bayer MaterialScience. Dr. Feng is the author of 30 technical publications and has been the invited speaker for numerous professional and technical conferences. Mr. Tritch is currently the Chairman of Westinghouse Electric Company. He served as the Chairman and Chief Executive Officer of Westinghouse since 2002. Mr. Tritch held numerous managerial positions from the time he began his Westinghouse career in 1971 as a product engineer in the former Power Circuit Breaker Division. He is a member of the American Nuclear Society and was appointed by President George W. Bush to the President's Export Council in 2007. In addition Mr. Tritch is the Chairman of the Engineering Board of Visitors at the University of Pittsburgh and Chairman of the Board of Trustees for the Senator John Heinz History Center in Pittsburgh. -

General Brehon B.Somervell

General Brehon B. Somervell and the Revival ofKoppers Company byJohn K.Ohl THEENDof World War II,the Koppers vast Mellon empire, decided to clean up the Koppers mishmash. Co. was widelyconsidered tobe the "dog"of Spurred by poor earnings from the public utilities and the obvious the Pittsburgh-based Mellon family empire. need to bring order to the corporate structure, he had the Born inthe early years of the century, the company reorganized in1944. Also, incompliance with a Securi- company was known best formanufacturing ties and Exchange Commission finding that Koppers' control of a by- product coke oven designed by Heinrich Eastern Gas and Fuel violated the Public Utilities Holding Koppers.ATThe by-product ovens made possible recovery of valuable Company Act,plans were developed to sell Eastern Gas and Fuel, chemicals that previously were lost up the chimney ofthe old- whichhad the effect of takingKoppers out of the utilitybusiness fashioned beehive coke oven. By the 1920s, the Mellon family and and almost everything that went withit,such as the coal mining a few of their intimates controlled Koppers, and under the leader- and railroad operations. Other elements were consolidated into ship of Henry B.Rust, president from 1915 until 1933, the firm one company centered on 14 divisions.2 experienced spectacular growth. Rust then expanded into soft-coal The 1944 reorganization gave ailingKoppers the form of mining,construction and operation of artificial gas and by-product corporate unification. Butfor itto be translated into substance, coke plants, ownership of a steel company and blast furnaces, Koppers needed fresh leadership. J. -

Pittsburgh Manufacturers Move Toward Greater Environmental Sustainability, Set New Goals

Pittsburgh manufacturers move toward greater environmental sustainability, set new goals https://www.bizjournals.com/pittsburgh/news/2021/03/02/pittsburgh-manufacturers-face- environmental-impact.html Julia Mericle 2 March 2021 Pittsburgh Business Times © 2021 American City Business Journals, Inc. All rights reserved. "Our journey started by figuring out how to measure everything.” Waste generation. Energy consumption. Water usage. Greenhouse gas emissions. All from a global perspective. Stephanie Reese, global environmental, health and safety and product stewardship manager at Pittsburgh-based MSA Safety Inc., said for the company to improve its environmental sustainability, it had to collect, analyze and, transparently, report this massive amount of data. It's a task that local companies have increasingly been diving into. For many manufacturers, 2020 provided an optimal time to address and prioritize environmental, social and corporate governance (ESG) performance. “The challenges of the last year have really brought to light a lot of these questions about what makes for a strong company over the long haul,” Joylette Portlock, executive director at Sustainable Pittsburgh, said. “As a result, we see more companies examining what it means to be a good employer, a responsible manufacturer or service provider, and a supportive community leader.” The U.S. Environmental Protection Agency attributes 22% of the nation’s total greenhouse gas emissions to industrial sources, and the Pittsburgh metropolitan area marks manufacturing as its fourth-largest industry, according to the 2018 Catalyst Connection Manufacturing Scorecard. “Imagine if every single one of these manufacturers was able to reduce the energy used in its processes by just a small percentage,” Portlock said.