Srep Investment Plan for Haiti

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

WFP News Video: Haiti November 2019

WFP News Video: Haiti November 2019 Location: Gonaives, Chansolme, Nord-Ouest department, Port au Prince Haiti Shot: 23rd, 25th – 26th, 29th November 2019 TRT: 03:12 Shotlist :00-:07 GV’s trash covered streets in Gonaives. Gonaives, Haiti Shot: 26 Nov 2019 :07-:26 Shots of health centre waiting room. Nutritionist Myriam Dumerjusten attends to 25 year-old mother of four Alectine Michael and checks her youngest child, 8 month-old Jacqueline for malnutrition. Gonaives, Haiti Shot: 26 Nov 2019 :26-:30 SOT Nutritionist Myriam Dumerjusten (French) “It’s a lack of food and a lack of economic means.” Gonaives, Haiti Shot: 26 Nov 2019 :30-:40 A convoy of 9 WFP trucks carry emergency food for a distribution to vulnerable people living in a remote rural area in Haiti Nord-Ouest department. The department is considered one of the most food insecure in the country according to a recent government study. Trucks arrive in Chansolme’s school compound where a large crowd awaits for the food distribution. Nord-Ouest department, Haiti Shot: 23 Nov 2019 :40-:52 Via Cesare Giulio Viola 68/70, 00148 Rome, Italy | T +39 06 65131 F +39 06 6590 632/7 WFP food is off-loaded from the trucks and organised by WFP staff to facilitate the distribution by groups of 4 people. Chansolme, Nord-Ouest department Shot: 23 Nov 2019 :52-1:07 People line up to confirm their ID before distribution. Priority is given to elderly people, pregnant women and handicapped who will be the first in line to receive the food assistance. -

")Un ")Un ")Un ")Un ")Un ")Un ")Un ")Un ")Un ")Un

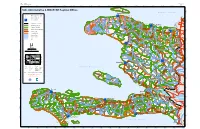

HAITI: 1:900,000 Map No: ADM 012 Stock No: M9K0ADMV0712HAT22R Edition: 2 30' 74°20'0"W 74°10'0"W 74°0'0"W 73°50'0"W 73°40'0"W 73°30'0"W 73°20'0"W 73°10'0"W 73°0'0"W 72°50'0"W 72°40'0"W 72°30'0"W 72°20'0"W 72°10'0"W 72°0'0"W 71°50'0"W 71°40'0"W N o r d O u e s t N " 0 Haiti: Administrative & MINUSTAH Regional Offices ' 0 La Tortue ! ° 0 N 2 " (! 0 ' A t l a n t i c O c e a n 0 ° 0 2 Port de Paix \ Saint Louis du Nord !( BED & Department Capital UN ! )"(!\ (! Paroli !(! Commune Capital (!! ! ! Chansolme (! ! Anse-a-Foleur N ( " Regional Offices 0 UN Le Borgne ' 0 " ! 5 ) ! ° N Jean Rabel " ! (! ( 9 1 0 ' 0 5 ° Mole St Nicolas Bas Limbe 9 International Boundary 1 (!! N o r d O u e s t (!! (!! Department Boundary Bassin Bleu UN Cap Haitian Port Margot!! )"!\ Commune Boundary ( ( Quartier Morin ! N Commune Section Boundary Limbe(! ! ! Fort Liberte " (! Caracol 0 (! ' ! Plaine 0 Bombardopolis ! ! 4 Pilate ° N (! ! ! " ! ( UN ( ! ! Acul du Nord du Nord (! 9 1 0 Primary Road Terrier Rouge ' (! (! \ Baie de Henne Gros Morne Limonade 0 )"(! ! 4 ! ° (! (! 9 Palo Blanco 1 Secondary Road Anse Rouge N o r d ! ! ! Grande ! (! (! (! ! Riviere (! Ferrier ! Milot (! Trou du Nord Perennial River ! (! ! du Nord (! La Branle (!Plaisance ! !! Terre Neuve (! ( Intermittent River Sainte Suzanne (!! Los Arroyos Perches Ouanaminte (!! N Lake ! Dondon ! " 0 (! (! ' ! 0 (! 3 ° N " Marmelade 9 1 0 ! ' 0 Ernnery (!Santiag o \ 3 ! (! ° (! ! Bahon N o r d E s t de la Cruz 9 (! 1 ! LOMA DE UN Gonaives Capotille(! )" ! Vallieres!! CABRERA (!\ (! Saint Raphael ( \ ! Mont -

Eleutherodactylus Heminota Shreve and Williams

336.1 AMPHIBIA: SALIENTIA: LEPTODACTYLIDAE ELEUTHERODACTYLUS HEMINOT A Catalogue of American Amphibians and Reptiles. SW Barahona, Barahona Province, Republica Dominicana). The altitudinal distribution is from sea level to 5600 ft (1700 m). ScHWARTZ,ALBERT. 1983. Eleutherodactylus heminota. • FOSSILRECORD.None. • PERTINENTLITERATURE.Other than the original description, Eleutherodactylus heminota E. heminota has been mentioned by Schwartz (1969) as being a Shreve and Williams member of the auriculatus group and as distinct from E. bakeri Cochran, and Schwartz and Thomas (1975) gave the geographic Eleutherodactylus bakeri heminota Shreve and Williams, 1963: and altitudinal distribution. 325. Type-locality, "Furey [Departement de I'Ouest], Republic of Haiti." Holotype, Mus. Compo Zool. Harvard University • REMARKS.Although E. heminota is represented by large num• 31734, gravid female, collected by E. E. Williams and A. S. bers of specimens in collections, there are no data on its habits or Rand on 8 August 1959 (not examined by author). voice. Most specimens have been obtained from native collectors, Eleutherodactylus heminota: Schwartz, 1965: 167. First recogni• and the facility with which they secure these frogs, most especially tion that Heminota is a species distinct from bakeri. in the vicinity of banana plantings, suggests that they encounter the frogs in the leaf bases of bananas. The large digital discs indicate • CONTENT.No subspecies are recognized. that E. heminota is most likely a climbing species. Since all known members of the auriculatus complex are vocal, it is amazing that • DEFINITION.A species of the auriculatus group of Antillean no voice is as yet associated unequivocally with this species. Eleutherodactylus characterized by the combination of small size Specimens of E. -

Masterlist Abri Provisoire

MASTERLIST ABRI PROVISOIRE SOMMAIRE # DEPARTEMENT # ABRIS PAGES 1 Artibonite 76 1 2 Centre 60 8 3 Grande-Anse 180 13 4 NiPPes 117 29 5 Nord 248 40 6 Nord-Est 38 63 7 Nord-Ouest 177 66 8 Ouest 212 82 9 Sud 182 101 10 Sud-Est 187 118 TOTAL 1477 COORDONEE GPS Capacité # Departement Commune Section Site Adresse Maximale Remarques Dernière mise à jour Latitude Longitude théorique Besoin de éParation au nivau du corPs 1 Artibonite Anse Rouge Centre Ville Ecole Nationale de Anse Rouge 13, RUE RAVINE 19.6352 -73.0539 0 mai 2017/ Par OIM du batiment et de la toiture 2 Artibonite Anse Rouge Ecole Eben-Ezer n/a n/a n/a 0 Besoin en eau et assainissement n/a 3 Artibonite Anse Rouge Centre Sociale de Anse Rouge n/a n/a n/a 0 Besoin en eau et assainissement n/a besoin d'aménagement de sanitaires suPlémentaire, travaux de finition 4 Artibonite Anse Rouge Centre Ville Ecole Nationale nan tiyo n/a 19.638460 -72.060023 80 mai 2017/ Par OIM (Portes, fenetres, Parquet) Renforcement de la toiture 5 Artibonite Gonaives Centre Ville Eglise et Ecole Catherine Flon n/a 19.47354 -72.66978 254 Besoin en eau et assainissement mai 2017/ Par OIM 6 Artibonite Gonaives Centre Ville Lycée Bicentenaire n/a 19.46324 -72.67587 1024 Besoin en eau et assainissement mai 2017/ Par OIM 7 Artibonite Gonaives Morne Blanc Abri de Morne Blanc n/a 19.51262 -72.66917 259 Besoin en eau et assainissement mai 2017/ Par OIM 8 Artibonite Gonaives Praville Eglise APostolique n/a n/a n/a 90 Besoin en eau et assainissement n/a Comité Thématique Evacuation et Gestion Abri Provisoire (CTGAP) -

Haiti Situation Response 2010

Haiti Situation Response 2010 Protection and assistance to internally displaced persons and host communities in Haiti Donor Relations and Resource Mobilization Service April 2010 Cover photo: Two girls from earthquake zone living in a host family washing and cooking. UNHCR / J. BJÖRGVINSSON Haiti To address the growing needs of people in Haiti displaced by January’s devastating earthquake, UNHCR is launching an expanded operation’s plan and budget. UNHCR is supporting the protection cluster in Haiti and is leading the ‘mirror’ protection cluster in the Dominican Republic. The expanded programme will extend the work of the protection cluster and provide material support to extremely vulnerable individuals. Community-based quick impact projects will support the needs of affected people hosted by friends and relatives in Port-au-Prince and in other areas. An earthquake measuring 7.0 on the technical experts in registration and UNHCR deployed a team of five staff Richter scale hit Haiti on 12 January profiling, and one logistics officer to members, who are supporting the 2010, causing untold human suffering oversee the distribution of the material efforts of the Dominican authorities in including the death of some 217,000 assistance provided (2,130 light weight addressing protection needs of the persons. UNHCR offered the tents, 18,850 rolls of plastic sheetings Haitians evacuated to the Dominican Emergency Relief Coordinator its for 103,400 beneficiaries, 17,400 solar Republic. UNHCR operates in the support to the UN humanitarian lamps, a field kit and an office kit). The border areas, providing material response effort to address massive and OHCHR/UNHCR protection cluster support to vulnerable people. -

Base Map - Departement Grand Anse - Earthquake of 14/08/2021 Public

HAITI - Base map - Departement Grand Anse - Earthquake of 14/08/2021 Public Ra vin e Ma Bonbon rtin )"H e a u TURKS AND CAICOS ISLANDS BAHAMAS Abricots )" (!G R H Anse ivi )"C èr CUBA Hler e du c )"H)"H Jérémie )"H )"H s cot )"H bri (!G )"H HAITI )" DOMINICAN Ri ère desA H REPUBLIC vi vi i èr R e )"H )" S H UNITED STATES er angues )" MINOR OUTLYING R H i vi ISLANDS ère JAMAICA B onbon )"H )"H Rivière de la Gr and Anse )"H naudée Gui La Roseaux LEGEND Health Facilities )"H Hospital Marfranc (!G Clinic (!G Populated places Capital City of Admin 1 Level Corail)" Capital City of Admin 2 Level )" be H)"H H om Lac Capital City of Admin 3 Level ière Rivi Riv )"H ère M Dame Marie )"Moron aro )"H Admin boundary )"H Departement level Chambellan Ri vi )"H èr Arrondissement level e Zi l é B l anche Pestel Roads )"H Primary road (!G he uc Secondary road an Ga ouc à B s ière ra Riv B )"H e JÉRÉMIE èr Tertiary road R i iv iv R iè re d e Other road D a m e M a rie Water River )"H River, reservoir Wetland )"H )" GRAND'ANSE H Landuse )"H Residential Rivière Forest des Roseaux )" H Nature reserve )" H )"H CORAIL Anse Source Fourneau d'Hainault ogue oldr V La Beaumont e ièr )"H iv R )"H Riviè re Bra s à Dro )"H ite Sour NIPPES ce Chér ie Ri vi èr e R R V ivi iviè endr ère re D L'ANSE-À-VEAU Bo e ibuche e Mandou is s R o Rivièr Ma se h au ot x II e Glace ANSE Rivièr D'HAINAULT Rivière G de La uinaud is ée (est) es Iro d Riv re ière d e La Gui Riviè maud So ée e Source Pimba " u Rivièr )H rc e Bœu Les Irois f ome Gér a e L ie d e ière e Mar h dé c u e Riv -

FY21 Q2 Country Updates

Act to End NTDs | East FY21 Q2 Monthly Updates January 1, 2021–March 31, 2021 Cooperative Agreement No. 7200AA18CA00040 Prepared for Rob Henry, AOR Office of Infectious Diseases U.S. Agency for International Development 1300 Pennsylvania Avenue, NW Washington DC, 20532 Prepared by RTI International 3040 Cornwallis Road Post Office Box 12194 Research Triangle Park, NC 27709-2194 Act to End NTDs | East Program Overview The U.S. Agency for International Development Act to End Neglected Tropical Diseases (NTDs) | East Program supports national NTD programs in reaching World Health Organization goals for NTD control and elimination through proven, cost-effective public health interventions. The Act to End NTDs | East (Act | East) Program also provides critical support to countries on their journey to self-reliance, helping them create sustainable programming for NTD control within robust and resilient health systems. The Act | East Program is being implemented by RTI International with a consortium of partners, led by RTI International and including includes The Carter Center; Fred Hollows Foundation; IMA World Health; Light for the World; Results for Development (R4D); Save the Children; Sightsavers; and Women Influencing Health, Education, and Rule of Law (WI-HER). ii Act | East Country Updates for USAID January–March 2021 January 2021 DRC Act | East Partner: RTI International Total population: 85,281,024 (2018 [est.]) COP: [Redacted] Districts: 519 districts RTI HQ Team: [Redacted] Endemic diseases (# ever endemic districts): Trachoma (65) TABLE: Activities supported by USAID in FY21 Trachoma Mapping Trachoma baseline mapping: 28 EUs, November-January 2021 MDA 1 HZ (Pweto), January 2021 TIS: 1 HZ (Kilwa), October 2020 DSAs (#EUs) TSS: 0 MERLA N/A HSS N/A Summary and explanation of changes made to table above since last month: • None Highlights: • The data for 26 EUs surveyed in the Kasai, Kasai Central, Kwilu and Kwango provinces in December were uploaded to Tropical Data for preliminary analysis and cleaning. -

Disabilities in Haitian Schools

Disabilities in Haitian Schools Disabilities in Haitian Schools Preliminary results of a research project in southern Haiti in the aftermath of Hurricane Matthew EDITED BY ROCHAMBEAU LAINY AND TRANSLATED BY DAVID DÉZIL AND TABITHA WILBUR QUÉBEC AND PORT-AU-PRINCE : ÉDITIONS SCIENCE ET BIEN COMMUN Disabilities in Haitian Schools by Rochambeau Lainy is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License, except where otherwise noted. Disabilities in Haitian Schools. Preliminary results of an action-research project in the south of Haiti after Hurricane Matthew Edited by Rochambeau Lainy Translated by David Tézil and Tabitha Wilbur, Indiana University Cover design: Kate McDonnell, photography by Danielo Saint-Cyr Editing and proofreading: Kate McDonnell Print edition ISBN: 978-2-924661-91-8 ePub edition ISBN: 978-2-924661-96-3 Legal Deposit – Bibliothèque et Archives nationales du Québec 2020 Legal Deposit – Library and National Archive Canada Legal deposit: 2nd quarter 2020 This book is licensed under a Creative Commons CC BY-SA 4.0 license. Science and Common Good Publishing http://editionscienceetbiencommun.org 1085 avenue de Bourlamaque Quebec City, Quebec G1R 2P4 Canada Distribution: [email protected] Contents Acknowledgements ix List of Abbreviations xi Introduction: Context and Problem 1 Rochambeau Lainy 1. Students, learning disorders and inclusive education in 9 Haiti: A review of the literature Nathalis Wamba 2. Prolegomena of the Study of Language Disorders and 25 Failing Students with Disabilities Rochambeau Lainy 3. Students with Disabilities and Childhood Protection: 33 Analysis of Data Collected in Grand’Anse Samuel Régulus et Vijonet Demero 4. Students with Disabilities: Education access and 47 implications for cognitive justice Samuel Régulus 5. -

Flash Appeal Haiti Earthquake

EARTHQUAKE FLASH AUGUST 2021 APPEAL HAITI 01 FLASH APPEAL HAITI EARTHQUAKE This document is consolidated by OCHA on behalf of the Humani- Get the latest updates tarian Country Team (HCT) and partners. It covers the period from August 2021 to February 2022. OCHA coordinates humanitarian action to ensure On 16 August 2021, a resident clears a home that was damaged during the crisis-affected people receive the assistance and earthquake in the Capicot area in Camp-Perrin in Haiti’s South Department. protection they need. It works to overcome obstacles Photo: UNICEF that impede humanitarian assistance from reaching The designations employed and the presentation of material in the report do not people affected by crises, and provides leadership in imply the expression of any opinion whatsoever on the part of the Secretariat of mobilizing assistance and resources on behalf of the the United Nations concerning the legal status of any country, territory, city or area humanitarian system or of its authorities, or concerning the delimitation of its frontiers or boundaries. www.unocha.org/rolac Humanitarian Response aims to be the central website for Information Management tools and services, enabling information exchange between clusters and IASC members operating within a protracted or sudden onset crisis. www.humanitarianresponse.info Humanitarian InSight supports decision-makers by giving them access to key humanitarian data. It provides the latest verified information on needs and delivery of the humanitarian response as well as financial contributions. www.hum-insight.com The Financial Tracking Service (FTS) is the primary provider of continuously updated data on global human- itarian funding, and is a major contributor to strategic decision making by highlighting gaps and priorities, thus contributing to effective, efficient and principled humani- tarian assistance. -

Cholera Treatment Facility Distribution for Haiti

municipalities listed above. listed municipalities H C A D / / O D F I **Box excludes facilities in the in facilities excludes **Box D A du Sud du A S Ile a Vache a Ile Ile a Vache a Ile Anse a pitres a Anse Saint Jean Saint U DOMINICAN REPUBLIC municipalities. Port-au-Prince Port-Salut Operational CTFs : 11 : CTFs Operational Delmas, Gressier, Gressier, Delmas, Pétion- Ville, and and Ville, G Operational CTFs : 13 : CTFs Operational E T I O *Box includes facilities in Carrefour, in facilities includes *Box N G SOUTHEAST U R SOUTH Arniquet A N P Torbeck O H I I T C A I Cote de Fer de Cote N M Bainet R F O Banane Roche A Bateau A Roche Grand Gosier Grand Les Cayes Les Coteaux l *# ! Jacmel *# Chantal T S A E H T U O SOUTHEAST S SOUTHEAST l Port à Piment à Port ! # Sud du Louis Saint Marigot * Jacmel *# Bodarie Belle Anse Belle Fond des Blancs des Fond # Chardonnières # * Aquin H T U O S SOUTH * SOUTH *# Cayes *# *# Anglais Les *# Jacmel de Vallée La Perrin *# Cahouane La Cavaillon Mapou *# Tiburon Marbial Camp Vieux Bourg D'Aquin Bourg Vieux Seguin *# Fond des Negres des Fond du Sud du Maniche Saint Michel Saint Trouin L’Asile Les Irois Les Vialet NIPPES S E P P I NIPPES N Fond Verrettes Fond WEST T S E WEST W St Barthélemy St *# *#*# Kenscoff # *##**# l Grand Goave #Grand #* * *#* ! Petit Goave Petit Beaumont # Miragoane * Baradères Sources Chaudes Sources Malpasse d'Hainault GRAND-ANSE E S N A - D N A R GRAND-ANSE G Petite Riviere de Nippes de Riviere Petite Ile Picoulet Ile Petion-Ville Ile Corny Ile Anse Ganthier Anse-a-Veau Pestel -

HAITI Physical Presence As of 07 October 2019

HAITI Physical presence as of 07 october 2019 This map shows the mapping of humanitarian and development NORD-OUEST NORD NORD-EST actors with a physical presence in ANSE-À-FOLEUR BOMBARDOPOLIS LA TORTUE PORT-DE-PAIX SAINT-LOUIS CAP-HAÏTIEN DONDON MILOT FORT-LIBERTÉ OUANAMINTHE Haiti. It shows the location of their ASA HI ID MFH ACF DU NORD HI COMPASSION Deep Springs CA GRC SJM HAÏTI offices in the different communes. The TF CHANSOLME MÔLE SAINT APRONHA ASA OFASO FAO ICDH WHH ASA CACH LIMONADE PIGNON BASSIN BLEU TF NICOLAS ID PAHO/WHO PAHO/WHO information was collected by OCHA GADEL IOM PWW Haiti Outreach IOM ASA JEAN RABEL PI Haiti via an online survey launched HI MdM-C MFH WVI UNASCAD OXFAM COMPASSION ACF ID UNASCAD in May 2019. PAHO/WHO HLD WHH UNASCAD WVI La Tortue # of 1 - 5 CENTRE organisations 6 - 10 Saint Louis Du Nord BELLADÈRE HINCHE MIREBALAIS NORD-OUEST Port De Paix COMPASSION MPP ACTED per commune Anse A Foleur NORD 11 - 15 Jean Rabel Chansolme FODES-5 PAHO/WHO APADEH Bassin Bleu NORD-EST ICDH UNASCAD Deep Springs Mole Saint Nicolas Cap Haitien 16 - 20 IOM WVI Gros Morne OXFAM LASCAHOBAS SAVANETTE 21 - 35 Bombardopolis Limonade Anse Rouge Milot GRAPDEI ITECA Fort Liberte MdM-Arg Marmelade Ouanaminthe Gonaives Dondon NIPPES ARTIBONITE OUEST ANSE-À-VEAU MIRAGOÂNE ANSE ROUGE GROS-MORNE SAINT-MARC J/P HRO FODES-5 COMPASSION Deep Springs CA ANSE À GALETS GRAND-GOÂVE PORT-AU-PRINCE BARADÈRES TF DESSALINES iTECA ITECA Pignon COMPASSION AQUADEV ACF ASA UNASCAD SCI UEPLM VERRETTES ARTIBONITE SCH WVI ASB ACTED MFH PAILLANT GONAÏVES -

20210505 Sitrep Covid.Pdf (Français)

MINISTERE DE LA SANTE PUBLIQUE ET DE LA POPULATION (MSPP) DIRECTION D'EPIDEMIOLOGIE, DES LABORATOIRES ET DE LA RECHERCHE (DELR) Numéro: 433 05/05/2021 6h00 pm Surveillance de la COVID-19, Haiti, 2020-2021 Au niveau mondial Cas confirmés de COVID-19 par Département et Commune au 5 mai 2021: du 19/03/2020 au 05/05/2021 154,608,198 cas confirmés, dont 3,231,674 décès ont été enregistrés, soit une létalité de 2.1% Source: OMS En Haïti: - 64,755 tests réalisés (138 nouveaux) - 13,227 cas confirmés (17 nouveaux) - 266 décès (0 nouveau) - 12,304 (93%) cas récupérés Létalité: 2.01% -1904 cas hospitalisés (1 nouveau) - De ces 13,227 cas confirmés, 44.24% sont de sexe féminin et 55.76% de sexe masculin Tab.1: Cas confirmés et décès de COVID-19 par département du 19 mars 2020 au 5 mai 2021, Haiti Nouveaux cas Nouveaux décès Département Cas Cumulés. Décès Cumulés Taux de positivité Taux de létalité (24h) (24h) Ouest 9,365 13 121 0 20.2% 1.29% Nord 819 1 38 0 22.5% 4.64% Artibonite 688 0 39 0 23.1% 5.67% Centre 687 0 16 0 27.5% 2.33% Nord-Est 380 0 6 0 11.4% 1.58% Sud-Est 306 0 9 0 27.8% 2.94% Sud 300 0 6 0 23.3% 2.00% Nord-Ouest 284 0 13 0 25.0% 4.58% Grand Anse 237 3 13 0 20.0% 5.49% Nippes 161 0 5 0 19.1% 3.11% Grand Total 13,227 17 266 0 20.6% 2.01% N-B.