AP Catalog 170117

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Daihatsu Launches New TAFT Mini Crossover As Part Three of DNGA

June 10, 2020 (1/6) Daihatsu Launches New TAFT Mini Crossover as Part Three of DNGA ~A partner that can be actively used in both everyday and leisure scenes, and that makes daily life more enjoyable~ TAFT G TAFT G (Equipped with the Plating Pack dealer’s option) Daihatsu Motor Co., Ltd. (hereinafter “Daihatsu”) announced today that its new TAFT*1 mini crossover will go on sale nationwide on June 10. Designed to be a “Tough & Almighty Fun Tool,” the TAFT seeks to be a partner that can be actively used in both everyday and leisure scenes, and that makes daily life more enjoyable. Following in the footsteps of the Tanto and the Rocky, which were launched in 2019, it forms part three of DNGA, Daihatsu’s next- generation approach to car-making. Daihatsu has positioned the TAFT as one of its core models, and will launch the car into the expanding mini crossover market. The TAFT’s exterior design exudes a toughness and power essential to SUVs through its square body, high minimum ground clearance, and large tires, while all grades come equipped as standard with the “Sky Feel Top,” a large glass roof above the front seats. The TAFT also adopts the new “Backpack Style” packaging concept. The front seats are designed to be a “crew space” that provides excitement and a variety of storage options; the rear of the vehicle is a “flexible space” that can be freely arranged. This new packaging concept enables the car to excel in both everyday and leisure scenes. Based on its approach of “providing advanced technologies to everyone,” Daihatsu has evolved its Smart Assist active safety system and equipped it as standard to all TAFT grades. -

(AV) and Alternative Fuel Vehicle (AFV) Florida Market Penetration Rate and VMT Assessment Study

Autonomous Vehicle (AV) and Alternative Fuel Vehicle (AFV) Florida Market Penetration Rate and VMT Assessment Study Final Report BDV25-977-48 Deliverable No. 10 PREPARED FOR Florida Department of Transportation October 2019 Autonomous Vehicle (AV) and Alternative Fuel Vehicle (AFV) Florida Market Penetration Rate and VMT Assessment Study Final Report BDV25-977-48 Prepared for: Florida Department of Transportation Mark E. Reichert Administrator for Metropolitan Planning Office of Policy Planning Prepared by: USF Center for Urban Transportation Research Sisinnio Concas, Ph.D. Alexander Kolpakov Austin M. Sipiora Braden R. Sneath October 2019 ii Disclaimer The opinions, findings, and conclusions expressed in this publication are those of the authors and not necessarily those of the Florida Department of Transportation or the U.S. Department of Transportation. iii Metric Conversion SYMBOL WHEN YOU KNOW MULTIPLY BY TO FIND SYMBOL LENGTH in inches 25.4 millimeters mm ft feet 0.305 meters m yd yards 0.914 meters m mi miles 1.61 kilometers km VOLUME fl oz fluid ounces 29.57 milliliters mL gal gallons 3.785 liters L ft3 cubic feet 0.028 cubic meters m3 yd3 cubic yards 0.765 cubic meters m3 NOTE: volumes greater than 1000 L shall be shown in m3 MASS oz ounces 28.35 grams g lb pounds 0.454 kilograms kg megagrams T short tons (2000 lb) 0.907 Mg (or "t") (or "metric ton") TEMPERATURE (exact degrees) 5 (F-32)/9 oF Fahrenheit Celsius oC or (F-32)/1.8 iv Technical Report Documentation 1. Report No. 2. Government Accession No. 3. Recipient's Catalog No. -

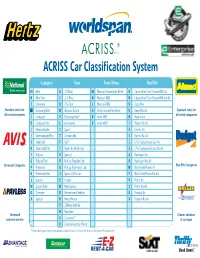

ACRISS Car Classification System

4WS 968 Car Industry Letter 6/12/06 09:15 Page 1 ACRISS Car Classification System Category Type Trans/Drive Fuel/Air M Mini B 2-3 Door M Manual Unspecified Drive R Unspecified Fuel/Power With Air N Mini Elite C 2/4 Door N Manual 4WD N Unspecified Fuel/Power Without Air E Economy D 4-5 Door C Manual AWD D Diesel Air Standard codes for H Economy Elite W Wagon/Estate A Auto Unspecified Drive Q Diesel No Air Standard codes for all rental companies all rental companies C Compact V PassengerVan* B Auto 4WD H Hybrid Air D Compact Elite L Limousine D Auto AWD I Hybrid No Air I Intermediate S Sport E Electric Air J Intermediate Elite T Convertible C Electric No Air S Standard F SUV* L LPG/Compressed Gas Air R Standard Elite J Open Air All Terrain S LPG/Compressed Gas No Air F Fullsize X Special A Hydrogen Air G Fullsize Elite P Pick up Regular Cab B Hydrogen No Air Increased Categories New Elite Categories P Premium Q Pick up Extended Cab M Multi Fuel/Power Air U Premium Elite Z Special Offer Car F Multi Fuel/Power No Air L Luxury E Coupe V Petrol Air W Luxury Elite M Monospace Z Petrol No Air O Oversize R Recreational Vehicle U Ethanol Air X Special H Motor Home X Ethanol No Air Y 2 Wheel Vehicle N Roadster Increased Greater selection customer service G Crossover* of car types K Commercial Van/Truck *These vehicle types require new booking codes which are listed in the chart on the back of this document. -

Car Wars 2020-2023 the Rise (And Fall) of the Crossover?

The US Automotive Product Pipeline Car Wars 2020-2023 The Rise (and Fall) of the Crossover? Equity | 10 May 2019 Car Wars thesis and investment relevance Car Wars is an annual proprietary study that assesses the relative strength of each automaker’s product pipeline in the US. The purpose is to quantify industry product trends, and then relate our findings to investment decisions. Our thesis is fairly straightforward: we believe replacement rate drives showroom age, which drives market United States Autos/Car Manufacturers share, which drives profits and stock prices. OEMs with the highest replacement rate and youngest showroom age have generally gained share from model years 2004-19. John Murphy, CFA Research Analyst Ten key findings of our study MLPF&S +1 646 855 2025 1. Product activity remains reasonably robust across the industry, but the ramp into a [email protected] softening market will likely drive overcrowding and profit pressure. Aileen Smith Research Analyst 2. New vehicle introductions are 70% CUVs and Light Trucks, and just 24% Small and MLPF&S Mid/Large Cars. The material CUV overweight (45%) will likely pressure the +1 646 743 2007 [email protected] segment’s profitability to the low of passenger cars, and/or will leave dealers with a Yarden Amsalem dearth of entry level product to offer, further increasing an emphasis on used cars. Research Analyst MLPF&S 3. Product cadence overall continues to converge, making the market increasingly [email protected] competitive, which should drive incremental profit pressure across the value chain. Gwen Yucong Shi 4. -

The Rise of China's Luxury Automotive Industry

Heritage with a High Price Tag: The Rise of China’s Luxury Automotive Industry Sydney Ella Smith AMES 499S Honors Thesis in the Department of Asian and Middle Eastern Studies Duke University Durham, North Carolina April 2018 Guo-Juin Hong Department of Asian and Middle Eastern Studies Supervising Professor Leo Ching Department of Asian and Middle Eastern Studies Committee Member Shai Ginsburg Department of Asian and Middle Eastern Studies Committee Member Heritage with a High Price Tag: The Rise of China’s Luxury Automotive Industry Sydney Ella Smith, B.A. Duke University, 2018 Supervisor: Guo-Juin Hong TABLE OF CONTENTS Author’s Note ...........................................................................................................ii Introduction: For Automobiles, Failure Builds Resiliency ......................................1 Chapter 1: Strategy Perspectives on the Chinese Automotive Industry ...................9 Michael Porter’s “Five-Forces-Model” ........................................................12 Michael Porter’s “Clusters and the New Economics of Competition” ........23 Chapter 2: Luxury Among the Nouveau Riche: The Chinese Tuhao (土豪) .........32 What is Luxury? ...........................................................................................34 Who Buys Luxury? ......................................................................................39 Evolving Trends in Luxury ..........................................................................45 Conclusion: Cars with Chinese Characteristics ......................................................49 -

Consumer Guide to Electric Vehicles

CONSUMER GUIDE TO ELECTRIC VEHICLES MARCH 2019 11006224 Today’s Choices in Cars Today’s electric car market is growing steadily, offering U.S. consumers more affordable, efficient, high-performance transportation options each year. Buy- ers can find an electric car in almost every vehicle class, with about 41 new models available today and about 132 projected by 2022. ELECTRIC VEHICLES DEMYSTIFIED Nationwide, a public charging net- This guide focuses exclusively on plug-in electric vehicles, work is expanding as well, enabling which have batteries that are recharged by plugging into more consumers to consider purchas- the electricity grid. There are two main types: battery ing an electric car. Most drivers still electric or all-electric vehicles, and plug-in hybrid electric vehicles. prefer to charge at home, however, due to convenience and savings over All-electric vehicles use no gasoline and are powered time. They plug in and charge their solely by an electric motor (or motors) and battery. Battery technology is rapidly advancing, costs are declining, and cars overnight, just like their smart vehicle range is increasing. phones. At the U.S. national average price of 12.5 cents per kilowatt-hour Plug-in hybrids are powered by an electric motor (or motors) and battery paired with an internal combustion (kWh), electricity is roughly equivalent engine. Most drive solely on electricity using battery to gasoline at $1 a gallon. Plus, many energy until the battery is discharged, thereafter continuing electricity providers offer special elec- to drive on gasoline like a conventional hybrid. tric vehicle rates. Conventional hybrids have smaller batteries and do Displacing gasoline with domestic not plug in. -

GENERAL MOTORS COMPANY (Exact Name of Registrant As Specified in Its Charter)

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, DC 20549-1004 FORM 8-K CURRENT REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 Date of Report (Date of earliest event reported) July 1, 2011 GENERAL MOTORS COMPANY (Exact Name of Registrant as Specified in its Charter) 001-34960 DELAWARE 27-0756180 (Commission (State or other jurisdiction (I.R.S. Employer File Number) of incorporation) Identification No.) 300 Renaissance Center, Detroit, Michigan 48265-3000 (Address of Principal Executive Offices) (Zip Code) (313) 556-5000 (Registrant’s telephone number, including area code) Not Applicable (Former name or former address, if changed since last report) Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: ☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) ☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17-CFR 240.14a-12) ☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) ☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) TABLE OF CONTENTS ITEM 8.01 Other Events Signature Index to Exhibits Sales Release and Charts Dated July 1, 2011 ITEM 8.01 Other Events On July 1, 2011, General Motors Company (GM) issued a news release announcing June sales. The release and charts are attached as Exhibit 99.1. EXHIBIT Exhibit Description Method of Filing Exhibit 99.1 Sales Release and Charts Attached as Exhibit Dated July 1, 2011 SIGNATURE Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized. -

Honda Utility Vehicles Brochure: CR-V, Passport, Pilot, HR-V

Honda Utility Family automobiles.honda.com CR-V / CR-V Hybrid Passport Pilot HR-V Odyssey Ridgeline CR-V crv.honda.com CR-V Hybrid crvhybrid.honda.com A Standout Experience A Hybrid Without Rival Boundless fun. • 190-hp,1 turbocharged 4-cylinder engine Now, in hybrid. • Two-motor hybrid powertrain • Continuously variable transmission (CVT) with Sport Mode • 212 total system horsepower3 • Real Time AWD with Intelligent Control SystemTM† • 3-Mode Drive System (ECON/Sport/EV) With sculpted lines, distinctive details and • Remote engine start† All the style and performance of the CR-V. All the benefits • Real Time AWD with Intelligent Control SystemTM impressive handling, the redesigned CR-V is the • Standard Honda Sensing® suite of safety and driver- of a hybrid. The first-ever CR-V Hybrid delivers fun on • Remote engine start crossover that doesn’t compromise. Its sporty assistive features the road with sleek good looks and plenty of features, • LED headlights ( ) †2 look and bold performance have helped make • Blind spot information system BSI with cross traffic monitor ® † including Honda Sensing standard on all trims. * • LED headlights and daytime running lights it the best-selling CUV over the last decade. † • One-touch power moonroof CR-V AWD Touring (left) shown in Aegean Blue Metallic Honda reminds you to properly secure cargo items and follow all applicable † - with accessory crossbars and roof box. load limits and loading guidelines. *Based on IHS Markit U.S. total new vehicle Available features. Please visit automobiles.honda.com/cr v#specifications registrations of Crossover Utility Vehicles from 2010 through January 2020. -

Alternative Fuel Vehicle Forecasts Final Report

Alternative Fuel Vehicle Forecasts Final report PRC 14-28F Alternative Fuel Vehicle Forecasts Texas A&M Transportation Institute PRC 14-28F April 2016 Authors Richard “Trey” Baker Lauren Cochran Nick Norboge Maarit Moran Jason Wagner Beverly Storey 2 Table of Contents List of Figures ................................................................................................................................ 5 List of Tables ................................................................................................................................. 6 List of Acronyms ........................................................................................................................... 7 Executive Summary ...................................................................................................................... 8 Alternative Fuel Technologies .................................................................................................... 8 Factors Affecting Adoption of Alternative Fuel Vehicles ........................................................ 10 Forecast ..................................................................................................................................... 11 Implications for the State’s Fuel Tax Revenues ........................................................................ 13 Introduction ................................................................................................................................. 15 Texas Funding Implications ...................................................................................................... -

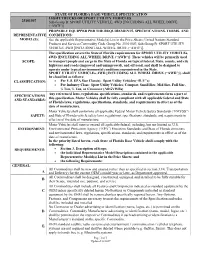

Sub-Group B: SPORT UTILITY VEHICLE

STATE OF FLORIDA BASE VEHICLE SPECIFICATION LIGHT TRUCKS OR SPORT UTILITY VEHICLES 25101507 Sub-Group B: SPORT UTILITY VEHICLE, 4WD [INCLUDING ALL WHEEL DRIVE (“AWD”)] PROPERLY EQUIPPED PER THE REQUIREMENTS, SPECIFICATIONS, TERMS, AND REPRESENTATIVE CONDITIONS: MODEL(S): See the applicable Representative Model(s) List in the Price Sheets; United Nations Standard Products and Services Commodity Code Group No. 25101507; Sub-Group B: SPORT UTILITY VEHICLE, 4WD [INCLUDING ALL WHEEL DRIVE (“AWD”)]. The specification covers the State of Florida requirements for SPORT UTILITY VEHICLEs, 4WD [INCLUDING ALL WHEEL DRIVE (“AWD”)]. These vehicles will be primarily used SCOPE: to transport people and cargo in the State of Florida on typical federal, State, county, and city highways and roads (improved and unimproved), and off-road, and shall be designed to operate under typical environmental conditions encountered in the State. SPORT UTILITY VEHICLEs, 4WD [INCLUDING ALL WHEEL DRIVE (“AWD”)], shall be classified as follows: CLASSIFICATION: • Per U.S. EPA Size Class(s): Sport Utility Vehicles (“SUV”s) • Per Industry Class: Sport Utility Vehicles; Compact, Small Size, Mid Size, Full Size, ½ Ton, ¾ Ton, or Crossover (All GVWRs) Any referenced laws, regulations, specifications, standards, and requirements form a part of SPECIFICATIONS this specification. Motor Vehicles shall be fully compliant with all applicable federal and State AND STANDARDS: of Florida laws, regulations, specifications, standards, and requirements in effect as of the date of manufacture. Motor Vehicles shall conform to all applicable Federal Motor Vehicle Safety Standards (“FMVSS”) SAFETY: and State of Florida vehicle safety laws, regulations, specifications, standards, and requirements in effect as of the date of manufacture. -

All-Wheel Drive Four-Wheel Drive

All-Wheel Drive vs. Four-Wheel Drive Part-Time / Full-Time 4WD is available in part- and full-time configurations. Like full- time AWD, full-time 4WD is always on and cannot be turned off Offered as either a part- or full-time system, AWD operates by the driver. Part-time 4WD is controlled by the driver either automatically and cannot be engaged or disengaged by the driver. electronically or, in the case of vehicles like the Jeep Wrangler, by using a floor-mounted shifter. FWD/ RWD The majority of AWD systems are available on front-wheel-drive 4WD systems are almost exclusively available on rear-wheel-drive (FWD) vehicles, though there are exceptions (such as the 2020 (RWD) vehicles (the FWD Jeep Compass being an exception to the Ford Explorer). As such, most vehicles with part-time AWD default rule). When part-time 4WD is not in use, these vehicles default to to FWD when the AWD system isn’t in operation. sending power to the rear wheels. Power Distribution All part-time 4WD systems have a transfer case with hi- and AWD almost always employs a single-speed differential without low-range settings. Low-range settings will deliver significantly high or low settings. When activated, some engine power is more torque for tough situations. Some also have an automatic distributed to the rear wheels in low-traction situations. Some setting that allows the vehicle’s computer to decide which wheels systems such as Acura’s Super Handling All-Wheel Drive (SH-AWD) will get power from the engine, effectively mimicking an AWD can also deliver more power to either of the rear wheels in an system. -

Koleos, the First 4X4 Crossover from Renault

PRESS RELEASE February 11, 2008 Koleos, the first 4x4 crossover from Renault Renault is pleased to present Koleos, its first ever crossover. Ideal for escaping the everyday routine, Renault Koleos is comfortable, easy to drive and boasts genuine off-road ability. It has been designed to be versatile, too, offering the same reassuring drive when motoring in and about town, on open roads and on motorways as it does when it is taken off the beaten track. Meanwhile, Renault Koleos delivers the same standard of comfort as that expected of a saloon car, as well as cabin space worthy of a compact MPV. Designed by Renault, developed by Nissan and manufactured in Renault Samsung Motors' Busan plant in Korea, Renault Koleos is the fruit of extremely close collaboration between teams from each of these Renault-Nissan Alliance brands. Renault Koleos will be on show at the Geneva Motor Show from March 4, 2008. The launch of Koleos marks a decisive step in the brand's development, not only in Europe but across the world. The release of its first 4x4 crossover is a sure sign that Renault has the capacity to take its own authentic stance and a completely fresh approach in segments from which it has traditionally been absent. Renault Koleos offers a unique standard of safety and comfort, a parameter that has become a recognised Renault hallmark which is not only clear for all to see but also highly affordable. The release of Koleos sees Renault take the wraps off its first ever 4x4 crossover, a vehicle designed for getting away from it all which combines an efficient all-wheel drive chassis, the dynamic lines of a saloon car and the cabin space of an MPV.