Real Estate Price Dynamics in India: an Overview of Residex Index with Special Reference to Kochi

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Accused Persons Arrested in Ernakulam City District from 15.11.2020To21.11.2020

Accused Persons arrested in Ernakulam City district from 15.11.2020to21.11.2020 Name of Name of the Name of the Place at Date & Arresting Court at Sl. Name of the Age & Cr. No & Sec Police father of Address of Accused which Time of Officer, which No. Accused Sex of Law Station Accused Arrested Arrest Rank & accused Designation produced 1 2 3 4 5 6 7 8 9 10 11 Ajaykumar , 65, Velleparambil H, 15.11.20 Cr 678/20 us 151 E T South S I of Police, Bailed by 1 Jayadevan Velaudhan Ravipuram Male Pallimukku at 18.00 CrPC P S E T South P Police S Kachappilly H, 36, 16.11.20 Cr 679/20 us 151 E T South Anilkumar, Bailed by 2 Abin Joseph Thomas Mannalipadam Ravipuram Male at 13.00 CrPC P S SI Police Ravipuram Ajaykumar , 18.11.20 25, staff Yuvaraj bar Cr 684/20 us 151 E T South S I of Police, Bailed by 3 Kunal Das Bidyuit das Thevara 20 at Male Thevara CrPC P S E T South P Police 21.10 S 24, staff Yuvaraj bar 19.11.20 Cr 685/20 us 151 E T South Anilkumar, Bailed by 4 Bhakthi Nayak sudhir Nayak Thevara Male Thevara at 21.45 CrPC P S SI Police 19.11.20 22, Udaya Colony Gandhi 66320 u/s 392, E T South Anilkumar, Bailed by 5 Mahindran Mahesh Ernakulam 20 at Male nagar, Kadavanthra 34 IPC P S SI Police 20.30 46, Vattakkatuveli, 15.11.20, Cr. 555/20, U/s Udayampero Jinson Dominic, SDMC Fort 6 Jayan MV Vijayan Valiyakulam Male Udayamperoor 16.30 hrs 151 of CrPC or SI of Police Kochi 54, Koladichira House, 16.11.20, Cr. -

Cochin Estuary, Southwest Coast of India

Article Author Version of : Water, vol.12(3); 2020; Article no: 908 What controls the flushing efficiency and particle transport pathways in a tropical estuary? Cochin estuary, southwest coast of India Sebin John1, 2, Muraleedharan K.R1*, C.Revichandran1, Abdul Azeez.S1, Seena G1, 2, Pierre W Cazenave3 1 CSIR‐National Institute of Oceanography, Regional Center,Kochi 2 Research Scholar, Bharathidasan University, Tiruchirappalli 3 Plymouth Marine Laboratory, UK * Correspondence: [email protected] Received: date; Accepted: date; Published: date Abstract: Estuaries with poor flushing and longer residence time retain the effluents and pollutants, ultimately resulting in eutrophication, declining in biodiversity and, finally deterioration of water quality.Cochin Estuary (CE), southwest coast of India is under the threat of nutrient enrichment by the anthropogenic interventions and terrestrial inputs through the land runoff. The present study used the FVCOM hydrodynamic model coupled with a Lagrangian particle module (passive) to estimate the residence time and to delineate site‐specific transport pathways in the CE. Moreover, understanding the back and forth movements and residence time of particles was elucidated using metrics such as path length, net displacement, tortuosity and time to flushed out from the system. Spatio‐temporal patterns of the particle distribution in the CE showed a similar trend during monsoon and post‐monsoon with an average residence time of 25 and 30 days respectively. During the low river discharge period(pre‐monsoon),flood‐ebb velocities resulteda minimum net transport of the water andlonger residence time of 90 days compared to that of high discharge period (monsoon). During the pre‐monsoon, particle releasedat the southern upstream (station. -

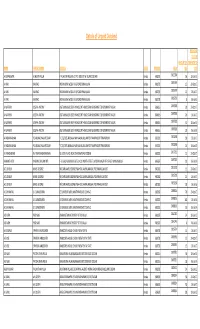

Details of Unpaid Dividend

Details of Unpaid Dividend PROPOSED DATE OF AMOUNT (IN TRANSFER TO NAME FATHER'S NAME ADDRESS STATE PINCODE FOLIO RS.) IEPF A GOPAKUMAR ACHUTAN PILLAI P. ACHUTAN PILLAI & CO P.O. BOX 507 W. ISLANO COCHIN Kerala 682003 0021306 56 18‐Jun‐15 A HARI KAK RAO INDIAN BANK WESDA. M G ROAD ERNAKULAM Kerala 682035 0039759 15 20‐Oct‐17 A HARI KAK RAO INDIAN BANK WESDA. M G ROAD ERNAKULAM Kerala 682035 0039759 15 16‐Jul‐17 A HARI KAK RAO INDIAN BANK WESDA. M G ROAD ERNAKULAM Kerala 682035 0039759 806‐Jul‐14 A MATHEW JOSEPH ANTONY ASST.MANAGER (EDP) FINANCE DPT HINDUSTAN NEWSPRINT LTD NEWSPRINT NAGAR Kerala 686616 0007828 20 20‐Oct‐17 A MATHEW JOSEPH ANTONY ASST.MANAGER (EDP) FINANCE DPT HINDUSTAN NEWSPRINT LTD NEWSPRINT NAGAR Kerala 686616 0007828 20 16‐Jul‐17 A MATHEW JOSEPH ANTONY ASST.MANAGER (EDP) FINANCE DPT HINDUSTAN NEWSPRINT LTD NEWSPRINT NAGAR Kerala 686616 0007828 32 18‐Jun‐15 A MATHEW JOSEPH ANTONY ASST.MANAGER (EDP) FINANCE DPT HINDUSTAN NEWSPRINT LTD NEWSPRINT NAGAR Kerala 686616 0007828 10 06‐Jul‐14 A PADMANABHAN P S ARUNACHALA REDDIAR T C 25/1695 ARUNALAYAM MANJALIKULAM RD THAMPANOOR TRIVANDRUM Kerala 695001 0018268 30 16‐Jul‐17 A PADMANABHAN P S ARUNACHALA REDDIAR T C 25/1695 ARUNALAYAM MANJALIKULAM RD THAMPANOOR TRIVANDRUM Kerala 695001 0018268 24 18‐Jun‐15 A VARADARAJAN R V ANANTHANARAYANAN V1/1673 PALACE ROAD THEKKAMADAM COCHIN Kerala 682002 0017215 15 20‐Oct‐17 A ANANTH IYER K ARUNA CHALAM IYER F‐3 GURU VAISHNAV FLATS 1‐A/10 NORTH STREET LAKSHMI NAGAR 4TH STAGE NANGANALLUR Kerala 695607 0007320 10 06‐Jul‐14 A C LOVELIN JAMES GEORGE -

Kochi City Biodiversity Index, 2020 Has Been Prepared Based on the SCBD Endorsed User Manual for TCBI Updated in 2014 (SCBD, 2014)

Kochi Municipal Corporation CITY BIODIVERSITY INDEX – KOCHI Supported by Supported in India by Prepared under Project Implemented in Kochi by Supported by: Ministry of Environment, Forest and Climate Change Government of India based on a decision of the German Bundestag Prepared under the BMU supported INTERACT-Bio Project. INTERACT-Bio is implemented by ICLEI – Local Governments for Sustainability and supported by the German Federal Ministry for the Environment, Nature Conservation and Nuclear Safety (BMU) through the International Climate Initiative (IKI). Project implemented in India by: ICLEI-Local Governments for Sustainability, South Asia Year of Publishing: 2020 Copyright ICLEI South Asia (2020) No part of this booklet may be disseminated or reproduced in any form (electronic or mechanical) without prior permission from or intimation to ICLEI South Asia. Permission and information may be sought at ([email protected]). Contact ICLEI-Local Governments for Sustainability, South Asia C-3 Lower Ground Floor, Green Park Extension, New Delhi-110016 Tel: +91–11–4974 7200; Email: [email protected] City Biodiversity Index – Kochi Contents Acronyms ------------------------------------------------------------------------------------------------------------------4 Background --------------------------------------------------------------------------------------------------------------5 Summary of the Scores ------------------------------------------------------------------------------------------------6 Geophysical Characteristics -

Stressed Assets Recovery Branch, 40/974, Iind Floor, R S Buildings, M G Road, Ernakulam – 682011

Stressed Assets Recovery Branch, 40/974, IInd Floor, R S Buildings, M G Road, Ernakulam – 682011. Tel: 0484 – 2383222 / 2382253 Fax: 2382253 e – mail: [email protected] THE TERMS AND CONDITIONS OF SALE Property will be sold on “AS IS WHERE IS, AS IS WHAT IS AND WHATEVER THERE IS” BASIS 1 Name and address of the 1) M/s. Lakshmi Enterprises, Prop. Sri Ajithkumar T K, 39/1038, Borrower Udayareshmi, Karakkat Road, Kochi-682016. 2) M/s. Lakshmi Distributors, Managing Partner Sri Ajithkumar T K, 39/1040, Udayareshmi, Karakkat Road,Kochi-682016. 3) Sri Ajithkumar T.K., 9E, Chakolas Waterscape, Pandit Karuppan Road, Thevara Kochi-682013 4) Mrs. A.T. Nalini, 7B2, Aathhreya Apartments, Vidya Road, Vidya Nagar, Kadavanthara, Kochi-682020. 3) Mr. Sidharth Thacholi, 9E, Chakolas Waterscape Pandit Karuppan Road, Thevara, Kochi-682013 4) Mrs. Usha Thacholi, 9E, Chakolas Waterscap, Pandit Karuppan Road, Thevara Kochi-682013. 5) Mrs. Roopila Soman, 7B2, Aathreya Apartments, Vidya Road, Vidya Nagar, Kadavanthara, Kochi-20 6) K.P.R. Pillay, Tharangam Manikath Road, Ravipuram, Kochi-682010. 7) Mrs. Vijayalakshmi N.G. , Tharangam, Manikath Road, Ravipuram, Ernakulam-682016. 8) Mrs. Lathika Prem, 101, Santhivihar Apartments, Elanjikal Lane , Kadavanthara Kochi-682020. 2 Name and address of the Branch, State Bank of India, Stressed Assets Recovery Branch, 40/974, IInd the Secured Creditor Floor, R S Buildings, Opp. Maharaja's College Ground, M G Road, Ernakulam – 682011. All that part and parcel of land having an extent of 13.96 ares(34.50 3 Description immovable secured cents) with house in Re. Sy. No. -

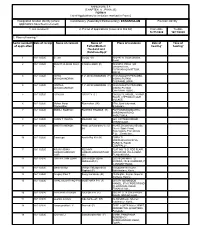

ANNEXURE 5.8 (CHAPTER V , PARA 25) FORM 9 List of Applications for Inclusion Received in Form 6 Designated Location Identity (W

ANNEXURE 5.8 (CHAPTER V , PARA 25) FORM 9 List of Applications for inclusion received in Form 6 Designated location identity (where Constituency (Assembly/£Parliamentary): ERANAKULAM Revision identity applications have been received) 1. List number@ 2. Period of applications (covered in this list) From date To date 16/11/2020 16/11/2020 3. Place of hearing * Serial number$ Date of receipt Name of claimant Name of Place of residence Date of Time of of application Father/Mother/ hearing* hearing* Husband and (Relationship)# 1 16/11/2020 Seena Sanjay (H) 39/2443 A, South janatha, Kochi, , 2 16/11/2020 ANANTHA KRISHNA C C S BIJUMON (F) 34/2047A, PERA 12D,, B CHAMARATH, PUTHUKKALAVATTOM, KOCHI, , 3 16/11/2020 NIVYA T V JAYACHANDRAN (F) 14/26 MALOTH PARAMBU, JAYACHANDRAN VISHNUPURAM, CHERANELLOOR, , 4 16/11/2020 NINITHA T V JAYACHANDRAN (F) 14/26 MALOTH PARAMBU, JAYACHANDRAN VISHNUPURAM, CHERANELLOOR, , 5 16/11/2020 RANJITH RAVI C V (F) CHULLIYIL HOUSE, VARMA ROAD, CHERANALLOOR VILLAGE, , 6 16/11/2020 Mohan Ittoop Rija mohan (W) 1766, Boat jetty road, Cheruvathur Ernakulam, , 7 16/11/2020 AMBILI ROSHAN ROSHAN THOMAS (H) POTHANAMKANDATHIL, KARSHAKA ROAD, VADUTHALA, , 8 16/11/2020 YASIN T YEHIYA MAKKAR (O) 223, VATTEKKUNNAM, ERNAKULAM, , 9 16/11/2020 SMRITHI MENON Pradeep Kulangara Veetil No.405,Dreamflower Bonita, (H) Green Ripple Road, Swamypady, Elamakkara P.O., , Ernakulam, , 10 16/11/2020 Swaroopa Amrith Raj N A (H) PWRA 71 VRINDHAVAN34/572A, PARAYIL ROAD, EDAPPALLY, , 11 16/11/2020 ARUN VISAKH RESHMY FLAT NO 10 D, RDS FLAIR, RAMACHANDRAN -

(Autonomous), Thevara Kochi, Kerala, 682013

1 SACRED HEART COLLEGE (AUTONOMOUS), THEVARA KOCHI, KERALA, 682013 CURRICULUM AND SYLLABI CHOICE BASED COURSE CREDIT AND SEMESTER SYSTEM (CBCSS) 2 Department of Sociology Sacred Heart College (Autonomous) Thevara, Kochi – 682 013, Kerala The Department of Sociology of Sacred Heart College Thevara (Autonomous) is committed to the vision of academic excellence, social commitment, and nation building, by facilitating our students with a suitable curricula, excellent teaching – learning methods and provision of avenues of field exposure. 3 B A SOCIOLOGY PROGRAMME FROM 2019 ADMISSION ONWARDS BOARD OF STUDIES IN SOCIOLOGY Sacred Heart College, Thevara, Kochi, Kerala 4 Members of Board of Studies in Sociology Chair Person - Dr. Sara Neena, Associate Professor in Sociology, Vimala College, Trichur Convenor – Benny Varghese, Associate Professor and Head, Dept of sociology, Sacred Heart College Thevara Members: Dr. Sajitha J Kurup, Asst. Professor, St. Teresa’s College, Ernakulam Prof. R K Varghese, Former Head, Dept. of Sociology, S H College Sibi K I, Assistant Professor, Dept of Sociology, S H College Sanjose A Thomas, Faculty, Dept of Sociology, S H College Sujesh Soman, Regional Manager, Cannon India 5 CONTENTS 1. Curriculum 2. Grievance Redressal Mechanism 3. Syllabus 4. Pattern of Question papers 6 1 CURRICULUM 1.1 SCOPE Applicable to all regular Under Graduate Programmes conducted by the Sacred Heart College (Autonomous) with effect from 2015-16 admissions. 1.1 STUDENT ATTRIBUTES Academic Excellence, Social Commitment, Citizenship Trainning 1.2 DEFINITION. 1.3.1. ‘Programme’ means a three year programme of study and examinations spread over six semesters, according to the regulations of the respective programme, the successful completion of which would lead to the award of a degree. -

Accused Persons Arrested in Ernakulam City District from 12.04.2020To18.04.2020

Accused Persons arrested in Ernakulam City district from 12.04.2020to18.04.2020 Name of Name of the Name of the Place at Date & Arresting Court at Sl. Name of the Age & Cr. No & Sec Police father of Address of Accused which Time of Officer, which No. Accused Sex of Law Station Accused Arrested Arrest Rank & accused Designation produced 1 2 3 4 5 6 7 8 9 10 11 211/2020 U/s 188,269 IPC & 118(e) of KP Rifas, Age. 34, S/o Act and Sec Kunjumuham 34, Kunjumuhammed, Thevara 12.04.2020 Vinoj A , S I of Released on 1 Rifas 4(2), 2, 5 of ET South PS med Male Chingam Punathil Junction at 07.10 hrs Police Station Bail Kerala House, Fortkochi Epidemic Ordinance 2020 212/2020 U/s 188,269 IPC & Alan Joseph, Age.39, 118(e) of KP S/o Joseph Xavier, Act and Sec 39, Thevara 12.04.2020 Dharmaratnam Released on 2 Alan Joseph Joseph Xavier Koramangalath house, 4(2)(a),5 of ET South PS Male Junction at 11.35 hrs , SI of Police Station Bail Kadavanthra P O, Kerala Ernakulam Epidemic Ordinance 2020 213/2020 U/s 188,269 IPC & Ramachandran, Age. 118(e) of KP 53, S/o Mahadeva Act and Sec Ramachandra Mahadeva 53, Iyyer, Flat No. 1D, NJK 12.04.2020 Dharmaratnam Released on 3 Manorama Jn 4(2)(a), 5 of ET South PS n Iyyer Male Narayaniyam at 19.35 hrs , SI of Police Station Bail Kerala Apartment, Thoundiyil Epidemic Road, Ernakulam Ordinance 2020 214/2020 U/s 188,269 IPC & Jinu Kurian, Age. -

Event Report the Post Graduate and Research Department of Chemistry Organized Prof

SACRED HEART COLLEGE (AUTONOMOUS) KOCHI, KERALA – 682013 ||www.shcollege.ac.in|| NAAC Accreditation 4th Cycle ||[email protected]|| 0484 2870577|| Criterion 3: Research, Innovations and Extension PROF. K V THOMAS ENDOWMENT INTERNATIONAL SEMINAR ON NEW TRENDS IN APPLIED CHEMISTRY (NTAC - 2017) PROF. K V THOMAS ENDOWMENT INTERNATIONAL Title: SEMINARON NEW TRENDS IN APPLIED CHEMISTRY (NTAC - 2017) Date: 09.02. 2017 – 11.02.2017 Venue: College Auditorium/Hotel Crowne Plaza Focus of the Event: Research Methodology Organizing Body: Department of Chemistry Resource Person: Justice P.Sathasivam ( The H’ble Governor of Kerala), Prof. K.V. Thomas M P, Dr. Suresh Das, Dr. Thomas Colacot Total Number of Attendees: 120 Event Report The Post Graduate and Research Department of Chemistry organized Prof. K.V.Thomas Endowment International Symposium on New Trends in Applied Chemistry at Sacred Heart College, Thevara and at Hotel Crowne Plaza from 9-11th February, 2017. The Symposium started with registration at 8.15 am on 9th February 2017 at Sacred Heart College auditorium. 133 outside participants registered for the symposium. The SACRED HEART COLLEGE (AUTONOMOUS) KOCHI, KERALA – 682013 ||www.shcollege.ac.in|| NAAC Accreditation 4th Cycle ||[email protected]|| 0484 2870577|| Criterion 3: Research, Innovations and Extension registration process was followed by the inaugural ceremony at 9.00 am. The Honorable Governor of Kerala Justice P. Sathasivam was the Chief Guest. The function was presided over by the M.P of Ernakulam constituency, Prof. K.V. Thomas who is an alumnus of the Department of Chemistry of Sacred Heart College. The Executive Vice president of KSCSTE Dr. -

Kochi Metro Which Is Being Formulated by DMRC Also Should Be Taken Up

CITY MOBILITY PLAN - KOCHI 1. INTRODUCTION 1.1 GENERAL Kochi, the largest agglomeration in the state of Kerala is the nerve centre of all commercial activities in Kerala. One of the major ports in the country Kochi is blessed with connection with other parts of the country through all modes of transport like road, rail, air and water. NH 17, NH 47, and NH 49 pass through Kochi. Kochi port is located on strategic International route. Broad gauge railway lines link up Kochi to all major cities of the country. Kochi has got one of the three international airports in the state. In addition to all these the regional road linkages are supplemented by an extensive network of navigation routes through the lagoon system, serving the movement of passenger and cargo. Insufficient carrying capacity of the intra-urban and sub urban routes, unhindered development of vast areas as urban extensions due to urbanization, unscientific planning in urban infrastructure development , absence of proper linkage of various forms of transportation etc. have resulted in an inadequate mobility system in the city and suburbs. As part of the comprehensive development of the city an efficient mobility plan has to be formulated. 1.2 STUDY AREA It was only in the beginning of the 19th century that Kochi , which was situated with in the narrow strip of land sandwiched between backwaters and sea outgrew to Ernakulam in the eastern side of the back waters. The narrow streets of Fort Kochi and Mattancherry were not sufficient to take up the travel demand even at that time. -

RESUME NAME: Sicily Rilu Joseph CONTACT: 8281353192 MAIL ID

RESUME NAME: Sicily Rilu Joseph CONTACT: 8281353192 MAIL ID: [email protected] EDUCATIONAL BACKGROUND: Post Graduate in Chemistry from St.Teresa’s College(Autonomous) affiliated to MG University, Kottayam in 2017 with A+ (95%). Chemistry graduate from St.Teresa’sCollege, Ernakulam(under MG University, Kottayam) in 2015 with 94.5%. Passed Senior School Certificate Examination(Class 12) from Assisi Vidyaniketan Public School(CBSE) in 2012 with 87.4%. Passed Secondary School Examination(class 10) from Assisi Vidyaniketan Public School(CBSE) in 2010 with 95%. PROJECTS DONE: BSc Project- ‘Spectrophotometric determination of Iron content in leaf samples’ under the guidance of Mrs.Anitta Antony in the academic year 2014-2015. MSc Project-‘Synthesis,Characterization and antimicrobial studies of biodegradable polymers and its metal complexes’ under the guidance of Dr.JayaT.Varkey in the academic year 2016-2017. ACHIEVEMENTS AND CERTIFICATES: Coordinator of Dr.(Sr.) Bertille endowment lecture on Çomputational Chemistry’ by Dr.Cyriac Mathew organized by Department of Chemistry and Centre for Research of St.Teresa’s College(Autonomous),Ernakulam on February 6,2019. Participated in the Albertian Knowledge Summit-An International Conference on Multidisciplinary Research organized by St.Albert’s College (Autonomous), Ernakulam on 4th and 5th January 2019. Guided two projects by final year B.Sc Chemistry students of Department of Chemistry and centre for Research of St.Teresa’s College(Autonomous),Ernakulam. Navadarshan incharge ,Scholar Support -

(AUTONOMOUS) KOCHI, KERALA – 682013 || || || [email protected]|| 0484 2870577 || NAAC Accreditation IV Cycle – Criterion V

SACRED HEART COLLEGE (AUTONOMOUS) KOCHI, KERALA – 682013 || www.shcollege.ac.in || || [email protected]|| 0484 2870577 || NAAC Accreditation IV Cycle – Criterion V REPORTS, PHOTOGRAPHS AND BROCHURES OF CULUTURAL ACTIVITIES AND COMPETITIONS: 2017-18 LEADERSHIP TRAINING- ALTIUS (24/03/2018) NSS Volunteers were part of the intercollegiate leadership development programme at SH College Thevara conducted by ALTIUS on March 24, 2018. The programme included talks, games and other interactive sessions to bring about a positive change in every student and to develop their personality to become the leaders of tomorrow. BREAK THE SILENCE- ANTI CORRUPTION CAMPAIGN (13/03/2018) Break the silence – NSS volunteers actively participated in the anti-corruption programme organized by the Vigilance and Anti-Corruption Bureau (VACB) of Ernakulum on March 13, 2018. Chief Justice of High court of Kerala and Superintendent of Police of VACB attended the programme. Inter collegiate competitions were conducted as part of the programme. SACRED HEART COLLEGE (AUTONOMOUS) KOCHI, KERALA – 682013 || www.shcollege.ac.in || || [email protected]|| 0484 2870577 || WOMEN'S DAY CELEBRATIONS (08/03/2018) Women’s Day was celebrated be Swasti Womens Club members of Sacred Heart college on 08th March 2018. A poster Exhibition was conducted as part of this event. FR. ABRAHAM KALLARAKKAL MEMORIAL LECTURE (25/02/2018) Department of Sociology organised a Seminar on Women Empowerment: Socio- Legal Realities on 22-02-2017. The sessions were led by Dr. Ugin Gomez Joseph, Labour Welfare Commissioner, Ministry of Defence, Govt. of India. Principal Fr. Prasant Palakkappillil presided over the function. Dr. Jose Kuriyedath CMI, Dr. Sibi Mathew, Dr.