Determination of Caffeine in Beverages

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Intake of Sugar-Sweetened Beverages and Fecundability in a North American Preconception Cohort

ORIGINAL ARTICLE Intake of Sugar-sweetened Beverages and Fecundability in a North American Preconception Cohort Elizabeth E. Hatch,a Amelia K. Wesselink,a Kristen A. Hahn,a James J. Michiel,a Ellen M. Mikkelsen,b Henrik Toft Sorensen,b Kenneth J. Rothman,a,c and Lauren A. Wisea Background: Dietary factors, including sugar-sweetened beverages, pproximately 10%–15% of North American couples may have adverse effects on fertility. Sugar-sweetened beverages Aexperience infertility, defined as the inability to con- 1 were associated with poor semen quality in cross-sectional studies, ceive after 12 or more months of attempting pregnancy. and female soda intake has been associated with lower fecundability Both female and male factors contribute to infertility, with in some studies. estimates of 39% of cases due to a female factor alone, 20% Methods: We evaluated the association of female and male sugar- to a male factor, 33% to both male and female factors, and sweetened beverage intake with fecundability among 3,828 women 8% with unknown cause.2 Thus, identifying modifiable fac- planning pregnancy and 1,045 of their male partners in a North Ameri- tors in both partners that can improve fertility (e.g., diet) can prospective cohort study. We followed participants until pregnancy could help couples avoid expensive and stressful fertility or for up to 12 menstrual cycles. Eligible women were aged 21–45 treatments. (male partners ≥21), attempting conception for ≤6 cycles, and not using fertility treatments. Participants completed a comprehensive The amount of added sugar in the American diet 3 baseline questionnaire, including questions on sugar-sweetened bever- increased by 19% between 1970 and 2005. -

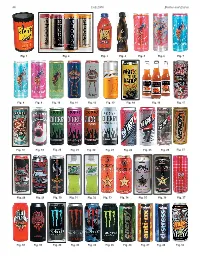

ENERGY DRINK Buyer’S Guide 2007

ENERGY DRINK buyer’s guide 2007 DIGITAL EDITION SPONSORED BY: OZ OZ3UGAR&REE OZ OZ3UGAR&REE ,ITER ,ITER3UGAR&REE -ANUFACTUREDFOR#OTT"EVERAGES53! !$IVISIONOF#OTT"EVERAGES)NC4AMPA &, !FTERSHOCKISATRADEMARKOF#OTT"EVERAGES)NC 777!&4%23(/#+%.%2'9#/- ENERGY DRINK buyer’s guide 2007 OVER 150 BRANDS COMPLETE LISTINGS FOR Introduction ADVERTISING EDITORIAL 1123 Broadway 1 Mifflin Place The BEVNET 2007 Energy Drink Buyer’s Guide is a comprehensive compilation Suite 301 Suite 300 showcasing the energy drink brands currently available for sale in the United States. New York, NY Cambridge, MA While we have added some new tweaks to this year’s edition, the layout is similar to 10010 02138 our 2006 offering, where brands are listed alphabetically. The guide is intended to ph. 212-647-0501 ph. 617-715-9670 give beverage buyers and retailers the ability to navigate through the category and fax 212-647-0565 fax 617-715-9671 make the tough purchasing decisions that they believe will satisfy their customers’ preferences. To that end, we’ve also included updated sales numbers for the past PUBLISHER year indicating overall sales, hot new brands, and fast-moving SKUs. Our “MIA” page Barry J. Nathanson in the back is for those few brands we once knew but have gone missing. We don’t [email protected] know if they’re done for, if they’re lost, or if they just can’t communicate anymore. EDITORIAL DIRECTOR John Craven In 2006, as in 2005, niche-marketed energy brands targeting specific consumer [email protected] interests or demographics continue to expand. All-natural and organic, ethnic, EDITOR urban or hip-hop themed, female- or male-focused, sports-oriented, workout Jeffrey Klineman “fat-burners,” so-called aphrodisiacs and love drinks, as well as those risqué brand [email protected] names aimed to garner notoriety in the media encompass many of the offerings ASSOCIATE PUBLISHER within the guide. -

Energy Drinks: Harmful Or Helpful?

ENERGY DRINKS: HARMFUL OR HELPFUL? Caffeine: An Overview If someone asked how much caffeine you consume each day could you give them an accurate answer? Manufacturers are not currently required to list the caffeine content of foods or beverages on nutrition labels, so it can be difficult to determine how much caffeine you have each day. Most of us know that excessive intake of caffeine may cause a racing heart rate and headaches, but did you know that it can also cause anxiety, increased blood pressure, heart palpitations, insomnia and, in extreme cases, nausea and vomiting (1)? People are sensitive to caffeine at all different levels, but the general guideline is to try to consume less than 300mg caffeine (equivalent to about 3, 8oz. cups of coffee) daily. Although some of these symptoms sound fairly miserable, the good news is that in small to moderate amounts, caffeine has actually been shown to increase concentration and mental alertness (2). To maximize the benefits of caffeine and minimize side effects, it is best to spread out your caffeine intake throughout the day. Large caffeine doses in short periods of time only add to an “energy boost” followed by a “crash”. Check out the Caffeine Ranges for Common Beverages table to get a better idea of what your average caffeine intake may be. Caffeine Ranges for Common Beverages* Beverage Serving Size Caffeine Range (mg) Coffee, drip 8 fluid oz. 104-192 Tea, brewed 8 fluid oz. 20-90 Iced Tea 8 fluid oz. 9-50 Soft Drinks 8 fluid oz. 20-40 Cocoa Beverage 8 fluid oz. -

Caffeine, Energy Drinks, and Effects on the Body

Caffeine, Energy Drinks, and Effects on the Body Source 1: "Medicines in My Home: Caffeine and Your Body" by the Food and Drug Administration Caffeine Content in Common Drinks and Foods (University of Washington) Item Item size Caffeine (mg) Coffee 150 ml (5 oz) 60–150 Coffee, decaf 150 ml (5 oz) 2–5 Tea 150 ml (5 oz) 40–80 Hot Cocoa 150 ml (5 oz) 1–8 Chocolate Milk 225 ml 2–7 Jolt Cola 12 oz 100 Josta 12 oz 58 Mountain Dew 12 oz 55 Surge 12 oz 51 Diet Coca Cola 12 oz 45 Coca Cola 12 oz 64 Coca Cola Classic 12 oz 23 Dr. Pepper 12 oz 61 Mello Yellow 12 oz 35 Mr. Pibb 12 oz 27 Pepsi Cola 12 oz 43 7-Up 12 oz 0 COPYRIGHT © 2015 by Vantage Learning. All Rights Reserved. No part of this work may be used, accessed, reproduced or distributed in any form or by any means or stored in a database or any retrieval system, without the prior written permission of Vantage Learning. Caffeine, Energy Drinks, and Effects on the Body Mug Root Beer 12 oz 0 Sprite 12 oz 0 Ben & Jerry's No Fat Coffee 1 cup 85 Fudge Frozen Yogurt Starbucks Coffee Ice Cream 1 cup 40–60 Dannon Coffee Yogurt 8 oz 45 100 Grand Bar 1 bar (43 g) 11.2 Krackel Bar 1 bar (47 g) 8.5 Peanut Butter Cup 1 pack (51 g) 5.6 Kit Kat Bar 1 bar (46 g) 5 Raisinets 10 pieces (10 g) 2.5 Butterfinger Bar 1 bar (61 g) 2.4 Baby Ruth Bar 1 bag (60 g) 2.4 Special Dark Chocolate Bar 1 bar (41 g) 31 Chocolate Brownie 1.25 oz 8 Chocolate Chip Cookie 30 g 3–5 Chocolate Ice Cream 50 g 2–5 Milk Chocolate 1 oz 1–15 Bittersweet Chocolate 1 oz 5–35 Source 3: Excerpt from "CAERS Adverse Events Reports Allegedly Related to 5 Hour Energy" by The Food and Drug Administration http://www.fda.gov/downloads/AboutFDA/CentersOffices/OfficeofFoods/CFSAN/CFSANFOIAElectron icReadingRoom/UCM328270.pdf Received Symptoms Outcomes Date ANAPHYLACTIC SHOCK, LIFE THREATENING, VISITED AN ER, URTICARIA, DYSPNOEA, VISITED A HEALTH CARE PROVIDER, 3/24/2011 LETHARGY, HYPERSOMNIA, OTHER SERIOUS (IMPORTANT MEDICAL ASTHENIA EVENTS) RENAL IMPAIRMENT, FOETAL LIFE THREATENING, CONGENITAL 4/21/2011 DISTRESS SYNDROME ANOMALY COPYRIGHT © 2015 by Vantage Learning. -

Eai LPZZ Rthqi Iopc Acatc Uakc Te^G^ Rghur Ekill >Ngers Run “ Reh V

M m a l l s r i d a h o M o n d a y , AAprin67^979 ------------------------------------ 7 4 tth h year. No. 106^I---------- T w tnrFal E a irth q iu a k ce k ill g o sli[a v ia ^^^^p^W 'Yugosiavav:—there-would bcrmonrdai r awa^M j^HBpi^^B i BELGRADE, Yug'ugoslavja (UPI) — Thehe strongest felt througttouhout Yugoslavia and as far horrifying picture.’’ ears leveled entire villages;s ond spread Germ any, AusAustria, Bulgaria, Albania arim d and Budva anind In Kotor, In the BokaDka Kolorska bay, aboyt 70 percen i.. eaiihguake tn 75 yeai i was de uninhabitable, includlnf' a liosp ^'read death and desilesthictlon along Yugoslavia/ia’s southern Yugoslavlarrlan seismologists said it v ■ * tr *ka bay • further to thUie all houses were made t quake to hitt YlYugoslavia In 75 years, jy.darAVfgftl or knocked dowiwn with 200 patients, officlaflcials said. Several thousand rcsldt Adriatic coast Easter:er Sunday. drialic ^B W W W PPB rch of Kotor were evacuate«ated to a clly soever stadium and It was In the quake-stricken;en area but The eplcententer was placcd In the Adr ■ 9 UUilUUlJ.'lfi^lng hoteljtd s and a 200-year old churc Li_. p^dent.Tlto wa of UIclhJ7and 215 miles soullulh of officials asked for tentsnts and blniikuts for the lhe liomde Ir- escaped unhurt. l o aa I;broadcast to the nation, he sold alw.ui' miles west of -■ • -near!vDubrovnlk. clear he was capital ot Bel{telgrade.. ■>' 200 people had t>een!€n,kUled, but made ll cle vas In the sea,”-said [tltd dlshipted road and rallwajway traffic In the area and ci Army units and specipecial civilian protecHon squads fi "W e were•e Itlucky lhat lhe epicenter wa ephonellnes, electricity and'nd waler supplies, police said all over Uie country■y vwere flowti by helicopters to quoting unoHlcialrw Rlbarlc, director of the LJ»JublJana geological t e l ^ Local govemmenri^ ^ clals said that oboutlUt 150 people Vladim ir Rib Qve had much worse. -

Part I: Analysis of Case 5 1

Part I: Analysis of Case 5 1. What are the strategically relevant components of the global and U.S. beverage industry macro-environment? How do the economic characteristics of the alternative beverage segment of the industry differ from that of other beverage categories? Explain. Market size The beverage market is a large market with the worldwide total market for beverages in 2009 was $1,581.7 billion. The total sale of beverages during 2009 in the US was nearly 458.3 billion gallons; with 48.2 percent of industry sales was from carbonated soft drinks and 29.2 percent of bottle water industry sales. In 2009, the market segment of alternative beverage include sports drinks, flavored or enhanced water, and energy drinks made up 4.0 percent, 1.6 percent, and 1.2 percent of industry sales, respectively. The global market for alternative beverages in the same year was $40.2 billion (12.7 billion liters), while the value of the U.S market for alternative beverages stood at $17 billion (4.2 billion liters). Meanwhile, in Asia-Pacific region, the market for alternative beverages in 2009 was $12.7 billion (6.2 billion liters) and it was $9.1 billion (1.6 billion liters) in the European market. Market growth The dollar value of the global beverage industry had grown at a 2.6 percent annually between 2005 and 2009 and was forecasted to grow at a 2.3 percent between 2010 and 2014. However, this indicator for the alternative beverage industry was much higher. For example, the dollar value of the global market for alternative beverages grew at a 9.8 percent annually between 2005 and 2009, but was expected to slow down to 5.7 percent annually between 2010 and 2014. -

Energy Drinks Presentation Part 2

What’s All The Buzz About?? Lois Bisson BSN, RN Michelle Keith BSN, RN, NCSN Chris Mancini BSN, RN, NCSN Barbara Schuster BSN, RN, NCSN Caffeine Extracted from the raw fruit of over 60 species of coffee plants. Also extracted from tea, kola nuts and cocoa. It is the main byproduct of guarana Use: 1. Strong cardiovascular stimulant 2. Pain reliever Caffeine continued... Most widely used psychoactive substance in the world and the only one that is currently legal! Currently, youth are consuming more caffeine than adults on a milligram per kilogram basis Caffeine continued... FDA limits caffeine in soft drinks to 0.02 percent (10mg/oz.) but there are no limits for ED’s Most ED’s exceed the soft drink restriction, with caffeine amounts nearly 9-28mg/oz. Children should consume no more than 150mg per day Chocolate=5-20mg Caffeine continued... Lethal dose in humans approximately 10gm, however death has been reported at 6.5mg Well absorbed with 99% of absorption occurring in the GI tract. Easily distributed throughout the body, and crosses the blood-brain barrier Children may experience more pronounced effects due to slower drug metabolism Caffeine continued... In 1993, a Canadian study showed: 25.3% of children aged 11-18 admitted to caffeine doping to enhance sport performance. 37.4% of 16-18 year olds admitted to caffeine doping to enhance sport performance Catchy Names... 5 hour energy Stacker 2 Kick Start PimpJuice 6 hour energy Nirtro 2 go Battery Energy Red Devil Redbull Shot Redline Full Throttle Rockstar Monster Vital 4 U Rip It BAWLS Hit Man SoBe Advertised to.. -

Energy Drinks for Children and Medicamentos Deben Tener Cuidado Y Limitar La Cantidad De Cafeína Que Ingieren

HOJA PARA EL PACIENTE DE JAMA La Revista de la American Medical Association NUTRICIÓN Bebidas energéticas as bebidas llamadas bebidas energéticas son populares, especialmente entre los adolescentes y los adultos jóvenes. Se publicita que estas bebidas energéticas brindan a CONTENIDO DE CAFEÍNA EN Llas personas un nivel de energía más alto, hacen que una persona se sienta más despierta BEBIDAS Y OTROS PRODUCTOS y potencian el período de atención. Bebidas energéticas Contenido de cafeína (mg) Las bebidas energéticas se comercializan en distintos tamaños de porción y contienen 5-Hour Energy.......................................207 cantidades de cafeína variables. Los refrescos (también conocidos como gaseosas, colas o sodas) Amp, 16 oz............................................143 pueden contener azúcar y cafeína, aunque la mayoría de los refrescos contienen menos cafeína BAWLS Guarana, 16 oz .........................100 que las bebidas energéticas si se los compara en onzas. Por ejemplo, una taza de café de 8 oz Full Throttle, 16 oz ................................197 Monster, 16 oz ......................................160 tiene alrededor de 100 mg de cafeína (ver la tabla a la derecha y la tabla expandida en línea, en No Fear, 16 oz.......................................174 www.jama.com). El número de JAMA del 16 de enero de 2013 contiene 2 artículos en los que NOS, 16 oz............................................260 se analizan los daños asociados con las bebidas energéticas. Red Bull, 16 oz ......................................152 -

Bottles and Extras Fall 2006 44

44 Fall 2006 Bottles and Extras Fig. 1 Fig. 2 Fig. 3 Fig. 4 Fig. 5 Fig. 6 Fig. 7 Fig. 8 Fig. 9 Fig. 10 Fig. 11 Fig. 12 Fig. 13 Fig. 14 Fig. 16 Fig. 17 Fig. 18 Fig. 19 Fig. 20 Fig. 21 Fig. 22 Fig. 23 Fig. 24 Fig. 25 Fig. 26 Fig. 27 Fig. 28 Fig. 29 Fig. 30 Fig. 31 Fig. 32 Fig. 33 Fig. 34 Fig. 35 Fig. 36 Fig. 37 Fig. 38 Fig. 39 Fig. 40 Fig. 42 Fig. 43 Fig. 45 Fig. 46 Fig. 47 Fig. 48 Fig. 52 Bottles and Extras March-April 2007 45 nationwide distributor of convenience– and dollar-store merchandise. Rosen couldn’t More Energy Drink Containers figure out why Price Master was not selling coffee. “I realized coffee is too much of a & “Extreme Coffee” competitive market,” Rosen said. “I knew we needed a niche.” Rosen said he found Part Two that niche using his past experience of Continued from the Summer 2006 issue selling YJ Stinger (an energy drink) for By Cecil Munsey Price Master. Rosen discovered a company named Copyright © 2006 “Extreme Coffee.” He arranged for Price Master to make an offer and it bought out INTRODUCTION: According to Gary Hemphill, senior vice president of Extreme Coffee. The product was renamed Beverage Marketing Corp., which analyzes the beverage industry, “The Shock and eventually Rosen bought the energy drink category has been growing fairly consistently for a number of brand from Price Master. years. Sales rose 50 percent at the wholesale level, from $653 million in Rosen confidently believes, “We are 2003 to $980 million in 2004 and is still growing.” Collecting the cans and positioned to be the next Red Bull of bottles used to contain these products is paralleling that 50 percent growth coffee!” in sales at the wholesale level. -

Science, Manufacture, and Marketing of Red Bull and Other Energy Drinks Zeno Yeates, ‘10

No Bull: Science, Manufacture, and Marketing of Red Bull and Other Energy Drinks Zeno Yeates, ‘10 (Photo by Yohan Moon) Yohan by (Photo Zeno smells bad. bad. smells Zeno he increasing prevalence of energy drinks over the The ingredients were explicitly listed on the can itself, and neither Tpast decade is a phenomenon that cannot simply be trademark nor patent existed to protect its formula; hence, Red dismissed as a passing obsession. What began with the advent of Bull was born [3]. Red Bull in 1984 has evolved into a colossus of different brands Careful observation of any university library will reveal the claiming anything from sharpened mental acuity to enhanced undeniable popularity of iPods and Red Bulls – the arsenal for athletic performance. Austrian-born Red Bull founder and CEO the true titan of academic endeavor confronting a full night of Dietrich Mateschitz relies on the younger generation for his sales intellectual tribulation. Nevertheless, some conjecture whether base, exploiting the teenage drive for risk-taking and adventure Red Bull’s buzz serves only to distract the active mind in the using dramatic product names, draconian logos, and sponsorship same way that prolonged auditory stimulation seems to. The of extreme sporting events [1]. Predictably, a multitude of most immediate answer is given on the container itself, which competitors have followed suit, introducing similar concoctions specifically claims to improve performance in times of elevated with dicey names such as Cocaine, Dare Devil, Pimp Juice, stress or strain, increase endurance, increase reaction speed, and Venom, and Monster. However, none of the claims of enhanced stimulate metabolism [4]. -

Caffeine Content in Foods and Beverages - Uptodate

16/02/2020 Caffeine content in foods and beverages - UpToDate Official reprint from UpToDate® © 2020 UpToDate, Inc. e/ou seus afiliados. Todos os direitos reservados.www.uptodate.com Caffeine content in foods and beverages Coffees Serving size, oz (mL) Caffeine, mg Coffee, brewed 8 (235) 133 (range: 102 to 200) Coffee, generic instant 8 (235) 93 (range: 27 to 173) Coffee, generic decaffeinated 8 (235) 5 (range: 3 to 12) Espresso 1 (30) 40 (range: 30 to 90) Espresso decaffeinated 1 (30) 4 Teas Serving size, oz (mL) Caffeine, mg Tea, brewed 8 (235) 53 (range: 40 to 120) Arizona Iced Tea, black 16 (470) 32 Arizona Iced Tea, green 16 (470) 15 Nestea 12 (355) 26 Snapple, Just Plain Unsweetened 16 (470) 18 Snapple, Kiwi Teawi 16 (470) 10 Snapple, Lemon, Peach, or Raspberry 16 (470) 42 Starbucks Tazo Chai Tea Latte (Grande) 16 (470) 100 Soft drinks Serving size, oz (mL) Caffeine, mg FDA official limit for cola and pepper soft 12 (355) 71 drinks 7-Up, regular or diet 12 (355) 0 Barq's Diet Root Beer 12 (355) 0 Barq's Root Beer 12 (355) 22 Coke, regular or diet 12 (355) 35 to 47 Dr. Pepper, regular or diet 12 (355) 42 to 44 Fanta, all flavors 12 (355) 0 Fresca, all flavors 12 (355) 0 Jolt Cola 12 (355) 72 Mellow Yellow 12 (355) 53 Mountain Dew, regular or diet 12 (355) 54 (20 oz = 90) Mountain Dew MDX, regular or diet 12 (355) 71 (20 oz = 118) Mug Root Beer, regular or diet 12 (355) 0 Pepsi, regular or diet 12 (355) 36 to 38 https://www.uptodate.com/contents/image/print?csi=dc8cf830-1b2b-4faa-9f01-bf4cf6c3967a&source=contentShare&imageKey=OBGYN%2F79304 -

22 Important Factors Affecting Our Ability to Compete Successfully Include the Taste and Flavor of Our Products, Trade and Consu

Important factors affecting our ability to compete successfully include the taste and flavor of our products, trade and consumer promotions, rapid and effective development of new, unique cutting edge products, attractive and different packaging, branded product advertising and pricing. Our products compete with all liquid refreshments and with products of much larger and substantially better financed competitors, including the products of numerous nationally and internationally known producers such as TCCC, PepsiCo, Red Bull Gmbh, the DPS Group, Kraft Foods Inc., and Nestle Beverage Company. We also compete with companies that are smaller or primarily national or local in operations such as Tree Top and Ocean Spray. Our products also compete with private label brands such as those carried by grocery store chains, convenience store chains, and club stores. Our Java Monster™ product line competes directly with Starbucks Frappuccino, Starbucks Double Shot, Starbucks Double Shot Energy Plus Coffee and other Starbucks coffee drinks, Rockstar Roasted, Caribou Coffee, Cinnabon coffee drinks, Godiva dairy based drinks and Full Throttle Coffee. There can be no assurance that we will not encounter difficulties in maintaining our current revenues or market share or position due to competition in the beverage industry. If our revenues decline, our business, financial condition and results of operations could be adversely affected. We derive a substantial portion of revenues from our energy drinks and competitive pressure in the “energy drink” category could adversely affect our operating results. A substantial portion of our sales are derived from our energy drinks, including in particular our Monster Energy® brand energy drinks. Our DSD segment, which comprises primarily energy drinks, represented 91.9% of net sales for the year ended December 31, 2009.