Results for the Year Ended March 2016 and Forecasts for the Year Ending March 2017

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Attachment 13

Appendix 13 Executive Summary ‘The modern world is built on steel which has become essential to economic growth. In developing and developed nations alike, steel is an indispensable part of life … The future growth in demand for steel will be driven mainly by the needs of the developing world.’1 Note: 87% of all world metals consumed are iron and steel. Australia is rich in natural resources. Among the key resources in abundance are iron ore and thermal and coking coal; the key feedstock for steel. Queensland has an abundance of coal, while Western Australia has an abundance of iron ore. Australia has a small population with limited steel production, so these resources are shipped internationally to be used as inputs to steel production. Strong growth in raw steel production and consumption, driven by the rapid industrialisation of China and India in particular, is expected to continue. This will necessitate substantial investment in new global steelmaking capacity. Australia plays a significant leading role in the export steelmaking supply-chain as it has an estimated 40% of the world’s high grade seaborne iron ore and 65% of the world’s seaborne coking coal. Project Iron Boomerang was developed by East West Line Parks Pty Ltd (“EWLP”) to explore the economic feasibility of establishing first-stage steel mill semi-finished steel production in Australia, close to the major raw materials inputs. This Pre-Feasibility Study provides strong evidence that the construction of first-stage smelter precincts offers many cost effective consolidation and efficiency savings, and that a dedicated railroad with all supporting infrastructure is feasible and economically favourable for steelmakers. -

CAVAL Bma Sustainable Development Report

SuStainable Development Covering health, safety, environmental and community performance for the year ended 30 June 2008 www.bmacoal.com Cover: Lexie Frankham, Goonyella Riverside Mine contents This page: Stuart Davison, South Walker Creek Mine note from marcelo bastos.............. 1 introduction ..................................... 2 Health & Safety................................ 3 Supporting our communities .......... 5 environment ..................................... 9 indigenous Relations ..................... 14 economic ....................................... 16 01 note from marcelo bastos Welcome to BHP Billiton Mitsubishi During FY08, climate change was Alliance’s (BMA) 2008 Sustainable a key focus area for BMA. Our new Development Report. growth projects have enabled us to take a ‘best practice’ approach This report details the progress we to reducing and mitigating our have made over the past year, our greenhouse gas emissions through current sustainable development a number of avenues including priorities and objectives, and how energy efficiency. we work to manage and govern our sustainability activities. Our Energy Excellence program, which aims at ensuring behavioural We were greatly encouraged by the change, innovation and technological feedback from our 2007 report. We are progress, is a key element of our proud of the progress we have made, overarching climate change approach. but we also acknowledge many areas for further improvement. Needless to say, the biggest environmental and social impact Our commitment to the health and during FY08 was the devastating safety of our people is absolute, and Central Queensland floods, affecting our impacts on the environment all our mine sites. and community also must not be As detailed further in this report, our compromised. employees not only supported our The nature of our business means it communities, but showed enormous takes a strong team effort to realise commitment and team work in these commitments, and I greatly managing the release of water and value the support of all our operations. -

BMA Bowen Basin Coal Growth Project Initial Advice Statement June 2008

BMA Bowen Basin Coal Growth Project Initial Advice Statement June 2008 BMA Bowen Basin Coal Growth Project – Initial Advice Statement Contents 1 Introduction 3 1.1 Project Background and Location 3 1.2 The Proponent 4 1.3 Project Need 4 1.4 Purpose and Scope 5 2 Project Description 8 2.1 Daunia Mine 8 2.1.1 Mineral Resource 8 2.1.2 Mining Operations 12 2.1.3 Supporting Site Infrastructure 12 2.1.4 Coal Handling and Processing Activities 13 2.1.5 Mine Waste Management 13 2.1.6 Workforce 13 2.1.7 Operational Land and Tenure 14 2.1.8 Environmental Authorities 14 2.2 Caval Ridge Mine 14 2.2.1 Mineral Resource 15 2.2.2 Mining Operations 18 2.2.3 Supporting Site Infrastructure 18 2.2.4 Coal Handling and Processing Activities 19 2.2.5 Mine Waste Management 20 2.2.6 Workforce 20 2.2.7 Operational Land and Tenure 20 2.2.8 Environmental Authorities 20 2.3 Goonyella Riverside Mine Expansion 22 2.3.1 Mineral Resource 22 2.3.2 Mining Operations 26 2.3.3 Supporting Site Infrastructure 28 2.3.4 Coal Handling and Processing Activities 28 2.3.5 Workforce 28 2.3.6 Operational Land and Tenure 29 2.3.7 Environmental Authorities 29 2.4 Airport Development 29 3 Existing Environment and Potential Impacts 31 3.1 Daunia Mine 31 3.1.1 Surface Water 31 3.1.2 Groundwater 31 C:\Hum_Temp\BMA_KM-#5858325-v2-BMA_Bowen_Basin_Growth_Project_Final_IAs.DOC PAGE i Rev 2 BMA Bowen Basin Coal Growth Project – Initial Advice Statement 3.1.3 Land Resources 32 3.1.4 Regional Ecosystems 32 3.1.5 Significant Flora and Fauna 33 3.1.6 Noise and Vibration 34 3.1.7 Air Quality 34 3.1.8 -

Reopening Norwich Park Coal Mine – from BHP Secret Internal Briefing Paper for BHP

® CFMEU Mining and Energy COMMONCAUSE Strong Union. Safer Workplace. www.cfmeu.com.au www.ourjobs.org.au VOL 81 NO. 1 FEBRUARY/ MARCH 2015 Reopening Norwich Park coal mine – from BHP secret internal briefing paper for BHP: “….. the success of the project will be dependent on being able to operate the mine efficiently while using labour that is paid significantly less than is currently the case at surrounding existing operations. A strong desire has been expressed that labour should be sourced from lower paying areas outside of Queensland (Adelaide, Melbourne for example). They are likely to try and leverage off the labour model used at Norwich Park to generate lower cost labour models at their other operations.” REGISTERED BY AUSTRALIA POST PP 243184/00025 POST AUSTRALIA BY REGISTERED Helping industry return their workers home, healthy and safe every day. In 2013-14, Coal Services partnered with industry to ensure a safe workplace and a healthy workforce. Mines Rescue • 550 skilled Brigadesmen response ready and around 60,000 training hours dedicated to building safety leaders for the NSW coal industry. Coal Mines Insurance • Paid $71.8 million towards compensation and treatment costs to support injured workers through their injury recovery and return to work. CS Health • Completed 11,457 pre-placement and periodic health surveillance medicals to monitor the health of the workforce and protect against occupational disease. Regulation & Compliance • Conducted respirable and inhalable dust sampling on 4,660 workers across every coal mine sites in NSW, including surface and underground operations and coal handling plants. www.coalservices.com.au 2014 Issue 04 - CSPL Stats.indd 1 25/07/2014 12:26:00 PM General President Tony Maher Reports CFMEU’s key role in Queensland and Victorian election wins hanks to the magnificent and the systematic destruction of our now in the Queensland Parliament role played by members of mining communities. -

Presentation Material (PDF:1.3MB)

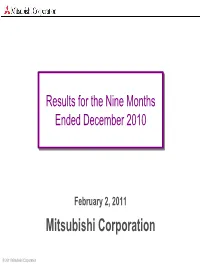

ResultsResults forfor thethe NineNine MonthsMonths EndedEnded DecemberDecember 20102010 February 2, 2011 Mitsubishi Corporation © 2011 Mitsubishi Corporation Change in Accumulated Quarterly Net Income (Loss) by Operating Segment Net Income/loss (Year Ending March 2011) (billion yen) 450 400.0400.0 billionbillion yenyen -Resource-related Total (Energy Business, Metals) 400 -Non-Resource-related Total (Industrial Finance, Logistics & Development, 359.7359.7 billionbillion yenyen Machinery, Chemicals, Living Essentials) 85.0 350 73.2 Energy Business 300 267.8267.8 billionbillion yenyen Metals 305.0 250 55.8 220.0 261.5 Industrial Finance, 188.3 Logistics & 200 Development Machinery 140.4140.4 billionbillion yenyen 203.2 150 147.4 26.3 Chemicals 9.0 8.5 100 49.0 82.1 108.4 44.4 Living Essentials 123.5 3.6 111.7 50 27.2 21.4 22.0 1.0 16.4 13.2 44.0 Adjustments and 7.7 33.9 65.3 36.9 Eliminations 8.8 21.3 0 (0.7) (13.5) (1.9) (28.5) (50) Three months ended Six months ended Nine months ended Forecast for year ending June 2010 September 2010 December 2010 March 2011 2 Change in Quarterly Net Income (Loss) by Operating Segment (Year Ending March 2011) Net Income/loss (billion yen) -Resource-related Total (Energy Business, Metals) 200 -Non-Resource-related Total (Industrial Finance, Logistics & Development, Machinery, Chemicals, Living Essentials) Energy Business 140.4140.4 billionbillion yenyen 150 127.4127.4 billionbillion yenyen Metals 26.3 91.991.9 billionbillion yenyen Industrial Finance, 29.5 Logistics & Development 100 17.4 Machinery 82.1 108.4 94.8 58.3 65.3 40.9 Chemicals 50 40.340.3 billionbillion yenyen 5.4 Living Essentials 1.0 2.6 17.2 16.4 10.8 33.9 31.4 8.2 46.4 40.3 7.7 5.5 Adjustments and 8.8 12.5 15.6 Eliminations 0 (1.9) 1.2 (12.8) Three months Three months Three months Forecast for three ended June 2010 ended September 2010 ended December 2010 months ending March 2011 (50) 3 Market Prices Commodity Prices, Foreign Exchange and Interest Rate Sensitivities Forecast for Three months Increase or six months ended decrease ending Dec. -

Mining in Conflicted Lands

Lessons learned from Case Studies of InternationalInternational Investment Financial in Extractive Flows and Land-use Industries and the Environment Best Practices for Transnational Investment in Extractive and Land Use Sectors School of International Service American University Foreword With the wave of globalization and the empowerment of civil societies around the world, foreign investment has become an increasingly important issue due to the inherent social and environmental impacts that foreign companies inflict upon the local communities in which they operate. The results of foreign investment are complicated: some investment improves local economic, environmental, and social conditions, while other investment leads to tensions between transnational companies and local communities. There are currently few broadly agreed-upon standards that guide how foreign companies should invest and behave in host countries in order to achieve not only business benefits, but also social responsibility and environmental sustainability. This portfolio of best and worst practices of foreign investment exhibits both positive and negative cases of foreign investment. This document is the cooperative product of the World Resources Institute (WRI) and the American University (AU) practicum team. IFFE’s Senior Associate, Mr. Hu Tao, and Research Analyst, Denise Leung, worked closely with the practicum team to develop the project. The AU practicum team consisted of professors Dr. Ken Conca and Dr. Judy Shapiro and eleven graduate students: Stephanie DaCosta, Kristin DeValue, Hilary Kirwan, Lauren Lane, John Noel, Sebastian O’Connor, Schuyler Olsson, Jen Richmond, Natnari Sihawong, Toussaint Webster, and Yuxi Zhao. In March 2013, the AU practicum team travelled to Beijing, China, to present their initial research and coordinate with a WRI partner research team from Beijing Normal University. -

Bowen Basin Coal Growth Project: Caval Ridge Mine

The Bowen Basin Coal Growth project—Caval Ridge Mine Coordinator-General’s change report on the housing impacts study instigation conditions July 2011 © State of Queensland. Published by Queensland Government, July 2011, 100 George Street, Brisbane Qld 4000. The Queensland Government supports and encourages the dissemination and exchange of information. However, copyright protects this publication. The State of Queensland has no objection to this material being reproduced, made available online or electronically but only if it is recognised as the owner of the copyright and this material remains unaltered. Copyright inquiries about this publication should be directed to [email protected] or in writing to: Administrator (Crown Copyright and Other IP), Department of Employment, Economic Development and Innovation, PO Box 15168, City East, Qld 4002. The Queensland Government is committed to providing accessible services to Queenslanders of all cultural and linguistic backgrounds. If you have difficulty understanding this publication and need a translator, please call the Translating and Interpreting Service (TIS National) on 131 450 and ask them to telephone the Queensland Department of Employment, Economic Development and Innovation on 132 523. Disclaimer: This report contains factual data, analysis, opinion and references to legislation. The Coordinator-General and the State of Queensland make no representations and give no warranties regarding the accuracy, completeness or suitability for any particular purpose of such data, analysis, opinion or references. You should make your own enquiries and take appropriate advice on such matters. Neither the Coordinator-General nor the State of Queensland will be responsible for any loss or damage (including consequential loss) you may suffer from using or relying upon the content of this report. -

Community 16

CR Tabs_Main:Layout 1 14/5/09 3:15 PM Page 16 Community 16 16 Community BMA is undertaking an extensive program of community consultation and stakeholder engagement, relating to the Caval Ridge Project. BMA’s community engagement process aims to: Identify community issues or concerns. Ensure BMA is responsive in mitigating against issues. Proactively work with stakeholders. Continue the long term relationship between BMA and the Bowen Basin community. The Caval Ridge Project community engagement process also considers the cumulative impacts of BMA’s operations, helping the community to understand the project specifically, as well as BMA’s broader growth plans. The community consultation process to date has engaged stakeholders at both a local and regional level, and provided project-specific information as well as information on the potential social, economic and environmental impacts, relating to the project. A regular program of consultation activities has helped ensure the community, employees and other stakeholders have had a number of opportunities to provide input and offer feedback. Key consultation activities included one-to-one discussions, information displays, hard copy and online information publications (such as fact sheets and newsletters), and consultation with service providers. Feedback from community engagement has informed mine planning and technical studies associated with the EIS, as well as BMA’s ongoing communication activities relating to its growth plans. To date, feedback from the community has highlighted concerns relating to noise and dust, housing and social services provision. 16.1 Consultation Objectives The objectives of the community engagement process are to: Initiate and maintain open communication with the community on all aspects of the project and the EIS. -

BHP RESULTS for the YEAR ENDED 30 JUNE 2020 Note: All Guidance Is Subject to Further Potential Impacts from COVID-19 During the 2021 Financial Year

Release Time IMMEDIATE Date 18 August 2020 Number 09/20 BHP RESULTS FOR THE YEAR ENDED 30 JUNE 2020 Note: All guidance is subject to further potential impacts from COVID-19 during the 2021 financial year. Keeping our people and communities safe We had no fatalities at our operated sites during the year and improved Total Recordable Injury Frequency. Our commitments to safety and social value have enabled us to operate reliably and safely during the COVID-19 pandemic. We had the support of our workforce, Traditional Owners, communities, governments, customers and suppliers. Maximise cash flow: Robust earnings and free cash flow generation despite COVID-19 Attributable profit of US$8.0 billion and Underlying attributable profit(i) of US$9.1 billion broadly in line with the prior year. Profit from operations of US$14.4 billion and Underlying EBITDA(i) of US$22.1 billion at a margin(i) of 53%, with unit costs reduced by 9% at our major assets due to foreign exchange, better productivity and improved operating stability. Net operating cash flow of US$15.7 billion, above US$15 billion for the fourth consecutive year, and free cash flow(i) of US$8.1 billion. Capital discipline: Major projects tracking well, early stage options added and balance sheet remains strong Capital and exploration expenditure(i) within guidance at US$7.6 billion. We now expect capital and exploration expenditure to be approximately US$7 billion for the 2021 financial year, reflecting the proactive deferral for value of a number of our petroleum projects, and approximately US$8.5 billion for the 2022 financial year. -

Annual Report 2017 Today BHP Is Stronger, Simpler and More Productive

Annual Report 2017 Today BHP is stronger, simpler and more productive. The Annual Report 2017 is available online at bhp.com. BHP Billiton Limited. ABN 49 004 028 077. Registered in Australia. Registered office: 171 Collins Street, Melbourne, Victoria 3000, Australia. BHP Billiton Plc. Registration number 3196209. Registered in England and Wales. Registered office: Nova South, 160 Victoria Street London SW1E 5LB United Kingdom. Each of BHP Billiton Limited and BHP Billiton Plc is a member of the Group, which has its headquarters in Australia. BHP is a Dual Listed Company structure comprising BHP Billiton Limited and BHP Billiton Plc. The two entities continue to exist as separate companies but operate as a combined Group known as BHP. The headquarters of BHP Billiton Limited and the global headquarters of the combined Group are located in Melbourne, Australia. The headquarters of BHP Billiton Plc are located in London, United Kingdom. Both companies have identical Boards of Directors and are run by a unified management team. Throughout this publication, the Boards are referred to collectively as the Board. Shareholders in each company have equivalent economic and voting rights in the Group as a whole. In this Annual Report, the terms ‘BHP’, ‘Group’, ‘BHP Group’, ‘we’, ‘us’, ‘our’ and ‘ourselves’ are used to refer to BHP Billiton Limited, BHP Billiton Plc and, except where the context otherwise requires, their respective subsidiaries. Cross references refer to sections of the Annual Report, unless stated otherwise. Our Charter BHP Annual -

E4C1 — 1 — BMA Growth Newsletter 1 EDITION 1 - MAY 2008 Letter

E4C1 — 1 — BMA Growth Newsletter 1 EDITION 1 - MAY 2008 letter GROWING BMA - COMMUNITY ENGAGEMENT BHP Billiton Mitsubishi Alliance (BMA) is Australia’s largest metallurgical coal miner and Contact details exporter. BMA owns and operates seven mines – Broadmeadow, Blackwater, Goonyella Riverside, Gregory Crinum, Peak Downs, Saraji, Norwich Park, and the Hay Point Coal Terminal 1800 078 797 near Mackay. In addition, BMA manages the operations of BHP Mitsui Coal; South Walker Creek [email protected] and Poitrel. The company employs over 8,900 people, including contractors. www.bmacoal.com Note from John: This is the fi rst in a series of regular newsletters to Operational growth aside, we recognise that inform you and keep you updated on our plans to the Bowen Basin and the industry as a whole grow our business, and on how we are working to is currently overheated, placing pressure on our meet the needs of the whole community. towns and community facilities. We are working This newsletter will outline two potential new with Government and independent groups to development projects - Caval Ridge Mine and look at addressing these issues in a sustainable Daunia Mine - as well as our approach to future way. We are also completing the Environmental growth. Impact Statement (EIS) process for our projects. We are long term members of the Bowen Basin We will keep you fully informed of our activities, community and these potential projects will and give you opportunities to provide input and strengthen our future in the region. feedback. In addition to feedback mechanisms listed overleaf, we encourage you to discuss our We are committed to conducting an open and plans through our informative mobile displays transparent engagement process with our and through EIS support processes we will be community and stakeholders so that we can holding throughout the year. -

2008 BHP Billiton Annual Report

Annual Report 2008 For several years now, Asian economies have been driven by a fundamental shift in the rate of industrialisation and urbanisation of their massive populations. These economies have accounted for more global growth than has the United States. This growth will drive the course of the world economy for years to come. BHP Billiton produces and supplies world markets, including the developing Asian and other economies, with many of the natural resources they rely on to fuel their growth. These resources include iron ore, copper, nickel, alumina, manganese, coal, uranium, oil and gas. As the world’s leading natural resources company, we are central to the growth of the world’s developing economies. We really are resourcing the future. Our Charter Outlining our purpose, plans, values and measures of success Our Charter outlines the actions, values and measures by which we judge our success in creating long-term value through discovering, developing and converting natural resources. Earning the trust of our employees, contractors, customers, suppliers, communities and shareholders is a vital aspect of our success. Our values embrace safety and the environment, integrity, high performance, win-win relationships, the courage to lead change and respect for each other. Link to ‘Our Charter’ at www.bhpbilliton.com/aboutus/charter This Annual Report is issued subject to the Important Notices appearing on page 268 of this Annual Report. BHP Billiton Limited. ABN 49 004 028 077. Registered in Australia. Registered office: 180 Lonsdale Street, Melbourne, Victoria 3000, Australia BHP Billiton Plc. Registration number 3196209. Registered in England and Wales. Registered office: Neathouse Place, London SW1V 1BH, UK Contents 1.