European Exchange Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

ANNA Annual Report.Indd

Association of National Numbering Agencies scrl AAnnualnnual RReporteport 22014013 Contents 3 Chairman’s Report 2014 5 Objectives and mission statements of ANNA 6 General meetings – ANNA administrative review 2014 13 ANNA Service Bureau – report for 2014 14 Securities business and state of ISIN implementation – worldwide 16 Allocation of ISIN for new financial instruments 19 Working Groups, Task Forces and Reginal Groups 25 List of members by COUNTRY as per May 2015 Appendices 29 A ISO 6166 – an outline of the standard 30 B ANNA Guidelines for ISO 6166, Version 12, August 2014 40 C Geographical division of countries among substitute agencies as per May 2015 50 D ISO 10962 – outline of the CFI-(Classification of financial Instruments-) Code 2 www.anna-web.com Chairman’s Report 2014 Dear ANNA Members and Partners, Association strategy, re-evaluating the approved short, medium and long term The year 2014 has been referred to as the direction. Some modifications were made transitionary year from the Age of Recovery to and the Association strategy was presented the Age of Divergence. for validation by the members at the last EGM; Looking at the events of 2014, Central Bank - A growing number of ANNA members actions and divergence have been the under- continued to contribute to the evolution of lying themes. The view remains that these the ISO 17442 – Legal Entity Identifier (LEI) two factors are having and will continue to standard, to promote ANNA’s federated have, significant influence on the global model and the value added benefits of our financial markets and the direction they will model and the National Numbering Agencies take in the near future. -

Final Report Amending ITS on Main Indices and Recognised Exchanges

Final Report Amendment to Commission Implementing Regulation (EU) 2016/1646 11 December 2019 | ESMA70-156-1535 Table of Contents 1 Executive Summary ....................................................................................................... 4 2 Introduction .................................................................................................................... 5 3 Main indices ................................................................................................................... 6 3.1 General approach ................................................................................................... 6 3.2 Analysis ................................................................................................................... 7 3.3 Conclusions............................................................................................................. 8 4 Recognised exchanges .................................................................................................. 9 4.1 General approach ................................................................................................... 9 4.2 Conclusions............................................................................................................. 9 4.2.1 Treatment of third-country exchanges .............................................................. 9 4.2.2 Impact of Brexit ...............................................................................................10 5 Annexes ........................................................................................................................12 -

Portfolio Optimization Analysis of Federation of Euro-Asian Stock Exchances (FEAS)

California State University, San Bernardino CSUSB ScholarWorks Theses Digitization Project John M. Pfau Library 2003 Portfolio optimization analysis of federation of Euro-Asian stock exchances (FEAS) Selim Larlar Follow this and additional works at: https://scholarworks.lib.csusb.edu/etd-project Part of the Corporate Finance Commons Recommended Citation Larlar, Selim, "Portfolio optimization analysis of federation of Euro-Asian stock exchances (FEAS)" (2003). Theses Digitization Project. 2365. https://scholarworks.lib.csusb.edu/etd-project/2365 This Project is brought to you for free and open access by the John M. Pfau Library at CSUSB ScholarWorks. It has been accepted for inclusion in Theses Digitization Project by an authorized administrator of CSUSB ScholarWorks. For more information, please contact [email protected]. PORTFOLIO OPTIMIZATION ANALYSIS OF FEDERATION OF ' EURO-ASIAN STOCK EXCHANGES (FEAS) A Project Presented to the Faculty of California State University, San Bernardino In Partial Fulfillment of the Requirements for the Degree Master of Business Administration Selim Larlar December 2003 PORTFOLIO OPTIMIZATION ANALYSIS OF FEDERATION OF EURO-ASIAN STOCK EXCHANGES (FEAS) i A Project I Presented to the ! Faculty of i California State University, San Bernardino I t I I i by Selim Larlar December 2003 Date ABSTRACT Institutional and individual investors all around the I globe are looking for different ways to diversify their I stock portfolio. This thesis will give them a chance to i understand the difference between Euro-Asian stock market i portfolios and the S&P 500. This thesis will also compare I performance analyses among ten founding members of the Federation of Euro-Asian Stock Exchanges (FEAS), the S&P 500 Indey, the Ten Composite Index and four sample portfolios, consisting of the ten founding member countries of FEAS and S&P 500. -

The List of Approved Stock Exchanges

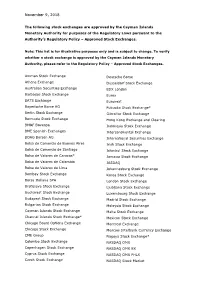

November 9, 2018 The following stock exchanges are approved by the Cayman Islands Monetary Authority for purposes of the Regulatory Laws pursuant to the Authority’s Regulatory Policy – Approved Stock Exchanges. Note: This list is for illustrative purposes only and is subject to change. To verify whether a stock exchange is approved by the Cayman Islands Monetary Authority, please refer to the Regulatory Policy – Approved Stock Exchanges. Amman Stock Exchange Deutsche Borse Athens Exchange Dusseldorf Stock Exchange Australian Securities Exchange EDX London Barbados Stock Exchange Eurex BATS Exchange Euronext Bayerische Borse AG Fukuoka Stock Exchange* Berlin Stock Exchange Gibraltar Stock Exchange Bermuda Stock Exchange Hong Kong Exchange and Clearing BM&F Bovespa Indonesia Stock Exchange BME Spanish Exchanges Intercontinental Exchange BOAG Borsen AG International Securities Exchange Bolsa de Comercio de Buenos Aires Irish Stock Exchange Bolsa de Comercio de Santiago Istanbul Stock Exchange Bolsa de Valores de Caracas* Jamaica Stock Exchange Bolsa de Valores de Colombia JASDAQ Bolsa de Valores de Lima Johannesburg Stock Exchange Bombay Stock Exchange Korea Stock Exchange Borsa Italiana SPA London Stock Exchange Bratislava Stock Exchange Ljubljana Stock Exchange Bucharest Stock Exchange Luxembourg Stock Exchange Budapest Stock Exchange Madrid Stock Exchange Bulgarian Stock Exchange Malaysia Stock Exchange Cayman Islands Stock Exchange Malta Stock Exchange Channel Islands Stock Exchange* Mexican Stock Exchange Chicago Board Options Exchange -

Doing Data Differently

General Company Overview Doing data differently V.14.9. Company Overview Helping the global financial community make informed decisions through the provision of fast, accurate, timely and affordable reference data services With more than 20 years of experience, we offer comprehensive and complete securities reference and pricing data for equities, fixed income and derivative instruments around the globe. Our customers can rely on our successful track record to efficiently deliver high quality data sets including: § Worldwide Corporate Actions § Worldwide Fixed Income § Security Reference File § Worldwide End-of-Day Prices Exchange Data International has recently expanded its data coverage to include economic data. Currently it has three products: § African Economic Data www.africadata.com § Economic Indicator Service (EIS) § Global Economic Data Our professional sales, support and data/research teams deliver the lowest cost of ownership whilst at the same time being the most responsive to client requests. As a result of our on-going commitment to providing cost effective and innovative data solutions, whilst at the same time ensuring the highest standards, we have been awarded the internationally recognized symbol of quality ISO 9001. Headquartered in United Kingdom, we have staff in Canada, India, Morocco, South Africa and United States. www.exchange-data.com 2 Company Overview Contents Reference Data ............................................................................................................................................ -

Over 100 Exchanges Worldwide 'Ring the Bell for Gender Equality in 2021' with Women in Etfs and Five Partner Organizations

OVER 100 EXCHANGES WORLDWIDE 'RING THE BELL FOR GENDER EQUALITY IN 2021’ WITH WOMEN IN ETFS AND FIVE PARTNER ORGANIZATIONS Wednesday March 3, 2021, London – For the seventh consecutive year, a global collaboration across over 100 exchanges around the world plan to hold a bell ringing event to celebrate International Women’s Day 2021 (8 March 2020). The events - which start on Monday 1 March, and will last for two weeks - are a partnership between IFC, Sustainable Stock Exchanges (SSE) Initiative, UN Global Compact, UN Women, the World Federation of Exchanges and Women in ETFs, The UN Women’s theme for International Women’s Day 2021 - “Women in leadership: Achieving an equal future in a COVID-19 world ” celebrates the tremendous efforts by women and girls around the world in shaping a more equal future and recovery from the COVID-19 pandemic. Women leaders and women’s organizations have demonstrated their skills, knowledge and networks to effectively lead in COVID-19 response and recovery efforts. Today there is more recognition than ever before that women bring different experiences, perspectives and skills to the table, and make irreplaceable contributions to decisions, policies and laws that work better for all. Women in ETFs leadership globally are united in the view that “There is a natural synergy for Women in ETFs to celebrate International Women’s Day with bell ringings. Gender equality is central to driving the global economy and the private sector has an important role to play. Our mission is to create opportunities for professional development and advancement of women by expanding connections among women and men in the financial industry.” The list of exchanges and organisations that have registered to hold an in person or virtual bell ringing event are shown on the following pages. -

List of Approved Regulated Stock Exchanges

Index Governance LIST OF APPROVED REGULATED STOCK EXCHANGES The following announcement applies to all equity indices calculated and owned by Solactive AG (“Solactive”). With respect to the term “regulated stock exchange” as widely used throughout the guidelines of our Indices, Solactive has decided to apply following definition: A Regulated Stock Exchange must – to be approved by Solactive for the purpose calculation of its indices - fulfil a set of criteria to enable foreign investors to trade listed shares without undue restrictions. Solactive will regularly review and update a list of eligible Regulated Stock Exchanges which at least 1) are Regulated Markets comparable to the definition in Art. 4(1) 21 of Directive 2014/65/EU, except Title III thereof; and 2) provide for an investor registration procedure, if any, not unduly restricting foreign investors. Other factors taken into account are the limits on foreign ownership, if any, imposed by the jurisdiction in which the Regulated Stock Exchange is located and other factors related to market accessibility and investability. Using above definition, Solactive has evaluated the global stock exchanges and decided to include the following in its List of Approved Regulated Stock Exchanges. This List will henceforth be used for calculating all of Solactive’s equity indices and will be reviewed and updated, if necessary, at least annually. List of Approved Regulated Stock Exchanges (February 2017): Argentina Bosnia and Herzegovina Bolsa de Comercio de Buenos Aires Banja Luka Stock Exchange -

Bofa List of Execution Venues

This List of Execution Venues and the associated Bank of America EMEA Order Execution Policy Summary form part of the General Terms & Conditions of Business available on the Bank of America MifID II Website www.bofaml.com/mifid2 The tables below set out the execution venues accessed by entities in the Bank of America Entities List and Associated Companies. These tables are not exhaustive and we may amend them from time to time in accordance with our policies. MLI and BofASE may also use other execution venues from time to time where they deem appropriate but in accordance with their policies (including the Bank of America Order Execution Policy). Asset class Region Regulated Markets of which MLI / BofASE is a direct member and MTFs accessed by MLI / BofASE Equities EMEA Aquis UK Equities EMEA Athex Group Equities EMEA Bloomberg BV Equities EMEA Bloomberg UK Equities EMEA Borsa Italiana Equities EMEA Cboe BV Equities EMEA Cboe UK Equities EMEA Deutsche Borse Xetra Equities EMEA Equiduct Equities EMEA Euronext Amsterdam Equities EMEA Euronext Brussels Equities EMEA Euronext Dublin Equities EMEA Euronext Lisbon Equities EMEA Euronext Oslo Equities EMEA Euronext Paris Equities EMEA ITG Posit Equities EMEA Liquidnet Equities EMEA Liquidnet Europe Equities EMEA London Stock Exchange 1 – ©2020 Bank of America Corporation Asset class Region Regulated Markets of which MLI / BofASE is a direct member and MTFs accessed by MLI / BofASE Equities EMEA NASDAQ OMX Nordic – Helsinki Equities EMEA NASDAQ OMX Nordic – Stockholm Equities EMEA NASDAQ OMX -

Public Listed Company in Bulgaria

Public Listed Company in Bulgaria The Bulgaria Stock Exchange operates in Sofia and was originally founded as Sofia Stock Exchange on April 1914 and it was re-established in 1991, after ceasing its operations during World War II. A Joint Stock Company (JSC) in Bulgaria is registered on the Register of the Public Companies as a Public Listed Company, the founders of which may be physical or legal persons of any nationality. Its Board of Directors must consist of at least 3 and not more than 9 persons. Its shares are traded on the Bulgarian Stock Exchange and are always dematerialized, registered and managed by the Central Depository. The minimum estimated value of the assets of a JSC in Bulgaria should 500.000 BGN. In the event where the estimated value falls below of this amount, then the Company ceases to be Public. Public Listed Companies, in general, enjoy the benefit of limited scrutiny due to their status of being listed in Stock Exchanges and in certain cases they can receive exemptions from reporting requirements under local regulations. The majority of Money Laundering Legislation around the world categorizes them as low-risk clients and the Due Diligence and KYC requirements for Public Listed Companies are very limited: in some instances may not even exist. Our Services: • Set up of a Public Bulgarian Company, according to the requirements of the legislation, in order for it to be listed on the Bulgaria Stock Exchange. • Drafting the constitutional documentation and the memorandum. • Assistance for completing and preparing the application, according to the current legislation and regulations. -

Stock Exchange and Suffix Table Ml/Business Wire Stock Exchanges.Pdf Last Updated 12 March 2021

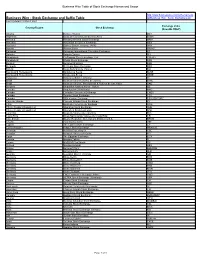

Business Wire Table of Stock Exchange Names and Usage http://www.businesswire.com/schema/news Business Wire - Stock Exchange and Suffix Table ml/Business_Wire_Stock_Exchanges.pdf Last Updated 12 March 2021 Exchange Value Country/Region Stock Exchange (NewsML ONLY) Albania Bursa e Tiranës BET Argentina Bolsa de Comercio de Buenos Aires BCBA Armenia Nasdaq Armenia Stock Exchange ARM Australia Australian Securities Exchange ASX Australia Sydney Stock Exchange (APX) APX Austria Wiener Börse WBAG Bahamas Bahamas International Securities Exchange BS Bahrain Bahrain Bourse BH Bangladesh Chittagong Stock Exchange, Ltd. CSEBD Bangladesh Dhaka Stock Exchange DSE Belgium Euronext Brussels BSE Bermuda Bermuda Stock Exchange BSX Bolivia Bolsa Boliviana de Valores BO Bosnia and Herzegovina Banjalucka Berza BLSE Bosnia and Herzegovina Sarajevska Berza SASE Botswana Botswana Stock Exchange BT Brazil Bolsa de Valores do Rio de Janeiro BVRJ Brazil Bolsa de Valores, Mercadorias & Futuros de Sao Paulo SAO Bulgaria Balgarska fondova borsa - Sofiya BB Canada Aequitas NEO Exchange NEO Canada Canadian Securities Exchange CNSX Canada Toronto Stock Exchange TSX Canada TSX Venture Exchange TSX VENTURE Cayman Islands Cayman Islands Stock Exchange KY Chile Bolsa de Comercio de Santiago SGO China, People's Republic of Shanghai Stock Exchange SHH China, People's Republic of Shenzhen Stock Exchange SHZ Colombia Bolsa de Valores de Colombia BVC Costa Rica Bolsa Nacional de Valores de Costa Rica CR Cote d'Ivoire Bourse Regionale Des Valeurs Mobilieres S.A. BRVM Croatia -

Northern Trust Emea Order Execution Policy

NORTHERN TRUST EMEA ORDER EXECUTION POLICY For Professional Clients of the following Northern Trust entities: • Northern Trust Global Services SE, and its branches • Northern Trust Securities LLP, and its branches • The Northern Trust Company, London branch Publication date: 1 January 2021 Contents INTRODUCTION .................................................................................................................................................................... 3 A. Purpose of this policy .................................................................................................................................................................................... 3 B. What is Best Execution? ............................................................................................................................................................................... 3 POLICY SCOPE ..................................................................................................................................................................... 4 A. Northern Trust entities subject to this Policy ................................................................................................................................................. 4 B. Types of Clients ............................................................................................................................................................................................. 4 C. Activities ....................................................................................................................................................................................................... -

Herefore Need to Recognise and Congratulate Them on Their Successes to Date

Press Release, Brussels, 9 June 2021 Launch of the European Small and Mid-Cap Awards 2021 The 9th edition of the European Small and Mid-Cap Awards will take place in November 2021 during the European Commission’s SME Week in Portorož, Slovenia. Small and mid-cap companies are vitally important in supporting the European economy. Equity is needed to buffer exogenous shocks and will be needed more than ever following the recent crisis so that public equity capital markets can perform to the best of their ability in helping businesses refinance their growth once the situation has subsided. Our Awards this year are even more significant as it is exactly these types of companies that will be key to re-equitising the European economy. We therefore need to recognise and congratulate them on their successes to date. EuropeanIssuers, the Federation of European Securities Exchanges (FESE) and the European Commission are delighted to announce that the following companies have been recognised within their national jurisdictions as the most outstanding listed companies across five categories: Nominations for the category Rising Star: • Almagro Capital listed on BME • Bilot PLC listed on Nasdaq Helsinki • Dadelo SA listed on Warsaw Stock Exchange • Ecomiam listed on Euronext • FOM Technologies listed on Nasdaq First North Growth Market Nominations for the category Star of 2021: • Aluflexpack AG listed on SIX Swiss Exchange • Compleo Charging Solutions AG listed on Deutsche Börse AG • eMan AS listed on Prague Stock Exchange • Entersoft SA listed on Athens Stock Exchange • Labomar SPA listed on Borsa Italiana • LeadDesk Oyj listed on Nasdaq Helsinki • Making Science listed on BME • Nacon SA listed on Euronext Nominations for the category International Star: • CZG - Česká zbrojovka Group SE listed on Prague Stock Exchange • Meritus ulaganja d.d.