Professional Services Strategy & Action Plan

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Common Plants of the Maldives Common Plants Common Plants of the Maldives Is a Starting Point for People Interested in Learning About Trees and Shrubs of the Maldives

series 1 series 1 Common plants of the Maldives Common plants Common Plants of the Maldives is a starting point for people interested in learning about trees and shrubs of the Maldives. It contains of the Maldives descriptions and photographs to help identify local plants as well as information on traditional uses in the Maldives and throughout the world. Whether you’re relaxing in your deck-chair or exploring the island vegetation, you will come to learn that all plants, within every ecosystem are not only beautiful but important for our survival as they provide food, medicine, soil stability, fresh air and water. books in this series are: Common Plants of the Maldives, Common Birds of the Maldives and Life on the Beach, Maldives. series 1 series 1 series 1 Common plants Common birds life on the beach of the Maldives of the Maldives Maldives LIVE&LEARN Environmental Education www.livelearn.org Common plants of the Maldives LIVE&LEARN Environmental Education Haa Alifu Atoll Haa Dhaalu INDIAN OCEAN The Maldives Atoll m There are Shaviyani Atoll approximately 1190 islands in the Maldives with some Noonu Atoll form of vegetation on Raa Atoll them. Lhaviyani Atoll m Approximately 200 are inhabited Baa Atoll islands and 990 are uninhabited. m There are 26 distinct Kaafu Atoll (Malé Atoll) geographical atolls. Alifu Alifu Atoll These are divided MALÉ into 20 administrative regions, with the Alifu Dhaalu Atoll capital Male’ making up a separate Vaavu Atoll administrative unit. Faafu Atoll m The Maldives is 860km long and Meemu Atoll 130km wide. Dhaalu Atoll m More than 99% of the country is water (115,000km2) with Thaa Atoll less than 0.3% land (300km2). -

Global Village Program Handbook 2012 Global Village Handbook

Global Village Program Handbook 2012 Global Village Handbook Published by: Habitat for Humanity Armenia Supported by: 2012 Habitat for Humanity Armenia, All rights reserved Global Village Program Handbook 2012 Table of Welcome from Habitat for Humanity Armenia Contents WELCOME TO ARMENIA Social Traditions, gestures, clothing, and culture 7 Dear Global Village team members, Traditional food 8 Language 8 Many thanks for your interest and Construction terms 9 willingness to join Habitat for Packing list 10 Humanity Armenia in building HFH ARMENIA NATIONAL PROGRAM simple, decent, affordable and The housing need in Armenia 11 Needs around the country and HFH's response 11 healthy homes in Armenia. You Repair & Renovation of homes in Spitak 12 will be a great help in this ancient Housing Microfinance Project in Tavush, Gegharkunik and Lori 13 country and for sure will have lots Housing Renovation Project in Nor Kharberd community 14 of interesting experiences while Partner Families Profiles/ Selection Criteria 15 working with homeowners and GV PROGRAM visiting different parts of Armenia. Global Village Program Construction Plans for the year 17 Living conditions of the volunteers 17 Our staff and volunteers are here to Construction site 18 assist you with any questions you Transportation 18 R&R options 18 may have. Do not hesitate to contact Health and safety on site 20 anyone whenever you have Health and safety off site 24 Type of volunteer work 25 questions. This handbook is for Actual Family Interactions/Community/Special Events 25 your attention to answer questions GV POLICIES 26 Gift Giving Policy 26 that you may have before landing HFH Armenia GV Emergency Management Plan 2012 27 in the country and during your USEFUL INFORMATION Habitat for Humanity service trip Arrival in Armenia (airport, visa) 28 to Armenia. -

IV. TRADE POLICIES by SECTOR (1) 1. the Maldives Is a Small Economy

Maldives WT/TPR/S/221 Page 33 IV. TRADE POLICIES BY SECTOR (1) INTRODUCTION 1. The Maldives is a small economy with limited natural resources and thus a narrow economic base; heavy dependence on tourism services and fisheries makes the economy and trade vulnerable to exogenous shocks. Although the economy is relatively open with trade in goods and services accounting for over 150% of GDP in 2009, tariffs remain relatively high and state involvement is prevalent in many sectors. High tariffs and state involvement tend to impede competition and thus result in an inefficient allocation of resources. To be more resilient, the economy would need to diversify, this could be achieved through greater private-sector involvement. At present, private-sector involvement remains weak (except tourism), presumably due to crowding out by the state-owned enterprises and the relatively high cost of doing business in the Maldives. 2. Fisheries account for almost all merchandise exports and the state-owned Maldives Industrial Fisheries Company (MIFCO) remains dominant in the sector. Fishing and fish processing is characterized by very little product diversification and low value-added products. Export receipts would be significantly greater if higher value-added processes, such as canning, were to become more prevalent. The agriculture sector is limited to 30 square miles of arable land, which is used to grow fruits and vegetables for personal consumption. The manufacturing sector remains weak; it is protected by high tariffs, but receives government support in the form of tariff concessions on imported inputs. 3. Tourism and related activities, such as transport and communications, dominate services, contributing to as much as 70% of GDP. -

The Fulbright in Kazakhstan

The Fulbright in Kazakhstan Handbook for U.S. Grantees Contact Information Cultural Affairs Assistant Asiyat Suleimenova Email: [email protected] Work phone - + 7 7172 702 295 Cell Phone: +7 777 223 0856 Assistant Cultural Affairs Officer Drew Peterson Email: [email protected] Work phone – + 7 7172 702 118 Cell phone – + 7 777 114 3680 Cultural Affairs Officer Katherine Kaetzer-Hodson Email: [email protected] Work phone – +7 7172 702 318 Cell phone – + 7 777 277 2723 Locations of the United States Mission in Kazakhstan: U.S. Embassy Astana 23-22 Str., No. 3, Ak Bulak, Astana 010010 Kazakhstan Phone: + 7 7172 70 21 00 Website: https://kazakhstan.usembassy.gov U.S. Consulate General Almaty Samal Towers 97 Zholdasbekov Str., 16th floor, Almaty 050051 Kazakhstan Phone: + 7 727 250 76 12 Website: http://almaty.usconsulate.gov/ Welcome to Kazakhstan Congratulations on receiving the Fulbright grant! We look forward to welcoming you to Kazakhstan soon. During your stay in Kazakhstan it is important that you maintain a close relationship with the U.S. Mission in order to successfully participate in the program. The Public Affairs Section will organize a general orientation program for the newly arrived Fulbright students and scholars. MAP OF KAZKAHSTAN KEY FACTS Official Name: Republic of Kazakhstan Type of Government: Republic Chief of State and Head of Government: President Nursultan A. Nazarbayev Capital City: Astana Languages: Official – Kazakh, and Russian Area: 2,717,300 sq. km/1,049,150 sq. mi Population: 16.9 million Religions: Islam 47%, Russian Orthodox 44% Currency: Tenge (T) Time Zones: Greenwich Mean Time (GMT) plus 4 to 6 hours; Eastern Standard Time (EST) plus 10 to 11 hours. -

Republic of Maldives

National Adaptation Programme of Action (NAPA) Republic of Maldives GEF Prepared by The Government of Maldives Ministry of Environment Energy and Water National Adaptation Programme of Action (NAPA) Republic of Maldives GEF Prepared by The Government of Maldives Ministry of Environment, Energy and Water i Maldives NAPA Team: Ms. Mariyam Saleem (Marine Research Centre) Lead Author and Project Manager: Dr. Ahmed Jamsheed Mohamed (Department of Ms. Lubna Moosa Public Health) Dr. Mohamed Shareef (Ministry of Planning and Co-Authors: National Development) Dr. Simad Saeed Ms. Hafeeza Abdulla (NAPA National Consultant) Dr. Mohamed Shiham Adam Ms. Mizna Mohamed (Ministry of Environment, Energy Dr. Abdulla Naseer and Water) Dr. Sheena Moosa Mr. Hussain Naeem (Ministry of Environment, Energy Mr. Ahmed Shaig and Water) Contributors: Editors: Mr. Ahmed Jameel (Ministry of Environment, Energy Dr. Simad Saeed and Water) Mr. Ahmed Shaig Mr. Amjad Abdulla (Ministry of Environment, Energy Ms. Lubna Moosa and Water) Mr. Ibrahim Shaheen (Maldives Transport and Support Staff: Contracting Company) Ms. Aminath Zumeena Ms. Fathmath Shafeega (Ministry of Planning and Mr. Ibrahim Hamza Khaleel National Development) Mr. Abdulla Mohamed Didi Mr. Mohamed Aslam (LaMer) Ms Athira Ali Mr. Hussain Zahir (Marine Research Centre) © Ministry of Environment, Energy and Water, 2006 The contents of this report may be reproduced in parts with acknowledgment of source. ISBN Published by: Ministry of Environment, Energy and Water, 2006 Fen Building Male', Republic of Maldives Tel: +960 3324861 Fax: +960 3322286 Email: [email protected] Website: www.environment.gov.mv Cartography, design and layout by: Ahmed Shaig Photos courtesy of: Portrait Gallery Printed by: National Adaptation Programme of Action - Maldives ii Foreword By President of the Republic of Maldives 27 December 2006 Our world is today faced with many mitigate against climate change, there is serious threats to the prospect of life and no local-level fix to this global problem. -

Directory of ICT Companies in Mauritius

Directory of ICT Companies In Mauritius 0 FOREWARD In line with its objective to facilitate and promote the development of the ICT industry, the National Computer Board (NCB), operating under the aegis of the Ministry of Technology, Communication and Innovation (MTCI), regularly published the ‘Directory of ICT Companies in Mauritius’ which provides comprehensive information on the Mauritian ICT industry operators. This publication is a good tool to market the know-how, product and services of ICT companies operating in Mauritius. It is also a guide for international outsourcers looking to do business with ICT service providers in Mauritius and potential investors in the ICT sector looking for local partners. Previous editions were printed as hard copies. The NCB published the first edition of the Directory of ICT Companies in Mauritius in 2006 and the second edition in 2009. The third edition was published in 2012. They received positive feedback from the local ICT industry players and were used as marketing materials to promote the expertise of the local ICT companies. This electronic version is an update of the third edition and it has incorporated updates on all operators which are members of local industry associations. The NCB is in the process of porting this Directory on a web platform, whereby operators will be able to immediately and securely update their company information and also allowing browsers to conduct user-friendly searches. The Directory provides a list of major local ICT operators, information on their activities, expertise, products and services, contact details, as well as on export potential and markets. We trust that the Directory of ICT Companies in Mauritius, published by the National Computer Board, will give a boost to our ICT exports and contribute to the development of a strong and sustainable ICT industry in Mauritius. -

Recommended Web Searches for Due Diligence

Recommended Web Searches for Due Diligence Note that the list below is meant to serve only as a guide and that online sources for due diligence are not limited to this list. The inclusion of these links does not in any way imply endorsement by ADB or its affiliates. Since these links are not under the control of ADB, it shall not be responsible for the contents of these linked sites or the opinions and statements expressed therein. This also applies to any additional links that may appear within these sites. Categories: • General Information Sources • Accredited Academic Institutions in the US and UK • Database for Due Diligence • Maps • Deep Web Search • Terrorism and Blacklists • Contracts Search • Country Information • Company Information • Nongovernment Organizations • People Search • Others General Information Sources Google www.google.com Yahoo www.search.yahoo.com Ask www.ask.com IceRocket www.icerocket.com The Internet Archive www.archive.org/web/web.php Database for Due diligence Websites require subscription or are password-protected Orbis and Zephyr https://bankscope2.bvdep.com/ip/ Accuity World Compliance https://accuity.worldcompliance.com https://compliancecatalyst.bvdinfo.com/ver- Compliance-Catalyst sion-2015714/home.serv?product=compliancecatalyst https://djrc.dowjones.com/factivaInternetVersion/Log- Dow Jones Risk & Compliance in.aspx Dun & BradStreet www.dnb.com http://www.lexisnexis.com/en-us/products/lexis-dili- LexisNexis Diligence gence.page Lexis https://www.lexis.com Nexis https://w3.nexis.com/new/ ProQuest www.proquest.com -

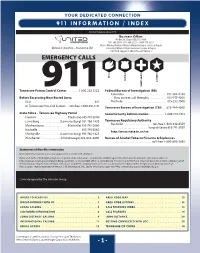

911 Information / Index

YOUR DEDICATED CONNECTION 911 INFORMATION / INDEX © United Communications 2015 Business Office: PO Box 38, Chapel Hill, TN 37034 rr Hours: Monday-Friday 8:00am-6:00pm Customer Service & Repair William H. Bradford – President & CEO Saturday 8:00am-4:30pm Customer Service & Repair 24/7 Tech Support 1-800-779-2227 Option 3 EMERGENCY CALLS FIRE POLICE AMBULANCE 911 SHERIFF Tennessee Poison Control Center . 1-800-222-1222 Federal Bureau of Investigation (FBI) Columbia. 931-388-0398 Before Excavating Near Buried Lines: if no answer, call Memphis. 901-747-4300 Dial . 811 Nashville . 615-232-7500 or Tennessee One-Call System . toll-free 1-800-351-1111 Tennessee Bureau of Investigation (TBI) . 615-744-4000 State Police – Tennessee Highway Patrol Social Security Administration . 1-800-772-1213 Franklin . (Nashville) 615-741-2060 Lewisburg . (Lawrenceburg) 931-766-1425 Tennessee Regulatory Authority Nashville . toll-free 1-800-342-8359 Murfreesboro . (Nashville) 615-741-2060 . long-distance 615-741-3939 Nashville . 615-741-2060 http://www.state.tn.us/tra Shelbyville . (Lawrenceburg) 931-766-1425 Winchester . (Chattanooga) 423-634-6890 Bureau of Alcohol Tobacco Firearms & Explosives . toll-free 1-800-800-3855 Statement of Non-Discrimination United Communications is an equal opportunity provider and employer. If you wish to file a Civil Rights program complaint of discrimination, complete the USDA Program Discrimination Complaint Form, found online at http://www.ascr.usda.gov/complaint_filing_cust.html, or at any USDA office, or call (866) 632-9992 to request the form. You may also write a letter containing all of the information requested in the form. Send your completed complaint form or letter to us by mail at U.S. -

Language Names and Norms in Bosnia and Herzegovina by Kirstin J. Swagman a Dissertation Submitted in Partial Fulfillment Of

Language Names and Norms in Bosnia and Herzegovina by Kirstin J. Swagman A dissertation submitted in partial fulfillment of the requirements for the degree of Doctor of Philosophy (Anthropology) in the University of Michigan 2011 Doctoral Committee Associate Professor Alaina M. Lemon, Chair Professor Judith T. Irvine Professor Sarah G. Thomason Associate Professor Barbra A. Meek Acknowledgements This dissertation owes its existence to countless people who provided intellectual, emotional, and financial support to me during the years I spent preparing for, researching, and writing it. To my dear friends and colleagues at the University of Michigan, I owe a debt that can hardly be put into words. To the ladies at Ashley Mews, who were constant interlocutors in my early engagements with anthropology and remained steady sources of encouragement, inspiration, and friendship throughout my fieldwork and writing, this dissertation grew out of conversations we had in living rooms, coffee shops, and classrooms. I owe the greatest thanks to my Bosnian interlocutors, who graciously took me into their homes and lives and tolerated my clumsy questions. Without them, this dissertation would not exist. I want to thank the many teachers and students who shared the details of their professional and personal lives with me, and often went above and beyond by befriending me and making time in their busy schedules to explain the seemingly obvious to a curious anthropologist. I owe the greatest debt to Luljeta, Alexandra, Sanjin, and Mirzana, who all offered support, encouragement, and insight in countless ways large and small. Daniel, Peter, Tony, Marina, and Emira were also great sources of support during my fieldwork. -

Maldives: Disaster Management Reference Handbook

CENTER FOR EXCELLENCE IN DISASTER MANAGEMENT & HUMANITARIAN ASSISTANCE WWW.CFE-DMHA.ORG MALDIVES Disaster Management Reference Handbook May 2021 Acknowledgements CFE-DM would like to thank the following people for their knowledge and support in developing this resource: Catherine Haswell, UN Resident Coordinator; Resident Coordinator’s Office; & the UN Country Team in Maldives Gabrielle Emery, Disaster Law Coordinator, International Federation of Red Cross and Red Crescent Societies (IFRC), Asia Pacific Regional Office; & The Maldivian Red Crescent Kristina Ortiz, Deputy Director & Hillary Midkiff, Maldives Coordinator – Governance and Vulnerable Populations Office, USAID/Sri Lanka & Maldives Front Cover A portion of the Haa Dhaalu Atoll in northern Maldives. Photo: NASA/METI/AIST/Japan Space Systems, and U.S./Japan ASTER Science Team Disclaimer This handbook has been prepared in good faith based on resources available at the time of publication. Information was gathered from the public domain, from local and government sources, as well as from subject matter experts. Where possible, a link to the original electronic source is provided in the endnote (reference) section at the end of the document. While making every attempt to ensure the information is relevant and accurate, the Center for Excellence in Disaster Management and Humanitarian Assistance (CFE-DM) does not guarantee or warrant the accuracy, reliability, completeness, or currency of the information in this publication. Each handbook is a working document and will be updated periodically as new, significant information becomes available. We hope that you find these handbooks informative, relevant, reliable, and useful in understanding disaster management and response for this country. We welcome and appreciate your feedback to improve this document and help fill any gaps to enhance its future utility. -

The Virgin Islands Vulnerability and Capacity Assessment of the Tourism Sector to Climate Change

The Virgin Islands Vulnerability and Capacity Assessment of the Tourism Sector to Climate Change Prepared by the Conservation and Fisheries Department, Ministry of Natural Resources and Labour April 2011 The Virgin Islands Vulnerability and Capacity Assessment of the Tourism Sector to Climate Change Prepared by the Conservation and Fisheries Department, Ministry of Natural Resources and Labour April 2011 Authors: Angela Burnett Penn and Atoya George Geographic Information System (GIS) maps: Rozina Norris-Gumbs ii | P a g e Table of Contents LIST OF FIGURES .................................................................................................................................... V LIST OF TABLES ...................................................................................................................................... X ACKNOWLEDGEMENTS ........................................................................................................................ 1 INTRODUCTION...................................................................................................................................... 2 Purpose of the Vulnerability and Capacity Assessment (VCA) ................................................................................ 2 Climate Change – What Is It? ................................................................................................................................. 5 EXECUTIVE SUMMARY ...................................................................................................................... -

December 1999 Vol

VJ 'ONSffii.:I l9l 'ON liWJgd 1008-0PL£6 V::::> ' OU~<lld OIVd PHd S/W '<lAV J<l)(:)Bg 'N StZ~ UTeJ~Old S<l!POlS Ul!!U<lUIJV ~~BlSOd . S' 0 W UO!}l!~Ul!~.IQ SlU<lpOlS UB!U<lUJJ\{ lYOJd-UON .. OUS<lld 'OS,:::> <lql JO JOOl!dS.M<lN <ltU HYE SHARZHOOM st Armenian Action .:.u.B· l:U.Pd-R~lF Year December 1999 Vol. 22, No. 2 ( 68) Supplement to The Collegian Karekin II Elected 132nd·Catllolicos of All Armenians By Barlow Der Mugrdechian joined by 22 other del Hye SharzhoomAdvisor egates from the Western Diocese, including four e afternoon air was filled other delegates from the with excitement a.nd antici Central Valley. T:pation on Wednesday, Oct The election of a 27, 1999, as 452 delegates from Catholicos has histori more than 30 countries prepared to cally been an important enter the doors of the sanctuary of event in Armenian his Holy Etchmiadzin, to cast their tory, for the primary rea ballots for the 132nd Catholicos of son that during periods All Armenians. when the Armenians had One by one the delegates en losttheirsovereignty, the tered· the Church as their names Armenian Church had were called, each feeling the weight provided not only spiri of responsibility as an elector who tual but political leader weuld decide the leader of the Ar ship as well (for example menian Church into the next mil the role of the Armenian lennium. Patriarch of Presiding over the election Constantinople as head we e Archbi hop Torkom of the Armenian millet Manoogian, Armenian Patriarch of during the period of Ot Jerusalem, Archbishop Mesrob (standing left to right) His Beatitude Archbishop Mesrop Mutafyan, Patriarch of Constantinople; His toman Turkish rule over Mutafyan, Armenian Patriarch of Holiness Aram I, Catholicos of the Great House of·Cilicia; and His Beatitude Archbishop .Torkom Western Armenia).