Social Scorecard: Sport

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Coventry Blaze Fixtures 18/19

COVENTRY BLAZE FIXTURES 18/19 Day Date Month Home or Away Opposition Competition Face-Off Saturday 25 August Away Cardiff Devils Pre-Season 7.00pm Sunday 26 August Home Cardiff Devils Pre-Season 5.15pm Wednesday 29 August Home Milton Keynes Lightning Pre-Season 7.30pm Saturday 1 September Home Amiens Gothiques Pre-Season 7.00pm Sunday 2 September Home Amiens Gothiques Pre-Season 5.15pm Wednesday 5 September Away Milton Keynes Lightning Pre-Season 7.30pm Saturday 8 September Away Guildford Flames Challenge Cup 6.00pm Sunday 9 September Home Guildford Flames Challenge Cup 5.15pm Saturday 15 September Away Milton Keynes Lightning Challenge Cup 7.00pm Sunday 16 September Home Nottingham Panthers Elite League 5.15pm Saturday 22 September Away Cardiff Devils Challenge Cup 7.00pm Sunday 23 September Home Milton Keynes Lightning Elite League 5.15pm Saturday 29 September Home Glasgow Clan Elite League 7.00pm Sunday 30 September Home Sheffield Steelers Elite League 5.15pm Saturday 6 October Away Nottingham Panthers Elite League 7.00pm Sunday 7 October Home Belfast Giants Elite League 5.15pm Saturday 13 October Away Manchester Storm Elite League 7.00pm Sunday 14 October Home Manchester Storm Elite League 5.15pm Saturday 20 October Away Glasgow Clan Elite League 7.00pm Sunday 21 October Home Milton Keynes Lightning Challenge Cup 5.15pm Saturday 27 October Away Fife Flyers Elite League 7.15pm Sunday 28 October Home Cardiff Devils Challenge Cup 5.15pm Wednesday 31 October Away Sheffield Steelers Elite League 7.30pm Saturday 3 November Away Cardiff -

Annual Report 2019 2 Newcastle Eagles Community Foundation

ANNUAL REPORT 2019 2 NEWCASTLE EAGLES COMMUNITY FOUNDATION FACTS AND FIGURES 2018-19 schools 81 participated 7,048 young people extra-curricular school9 clubs 6 1 took part established within the council champion of East End of Newcastle finals champions final 419 all the BBL squad players deliver Hoops 4 Health roadshows young people have attended 0 3 times club teams compete or more within our junior 76 central venue league 72 OVER OVER players club or after 49 school sites 2,000 800 attending competing in 5 to 9 clubs our central years olds every venue league 12 week every week officiating receiving staff for CVL 1,500 coaching more than foundation school club sites 7 trustees 22 across the region full time 7,000 staff volunteer hours 9 part time donated this season 40 staff zero our clubs cater from 5 years old to senior age groups core-funding ANNUAL REPORT 2019 3 INTRODUCTION 2018-19 was a landmark year for the Eagles Community Foundation, with a long term vision realised when we all moved into the Eagles Community Arena (ECA). It is impossible to properly articulate in these pages the gratitude to all past and present employees, partners, sponsors, funders, and volunteers who have made this possible. 2018/19 has seen us continue the fine work across the community and in schools, and the most exciting development of all has been the capacity we have as an organization to now host all of our holiday camps, tournaments, leagues and events at our own facility. All of our users have benefited from the outstanding facilities, and we are continually building bridges across the entire North East community to grow our provision, delivery and the opportunities for all interested in sport. -

Plymouth Raiders V DBL Sharks Sheffield

GAME PACK Plymouth Raiders v DBL Sharks Sheffield Sunday 4 February 2018 4:00 PM BBL Championship Plymouth Pavillions Head to Head Plymouth Raiders DBL Sharks Sheffield Overall: Championship 13 30 Trophy 0 4 Cup 1 1 Play Offs 1 0 Total 15 35 Home: Championship 9 18 Trophy 0 1 Cup 0 1 Play Offs 1 0 Total 10 20 Away: Championship 4 12 Trophy 0 3 Cup 1 0 Play Offs 0 0 Total 5 15 @ Neutral Venue: Championship 0 0 Trophy 0 0 Cup 0 0 Play Offs 0 0 Total 0 0 Last 10 Matches: 4 6 Biggest Win by 29 point(s) 02/10/16 @ EIS Sheffield by 43 point(s) 01/10/10 @ EIS Sheffield 95-66 BBL Championship 116-73 BBL Championship Last Win by 29 point(s) 02/10/16 @ EIS Sheffield by 5 point(s) 13/10/17 @ EIS Sheffield 95-66 BBL Championship 83-78 BBL Championship Past Meetings Plymouth Raiders v DBL Sharks Sheffield 2017/2018 29/04/2018 CH Plymouth Pavillions Plymouth Raiders - Sheffield Sharks 04/02/2018 CH Plymouth Pavillions Plymouth Raiders - Sheffield Sharks 13/10/2017 CH EIS Sheffield Sheffield Sharks 83- 78 Plymouth Raiders 2016/2017 05/03/2017 CH Plymouth Pavillions Plymouth Raiders 81- 87 Sheffield Sharks 25/11/2016 CH EIS Sheffield Sheffield Sharks 87- 78 Plymouth Raiders 02/10/2016 CH EIS Sheffield Sheffield Sharks 66- 95 Plymouth Raiders 2015/2016 17/04/2016 CH Plymouth Pavillions Plymouth Raiders 84- 76 Sheffield Sharks 04/03/2016 CH Plymouth Pavillions Plymouth Raiders 82- 77 Sheffield Sharks 31/01/2016 TRO Quarter Finals Plymouth Pavillions Plymouth Raiders 73- 99 Sheffield Sharks 29/01/2016 CH EIS Sheffield Sheffield Sharks 74- 68 Plymouth Raiders -

C:\Work\BBL\Press Packs\20180311 CH Glasgow

GAME PACK Glasgow Rocks v Cheshire Phoenix Sunday 11 March 2018 5:00 PM BBL Championship Emirates Arena Head to Head Glasgow Rocks Cheshire Phoenix Overall: Championship 28 38 Trophy 2 3 Cup 3 2 Play Offs 3 3 Total 36 46 Home: Championship 14 19 Trophy 2 2 Cup 2 0 Play Offs 1 0 Total 19 21 Away: Championship 14 19 Trophy 0 0 Cup 0 2 Play Offs 2 2 Total 16 23 @ Neutral Venue: Championship 0 0 Trophy 0 1 Cup 1 0 Play Offs 0 1 Total 1 2 Last 10 Matches: 5 5 Biggest Win by 38 point(s) 30/09/07 @ Braehead Arena by 39 point(s) 09/02/01 @ Edinburgh 102-64 BBL Championship 105-66 BBL Championship Last Win by 6 point(s) 15/10/17 @ Cheshire Oaks Arena by 4 point(s) 17/12/17 @ Cheshire Oaks Arena 86-80 BBL Championship 79-75 BBL Trophy First Round Past Meetings Glasgow Rocks v Cheshire Phoenix 2017/2018 01/04/2018 CH Cheshire Oaks Arena Cheshire Phoenix - Glasgow Rocks 11/03/2018 CH Emirates Arena Glasgow Rocks - Cheshire Phoenix 17/12/2017 TRO First Round Cheshire Oaks Arena Cheshire Phoenix 79- 75 Glasgow Rocks 15/10/2017 CH Cheshire Oaks Arena Cheshire Phoenix 80- 86 Glasgow Rocks 2016/2017 17/02/2017 CH Emirates Arena Glasgow Rocks 95- 82 Cheshire Phoenix 30/12/2016 CH Emirates Arena Glasgow Rocks 84- 85 Cheshire Phoenix OT1 27/11/2016 CH Cheshire Oaks Arena Cheshire Phoenix 67- 88 Glasgow Rocks 2015/2016 14/02/2016 CH Cheshire Oaks Arena Cheshire Phoenix 90- 81 Glasgow Rocks 29/01/2016 CH Emirates Arena Glasgow Rocks 87- 97 Cheshire Phoenix 11/10/2015 CH Cheshire Oaks Arena Cheshire Phoenix 76- 78 Glasgow Rocks 2014/2015 26/04/2015 PO Quarter -

Journal of the Royal Horticultural Society of London

I 3 2044 105 172"381 : JOURNAL OF THE llopl lortimltoal fbck EDITED BY Key. GEORGE HEXSLOW, ALA., E.L.S., F.G.S. rtanical Demonstrator, and Secretary to the Scientific Committee of the Royal Horticultural Society. VOLUME VI Gray Herbarium Harvard University LOXD N II. WEEDE & Co., PRINTERS, BEOMPTON. ' 1 8 8 0. HARVARD UNIVERSITY HERBARIUM. THE GIFT 0F f 4a Ziiau7- m 3 2044 i"05 172 38" J O U E N A L OF THE EDITED BY Eev. GEOEGE HENSLOW, M.A., F.L.S., F.G.S. Botanical Demonstrator, and Secretary to the Scientific Committee of the Royal Horticultural Society. YOLUME "VI. LONDON: H. WEEDE & Co., PRINTERS, BROMPTON, 1 8 80, OOUITOIL OF THE ROYAL HORTICULTURAL SOCIETY. 1 8 8 0. Patron. HER MAJESTY THE QUEEN. President. The Eight Honourable Lord Aberdare. Vice- Presidents. Lord Alfred S. Churchill. Arthur Grote, Esq., F.L.S. Sir Trevor Lawrence, Bt., M.P. H. J". Elwes, Esq. Treasurer. Henry "W ebb, Esq., Secretary. Eobert Hogg, Esq., LL.D., F.L.S. Members of Council. G. T. Clarke, Esq. W. Haughton, Esq. Colonel R. Tretor Clarke. Major F. Mason. The Rev. H. Harpur Crewe. Sir Henry Scudamore J. Denny, Esq., M.D. Stanhope, Bart. Sir Charles "W. Strickland, Bart. Auditors. R. A. Aspinall, Esq. John Lee, Esq. James F. West, Esq. Assistant Secretary. Samuel Jennings, Esq., F.L S. Chief Clerk J. Douglas Dick. Bankers. London and County Bank, High Street, Kensington, W. Garden Superintendent. A. F. Barron. iv ROYAL HORTICULTURAL SOCIETY. SCIENTIFIC COMMITTEE, 1880. Chairman. Sir Joseph Dalton Hooker, K.C.S.I., M.D., C.B.,F.R.S., V.P.L.S., Royal Gardens, Kew. -

Basketball England NBL Junior Structure 2017 – 2018 * = Appeal Lodged Team Requesting Premier Status Under 18 Men

Basketball England NBL Junior Structure 2017 – 2018 * = Appeal lodged team requesting Premier status Under 18 Men Premier Leagues North South Birmingham Mets Bristol Academy Flyers Charnwood College Riders Canterbury Academy Crusaders Cheshire Phoenix City of London Pride Cheshire Wire London Thunder Lewisham Derby Trailblazers London United Leeds Force London Westside Rangers Liverpool London Youngblood Lions Acers Manchester Magic Oaklands Wolves Myerscough College Spinners Reading Rockets Academy Newcastle Eagles Southwark Legends Sheffield Junior Sharks Surrey Rams I Team Birmingham Elite Team Solent Kestrels Midlands West Midlands East North East City of Birmingham Rockets Derby Trailblazers City of Edinburgh Coventry Tornadoes Derbyshire Spartans Derbyshire Arrows Frankley Falcons Ilkeston Outlaws Doncaster Danum Eagles Northants Thunder Leicester Dynamite Durham Wildcats Shropshire Warriors Leicester Riders II East Durham Lions Team Birmingham Elite II Leicester Warriors Harrogate St Aidan's Spartans West Bromwich Albion FC Mansfield Giants Kingston Panthers Worcester Wolves Nottingham Junior Hoods Leeds Tigers Rutland Thunders QE York Knights Team Sunderland York Eagles North West East South I Barrow Thorns Brentwood Fire Brent Ballers Cheshire Wire II Bucks Hornets CCF Barnet Bulldogs Lancashire Spinners Bury Cambridge Cats Haringey Hawks Manchester Giants East Hertfordshire Royals Islington Panthers Oldham Eagles Essex Junior Blades London Greenhouse Pioneers Preston Pride II Essex Rockets London Pulse Preston Pride Orange Harlow -

2021/22 Schedule

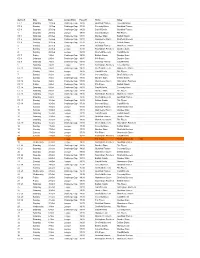

Game # Day Date Competition Faceoff Home Away CC 1 Saturday 18-Sep Challenge Cup 18:00 Guildford Flames Coventry Blaze CC 2 Sunday 19-Sep Challenge Cup 17:30 Coventry Blaze Guildford Flames CC 3 Saturday 25-Sep Challenge Cup 19:00 Cardiff Devils Guildford Flames 1 Saturday 25-Sep League 19:00 Coventry Blaze Fife Flyers CC 4 Saturday 25-Sep Challenge Cup 19:00 Dundee Stars Belfast Giants CC 5 Saturday 25-Sep Challenge Cup 19:00 Manchester Storm Sheffield Steelers CC 6 Sunday 26-Sep Challenge Cup 17:30 Fife Flyers Belfast Giants 2 Sunday 26-Sep League 18:00 Guildford Flames Manchester Storm 3 Sunday 26-Sep League 16:00 Nottingham Panthers Dundee Stars 4 Sunday 26-Sep League 16:00 Sheffield Steelers Cardiff Devils CC 7 Friday 1-Oct Challenge Cup 19:00 Belfast Giants Dundee Stars CC 8 Saturday 2-Oct Challenge Cup 19:15 Fife Flyers Dundee Stars CC 9 Saturday 2-Oct Challenge Cup 18:00 Guildford Flames Cardiff Devils 5 Saturday 2-Oct League 19:00 Nottingham Panthers Coventry Blaze CC 10 Saturday 2-Oct Challenge Cup 19:00 Sheffield Steelers Manchester Storm 6 Sunday 3-Oct League 18:00 Cardiff Devils Fife Flyers 7 Sunday 3-Oct League 17:30 Coventry Blaze Sheffield Steelers CC 11 Sunday 3-Oct Challenge Cup 17:00 Dundee Stars Belfast Giants CC 12 Sunday 3-Oct Challenge Cup 17:30 Manchester Storm Nottingham Panthers CC 13 Friday 8-Oct Challenge Cup 19:30 Fife Flyers Belfast Giants CC 14 Saturday 9-Oct Challenge Cup 19:00 Cardiff Devils Coventry Blaze CC 15 Saturday 9-Oct Challenge Cup 19:00 Dundee Stars Fife Flyers CC 16 Saturday 9-Oct Challenge Cup -

Peterborough Petes 2018-19 Regular Season Media Guide

Peterborough Petes 2018-19 Regular Season Media Guide ROSTER Name Pos/Shot Ht Wt DOB OHL Draft 2017-18 Team Austin, Tye G/L 6.04 199 28-May-02 Pbo’s 3rd Rnd., 43 / ‘18 Kanata Lasers (HEOMAAA) Butler, Cameron RW/R 6.04 197 9-Jun-02 Pbo’s 2nd Rnd., 27 / ‘18 York-Simcoe Express (ETAMmHL) Čermák, Erik LW/L 5.11 154 2-Mar-01 Pbo’s CHL 2nd Rnd., 54 / ‘18 Red Bull Salzburg (Czech U18) Chisholm, Declan LD/L 6.01 188 12-Jan-00 Pbo's 2nd Rnd., 24 / '16 Peterborough Petes Curran, Blake G/L 6.01 176 15-Apr-99 Pbo’s U18 3rd Rnd., 55 / ‘17 Lindsay Muskies (OJHL) Denault, Chad RW/R 6.01 192 17-Apr-00 Pbo's 3rd Rnd., 49 / '16 Peterborough Petes Der-Arguchintsev, Semyon C/R 5.11 161 15-Sep-00 Pbo's 2nd Rnd., 27 / '16 Peterborough Petes Fraser, Cole RD/R 6.02 201 23-Aug-99 Pbo's 3rd Rnd., 50 / '15 Peterborough Petes Gallant, Zach C/L 6.02 192 6-Mar-99 Pbo's 1st Rnd., 5 / '15 Peterborough Petes Grondin, Max C/L 6.04 200 4-Jul-00 Sag’s 2nd Rnd., 37 / ‘16 Saginaw Spirit Hanna, Quinn D/R 6.03 205 14-Apr-99 Gue’s 5th Rnd., 64 / ‘15 Sherbrooke Phoenix (QMJHL) Hinz, Brady C/R 5.08 147 3-May-00 Sar’s 3rd Rnd., 52 / ‘16 Peterborough Petes Hutton, Dustin LW/R 5.09 145 22-Sep-01 Pbo’s U18 1st Rnd., 3 / ‘18 Vaughan Kings (GTHLMHL) Jones, Hunter G/L 6.04 194 21-Sep-00 Pbo's 5th Rnd., 89 / '16 Peterborough Petes Kirk, Liam LW/L 6.01 167 3-Jan-00 Pbo’s CHL 1st Rnd., 8 / ‘18 Sheffield Steelers (EIHL) Little, Michael LW/L 6.00 187 21-Feb-00 Miss’ 3rd Rnd., 59 / ‘16 Mississauga Steelheads Merkley, Ryan D/R 5.11 163 14-Aug-00 Gue’s 1st Rnd., 1 / ‘16 Guelph Storm McNamara, Matt RD/R 6.00 181 10-May-00 Pbo's 6th Rnd., 108 / '16 Peterborough Petes Osmanski, Austin RD/L 6.04 204 30-Apr-98 Miss’ 6th Rnd., 105 / ‘14 Peterborough Petes Paquette, Chris C/R 6.02 210 27-Mar-98 Nia’s 2nd Rnd., 30 / ‘14 Peterborough Petes Parker-Jones, John D/R 6.06.5 227 7-Apr-00 Free Agent Peterborough Petes Robertson, Nick C/L 5.08 156 11-Sept-01 Pbo’s 1st Rnd., 16 / ‘17 Peterborough Petes Spearing, Shawn LD/L 6.00 183 26-Jul-02 Pbo’s 4th Rnd., 75 / ‘18 Toronto Jr. -

Basketball OFFICIAL RESULTS VERSION HISTORY

5–15 APRIL Basketball OFFICIAL RESULTS VERSION HISTORY SHARE THE DREAM Cairns Convention Centre Basketball (CCV) Townsville Entertainment and Convention Centre (TEN) Gold Coast Convention and Exhibition Centre (GCE) Apr 5 – Apr 15 Competition Format and Rules Gold Coast 2018 Commonwealth Games Competition Format The basketball program at the Gold Coast 2018 Commonwealth Games consists of men’s and women’s tournaments. The competition will include eight teams in each of the men’s and women’s events. Each team will consist of 12 athletes. The format and rules for both tournaments are the same. They will begin with the preliminary round, for which the eight teams will be divided into two pools of four teams, with the top four ranked teams in Pool A. Competing nations: Preliminary rounds at Cairns Convention Centre: Men Pool A Women Pool B Australia New Zealand Nigeria Jamaica New Zealand India Canada Malaysia Preliminary rounds at Townsville Entertainment and Convention Centre: Men Pool B Women Pool A England Australia Cameroon Canada India England Scotland Mozambique The top two teams from Pool A proceed to the semifinals, while the bottom two teams from Pool A will play the top two teams from Pool B in the qualifying finals. The winners of the qualifying finals proceed to the semifinals. The remaining teams from Pool B are eliminated. Following the preliminary round, the competition will follow a straight knockout format, with semifinals, a bronze medal game and gold medal game. Sport Rules and Procedures Game description: In accordance with FIBA regulations, basketball games for both men and women will last 40 minutes, with each game consisting of four periods of 10 minutes. -

Scottish Rugby Annual Report 2010/11 Scottish Rugby Annual Report 2010/11 Page 0 3

ANNUAL REPORT 2010 /11 PAGE 0 2 SCOTTISH RUGBY ANNUAL REPORT 2010/11 SCOTTISH RUGBY ANNUAL REPORT 2010/11 PAGE 0 3 CONTENTS President’s Message 04-05 Chairman’s Review 06-09 Finance Director’s Review 10-11 Performance 12-21 Community 22-29 Results and Awards 30-39 Working with Government 40-41 Scottish Rugby Board Report 42-43 Financial Statements 44-59 A Year of Governance 60-63 A Year in Pictures 64-65 Sponsor Acknowledgements 66 FORRESTER MINI FESTIVAL, MAY 2011 PAGE 0 4 SCOTTISH RUGBY ANNUAL REPORT 2010/11 SCOTTISH RUGBY ANNUAL REPORT 2010/11 PAGE 0 5 PRESIDENT’S MESSAGE IAN M cLAUCHLAN ONE OF THE GREAT PRIVILEGES and keep encouraging the youngsters to take up and enjoy OF THIS ROLE OF PRESIDENT IS our great game. TRAVELLING ROUND OUR RUGBY On that note, the standard of our school and youth games has also been impressive to witness, giving real grounds for CLUBS AND SEEING, AT FIRST HAND, continued optimism for the future of the game. THE GREAT WORK THAT IS GOING Turning to the bigger lads, another personal highlight from ON WITH SO MANY ENTHUSIASTIC the season was watching the sevens at Melrose in April, AND TALENTED YOUNGSTERS particularly the final game where Melrose won their own ACROSS SCOTLAND. tournament – a fantastic occasion and great weekend of rugby. Moving from sevens to fives, this month’s Islay Beach Early in May I was delighted to be invited to Dalziel Rugby Rugby event was, as ever, a grand spectacle and great fun Club's 21st Festival of Youth Rugby at Dalziel Park in for all, whether playing or watching from the sidelines in Motherwell, the home of the Dalziel Dragons youth section. -

Hamilton Bulldogs 18 9 8 1 0 19 .528 70 68 205 5-5-0-0 9 Barrie Colts 18 9 8 1 0 19 .528 72 59 287 6-4-0-0

HOME GAME 11 at the PMC 550 Lansdowne St. W 705-748-6200 @Marlin_Ptbo www.marlintravel.ca/1239 TABLE OF CONTENTS FAST FACTS 4 Petes vs. Bulldogs Entwining Athletics & Academics 5 LIAM HEELIS CONFERENCE PETERBOROUGH 7 STANDINGS 10 PETES ROSTER HAMILTON LEAGUE 11 BULLDOGS ROSTER 15 LEADERS OFFICIAL GAMEDAY PROGRAM PAGE 3 Last Game (October 6/18): Petes 2 at Bulldogs 3 This Season vs HAM: 0-2-0-0 2017-18 Regular Season vs HAM: 2-5-0-0 Last Five Years vs HAM: 14-12-1-0 Last Five Years vs HAM on home ice: 8-6-0-0 Entwining Athletics and Academics: LAST GAME TOP SCORERS PBO: 5-3 L vs KIT PBO: Chisholm - 19GP - 2G - 16A - 18P HAM: 2-1 W @ KGN HAM: Saigeon - 18GP - 11G - 19A - 30P liam heelis SPECIAL TEAMS The prospect of life beyond hockey was eased when the OHL introduced PBO: PP 11.8% (19th), PK 82.7% (7th) a financial commitment to the education of all its players. Furthermore, HAM: PP 28.2% (3rd), PK 76.6% (18th) the Petes evolved the identity of its young men from hockey players to student-athletes, when ‘64-’67 alumnus Gary Monahan was the first Pete Tonight’s game marks the third of seven games between these division rivals. In to attend a post-secondary institution - Trent University - while representing Peterborough’s first 10 games of the season, Hamilton was the only team the Petes the maroon and white. were unable to solve. Since the development of players’ roles in junior hockey, many men have Defenceman Declan Chisholm leads the Petes versus Hamilton with 2 assists 2 games so far, while Arthur Kaliyev leads the Bulldogs when facing the Petes with 2 used their resources - whether it be attending lectures or taking advantage goals and 4 assists in 2 games this season. -

Rebel Cities: from the Right to the City to the Urban Revolution

REBEL CITIES REBEL CITIES From the Right to the City to the Urban Revolution David Harvey VERSO London • New York First published by Verso 20 12 © David Harvey All rights reserved 'Ihe moral rights of the author have been asserted 13579108642 Verso UK: 6 Meard Street, London WI F OEG US: 20 Jay Street, Suite 1010, Brooklyn, NY 1120 I www.versobooks.com Verso is the imprint of New Left Books eiSBN-13: 978-1-84467-904-1 British Library Cataloguing in Publication Data A catalogue record for this book is available from the British Library Library of Congress Cataloging-in-Publication Data Harvey, David, 1935- Rebel cities : from the right to the city to the urban revolution I David Harvey. p. cm. Includes bibliographical references and index. ISBN 978-1-84467-882-2 (alk. paper) -- ISBN 978-1-84467-904-1 I. Anti-globalization movement--Case studies. 2. Social justice--Case studies. 3. Capitalism--Case studies. I. Title. HN17.5.H355 2012 303.3'72--dc23 2011047924 Typeset in Minion by MJ Gavan, Cornwall Printed in the US by Maple Vail For Delfina and all other graduating students everywhere Contents Preface: Henri Lefebvre's Vision ix Section 1: The Right to the City The Right to the City 3 2 The Urban Roots of Capitalist Crises 27 3 The Creation of the Urban Commons 67 4 The Art of Rent 89 Section II: Rebel Cities 5 Reclaiming the City for Anti-Capitalist Struggle 115 6 London 201 1: Feral Capitalism Hits the Streets 155 7 #OWS: The Party of Wall Street Meets Its Nemesis 159 Acknowledgments 165 Notes 167 Index 181 PREFACE Henri Lefebvre's Vision ometime in the mid 1970s in Paris I came across a poster put out by S the Ecologistes, a radical neighborhood action movement dedicated to creating a more ecologically sensitive mode of city living, depicting an alternative vision for the city.