Shared Roots: the Federal Reserve System and the Farm Credit System

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Modernizing Financial Services: the Glass-Steagall Act Revisited

MODERNIZING FINANCIAL SERVICES: THE GLASS-STEAGALL ACT REVISITED National Association of Federally-Insured Credit Unions NATIONAL ASSOCIATION OF FEDERALLY-INSURED CREDIT UNIONS | NAFCU.ORG | 1 INTRODUCTION: Since the financial crisis, the credit union industry has experienced significant consolidation in the financial marketplace while the largest banks have reaped record profits and grown in both size and scope. From 2008 to 2017, the National Credit Union Administration (NCUA) chartered only 29 new federal credit unions while, during that same period, 2,528 credit unions closed or merged out of existence. The post-crisis regulatory environment has contributed to this decade-long trend of consolidation, but credit unions have also faced barriers to growth in the form of field of membership rules, capital requirements, and limits on interest rates, among many other restrictions. Accordingly, while it is essential to promote regulatory relief that reduces compliance burdens, credit unions also need modern rules to evolve and grow. Regulatory burden and the pressure to consolidate affects more than just the credit union industry. Community banks have experienced similar declines.1 The lack of new charters among community institutions illustrates the extent to which complex and poorly tailored regulations have put a stranglehold on growth and, by extension, limited consumer financial services. In recognition of these trends and the need for regulatory relief, Congress recently passed the Economic Growth, Regulatory Relief, and Consumer Protection Act (S. 2155). S. 2155 garnered bipartisan support and helped alleviate some burdens associated with reporting under the Home Mortgage Disclosure Act and the NCUA’s member business lending rules, and provided new safe harbors for compliance with federal consumer financial protection laws. -

Concise Encyclopedia of the Great Recession, 2007-2010

THE CONCISE ENCYCLOPEDIA OF THE GREAT RECESSION 2007–2010 Jerry M. Rosenberg The Scarecrow Press, Inc. Lanham • Toronto • Plymouth, UK 2010 Published by Scarecrow Press, Inc. A wholly owned subsidiary of The Rowman & Littlefield Publishing Group, Inc. 4501 Forbes Boulevard, Suite 200, Lanham, Maryland 20706 http://www.scarecrowpress.com Estover Road, Plymouth PL6 7PY, United Kingdom Copyright © 2010 by Jerry M. Rosenberg All rights reserved. No part of this book may be reproduced in any form or by any electronic or mechanical means, including information storage and retrieval systems, without written permission from the publisher, except by a reviewer who may quote passages in a review. British Library Cataloguing in Publication Information Available Library of Congress Cataloging-in-Publication Data Rosenberg, Jerry Martin. The concise encyclopedia of the great recession 2007–2010 / Jerry M. Rosenberg. p. cm. Includes bibliographical references and index. ISBN 978-0-8108-7660-6 (hardback : alk. paper) — ISBN 978-0-8108-7661-3 (pbk. : alk. paper) — ISBN 978-0-8108-7691-0 (ebook) 1. Financial crises—United States—History—21st century—Dictionaries. 2. Recessions—United States—History—21st century—Dictionaries. 3. Financial institutions—United States—History—21st century—Dictionaries. I. Title. HB3743.R67 2010 330.9'051103—dc22 2010004133 ϱ ™ The paper used in this publication meets the minimum requirements of American National Standard for Information Sciences—Permanence of Paper for Printed Library Materials, ANSI/NISO Z39.48-1992. Printed in the United States of America For Ellen Celebrating fifty years of love and adventure. She is my primary motivation. As a lifelong partner, Ellen keeps me spirited and vibrant. -

How Laws and Regulations Affect Credit Unions

C H A P T E R O N E HOW LAWS AND REGULATIONS AFFECT CREDIT UNIONS his chapter covers the chartering, structure, and oversight of federal credit unions, Tincluding a discussion of the Federal Credit Union Act, the various sources of authority issued by the National Credit Union Administration (NCUA), the role of NCUA as insurer, and the role of state regulators. We also briefly discuss federal financial institution legislation and regulation in consumer protection, employment, and other areas of interest to credit union directors. CHARTERING, STRUCTURE, AND OVERSIGHT AUTHORITY Like any other financial institution, credit unions are governed by the laws that allow them to be organized and maintained. The Federal Credit Union Act is the legal founda- tion for federal credit unions. In addition, most states have their own credit union laws, giving credit unions a dual structure for chartering and regulatory oversight. The National Credit Union Administration (NCUA) is the independent agency that exercises regulatory oversight of federal credit unions. NCUA has authority over managing the National Credit Union Share Insurance Fund (NCUSIF) and examining both federal credit unions and federally insured state-chartered credit unions. Individual state credit union acts also name the regulatory agency, establish the agency’s power and authority, establish the form, structure, and powers of state-chartered credit unions, and specify share insurance requirements. 1 Federal Credit Union Act The Federal Credit Union Act is the law that established NCUA. It also defines the basic structure of federal credit unions in such areas as chartering, field of membership, and loan and investment powers. -

Policy Issues Related to Credit Union Lending

Policy Issues Related to Credit Union Lending ,name redacted, Specialist in Financial Economics November 18, 2015 Congressional Research Service 7-.... www.crs.gov R43167 Policy Issues Related to Credit Union Lending Summary Credit unions make loans to their members, to other credit unions, and to corporate credit unions that provide financial services to individual credit unions. There are statutory restrictions on their business lending activities, which the credit union industry has long advocated should be lifted. Specific restrictions on business lending include an aggregate limit on an individual credit union’s member business loan balances and on the amount that can be loaned to one member. Industry spokespersons have argued that easing the restrictions on member business lending could increase the available pool of credit for small businesses. Credit unions also lack sources of capital beyond retained earnings, and alternative supplemental capital sources would allow them to increase their lending while remaining in compliance with safety and soundness regulatory requirements. Community bankers, who often compete with credit unions, argue that policies such as raising the business lending cap would allow credit unions to expand beyond their congressionally mandated mission and could pose a threat to financial stability. Members of the 114th Congress have introduced legislation that would allow credit unions to expand their lending activities. H.R. 989, the Capital Access for Small Business and Jobs Act, was introduced and referred to the House Committee on Financial Services on February 13, 2015. H.R. 989 would redefine net worth for credit unions to include additional sources of supplemental capital. In addition, H.R. -

2021 Key Federal Issues

2021 KEY FEDERAL ISSUES 2021 CUNA GAC Update Credit Union Difference • Established by Congress over 80 years ago, credit • We anticipate credit union opponents will unions have a strong, positive reputation as seek, as they did in the 116th Congress, to have member-owned, community-centered financial legislation introduced that would eliminate the cooperatives. income tax exemption for credit unions, either across the board or focused on large asset • Congress designated credit unions as not-for- profit credit unions and subject credit unions to the organizations because of their unique structure Community Reinvestment Act (CRA). and mission within the financial service industry. • Michigan credit unions are adamantly opposed • Banks were created and operate under their own to any such legislation and ask for support in distinct structure with a mission different from defeating this or similar legislation. credit unions. • Credit unions are not subject to the CRA for • Congress has long recognized that different many reasons, among them: structures necessitate different tax treatments, not only in the financial service sector but ° At no time in our 100-plus year history have throughout other areas of our economy. credit unions engaged in “redlining”, we are member owned financial institutions that • Banks can raise capital for the equity and bond serve the needs of our members, markets. Credit unions can only raise capital ° We are committed to serving diverse and through retained earnings. historically underserved communities, • Credit union boards are drawn from members, ° 75% of credit union branches are in middle, elected by the members and serve as unpaid moderate and low-income communities, and volunteers. -

The Dodd-Frank Wall Street Reform and Consumer Protection Act July 2010 the DODD-FRANK WALL STREET REFORM and CONSUMER PROTECTION ACT

Understanding the New Financial Reform Legislation: The Dodd-Frank Wall Street Reform and Consumer Protection Act July 2010 THE DODD-FRANK WALL STREET REFORM AND CONSUMER PROTECTION ACT For more information about the matters raised in this Legal Update, please contact your regular Mayer Brown contact or one of the following: Scott A. Anenberg Charles M. Horn +1 202 263 3303 +1 202 263 3219 [email protected] [email protected] Michael R. Butowsky Jerome J. Roche +1 212 506 2512 +1 202 263 3773 [email protected] [email protected] Joshua Cohn David R. Sahr +1 212 506 2539 +1 212 506 2540 [email protected] [email protected] Thomas J. Delaney Jeffrey P. Taft +1 202 263 3216 +1 202 263 3293 [email protected] [email protected] Table of Contents Index of Acronyms / Abbreviations .................................................................................................xv The Dodd-Frank Wall Street Reform and Consumer Protection Act ................................................ 1 A. Summary ................................................................................................................... 1 B. A Very Brief History of the Legislation ...................................................................... 1 C. Overview of the Legislation ...................................................................................... 2 1. Framework for Financial Stability ................................................................. 2 2. Orderly Liquidation Regimen ....................................................................... -

Final Report of the Reconstruction Finance Corporation

FINAL REPORT on the Reconstruction Finance Corporation Pursuant to Section 6(c) Reorganization Plan No. 1 of 1957 SECRETARY OF THE TREASURY UNITED STATES GOVERNMENT FKttJTING OFFICE WASHINGTON 1959 For ale by the Superintendent ef Decutacnti, U-S.GovcnracQt Printing Office Digitized for FRASER http://fraser.stlouisfed.org/ Federal Reserve Bank of St. Louis Digitized for FRASER http://fraser.stlouisfed.org/ Federal Reserve Bank of St. Louis THC SECRETARY OF THE TREASURY WASHINGTON May 6, 1959 Sirs: I have the honor to submit herewith the final report on the Reconstruction Finance Corporation which is required under Section 6 (c) of Reorganization Plan No* 1 of 1957. The report was prepared under the direction of Mr* Laurence B. Robbing, who presently is serving in the capacity of Assistant Secretary of the Treasury. Prior to confirmation in his present position, Mr. Robbins served both as Deputy Administrator and Administrator of the Reconstruction Finance Corporation and directed the liquidation of that Corporation's affairs. Secretary of the Treasury To the President of the Senate To the-Speaker of the House of Representatives iii Digitized for FRASER http://fraser.stlouisfed.org/ Federal Reserve Bank of St. Louis Digitized for FRASER http://fraser.stlouisfed.org/ Federal Reserve Bank of St. Louis FOREWORD The Reconstruction Finance Corporation was among the largest and undoubtedly was the most complex of all Federal lending agen- cies. In its operations it disbursed more than $40 billion, and was conditionally committed to disburse many billions more under guar- anties of loans and investments made by private financial institutions. Organized during a severe economic depression, the RFC passed through periods of recovery, preparedness, war, reconversion, eco- nomic expansion, another war and, finally, stability and prosperity. -

GAO-16-175, Financial Regulation

United States Government Accountability Office Report to Congressional Requesters February 2016 FINANCIAL REGULATION Complex and Fragmented Structure Could Be Streamlined to Improve Effectiveness GAO-16-175 February 2016 FINANCIAL REGULATION Complex and Fragmented Structure Could Be Streamlined to Improve Effectiveness Highlights of GAO-16-175, a report to congressional requesters Why GAO Did This Study What GAO Found The U.S. financial regulatory structure The U.S. financial regulatory structure is complex, with responsibilities has evolved over the past 150 years in fragmented among multiple agencies that have overlapping authorities. As a response to various financial crises result, financial entities may fall under the regulatory authority of multiple and the need to keep pace with regulators depending on the types of activities in which they engage (see figure developments in financial markets and on next page). While the Dodd-Frank Wall Street Reform and Consumer products in recent decades. Protection Act (Dodd-Frank Act) made a number of reforms to the financial GAO was asked to review the financial regulatory system, it generally left the regulatory structure unchanged. regulatory structure and any related impacts of fragmentation or overlap. U.S. regulators and others have noted that the structure has contributed to the This report examines the structure of overall growth and stability in the U.S. economy. However, it also has created the financial regulatory system and the challenges to effective oversight. Fragmentation and overlap have created effects of fragmentation and overlap on inefficiencies in regulatory processes, inconsistencies in how regulators oversee regulators’ oversight activities. GAO similar types of institutions, and differences in the levels of protection afforded to reviewed relevant laws and agency consumers. -

Federal Farm Loan Bureau

U. S. TREASURY DEPARTMENT FEDERAL FARM LOAN BUREAU Circular No. 20 THE FEDERAL FARM LOAN ACT AS AMENDED TO JULY 16, 1932 Exclusive of Provisions relating to Federal Intermediate Credit Banks Appendix, containing certain other Acts of the Congress having a direct relation to the Federal Farm Loan Act INDEX ISSUED BY THE FEDERAL FARM LOAN BOARD JULY, 1932 UNITED STATES GOVERNMENT PRINTING OFFICE WASHINGTON : 1932 Digitized for FRASER http://fraser.stlouisfed.org/ Federal Reserve Bank of St. Louis EDITORIAL NOTE This circular contains all provisions of the Federal Farm Loan Act and amendments thereto relating to Federal land banks, joint stock land banks, and national farm loan associations in effect on July 16, 1932. The provisions of the act have been classified in accordance with the codification thereof in title 12 of the official Code of Laws of the United States of America in Force December 26, 1926, and supplements thereto. In the left margin of this circular opposite each provision is printed the section number of such provision in title 12 of the Code. In the right margin is printed the number of the section of the Federal Farm Loan Act, as amended, of which the pro vision is a part. At the end of each provision is a parenthetical reference to the act of Congress from which the provision was derived and to any subsequent amendatory acts. The symbol “ 12 U. S. C.” refers to United States Code, title 12. The symbol “ F. F. L. Act” refers to the Federal Farm Loan Act, as amended. The official Code has been followed in its editing of the text of the act and amendments thereto, by the omission of “ that55 at the opening of paragraphs, the omission of obsolete provisions, etc. -

Gramm-Leach-Bliley Act

Notes to the Reader 1. This document is extracted from Committee Print 108-B of the Committee on Financial Services of the U.S. House of Representa- tives, and was prepared at the direction of that Committee. 2. Any material contained within brackets ø¿ is not part of the text of the law but is inserted as an aid to the reader. 3. Citations have been included to enable the reader to locate the same material in the United States Code (U.S.C.). These citations are not a part of the text of the law in which they appear. For changes after the revision date of this excerpt (September 30, 2004) to provisions of law in this publication that have citations to the U.S. Code, see the United States Code Classification Tables pub- lished by the Office of the Law Revision Counsel of the House of Representatives at http://uscode.house.gov/uscct.htm. REVISED THROUGH SEPTEMBER 30, 2004 GRAMM-LEACH-BLILEY ACT Be it enacted by the Senate and House of Representatives of the United States of America in Congress assembled, SECTION 1. SHORT TITLE; TABLE OF CONTENTS. (a) ø12 U.S.C. 1811 note¿ SHORT TITLE.—This Act may be cited as the ‘‘Gramm-Leach-Bliley Act’’. * * * * * * * TITLE II—FUNCTIONAL REGULATION Subtitle A—Brokers and Dealers * * * * * * * SEC. 206. ø15 U.S.C. 78c note¿ DEFINITION OF IDENTIFIED BANKING PRODUCT. (a) DEFINITION OF IDENTIFIED BANKING PRODUCT.—For pur- poses of paragraphs (4) and (5) of section 3(a) of the Securities Ex- change Act of 1934 (15 U.S.C. -

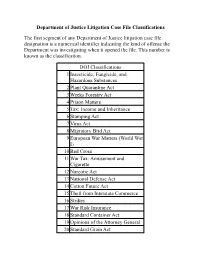

DOJ Classifications for Webpage

Department of Justice Litigation Case File Classifications The first segment of any Department of Justice litigation case file designation is a numerical identifier indicating the kind of offense the Department was investigating when it opened the file. This number is known as the classification. DOJ Classifications 1 Insecticide, Fungicide, and Hazardous Substances 2 Plant Quarantine Act 3 Weeks Forestry Act 4 Prison Matters 5 Tax: Income and Inheritance 6 Stamping Act 7 Virus Act 8 Migratory Bird Act 9 European War Matters (World War I) 10 Red Cross 11 War Tax: Amusement and Cigarette 12 Narcotic Act 13 National Defense Act 14 Cotton Future Act 15 Theft from Interstate Commerce 16 Strikes 17 War Risk Insurance 18 Standard Container Act 19 Opinions of the Attorney General 20 Standard Grain Act 21 Food and Drug (Prosecution) 22 Food and Drug (Seizure) 23 Liquor Violations 24 High Cost of Living 25 Selective Service Act 26 Dyer Act (Automobile Theft) 27 Patents 28 Copyrights 29 National Banking Act 30 Quarantine 31 White Slave Traffic (Mann Act) 32 Federal Building Space 33 Federal Building Sites 34 Lacy Act (Game) 35 Civil Service Act 36 Mail Fraud 37 Bonus Overpayment, World War I 38 Naturalization 39 Immigration 40 Passport and Visa Matters 41 Explosives 42 Desertion from Armed Forces of U.S., Harboring such Deserters 43 Illegal Wearing of Uniform 44 Department of Justice Administrative Files (Closed) 45 Crime on the High Seas 46 Fraud Against the Government 47 Impersonation of Federal Officer 48 Postal Violations 49 Bankruptcy 50 Peonage -

(Infographic) | Hiway Credit Union

Credit Union HISTORY For more than 100 years, credit unions have provided fi nancial services to their members in the United States Credit unions are unique depository institutions created not for profi t, but to serve their members as credit co-operatives. A BRIEF HISTORY OF CREDIT UNIONS IN THE UNITED STATES 1800s ENGLAND & GERMANY The earliest fi nancial Distinguishing features of these early co-operatives date back credit unions included: to the beginning of • Democratic governance 19th century in England. • Each member has one vote, regardless A few decades later, of the size of the member’s deposits credit unions took root in Germany. These early • Member-elected board of directors credit unions became the • Volunteer based model for today’s credit unions in the United States. 1900 LÉVIS, QUEBEC, CANADA The credit union concept Alphonse Desjardins crossed the Atlantic to Lévis, Quebec, where Alphonse Desjardins organized La Caisse populaire de Lévis. A former journalist and 1909 the French-language MANCHESTER, 1 stenographer for the NEW HAMPSHIRE Canadian House of Commons, Desjardins Desjardins helped a group became aware of of Franco-American moneylenders charging Catholics organize outrageous interest. In St. Mary’s Cooperative response, he organized Credit Association. This this fi rst credit union fi rst credit union in the in North America to United States opened its provide a ordable credit doors in 1909. to working-class families. 1909 CU ACT MASSACHUSETTS CREDIT UNION ACT Edward Filene As a result of the e orts of Edward Filene, a merchant and philanthropist, and Pierre Jay, the Massachusetts Banking Commissioner, the 1920s Massachusetts Credit Union GROWING Act became law on April 15, POPULARITY 1909.