Sustainability Report 2018(4.0MB)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

May 11, 2011 Company Name: Terumo Corporation Representative: Yutaro Shintaku, President Code No.: 4543, TSE Section 1 Inquirie

May 11, 2011 Company name: Terumo Corporation Representative: Yutaro Shintaku, President Code No.: 4543, TSE Section 1 Inquiries: Tetsuya Kumei, General Manager, Corporate Communication / IR Dept. Notice Concerning the Renewal of a Policy for Large-scale Acquisitions of Terumo Shares (Takeover Defense Measures) In the Board of Directors held on April 30, 2008, Terumo Corporation decided upon the Company’s basic policy regarding those who control decisions on the Company’s financial and business policies. Giving consideration to this policy, the Company also decided upon introduction of policy for large-scale acquisitions of the Company’s shares (hereinafter referred to as the “Current Plan”) as a means to prevent decisions on the Company’s financial and business policies from being controlled by an inappropriate party. The Current Plan was approved by shareholders in the 93rd Annual General Meeting of Shareholders held on June 27, 2008. The effective period of the Current Plan is until the conclusion of the final Annual General Meeting of Shareholders in the business year ending no more than three years from the time of the conclusion of the 93rd Annual General Meeting of Shareholders. Based on consideration of recent trends in debate on takeover defense measures including amendments of the law since the Current Plan was implemented and the Corporate Value Study Group established by the Ministry of Economy, Trade and Industry, the Company reaffirmed that the current policy should be maintained in the Board of Directors held on May 11, 2011, and passed a resolution to make revisions to the Current Plan required by amendments to the law (the revised plan is hereinafter referred to as the “Plan”) and renew the Current Plan in the form of the Plan as a means to prevent decisions on the Company’s financial and business policies from being controlled by an inappropriate party. -

FTSE Japan ESG Low Carbon Select

2 FTSE Russell Publications 19 August 2021 FTSE Japan ESG Low Carbon Select Indicative Index Weight Data as at Closing on 30 June 2021 Constituent Index weight (%) Country Constituent Index weight (%) Country Constituent Index weight (%) Country ABC-Mart 0.01 JAPAN Ebara 0.17 JAPAN JFE Holdings 0.04 JAPAN Acom 0.02 JAPAN Eisai 1.03 JAPAN JGC Corp 0.02 JAPAN Activia Properties 0.01 JAPAN Eneos Holdings 0.05 JAPAN JSR Corp 0.11 JAPAN Advance Residence Investment 0.01 JAPAN Ezaki Glico 0.01 JAPAN JTEKT 0.07 JAPAN Advantest Corp 0.53 JAPAN Fancl Corp 0.03 JAPAN Justsystems 0.01 JAPAN Aeon 0.61 JAPAN Fanuc 0.87 JAPAN Kagome 0.02 JAPAN AEON Financial Service 0.01 JAPAN Fast Retailing 3.13 JAPAN Kajima Corp 0.1 JAPAN Aeon Mall 0.01 JAPAN FP Corporation 0.04 JAPAN Kakaku.com Inc. 0.05 JAPAN AGC 0.06 JAPAN Fuji Electric 0.18 JAPAN Kaken Pharmaceutical 0.01 JAPAN Aica Kogyo 0.07 JAPAN Fuji Oil Holdings 0.01 JAPAN Kamigumi 0.01 JAPAN Ain Pharmaciez <0.005 JAPAN FUJIFILM Holdings 1.05 JAPAN Kaneka Corp 0.01 JAPAN Air Water 0.01 JAPAN Fujitsu 2.04 JAPAN Kansai Paint 0.05 JAPAN Aisin Seiki Co 0.31 JAPAN Fujitsu General 0.01 JAPAN Kao 1.38 JAPAN Ajinomoto Co 0.27 JAPAN Fukuoka Financial Group 0.01 JAPAN KDDI Corp 2.22 JAPAN Alfresa Holdings 0.01 JAPAN Fukuyama Transporting 0.01 JAPAN Keihan Holdings 0.02 JAPAN Alps Alpine 0.04 JAPAN Furukawa Electric 0.03 JAPAN Keikyu Corporation 0.02 JAPAN Amada 0.01 JAPAN Fuyo General Lease 0.08 JAPAN Keio Corp 0.04 JAPAN Amano Corp 0.01 JAPAN GLP J-REIT 0.02 JAPAN Keisei Electric Railway 0.03 JAPAN ANA Holdings 0.02 JAPAN GMO Internet 0.01 JAPAN Kenedix Office Investment Corporation 0.01 JAPAN Anritsu 0.15 JAPAN GMO Payment Gateway 0.01 JAPAN KEWPIE Corporation 0.03 JAPAN Aozora Bank 0.02 JAPAN Goldwin 0.01 JAPAN Keyence Corp 0.42 JAPAN As One 0.01 JAPAN GS Yuasa Corp 0.03 JAPAN Kikkoman 0.25 JAPAN Asahi Group Holdings 0.5 JAPAN GungHo Online Entertainment 0.01 JAPAN Kinden <0.005 JAPAN Asahi Intecc 0.01 JAPAN Gunma Bank 0.01 JAPAN Kintetsu 0.03 JAPAN Asahi Kasei Corporation 0.26 JAPAN H.U. -

JPX-Nikkei Index 400 Constituents (Applied on August 31, 2021) Published on August 6, 2021 No

JPX-Nikkei Index 400 Constituents (applied on August 31, 2021) Published on August 6, 2021 No. of constituents : 400 (Note) The No. of constituents is subject to change due to de-listing. etc. (Note) As for the market division, "1"=1st section, "2"=2nd section, "M"=Mothers, "J"=JASDAQ. Code Market Divison Issue Code Market Divison Issue 1332 1 Nippon Suisan Kaisha,Ltd. 3048 1 BIC CAMERA INC. 1417 1 MIRAIT Holdings Corporation 3064 1 MonotaRO Co.,Ltd. 1605 1 INPEX CORPORATION 3088 1 Matsumotokiyoshi Holdings Co.,Ltd. 1719 1 HAZAMA ANDO CORPORATION 3092 1 ZOZO,Inc. 1720 1 TOKYU CONSTRUCTION CO., LTD. 3107 1 Daiwabo Holdings Co.,Ltd. 1721 1 COMSYS Holdings Corporation 3116 1 TOYOTA BOSHOKU CORPORATION 1766 1 TOKEN CORPORATION 3141 1 WELCIA HOLDINGS CO.,LTD. 1801 1 TAISEI CORPORATION 3148 1 CREATE SD HOLDINGS CO.,LTD. 1802 1 OBAYASHI CORPORATION 3167 1 TOKAI Holdings Corporation 1803 1 SHIMIZU CORPORATION 3231 1 Nomura Real Estate Holdings,Inc. 1808 1 HASEKO Corporation 3244 1 Samty Co.,Ltd. 1812 1 KAJIMA CORPORATION 3254 1 PRESSANCE CORPORATION 1820 1 Nishimatsu Construction Co.,Ltd. 3288 1 Open House Co.,Ltd. 1821 1 Sumitomo Mitsui Construction Co., Ltd. 3289 1 Tokyu Fudosan Holdings Corporation 1824 1 MAEDA CORPORATION 3291 1 Iida Group Holdings Co.,Ltd. 1860 1 TODA CORPORATION 3349 1 COSMOS Pharmaceutical Corporation 1861 1 Kumagai Gumi Co.,Ltd. 3360 1 SHIP HEALTHCARE HOLDINGS,INC. 1878 1 DAITO TRUST CONSTRUCTION CO.,LTD. 3382 1 Seven & I Holdings Co.,Ltd. 1881 1 NIPPO CORPORATION 3391 1 TSURUHA HOLDINGS INC. 1893 1 PENTA-OCEAN CONSTRUCTION CO.,LTD. -

TOBAM Maximum Diversification All World Developed Ex North America USD

TOBAM Maximum Diversification All World Developed ex North America USD 31/12/2019 Instrument Weight BP PLC 0.10% IDEMITSU KOSAN CO LTD 0.21% INPEX HOLDINGS INC 0.07% JX HOLDINGS INC 0.09% NESTE OIL OYJ 1.16% OMV AG 0.08% SANTOS LTD 0.02% SBM OFFSHORE NV 0.05% TGS NOPEC GEOPHYSICAL CO ASA 0.02% VOPAK 0.02% WOOD GROUP (JOHN) PLC 0.02% AIR LIQUIDE 0.23% AIR WATER INC 0.02% AKZO NOBEL 0.12% ALUMINA LTD 0.03% AMCOR PLC-CDI 0.08% AVON RESOURCES LTD 0.53% BORAL LTD 0.02% CHR HANSEN HOLDING A/S 0.08% DAICEL CHEMICAL INDUSTRIES 0.02% DOWA HOLDINGS CO LTD 0.01% EMS-CHEMIE HOLDING AG-REG 0.03% FLETCHER BUILDING LTD 0.02% FORTESCUE METALS GROUP LTD 0.60% GIVAUDAN-REG 0.16% HITACHI CHEMICAL CO LTD 0.03% HUHTAMAKI OYJ 0.03% ISRAEL CHEMICALS LTD 0.02% JAMES HARDIE INDUSTRIES-CDI 0.07% JFE HOLDINGS INC 0.02% KANSAI PAINT CO LTD 0.03% KURARAY CO LTD 0.03% MITSUBISHI MATERIALS CORP 0.02% NEWCREST MINING LTD 1.35% TOBAM Maximum Diversification All World Developed ex North America USD 31/12/2019 Instrument Weight NIPPON PAINT CO LTD 0.05% NIPPON PAPER INDUSTRIES CO L 0.04% NIPPON SHOKUBAI CO LTD 0.01% NISSAN CHEMICAL INDUSTRIES 0.04% NOF CORP 0.02% NORTHERN STAR RESOURCES LTD 0.66% NOVOZYMES A/S-B SHARES 0.07% OJI PAPER CO LTD 0.03% ORICA LTD 0.02% ORORA LTD 0.02% SARACEN MINERAL HOLDINGS LTD 0.32% SMURFIT KAPPA GROUP PLC 0.04% SYMRISE AG 0.04% TAIHEIYO CEMENT CORP 0.02% TAIYO NIPPON SANSO CORP 0.02% TEIJIN LTD 0.02% THYSSENKRUPP AG 0.04% TORAY INDUSTRIES INC 0.02% WIENERBERGER AG 0.02% ADP 0.04% AENA SA 0.09% ALFA LAVAL AB 0.04% ALL NIPPON AIRWAYS CO LTD -

Istoxx® Mutb Japan Momentum 300 Index

ISTOXX® MUTB JAPAN MOMENTUM 300 INDEX Components1 Company Supersector Country Weight (%) Z HOLDINGS Technology Japan 0.69 M3 Health Care Japan 0.65 KOEI TECMO HOLDINGS Technology Japan 0.65 MENICON Health Care Japan 0.59 CAPCOM Technology Japan 0.58 FUJITEC Industrial Goods & Services Japan 0.56 Ibiden Co. Ltd. Industrial Goods & Services Japan 0.56 NIPPON PAINT HOLDINGS Chemicals Japan 0.56 RENESAS ELECTRONICS Technology Japan 0.55 JEOL Industrial Goods & Services Japan 0.55 INTERNET INTV.JAPAN Technology Japan 0.53 JSR Corp. Chemicals Japan 0.52 NET ONE SYSTEMS Technology Japan 0.51 Fujitsu Ltd. Technology Japan 0.51 Bank of Kyoto Ltd. Banks Japan 0.51 Hokuhoku Financial Group Inc. Banks Japan 0.51 FUJITSU GENERAL Personal & Household Goods Japan 0.50 Iyo Bank Ltd. Banks Japan 0.50 Kyushu Financial Group Banks Japan 0.50 77 Bank Ltd. Banks Japan 0.49 COCOKARA FINE INC. Retail Japan 0.49 TOSHIBA TEC Industrial Goods & Services Japan 0.48 JCR PHARMACEUTICALS Health Care Japan 0.48 MONOTARO Retail Japan 0.48 COSMOS PHARM. Retail Japan 0.48 Tokyo Electron Ltd. Technology Japan 0.48 Nomura Research Institute Ltd. Technology Japan 0.48 Olympus Corp. Health Care Japan 0.47 SUNDRUG Retail Japan 0.47 Chiba Bank Ltd. Banks Japan 0.47 NEC NETWORKS & SY.INTG. Technology Japan 0.47 Nomura Holdings Inc. Financial Services Japan 0.47 TOKYO OHKA KOGYO Technology Japan 0.47 PENTA-OCEAN CONSTRUCTION Construction & Materials Japan 0.47 FUYO GENERAL LEASE Financial Services Japan 0.46 FUJI Industrial Goods & Services Japan 0.46 Hachijuni Bank Ltd. -

JAPANESE INDUSTRY and POLICY NEWS February-March, 2021

JAPANESE INDUSTRY AND POLICY NEWS February-March, 2021 Legislation and Policy News ⚫ JCM's first credit issuance with Kenya 974 tons in solar power generation business ⚫ Achieves unmanned platooning technology for trucks following trucks on highways ⚫ Government decides to revise the Global Warming Countermeasures Promotion Law by Cabinet decision, "2050 Carbon Neutral" clarified Survey and Business Data ⚫ CO2 concentration near Japan continues to increase, Japan Meteorological Agency Company & Organization News ⚫ J-Power begins production of next-generation energy hydrogen in Australia, Transport to Japan ⚫ Mitsubishi Heavy Industries establishes "MHI Vestas Japan", a sales company for wind power generation equipment ⚫ Japanese "RE100" member companies reached 50, the second largest in the world, but there are challenges in procuring renewable energy ⚫ Completed international hydrogen supply chain demonstration by Chiyoda corporation, etc. Supplying over 100 tons ⚫ TEPCO participates in demonstration of floating wind turbines in Northern Europe, aiming for construction in Japan ⚫ Business alliance with Circularise B.V., introduction of traceability management platform to Asia for building a circular economy ⚫ ITOCHU and Aquafil announce a strategic partnership to support and to expand the nylon circular business ⚫ NYK operates 44 MW wind power generation facility at Belgian finished vehicle terminal ⚫ ITOCHU announced strategic joint venture with Air Liquide on hydrogen value chain development ⚫ Euglena completes bio-jet fuel to fly -

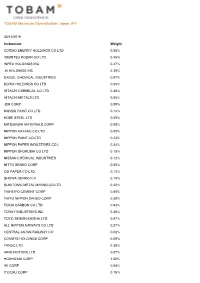

TOBAM Maximum Diversification Japan JPY

TOBAM Maximum Diversification Japan JPY 30/12/2019 Instrument Weight COSMO ENERGY HOLDINGS CO LTD 0.05% IDEMITSU KOSAN CO LTD 0.46% INPEX HOLDINGS INC 0.47% JX HOLDINGS INC 0.35% DAICEL CHEMICAL INDUSTRIES 0.07% DOWA HOLDINGS CO LTD 0.05% HITACHI CHEMICAL CO LTD 0.38% HITACHI METALS LTD 0.05% JSR CORP 0.09% KANSAI PAINT CO LTD 0.14% KOBE STEEL LTD 0.05% MITSUBISHI MATERIALS CORP 0.08% NIPPON KAYAKU CO LTD 0.05% NIPPON PAINT CO LTD 0.23% NIPPON PAPER INDUSTRIES CO L 0.24% NIPPON SHOKUBAI CO LTD 0.18% NISSAN CHEMICAL INDUSTRIES 0.12% NITTO DENKO CORP 0.05% OJI PAPER CO LTD 0.13% SHOWA DENKO K K 0.10% SUMITOMO METAL MINING CO LTD 0.20% TAIHEIYO CEMENT CORP 0.05% TAIYO NIPPON SANSO CORP 0.30% TOKAI CARBON CO LTD 0.93% TORAY INDUSTRIES INC 0.26% TOYO SEIKAN KAISHA LTD 0.07% ALL NIPPON AIRWAYS CO LTD 0.27% CENTRAL JAPAN RAILWAY CO 0.02% COMSYS HOLDINGS CORP 0.09% FANUC LTD 0.38% HINO MOTORS LTD 0.07% HOSHIZAKI CORP 1.50% IHI CORP 0.08% ITOCHU CORP 0.16% TOBAM Maximum Diversification Japan JPY 30/12/2019 Instrument Weight JAPAN AIRLINES CO LTD 0.49% JGC HOLDINGS CORP 0.09% JS GROUP CORP 0.85% KEIHAN ELECTRIC RAILWAY CO 0.13% KEIO CORP 0.18% KINTETSU CORP 0.26% KOMATSU LTD 0.07% KYOWA EXEO CORP 0.06% KYUSHU RAILWAY COMPANY 0.13% MAKITA CORP 0.22% MITSUBISHI CORP 0.69% MITSUBISHI HEAVY INDUSTRIES 0.31% NAGOYA RAILROAD CO LTD 0.14% NANKAI ELECTRIC RAILWAY CO 0.08% OBAYASHI CORP 0.13% ODAKYU ELECTRIC RAILWAY CO 0.20% PARK24 CO LTD 1.15% RECRUIT HOLDINGS CO LTD 0.10% SANKYU INC 0.07% SECOM CO LTD 0.06% SEIBU HOLDINGS INC 0.09% SEINO HOLDINGS CO LTD -

List of Donor Companies: Business Sector Emergency Donation for Earthquake Victims in Central Java, Indonesia, on May 27, 2006 (In Alphabetical Order of Companies)

List of Donor Companies: Business Sector Emergency Donation for Earthquake Victims in Central Java, Indonesia, on May 27, 2006 (in alphabetical order of companies) As of August 25, 2006 Nippon Keidanren Total amount contributed: \1,621,520,000.- Nippon Keidanren has been instrumental in soliciting business sector funds when disasters hit hard various parts of the world in the past. On May 27, 2006, central part of Java Island, Indonesia, was struck by a heavy earthquake, claiming more than 5,000 human lives and injuring almost 40,000, creating over 400,000 refugees and causing damages to more than 500,000 houses. Believing that the damages there were extensive, Nippon Keidanren initiated fund raising activities and provided solicited funds and goods such as tents and water purifiers for Indonesian people through Red Cross and NPOs under the auspice of the Japan Platform. Following is the list of donor companies that provided funds and goods through Nippon Keidanren and / or independently. 1 ABB K.K. 40 BOSCH CORPORATION 79 DAIWA HOUSE INDUSTRY CO.,LTD. 2 ACOM CO.,LTD. 41 BRIDGESTONE CORPORATION 80 DAIWA SECURITIES GROUP INC. 3 ADEKA CORPORATION 42 BROTHER INDUSTRIES,LTD. 81 DAIWABO COMPANY LIMITED 4 ADVANEX INC. 43 BUNKYODO CO.,LTD. 82 DENKI KAGAKU KOGYO K.K. 5 ADVANTEST CORPORATION 44 BUSINESS CONSULTANTS,INC. 83 DENSO CORPORATION 6 AEON 45 CALBEE FOODS CO.,LTD. 84 DENTSU INC. 7 AICHI STEEL CORPORATION 46 Canon Group 85 DHC CORPORATION 8 AICHI TOKEI DENKI CO.,LTD. 47 CAPCOM CO.,LTD. 86 DOWA MINING COMPANY,LTD. 9 AIFUL CORPORATION 48 CASIO COMPUTER CO.,LTD. -

Nissan Motor Co., Ltd

Financial Information as of March 31, 2012 (The English translation of the “Yukashoken-Houkokusho” for the year ended March 31, 2012) Nissan Motor Co., Ltd. Table of Contents Page Cover...........................................................................................................................................................................1 Part I Information on the Company...........................................................................................................2 1. Overview of the Company .........................................................................................................................2 1. Key financial data and trends........................................................................................................................2 2. History ..........................................................................................................................................................4 3. Description of business .................................................................................................................................6 4. Information on subsidiaries and affiliates .....................................................................................................7 5. Employees...................................................................................................................................................13 2. Business Overview ......................................................................................................................................14 -

Annual Securities Report

[Translation] Annual Securities Report (The 130th Business Term) From January 1, 2019 to December 31, 2019 2-47, Shikitsuhigashi 1-chome, Naniwa-ku, Osaka, JAPAN Kubota Corporation TABLE OF CONTENTS Cover 1. Overview of the Company ………………………………...…………………………................................................................ 1 1. Key Financial Data ……………………………………………………………………………………………….……………………………… 1 2. History…................................................................................................................................................... 3 3.Description of Business …........................................................................................................................ 4 4. Information on Affiliates …………………………………………………………………..……...…………………………….………… 7 5. Employees …............................................................................................................................................ 10 2. Business Overview …………………………………………………………………...…………………………………………………………….…. 11 1. Business Issues to Address ………………………………………………………………………..……...……………………….…… 11 2. Risk Factors …………………………………………………………………………………..……...……………………….…………………… 12 3 . Analysis of Consolidated Financial Position, Results of Operations, and Cash Flows............................. 14 4. Material Contracts ………..……..…………………………………………………………….………………………..………………..… 18 5. Research and Development (R&D) ……………………………………………..……...……………………………………….…….. 18 3. Property, Plant, and Equipment ……………………………………..……………………...………………………………………..………. 21 1. Summary of -

Calling on the Japanese Government to Raise Its 2030 Renewable Energy Target to 40-50%

18th January 2021 Calling on the Japanese government to raise its 2030 renewable energy target to 40-50% With commitments by EU countries, Japan, South Korea, Canada, New Zealand, and with the United States intending to join this year, ‘carbon neutral by 2050’ has become a common goal of more than 120 countries around the globe. Key to meeting the goal is the promotion of a rapid and significant expansion of renewable energy along with improvements in energy efficiency. EU countries and U.S. states have already set progressive goals to be reached by 2030, ranging from 40-74% share in each electricity mix. In contrast, Japan’s target shares of renewable energy for fiscal 2030 electricity mix is 22- 24%. In order for Japan to meet its responsibilities to be one of the leaders in global efforts, the target needs to be much more ambitious. An ambitious target will stimulate renewable energy deployment, and Japanese companies will be able to play a greater role in the global business environment, where decarbonization is accelerating. It will enable Japanese companies more committed to the challenge of mitigating the climate crisis. We, as part of the global business community, call for the renewable energy target for fiscal 2030 to be revised from 22-24% to 40-50% in the next Strategic Energy Plan formulated this year. Signatories (alphabetical order) (Total 92 companies) ADVANTEST CORPORATION DAIICHI SANKYO COMPANY, LIMITED AEON CO., LTD. Daito Trust Construction Co., Ltd. Ajinomoto Co., Inc. Daiwa House Industry Co., Ltd. AMITA HOLDINGS CO., LTD. Eisai Co., Ltd. ANA HOLDINGS INC. -

M Funds Quarterly Holdings 3.31.2020*

M International Equity Fund 31-Mar-20 CUSIP SECURITY NAME SHARES MARKET VALUE % OF TOTAL ASSETS 233203421 DFA Emerging Markets Core Equity P 2,263,150 35,237,238.84 24.59% 712387901 Nestle SA, Registered 22,264 2,294,710.93 1.60% 711038901 Roche Holding AG 4,932 1,603,462.36 1.12% 690064001 Toyota Motor Corp. 22,300 1,342,499.45 0.94% 710306903 Novartis AG, Registered 13,215 1,092,154.20 0.76% 079805909 BP Plc 202,870 863,043.67 0.60% 780087953 Royal Bank of Canada 12,100 749,489.80 0.52% ACI07GG13 Novo Nordisk A/S, Class B 12,082 728,803.67 0.51% B15C55900 Total SA 18,666 723,857.50 0.51% 098952906 AstraZeneca Plc 7,627 681,305.26 0.48% 406141903 LVMH Moet Hennessy Louis Vuitton S 1,684 625,092.87 0.44% 682150008 Sony Corp. 10,500 624,153.63 0.44% B03MLX903 Royal Dutch Shell Plc, Class A 35,072 613,753.12 0.43% 618549901 CSL, Ltd. 3,152 571,782.15 0.40% ACI02GTQ9 ASML Holding NV 2,066 549,061.02 0.38% B4TX8S909 AIA Group, Ltd. 60,200 541,577.35 0.38% 677062903 SoftBank Group Corp. 15,400 539,261.93 0.38% 621503002 Commonwealth Bank of Australia 13,861 523,563.51 0.37% 092528900 GlaxoSmithKline Plc 26,092 489,416.83 0.34% 891160954 Toronto-Dominion Bank (The) 11,126 473,011.14 0.33% B1527V903 Unilever NV 9,584 472,203.46 0.33% 624899902 KDDI Corp.