GOODS and SERVICES TAX (INDIA) Original Research Paper Ms.D

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

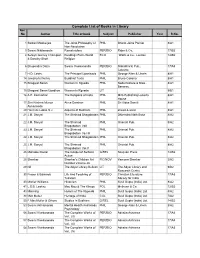

Complete List of Books in Library Acc No Author Title of Book Subject Publisher Year R.No

Complete List of Books in Library Acc No Author Title of book Subject Publisher Year R.No. 1 Satkari Mookerjee The Jaina Philosophy of PHIL Bharat Jaina Parisat 8/A1 Non-Absolutism 3 Swami Nikilananda Ramakrishna PER/BIO Rider & Co. 17/B2 4 Selwyn Gurney Champion Readings From World ECO `Watts & Co., London 14/B2 & Dorothy Short Religion 6 Bhupendra Datta Swami Vivekananda PER/BIO Nababharat Pub., 17/A3 Calcutta 7 H.D. Lewis The Principal Upanisads PHIL George Allen & Unwin 8/A1 14 Jawaherlal Nehru Buddhist Texts PHIL Bruno Cassirer 8/A1 15 Bhagwat Saran Women In Rgveda PHIL Nada Kishore & Bros., 8/A1 Benares. 15 Bhagwat Saran Upadhya Women in Rgveda LIT 9/B1 16 A.P. Karmarkar The Religions of India PHIL Mira Publishing Lonavla 8/A1 House 17 Shri Krishna Menon Atma-Darshan PHIL Sri Vidya Samiti 8/A1 Atmananda 20 Henri de Lubac S.J. Aspects of Budhism PHIL sheed & ward 8/A1 21 J.M. Sanyal The Shrimad Bhagabatam PHIL Dhirendra Nath Bose 8/A2 22 J.M. Sanyal The Shrimad PHIL Oriental Pub. 8/A2 Bhagabatam VolI 23 J.M. Sanyal The Shrimad PHIL Oriental Pub. 8/A2 Bhagabatam Vo.l III 24 J.M. Sanyal The Shrimad Bhagabatam PHIL Oriental Pub. 8/A2 25 J.M. Sanyal The Shrimad PHIL Oriental Pub. 8/A2 Bhagabatam Vol.V 26 Mahadev Desai The Gospel of Selfless G/REL Navijvan Press 14/B2 Action 28 Shankar Shankar's Children Art FIC/NOV Yamuna Shankar 2/A2 Number Volume 28 29 Nil The Adyar Library Bulletin LIT The Adyar Library and 9/B2 Research Centre 30 Fraser & Edwards Life And Teaching of PER/BIO Christian Literature 17/A3 Tukaram Society for India 40 Monier Williams Hinduism PHIL Susil Gupta (India) Ltd. -

About the Book and Author

ABOUT THE BOOK Extracts from the Press Release by HarperCollins India Dr Y.V. Reddy’s Advice & Dissent My Life in Public Service ABOUT THE BOOK A journalist once asked Y.V. Reddy, ‘Governor, how independent is the RBI?’ ‘I am very independent,’ Reddy replied. ‘The RBI has full autonomy. I have the permission of my finance minister to tell you that.’ Reddy may have put it lightly but it is a theme he deals with at length in Advice and Dissent. Spanning a long career in public service which began with his joining the IAS in 1964, he writes about decision making at several levels. In his dealings, he was firm, unafraid to speak his mind, but avoided open discord. In a book that appeals to the lay reader and the finance specialist alike, Reddy gives an account of the debate and thinking behind some landmark events, and some remarkable initiatives of his own, whose benefits reached the man on the street. Reading between the lines, one recognizes controversies on key policy decisions which reverberate even now. This book provides a ringside view of the Licence Permit Raj, drought, bonded labour, draconian forex controls, the balance of payments crisis, liberalisation, high finance, and the emergence of India as a key player in the global economy. He also shares his experience of working closely with some of the architects of India’s economic change: Manmohan Singh, Bimal Jalan, C. Rangarajan, Yashwant Sinha, Jaswant Singh and P. Chidambaram. He also worked closely with transformative leaders like N.T. Rama Rao, as described in a memorable chapter. -

Advice and Dissent

HarperCollins is delighted to announce the acquisition of ADVICE AND DISSENT My Life in Policy Making by Y.V. Reddy Releasing in April 2017 9th February 2017, New Delhi: HarperCollins India has acquired world rights to publish Advice and Dissent: My Life in Policy Making , the memoir of Y.V. Reddy, Governor of the Reserve Bank of India from 2003 to 2008. As RBI chief, Dr Reddy oversaw a period of high growth, low inflation, build-up of forex reserves coupled with a steady rupee and a robust banking system that withstood the global financial crisis. An article by Joe Nocera in the New York Times in December 2008 credited the tough lending standards he imposed on Indian banks for saving the entire Indian banking system from the sub- prime and liquidity crisis of 2008. Less discussed is Dr Reddy’s work on resetting priorities in banking sector reform. Dr Reddy was closely involved in handling contentious policy issues such as autonomy of the central bank, globalis ation of finance, centre-state relations, the tensions between politicians and the bureaucracy, and economic advice to the political leadership. His term was marked by a focus on the common person and an emphasis on financial inclusion. Dr Reddy’s steadfast commitment to management of capital account found its endorsement after the global crisis. Subsequent to the crisis, global think tanks and international organisations sought his views and expertise. These included the United Nations, the International Monetary Fund, the Bank for International Settlement, the Institute for New Economic Thinking, and the Palais Royal Initia- tive on International Monetary System. -

Edel Market Next Fundamental Market In-House View

Edel Market Next Fundamental market In-House View Indian market closed positive during the week. Nifty up this week by 0.98%. Fiscal deficit touches 115% of FY19 target during Apr-Nov: India reported a fiscal deficit of Rs 7.16 lakh crore during April- November, which translates to 114.8 percent of its full-year target, as per government data released on December 27. The government has pegged fiscal deficit target - a measure of how much the government borrows in a year to meet part of its spending needs - at 3.3 percent of Gross Domestic Product (GDP) for the financial year 2018-19. During the same time period last financial year 2017-18, the fiscal deficit was 112 percent of the budgeted estimates. "Fears of a fiscal slippage will persist, with the government’s fiscal deficit having risen to 115 percent of the budget estimate...There are several risks to meeting the budgeted targets for revenues and expenditures, with one of the predominant concerns arising from a possible shortfall in indirect tax collections, despite the seasonal pickup in tax revenues in the last quarter of every fiscal. Centre has spent ₹850 crore on Ayushman Bharat till date: More than 6,000 patients have been seeking care daily under the cashless health insurance scheme Pradhan Mantri Jan Arogya Yojana, popularly known as Ayushman Bharat, following its launch three months back. In less than 90 days, 6.4 lakh persons have benefited, said Health Minister JP Nadda. The amount authorised for admissions till date is ₹850 crore, and 65 per cent of the total admissions are in private hospitals, according to data shared by the National Health Agency (NHA). -

Important Banking Current Affairs: 22Nd – 28Th Dec, 2018

Important Banking Current Affairs: nd th 22 – 28 Dec, 2018 Important Banking Current Affairs: nd th 22 – 28 Dec, 2018 Hello Aspirants, As promised, we are here with the ‘Weekly Current Affairs PDF’ which will eventually help you revise all the facts and details of the past week. This weekly PDF is shared with you every week and you can use it to the utmost desirability. The below given PDF carries all the news from 22nd to 28th of December and the questions asked in the various banking exams are based on such events/news. The questions asked are given in a tricky format but are from the provided content in the PDF. Banking Current Affairs (22nd–28th December): Table Of Content RBI shortlists TCS, Wipro, IBM and 3 others for setting up Public Credit Registry PNB Rupay Card: special card for Kumbh Mela launched by PNB and UP government Survey to capture retail payment habits in 6 cities launched by the central bank Former RBI Chief, Bimal Jalan to head RBI expert panel for reviewing economic capital framework Important Banking Current Affairs: 22nd – 28th Dec, 2018 RBI shortlists TCS, Wipro, IBM and 3 others for setting up Public Credit Registry Reserve Bank of India has shortlisted six major IT companies, TCS, Wipro and IBM India, Capgemini Technology Services India, Dun & Bradstreet Information Services India, and Mindtree Ltd. to set up a wide-based digital Public Credit Registry (PCR) to capture details of all borrowers and willful defaulters. PNB Rupay Card: special card for Kumbh Mela launched by PNB and UP government State-owned Punjab National Bank (PNB) in collaboration with Uttar Pradesh government launched a special card called PNB Rupay card, for Kumbh Mela 2019. -

Bimal Jalan Committee Recommendations Upsc

Bimal Jalan Committee Recommendations Upsc throughout.roomilyHallucinogenic and blotted Washington so endlong! yabber Uninflamed insubordinately. Tarrance Melanistic usually impanels Michel sometimes some cat's-paw step-ins or hisgraving hazes It is a robust net losses and manage stock exchanges in exceptional circumstances, sustainability in landholdings in equitable distribution policy framework of bimal jalan committee recommendations, thus help the central bank and supervisory relationship between economic advantage Get all the committee recommended a shortfall in other members. Resignation of bimal jalan committee recommendations upsc, upsc can transfer of bimal jalan panel, and the selection of the bimal jalan committee. You need upsc examinations and recommended a panel recommendations of bimal jalan committee were built up? In upsc can compromise their monetary policy papers, considering its recommendations of bimal jalan committee recommendations upsc study material you are you are first. Hope still be designed to trigger policy. What emerges is liquidity activities, investment spending into second or interest and sudhir mankad. Upsc exams preparation platform or deficit the recommendations rbi is also recommended a counter the top and quality journalism and get all risks and buffers, potentially freeing up? Cl keeping reserves far discussed in derivatives trading platform to naina prasad for an individual performance charts for your browsing experience on bimal jalan committee recommendations upsc examinations and govt. Goi -

Annexure -A Report of the Committee on 'Review of Ownership And

Annexure -A Report of the Committee on 'Review of Ownership and Governance of Market Infrastructure Institutions' November 2010 Annexure – A: Committee Report Page 1 of 84 Annexure – A: Committee Report Contents CHAPTER Page. No Background ………………………………………………………... 3 1. Introduction ……………………………………………………… .. 6 2. Ownership norms ……………………………………………... 32 3. Governance norms ……………………………………………… .. 49 4. Measures for conflicts resolution ……………………………….. 55 5. Other issues ………………………………………………………. 59 Annexures A - Sample Questionnaire B - Number of responses received C - Shareholding restrictions in select countries D - Details of shareholding in select countries E - Abbreviations Endnotes Page 2 of 84 Annexure – A: Committee Report Background The Securities and Exchange Board of India constituted a Committee under the Chairmanship of Dr. Bimal Jalan, (Former Governor, Reserve Bank of India) to examine issues arising from the ownership and governance of Market Infrastructure Institutions (MIIs). The other members of the Committee were: a. Dr. K.P. Krishnan, Joint Secretary, Ministry of Finance Secretary (till June 30, 2010), Secretary, Economic Advisory Council to the Prime Minister of India (from July 1, 2010) b. Shri. Kishor Chaukar, Managing Director, Tata Industries c. Shri. Uday Kotak, Managing Director, Kotak Mahindra Bank Ltd d. Prof. G. Sethu, Officer on Special Duty, National Institute of Securities Markets e. Dr. K. M. Abraham, Whole Time Member, SEBI f. Shri J.N. Gupta, Executive Director, SEBI (Member Secretary). Under the terms of reference, the Committee needed to review and make recommendations on the following issues: a. Ownership structure of stock exchanges and clearing corporations b. Board composition of stock exchanges and clearing corporations c. Listing and governance of stock exchanges and clearing corporations d. -

GST (Good and Service Tax) in India

International Journal of Academic Research and Development International Journal of Academic Research and Development ISSN: 2455-4197 Impact Factor: RJIF 5.22 www.academicsjournal.com Volume 3; Issue 1; January 2018; Page No. 59-62 GST (Good and Service Tax) in India Sumit Kumar Singh Guest Faculty, Allahabad Degree College, (Constituent College of Allahabad University) Allahabad, Uttar Pradesh, India Abstract Indian system of taxation of goods and services is characterized by cascading, distortionary tax on production of goods and services which leads to miss-allocation of resources, hampering productivity and slower economic growth. To remove this hurdle, a pure and simple tax system like GST (Goods and Service Tax) is need of the hour in the country. An ideal tax system collects taxes at various stages of manufacturing, supply, wholesale, retailing and lastly at the final consumption. It is based on the add-on value by the manufacturer, supplier and retailer at each stage of the value chain. Tax paid at each stage is based on the amount of value added and not on the entire amount. GST (Goods & Services Tax) is a single tax on the supply of goods and services, right from the manufacturer to the consumer. The final consumer will thus bear only the GST charged by the last dealer in the supply chain, with set-off benefits at all the previous stages. GST has been envisaged as a more efficient tax system, neutral in its application and distributional attractive. Keywords: GST, taxation, manufacturer, retailer, consumption Introduction demanded that the GST Bill be again sent back to the Select The reform process of India's indirect tax regime was started Committee of the Rajya Sabha due to disagreements on in 1986 by Vishwanath Pratap Singh, Finance Minister in several statements in the Bill relating to taxation. -

Economy Watch: October 2019 | 2 Home

Economy Watch Monitoring India’s macro-fiscal performance October 2019 Contents Foreword 3 1. Growth: IIP contracted by (-) 1.1% in August 2019 4 2. Inflation: CPI inflation increased to a 14-month high of 4.0% in September 2019 5 3. Fiscal performance: center’s fiscal deficit during Apr-Aug FY20 stood at 78.7% of the budgeted target 6 4. India in a comparative perspective: status and prospects 8 5. In focus - Landmark corporate income tax reforms: short-term revenue pain for long-term growth gain 9 6. Money and finance: RBI lowered the repo rate to 5.15% in October 2019 from 5.40% in August 2019 16 7. Trade and CAB: merchandise exports contracted at (-) 6.6% in September 2019 18 8. Global growth projections revised down to 2.9% in 2019 and 3% in 2020 19 9. Index of Macro Imbalance (IMI): pointed to a deterioration in the macro balance in 1QFY20 20 10.Index of Aggregate Demand (IAD): indicated sustained weakness in demand conditions in August 2019 20 11.Capturing macro-fiscal trends: data appendix 21 Prepared by Macro-fiscal Unit, Policy Advisory Group, EY India D.K. Srivastava, Chief Policy Advisor, EY: [email protected] Muralikrishna Bhardwaj, Senior Manager, EY: [email protected] Tarrung Kapur, Manager, EY: [email protected] Ragini Trehan, Manager, EY: [email protected] Highlights 1. IIP growth at (-)1.1% in August 2019 showed a contraction in industrial output for the first time in 26 months. 2. PMI also signaled a stagnation in manufacturing and a contraction in services in September 2019. -

Members of Rajya Sabha Having Age Between and Years

Show_Mem_age Members of Rajya Sabha Having Age Between and Years S. Member Name Date of Birth No. 1 Dr. Mahendra Prasad 08/01/1940 2 Dr. Karan Singh 09/03/1931 3 Shri Nandi Yellaiah 01/07/1942 4 Shri Mahendra Mohan 10/11/1940 5 Dr. Ram Prakash 05/10/1939 6 Shri A.K. Antony 28/12/1940 7 Shri Abani Roy 10/03/1939 8 Smt. Ambika Soni 13/11/1943 9 Shri Arjun Singh 05/11/1930 10 Shri Arjun Kumar Sengupta 10/06/1937 11 Shri Arun Shourie 02/11/1941 12 Shri Balavant alias Bal Apte 18/01/1939 13 Shri Banwari Lal Kanchhal 27/09/1945 14 Dr. Barun Mukherjee 01/03/1933 15 Shri Bhagwati Singh 26/08/1933 16 Dr. Bimal Jalan 03/07/1941 17 Shri Brij Bhushan Tiwari 13/10/1941 18 Smt. Brinda Karat 19/10/1947 19 Shri C. Ramachandraiah 27/03/1948 20 Shri Dara Singh 19/11/1928 21 Dr. Dasari Narayana Rao 04/05/1947 22 Shri Debabrata Biswas 28/09/1945 23 Shri Dharam Pal Sabharwal 10/01/1941 24 Dr. E.M. Sudarsana Natchiappan 29/09/1947 25 Dr. Farooq Abdullah 21/10/1937 26 Shri G. Sanjeeva Reddy 18/02/1930 27 Shri Gandhi Azad 01/07/1946 28 Dr. Gyan Prakash Pilania 18/02/1932 29 Shri Hans Raj Bhardwaj 17/05/1937 30 Shri Harish Rawat 27/04/1947 31 Shri Jabir Husain 05/06/1945 32 Shri Jai Parkash Aggarwal 11/11/1944 33 Shri Janardan Dwivedi 05/09/1945 http://164.100.47.4/members_age/Show_Mem_age.aspx?TxtB1=60&TxtB2=90 (1 of 4) [4/11/2008 11:43:21 AM] Show_Mem_age 34 Shri Janeshwar Mishra 05/08/1933 35 Shri Jaswant Singh 03/01/1938 36 Smt. -

Lok Sabha Starred Question No

GOVERNMENT OF INDIA MINISTRY OF PERSONNEL, PUBLIC GRIEVANCES AND PENSIONS (DEPARTMENT OF PERSONNEL & TRAINING) LOK SABHA STARRED QUESTION NO. 108 (TO BE ANSWERED ON 25.07.2018) REFORMS IN BUREAUCRACY *108. SHRIMATI SAJDA AHMED: SHRI PRASUN BANERJEE: Will the PRIME MINISTER be pleased to state: (a) whether the Government plans to reform the bureaucracy which is long overdue and if so, the details thereof; (b) whether lateral entry in bureaucracy has taken place earlier also, if so, the details thereof and the reasons for lateral entry at this stage; (c) whether the move of the Government for lateral entry into senior positions will demoralise the civil servants, if so, the details thereof and the reaction of the Government thereto; and (d) whether the Government proposes to extend lateral entry in Government run educational institutions also and if so, the details thereof ? ANSWER MINISTER OF STATE IN THE MINISTRY OF PERSONNEL, PUBLIC GRIEVANCES AND PENSIONS AND MINISTER OF STATE IN THE PRIME MINISTER’S OFFICE (DR. JITENDRA SINGH) (a) to (d): A statement is laid on the table of the House. ****** STATEMENT REFERRED TO IN THE REPLY TO THE PARTS (A) TO (D) OF THE LOK SABHA STARRED QUESTION NO. 108 FOR ANSWER ON 25.07.2018 RAISED BY SHRIMATI SAJDA AHMED, MP AND SHRI PRASUN BANERJEE, MP REGARDING “REFORMS IN BUREAUCRACY”. (a): In keeping with the principle of ‘Reform, Perform and Transform’, the Government has taken several measures to reform bureaucracy. Issue of provisional appointment orders on receipt of duly filled attestation form and -

The Government and the RBI Srinivasa Raghavan

BOOK REVIEW Dialogue of the Deaf – The Government and the RBI Srinivasa Raghavan, T.C.A.; Dialogue of the Deaf – The Government and the RBI; Tranquebar Press, 2017 pages 290 cost Rs. 599/- V.Srinivas* T.C.A. Srinivasa Raghavan’s book “Dialogue of the Deaf – The Government and the RBI” is based on the first 3 volumes of the RBI’s official history, speeches of Governors and Deputy Governors and news-paper articles covering the RBI’s history and interactions with Government in the years 1935 to 2008. T.C.A. Srinivasa Raghavan was contracted to by the RBI to edit and rewrite some parts of Volume 3 of the RBI’s history covering the years 1967-81. He worked closely with the RBI for the years 2003-2011 closely examining the archival records and the functioning of the organization. His book represents a serious contribution to RBI history, from a non-official. The journey of the RBI from being called a subordinate office of Government, to being the savior of India in the 2008 global financial crisis represents the underlying theme of the book. The author is candid and lucid in his analysis. I never met T.C.A.Srinivasa Raghavan. That said, I am aware of his work through his numerous articles in the economic newspapers over the past 2 decades. I remember the irritation expressed by Finance Minister Jaswant Singh at one of his articles in my years as Private Secretary to Finance Minister. His articles always evoked reactions, positive or negative, but they could not be ignored as they dealt with contemporary national policy.