Investment Strategies That Emerge After Decoding Wall Street Propaganda

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

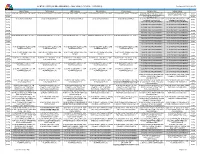

(US PROGRAMMING) - JAN, 2019 (1/7/2019 - 1/13/2019) Date Updated:12/13/2018 6:40:14 PM

MONTHLY GRID (US PROGRAMMING) - JAN, 2019 (1/7/2019 - 1/13/2019) Date Updated:12/13/2018 6:40:14 PM MON (1/7/2019) TUE (1/8/2019) WED (1/9/2019) THU (1/10/2019) FRI (1/11/2019) SAT (1/12/2019) SUN (1/13/2019) 05:00A 05:00 AM WORLDWIDE EXCHANGE 05:00 AM WORLDWIDE EXCHANGE 05:00 AM WORLDWIDE EXCHANGE 05:00 AM WORLDWIDE EXCHANGE 05:00 AM WORLDWIDE EXCHANGE 05:00 AM AMERICAN GREED 43B - 05:00 AM THE PROFIT: HIGH 05:00A THE BLING RING CNAMG043B0KH STAKES (PRIME TIME BUG) 05:30A 05:30 AM ON THE MONEY 05:30A CNOTM01129H 06:00A 06:00 AM SQUAWK BOX 06:00 AM SQUAWK BOX 06:00 AM SQUAWK BOX 06:00 AM SQUAWK BOX 06:00 AM SQUAWK BOX 06:00 AM OPTIONS ACTION (2 LINE 06:00 AM OPTIONS ACTION (2 LINE 06:00A TICKER/NO BUGSTACK) TICKER/NO BUGSTACK) 06:30A 06:30 AM PAID PROGRAMMING 06:30 AM PAID PROGRAMMING 06:30A 07:00A 07:00 AM PAID PROGRAMMING 07:00 AM PAID PROGRAMMING 07:00A 07:30A 07:30 AM PAID PROGRAMMING 07:30 AM PAID PROGRAMMING 07:30A 08:00A 08:00 AM PAID PROGRAMMING 08:00 AM PAID PROGRAMMING 08:00A 08:30A 08:30 AM PAID PROGRAMMING 08:30 AM PAID PROGRAMMING 08:30A 09:00A 09:00 AM SQUAWK ON THE STREET 09:00 AM SQUAWK ON THE STREET 09:00 AM SQUAWK ON THE STREET 09:00 AM SQUAWK ON THE STREET 09:00 AM SQUAWK ON THE STREET 09:00 AM PAID PROGRAMMING 09:00 AM PAID PROGRAMMING 09:00A 09:30A 09:30 AM PAID PROGRAMMING 09:30 AM PAID PROGRAMMING 09:30A 10:00A 10:00 AM PAID PROGRAMMING 10:00 AM PAID PROGRAMMING 10:00A 10:30A 10:30 AM PAID PROGRAMMING 10:30 AM PAID PROGRAMMING 10:30A 11:00A 11:00 AM SQUAWK ALLEY (2 LINE 11:00 AM SQUAWK ALLEY (2 LINE 11:00 AM SQUAWK -

25 RULES for INVESTING Jim Cramer’S 25 RULES for INVESTING

Jim Cramer’s 25 RULES FOR INVESTING Jim Cramer’s 25 RULES FOR INVESTING Rule No.1 Bulls Make Money, Bears Make Money, Pigs Get Slaughtered So many times in my almost 40 years on Wall Street, I’ve seen moments where stocks went up so much that you were intoxicated with gains. It is precisely at that point of intoxication, though, that you need to remind yourself of an old Wall Street saying: “Bulls make money, bears make money, but pigs get slaughtered.” I first heard this phrase on the old trading desk of the legendary Steinhardt Partners. I would be having a big run in some stock (or the market entirely) and Michael Steinhardt would tell me that I had made a lot of money — perhaps too much money — and maybe I was being a pig. I had no idea what he was talking about. I was so grateful that unlike so many others, I had stayed in and caught some very big gains. Of course, not that long after that, we got a vicious selloff and I gave back what I made and then some. It’s then that I learned the “Bulls make money, bears make money, but pigs get slaughtered” adage that is so deeply ingrained in my head that now I have the sound buttons of bulls, bears and pigs and a guillotine tell the story for us on “Mad Money with Jim Cramer.” Just so you know, the same thesis applies to those who press their bets on the short side. We’ve had some major corrections of stocks over the years, but other than in 2000 and then again in 2007-2009, most stocks bounced back after their declines. -

Yahoo Ties up with CNBC on Financial News 13 June 2012, by RYAN NAKASHIMA

Yahoo ties up with CNBC on financial news 13 June 2012, by RYAN NAKASHIMA (AP) - Yahoo is taking another step toward original Combined, the companies reach more than 40 news programming. million people in the U.S. online every month. The website is partnering with CNBC to produce CNBC digital senior vice president Kevin Krim said original financial news stories and video. It will the tie-up represents more than just a way to feature CNBC content prominently on the Yahoo expand CNBC's online audience. The partnership Finance page. will combine its Web presence with TV offerings and enable it to reach the highly informed CNBC, the cable TV channel owned by Comcast businesspeople advertisers value. He said third Corp.'s NBCUniversal, airs shows such as "Fast party research has shown that CNBC and Yahoo Money," ''Mad Money with Jim Cramer" and reach 71 percent of all active traders and 54 "Squawk on the Street." percent of top company executives in the U.S. Starting immediately, Yahoo will feature a breaking "It's not just empty calories, as we call it," Krim said. news ticker, new material on stock quote pages "We are able to deliver very high quality content to and other content produced by the CNBC a very high quality audience at an unprecedented newsroom. scale." In one of the first examples of the partnership, Copyright 2012 The Associated Press. All rights CNBC international correspondent Michelle Caruso- reserved. This material may not be published, Cabrera will collaborate with Yahoo to cover the broadcast, rewritten or redistributed. upcoming Greek parliamentary elections and investor concerns about the euro zone. -

Thursday Best Bets

THURSDAY PRIME TIME MARCH 8 S1 – DISH S2 - DIRECTV Thursday 6 PM 6:30 7 PM 7:30 8 PM 8:30 9 PM 9:30 10 PM 10:30 11 PM 11:30 S1 S2 Best Bets WSAZ :35 WSAZ NBC News Wheel of Jeopardy! 30 Rock Parks and The Office Up All Awake "The Little WSAZ Jay 3 3 NBC News Fortune (N) Rec (N) Night (N) Guy" News Leno WLPX Ghost Whisperer "The Cold Case "Jackals" Cold Case "Officer Cold Case "Mind Criminal Minds Criminal Minds "Sex, ION Gravesitter" Down" Games" "Lessons Learned" Birth, Death" 29 - TV10 5:30 Paid Eye for An Crime Lift Up America: Ambassadors of Compassion Hollywood Legends Fearless Singers & Newslines Program Eye Strike "Clint Eastwood" Music Songs - - WCHS News at 6 World Judge Ent. Wipeout Grey's A. "Hope for Private Practice Eyewitn- :35 News ABC News Judy Tonight the Hopeless" "Breaking the Rules" ess News Nightline 8 8 WVAH Big Bang Two and a Two and a Big Bang American Idol "1 The Finder "Eye of the Eyewitness News at The Excused FOX Theory Half Men Half Men Theory Voted Off" (N) Storm" (N) 10 p.m. Simpsons 11 11 WOWK News 13 CBSNews 13 News Inside Big Bang Big Bang Person of Interest The Mentalist "Cheap News 13 :35 David CBS at 6 p.m. Edition Theory (N) Theory "Baby Blue" (N) Burgundy" (N) Letterman 13 13 WKYT 27 CBSNews Wheel of NCAA Basketball SEC Tournament First Round Site: New NCAA Basketball SEC Tournament First Round CBS NewsFirst Fortune Orleans Arena -- New Orleans, La. -

Finance Book Reviews Ebook

Reach your peak!™ TABLE OF CONTENTS Introduction Relationships When She Makes More .........................................................................................................2 One Bed, One Bank Account ...............................................................................................3 Emotional Currency ...............................................................................................................5 Thin, Rich, And Happy ...........................................................................................................6 Permission To Prosper ...........................................................................................................7 The Cure For Money Madness .............................................................................................8 Smart Couples Finish Rich ....................................................................................................9 Global Economics Hormegeddon .....................................................................................................................10 When The Money Runs Out ...............................................................................................11 After The Music Stopped ...................................................................................................13 House Of Debt ....................................................................................................................15 Money, Greed, And God ....................................................................................................17 -

Cramer on Retirement: Should You Buy a Small Business with Your Nest

Cramer on Retirement: Should You Buy a Small Business With Your Nest... http://www.thestreet.com/story/11749868/1/cramer-on-retirement-should... Home Cramer Cramer's Portfolio Cramer's Blog Cramer's Videos Cramer's Articles Cramer's 25 Investing Rules Cramer's 10 Commandments Mad Money Recap Mad Money Stock Screener Action Alerts PLUS Charitable Trust Portfolio Most Recent Trade Alert 25 Investing Rules 10 Trading Commandments Real Money Jim Cramer's Blog Financial Experts Research and Commentary Technical Analysis Ideas Columnist Conversations FREE Previews Markets Stock Market Today FOREX Rates Commodity Prices Gold Prices Today Analyst Up/Downgrades Economic Events Calendar News Latest News Biotech and Drugs Technology News Banking and Finance Small Business News 5 Dumbest on Wall Street Investing Stock Screener Best Stocks for 2013 Best Funds for 2013 Best ETFs for 2013 1 of 11 12/16/2013 6:52 Cramer on Retirement: Should You Buy a Small Business With Your Nest... http://www.thestreet.com/story/11749868/1/cramer-on-retirement-should... Dividends and Income Financial Dictionary Investing in Stocks Investing in Bonds Investing in Mutual Funds Investing in ETFs Trading Broker Comparison Stock Upgrades Technical Analysis Option Trading Strategies Josh Brown's Side Street Money Retirement (IRAs, 401ks) Real Estate Travel - Leisure Running a Business Bank Safety Ratings Insurer Safety Ratings Credit Resource Center 2013 Tax Calendar Advisors Financial Advisor Forum Futures Commodity Futures Financial Futures Futures Education Video TheStreet TV Cramer on Demand Market Updates Options Economics & Politics Technology Small Business CEO Interviews Features Video Archive PREMIUM SERVICES Action Alerts PLUS Action Alerts OPTIONS - Just Launched! Real Money Trifecta Stocks Dividend Stock Advisor Stocks Under $10 2 of 11 12/16/2013 6:52 Cramer on Retirement: Should You Buy a Small Business With Your Nest.. -

1St Quarter, and the Broader S&P 500 Was up 12%, While the NASDAQ Reversed Last Year’S Decline and Shot Ahead 18.7% to Start 2012

VIEWPOINTS ST 1 QUARTER 2012 ADVISORY NEWSLETTER MARKET COMMENTARY FREDRIC W. WILLIAMS Technology’s Double Edged Sword… There’s no doubt that technological advancement and the ubiquitous availability of information have had a profound impact on the art, science and discipline of investing. From hardware to apps, and from tablets to smartphones, the nearly instantaneous access to data, as well as its inevitable media “interpretation”, has created a very different set of investment dynamics than even just a few decades ago. The question, of course, is – has this all been for the betterment of the individual investor? Remembering that CNBC (with the original moniker of the Consumer News and Business Channel before its takeover of the Financial News Network in 1991) only became part of our media world in 1989, we can recall that economic and investment news was solemnly delivered every evening by the likes of Huntley & Brinkley or Walter Cronkite – whose collective heart rates were just north of those of hibernating bears. Now we have Squawk Box, Fast Money and Mad Money (featuring an overly-caffeinated Jim Cramer roaming around a kitsch-filled set exclaiming “boo-yah!” at apparently attractive investment ideas) with CNBC broadcasting 24/7/365, including live news broadcasts from 4 AM to 8 PM daily. Similarly, when I was a young pup in this business back in the late ‘70s, stock exchange data was pushed through phone lines to small green cathode tubes (referred to as Quotrons or Bunker Ramos), while news came over a wider version of the old ticker tapes where thermal printing provided streaming paper rolls of analog information…just a tad different than today’s internet connectivity to web sites like Bloomberg, MarketWatch and Briefing, to name but a few. -

ETF Arbitrage May Be Driving Market Volatility - Thestreet

ETF Arbitrage May Be Driving Market Volatility - TheStreet http://www.thestreet.com/story/11644440/1/etf-arbitrage-may-be-drivi... WHAT TO WATCH FOR IN 2013 Home Stock Market Today Economic Calendar Earnings Calendar Dividend Calendar Stock Upgrades FOREX Rates Gold Price Today Silver Price Today Initial Public Offerings Stock Alerts 2013 Market Holidays Business News Latest News Biotech News Technology News Financial News Mergers & Acquisitions Airline News Automotive News Small Business News Political News Opinion Fiscal Cliff 2013 How to Invest Financial Dictionary Investing in Bonds Investing in Mutual Funds Investing in ETFs Investment Research Top Stocks Top Mutual Funds Top ETFs Stock Screener High-Dividend Stocks Insider Trading Data Where to Invest in 2013 Stock Game Earnings Calendar Dividend Calendar Bank Ratings 1 di 11 10.12.2012 16:07 ETF Arbitrage May Be Driving Market Volatility - TheStreet http://www.thestreet.com/story/11644440/1/etf-arbitrage-may-be-drivi... Mad Money Recap Mad Money Stock Screener Stock Upgrades Technical Analysis Dividend Stock Picks Option Trading Strategies Real Money Previews Side Street Personal Finance Retirement (IRAs, 401ks) Real Estate Travel - Leisure Starting a Business Bank Safety Ratings Insurer Safety Ratings Holiday 2012 Guide Credit Resource Center Videos Latest Videos Jim Cramer Debra Borchardt Lindsey Bell Gregg Greenberg Stephanie Link Nightly Business Report CEO Interviews Video Archive Videos on Facebook PREMIUM SERVICES Action Alerts PLUS **Special-51% OFF** Real Money Stocks Under $10 Breakout Stocks Options Profits Top Stocks Daily Swing Trade Portfolio PLUS Real Money Pro Chat on The Street Chairman's Club Compare All HOT TOPICS: Top 50 Tech Stocks for 2013 Best Ideas Webinar Worst Biotech CEO Celldex Pandora $19.99 Netflix Apple Price Target Stock Game Earnings Calendar Dividend Calendar Bank Ratings Mad Money Screener 2 di 11 10.12.2012 16:07 ETF Arbitrage May Be Driving Market Volatility - TheStreet http://www.thestreet.com/story/11644440/1/etf-arbitrage-may-be-drivi.. -

Taking Stock of Jim Cramer's 'Mad Money' Picks

Taking stock of Jim Cramer's 'Mad Money' picks http://sfgate.com/cgi-bin/article.cgi?file=/chronicle/archive/2005/07/... www.sfgate.com Return to regular view Taking stock of Jim Cramer's 'Mad Money' picks - Alan T. Saracevic Sunday, July 31, 2005 Watching Jim Cramer host his hyperkinetic stock-picking show produces a range of emotional reactions. There's laughter. There's concern. There's amazement. And let's not forget horror. To say Cramer is animated is like saying Al Gore is calm -- a gross understatement of character corrected only by an exponential increase in adjective. Al Gore is bone-crushingly dull. Jim Cramer is flat-out insane. If you haven't seen the show, "Mad Money" on CNBC, Cramer uses his years of experience as a Wall Street insider and hedge fund operator to help viewers pick stocks. The best part of the show, by far, is the final segment, "Lightning Round." Pacing around the cheesy set of the show and sweating profusely, Cramer takes calls from around the country that invariably begin with the greeting, "Booya, Jim!" "Booya, Bill!!!!" Cramer hollers back, staring maniacally at the camera and waiting for the caller to throw out a favorite stock. More often than not, Cramer will yammer out something positive about the company's standing and recommend a buy, which he signals by slamming this giant button on his desk that produces a stampeding cartoon bull on the screen that bellows its approval as it rushes toward the viewer. It's like the George Michael Sports Machine on steroids. -

Review Article the Study of Money

Review Article The Study of Money By JONATHAN KIRSHNER* Benjamin J. Cohen. The Geography of Money. Ithaca, N.Y.: Cornell University Press, 1998, 229 pp. Susan Strange. Mad Money: When Markets Outgrow Governments. Ann Arbor: University of Michigan Press, 1998, 212 pp. ONETARY phenomena now define the contours of the con- Mtemporary global economy. This is new, and it has transformed the study of international political economy (IPE). By contrast, for most of the past two centuries, money, as John Stuart Mill argued (and like a good baseball umpire), was only noticeable when it failed. This was cer- tainly the case during the dramatic expansion of the international econ- omy following the Second World War, and it was reflected in the concurrent development of the subdiscipline of IPE. The real economy —trade, especially liberalization, integration, and strategy—dominated the agenda, while monetary politics tended to pop up when its more se- vere pathologies—sterling crises, the collapse of Bretton Woods, the dol- lar cycle—threatened to disrupt the smooth functioning of world trade. At the dawn of the twenty-first century, however, these roles have re- versed. Money leads and the real economy must follow. From an eco- nomic perspective, this has an Alice-in-Wonderland quality to it: money, once the handmaiden of the modern economy, has become its mistress. For students of IPE, this presents a fundamental and profound question: in what way are politics affected by this change? Two excellent books, The Geography of Money, by Benjamin Cohen, and Mad Money, by Susan Strange, will frame, support, and serve as the point of departure for scholars addressing this vital question. -

Home Cramer Cramer's Portfolio Cramer's Blog Cramer's Videos Cramer's Articles Cramer's 25 Investing Rules Cramer's 10 Commandme

Keywords Home Cramer Cramer's Portfolio Cramer's Blog Cramer's Videos Cramer's Articles Cramer's 25 Investing Rules Cramer's 10 Commandments Mad Money Recap Mad Money Stock Screener Best Stocks for 2014 Action Alerts PLUS Charitable Trust Portfolio Most Recent Trade Alert 25 Investing Rules 10 Trading Commandments Best Stocks for 2014 Stephanie Link's Blog Real Money Jim Cramer's Blog Financial Experts Research and Commentary Technical Analysis Ideas Columnist Conversations FREE Previews RM's Top Ideas for 2014 Markets Stock Market Today FOREX Rates Commodity Prices Gold Prices Today Analyst Up/Downgrades Economic Events Calendar News Latest News Biotech and Drugs Technology News Banking and Finance Small Business News 5 Dumbest on Wall Street Investing Stock Screener Best Stocks for 2014 Best Funds for 2014 Best ETFs for 2014 Dividends and Income Financial Dictionary Investing in Stocks Investing in Bonds Investing in Mutual Funds Investing in ETFs Investing in Options Trading Broker Comparison Stock Upgrades Technical Analysis Option Trading Strategies Options Trading Basics Stephanie Link's Blog Herb Greenberg's Blog StockPickr Stock Game Money Retirement (IRAs, 401ks) Real Estate Travel - Leisure Running a Business Bank Safety Ratings Insurer Safety Ratings Individual Tax Calendar 2014 Financial Advisors Financial Advisor Forum Video TheStreet TV Cramer on Demand Market Updates Options Economics & Politics Technology Small Business CEO Interviews Features Video Archive PREMIUM SERVICES Action Alerts PLUS Action Alerts OPTIONS Breakout -

Weekly Market Summary

Weekly Market Summary Weekly Market Summary October 12th, 2018 Still Pretending to FULLY Understand Every Market Move?! We Surely DON'T!! Fadi Nasser - Deputy Chief Investment & Treasury Officer U.S. equity futures staged a rebound this morning after the worst two-day equity slump since February, as a combination of negative technical and persisting fears of trade wars continued to exert outsize influence on the stock market. December contracts on the Dow Index climbed as much as 1.3% in Asian trading Friday, compared with the cash market’s 6.7% decline over the past week. Stock trading turned extra volatile yesterday as the S&P 500 neared and then fell through its 200-day moving average, a chart line that has put a floor under several selloffs earlier this year. One of the worst myths out there is that the market is always rational and makes sense; That is surely not true! The other one is that many investors pretend to fully understand market moves: If that is the case and you have a really good theory about why stocks have tanked lately, then line up next to everyone else who has a really good theory! On any given day, the market can make seemingly random moves for reasons that do not make sense: Sometimes stocks go up when they should have gone down, and sometimes entire sectors move for ridiculous reasons! "Never assume that just because something happened, it has to make sense because the market is always supposed to make sense. That's nonsense," Jim Cramer – host of CNBC’s “Mad Money” once said.