Hu B B Ing. a C Hieving E Ven More S Tarhu B L Td a N Nual Report 2 0 11

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

C NTENTASIA Data • Buyers •

programming • schedules • C NTENTASIA data • buyers • www.contentasia.tv Issue 124: 18-31 July 2011 what’sinside 100% success for new S’pore rule My 360º Life Exclusive deals vanish in face of cross-carriage Romain Oudart, TV5 Monde Singapore’s official efforts to StarHub, although the deal is said ContentAsia’s regular 2011 steer the pay-TV market away to have been done. section asks media execs what from exclusive carriage con- The pressure to up its game downtherabbithole differences the latest gadgets, tracts appears to have been is now on telco SingTel, widely tablets, applications & other 100% successful. believed to have been a driving tech wonders are making to Not a single exclusive carriage force for a new environment. their lives and thoughts. What’s really going on deal has been signed since 12 SingTel added three channels page 10 out there... March 2010 – the date media to its Mio TV line up this month authorities set as the dividing (see p4) but is yet to add any INproduction “Some things have line between old and new car- new mega-players, like FIC. Oth- Scrawl Studios changed about our world... riage regimes. Existing deals ers, such as Discovery and HBO, A who’s who of production We want to weigh all of that on that date are unaffected. remain exclusive to StarHub as houses across Asia Pacific. into our [Australia Network] Channels with new exclusive their agreements pre-date March page 12 tender process,” Australian PM agreements have to offer them 2010. BPL and ESPN Star Sports are Julia Gillard was quoted by The to rival carriers from 1 August exclusive to SingTel Mio. -

Impacts of Cross-Carriage Measure On

國立政治大學廣播電視學研究所 Department & Graduate Institute of Radio & Television College of Communication National Chengchi University 碩士論文 Master’s 治Thesis 政 大 立 學 「跨台聯播」國 對新加坡付費電視產業競爭與策略 ‧ 之影響研究 ‧ N a y t Impacts of Crosst -Carriage Measure on Competitioni and io s Strategies in Singapore’sn Subscription Televisionr Industry a e l i v C n hengchi U Student: Lin Kaiyan 林楷雁 Advisor: Professor Liu Yu-Li 劉幼琍教授 中華民國101年6月 Acknowledgements Finally, amidst the passing of two loved ones and coping with the grief, the end of this journey has arrived. Words are insufficient to express my emotions but I am forever grateful for the guidance, support, love and constructive opinions during this journey. I especially would like to express my gratitude to the following people: - to my advisor Prof Liu, thank you for taking the time amongst your busy schedule in guiding me through the thesis and advising me throughout the course of my studies; - to Prof Tseng and Prof Shih on my thesis committee, thank you for your valuable feedback and critiques; 治 - to all my other professors, thank政 you for sharing 大your lessons of life, valuable work experiences, knowledge 立and expertise; - to Alladin, Conny and Vivi, thank you for showering me 學with so much administrative support, laughter, love and care; 國 - to Mandy and Irina, I really owe you two much for helping me in tying up the loose ends of this journey; ‧ - to my friends, who‧ have been hearing me rant but yet still tolerating with me and giving N me so much love anda support especially through my lowest periods;y t - and to my dear classmates,t thank you for simply being comrades-i in-arms in this i s o r unforgettable journey. -

C NTENTASIA See Page 4

The Job Space The place to look for the jobs that count C NTENTASIA See page 4 www.contentasia.tv Issue 95: April 26-May 9, 2010 Strong pay-TV prospects June rollout for Food Network Asia in Asia-Pac, MPA Scripps ramps up local content acquisitions India’s pay-TV market is Scripps Networks International poised for long-term profitable is rumoured to be prepping for growth as media owners and a 1 June rollout of its HD Food atiger’seyes distributors expand market Network in Asia. share “with an eye on profits The Food Network Asia will de- What’s really going on rather than at the expense of but in at least two markets, and out there... profits”, Media Partners Asia’s possibly four. These almost certain- (MPA) new report, Asia Pacific ly include Singapore and Taiwan, Pay-TV & Broadband Markets Food, glorious food… with best bets that the other two and this year’s MIPTV 2010, says. will be Malaysia and Korea. But regulation, “which had a higher focus than ever Scripps has not confirmed the – both on and off screen – on continues to commoditise launches, saying the announce- and destroy industry value,” all things edible. ments will come from its carriage At the top of our culinary remains a major threat to partners. growth assumptions for India, fabulosity list this year are Meanwhile, the network has Scripps, AETN and Fremantle- a country poised to become picked up season one of Aussie the largest direct-broadcast Media. cooking show, Luke Nguyen’s And then there was Japa- market on earth in two years Vietnam, from SBS Australia for time, MPA says. -

Farewell to Schoolbooks! Japanese Execs Visit FPIP…Page 2 Win a Family Lunch for 6 at Mamou Power Plant Mall and Celebrate

MARCH 2015 www.lopezlink.ph Win a family lunch for 6 at Mamou Power Plant Mall and celebrate your 2015 graduates. To join, see page 5. Run for the scholars @ StoryDZMM on page 10.Takbo 2015! http://www.facebook.com/lopezlinkonline www.twitter.com/lopezlinkph EDC greens THE race to harness the wind has been won! Thanks to an intrepid team from the Lopez Group, kapamilya who visit the changed landscape of Ilocos Norte feel a twinge of pride when faced with the rows of shiny windmills spinning in the breeze. the grid Turn to page 6 Japanese execs Echo, Paulo Farewell to …page 2 face off in new schoolbooks! visit FPIP …page 12 series…page 4 Lopezlink March 2015 Lopezlink March 2015 Biz News Biz News Mandaluyong honors OML, SKY Dispatch from Japan THAITHE FROM PHOTOEMBASSY 21st cityhood Meanwhile, SKY received anniversary. a plaque of appreciation in O M L recognition of its involvement r e c e i v e d in job fair programs in the the Ulirang city. During these job fairs, Ma nd a leño SKY’s Consumer Sales team Award for partnered with third-party Community agencies in providing job op- Service. He portunities for sales agents. was joined by The city government said Rosa Rosal SKY’s job generation efforts AMML (5th from left) and the ASEAN ambassadors present a farewell gift to Amb. Upatising ( C o m m u - have contributed in supporting nity Service), its developmental agenda, advo- Joseph Lee cacies and pro-people initiatives AMML leads ASEAN farewell to Thai envoy Lopez Group chairman emeritus Oscar M. -

Hospitality and Institutions Programming Rate Card

Hospitality and Institutions 160+ Programming Rate Card Channels Access to DIRECTV® HD programming requires a DIRECTV® HD Receiver, HD television equipment and an HD Access fee of $0.75 per room per month. HD access fee is required in order to receive ANY HD channel within any package. PURCHASING GUIDELINES: All rates are per Subscriber Unit* per month with a minimum of $25 in programming services**. New properties with less than 20 units will be charged a small property fee of $25.99 per month. The small property fee will not be counted towards the $25 programming minimum. Charges must be based on 100% of the subscriber units at all times. The property does not have to display all feeds or channels in a package. Blackout restrictions and other conditions apply to sports programming. All programming and pricing subject to change. BASE PACKAGES: TM 45+ FAMILY Package Get 49 channels with over 10 in HD to fit many of your programming needs. $2.49 Channels This package includes popular channels such as Disney, Food Network, HLN and Weather Channel. PER UNIT BabyFirstTV TM DIY Network HD Home Shopping Network QVC Bloomberg Television HD Enlace Investigation Discovery HD RFD-TV Boomerang EWTN Jewelry Television Science HD BYU-TV Food Network HD Jewish Life TV ShopHQ CANAL ONCE Free Speech TV LINK TV Sprout Christian Television Network (CTN) GEB America NASA TV TCT Network Church Channel Gem Shopping Network National Geographic Channel HD TeenNick C-SPAN GOD TV Nick Toons The Weather Channel HD Daystar Hallmark Channel HD Nickelodeon/Nick at Nite (East) HD The Word Network Discovery Family Channel HGTV HD Nickelodeon/Nick at Nite (West) HD Trinity Broadcasting Network Disney Channel (East) HD HITN-TV Nick Jr. -

UNIVERSITY of CALIFORNIA, IRVINE Accelerating Innovation In

UNIVERSITY OF CALIFORNIA, IRVINE Accelerating Innovation in Global Contexts DISSERTATION submitted in partial satisfaction of the requirements for the degree of DOCTOR OF PHILOSOPHY in Information and Computer Sciences by Julia Katherine Haines Dissertation Committee: Bren Professor of Information and Computer Sciences Judith S. Olson, Chair Bren Professor of Information and Computer Sciences Gary M. Olson Professor Bonnie Nardi Assistant Professor Melissa Mazmanian 2015 © 2015 Julia Katherine Haines DEDICATION To all the founders I have met in this journey in admiration of their dedication and perseverance Xii TABLE OF CONTENTS LIST OF FIGURES .............................................................................................................................................. v LIST OF TABLES ............................................................................................................................................... vi ACKNOWLEDGMENTS ................................................................................................................................. vii CURRICULUM VITAE ................................................................................................................................... viii ABSTRACT OF THE DISSERTATION .......................................................................................................... x CHAPTER 1. Introduction ............................................................................................................................. 1 CHAPTER -

Philippines in View a CASBAA Market Research Report

Philippines in View A CASBAA Market Research Report An exclusive report for CASBAA Members Table of Contents 1 Executive Summary 4 1.1 Pay-TV Operators 4 1.2 Pay-TV Subscriber Industry Estimates 5 1.3 Pay-TV Average Revenue Per User (ARPU) 5 1.4 Media Ownership of FTAs 6 1.5 Innovations and New Developments 6 1.6 Advertising Spend 6 1.7 Current Regulations 6 2 Philippine TV Market Overview 8 2.1 TV Penetration 8 2.2 Key TV Industry Players 9 2.3 Internet TV and Mobile TV 11 3 Philippine Pay-TV Structure 12 3.1 Pay-TV Penetration Compared to Other Countries 12 3.2 Pay-TV Subscriber Industry Estimates 12 3.3 Pay-TV Subscribers in the Philippines 13 3.4 Pay-TV Subscribers by Platform 14 3.5 Pay-TV Operators’ Market Share and Subscriber Growth 14 3.6 Revenue of Major Pay-TV Operators 16 3.7 Pay-TV Average Revenue Per User (ARPU) 17 3.8 Pay-TV Postpaid and Prepaid Business Model 17 3.9 Pay-TV Distributors 17 3.10 Pay-TV Content and Programming 18 3.11 Piracy in The Philippine Pay-TV Market 20 4 Overview of Philippine Free-To-Air (FTA) Broadcasting 21 4.1 Main FTA Broadcasters 21 4.2 FTA Content and Programming 26 5 Future Developments in the Philippine TV Industry 27 5.1 FTA Migration to Digital 27 5.2 New Developments and Existing Players 28 5.3 Emerging Players and Services 29 Table of Contents 6 Technology in the Philippine TV Industry 30 6.1 6.1 SKYCABLE 30 6.2 Cignal 30 6.3 G Sat 30 6.4 Dream 30 7 Advertising in the Philippine TV Industry 31 7.1 Consumer Affluence and Ability to Spend 31 7.2 General TV Viewing Behaviour 32 7.3 Pay-TV and -

C NTENTASIA #Thejobsspace Pages 7

6-19 April 2015 C NTENTASIA #TheJobsSpace pages 7 www.contentasia.tv l https://www.facebook.com/contentasia?fref=ts facebook.com/contentasia l @contentasia l www.asiacontentwatch.com FreeView gears up for Thai launch New platform promises subscription free HD New Thai-owned satellite platform FreeView soft launches in Thailand by May with plans for more than 110 free- TV channels – including 40 HD channels – over the next three years as well as ex- pansion to neighbouring markets in the following phases. Story on page 2 Celestial Tiger launches 1st original production Double Vision to make new reality show for Kix Hong Kong-based channel operator, Celestial Tiger Entertainment (CTE), has launched its first original production initia- tive. Malaysian production house Double Vision has been commissioned to pro- duce the 12-part reality show, Story on page 4 HK Filmart closes on 7,100+ visitors ATV drama plays out against vibrant backdrop As Hong Kong free-TV broadcaster Asia Television (ATV) faced a dramatic end, Hong Kong’s media bosses played host to the most vibrant Filmart ever, with a re- cord 7,100 attendees at the 19th annual event. More on page 18 C NTENTASIA 6-19 April 2015 Page 2. A+E greenlights new FreeView gears up for Thailand launch photo format season New satellite platform promises subscription-free HD History Asia to air New Thai-owned satellite platform Step’s Philipp Heussen, who is leading the Photo Face-Off 2 this year FreeView soft launches in Thailand by FreeView project. May with plans for more than 110 free- He describes FreeView’s content policy TV channels – including 40 HD channels as “mass niche”, divided into about 25 – over the next three years as well as ex- categories ranging from travel and food pansion to neighbouring markets in the to kids and news. -

Ppibox All Package.Xlsx

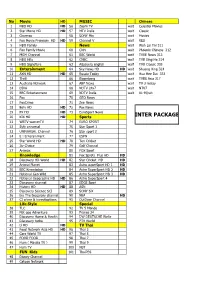

No Movie HD MUSIC Chinese 1 HBO HD HD 56 Zoom TV wait Celestial Movies 2 Star Movie HD HD 57 MTV India wait Classic 3 Cinemax 58 SONY Mix wait Movies 4 Fox Movie Premium HD HD 59 Channel V wait RED 5 HBO Family News wait Wah Lai Toi 311 6 Fox Family Movie 60 CNN wait Phoenix Chinese 312 7 MGM Channel 61 BBC World wait TVBE News 313 8 HBO Hits 62 CNBC wait TVB Xing He 314 9 HBO Signature 63 Aljazeera english wait TVB Classic 305 10 Enterainment 64 Sky News HD HD wait Shuang Xing 324 11 AXN HD HD 65 Russia Today wait Hua Hee Dai 333 12 Thrill 66 Bloomberg wait TVBS Asia 317 13 Australia Network 67 ABP News wait TV 3 malay 14 DIVA 68 NDTV 24x7 wait NTV7 15 BBC Entertenment 69 NDTV India wait AL-Hijrah 16 Fox 70 GEO News 17 FoxCrime 71 Zee News 18 Betv HD HD 72 Fox News 19 FX HD HD 73 EuroSport News 20 KIX HD HD Sports INTER PACKAGE 21 WBTV warnerTV 74 EURO SPORT 22 Syfy universal 75 Star Sport 1 23 UNIVERSAL Channel 76 Star sport 2 24 E ! Enterainment 77 ESPN 25 Star World HD HD 78 Ten Cricket 26 Itv Choice 79 Golf Channel 27 Animax 80 FOX Sport Knowledge 81 Fox Sprots Plus HD HD 28 Discovery HD World HD 82 Star Cricket HD HD 29 Animal Planet 83 Astro superSport HD 1 HD 30 BBC Knowledge 84 Astro SuperSport HD 2 HD 31 National Geo Wild 85 Astro SuperSport HD 3 HD 32 National Geographic HD HD 86 Astro SuperSport 4 33 Discovery channel 87 EDGE Sport 34 History HD HD 88 ASN 35 Discovery Science SCI 89 SONY SiX 36 bio The biogarpry channel 90 NBA HD 37 CI crime & investigations 91 OutDoor Channel Life Style Special 38 TLC 92 TV 5 Monde 39 Nat geo Adventure 93 France 24 40 Discovery Home & Health 94 DW DEUTSCHE Welle 41 Discovery turbo 95 PTV World 42 Li HD HD TV Thai 43 Food Network Asia HD HD 96 Thai 3 44 Care World TV 97 Thai 5 45 FOOD FOOD 98 Thai 7 46 Hum ( Masala TV ) 99 Thai 9 47 Hum TV 100 NBT FUN Kids 101 ThaiPBS 48 Disney Channel 49 Catoon Network. -

Ppibox All Package.Xlsx

No India HD KnowledgeSports 1 Sony HD 57 Discovery HD World HD 103 EURO SPORT 2 ZeeTV HD 58 Animal Planet 104 Star Sport 1 3 StarPlus HD 59 BBC Knowledge 105 Star sport 2 4 Colors HD 60 National Geo Wild 106 ESPN 5 Sony SAB 61 National Geographic HD HD 107 Ten Cricket 6 SAHARA ONE 62 Discovery channel 108 Golf Channel 7 Sony Max 63 History HD HD 109 FOX Sport 8 Movie OK HD 64 Discovery Science SCI 110 Fox Sprots Plus HD HD 9 Zee Cinema HD 65 bio The biogarpry channel 111 Star Cricket HD HD 10 Like OK HD 66 CI crime & investigations 112 Astro superSport HD 1 HD 11 Star Gold HD Life Style 113 Astro SuperSport HD 2 HD 12 Filmy 67 TLC 114 Astro SuperSport HD 3 HD 13 UTV Movie 68 Nat geo Adventure 115 Astro SuperSport 4 14 DD 1 69 Discovery Home & Health 116 EDGE Sport 15 AAJ Tak 70 Discovery turbo 117 ASN 16 aastha 71 Li HD HD 118 SONY SiX 17 Zee Bangala 72 Food Network Asia HD HD 119 NBA HD 18 Sanska 73 Care World TV 120 OutDoor Channel 19 Zee Marathi 74 FOOD FOOD Special 20 Asia Net Plus 75 Hum ( Masala TV ) 121 TV 5 Monde 21 Sun tv 76 Hum TV 122 France 24 22 Star Vijar FUN Kids 123 DW DEUTSCHE Welle 23 KTV 77 Disney Channel 124 PTV World 24 ETV Gujarati 78 Catoon Network TV Thai 25 ETV Rajsthan 79 Disney Junior 125 Thai 3 26 Jaya TV 80 Nickelodeon 126 Thai 5 27 PTC Panjabi 81 Cbeebies BBC 127 Thai 7 28 ZEE Panjabi 82 Disney XD 128 Thai 9 29 PTC CHAKDE 83 POGO 129 NBT 30 ETC Panjabe 84 Hungama 130 ThaiPBS Movie MUSIC 31 HBO HD HD 85 Zoom TV Chinese 32 Star Movie HD HD 86 MTV India wait Celestial Movies 33 Cinemax 87 SONY Mix wait Classic -

D:\Channel Change & Guide\Chann

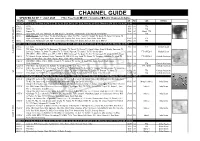

CHANNEL GUIDE UPDATED AS OF 1ST JULY 2020 FTA = Free To Air SCR = Scrambled Radio Channels in Italics FREQ/POL CHANNEL SR FEC CAS NOTES ARABSAT 5C at 20.0 deg E: Bom Az 256 El 27, Blr Az 262 El 24, Del Az 253 El 20, Chen Az 263 El 21, Bhopal Az 256 El 21, Cal Az 261 El 11 S 3796 LSRTV 1850 3/4 FTA A 3809 RSSBC TV 1600 2/3 FTA T E 3853 L Espace TV 1388 3/5 Mpeg4 FTA L L 3884 R Iqraa Arabic, ERI TV1, Ekhbariya TV, KSA Sports 2, 2M Monde, El Mauritania. Canal Algeria, Al Maghribia 27500 5/6 FTA I T 3934 L ASBU Bouquet: South Sudan TV, Abu Dhabi Europe, Oman TV, KTV 1, Saudi TV, Sharjah TV, Quran TV, Sudan TV, Sunna TV, E Libya Al Watanya; Holy Quran Radio, Emarat FM, Program One, Radio Quran, Qatar Radio, Radio Oman 27500 7/8 FTA & 3964 L Al Masriyah, Al Masriyah USA, Nile Tv International, Nile News, Nile Drama, Nile Life, Nile Sport, ERTU 1 27500 3/4 FTA C A BADR 5 at 26 deg East: Bom Az 253 El 33.02, Blr Az 259.91 El 29.71, Del 248.93 El 25.47, Chennai Az 260.76 El 26.88, Bhopal Az 252 El 27 B L 4087 L Tele Sahel 3330 3/4 FTA Medium Beam E T 4102 L TNT Niger: Télé Sahel, Tal TV, Espérance TV, Liptako TV, Ténéré TV, Dounia TV, Canal 3 Niger, Canal 3 Monde, Saraounia TV, V Bonferey, Tambara TV, Anfani TV, Labari TV, TV Fidelité, Niger 24, Télé Sahel, Tal TV, Voix du Sahel 20000 2/3 FTA MPEG-4 Medium Beam IRIB: IRIB 1, IRIB 2, IRIB 3 (scr), IRIB 4, IRIB 5, IRINN, Amouzesh TV, Quran TV, Doc TV, Namayesh TV, Ofogh TV, Ifilm, Press 11881 H TV, Varzesh, Pooya, Salamat, Nasim, Tamasha HD, IRIB 3 HD (scr), Omid TV, Shoma TV, Tamasha, Alkhatwar TV, Irkala TV, 27500 5/6 FTA MPEG-4 Central Asia beam Sepehr TV HD; Radio Iran, Radio Payam, Radio Jawan, Radio Maaref etc 11900 V IRIB: IRIB 1, IRIB 2, IRIB 3, IRINN, Amouzesh TV, Salamat TV, Sepehr HD; Radio Iran, Radio Payam, Radio Jawan, Radio Maaref etc. -

Primary & Secondary Sources

Primary & Secondary Sources Brands & Products Agencies & Clients Media & Content Influencers & Licensees Organizations & Associations Government & Education Research & Data Multicultural Media Forecast 2019: Primary & Secondary Sources COPYRIGHT U.S. Multicultural Media Forecast 2019 Exclusive market research & strategic intelligence from PQ Media – Intelligent data for smarter business decisions In partnership with the Alliance for Inclusive and Multicultural Marketing at the Association of National Advertisers Co-authored at PQM by: Patrick Quinn – President & CEO Leo Kivijarv, PhD – EVP & Research Director Editorial Support at AIMM by: Bill Duggan – Group Executive Vice President, ANA Claudine Waite – Director, Content Marketing, Committees & Conferences, ANA Carlos Santiago – President & Chief Strategist, Santiago Solutions Group Except by express prior written permission from PQ Media LLC or the Association of National Advertisers, no part of this work may be copied or publicly distributed, displayed or disseminated by any means of publication or communication now known or developed hereafter, including in or by any: (i) directory or compilation or other printed publication; (ii) information storage or retrieval system; (iii) electronic device, including any analog or digital visual or audiovisual device or product. PQ Media and the Alliance for Inclusive and Multicultural Marketing at the Association of National Advertisers will protect and defend their copyright and all their other rights in this publication, including under the laws of copyright, misappropriation, trade secrets and unfair competition. All information and data contained in this report is obtained by PQ Media from sources that PQ Media believes to be accurate and reliable. However, errors and omissions in this report may result from human error and malfunctions in electronic conversion and transmission of textual and numeric data.