Utility-Scale Solar: Empirical Trends in Project Technology, Cost

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

WHAT IS the FUTURE ENERGY JOBS ACT? an In-Depth Look Into Illinois’ New Energy Legislation

CUB WHAT IS THE FUTURE ENERGY JOBS ACT? An in-depth look into Illinois’ new energy legislation The Future Energy Jobs Act (Senate Bill of negotiations between energy companies, 2814) is one of the most signifi cant pieces consumer advocates, and environmental groups. of energy legislation ever to pass the Illinois This fact sheet is designed to show you how General Assembly. It followed nearly two years the new law will impact electric customers. MAIN FEATURES OF THE ACT HOW DO THESE CONSUMER PROTECTIONS HELP ME? ENERGY EFFICIENCY Energy Effi ciency • Requires Commonwealth Edison and Ameren Illinois— What the act does: the state’s two biggest electric utilities—to dramatically It requires Illinois’ largest electric utilities to launch one of expand their energy effi ciency programs and reduce the nation’s most ambitious plans for customer electricity electricity waste, lowering Illinois power bills by billions savings. By 2030, ComEd must expand and enhance custom- of dollars through 2030. er effi ciency programs to cut electricity waste by a record • Expands the defi nition of “low income” beyond just 21.5 percent, and Ameren by 16 percent. people who qualify for state assistance, and it directs the utilities to engage with economically disadvantaged communities in designing and delivering new programs 21.5% 16% for customers most challenged to pay bills. RENEWABLE ENERGY Why that’s important: For years, Illinois effi ciency standards have required utilities to • Fixes Illinois’ renewable energy laws, which will spark offer a whole menu of helpful programs—such as refrigerator billions of dollars in new investment to develop wind and recycling and rebates on effi cient appliances—that allow cus- solar power in Illinois. -

Boulder Solar Power JUN 3 2016 MBR App.Pdf

20160603-5296 FERC PDF (Unofficial) 6/3/2016 12:51:20 PM UNITED STATES OF AMERICA BEFORE THE FEDERAL ENERGY REGULATORY COMMISSION Boulder Solar Power, LLC ) Docket No. ER16-_____-000 APPLICATION FOR MARKET-BASED RATE AUTHORIZATION, REQUEST FOR DETERMINATION OF CATEGORY 1 SELLER STATUS, REQUEST FOR WAIVERS AND BLANKET AUTHORIZATIONS, AND REQUEST FOR WAIVER OF PRIOR NOTICE REQUIREMENT Pursuant to Section 205 of the Federal Power Act (“FPA”),1 Section 35.12 of the regulations of the Federal Energy Regulatory Commission (“FERC” or the “Commission”),2 Rules 204 and 205 of the Commission’s Rules of Practice and Procedure,3 and FERC Order Nos. 697, et al.4 and Order No. 816,5 Boulder Solar Power, LLC (“Applicant”) hereby requests that the Commission: (1) accept Applicant’s proposed baseline market-based rate tariff (“MBR Tariff”) for filing; (2) authorize Applicant to sell electric energy, capacity, and certain ancillary services at market-based rates; (3) designate Applicant as a Category 1 Seller in all regions; and (4) grant Applicant such waivers and blanket authorizations as the Commission has granted to other sellers with market-based rate authorization. Applicant requests that the Commission waive its 60-day prior notice requirement6 to allow Applicant’s MBR Tariff to become effective as of July 1, 2016. In support of this Application, Applicant states as follows: 1 16 U.S.C. § 824d (2012). 2 18 C.F.R. § 35.12 (2016). 3 Id. §§ 385.204 and 385.205. 4 Mkt.-Based Rates for Wholesale Sales of Elec. Energy, Capacity & Ancillary Servs. by Pub. Utils., Order No. -

The Unseen Costs of Solar-Generated Electricity

THE UNSEEN COSTS OF SOLAR-GENERATED ELECTRICITY Megan E. Hansen, BS, Strata Policy Randy T Simmons, PhD, Utah State University Ryan M. Yonk, PhD, Utah State University The Institute of Political Economy (IPE) at Utah State University seeks to promote a better understanding of the foundations of a free society by conducting research and disseminating findings through publications, classes, seminars, conferences, and lectures. By mentoring students and engaging them in research and writing projects, IPE creates diverse opportunities for students in graduate programs, internships, policy groups, and business. PRIMARY INVESTIGATORS: Megan E. Hansen, BS Strata Policy Randy T Simmons, PhD Utah State University Ryan M. Yonk, PhD Utah State University STUDENT RESEARCH ASSOCIATES: Matthew Crabtree Jordan Floyd Melissa Funk Michael Jensen Josh Smith TABLE OF CONTENTS Table of Contents ................................................................................................................................................................ 2 Executive Summary ............................................................................................................................................................. 1 Introduction ......................................................................................................................................................................... 1 Solar Energy and the Grid ............................................................................................................................................ -

Solar Thermal Energy an Industry Report

Solar Thermal Energy an Industry Report . Solar Thermal Technology on an Industrial Scale The Sun is Our Source Our sun produces 400,000,000,000,000,000,000,000,000 watts of energy every second and the belief is that it will last for another 5 billion years. The United States An eSolar project in California. reached peak oil production in 1970, and there is no telling when global oil production will peak, but it is accepted that when it is gone the party is over. The sun, however, is the most reliable and abundant source of energy. This site will keep an updated log of new improvements to solar thermal and lists of projects currently planned or under construction. Please email us your comments at: [email protected] Abengoa’s PS10 project in Seville, Spain. Companies featured in this report: The Acciona Nevada Solar One plant. Solar Thermal Energy an Industry Report . Solar Thermal vs. Photovoltaic It is important to understand that solar thermal technology is not the same as solar panel, or photovoltaic, technology. Solar thermal electric energy generation concentrates the light from the sun to create heat, and that heat is used to run a heat engine, which turns a generator to make electricity. The working fluid that is heated by the concentrated sunlight can be a liquid or a gas. Different working fluids include water, oil, salts, air, nitrogen, helium, etc. Different engine types include steam engines, gas turbines, Stirling engines, etc. All of these engines can be quite efficient, often between 30% and 40%, and are capable of producing 10’s to 100’s of megawatts of power. -

Estimating the Quantity of Wind and Solar Required to Displace Storage-Induced Emissions † ‡ Eric Hittinger*, and Ineŝ M

Article Cite This: Environ. Sci. Technol. 2017, 51, 12988-12997 pubs.acs.org/est Estimating the Quantity of Wind and Solar Required To Displace Storage-Induced Emissions † ‡ Eric Hittinger*, and Ineŝ M. L. Azevedo † Department of Public Policy, Rochester Institute of Technology, Rochester, New York 14623, United States ‡ Department of Engineering & Public Policy, Carnegie Mellon University, Pittsburgh, Pennsylvania 15213, United States *S Supporting Information ABSTRACT: The variable and nondispatchable nature of wind and solar generation has been driving interest in energy storage as an enabling low-carbon technology that can help spur large-scale adoption of renewables. However, prior work has shown that adding energy storage alone for energy arbitrage in electricity systems across the U.S. routinely increases system emissions. While adding wind or solar reduces electricity system emissions, the emissions effect of both renewable generation and energy storage varies by location. In this work, we apply a marginal emissions approach to determine the net system CO2 emissions of colocated or electrically proximate wind/storage and solar/storage facilities across the U.S. and determine the amount of renewable energy ff fi required to o set the CO2 emissions resulting from operation of new energy storage. We nd that it takes between 0.03 MW (Montana) and 4 MW (Michigan) of wind and between 0.25 MW (Alabama) and 17 MW (Michigan) of solar to offset the emissions from a 25 MW/100 MWh storage device, depending on location and operational mode. Systems with a realistic combination of renewables and storage will result in net emissions reductions compared with a grid without those systems, but the anticipated reductions are lower than a renewable-only addition. -

Fire Fighter Safety and Emergency Response for Solar Power Systems

Fire Fighter Safety and Emergency Response for Solar Power Systems Final Report A DHS/Assistance to Firefighter Grants (AFG) Funded Study Prepared by: Casey C. Grant, P.E. Fire Protection Research Foundation The Fire Protection Research Foundation One Batterymarch Park Quincy, MA, USA 02169-7471 Email: [email protected] http://www.nfpa.org/foundation © Copyright Fire Protection Research Foundation May 2010 Revised: October, 2013 (This page left intentionally blank) FOREWORD Today's emergency responders face unexpected challenges as new uses of alternative energy increase. These renewable power sources save on the use of conventional fuels such as petroleum and other fossil fuels, but they also introduce unfamiliar hazards that require new fire fighting strategies and procedures. Among these alternative energy uses are buildings equipped with solar power systems, which can present a variety of significant hazards should a fire occur. This study focuses on structural fire fighting in buildings and structures involving solar power systems utilizing solar panels that generate thermal and/or electrical energy, with a particular focus on solar photovoltaic panels used for electric power generation. The safety of fire fighters and other emergency first responder personnel depends on understanding and properly handling these hazards through adequate training and preparation. The goal of this project has been to assemble and widely disseminate core principle and best practice information for fire fighters, fire ground incident commanders, and other emergency first responders to assist in their decision making process at emergencies involving solar power systems on buildings. Methods used include collecting information and data from a wide range of credible sources, along with a one-day workshop of applicable subject matter experts that have provided their review and evaluation on the topic. -

Alphabet's 2019 CDP Climate Change Report

Alphabet, Inc. - Climate Change 2019 C0. Introduction C0.1 (C0.1) Give a general description and introduction to your organization. As our founders Larry and Sergey wrote in the original founders' letter, "Google is not a conventional company. We do not intend to become one." That unconventional spirit has been a driving force throughout our history -- inspiring us to do things like rethink the mobile device ecosystem with Android and map the world with Google Maps. As part of that, our founders also explained that you could expect us to make "smaller bets in areas that might seem very speculative or even strange when compared to our current businesses." From the start, the company has always strived to do more, and to do important and meaningful things with the resources we have. Alphabet is a collection of businesses -- the largest of which is Google. It also includes businesses that are generally pretty far afield of our main internet products in areas such as self-driving cars, life sciences, internet access and TV services. We report all non- Google businesses collectively as Other Bets. Our Alphabet structure is about helping each of our businesses prosper through strong leaders and independence. We have always been a company committed to building products that have the potential to improve the lives of millions of people. Our product innovations have made our services widely used, and our brand one of the most recognized in the world. Google's core products and platforms such as Android, Chrome, Gmail, Google Drive, Google Maps, Google Play, Search, and YouTube each have over one billion monthly active users. -

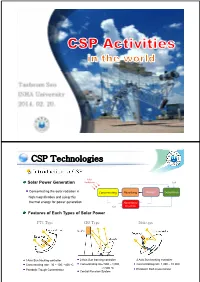

CSP Technologies

CSP Technologies Solar Solar Power Generation Radiation fuel Concentrating the solar radiation in Concentrating Absorbing Storage Generation high magnification and using this thermal energy for power generation Absorbing/ fuel Reaction Features of Each Types of Solar Power PTC Type CRS Type Dish type 1Axis Sun tracking controller 2 Axis Sun tracking controller 2 Axis Sun tracking controller Concentrating rate : 30 ~ 100, ~400 oC Concentrating rate: 500 ~ 1,000, Concentrating rate: 1,000 ~ 10,000 ~1,500 oC Parabolic Trough Concentrator Parabolic Dish Concentrator Central Receiver System CSP Technologies PTC CRS Dish commercialized in large scale various types (from 1 to 20MW ) Stirling type in ~25kW size (more than 50MW ) developing the technology, partially completing the development technology development is already commercialized efficiency ~30% reached proper level, diffusion level efficiency ~16% efficiency ~12% CSP Test Facilities Worldwide Parabolic Trough Concentrator In 1994, the first research on high temperature solar technology started PTC technology for steam generation and solar detoxification Parabolic reflector and solar tracking system were developed <The First PTC System Installed in KIER(left) and Second PTC developed by KIER(right)> Dish Concentrator 1st Prototype: 15 circular mirror facets/ 2.2m focal length/ 11.7㎡ reflection area 2nd Prototype: 8.2m diameter/ 4.8m focal length/ 36㎡ reflection area <The First(left) and Second(right) KIER’s Prototype Dish Concentrator> Dish Concentrator Two demonstration projects for 10kW dish-stirling solar power system Increased reflection area(9m dia. 42㎡) and newly designed mirror facets Running with Solo V161 Stirling engine, 19.2% efficiency (solar to electricity) <KIER’s 10kW Dish-Stirling System in Jinhae City> Dish Concentrator 25 20 15 (%) 10 발전 효율 5 Peak. -

2011 Indiana Renewable Energy Resources Study

September 2011 2011 Indiana Renewable Energy Resources Study Prepared for: Indiana Utility Regulatory Commission and Regulatory Flexibility Committee of the Indiana General Assembly Indianapolis, Indiana State Utility Forecasting Group | Energy Center at Discovery Park | Purdue University | West Lafayette, Indiana 2011 INDIANA RENEWABLE ENERGY RESOURCES STUDY State Utility Forecasting Group Energy Center Purdue University West Lafayette, Indiana David Nderitu Tianyun Ji Benjamin Allen Douglas Gotham Paul Preckel Darla Mize Forrest Holland Marco Velastegui Tim Phillips September 2011 2011 Indiana Renewable Energy Resources Study - State Utility Forecasting Group 2011 Indiana Renewable Energy Resources Study - State Utility Forecasting Group Table of Contents List of Figures .................................................................................................................... iii List of Tables ...................................................................................................................... v Acronyms and Abbreviations ............................................................................................ vi Foreword ............................................................................................................................ ix 1. Overview ............................................................................................................... 1 1.1 Trends in renewable energy consumption in the United States ................ 1 1.2 Trends in renewable energy consumption in Indiana -

Environmental and Economic Benefits of Building Solar in California Quality Careers — Cleaner Lives

Environmental and Economic Benefits of Building Solar in California Quality Careers — Cleaner Lives DONALD VIAL CENTER ON EMPLOYMENT IN THE GREEN ECONOMY Institute for Research on Labor and Employment University of California, Berkeley November 10, 2014 By Peter Philips, Ph.D. Professor of Economics, University of Utah Visiting Scholar, University of California, Berkeley, Institute for Research on Labor and Employment Peter Philips | Donald Vial Center on Employment in the Green Economy | November 2014 1 2 Environmental and Economic Benefits of Building Solar in California: Quality Careers—Cleaner Lives Environmental and Economic Benefits of Building Solar in California Quality Careers — Cleaner Lives DONALD VIAL CENTER ON EMPLOYMENT IN THE GREEN ECONOMY Institute for Research on Labor and Employment University of California, Berkeley November 10, 2014 By Peter Philips, Ph.D. Professor of Economics, University of Utah Visiting Scholar, University of California, Berkeley, Institute for Research on Labor and Employment Peter Philips | Donald Vial Center on Employment in the Green Economy | November 2014 3 About the Author Peter Philips (B.A. Pomona College, M.A., Ph.D. Stanford University) is a Professor of Economics and former Chair of the Economics Department at the University of Utah. Philips is a leading economic expert on the U.S. construction labor market. He has published widely on the topic and has testified as an expert in the U.S. Court of Federal Claims, served as an expert for the U.S. Justice Department in litigation concerning the Davis-Bacon Act (the federal prevailing wage law), and presented testimony to state legislative committees in Ohio, Indiana, Kansas, Oklahoma, New Mexico, Utah, Kentucky, Connecticut, and California regarding the regulations of construction labor markets. -

Analysis of Solar Community Energy Storage for Supporting Hawaii's 100% Renewable Energy Goals Erin Takata [email protected]

The University of San Francisco USF Scholarship: a digital repository @ Gleeson Library | Geschke Center Master's Projects and Capstones Theses, Dissertations, Capstones and Projects Spring 5-19-2017 Analysis of Solar Community Energy Storage for Supporting Hawaii's 100% Renewable Energy Goals Erin Takata [email protected] Follow this and additional works at: https://repository.usfca.edu/capstone Part of the Natural Resources Management and Policy Commons, Oil, Gas, and Energy Commons, and the Sustainability Commons Recommended Citation Takata, Erin, "Analysis of Solar Community Energy Storage for Supporting Hawaii's 100% Renewable Energy Goals" (2017). Master's Projects and Capstones. 544. https://repository.usfca.edu/capstone/544 This Project/Capstone is brought to you for free and open access by the Theses, Dissertations, Capstones and Projects at USF Scholarship: a digital repository @ Gleeson Library | Geschke Center. It has been accepted for inclusion in Master's Projects and Capstones by an authorized administrator of USF Scholarship: a digital repository @ Gleeson Library | Geschke Center. For more information, please contact [email protected]. This Master's Project Analysis of Solar Community Energy Storage for Supporting Hawaii’s 100% Renewable Energy Goals by Erin Takata is submitted in partial fulfillment of the requirements for the degree of: Master of Science in Environmental Management at the University of San Francisco Submitted: Received: ...................................……….. ................................…………. -

Understanding Solar Lease Revenues

LIVE WORK PLAY RETIRE TURNING LAND INTO REVENUES: UNDERSTANDING SOLAR LEASE REVENUES Reprint Date: August 25, 2020 Mayor Kiernan McManus Council Member Council Member Council Member Council Member Mayor pro tem Claudia Bridges Tracy Folda Judith A. Hoskins James Howard Adams City Manager Finance Director Alfonso Noyola, ICMA-CM Diane Pelletier, CPA Boulder City Revenue Overview Table of Contents Unlike most other municipalities and counties in Nevada, the revenue stream for Boulder City does not include the lucrative Some History . gaming tax. Prior to the recession of 2007 - 2009, the City’s • 4 • revenue stream did not have a sizable amount of monies from land leases. With the recent focus by California and more Charter/Ordinance Requirements recently at the national level on renewable energy development, • 4 • the City was in a key position to take advantage of its unique Land Lease Process position for solar development by leasing city-owned land for • 6 • energy production. Because of those prudent actions, today the Energy Lease Revenue History solar lease revenues equate to roughly 28% to 34% of the City’s • 7 • overall revenue stream to support vital governmental functions. Energy Lease Revenue Projections • • But is Land Lease Revenue Stable? 9 A common question posed to our City Council surrounds the Energy Lease Revenue Potential stability of land lease revenues. Traditional commercial or • 9 • residential land leases have many risks, as the tenants are Overall Energy Lease Revenue subject to market conditions or changes in employment. And History and Projections with recessions, these types of leases are common casualties • 10 • of a downturn in the economy.