Dr. Pepper Snapple Group Inc. Energy Beverages

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Coca-Cola: a Powerful Brand – an Effective Marketing Strategy

View metadata, citation and similar papers at core.ac.uk brought to you by CORE provided by eLibrary National Mining University Zaloznykh K., Kaimashnikova K. T.V. Kogemyakina, research supervisor Kriviy Rih Economic Institute of National Vadim Hetman Economic University of Kyiv COCA-COLA: A POWERFUL BRAND – AN EFFECTIVE MARKETING STRATEGY Branding is one of the most important aspects of any business, large or small, retail or business to business. It's important to spend time investing in researching, defining, and building your brand. An effective brand strategy gives you a major edge in increasingly competitive markets. To succeed in branding you must understand the needs and wants of your customers and prospects. You do this by integrating your brand strategies through your company at every point of public contact. Brand looks like the relationship between a product and its customer. A strong brand is invaluable as the battle for customers intensifies day by day. Brand is the source of a promise to your consumer. It's a foundational piece in your marketing communication and one you do not want to be without. For the last several years, when we ask people to think about a successful brand, we often ask them to think of Coca-Cola because, well, Coke is it. That’s why we decide to investigate the world’s powerful brand – coca - cola. The Coca-Cola Company is the world's largest beverage company, largest manufacturer, distributor and marketer of non-alcoholic beverage concentrates and syrups in the world, and one of the largest corporations in the United States. -

Intake of Sugar-Sweetened Beverages and Fecundability in a North American Preconception Cohort

ORIGINAL ARTICLE Intake of Sugar-sweetened Beverages and Fecundability in a North American Preconception Cohort Elizabeth E. Hatch,a Amelia K. Wesselink,a Kristen A. Hahn,a James J. Michiel,a Ellen M. Mikkelsen,b Henrik Toft Sorensen,b Kenneth J. Rothman,a,c and Lauren A. Wisea Background: Dietary factors, including sugar-sweetened beverages, pproximately 10%–15% of North American couples may have adverse effects on fertility. Sugar-sweetened beverages Aexperience infertility, defined as the inability to con- 1 were associated with poor semen quality in cross-sectional studies, ceive after 12 or more months of attempting pregnancy. and female soda intake has been associated with lower fecundability Both female and male factors contribute to infertility, with in some studies. estimates of 39% of cases due to a female factor alone, 20% Methods: We evaluated the association of female and male sugar- to a male factor, 33% to both male and female factors, and sweetened beverage intake with fecundability among 3,828 women 8% with unknown cause.2 Thus, identifying modifiable fac- planning pregnancy and 1,045 of their male partners in a North Ameri- tors in both partners that can improve fertility (e.g., diet) can prospective cohort study. We followed participants until pregnancy could help couples avoid expensive and stressful fertility or for up to 12 menstrual cycles. Eligible women were aged 21–45 treatments. (male partners ≥21), attempting conception for ≤6 cycles, and not using fertility treatments. Participants completed a comprehensive The amount of added sugar in the American diet 3 baseline questionnaire, including questions on sugar-sweetened bever- increased by 19% between 1970 and 2005. -

ENERGY DRINK Buyer’S Guide 2007

ENERGY DRINK buyer’s guide 2007 DIGITAL EDITION SPONSORED BY: OZ OZ3UGAR&REE OZ OZ3UGAR&REE ,ITER ,ITER3UGAR&REE -ANUFACTUREDFOR#OTT"EVERAGES53! !$IVISIONOF#OTT"EVERAGES)NC4AMPA &, !FTERSHOCKISATRADEMARKOF#OTT"EVERAGES)NC 777!&4%23(/#+%.%2'9#/- ENERGY DRINK buyer’s guide 2007 OVER 150 BRANDS COMPLETE LISTINGS FOR Introduction ADVERTISING EDITORIAL 1123 Broadway 1 Mifflin Place The BEVNET 2007 Energy Drink Buyer’s Guide is a comprehensive compilation Suite 301 Suite 300 showcasing the energy drink brands currently available for sale in the United States. New York, NY Cambridge, MA While we have added some new tweaks to this year’s edition, the layout is similar to 10010 02138 our 2006 offering, where brands are listed alphabetically. The guide is intended to ph. 212-647-0501 ph. 617-715-9670 give beverage buyers and retailers the ability to navigate through the category and fax 212-647-0565 fax 617-715-9671 make the tough purchasing decisions that they believe will satisfy their customers’ preferences. To that end, we’ve also included updated sales numbers for the past PUBLISHER year indicating overall sales, hot new brands, and fast-moving SKUs. Our “MIA” page Barry J. Nathanson in the back is for those few brands we once knew but have gone missing. We don’t [email protected] know if they’re done for, if they’re lost, or if they just can’t communicate anymore. EDITORIAL DIRECTOR John Craven In 2006, as in 2005, niche-marketed energy brands targeting specific consumer [email protected] interests or demographics continue to expand. All-natural and organic, ethnic, EDITOR urban or hip-hop themed, female- or male-focused, sports-oriented, workout Jeffrey Klineman “fat-burners,” so-called aphrodisiacs and love drinks, as well as those risqué brand [email protected] names aimed to garner notoriety in the media encompass many of the offerings ASSOCIATE PUBLISHER within the guide. -

Vectra-Owners-Manual-July-2007.Pdf

Owner’s Manual VECTRA Operation, Safety and Maintenance ©Copyright by Vauxhall Motors Ltd., England. VECTRA Reproduction or translation, in whole or in parts, is not permitted without prior written consent from Vauxhall Motors Ltd. All rights as understood under the copyright laws are explicitly reserved by Vauxhall Motors Ltd. All information, illustrations and specifications contained in this manual are based on the latest production information available at the time of publication. The right is reserved to make changes at any time without notice. Edition: July 2007. TS 1557-A-08 VAUXHALL Vectra Operation, Safety, Maintenance Data specific to your vehicle Please enter your vehicle’s data here to keep it ea sily accessible. This information is available under the section "Technical data" as well as on the identification plate and in the Service Booklet. Fuel De signation Engine oil Grade Viscosity Tyre pressure T yre size with up to 3 pe ople with fu ll load Summer tyres Front Rear Front Rear Winter tyres Front Rear Front Rear Weights Permissible Gross Vehicle Weight – EC kerbweight =Loading Your Vectra Make use of the Owner’s This symbol signifies: is an intelligent combination of forward- Manual: 6 Continue reading on next page. looking technology, impressive safety, z The "In brief" section will give you an 3 The asterisk signifies equipment not environmental friendliness and economy. initial overview. fitted to all vehicles (model variants, It now lies with you to drive your vehicle z The table of contents at the beginning of engine options, models specific to one safely and ensure that it performs the Owner’s Manual and within the country, optional equipment, Genuine perfectly. -

Strategic Analysis of the Coca-Cola Company

STRATEGIC ANALYSIS OF THE COCA-COLA COMPANY Dinesh Puravankara B Sc (Dairy Technology) Gujarat Agricultural UniversityJ 991 M Sc (Dairy Chemistry) Gujarat Agricultural University, 1994 PROJECT SUBMITTED IN PARTIAL FULFILLMENT OF THE REQUIREMENTS FOR THE DEGREE OF MASTER OF BUSINESS ADMINISTRATION In the Faculty of Business Administration Executive MBA O Dinesh Puravankara 2007 SIMON FRASER UNIVERSITY Summer 2007 All rights reserved. This work may not be reproduced in whole or in part, by photocopy or other means, without permission of the author APPROVAL Name: Dinesh Puravankara Degree: Master of Business Administration Title of Project: Strategic Analysis of The Coca-Cola Company. Supervisory Committee: Mark Wexler Senior Supervisor Professor Neil R. Abramson Supervisor Associate Professor Date Approved: SIMON FRASER UNIVEliSITY LIBRARY Declaration of Partial Copyright Licence The author, whose copyright is declared on the title page of this work, has granted to Simon Fraser University the right to lend this thesis, project or extended essay to users of the Simon Fraser University Library, and to make partial or single copies only for such users or in response to a request from the library of any other university, or other educational institution, on its own behalf or for one of its users. The author has further granted permission to Simon Fraser University to keep or make a digital copy for use in its circulating collection (currently available to the public at the "lnstitutional Repository" link of the SFU Library website <www.lib.sfu.ca> at: ~http:llir.lib.sfu.calhandle/l8921112>)and, without changing the content, to translate the thesislproject or extended essays, if technically possible, to any medium or format for the purpose of preservation of the digital work. -

Eai LPZZ Rthqi Iopc Acatc Uakc Te^G^ Rghur Ekill >Ngers Run “ Reh V

M m a l l s r i d a h o M o n d a y , AAprin67^979 ------------------------------------ 7 4 tth h year. No. 106^I---------- T w tnrFal E a irth q iu a k ce k ill g o sli[a v ia ^^^^p^W 'Yugosiavav:—there-would bcrmonrdai r awa^M j^HBpi^^B i BELGRADE, Yug'ugoslavja (UPI) — Thehe strongest felt througttouhout Yugoslavia and as far horrifying picture.’’ ears leveled entire villages;s ond spread Germ any, AusAustria, Bulgaria, Albania arim d and Budva anind In Kotor, In the BokaDka Kolorska bay, aboyt 70 percen i.. eaiihguake tn 75 yeai i was de uninhabitable, includlnf' a liosp ^'read death and desilesthictlon along Yugoslavia/ia’s southern Yugoslavlarrlan seismologists said it v ■ * tr *ka bay • further to thUie all houses were made t quake to hitt YlYugoslavia In 75 years, jy.darAVfgftl or knocked dowiwn with 200 patients, officlaflcials said. Several thousand rcsldt Adriatic coast Easter:er Sunday. drialic ^B W W W PPB rch of Kotor were evacuate«ated to a clly soever stadium and It was In the quake-stricken;en area but The eplcententer was placcd In the Adr ■ 9 UUilUUlJ.'lfi^lng hoteljtd s and a 200-year old churc Li_. p^dent.Tlto wa of UIclhJ7and 215 miles soullulh of officials asked for tentsnts and blniikuts for the lhe liomde Ir- escaped unhurt. l o aa I;broadcast to the nation, he sold alw.ui' miles west of -■ • -near!vDubrovnlk. clear he was capital ot Bel{telgrade.. ■>' 200 people had t>een!€n,kUled, but made ll cle vas In the sea,”-said [tltd dlshipted road and rallwajway traffic In the area and ci Army units and specipecial civilian protecHon squads fi "W e were•e Itlucky lhat lhe epicenter wa ephonellnes, electricity and'nd waler supplies, police said all over Uie country■y vwere flowti by helicopters to quoting unoHlcialrw Rlbarlc, director of the LJ»JublJana geological t e l ^ Local govemmenri^ ^ clals said that oboutlUt 150 people Vladim ir Rib Qve had much worse. -

Part I: Analysis of Case 5 1

Part I: Analysis of Case 5 1. What are the strategically relevant components of the global and U.S. beverage industry macro-environment? How do the economic characteristics of the alternative beverage segment of the industry differ from that of other beverage categories? Explain. Market size The beverage market is a large market with the worldwide total market for beverages in 2009 was $1,581.7 billion. The total sale of beverages during 2009 in the US was nearly 458.3 billion gallons; with 48.2 percent of industry sales was from carbonated soft drinks and 29.2 percent of bottle water industry sales. In 2009, the market segment of alternative beverage include sports drinks, flavored or enhanced water, and energy drinks made up 4.0 percent, 1.6 percent, and 1.2 percent of industry sales, respectively. The global market for alternative beverages in the same year was $40.2 billion (12.7 billion liters), while the value of the U.S market for alternative beverages stood at $17 billion (4.2 billion liters). Meanwhile, in Asia-Pacific region, the market for alternative beverages in 2009 was $12.7 billion (6.2 billion liters) and it was $9.1 billion (1.6 billion liters) in the European market. Market growth The dollar value of the global beverage industry had grown at a 2.6 percent annually between 2005 and 2009 and was forecasted to grow at a 2.3 percent between 2010 and 2014. However, this indicator for the alternative beverage industry was much higher. For example, the dollar value of the global market for alternative beverages grew at a 9.8 percent annually between 2005 and 2009, but was expected to slow down to 5.7 percent annually between 2010 and 2014. -

CIR WP Energy Drinks 0113 CIR WP Energy Drinks 0113 1/28/13 2:19 PM Page 1

CIR_WP_Energy Drinks_0113_CIR_WP_Energy Drinks_0113 1/28/13 2:19 PM Page 1 CIRCADIAN ® White Paper ENERGY DRINKS The Good, the Bad, and the Jittery Jena L. Pitman-Leung, Ph.D., Becca Chacko, & Andrew Moore-Ede 2 Main Street, Suite 310 Stoneham, MA 02180 USA tel 781-439-6300 fax 781-439-6399 [email protected] www.circadian.com CIR_WP_Energy Drinks_0113_CIR_WP_Energy Drinks_0113 1/28/13 2:19 PM Page 2 ENERGY DRINKS Introduction Energy drinks have become the new “go-to” source of caffeine in our 24/7 society, particularly for young people. Available nearly everywhere, affordable and conveniently packaged, energy drinks represent an apparently simple solution to the worldwide exhaustion epidemic. Yet despite their widespread consumption and popularity - sales in the United States reached over $10 billion in 2012 - many questions still remain about their safety and efficacy (Meier, January 2013). To start with, most energy drinks contain ingredients that consumers are not familiar with, and that haven’t been studied for safe consumption in a laboratory environment. The goal of this whitepaper is to provide background information on what makes energy drinks different from other common sources of caffeine, examine the ingredients that give energy drinks their “boost”, and identify best consumption practices and potential safety issues.* I. What Are Energy Drinks Anyway? You might say that energy drinks are the older, stronger, jock brother of caffeinated soft drinks. They share some similarities – both are typically carbonated, contain caffeine and sugar, and are available everywhere. However, the biggest difference between energy drinks and sodas is how they are classified by the United States Food & Drug Administration (FDA). -

IPFW Coca Cola Product List

Brand Family Flavors Coca Cola Classic Barq’s (Root Beer & Red Crème The #1 soft drink in the world with Soda) that refreshing and uplifting cola Fanta (Orange, Grape) taste. Mello Yello Also available in Caffeine-Free Pibb Minute Maid Fruit Drinks Fruit juice drink containing real fruit Coke Zero and natural ingredients that provide No calories or carbs, but same great delicious taste and quality. taste as Coca-Cola Classic! Also available in the Zero line: Cherry FLAVORS: Lemonade, Pink Coke Zero, Sprite Zero, Vault Zero Lemonade, Orangeade, Fruit Punch (Light Cherry Limeade, Light Orangeade only available in 12oz cans) Diet Coke Nestea The #1 diet soft drink with refreshing, A combination of great taste with the authentic cola taste. The freedom to physical restoration of tea. indulge without the calories. Also available in Caffeine-Free and Lime. FLAVORS: Sweet with Lemon, Red Tea with Pomegranate & Passion Fruit Cherry Coke & Cherry Zero Dasani Water Purified water enhanced with minerals Adds a bold, exhilarating taste of for a pure, fresh taste. Cherry to Coca-Cola. (Diet Cherry only available in 12oz. cans) Dasani Flavors: Refreshing taste of Dasani Water with Lemon or Strawberry flavor. POWERade & POWERade Zero (20oz.) Thirst quenching sports drink that Sprite & Sprite Zero replenishes the active body. The leading teen brand. Clean and crisp refreshment. No caffeine. FLAVORS: Mountain Blast, Fruit Punch, Orange, Lemon-Lime, Grape, Strawberry Lemonade Powerade Zero: Mixed Berry, Grape, Fruit Punch Minute Maid 100% Juice Vault 100% Fruit Juice with a name Drinks like a soda, kicks like an consumers trust. (450mL or 10oz. -

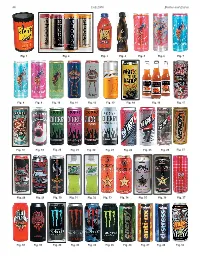

Bottles and Extras Fall 2006 44

44 Fall 2006 Bottles and Extras Fig. 1 Fig. 2 Fig. 3 Fig. 4 Fig. 5 Fig. 6 Fig. 7 Fig. 8 Fig. 9 Fig. 10 Fig. 11 Fig. 12 Fig. 13 Fig. 14 Fig. 16 Fig. 17 Fig. 18 Fig. 19 Fig. 20 Fig. 21 Fig. 22 Fig. 23 Fig. 24 Fig. 25 Fig. 26 Fig. 27 Fig. 28 Fig. 29 Fig. 30 Fig. 31 Fig. 32 Fig. 33 Fig. 34 Fig. 35 Fig. 36 Fig. 37 Fig. 38 Fig. 39 Fig. 40 Fig. 42 Fig. 43 Fig. 45 Fig. 46 Fig. 47 Fig. 48 Fig. 52 Bottles and Extras March-April 2007 45 nationwide distributor of convenience– and dollar-store merchandise. Rosen couldn’t More Energy Drink Containers figure out why Price Master was not selling coffee. “I realized coffee is too much of a & “Extreme Coffee” competitive market,” Rosen said. “I knew we needed a niche.” Rosen said he found Part Two that niche using his past experience of Continued from the Summer 2006 issue selling YJ Stinger (an energy drink) for By Cecil Munsey Price Master. Rosen discovered a company named Copyright © 2006 “Extreme Coffee.” He arranged for Price Master to make an offer and it bought out INTRODUCTION: According to Gary Hemphill, senior vice president of Extreme Coffee. The product was renamed Beverage Marketing Corp., which analyzes the beverage industry, “The Shock and eventually Rosen bought the energy drink category has been growing fairly consistently for a number of brand from Price Master. years. Sales rose 50 percent at the wholesale level, from $653 million in Rosen confidently believes, “We are 2003 to $980 million in 2004 and is still growing.” Collecting the cans and positioned to be the next Red Bull of bottles used to contain these products is paralleling that 50 percent growth coffee!” in sales at the wholesale level. -

Science, Manufacture, and Marketing of Red Bull and Other Energy Drinks Zeno Yeates, ‘10

No Bull: Science, Manufacture, and Marketing of Red Bull and Other Energy Drinks Zeno Yeates, ‘10 (Photo by Yohan Moon) Yohan by (Photo Zeno smells bad. bad. smells Zeno he increasing prevalence of energy drinks over the The ingredients were explicitly listed on the can itself, and neither Tpast decade is a phenomenon that cannot simply be trademark nor patent existed to protect its formula; hence, Red dismissed as a passing obsession. What began with the advent of Bull was born [3]. Red Bull in 1984 has evolved into a colossus of different brands Careful observation of any university library will reveal the claiming anything from sharpened mental acuity to enhanced undeniable popularity of iPods and Red Bulls – the arsenal for athletic performance. Austrian-born Red Bull founder and CEO the true titan of academic endeavor confronting a full night of Dietrich Mateschitz relies on the younger generation for his sales intellectual tribulation. Nevertheless, some conjecture whether base, exploiting the teenage drive for risk-taking and adventure Red Bull’s buzz serves only to distract the active mind in the using dramatic product names, draconian logos, and sponsorship same way that prolonged auditory stimulation seems to. The of extreme sporting events [1]. Predictably, a multitude of most immediate answer is given on the container itself, which competitors have followed suit, introducing similar concoctions specifically claims to improve performance in times of elevated with dicey names such as Cocaine, Dare Devil, Pimp Juice, stress or strain, increase endurance, increase reaction speed, and Venom, and Monster. However, none of the claims of enhanced stimulate metabolism [4]. -

Voirivsiiaa Iranoh

voirivsiiaaIraNoH California Proposition 65 Warning WARNING: Engine Exhaust, some of its constituents, and certain vehicle components contain or emit chemicals known to the State of California to cause cancer and birth defects or other reproductive harm. Keep this owner’s manual handy, so you can refer to it at any time. This owner’s manual is considered a permanent part of the outboard motor and should remain with the outboard motor if resold. The information and specifications included in this publication were in effect at the time of approval for printing. Honda Motor Co., Ltd. reserves the right, however, to discontinue or change specifications or design at any time without notice and without incurring any obligation whatever. No part of this publication may be reproduced without written permission. INTRODUCTION Congratulations on your selection of We suggest you read the warranty a Honda outboard motor. We are certain policy to fully understand its coverage you will be pleased with your purchase and your responsibilities of ownership. of one of the finest outboard motors on The warranty policy is a separate the market. document that should have been given to you by your dealer. We want to help you get the best results from your new outboard motor and to When your outboard motor needs operate it safely. This manual contains the scheduled maintenance, keep in mind that information on how to do that; please read your Honda marine dealer is specially it carefully. trained in servicing Honda outboard motors. Your Honda marine dealer is As you read this manual, you will dedicated to your satisfaction and will be find information preceded by a pleased to answer your questions and -1 symbol.