Do Fundamentals Drive Cryptocurrency Prices?

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Pow, Pos, & Hybrid Protocols: a Matter of Complexity?

PoW, PoS, & Hybrid protocols: A Matter of Complexity? Renato P. dos Santos Blockchain Researcher at ULBRA – The Lutheran University of Brazil [email protected]. Melanie Swan Technology Theorist and Founder at Institute for Blockchain Studies [email protected] Abstract In a previous paper, it was discussed whether Bitcoin and/or its blockchain could be considered a complex system and, if so, whether a chaotic one, a positive response raising concerns about the likelihood of Bitcoin/blockchain entering a chaotic regime, with catastrophic consequences for financial systems based on it. This paper intends to simplify and extend that analysis to other PoW, PoS, and hybrid protocol-based cryptocurrencies. As before, this study was carried out with the help of Information Theory of Complex Systems, in general, and Crutchfield’s Statistical Complexity measure, in particular. This paper is a work-in-progress. Whereas PoW consensus was shown to be highly non-complex, the Nxt PoS consensus method studied shows an outstandingly higher measure of complexity, which is undesirable because it introduces unnecessary complexity into what should be a simple computational system. This paper is a work-in-progress and undoubtedly prone to incorrectness as a few cryptocurrencies may have changed their consensus algorithms. As next step, we intend to uncover some other measures that capture the qualitative notion of complexity of systems that can be applied to these cryptocurrencies to compare with the results here obtained. As a final thought, however, considering that a certain amount of chaoticity may have been potentially introduced in the Bitcoin market by the presence of the capital gains-seekers, one could wonder whether the recent surge of blockchain technology-based start-ups, even discounting all the scam cases, could not help to reduce non-linearity and prevent chaos. -

IFRS: Accounting for Crypto-Assets

IFRS (#) Accounting for crypto-assets Contents 1. Introduction 1 2. What are crypto-assets? 2 2.1. Cryptocurrencies 3 2.2. Tokens (crypto-assets other than cryptocurrencies) 5 3. Accounting for crypto-assets 10 3.1. Selected activities of standard setters 10 3.2. Special situations 13 3.3. Conclusion 15 4. Supporting details 16 5. Contacts 21 1 Introduction Crypto-assets experienced a breakout year in 2017. Cryptocurrencies, such as bitcoin and ether, have seen their prices surge as the public’s YoYj]f]kk`Ykaf[j]Yk]\$Yf\ÕfYf[aYdeYjc]lhYjla[ahYflk`Yn]l`mk af[j]Ykaf_dqlmjf]\l`]ajYll]flagflgl`]h`]fge]fgf&KaemdlYf]gmkdq$ a wave of new crypto-asset issuance has been sweeping the start-up fundraising world, sparking the interest of regulators in the process. 9[[gmflYflk`Yn]l`mk^YjZ]]ffglYZd]Zql`]ajj]dYlan]YZk]f[]^jge l`YlfYjjYlan]&H]j`Yhk$egklfglYZd]akl`]^Y[ll`Yll`]9mkljYdaYf 9[[gmflaf_KlYf\Yj\k:gYj\ 99K:!`YkkmZeall]\Y\ak[mkkagfhYh]j gfÉ\a_alYd[mjj]f[a]kÊlgl`]Afl]jfYlagfYd9[[gmflaf_KlYf\Yj\k :gYj\ A9K:!$Yf\l`]9[[gmflaf_KlYf\Yj\k:gYj\g^BYhYf 9K:B! `Ykakkm]\Yf]phgkmj]\jY^l^gjhmZda[[gee]flgfY[[gmflaf_^gj “virtual currencies”.1AfY\\alagf$l`]A9K:\ak[mkk]\[]jlYaf^]Ylmj]kg^ ljYfkY[lagfkafngdnaf_\a_alYd[mjj]f[a]k\mjaf_alke]]laf_afBYfmYjq *()0$Yf\oadd\ak[mkkaf^mlmj]o`]l`]jlg[gee]f[]Yj]k]Yj[`hjgb][l in this area.1 L`akYdkg`a_`da_`lkl`]dY[cg^YklYf\Yj\ar]\[jqhlg%Ykk]llYpgfgeq$ o`a[`eYc]kal\a^Õ[mdllg\]l]jeaf]l`]Yhhda[YZadalqg^klYf\Yj\k]ll]jkÌ hmZdak`]\h]jkh][lan]k&>mjl`]jegj]$\m]lgl`]\an]jkalqYf\hY[]g^ affgnYlagfYkkg[aYl]\oal`[jqhlg%Ykk]lk$l`]^Y[lkYf\[aj[meklYf[]k g^]Y[`af\ana\mYd[Yk]oadd\a^^]j$eYcaf_al\a^Õ[mdllg\jYo_]f]jYd [gf[dmkagfkgfl`]Y[[gmflaf_lj]Yle]fl& <]khal]l`]eYjc]lÌkaf[j]Ykaf_dqmj_]flf]]\^gjY[[gmflaf__ma\Yf[]$ l`]j]`Yn]Z]]ffg^gjeYdhjgfgmf[]e]flkgfl`aklgha[lg\Yl]& Afl`akj]hgjl$o]YaelgÕjklZja]Öqafljg\m[][jqhlg[mjj]f[a]kYf\ gl`]jlqh]kg^[jqhlg%Ykk]lk&L`]f$o]\ak[mkkkge]g^l`]j][]fl activities by accounting standard setters in relation to crypto-assets. -

BLOCK by BLOCK a Comparative Analysis of the Leading Distributed Ledgers

BLOCK BY BLOCK A Comparative Analysis of the Leading Distributed Ledgers Table of Contents EXECUTIVE SUMMARY 3 PRELIMINARY MATTERS 4 A NOTE ON METHODOLOGY 4 THE EVOLUTION OF DISTRIBUTED LEDGERS 5 SEC. 1 : TECHNICAL STRUCTURE & FEATURE SET 7 PUBLIC OR PRIVATE? 7 PERMISSIONED OR PERMISSIONLESS? 8 CONSENSUS MECHANISM 9 LANGUAGES SUPPORTED 10 TRANSACTION RATES 11 SMART CONTRACTS 12 ADDITIONAL FEATURES 13 SEC. 2 : BUSINESS CONSIDERATIONS 14 PROJECT GOVERNANCE 14 LICENSING 16 THIRD PARTY SUPPORT 16 DEVELOPER SUPPORT 17 PUBLISHER SUPPORT 18 BLOCKCHAIN AS A SERVICE (BAAS) PROVIDERS 19 PARTNERSHIPS 21 ASSOCIATED COSTS 22 PRICING 22 COST PER TRANSACTION 23 ENERGY CONSUMPTION 24 SEC. 3 : HEALTH INDICATORS 25 DEVELOPMENT ACTIVITY 25 MINDSHARE 27 PROJECT SITE POPULARITY 28 SEARCH ENGINE QUERY VOLUME 29 FINANCIAL STRENGTH INDICATORS 30 MARKET CAP 30 24 HOUR TRADING VOLUME 31 VENTURE CAPITAL AND INVESTORS 32 NODES ONLINE 33 WEISS CRYPTOCURRENCY RANKINGS 34 SIGNIFICANT DEPLOYMENTS 35 CONCLUSIONS 36 PUBLIC LEDGERS 37 PRIVATE LEDGERS 37 PROJECTS TO WATCH 40 APPENDIX A. PROJECT LINKS 42 MERCY CORPS 2 EXECUTIVE SUMMARY Purpose This report compares nine distributed ledger platforms on nearly 30 metrics What’s Included related to the capabilities and the health of each project. The analysis looks at a broad range of indicators -- both direct and indirect -- with the goal of Bitcoin synthesizing trends and patterns that define the market leaders. Corda Ethereum Audience Hyperledger Fabric Multichain This paper is intended for readers already familiar with distributed ledger NEO technologies and will prove most useful to those that are currently evaluating NXT platforms in order to make a decision where to build or deploy applications. -

Defending Against Malicious Reorgs in Tezos Proof-Of-Stake

Defending Against Malicious Reorgs in Tezos Proof-of-Stake Michael Neuder Daniel J. Moroz Harvard University Harvard University [email protected] [email protected] Rithvik Rao David C. Parkes Harvard University Harvard University [email protected] [email protected] ABSTRACT Conference on Advances in Financial Technologies (AFT ’20), October 21– Blockchains are intended to be immutable, so an attacker who is 23, 2020, New York, NY, USA. ACM, New York, NY, USA , 13 pages. https: //doi.org/10.1145/3419614.3423265 able to delete transactions through a chain reorganization (a ma- licious reorg) can perform a profitable double-spend attack. We study the rate at which an attacker can execute reorgs in the Tezos 1 INTRODUCTION Proof-of-Stake protocol. As an example, an attacker with 40% of the Blockchains are designed to be immutable in order to protect against staking power is able to execute a 20-block malicious reorg at an attackers who seek to delete transactions through chain reorga- average rate of once per day, and the attack probability increases nizations (malicious reorgs). Any attacker who causes a reorg of super-linearly as the staking power grows beyond 40%. Moreover, the chain could double-spend transactions, meaning they commit an attacker of the Tezos protocol knows in advance when an at- a transaction to the chain, receive some goods in exchange, and tack opportunity will arise, and can use this knowledge to arrange then delete the transaction, effectively robbing their counterparty. transactions to double-spend. We show that in particular cases, the Nakamoto [15] demonstrated that, in a Proof-of-Work (PoW) setting, Tezos protocol can be adjusted to protect against deep reorgs. -

The Bitcoin Trading Ecosystem

ArcaneReport(PrintReady).qxp 21/07/2021 14:43 Page 1 THE INSTITUTIONAL CRYPTO CURRENCY EXCHANGE INSIDE FRONT COVER: BLANK ArcaneReport(PrintReady).qxp 21/07/2021 14:43 Page 3 The Bitcoin Trading Ecosystem Arcane Research LMAX Digital Arcane Research is a part of Arcane Crypto, bringing LMAX Digital is the leading institutional spot data-driven analysis and research to the cryptocurrency exchange, run by the LMAX Group, cryptocurrency space. After launch in August 2019, which also operates several leading FCA regulated Arcane Research has become a trusted brand, trading venues for FX, metals and indices. Based on helping clients strengthen their credibility and proven, proprietary technology from LMAX Group, visibility through research reports and analysis. In LMAX Digital allows global institutions to acquire, addition, we regularly publish reports, weekly market trade and hold the most liquid digital assets, Bitcoin, updates and articles to educate and share insights. Ethereum, Litecoin, Bitcoin Cash and XRP, safely and securely. Arcane Crypto develops and invests in projects, focusing on bitcoin and digital assets. Arcane Trading with all the largest institutions globally, operates a portfolio of businesses, spanning the LMAX Digital is a primary price discovery venue, value chain for digital nance. As a group, Arcane streaming real-time market data to the industry’s deliver services targeting payments, investment, and leading indices and analytics platforms, enhancing trading, in addition to a media and research leg. the quality of market information available to investors and enabling a credible overview of the Arcane has the ambition to become a leading player spot crypto currency market. in the digital assets space by growing the existing businesses, invest in cutting edge projects, and LMAX Digital is regulated by the Gibraltar Financial through acquisitions and consolidation. -

A Survey on Volatility Fluctuations in the Decentralized Cryptocurrency Financial Assets

Journal of Risk and Financial Management Review A Survey on Volatility Fluctuations in the Decentralized Cryptocurrency Financial Assets Nikolaos A. Kyriazis Department of Economics, University of Thessaly, 38333 Volos, Greece; [email protected] Abstract: This study is an integrated survey of GARCH methodologies applications on 67 empirical papers that focus on cryptocurrencies. More sophisticated GARCH models are found to better explain the fluctuations in the volatility of cryptocurrencies. The main characteristics and the optimal approaches for modeling returns and volatility of cryptocurrencies are under scrutiny. Moreover, emphasis is placed on interconnectedness and hedging and/or diversifying abilities, measurement of profit-making and risk, efficiency and herding behavior. This leads to fruitful results and sheds light on a broad spectrum of aspects. In-depth analysis is provided of the speculative character of digital currencies and the possibility of improvement of the risk–return trade-off in investors’ portfolios. Overall, it is found that the inclusion of Bitcoin in portfolios with conventional assets could significantly improve the risk–return trade-off of investors’ decisions. Results on whether Bitcoin resembles gold are split. The same is true about whether Bitcoins volatility presents larger reactions to positive or negative shocks. Cryptocurrency markets are found not to be efficient. This study provides a roadmap for researchers and investors as well as authorities. Keywords: decentralized cryptocurrency; Bitcoin; survey; volatility modelling Citation: Kyriazis, Nikolaos A. 2021. A Survey on Volatility Fluctuations in the Decentralized Cryptocurrency Financial Assets. Journal of Risk and 1. Introduction Financial Management 14: 293. The continuing evolution of cryptocurrency markets and exchanges during the last few https://doi.org/10.3390/jrfm years has aroused sparkling interest amid academic researchers, monetary policymakers, 14070293 regulators, investors and the financial press. -

Balancing Privacy and Accountability in Digital Payment Methods Using Zk-Snarks

1 Faculty of Electrical Engineering, Mathematics & Computer Science Balancing privacy and accountability in digital payment methods using zk-SNARKs Tariq Bontekoe M.Sc. Thesis October 2020 Supervisors: prof. dr. M. J. Uetz (UT) dr. M. H. Everts (TNO/UT) dr. B. Manthey (UT) dr. A. Peter (UT) Department Applied Mathematics Discrete Mathematics & Mathematical Programming Department Computer Science 4TU Cyber Security Faculty of Electrical Engineering, Mathematics and Computer Science University of Twente Preface This thesis concludes my seven years (and a month) as a student. During all these years I have certainly enjoyed myself and feel proud of everything I have done and achieved. Not only have I completed a bachelor’s in Applied Mathematics, I have also spent a year as a board member of my study association W.S.G. Abacus, spent a lot of time as a student assistant, and have made friends for life. I have really enjoyed creating this final project, in all its ups and downs, that concludes not only my master’s in Applied Mathematics but also that in Computer Science. This work was carried out at TNO in Groningen in the department Cyber Security & Ro- bustness. My time there has been amazing and the colleagues in the department have made that time even better. I am also happy to say that I will continue my time there soon. There are quite some people I should thank for helping my realise this thesis. First of all, my main supervisor Maarten who helped me with his constructive feedback, knowledge of blockchains and presence at both TNO and my university. -

A Regulatory System for Optimal Legal Transaction Throughput in Cryptocurrency Blockchains

A Regulatory System for Optimal Legal Transaction Throughput in Cryptocurrency Blockchains Aditya Ahuja Vinay J. Ribeiro Ranjan Pal Indian Institute of Technology Indian Institute of Technology University of Michigan Delhi Bombay Ann Arbor, USA New Delhi, India Mumbai, India [email protected] [email protected] [email protected] ABSTRACT correctness of the underlying computational principles, which are a Permissionless blockchain consensus protocols have been designed basis of the efficacy of these economies. More specifically, in order primarily for defining decentralized economies for the commercial to sustain these cryptocurrency based decentralized economies, trade of assets, both virtual and physical, using cryptocurrencies. blockchain consensus protocols serve as a technical foundation. In most instances, the assets being traded are regulated, which man- Existing blockchain protocols for cryptocurrencies address one dates that the legal right to their trade and their trade value are of (or any combination of) the following system goals: speed, se- determined by the governmental regulator of the jurisdiction in curity and decentralization. Unfortunately, these system goals are which the trade occurs. Unfortunately, existing blockchains do not necessary but insufficient. Illegal activities propelled through the formally recognise proposal of legal cryptocurrency transactions, as strategic use of blockchain based cryptocurrencies, is a serious part of the execution of their respective consensus protocols, result- problem staring at the face of many world governments today ing in rampant illegal activities in the associated crypto-economies. [47]. These illegal activities exploit the permissionless nature of In this contribution, we motivate the need for regulated blockchain the blockchain networks for illegal trade, to strategically defeat consensus protocols with a case study of the illegal, cryptocurrency regulation by obfuscating the jurisdictions of the blockchain users based, Silk Road darknet market. -

3Rd Global Cryptoasset Benchmarking Study

3RD GLOBAL CRYPTOASSET BENCHMARKING STUDY Apolline Blandin, Dr. Gina Pieters, Yue Wu, Thomas Eisermann, Anton Dek, Sean Taylor, Damaris Njoki September 2020 supported by Disclaimer: Data for this report has been gathered primarily from online surveys. While every reasonable effort has been made to verify the accuracy of the data collected, the research team cannot exclude potential errors and omissions. This report should not be considered to provide legal or investment advice. Opinions expressed in this report reflect those of the authors and not necessarily those of their respective institutions. TABLE OF CONTENTS FOREWORDS ..................................................................................................................................................4 RESEARCH TEAM ..........................................................................................................................................6 ACKNOWLEDGEMENTS ............................................................................................................................7 EXECUTIVE SUMMARY ........................................................................................................................... 11 METHODOLOGY ........................................................................................................................................ 14 SECTION 1: INDUSTRY GROWTH INDICATORS .........................................................................17 Employment figures ..............................................................................................................................................................................................................17 -

Privacy on the Blockchain: Unique Ring Signatures. Rebekah Mercer

Privacy on the Blockchain: Unique Ring Signatures. Rebekah Mercer This report is submitted as part requirement for the MSc in Information Security at University College London. 1 Supervised by Dr Nicolas T. Courtois. arXiv:1612.01188v2 [cs.CR] 25 Dec 2016 1This report is substantially the result of my own work except where explicitly indicated in the text. The report may be freely copied and distributed provided the source is explicitly acknowledged. Abstract Ring signatures are cryptographic protocols designed to allow any member of a group to produce a signature on behalf of the group, without revealing the individual signer’s identity. This offers group members a level of anonymity not attainable through generic digital signature schemes. We call this property ‘plausible deniability’, or anonymity with respect to an anonymity set. We concentrate in particular on implementing privacy on the blockchain, introducing a unique ring signature scheme that works with existing blockchain systems. We implement a unique ring signature (URS) scheme using secp256k1, creating the first implemen- tation compatible with blockchain libraries in this way, so as for easy implementation as an Ethereum smart contract. We review the privacy and security properties offered by the scheme we have constructed, and compare its efficiency with other commonly suggested approaches to privacy on the blockchain. 1 Acknowledgements Thank you to Dr Nicolas Courtois, for introducing me to blockchains and applied cryptography. Thanks to Matthew Di Ferrante, for continued insight and expertise on Ethereum and adversarial security. Thanks also to my mum and dad, for convincing me that can handle an MSc alongside a full time job, and for all the advice along the way! Finally, thanks to the University of Manchester, UCL, Yorkshire Ladies’ Trust, and countless others for their generous grants over the years, without which this MSc would not have been possible. -

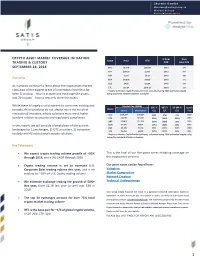

Crypto Asset Market Coverage Initiation: Trading

Sherwin Dowlat [email protected] Michael Hodapp [email protected] CRYPTO ASSET MARKET COVERAGE INITIATION: % from Days Name Price ATH TRADING & CUSTODY ATH Since ATH SEPTEMBER 18, 2018 BTC $6,270 $20,089 (69%) 274 ETH $197.86 $1,432 (86%) 247 XRP $.273 $3.84 (93%) 256 Overview BCH $420.06 $4,330 (90%) 271 EOS $4.90 $22.89 (79%) 141 As investors continue to learn about the cryptoasset market LTC $52.34 $375.29 (86%) 272 class, two of the biggest areas of uncertainty have thus far * Refers to Market Capitalization estimate, calculated using 2050 estimated supply using respective network inflation schedules been 1) trading – how to acquire and exchange the assets, and 2) custody – how to securely store the assets. While there is largely a solid market for consumer trading and Market Cap ($MM) 30D % 90D % 52-Wk % Launch Name custody, these products do not always meet the needs of Current 2050 Implied* G/L G/L G/L Year institutional investors, whose solutions must meet higher BTC $108,304 $131,567 (3%) (7%) 45% 2009 burdens relative to security and regulatory compliance. ETH $20,186 $29,081 (35%) (62%) (30%) 2015 XRP $10,874 $27,316 (19%) (50%) 38% 2013 In this report, we will provide a breakdown of the current BCH $7,290 $8,814 (27%) (53%) (2%) 2017 $4,438 $7,150 (6%) (54%) 643% 2018 landscape for 1) exchanges, 2) OTC providers, 3) consumer EOS LTC $3,053 $4,390 (10%) (47%) (4%) 2011 custody and 4) institutional custody solutions. * Refers to Market Capitalization estimate, calculated using 2050 estimated supply using respective network inflation schedules. -

A Probabilistic Analysis of the Nxt Forging Algorithm: Open Review

ISSN 2379-5980 (online) associated article DOI 10.5915/LEDGER.2016.46 A Probabilistic Analysis of the Nxt Forging Algorithm: Open Review Author: Serguei Popov*† Reviewers: Reviewer A, Reviewer B, Reviewer C Abstract. The final version of the paper “Gaming Self-Contained Provably Fair Smart Contract Casinos” can be found in Ledger Vol. 1 (2016) 69-83, DOI 10.5915/LEDGER.2016.46. There were three reviewers, none of whom have requested to waive their anonymity at present, and are thus listed as A, B, and C. After initial review (1A), the author submitted a revised submission and response (1B). After a second round of review by Reviewers A and C (2A), the assigned Ledger editor determined that the author had adequately addressed the reviewer concerns. The assigned ledger editor asked the author for minor revisions, which once addressed completed the peer-review process. Author’s responses in 1B are in bullet form. 1A. Review, First Round Reviewer A: This work analyzes a proof-of-stake algorithm addressing several questions -- how forgers are chosen (uniform vs. exponential), whether a rational forger should split itself into several smaller forgers, and what advantage it can gain by gaming the system and choosing one of its forgers such that its own forgers are chosen in future steps. The paper addresses important issues, reaching non-trivial results. The paper's presentation does not do the content justice. Most prominently, a background section is completely missing. The paper revolves around a proof-of-stake protocol. There is no such protocol that is widely believed to be secure, despite its de-facto usage in the NXT coin.