Australian Share Index Quarterly Investment Option Update

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2021 Half Year Results Presentation 2 1H21 RESULTS PRESENTATION 15 April 2021

1H21 INVESTOR MATERIALS 15 April 2021 Half Year ended 28 February 2021 BANK OF QUEENSLAND LIMITED ABN 32 009 656 740. AFSL NO 244616. CONTENTS 1H21 RESULTS PRESENTATION 3 ABOUT BOQ 30 1H21 RESULTS 34 PORTFOLIO QUALITY 38 CAPITAL, FUNDING & LIQUIDITY 45 DIVISIONAL RESULTS 52 ECONOMIC ASSUMPTIONS 56 Bank of Queensland Limited 2021 Half Year Results Presentation 2 1H21 RESULTS PRESENTATION 15 April 2021 Half Year ended 28 February 2021 BANK OF QUEENSLAND LIMITED ABN 32 009 656 740. AFSL NO 244616. AGENDA INTRODUCTION Cherie Bell, General Manager Investor Relations RESULTS OVERVIEW George Frazis, Managing Director and CEO FINANCIAL DETAIL AND PORTFOLIO QUALITY Ewen Stafford, Chief Financial Officer and Chief Operating Officer SUMMARY & OUTLOOK George Frazis, Managing Director and CEO Q&A George Frazis, Managing Director and CEO Ewen Stafford, Chief Financial Officer and Chief Operating Officer Bank of Queensland Limited 2021 Half Year Results Presentation 4 RESULTS OVERVIEW GEORGE FRAZIS MANAGING DIRECTOR AND CEO 1H21 OVERVIEW 1. Statutory profit growth of 66%, cash net profit up 9%, and EPS growth of 3%1, reflecting strong growth whilst managing margin, costs and lower impairments 2. Good business momentum, with strong housing loan growth of 1.6x system and improved NIM to 1.95% 3. Delivering on the strategic transformation, over the last three halves, with go live of the first phase of the retail digital banking platform, and acquisition of ME Bank announced 4. Asset quality remains sound, reflected by loan impairment expense to GLAs reducing to 10bps and arrears reducing over the half. Prudent provision levels maintained 5. Capital strength to support business growth and transformation investment with CET1 of 10.03% 6. -

Westpac Online Investment Loan Acceptable Securities List - Effective 3 September2021

Westpac Online Investment Loan Acceptable Securities List - Effective 3 September2021 ASX listed securities ASX Code Security Name LVR ASX Code Security Name LVR A2M The a2 Milk Company Limited 50% CIN Carlton Investments Limited 60% ABC Adelaide Brighton Limited 60% CIP Centuria Industrial REIT 50% ABP Abacus Property Group 60% CKF Collins Foods Limited 50% ADI APN Industria REIT 40% CL1 Class Limited 45% AEF Australian Ethical Investment Limited 40% CLW Charter Hall Long Wale Reit 60% AFG Australian Finance Group Limited 40% CMW Cromwell Group 60% AFI Australian Foundation Investment Co. Ltd 75% CNI Centuria Capital Group 50% AGG AngloGold Ashanti Limited 50% CNU Chorus Limited 60% AGL AGL Energy Limited 75% COF Centuria Office REIT 50% AIA Auckland International Airport Limited 60% COH Cochlear Limited 65% ALD Ampol Limited 70% COL Coles Group Limited 75% ALI Argo Global Listed Infrastructure Limited 60% CPU Computershare Limited 70% ALL Aristocrat Leisure Limited 60% CQE Charter Hall Education Trust 50% ALQ Als Limited 65% CQR Charter Hall Retail Reit 60% ALU Altium Limited 50% CSL CSL Limited 75% ALX Atlas Arteria 60% CSR CSR Limited 60% AMC Amcor Limited 75% CTD Corporate Travel Management Limited ** 40% AMH Amcil Limited 50% CUV Clinuvel Pharmaceuticals Limited 40% AMI Aurelia Metals Limited 35% CWN Crown Limited 60% AMP AMP Limited 60% CWNHB Crown Resorts Ltd Subordinated Notes II 60% AMPPA AMP Limited Cap Note Deferred Settlement 60% CWP Cedar Woods Properties Limited 45% AMPPB AMP Limited Capital Notes 2 60% CWY Cleanaway Waste -

It's Personal

SIMON PUGH & PETER WOODS QLM Label Makers BOQ Business Banking customers It’s personal LYNNE POWER BOQ Owner-Manager KATIE KOCHANSKI Daisy Hill branch BOQ customer since age 7 Shareholder Review 2010 BOQ SHR 2010 FA - PRINT.indd 2 21/10/10 11:30 AM JONAH & AMBER Community members SHIRLEY KOLPAK Shareholder It’s personal BOQ SHR 2010 FA - PRINT.indd 3 21/10/10 11:30 AM CONTENTS 1 Operational overview 3 Acquisitions 4 Financial highlights 7 Chairman’s report 11 Managing Director’s report 15 Community 17 Customers 17 Environment 18 Employees 19 Executive team 21 Your Board 25 Remuneration overview 26 Financial calender BOQ SHR 2010 FA - PRINT.indd 4 21/10/10 11:30 AM BRAND RELAUNCH In February 2010, BOQ launched At BOQ, most of our branches are run by local a new brand promise: Owner-Managers. This means they’re running your own personal bank a small business, so they get what it means to The new brand was the culmination of deliver personal service. So we really can deliver an 18 month “inside out” brand review, on our promise of being your own personal bank. where both staff and customers helped The brand relaunch also represented the to really define what makes BOQ different perfect moment in time to reintroduce ourselves to the other banks. The overwhelming as BOQ, rather than the state-centric name of response was that for us, it’s personal. Bank of Queensland. Over the past decade, we have expanded right across Australia. And it all started with this simple question. -

Important Changes to the Commonwealth Awards Program

Important changes to the Commonwealth Awards program Changes to the Commonwealth Awards program As part of the changes that are being made to introduce new Commonwealth Bank American Express Cards alongside Commonwealth Bank MasterCard and Visa credit cards there are changes to the Commonwealth Awards program. From 23 October 2009 existing Platinum Awards, Gold Awards and Awards credit card accounts can request to receive a new Commonwealth Bank American Express credit card and a replacement Commonwealth Bank MasterCard or Visa credit card. Using the new Commonwealth Bank American Express credit card you’ll be able to earn Commonwealth Awards points faster: Commonwealth Awards points earned per dollar spent American Express® MasterCard®/Visa® Platinum Awards 3 Awards points 1 Awards point Gold Awards 2 Awards points 1 Awards point Awards 1.5 Awards points 1 Awards point From the end date of the statement issued on your card account in January 2010 there will be a change to the number of Awards points that you can earn (points capping) and the rates at which you are able to earn points. As a result changes will be made to your terms and conditions and these are detailed in the following pages. 1 Changes to the Commonwealth Awards program Clauses 18 and 19 of the Commonwealth Awards Program Terms and Conditions (17 August 2009) have been replaced with the following clauses. Earning Awards points 18. Members can earn Commonwealth Awards points relative to the number of Australian dollars charged, billed and paid for eligible transactions on their Card account. The number of Commonwealth Awards points a Member may earn is capped according to the Member’s Card type and whether or not the Member has opted-in to Qantas Frequent Flyer Direct. -

Specialist Australian Small Companies Quarterly Investment Option Update

Specialist Australian Small Companies Quarterly Investment Option Update 31 December 2020 Aim and Strategy Sector Allocation % To provide a total return (income and capital growth) Consumer Discretionary 21.97 after costs and before tax, above the performance Materials 17.24 benchmark, the S&P/ASX Small Ordinaries Industrials 14.87 Accumulation Index, on a rolling three-year basis. The Health Care 9.90 portfolio invests in small companies listed on the Information Technology 8.64 Australian Securities Exchange (ASX). For this Financials 6.06 portfolio small companies are considered to be those Communication Services 5.61 outside the top 100 listed companies (by market Consumer Staples 5.50 value). Up to 20% of the portfolio may be invested in Real Estate 5.37 unlisted companies that the investment manager Cash 2.80 believes are likely to be listed in the next 12 months, or Energy 2.05 in companies between the top 50 and 100 listed on the ASX. Top Holdings % City Chic Collective Ltd 2.49 Investment Option Performance Lynas Rare Earths Ltd 2.43 To view the latest investment performances for each Eagers Automotive Ltd 2.07 product, please visit www.amp.com.au/performance Integral Diagnostics Ltd 2.04 Marley Spoon AG 1.89 Investment Option Overview Technology One Ltd 1.85 Investment category Australian Shares Pilbara Minerals Ltd 1.84 Suggested minimum investment Seven Group Holdings Ltd 1.83 7 years timeframe Ingenia Communities Group 1.78 Relative risk rating Very High Auckland International Airport 1.75 Investment style Active Manager style Multi-manager Asset Allocation Benchmark (%) Australian Shares 100 Cash 0 Actual Allocation % International Shares 11.61 Australian Shares 82.23 Listed Property and Infrastructure 3.36 Cash 2.80 Fund Performance The Fund posted a very strong positive absolute return and outperformed its benchmark over the December quarter. -

Of the Corporations Act, AMP Limited Advises Its Current Interest in Shares of AMP Ltd

Company Secretary AMP Limited ABN: 49 079 354 519 33 Alfred Street Sydney NSW 2000 Australia GPO Box 4134 Sydney NSW 2001 Australia Email: [email protected] Web: amp.com.au Telephone: (02) 9257 5000 Facsimile: (02) 9257 7178 19-August-2021 Manager ASX Market Announcements Australian Securities Exchange Level 4, 20 Bridge Street Sydney NSW 2000 Notice Pursuant to Corporations Act Sub-section 259C(2) Exemption Dear Sir/Madam, Pursuant to an exemption under Sub-section 259C(2) of the Corporations Act, AMP Limited advises its current interest in shares of AMP Ltd. Marissa Bendyk Company Secretary, AMP Limited AMP Ltd ABN 49 079 354 519 Corporations Act 2001 Subsection 259C(2) Exemption To: AMP Ltd ACN/ARSN: 079 354 519 Shareholder: AMP Limited (ACN 079 354 519) and its related bodies corporate. Notice Date: 18-Aug-2021 1. Previous Notice Particulars of the shareholders' previous notice under sub-section 259C(2) exemption was given on: The previous notice was given to the company on: 05-Aug-2021 The previous notice was dated: 04-Aug-2021 2. Previous and present voting power The total number and percentage of shares in each class of voting shares in the company to which the shareholder has an interest in or derivative exposure to, when last required and when now required to give notice, are: Previous Notice Present Notice Class of securities Persons' votes Voting Power Persons' votes Voting Power Ordinary Share 53,430,902 1.64% 53,595,691 1.64% 3. Change in interest and derivative exposure Particulars of each change in, or change in the nature of, the interests of the substantial holder in, or derivative exposure to voting shares since the shareholder was last required to give a notice are: See Annexure 'A' 4. -

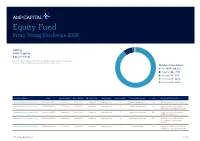

Equity Fund Proxy Voting Disclosure 2020

Equity Fund Proxy Voting Disclosure 2020 Voting AMP Capital Equity Fund Note: The below disclosures refer to Australian listed securities only and do not include foreign listed securities held in the portfolio. Number of resolutions: n For 1077 - 90.2% n Against 88 - 7.3% n Abstain 18 - 1.5% n Unvoted 8 – 0.7% n Unvoted 3 – 0.3% Company Name ISIN Meeting Date Record Date Meeting Type Proponent Proposal No. Type of Proposal Vote Proposal Description Northern Star Resources Ltd AU000000NST8 1/22/2020 1/20/2020 Ordinary Management 1 Capital Management For Ratify Placement of Securities Northern Star Resources Ltd AU000000NST8 1/22/2020 1/20/2020 Ordinary Management 2 Capital Management For Approve Issue of Securities (Executive chair Bill Beament) Northern Star Resources Ltd AU000000NST8 1/22/2020 1/20/2020 Ordinary Management 3 Capital Management For Approve Issue of Securities (NED Mary Hackett) Northern Star Resources Ltd AU000000NST8 1/22/2020 1/20/2020 Ordinary Management 4 Capital Management For Approve Issue of Securities (Former NED Christopher Rowe) Northern Star Resources Ltd AU000000NST8 1/22/2020 1/20/2020 Ordinary Management 5 Board Related For Approve Financial Assistance (Kalgoorlie Lake View Pty Ltd) AMP Capital Equity Fund 1 of 58 Company Name ISIN Meeting Date Record Date Meeting Type Proponent Proposal No. Type of Proposal Vote Proposal Description Virgin Money UK Plc. AU0000064966 1/29/2020 1/24/2020 Annual Management 1 Audit/Financials For Accounts and Reports Virgin Money UK Plc. AU0000064966 1/29/2020 1/24/2020 Annual Management 2 Compensation For Remuneration Policy (Binding) Virgin Money UK Plc. -

Bankwest Qantas Transaction Account Product Schedule

Bankwest Qantas Transaction Account Product Schedule NB: This Product Schedule is specific to the above account and/or any facility made available with the account. Together with the Schedule you will be given our Bankwest Investment and Transaction Accounts Terms and Conditions, our Bankwest Banking Services Rights and Obligations brochure, our Bankwest Your Guide to Banking Fees brochure and our Bankwest Account Access Conditions of Use. Together these documents comprise the Bank's Product Disclosure Statement (PDS) for the account and/or facility. 1 About the Qantas Transaction Account The Bankwest Qantas Transaction Account is an account for personal customers who are over 18 years of age that may earn credit interest, and provides unlimited access to Bankwest facilities, including over-the-counter, Bankwest ATMs, Phone Banking, Bankwest Online Banking and Cheque Access. There is a limit of one account per person, whether as a single or joint account holder. The Bankwest Qantas Transaction Account will allow customers to earn Qantas Frequent Flyer points. Qantas Frequent Flyer points may be subject to personal income or other tax assessment. You should check with your accountant or tax adviser for further information. 2 Features 2.1 This account offers the following optional facilities: A Payment Device*; Bankwest Online Banking; Bankwest Platinum Debit Mastercard - only available to Australian Citizens, Temporary or Permanent Residents over 18 with an Australian residential address (limited exceptions may apply subject to conditions), who deposit a minimum $4,000 to the account per calendar month; Cheque Access; Debit Mastercard - only available to Australian Citizens, Temporary or Permanent Residents over 18 with an Australian residential address (limited exceptions may apply subject to conditions); Direct Debit Facility; Online Business Banking Periodical Payments; and Phone Banking; *Effective 28 September 2021 the Bankwest Halo payment device is withdrawn from sale. -

Suncorp Group Limited (Sun) 3 August 2017

SUNCORP GROUP LIMITED (SUN) 3 AUGUST 2017 RESULTS Full Year 2017 Full Year 2016 CHANGE Cash Earnings ($m) 1,145 1,089 +5.1% Australian Insurance GWP ($m) 8,111 7,803 +3.9% Gross Written Premiums Australian Insurance NPAT ($m) 723 558 +29.6 Banking & Wealth NPAT ($m) 400 418 -4.3% Group NPAT ($m) 1,075 1,038 +3.6% Bloomberg Consensus ($m) 1,210 Final Dividend ($) 0.40 0.38 +5.3% Suncorp (SUN) insurance arm outperforms its banking division Suncorp Group Limited (SUN) cash profit for the 2017 full year came in lower than expected as the banking and insurance firm continues to spend on its refresh strategy. SUN posted a group Net Profit After Tax (NPAT) increase of 3.6% to $1,075 million, helped by a lift in insurance premiums and tight cost management. Suncorp’s Australian insurance business listed a better than expected lift in profit, helped by a 3.9% lift in Gross Written Premiums and lower costs from Natural hazards. SUN noted that recent elevated incidence claims within the income protection and trauma businesses are being carefully monitored. General insurance claims lifted in the second half of the year group claims ratio of 71.1% up from 66.4% in the first half of the year. Suncorp’s Life Insurance net profit after tax fell 50% to $34 million as the company works to keep underlying profits stable. Challenging market conditions has made it harder to lock in new business and renew contracts. SUN’s New Zealand insurance unit was hit by the Kaikoura earthquake and related reinsurance costs due to the quake. -

MACQUARIE GROUP CAPITAL NOTES 4 PROSPECTUS Guidance for Investors

Macquarie Group Capital Notes 4 Prospectus for the issue of Macquarie Group Capital Notes 4 (MCN4) to raise $750 million with the ability to raise more or less. Issuer Arranger and Joint Lead Managers Co-Managers Macquarie Group Limited Joint Lead Manager ANZ Securities Limited Macquarie Equities Limited ABN 94 122 169 279 Macquarie Capital Citigroup Global Markets Australia Bell Potter Securities Limited Pty Limited (Australia) Limited JBWere Limited Commonwealth Bank of Australia Ord Minett Limited Evans Dixon Corporate Advisory Pty Limited J.P. Morgan Securities Australia Limited Morgans Financial Limited National Australia Bank Limited Westpac Institutional Bank macquarie.com Important notices About this Prospectus Past performance information This Prospectus relates to the offer by Macquarie Group Limited The financial information provided in this Prospectus is for information ABN 94 122 169 279 (“MGL”) of Macquarie Group Capital Notes 4 purposes only and is not a forecast of performance to be expected in (“MCN4”) to raise $750 million with the ability to raise more or less future periods. Past performance and trends should not be relied upon (the “Offer”). as being indicative of future performance and trends. This Prospectus is dated 5 March 2019 and a copy was lodged with Financial statements and forward looking information the Australian Securities and Investments Commission (“ASIC”) on Section 3.7 sets out financial information in relation to MGL. The basis that date pursuant to section 713(1) of the Corporations Act 2001 of preparation of that information is set out in section 3.7. All financial (Cth) (“Corporations Act”) (as modified by the ASIC Corporations amounts contained in this Prospectus are expressed in Australian (Regulatory Capital Securities) Instrument 2016/71). -

Bankwest – Same Bank, Different Look. Yes, We're Evolving Our Look, But

Stay safe online. Never share your personal details or log into online banking accounts directly from an email or SMS. No images? view in browser. Bankwest – same bank, different look. Yes, we’re evolving our look, but rest assured we're still the same Bankwest on the inside – 125 years young and every bit committed to helping you and your customers bank less. While it won’t change the way you, your brokers or your customers bank with us, here’s how we will look a little different: 1. Different logo - we've taken inspiration from our current logo and created a new one that feels familiar. 2. Modern design - a new look that's been designed with a digital-first approach and is fuss- free. 3. Accessible colours - a brighter palette that’s easier for those with visual impairments to view and read info online. Rolling out a new look will take time, so our old logo and new logo will co-exist for a while before our refresh is complete. At first, you'll notice changes to our website, the Bankwest App and emails. After that, we'll update online banking, eStatements and our branches. In the meantime, if you see our old logo on a document, while our new logo is on an email – don't worry, it's still us! We ask that you please update the Bankwest logo across your internal platforms, systems, website, marketing materials, etc, using the attached file provided. To support brokers with keeping their websites and marketing materials up-to-date, we hope you can please share the attached logo and the below disclaimer message with accredited Bankwest brokers in your member base. -

AMP17367 Reviewvis 27.Indd

2013 shareholder review Dividends Dividend cents per share The fi nal dividend of Final dividend 11.5 cents per share will Interim dividend be paid on 10 April 2014. The fi nal dividend will be 30 30 70% franked and brings 30 29 the total dividend for 2013 25 16 15 to 23 cents per share. 14 23 The payout ratio for the 20 12.5 full 2013 dividend is 80% 11.5 of the 2013 underlying profi t, which is at the 15 15 top of AMP’s target payout 10 14 range of 70–80% of 12.5 underlying profi t. 11.5 0 2009 2010 2011 2012 2013 Annual general meeting AMP’s 2014 annual general meeting (AGM) will be held at 10.00am (AEST) on Thursday 8 May 2014 at the Savoy Ballroom, Grand Hyatt Melbourne, 123 Collins Street, Melbourne, Australia. Full details of the 2014 AGM, including the notice of meeting and a link to the live webcast, are available at amp.com.au/agm. AMP 2013 annual report The full AMP 2013 annual report, including the complete fi nancial report, can be found at amp.com.au/2013annualreport. AMP Limited ABN 49 079 354 519. Unless otherwise specified, all amounts are in Australian dollars. Information in the review is current as at 3 March 2014. AMP was founded on a simple yet bold idea – that every individual should have the power and ability to control his or her life. For more than 160 years, we’ve dedicated ourselves to making this possible. And while we’ve grown and changed over the decades, one thing has remained the same – our unwavering sense of purpose to help people own tomorrow.