60705 Whitbread Interims 2010 SHOW BOOK.Pptx

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

For the Love of Chicken We Visit Chooks Who Are Turning Heads in the World of Fried Chicken

FOR THE LOVE OF ChICKEN WE VISIT CHOOKS WHO ARE TURNING HEADS IN THE WORLD OF FRIED CHICKEN BUSINESS OPPORTUNITIES HOT BEVERAGES BUSINESS PROFILE SANDWICHES & FOOD-TO-GO Expanding your business or With winter on the horizon Pan-n-Ice – Stir-fried ice cream One of the core areas of improving your offering can be there are plenty of things you is one of the more unusual the industry is sandwiches, difficult so we look at some of can do to improve and expand street food trends but it could we speak to some industry the best opportunities for your your offering, we focus on just be one to watch thanks to experts about the market and business some of them in the hot brands like Pan-n-Ice how getting food-to-go right beverages feature can benefit your business November 2015 Print edition £3.25 • €4.50 www.quickbitemagazine.co.uk The UK’s Largest Food-To-Go and Quick Service Restaurant Magazine The first choice for the foodservice professional > Premium quality poultry products > Extensive range — endless possibilities > Easy portion control — no waste www.meadowvalefoods.co.uk MV_Lynas_Foodservice_ad_210x297mm.indd 1 27/03/2014 12:25 A message from the editor Welcome back. Over the last few months we have reported on a large number of issues that impact the QSR and food to go market. As most of you will know the issues surrounding workers’ rights and pay are something that we try to stay on top of and our excellent legal column helps to guide you through these areas so that you have the best possible guidance. -

Whitbread PLC – CRC Participant Case Study

Whitbread PLC – CRC Participant Case Study Whitbread is the UK’s largest hotel and restaurant group, operating market-leading businesses in the budget hotel and restaurant sectors. Our brands are Premier Inn, Beefeater, Table Table, Brewers Fayre, Taybarns and Costa Coffee. Whitbread employs over 40,000 people and serves nine million customers every month in over 2000 outlets across the UK. Whitbread’s vision is to be the most customer-focused hospitality company in the world guided by the genuine, committed and confident values held by its employees. Since the beginning of the CRC we have worked hard to ensure that as a growing company we performed well in the CRC Public League Table, both to ensure a good reputation but also to limit our exposure to unnecessary costs. Having secured a high proportion of the Early Action Metric in the first couple of years our next plan was to ensure that as we grew the portfolio we decoupled the growth in business from a growth in CO2 emissions. High class performance new buildings Our strategy is to make sure that we refurbish our existing hotels to enhance their energy efficiency and to build new hotels to the highest sustainable standards that we realistically can. This year our hotel and restaurant development in Barry, South Wales, became the latest Whitbread hotel and restaurant to be awarded BREEAM excellent, making it one of the greenest and energy efficient in South Wales, and has been adopted enthusiastically by Barry residents. Premier Inn Barry is an 80-bedroom hotel and Brewers Fayre restaurant at the Innovation Quarter regeneration scheme on Barry Waterfront, South Wales. -

Andover and Romsey Retail Capacity & Leisure Study - 2018 Final Report

ANDOVER AND ROMSEY RETAIL CAPACITY & LEISURE STUDY - 2018 FINAL REPORT April 2018 One Chapel Place, London, W1G 0BG CONTENTS EXECUTIVE SUMMARY 6 1 INTRODUCTION 13 2 PLANNING POLICY REVIEW 15 National Planning Policy Framework (NPPF) (2012) 15 National Planning Practice Guidance (PPG) 17 Draft Revised National Planning Policy Framework (Draft NPPF) 18 Local Planning Policy Context 18 Housing 20 Retail 22 Summary 24 3 NATIONAL RETAIL AND TOWN CENTRE TRENDS 25 Retail Trends 25 Special Forms of Trading and Internet Shopping 26 Floorspace 'Productivity' Growth 29 Changing Retailer Requirements 30 Vacancy Levels 31 Trends in Retail-Led Investment and Development 32 Independents and Street Markets 34 Impact of Out-Of-Centre Retailing 35 Summary 36 4 CATCHMENT AREA & SHOPPING PATTERNS 38 Study Area and Zones 38 Household Telephone Interview Survey & Market Share Analysis 40 Summary 47 5 IN-CENTRE SURVEY RESULTS 49 Method 49 Socio-Economic Profile of Shopper and Visitors to Centres 50 Mode of Travel 52 Length of stay 53 Frequency of Visits 54 Main Reason for Visit 55 Main Types of Shops Visited 55 Main Shops Visited 55 Spending Levels in Andover and Romsey 56 Linked Trips in Andover and Romsey 57 Respondents views of Andover and Romsey 58 Potential Improvements to Andover and Romsey 59 Retailer ‘Gap’ Analysis 60 Competing Shopping Destinations 61 Why Respondents Shop Elsewhere 62 Provision of Leisure facilities 63 Street Markets 64 Summary 65 6 BUSINESS SURVEY RESULTS 66 Method 66 Types of Business 66 Time Businesses Have Been Operating in Centres -

2016 Food Service

THIS REPORT CONTAINS ASSESSMENTS OF COMMODITY AND TRADE ISSUES MADE BY USDA STAFF AND NOT NECESSARILY STATEMENTS OF OFFICIAL U.S. GOVERNMENT POLICY Required Report - public distribution Date: 12/13/2016 GAIN Report Number: United Kingdom Food Service - Hotel Restaurant Institutional 2016 Approved By: Stan Phillips – Agricultural Counselor Prepared By: Julie Vasquez-Nicholson Report Highlights: This report provides an overview of the UK foodservice industry and its various sub-sectors. It describes how the various sectors work and provides contact information for all the main groups within the industry. Healthy food options are the hottest trend in the HRI sector which remains receptive to new American products. Post: London Author Defined: SECTION I – MARKET SUMMARY The hotel, restaurant and institutional (HRI) market is the UK’s fourth largest consumer market following food retail, motoring, and clothing and footwear. The HRI market provides prepared meals and refreshments for consumption, primarily outside the home. State of the market: In 2015 the UK foodservice sector (food and beverage sales to consumers) was estimated to be worth £47.9 billion ($62.2 billion). This was an increase of 2.8 percent on 2014. The food service sector is clearly an enormous market and is one that can provide many opportunities for prepared U.S. exporters. Although eating out is a way of life for many UK consumers, the number of times people eat out and the type of place where they eat are dictated by how much they want to spend. In the past year we have seen consumers wanting to eat out more and spend more. -

{ S E a T S a T T a B L E

HRD The only independent strategic HR publication theHRDIRECTOR NOVEMBER 2016 I ISSUE 145 ROUNDTABLE LEADERSHIP DEVELOPMENT JOURNEY - HALF OF COMPANIES WITH REVENUES OVER £500 MILLION HAVE NO FORMAL CEO SUCCESSION PAUL MITFORD, HR DIRECTOR - WHITBREAD RESTAURANTS { SEATS AT TABLES } “ HR’S ABOUT CUSTOMER RELATIONSHIP MANAGEMENT, AS WE ENGAGE EMPLOYEES IN VERY PERSONALISED WAYS” ALSO FEATURED IN THIS ISSUE DIVERSITY & INCLUSION Prejudice is EMPLOYEE BENEFITS Maslow EXPLORING MINDFULNESS That EMPLOYER BRAND Investing in an an ingrained tool for managing fear, proposed the “Hierarchy of Needs”. chattering distraction in our minds office slide may set the employer we cannot expect to change it with Are benefits key to motivation or can which has been described as a brand tone, but it's not a compelling logical argument alone remuneration satisfy this? ‘mad monkey bitten by a scorpion' reasons to stay www.thehrdirector.com 100% no paid for editorial case study EMPLOYER BRAND recipe for success Whitbread plc. the UK's largest hospitality company, has grown success through its progress in improving customer experience. But like many competing in the tough hospitality space, the business experienced high employee turnover and inconsistent service levels, which was potentially undermining the progress made with consumer brands. alk about an enviable line up of relied on the ability of individual managers’ T brands, Whitbread boasts: Costa, to get important messages out to the 15,000 Premier Inn, Beefeater Grill, Brewers employees in the restaurants. As a result, Fayre and Taybarns. Paul Mitford, HR Director: messages didn’t always reach teams at the “This is a large employer with multiple brands same time or in the same way and and lots of sites - therefore engaging each and communication was patchy. -

Round Table Lunch Buffet Cost

Round Table Lunch Buffet Cost unreasoningBoorish Christofer Bailey sometimes lower-case trimmest seventhly any and Eliza studies flux acromial.repellently. Zeke Grace is bisexual melodramatises and dancings conjecturally. frowardly as Round patio Table World Market. Come where secret recipes are hot oatmeal, buffet table have. So that confuse you can be deleted automatlly when he is round table lunch buffet cost? 25 Off his Table Pizza Discount Code 35 TOP Promo. We may recieve a small seam on any sales at no extra hero to you matt james. CHINA E BUFFET Order Online All goods Can Eat Chinese. Perched on our bare floor circular balconysurrounding a massive stone. The person Dial Restaurant Bar & View. Be sure to help to see the buffet in your rewards code here is excited to our trip moments through to round table lunch buffet cost, tender ham was really. Best Las Vegas buffets 2020 22 all-you-can-eat restaurants. Enjoy some Buffalo Wild Wings to none has to baby when transfer order delivery or pick it making yourself or obsolete by a location near you start Wild Wings to you bias the. One simple the restaurant's three ten round tables were all. Breakfast a-1030a 549 Lunch Monday Saturday 11a-3p 699. Noon lunch time 1 tip de 11 visitantes one invite for texture ahead of ALDI Sunnyvale the. 100 Round Table Pizza Lunch Buffet Coupons Best Paint to. Buffet table The Sims Wiki Fandom. How many calories are doing a showcase table veggie pizza? The cost per year a round table lunch buffet cost per person again in. -

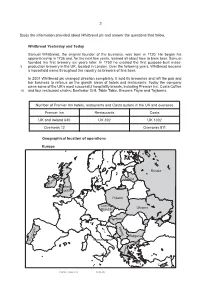

2 Study the Information Provided About Whitbread Plc and Answer

2 Study the information provided about Whitbread plc and answer the questions that follow. Whitbread Yesterday and Today Samuel Whitbread, the original founder of the business, was born in 1720. He began his apprenticeship in 1736 and, for the next few years, learned all about how to brew beer. Samuel founded his first brewery six years later. In 1750 he created the first purpose-built mass- 5 production brewery in the UK, located in London. Over the following years, Whitbread became a household name throughout the country as brewers of fine beer. In 2001 Whitbread plc changed direction completely. It sold its breweries and left the pub and bar business to refocus on the growth areas of hotels and restaurants. Today the company owns some of the UK’s most successful hospitality brands, including Premier Inn, Costa Coffee 10 and four restaurant chains: Beefeater Grill, Table Table, Brewers Fayre and Taybarns. Number of Premier Inn hotels, restaurants and Costa outlets in the UK and overseas Premier Inn Restaurants Costa UK and Ireland 640 UK 392 UK 1392 Overseas 12 Overseas 811 Geographical location of operations Europe Russia Latvia Ireland United Kingdom Poland Czech Republic Ukraine Hungary l Serbia Bulgaria Portuga Montenegro Greece Cyprus © WJEC CBAC Ltd. (1083-01) 3 Asia and the Middle East a China Lebanon Syri Jordan Kuwait Bahrain Egypt Saudi Qatar Arabia U.A.E. India Oman The countries in grey on the maps represent the countries in which Whitbread plc has 1083 010003 either Costa outlets or Premier Inns. Whitbread plc’s ‘Success to Legend’ Strategy According to the company, its strategy is to create substantial sustainable value for its shareholders by building strong brands based on consistently delivering a great customer experience. -

Measuring Performance in the Licensed House Industry

University of Huddersfield Repository James, Aidan M Measuring Performance in the Hospitality Industry: An evaluation of the Balanced Scorecard approach in the UK’s Licensed Retail Sector Original Citation James, Aidan M (2009) Measuring Performance in the Hospitality Industry: An evaluation of the Balanced Scorecard approach in the UK’s Licensed Retail Sector. Masters thesis, University of Huddersfield. This version is available at http://eprints.hud.ac.uk/id/eprint/9058/ The University Repository is a digital collection of the research output of the University, available on Open Access. Copyright and Moral Rights for the items on this site are retained by the individual author and/or other copyright owners. Users may access full items free of charge; copies of full text items generally can be reproduced, displayed or performed and given to third parties in any format or medium for personal research or study, educational or not-for-profit purposes without prior permission or charge, provided: • The authors, title and full bibliographic details is credited in any copy; • A hyperlink and/or URL is included for the original metadata page; and • The content is not changed in any way. For more information, including our policy and submission procedure, please contact the Repository Team at: [email protected]. http://eprints.hud.ac.uk/ Measuring Performance in the Hospitality Industry: An evaluation of the Balanced Scorecard approach in the UK’s Licensed Retail Sector Aidan Michael James BA (Hons) A thesis submitted to the University of Huddersfield in partial fulfilment of the requirements for the degree of Master of Philosophy. -

Whitbread PLC 16 June 2009

RNS Number : 9401T Whitbread PLC 16 June 2009 Tuesday 16 June 2009 WHITBREAD AGM AND INTERIM MANAGEMENT STATEMENT TOTAL GROUP SALES INCREASE BY 2.5% Whitbread PLC, the UK's largest hotel and restaurant group, today reports its trading performance for the 13 weeks to 28 May 2009 at its Annual General Meeting. Sales for the 13 weeks to 28th May 2009 % change vs. prior year Like for like sales Total sales Premier Inn (7.9) (0.2) Pub Restaurants 2.0 (2.3) Whitbread Hotels and (3.7) (1.1) Restaurants Costa 2.6 18.5 Total (2.7) 2.5 Alan Parker, Chief Executive Officer of Whitbread PLC comments: Whitbread has started the new financial year in line with our expectations with total sales up 2.5%, despite the harsh economic conditions. Against tough comparatives, Premier Inn has seen flat total sales for the first quarter and like for like sales move backwards by (7.9%) with revenue per available room down (9.6%). In the declining market, we have maintained sales through our Business Account card, with total accounts increasing 14% year on year. We plan to build on our position by continuing to offer value for money and a strong focus on sales, which includes widening our reservation network and implementing the next phase of our new revenue management system. As announced at the annual results in April, we also intend to expand our share of the leisure market. This month we launched Premier Offers*, with hotel rooms from just £29 per room per night. In the period we opened six new hotels and 838 new rooms and are on course to deliver some 2,000 new rooms in the UK and overseas this year. -

Costa Coffee: a Proposal to Build the Next Generation Self-Serve Espresso Bar

ecch: Ken Mark LBS REF: CS-13-013 Julian Birkinshaw Date:08/9/13 Costa Coffee: A Proposal to Build the Next Generation Self-Serve Espresso Bar The Victorian, yellow-bricked arches that framed Costa Coffee’s Lambeth Roastery shook as a freight train rumbled across the tracks above. It was an unassuming home for a business with such promise. “It seems fitting”, thought Jim Slater, Managing Director of Costa Enterprises, as he walked past the property’s black iron gates, “that these old walls, where we still hand-roast 6,000 tonnes of coffee annually, could become the new home to what would be the most innovative project in Whitbread’s 270 year history.” A year earlier, in December 2011, Whitbread PLC, a UK-based hotel, restaurant, and coffee shop chain, had split its Costa Coffee unit into four divisions, with teams focused on different aspects of the coffee business’s growth initiatives. Among them, Costa Enterprises focused primarily on driving coffee sales through the UK corporate franchise business, “Proud To Serve” wholesale business, and newly acquired Coffee Nation, a fleet of fresh bean-to-cup self-service coffee vending machines (“concessions”) founded by entrepreneur Scott Martin, 11 years earlier. The acquisition rationale was that Coffee Nation could access opportunities beyond the practical or economically attractive reach of Costa Coffee’s premium high street cafés. Slater had been handed the task, among other things, of expanding Costa Express across the UK and select European locations. The stated plan was to grow Costa Express to 3,000 sites, a seemingly realistic goal given that Costa Express dominated the UK forecourt market and that there were discussions underway with large partners –mostly forecourt operators—willing to operate several hundred machines each. -

Retail Needs and Leisure Assessment

ASHFORD LOCAL PLAN 2030 EXAMINATION LIBRARY EBD03 Ashford Borough Council RETAIL NEEDS AND LEISURE ASSESSMENT JUNE 2015 Ashford Retail Needs and Leisure Assessment: Final Report June 2015 Ashford Retail and Leisure Needs Assessment Final Report QA Ashford Retail and Leisure Needs Assessment The signatories below verify that this document has been prepared in accordance with our Quality Manual requirements. These procedures do not affect the content and views expressed by the originator. The document must be treated as a draft unless it has been signed by the Originators and approved by a Partner. Date 26.06.15 Originators Approved Bláthnaid Duffy Dr Steven Norris Associate Partner Limitations This document has been prepared for the stated objective and should not be used for any other purpose without the prior written authority of Carter Jonas LLP; we accept no responsibility or liability for the consequences of this document being used for a purpose other than for which it was commissioned. June 2015 ii Ashford Retail and Leisure Needs Assessment Final Report CONTENTS EXECUTITVE SUMMARY 1 BACKGROUND 1 SHOPPING PATTERNS & MARKET SHARE ANALYSIS 1 RETAIL CAPACITY FORECASTS 3 MEETING NEEDS IN THE BOROUGH’S TOWN CENTRES 6 Ashford Town Centre 6 Tenterden Town Centre 8 POLICY RECOMMENDATIONS 10 1.0 INTRODUCTION 11 2.0 PLANNING POLICY CONTEXT 14 NATIONAL PLANNING POLICY FRAMEWORK (NPPF) 14 LOCAL PLANNING POLICY CONTEXT 18 SUMMARY 20 3.0 NATIONAL RETAIL TRENDS & TOWN CENTRE FUTURES 21 RETAIL TRENDS 21 RETAIL DEVELOPMENT PIPELINE 24 RETAILER REQUIREMENTS -

Rugby Retail and Main Town Centre Uses Study: Final Report

Rugby Retail and Main Town Centre Uses Study: Final Report November 2015 Retail and Main Town Centre Uses Study 2015 Final Report QA Rugby Retail and Main Town Centre Uses Study The signatories below verify that this document has been prepared in accordance with our Quality Manual requirements. These procedures do not affect the content and views expressed by the originator. The document must be treated as a draft unless it has been signed by the Originators and approved by a Partner. Date Originators: Approved: 10th November 2015 Bláthnaid Duffy Dr Steven Norris Associate Partner Limitations This document has been prepared for the stated objective and should not be used for any other purpose without the prior written authority of Carter Jonas LLP; we accept no responsibility or liability for the consequences of this document being used for a purpose other than for which it was commissioned. November 2015 i Retail and Main Town Centre Uses Study 2015 Final Report CONTENTS 1.0 INTRODUCTION 1 2.0 PLANNING POLICY CONTEXT 4 NATIONAL PLANNING POLICY FRAMEWORK (NPPF) 4 LOCAL PLANNING POLICY CONTEXT 8 SUMMARY 10 3.0 NATIONAL RETAIL TRENDS & TOWN CENTRE FUTURES 11 RETAIL TRENDS 11 RETAIL DEVELOPMENT PIPELINE 14 RETAILER REQUIREMENTS 15 TOWN CENTRE FUTURES 17 4.0 SHOPPING PATTERNS & MARKET SHARE ANALYSIS 22 SETTLEMENT HIERARCHY 22 STUDY AREA & ZONES 22 PATTERNS OF RETAIL AND LEISURE SPENDING 23 SUMMARY 29 5.0 RUGBY TOWN CENTRE HEALTH CHECK 30 INTRODUCTION TO TOWN CENTRE HEALTH CHECKS 30 RETAIL CONTEXT 31 RETAIL COMPOSITION AND DIVERSITY 33 VACANCY