States of Jersey Annual Report and Accounts 2020

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

St Peter Q3 2020.Pdf

The Jersey Boys’ lastSee Page 16 march Autumn2020 C M Y CM MY CY CMY K Featured What’s new in St Peter? Very little - things have gone Welcomereally quiet it seems, so far as my in-box is concerned anyway. Although ARTICLES the Island has moved to Level 1 of the Safe Exit Framework and many businesses are returning to some kind of normal, the same cannot be said of the various associations within the Parish, as you will see from 6 Helping Wings hope to fly again the rather short contributions from a few of the groups who were able to send me something. Hopefully this will change in the not too distant future, when social distancing returns to normal. There will be a lot of 8 Please don’t feed the Seagulls catching up to do and, I am sure, much news to share in Les Clefs. Closed shops So in this autumn edition, a pretty full 44 pages, there are some 10 offerings from the past which I hope will provide some interesting reading and visual delight. With no Battle of Flowers parades this year, 12 Cash for Trash – Money back on Bottles? there’s a look back at the 28 exhibits the Parish has entered since 1986. Former Constable Mac Pollard shares his knowledge and experiences about St Peter’s Barracks and ‘The Jersey Boys’, and we learn how the 16 The Jersey Boys last march retail sector in the Parish has changed over the years with an article by Neville Renouf on closed shops – no, not the kind reserved for union members only! We also learn a little about the ‘green menace’ in St 20 Hey Mr Bass Man Aubin’s Bay and how to refer to and pronounce it in Jersey French, and after several complaints have been received at the Parish Hall, some 22 Floating through time information on what we should be doing about seagulls. -

202-03-55145 Company Name Address 1-2-1 MENTORING 1-2-1

Freedom of Information Request Ref: 202-03-55145 Company Name Address 1-2-1 MENTORING 1-2-1 MENTORING , 14 HILL STREET , ST. HELIER , JE2 4UA ACET JERSEY 6 ACET JERSEY , PLAISANCE TERRACE , LA ROUTE DU FORT , ST. SAVIOUR , JE2 7PA ACREWOOD DAY NURSERY ACREWOOD DAY NURSERY , PETIT MENAGE , BELVEDERE HILL , ST. SAVIOUR , JE2 7RP ADVANCE PLUS SOCIAL SECURITY DEPARTMENT , PHILIP LE FEUVRE HOUSE, LA MOTTE STREET , ST. HELIER , JE4 8PE ADVANCE TO WORK SOCIAL SECURITY DEPARTMENT , PHILIP LE FEUVRE HOUSE, LA MOTTE STREET , ST. HELIER , JE4 8PE AGE CONCERN JERSEY AGE CONCERN , 37 WINDSOR HOUSE , VAL PLAISANT , ST. HELIER , JE2 4TA ALL CARE JERSEY LTD ALL CARE JERSEY LTD , 7 COMMERCIAL BUILDINGS , ST. HELIER , JE2 3NB AUTISM JERSEY TOP FLOOR , 2 BRITANNIA PLACE OFFICES , BATH STREET , ST. HELIER , JE2 4SU BAILIFF'S CHAMBERS - SOJ003 ROYAL COURT HOUSE, , ROYAL SQUARE, , ST. HELIER , JE11BA Freedom of Information Request Ref: 202-03-55145 BEAULIEU CONVENT SCHOOL BEAULIEU PRIMARY SCHOOL , WELLINGTON ROAD , ST. HELIER , JE2 4RJ BRIGHTER FUTURES BRIGHTER FUTURES , THE BRIDGE , LE GEYT ROAD , JE2 7NT BRIG-Y-DON CHILDREN'S CHARITY LARN A LOD , LA RUE DU COIN , GROUVILLE , JE3 9QR CAMBRETTE NURSING SERVICES 1ST FLOOR OFFICE , 17 QUEEN STREET , ST. HELIER , JE2 4WD CARING HANDS LTD SANCTUARY HOUSE , HIGH STREET , ST AUBIN , ST. BRELADE , JE3 8BZ CENTRE POINT TRUST CENTRE POINT TRUST , LE HUREL , LA POUQUELAYE , ST. HELIER , JE2 3FW CHARLIE FARLEY'S NURSERIES CHARLIE FARLEY'S NURSERIES , FAIRFIELDS , NORCOTT ROAD , ST. SAVIOUR , JE2 7PS CHILD CARE REGISTRATION EDUCATION, SPORT & CULTURE , PO BOX 142, HIGHLANDS COLLEGE , LA RUE DU FROID VENT , ST. -

The 22Nd Jersey Youth Assembly Convened on 19Th March 2019 at 1.30 P.M

The 22nd Jersey Youth Assembly convened on 19th March 2019 at 1.30 p.m. in the States Chamber, under the Presidency of the Bailiff, Sir William James Bailhache _________________ The following members were present: Lily Dobber Storm Rothwell Jenna Stocks Emma Pallent James Dunn Sam Wright Ross Laurent Jacob Burgin Patryk Lalka Morgan Brady Jemima Butler Eoghan Spillane Rhian Murphy Heather Orpin Aimee Hugh Rosie Nicholls Clara Garrood Max Johnson Sean Hughes Sam Gibbins Thomas Glover Jennifer Luiz Evan Campbell Stella Greene Fynn Mason Jennifer Cullen Christie Lyons Romy Smith The following members were en défaut: Philip Romeril Thomas Eva Christopher Stride Thomas Bowden Tanguy Billet Masters Scott Douglas Lysander Mawby Matthew Mourant Liam O'Connell Jack Rive Oscar Shurmer Holly Clark Alice O’Connell States Members present: Senator John Le Fondré, Chief Minister Senator Ian Gorst, Minister for External Relations Senator Tracey Vallois, Minister for Education Senator Sam Mézec, Minister for Children and Housing Deputy Kevin Lewis, Minister for Infrastructure Deputy Montfort Tadier of St. Brelade, Assistant Minister for Economics, Tourism, Sport and Culture Deputy Susie Pinel of St. Clement, Minister for Treasury and Resources Deputy Richard Renouf of St. Ouen, Minister for Health and Social Services Deputy Russell Labey of St. Helier, Chairman of the Privileges and Procedures Committee _________________ Prayers were read in French by Miss Rosie Nicholls of Jersey College for Girls _________________ COMMUNICATIONS BY THE BAILIFF The Bailiff of Jersey, Sir William James Bailhache, welcomed students to the 22nd Annual Jersey Youth Assembly. QUESTIONS Storm Rothwell of Jersey College for Girls asked a question of Senator Tracey Vallois, Minister for Education regarding the range of issues covered by the PSHE curriculum. -

States of Jersey Statistics Unit

States of Jersey Statistics Unit Jersey in Figures 2013 Table of Contents Table of Contents……………………………………………. i Foreword……………………………………………………… ii An Introduction to Jersey………………...…………………. iii Key Indicators……………………………………...………… v Chapter 1 Size and Land Cover of Jersey ………….………………… 1 2 National Accounts…………………...…………….………... 2 3 Financial Services…………………………………….……... 9 4 Tourism……………………………………………………….. 13 5 Agriculture and Fisheries………………………….………... 16 6 Employment………..………………………………………… 19 7 Prices and Earnings………………………………….……... 25 8 States of Jersey Income and Expenditure..………………. 30 9 Tax Receipts…………………………………………….…… 34 10 Impôts………………………………………………………… 38 11 Population…………………………………………….……… 40 12 Households…………………………………………….…….. 45 13 Housing…………………………………………………….…. 47 14 Education…………………………………………………….. 51 15 Culture and Heritage….……………………………….……. 53 16 Health…………………………………………………….…… 56 17 Crime…………………………………………………….……. 59 18 Jersey Fire Service………………………………………….. 62 19 Jersey Ambulance Service…………………………………. 64 20 Jersey Coastguard…………………………………………... 66 21 Social Security………………………………………….……. 68 22 Overseas Aid……………………………………...…….…… 70 23 Sea and Air Transport…………………………………....…. 71 24 Vehicle Transport……………………………………………. 74 25 Energy and Environment..………………………………...... 78 26 Water…………………………………………………………. 82 27 Waste Management……………………………………….... 86 28 Climate……………………………………………………….. 92 29 Better Life Index…………………………………………….. 94 Key Contacts………………………………………………… 96 Other Useful Websites……………………………………… 98 Reports Published by States of Jersey Statistics -

The Island Identity Policy Development Board Jersey's

The Island Identity Policy Development Board Jersey’s National and International Identity Interim Findings Report 1 Foreword Avant-propos What makes Jersey special and why does that matter? Those simple questions, each leading on to a vast web of intriguing, inspiring and challenging answers, underpin the creation of this report on Jersey’s identity and how it should be understood in today’s world, both in the Island and internationally. The Island Identity Policy Development Board is proposing for consideration a comprehensive programme of ways in which the Island’s distinctive qualities can be recognised afresh, protected and celebrated. It is the board’s belief that success in this aim must start with a much wider, more confident understanding that Jersey’s unique mixture of cultural and constitutional characteristics qualifies it as an Island nation in its own right. An enhanced sense of national identity will have many social and cultural benefits and reinforce Jersey’s remarkable community spirit, while a simultaneously enhanced international identity will protect its economic interests and lead to new opportunities. What does it mean to be Jersey in the 21st century? The complexity involved in providing any kind of answer to this question tells of an Island full of intricacy, nuance and multiplicity. Jersey is bursting with stories to tell. But none of these stories alone can tell us what it means to be Jersey. In light of all this complexity why take the time, at this moment, to investigate the different threads of what it means to be Jersey? I would, at the highest level, like to offer four main reasons: First, there is a profound and almost universally shared sense that what we have in Jersey is special. -

Town Crier the Official Parish of St Helier Magazine

TheSt Helier TOWN CRIER THE OFFICIAL PARISH OF ST HELIER MAGAZINE picture: Gosia Hyjek Parish Matters • The Dean in Germany • Constable’s Comment • Town Matters Parish Notice Board • Dates for your diary • St Helier Gazette Delivered by Jersey Post to 19,000 homes and businesses every month. Designed and printed in Jersey by MailMate Publishing working in partnership with the Parish of St Helier. FREEFREE Samsung FRREEE PLUSPLLUUSU FREENG AMSSU £20 SAMSUNGSAM HUUB IDEODEO HHUB VI HHEERERR!! VOUCHER!VOUC GalaxyGalaxy S4 on Smart Ultimate just £46p/m TermsTTeerms andand conditionsconditions apply for full terms visit www.sure.comwww.sure.com Welcome to the August edition of the Town Crier, arranged by the Parish, while the month in a month when lots of parishioners will be able closed with the Minden Day parade, a to enjoy some holiday, and hopefully some more commemoration of an earlier conflict in which of the fine weather that we saw in July. Last we fought on the same side as Germany (or month the new Street Party provided a Prussia) against the French. The main event in spectacular end to the Fête de St Hélier, and August is, of course, the Battle of Flowers, with Deputy Rod Bryans’ photo of the fire eater in the Portuguese Food Fair also taking place later action outside the Town Hall conveys the in the month, so it promises to be a busy time excitement of the event. The festival began with for the Parish. These events would not be able the annual pilgrimage to the Hermitage, and to take place without the support of our included the Flower Festival in the Town Church Honorary Police, who also play a vital part in featured on our front cover, and the annual Rates keeping the Parish safe: any parishioners aged Assembly when ratepayers agreed the budget for between 20 and 69 who are interested in getting the new financial year. -

Ports of Jersey – Assessment of Market Power ______Final Notice

Ports of Jersey – Assessment of Market Power ____________________________ Final Notice Jersey Competition Regulatory Authority Document No: CICRA 16/41 October 2016 Jersey Competition Regulatory Authority 2nd Floor Salisbury House, 1-9 Union Street, St Helier, Jersey, JE2 3RF Tel: +44 (0)1534 514990 Web: www.cicra.je Page 1 ©CICRA October 2016 Contents 1. Executive Summary ......................................................................................................................... 3 2. Introduction .................................................................................................................................... 4 3. Legal framework and issues ............................................................................................................ 6 4. General approach to market definition .......................................................................................... 8 5. Approach to Dominance/Significant Market Power ..................................................................... 11 6. Market definition and market power in the provision of airport operation services (excluding private users) ................................................................................................................................ 12 7. Market definition and market power in the provision of airport operation services to private users .............................................................................................................................................. 22 8. Market definition -

All Publicly Owned Sites Sorted by Parish Name

All Publicly Owned Sites Sorted by Parish Name Sorted by Proposed for Then Sorted by Site Name Site Use Class Tenure Address Line 2 Address Line 3 Vingtaine Name Address Parish Postcode Controlling Department Parish Disposal Grouville 2 La Croix Crescent Residential Freehold La Rue a Don Vingtaine des Marais Grouville JE3 9DA COMMUNITY & CONSTITUTIONAL AFFAIRS Grouville B22 Gorey Village Highway Freehold Vingtaine des Marais Grouville JE3 9EB INFRASTRUCTURE Grouville B37 La Hougue Bie - La Rocque Highway Freehold Vingtaine de la Rue Grouville JE3 9UR INFRASTRUCTURE Grouville B70 Rue a Don - Mont Gabard Highway Freehold Vingtaine des Marais Grouville JE3 6ET INFRASTRUCTURE Grouville B71 Rue des Pres Highway Freehold La Croix - Rue de la Ville es Renauds Vingtaine des Marais Grouville JE3 9DJ INFRASTRUCTURE Grouville C109 Rue de la Parade Highway Freehold La Croix Catelain - Princes Tower Road Vingtaine de Longueville Grouville JE3 9UP INFRASTRUCTURE Grouville C111 Rue du Puits Mahaut Highway Freehold Grande Route des Sablons - Rue du Pont Vingtaine de la Rocque Grouville JE3 9BU INFRASTRUCTURE Grouville Field G724 Le Pre de la Reine Agricultural Freehold La Route de Longueville Vingtaine de Longueville Grouville JE2 7SA ENVIRONMENT Grouville Fields G34 and G37 Queen`s Valley Agricultural Freehold La Route de la Hougue Bie Queen`s Valley Vingtaine des Marais Grouville JE3 9EW HEALTH & SOCIAL SERVICES Grouville Fort William Beach Kiosk Sites 1 & 2 Land Freehold La Rue a Don Vingtaine des Marais Grouville JE3 9DY JERSEY PROPERTY HOLDINGS -

Enforcement-Of-Credi

REGISTRATION FORM Please note that this form is for registration only and does not include accommodation. Title: First Name: Surname: University/Company/Firm: Address: Tel: Email: REGISTRATION FEES: Delegate - registration before 14 September 2014 £245.00 Delegate - registration after 14 September 2014 £295.00 Academic/student rate £195.00 METHOD OF PAYMENT: I enclose a cheque payable to “Institute of Law” in GBP I am arranging for a bank transfer in GBP to Account Name: Institute of Law; Bank: HSBC; Branch: St Helier; Sort Code: 40-25-34; Account Number: 12245620. Please use delegate name as reference. PLEASE RETURN THIS FORM TO: Lori-Ann Foley, Manager Institute of Law, Law House, 1 Seale Street, St Helier, Jersey, Channel Islands, JE2 3QG Tel: + 44 (0)1534 826060 Email: [email protected] Website: www.lawinstitute.ac.je INFORMATION The Enforcement of Creditors’ Rights HOW TO GET TO JERSEY HOTEL INFORMATION in the Channel Islands: Jersey has daily air links with many United Kingdom The Institute of Law has negotiated a corporate rate airports. London Gatwick, London City and Stanstead (per night) at the following hotels: have direct links to Jersey with BA (www.ba.com) and Flybe (www.flybe.com). Regular scheduled flights also The Pomme d'Or Hotel (4 star hotel in the centre of Issues in Asset Security and Insolvency depart from several UK regional airports such as St Helier) (www.seymourhotels.com/PommedOrHotel) Edinburgh, Manchester, Birmingham, Bristol, Southampton £88.00 per night for a standard room including breakfast. and Exeter. Blue Islands (www.blueislands.com) operate direct flights to Paris, Amsterdam, Geneva and Zurich. -

R.76/2021 the Island Identity Policy Development Board Jersey’S National and International Identity

R.76/2021 The Island Identity Policy Development Board Jersey’s National and International Identity Interim Findings Report 1 Foreword Avant-propos What makes Jersey special and why does that matter? Those simple questions, each leading on to a vast web of intriguing, inspiring and challenging answers, underpin the creation of this report on Jersey’s identity and how it should be understood in today’s world, both in the Island and internationally. The Island Identity Policy Development Board is proposing for consideration a comprehensive programme of ways in which the Island’s distinctive qualities can be recognised afresh, protected and celebrated. It is the board’s belief that success in this aim must start with a much wider, more confident understanding that Jersey’s unique mixture of cultural and constitutional characteristics qualifies it as an Island nation in its own right. An enhanced sense of national identity will have many social and cultural benefits and reinforce Jersey’s remarkable community spirit, while a simultaneously enhanced international identity will protect its economic interests and lead to new opportunities. What does it mean to be Jersey in the 21st century? The complexity involved in providing any kind of answer to this question tells of an Island full of intricacy, nuance and multiplicity. Jersey is bursting with stories to tell. But none of these stories alone can tell us what it means to be Jersey. In light of all this complexity why take the time, at this moment, to investigate the different threads of what it means to be Jersey? I would, at the highest level, like to offer four main reasons: First, there is a profound and almost universally shared sense that what we have in Jersey is special. -

Strategic Flood Risk Assessment

Jersey Strategic Flood Risk Assessment Government of Jersey Project number: 60627145 April 2021 Jersey Strategic Flood Risk Assessment AECOM Project Number: 60627145 Quality information Prepared by Checked by Verified by Approved by Hannah Booth Sarah Littlewood Emily Craven Bernadine Maguire Graduate Water Principal Flood Risk Associate Principal Flood Risk & Consultant Consultant Coastal Consultant Bernadine Maguire Principal Flood Risk & Coastal Consultant Revision History Revision Revision date Details Authorized Name Position 1 April 2020 Draft for comment BM Bernadine Maguire Principal 2 December 2020 Final draft BM Bernadine Maguire Principal 3 January 2021 Final BM Bernadine Maguire Principal 4 March 2021 Final BM Bernadine Maguire Principal 5 April 2021 Final BM Bernadine Maguire Principal Prepared for: Government of Jersey Prepared by: AECOM Infrastructure & Environment UK Limited Midpoint, Alencon Link Basingstoke Hampshire RG21 7PP United Kingdom T: +44(0)1256 310200 aecom.com © 2021 AECOM Infrastructure & Environment UK Limited. All Rights Reserved. This document has been prepared by AECOM Infrastructure & Environment UK Limited (“AECOM”) for sole use of our client (the “Client”) in accordance with generally accepted consultancy principles, the budget for fees and the terms of reference agreed between AECOM and the Client. Any information provided by third parties and referred to herein has not been checked or verified by AECOM, unless otherwise expressly stated in the document. No third party may rely upon this document -

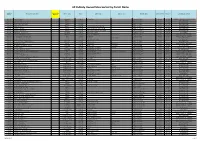

Strategic Plan: Progress Against Initiatives As at 30Th June 2007

STATES OF JERSEY r STRATEGIC PLAN: PROGRESS AGAINST INITIATIVES AS AT 30TH JUNE 2007 Presented to the States on 13th September 2007 by the Chief Minister STATES GREFFE STRATEGIC PLAN – PROGRESS AGAINST INITIATIVES AS AT 30TH JUNE 2007 I am pleased to present to the States the third 6-monthly update which records progress against the initiatives set out in the Strategic Plan initiatives as at June 2007. Progress has been steady, with the majority of initiatives on track. Inevitably with such a large number of initiatives being implemented over a long period, and with challenging targets for delivery from the outset, progress may vary and it is to be expected that some projects will slip against deadlines for a variety of reasons. Analysis of the status of each initiative shows that of the 249 entries for June – · 207 (83%) were on track · 32 (13%) were slightly behind schedule · 10 (4%) were seriously off track As with previous updates, the report is ordered by Minister. Any questions that Members may have on individual initiatives should therefore be directed to the appropriate Minister. Senator Frank Walker CHIEF MINISTER STRATEGIC PLAN INITIATIVES - PROGRESS REPORT as at 30th June 2007 KEY: Green On track - no change from last reporting period On track - progress/improvement on last reporting period On track - but some slippage since last reporting period Amber Slightly behind schedule/off track - not critical - no change from last reporting period Slightly behind schedule/off track - not critical - progress/improvement on last