Dr.Reddy's ��• Hyderabad - 500 034, Telangana, India

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

United Spirits Limited Corporate Identity Number: L01551KA1999PLC024991 Registered Office: ‘UB Tower’, #24, Vittal Mallya Road, Bangalore - 560 001

United Spirits Limited Corporate Identity Number: L01551KA1999PLC024991 Registered Office: ‘UB Tower’, #24, Vittal Mallya Road, Bangalore - 560 001. Tel: +91 80 3985 6500; Fax: +91 80 3985 6862; www.unitedspirits.in, Email: [email protected] NOTICE NOTICE IS HEREBY GIVEN OF THE FIFTEENTH ANNUAL GENERAL MEETING (“AGM”) of United Spirits Limited (the “Company”) to be held at Level 1, UB Tower, #24, Vittal Mallya Road, Bangalore 560 001 on Tuesday, September 30, 2014 at 2.30 p.m. for the following purposes: ORDINARY BUSINESS 1. To receive, consider and adopt the Audited Statement of Profit and Loss for the financial year ended March 31, 2014, the Balance Sheet as at that date and the Reports of the Directors and Auditors thereon. 2. To appoint a Director in place of Dr. Vijay Mallya (DIN: 00122890), who retires by rotation and being eligible, offers himself for re-appointment. 3. To consider and if thought fit, to pass with or without modification(s), the following resolution as an Ordinary Resolution: RESOLVED that the vacancy in the Board of Directors of the Company arising out of the retirement of Mr. Gilbert Ghostine (DIN: 06555302) who retires by rotation at this AGM and has not offered himself for re-appointment, not be filled up as of the current date. 4. To appoint Statutory Auditors and to fix their remuneration. To consider and if thought fit, to pass with or without modification(s), the following resolution as an Ordinary Resolution: RESOLVED that pursuant to the provisions of Section 139 of the Companies Act, 2013 and the rules made thereunder, and pursuant to the recommendation of the Audit Committee of the Board of Directors, M/s. -

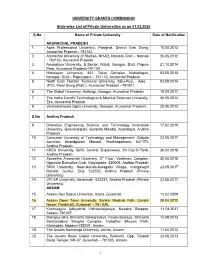

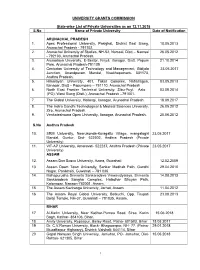

UNIVERSITY GRANTS COMMISSION State-Wise List of Private

UNIVERSITY GRANTS COMMISSION State-wise List of Private Universities as on 01.02.2020 S.No Name of Private University Date of Notification ARUNACHAL PRADESH 1. Apex Professional University, Pasighat, District East Siang, 10.05.2013 Arunachal Pradesh - 791102. 2. Arunachal University of Studies, NH-52, Namsai, Distt – Namsai 26.05.2012 - 792103, Arunachal Pradesh. 3. Arunodaya University, E-Sector, Nirjuli, Itanagar, Distt. Papum 21.10.2014 Pare, Arunachal Pradesh-791109 4. Himalayan University, 401, Takar Complex, Naharlagun, 03.05.2013 Itanagar, Distt – Papumpare – 791110, Arunachal Pradesh. 5. North East Frontier Technical University, Sibu-Puyi, Aalo 03.09.2014 (PO), West Siang (Distt.), Arunachal Pradesh –791001. 6. The Global University, Hollongi, Itanagar, Arunachal Pradesh. 18.09.2017 7. The Indira Gandhi Technological & Medical Sciences University, 26.05.2012 Ziro, Arunachal Pradesh. 8. Venkateshwara Open University, Itanagar, Arunachal Pradesh. 20.06.2012 S.No Andhra Pradesh 9. Bharatiya Engineering Science and Technology Innovation 17.02.2019 University, Gownivaripalli, Gorantla Mandal, Anantapur, Andhra Pradesh 10. Centurian University of Technology and Management, Gidijala 23.05.2017 Junction, Anandpuram Mandal, Visakhapatnam- 531173, Andhra Pradesh. 11. KREA University, 5655, Central, Expressway, Sri City-517646, 30.04.2018 Andhra Pradesh 12. Saveetha Amaravati University, 3rd Floor, Vaishnavi Complex, 30.04.2018 Opposite Executive Club, Vijayawada- 520008, Andhra Pradesh 13. SRM University, Neerukonda-Kuragallu Village, mangalagiri 23.05.2017 Mandal, Guntur, Dist- 522502, Andhra Pradesh (Private University) 14. VIT-AP University, Amaravati- 522237, Andhra Pradesh (Private 23.05.2017 University) ASSAM 15. Assam Don Bosco University, Azara, Guwahati 12.02.2009 16. Assam Down Town University, Sankar Madhab Path, Gandhi 29.04.2010 Nagar, Panikhaiti, Guwahati – 781 036. -

List of Registered Colonies Approved Under Hp Apartment

LIST OF REGISTERED COLONIES APPROVED UNDER H.P. APARTMENT AND PROPERTY REGULATION ACT, 2005 Sr. Name and Address of the Location of Project Licence No. & dated No Promoter . 1 2 3 4 Year-2005 (02) 1 Sh. Amarnath Aggarwal Village Dakru Pargana-Nalagarh, HIMUDA/LIC-1/2005 M/s Amar Nath Aggarwal Tehsil Nalagarh, District Solan, dated 5.10.2005. Builders Pvt. Ltd. Office 407, H.P. Motor Market, Mani Majra Chandigarh 2. Sh. Harish Aggarwal, M/s Mauza Katha Pargana, HIMUDA/LIC-2/2005 Mount View Group Housing Co. Dharampur( Baddi), Teshil dated 5.12.2005 Plot No.176, HPSIDC, Industrial Nalagarh, District Solan, H.P. Area, Baddi, District Solan, H.P. Year-2006 (11) 3. Sh. Lalit Jindal, M/s Hill View Village Bhatouli Kalan, Pargana- HIMUDA/LIC-3/2006 Infrastructure Pvt. Ltd-2048, Dharampur, Tehsil Nalagarh, dated 5.5.2006. Sector-15-C, Chandigarh, U.T. District Solan, H.P. 4. Sh. Amarnath Aggarwal, M/s Village Dakru Pargana-Nalagarh, HIMUDA/LIC-4/2006 Amar Nath Aggarwal Builders Tehsil Nalagarh, District Solan, dated 12.5.2006. Pvt. Ltd. Regd. Office, 407 H.P. Motor Market Manimajra Chandigarh and Central Office SCO-10-11, Sector, Panchkulla, Haryana 5. Sh. Ashwin Johar, M/s MDC Village Bhatouli Kalan, Pargana, HIMUDA/LIC-5/2006 Estates Pvt. Ltd. 319, Sector-21- Dharampur, Tehsil Nalagarh, dated 17.6.2006 A, Chandigarh U.T. District Solan, H.P. 6. Sh. Daleep Moudgil, M/s Omax Village Billanwali Gujran HIMUDA/LIC-6/2006 Construction Ltd.,7-Local Pargana-Dharampur, Tehsil dated 4.7.2006 Shopping Centre, Omax House, Nalagarh, District Solan, H.P. -

Application for Appointment on the Post of Assistant Professor

I Block-202, Gillco Towers, Gillco Valley, Kharar,Sector 127, Mohali, Punjab E-mail: [email protected] Mobile: 91-8628885639, 91-8894987978 Dr. GEORGE THOMAS OBJECTIVE My goal is to be associated with an institution that can utilize my experience and skills; hereafter augmenting both its productivity and position that will eventually amalgamate into my growth and expansion. PROFESSIONAL ASSOCIATION: Life member of All India Management Association (AIMA), Membership No. LM- 200811196, since 1st April, 2008 Former Joint Secretary of Gwalior Management Association, January 2013-14 Counselor for M.B.A. program for Gwalior Chapter in Indira Gandhi National Open University (IGNOU), ID No. 04136 Editor/ Member Editorial Board Editor-in-Chief of ‘The Catalyst Journal of Management’, a refereed bi-annual Journal of School of Management Studies, Baddi University of Emerging Sciences and Technology, Baddi, Himachal Pradesh ISSN: 2455-7929 Editor of the ‘International Journal of Business Innovation’, a refereed bi-annual international journal of School of Management, Maharaja Agrasen University, Baddi, Himachal Pradesh, ISSN:2394-8086 Managing Editor of ‘Agrani Samkalp’, a bi-annual newsletter of Maharaja Agrasen University, Baddi, Himachal Pradesh, Reg. No. DELBIL/2004/13585 Member of the Editorial Board of ‘Tourism Dimensions’, a refereed International Journal of Tourism, Maharaja Agrasen University, Baddi, Himachal Pradesh, ISSN: 2349-7394 Total Work Experience: 22 years since 1994 17 years of Teaching Experience, including 8 -

View Annual Report

CONTENTS CHAIRMAN’S LETTER DEAR SHAREHOLDERS FY2012 has been a good year for your Company. The key financial results were: ¥ Consolidated revenues increased by 30% to Rs. 96.7 billion in FY2012. ¥ Earnings before interest, taxes, depreciation and amortization (EBITDA)1 rose by 55% to Rs. 25.4 billion. ¥ Profit after Tax (PAT)2 grew by 45% to Rs. 15.3 billion. ¥ Diluted Earnings per Share (EPS) increased from Rs. 64.9 in FY2011 to Rs. 83.8 in FY2012. I am particularly delighted by four developments. First, your Company succeeded in yet another blockbuster generic launch in the USA under 180- days marketing exclusivity. Dr. Reddy’s launched olanzapine 20 mg tablets, the generic version of the brand Zyprexa®. Olanzapine is used to treat schizophrenia and bipolar disorder. This product has added around USD 100 million to your Company’s revenues for FY2012. Second, the biosimilars business continues along its impressive growth path. In my letter to you last year, I had discussed the critical importance of developing biosimilars in the years to come. I am happy to note that your Company’s global biosimilars business grew by 45% over last year and recorded sales of USD 26 million. Today, the biosimilars portfolio of Dr. Reddy’s constitutes (i) filgrastim, (ii) peg-filgrastim, (iii) rituximab and (iv) darbepoetin alfa, which have commercial presence in 13 countries among emerging markets. These are helping to treat patients suffering from cancer — and at prices that are significantly more affordable than the corresponding innovator drugs. Soon, I expect to see Dr. Reddy’s biosimilars entering developed markets. -

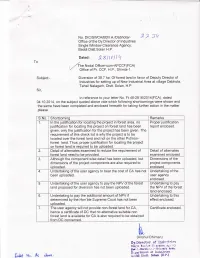

Dated: A8)10)1, to ,,An.Nodal Officer-Cum-APCCF(FCA) "./ Office of Pr

No.DlC/swcA/BD/1.A./Dabhota/- 22 3q Office of the Dy.Director of lndustries Single Window Clearance Agency, Baddi Distt.Solan H.P. Dated: A8)10)1, To ,,An.Nodal officer-cum-APCCF(FCA) "./ Office of Pr. CCF, H.P., Shimla-1. Subject:- Diversion of 38.7 ha. Of forest land in favor of Deputy Director of Industries for setting up of New lndustrialArea at village Dabhota, Tehsil Nalagarh, Distt. Solan, H.P. Sir, ln reference to your letter No. F|.48-281612014(FCA), dated 04.10.2014, on the subject quoted above vide which following shortcomings were shown and the same have been completed and enclosed herewith for taking further action in the matter please. S.No. Shorlcominq Remarks 1. ln the justification for locating the project in forest area, no Proper justification justification for locating this project on forest land has been report enclosed. given, only the justification for the project has been given. The requirement of this check list is why the project is to be located over the forest land and not on the other Pvt/non- forest land. Thus, proper justification for locating the project on forest land is required to be uploaded. 2. Detail of alternates examined to reduce the requirement of Detail of alternates forest land need to be provided. examined enclosed. 3. Although the component wise detail has been uploaded, but Dimensions of the dimensions of the project components are also required to project components uoloaded. enclosed. 4. Underlaking of the user agency to bear the cost of CA has not Undertaking of the been uploaded. -

Baddi Barotiwala Nalagarh Development Authority

BADDI BAROTIWALA NALAGARH DEVELOPMENT AUTHORITY (BBNDA) invites REQUEST FOR PROPOSAL For Setting up of Integrated Solid Waste Management Project for Collection, Transportation, Processing and Disposal in Baddi Cluster in the State of Himachal Pradesh on Public Private Partnership (PPP) Basis The Chief Executive Officer, BBNDA invites interested parties with proven experience and credentials in undertaking similar work to participate in the tendering process for setting up of Solid Waste Management Plant under cluster formation covering the areas falling within the jurisdiction of the following Urban Local Bodies on PPP mode under DBFOT format for a Concession Period of 25 (twenty five) years inclusive of construction period for setting up of processing facility: Sr. No. Designated ULB/ Participating ULBs BBNDA (Designated ULB) 1. 2. Municipal Council Baddi (Participating ULB) 3. Municipal Council Nalagarh (Participating ULB) 4. Municipal Council Parwanoo (Participating ULB) For further details i.e. detailed scope of work, minimum eligibility criteria, bidding procedure and other terms and conditions, please refer to the detailed RFP documents hosted on website www.hptender.gov.in; https://admis.hp.nic.in/himachal/hpidb or contact at the address given below. The interested bidders are invited to attend the pre‐bid meeting which shall be held on 23rd February, 2018 at 1130 hrs at Himachal Bhawan, New Delhi. For further updates, please visit website www.hptender.gov.in and https://admis.hp.nic.in/himachal/hpidb periodically as all updates -

Manufacturing Units Granted Certificate of Pharmaceutical Products (COPP)

Manufacturing Units granted Certificate of Pharmaceutical Products (COPP) in various States of India* Sr. State Total no. of WHO GMP No. Certified Manufacturers 1. Andhra Pradesh 35 2. Assam 01 3. Delhi (NCT) 09 4. Goa 38 5. Gujarat 423 6. Haryana 40 7. Himachal Pradesh 115 8. Jammu and Kashmir 15 9. Karnataka 82 10. Kerala 10 11. Madhya Pradesh 37 12. Maharashtra 209 13. Odisha(Orissa) 01 14. Puducherry 16 15. Punjab 11 16. Rajasthan 19 17. Sikkim 13 18. Tamil Nadu 74 19. Telangana 52 20. Uttar Pradesh 18 21. Uttarakhand 104 22. West Bengal 07 Total 1329 * List as received from the States / UTs through Zonal / Sub-Zonal Offices of CDSCO as on February 2015. Sr. No Sub-Sr. no. Name and address of WHO GMP Certified Manufacturers State-wise ANDHRA PRADESH 1. 1) EISAI PHARMATECHNOLOGY AND MANUFACTURING PVT. LTD, Ramky Pharma City (SEZ), Parawada,Visakhapatnam-Dist. 2. 2) DR.REDDY'S LABS LTD.,UNIT-7, Pydibhimavaram, Srikakulam District. 3. 3) DIVI'S LABORATORIES LIMITED UNIT-II, UNIT-II, Chippada Village, Visakhapatnam Dist. 4. 4) WANBURY LIMITED, Doctors Organic Chemicals Division, Iragavaram, K.IIIindalaparru, West Godavari Dist. 5. 5) Mylan LABORATORIES LTD, Plot No.5, Road No.12,Tadi (V), Visakhapatnam-Dist. 6. 6) S.M.S.PHARMACEUTICALS LIMITED, Plot No.28,Parawada, Visakhapatnam District. 7. 7) SMILAX LABORATORIES LTD, Plot No.70 & 71,Parwada, Visakhapatnam District. 8. 8) RA CHEM PHARMA LTD, R.S.No.50/1, Mukteshwarapuram, Krishna - District. 9. 9) LEE PHARMA LIMITED, Plot No.V, Phase-II, VSEZ, Duvvada, Sabbavaram (M), Visakhapatnam-Dist. -

Gurdaspur Punjab Kings Whisky 180 35 2 Ab Grains Spirits Pvt

Sr. No. WHOLESALE_VEND_NAME BRAND_NAME SIZE_CODE MRP 1 AB GRAINS SPIRITS PVT. LTD. - GURDASPUR PUNJAB KINGS WHISKY 180 35 2 AB GRAINS SPIRITS PVT. LTD. - GURDASPUR PUNJAB KINGS WHISKY 375 65 3 AB GRAINS SPIRITS PVT. LTD. - GURDASPUR PUNJAB KINGS WHISKY 750 130 4 ALCOBREW DIST (I) PVT LTD. - DERABASSI AUBERGE PREMIUM VODKA GR APPLE 180 100 5 ALCOBREW DIST (I) PVT LTD. - DERABASSI AUBERGE PREMIUM VODKA GR APPLE 375 200 6 ALCOBREW DIST (I) PVT LTD. - DERABASSI AUBERGE PREMIUM VODKA GR APPLE 750 400 7 ALCOBREW DIST (I) PVT LTD. - DERABASSI OLD SMUGGLER BL SCOTCH WHISKY 750 1050 8 ALCOBREW DIST (I) PVT LTD. - DERABASSI OLD SMUGL. XXX MATURED RUM 180 60 9 ALCOBREW DIST (I) PVT LTD. - DERABASSI OLD SMUGL. XXX MATURED RUM 375 120 10 ALCOBREW DIST (I) PVT LTD. - DERABASSI OLD SMUGL. XXX MATURED RUM 750 240 11 ALCOBREW DIST (I) PVT LTD. - DERABASSI WHITE & BLUE PREMIUM WHISKY 180 100 12 ALCOBREW DIST (I) PVT LTD. - DERABASSI WHITE & BLUE PREMIUM WHISKY 375 205 13 ALCOBREW DIST (I) PVT LTD. - DERABASSI WHITE & BLUE PREMIUM WHISKY 750 410 14 ALLIED BLEND&DIST P LTD - AURANGABAD WODKA GORB. VODKA GREEN APPLE 180 145 15 ALLIED BLEND&DIST P LTD - AURANGABAD WODKA GORB. VODKA GREEN APPLE 750 580 16 ALLIED BLEND&DIST P LTD - AURANGABAD WODKA GORB. VODKA ORANGE 180 145 17 ALLIED BLEND&DIST P LTD - AURANGABAD WODKA GORB. VODKA ORANGE 750 580 18 ALLIED BLEND&DIST P LTD - AURANGABAD WODKA GORBATSCHOW VODKA 60 45 19 ALLIED BLEND&DIST P LTD - AURANGABAD WODKA GORBATSCHOW VODKA 90 70 20 ALLIED BLEND&DIST P LTD - AURANGABAD WODKA GORBATSCHOW VODKA 180 135 21 ALLIED BLEND&DIST P LTD - AURANGABAD WODKA GORBATSCHOW VODKA 375 275 22 ALLIED BLEND&DIST P LTD - AURANGABAD WODKA GORBATSCHOW VODKA 750 550 23 A-ONE WINERIES - SANGRUR ORIGINAL CH RARE DEL WHISKY 180 50 24 A-ONE WINERIES - SANGRUR ORIGINAL CH RARE DEL WHISKY 375 100 25 A-ONE WINERIES - SANGRUR ORIGINAL CH RARE DEL WHISKY 750 200 26 BACARDI INDIA PRIVATE LTD. -

Action Plan of Baddi

Original Application. No. 1038 of 2018, dated 13.12.2018 In the matter of NEWS ITEM PUBLISHED IN “THE ASIAN AGE” Authored by Sanjay Kaw Titled “CPCB to rank industrial units on pollution levels” ACTION PLAN For Baddi Industrial Cluster (For Severely Polluted Areas of Himachal Pradesh) Submitted in compliance to the Hon’ble National Green Tribunal (NGT) order Dated 13th December, 2018 HP State Pollution Control Board Him Parivesh, Phase – III, New Shimla - 171009 INDEX FOREWORD 1 Chapter-1 2-9 1. Introduction 1.1. Area Details including brief history (background information) 1.2. Location 1.3. Location Map 1.4. CEPI Score (Air, Water, Land and Total) 1.5. Eco-geological features 1.6. The Climate of the Region 1.7 Geological Pattern 1.8 Major Water Bodies 1.9 Ecological parks, Sanctuaries, flora and fauna or any eco sensitive zones 1.10Industry classification and Highly Polluting industries (17 categories) 1.10.1 Red category industries 1.10.2 Orange and Green category industries 1.10.3 Grossly Polluting industries Chapter – 2 10-44 2.(A) Air Quality 2.A. 1. Present status of Air environment 2.A.2. Critical locations for air quality monitoring 2.A.3. Ambient Air Quality Status 2.A.4. Predominant Soures 2.A.5. Sources of air Pollution viz industrial, domestic (Coal & Biomass burning), natural and Transport & Heavy Earth Movers 2.A.5.1Air Polluting Industries in the area/ cluster 2.A.6.Impact of activities of nearby area 2.A.7.Action Plan for compliance and control of pollution 2.A.7.1.Existing infrastructure facilities – Ambient air quality monitoring network 2.A.7.2. -

Editorial Board Department of Orthodontics, KMCT Dental College, Kozhikode, Kerala, India Vikram Bhojia Jagat Bushan I.K

ISSN 2321-1482 Dental Journal of Advance Studies Official Publication of Himachal Pradesh University Chief Patron Financial Advisor Sanjay Tiwari Department of Conservative Dentistry Professor Sikander Kumar Deepti Garg & Endodontics, Pandit Bhagwat Dayal Vice Chancellor, Department of Oral Pathology & Sharma Post Graduate Institute of H.P. University, Shimla, Microbiology, Bhojia Dental College & Medical Sciences, Rohtak, Haryana, Himachal Pradesh, India Hospital, Baddi, Himachal Pradesh, India India Binu Purushothaman Patron Editorial Board Department of Orthodontics, KMCT Dental College, Kozhikode, Kerala, India Vikram Bhojia Jagat Bushan I.K. Pandit Bhojia Dental College & Hospital, Department of Conservative Dentist- Department of Pedodontics, Baddi, Himachal Pradesh, India ry & Endodontics, Dr. HSJ Institute DAV Dental College & Hospital, of Dental Sciences, Chandigarh, Haryana, India Editor Emeritus Punjab, India Uttam Kumar Sen Kavipal Singh Department of Prosthodontics, Tarun Kalra Department of Prosthodontics, Sri Guru Haldia Institute of Dental Sciences & Department of Prosthodontics, Bhojia Ram Das Institute of Medical Sciences & Research, Haldia, West Bengal, India Dental College & Hospital, Baddi, Research, Amritsar, Punjab, India Rajan Gupta Himachal Pradesh, India Aparna Palekar Department of Periodontology, Department of Conservative Dentistry Himachal Institute of Dental Sciences, Editor-in-Chief & Endodontics, Rural Dental College, Paonta Sahib, Himachal Pradesh, India Pravara Institute of Medical Sciences, Vinay Dua -

State-Wise List of Private Universities As on 12.11.2018 S.No Name of Private University Date of Notification

UNIVERSITY GRANTS COMMISSION State-wise List of Private Universities as on 12.11.2018 S.No Name of Private University Date of Notification ARUNACHAL PRADESH 1. Apex Professional University, Pasighat, District East Siang, 10.05.2013 Arunachal Pradesh - 791102. 2. Arunachal University of Studies, NH-52, Namsai, Distt – Namsai 26.05.2012 - 792103, Arunachal Pradesh. 3. Arunodaya University, E-Sector, Nirjuli, Itanagar, Distt. Papum 21.10.2014 Pare, Arunachal Pradesh-791109 4. Centurian University of Technology and Management, Gidijala 23.05.2017 Junction, Anandpuram Mandal, Visakhapatnam- 531173, Andhra Pradesh. 5. Himalayan University, 401, Takar Complex, Naharlagun, 03.05.2013 Itanagar, Distt – Papumpare – 791110, Arunachal Pradesh. 6. North East Frontier Technical University, Sibu-Puyi, Aalo 03.09.2014 (PO), West Siang (Distt.), Arunachal Pradesh –791001. 7. The Global University, Hollongi, Itanagar, Arunachal Pradesh. 18.09.2017 8. The Indira Gandhi Technological & Medical Sciences University, 26.05.2012 Ziro, Arunachal Pradesh. 9. Venkateshwara Open University, Itanagar, Arunachal Pradesh. 20.06.2012 S.No Andhra Pradesh 10. SRM University, Neerukonda-Kuragallu Village, mangalagiri 23.05.2017 Mandal, Guntur, Dist- 522502, Andhra Pradesh (Private University) 11. VIT-AP University, Amaravati- 522237, Andhra Pradesh (Private 23.05.2017 University) ASSAM 12. Assam Don Bosco University, Azara, Guwahati 12.02.2009 13. Assam Down Town University, Sankar Madhab Path, Gandhi 29.04.2010 Nagar, Panikhaiti, Guwahati – 781 036. 14. Mahapurusha Srimanta Sankaradeva Viswavidyalaya, Srimanta 14.08.2013 Sankaradeva Sangha Complex, Haladhar Bhuyan Path, Kalongpar, Nagaon-782001, Assam. 15. The Assam Kaziranga University, Jorhat, Assam. 11.04.2012 16. The Assam Royal Global University, Betkuchi, Opp. Tirupati 23.08.2013 Balaji Temple, NH-37, Guwahati – 781035, Assam.