Pdf 209.31 B

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

We Want to Help the World Reach Net Zero and Improve People's Lives

BP Sustainability Report 2019 Our purpose is reimagining energy for people and our planet. We want to help the world reach net zero and improve people’s lives. We will aim to dramatically reduce carbon in our operations and production and grow new low carbon businesses, products and services. We will advocate for fundamental and rapid progress towards Paris and strive to be a leader in transparency. We know we don’t have all the answers and will listen to and work with others. We want to be an energy company with purpose; one that is trusted by society, valued by shareholders and motivating for everyone who works at BP. We believe we have the experience and expertise, the relationships and the reach, the skill and the will, to do this. Introduction Message from Bernard Looney 2 Our ambition 4 2019 at a glance Energy in context 8 Sustainability at BP UN Sustainable Development Goals 11 Sustainability at BP 11 Key sustainability issues 14 Our focus areas Climate change and the energy transition 16 Our role in the energy transition 18 Our ‘reduce, improve, create’ framework 20 Accrediting our lower carbon activities 22 Reducing emissions in our operations 23 Improving our products 26 Creating low carbon businesses 30 Safety 36 Process safety 38 Personal safety 39 Safety performance 41 Our value to society 42 Creating social value 44 Social investment 45 Local workers and suppliers 46 Human rights 47 Community engagement 48 Our impact on communities 49 Labour rights 50 Doing business responsibly Environment 54 People 60 Business ethics 68 Navigating our reports Governance Our quick read Human rights governance 74 provides a summary of the Executive oversight of sustainability 74 Sustainability Report, including key Managing risks 75 highlights and performance in 2019. -

FTSE Factsheet

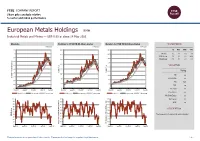

FTSE COMPANY REPORT Share price analysis relative to sector and index performance European Metals Holdings EMH Industrial Metals and Mining — GBP 0.69 at close 14 May 2021 Absolute Relative to FTSE UK All-Share Sector Relative to FTSE UK All-Share Index PERFORMANCE 14-May-2021 14-May-2021 14-May-2021 1.1 450 900 1D WTD MTD YTD 1 Absolute 0.0 -6.8 -4.2 7.8 400 800 Rel.Sector 1.2 -2.9 -7.5 -20.3 0.9 700 Rel.Market -1.1 -5.5 -4.8 -1.3 350 0.8 600 300 0.7 VALUATION 500 0.6 250 400 Trailing Relative Price Relative 0.5 Price Relative 200 300 PE -ve 0.4 Absolute Price (local currency) (local Price Absolute 150 EV/EBITDA -ve 200 0.3 PB 12.3 100 0.2 100 PCF -ve 0.1 50 0 Div Yield 0.0 May-2020 Aug-2020 Nov-2020 Feb-2021 May-2021 May-2020 Aug-2020 Nov-2020 Feb-2021 May-2021 May-2020 Aug-2020 Nov-2020 Feb-2021 May-2021 Price/Sales +ve Absolute Price 4-wk mov.avg. 13-wk mov.avg. Relative Price 4-wk mov.avg. 13-wk mov.avg. Relative Price 4-wk mov.avg. 13-wk mov.avg. Net Debt/Equity 0.0 100 90 90 Div Payout 0.0 90 80 80 ROE -ve 80 70 70 70 Index) Share Share Sector) Share - - 60 60 60 DESCRIPTION 50 50 50 40 40 40 The Company is focusing in tin mining industry. -

Annex 1: Parker Review Survey Results As at 2 November 2020

Annex 1: Parker Review survey results as at 2 November 2020 The data included in this table is a representation of the survey results as at 2 November 2020, which were self-declared by the FTSE 100 companies. As at March 2021, a further seven FTSE 100 companies have appointed directors from a minority ethnic group, effective in the early months of this year. These companies have been identified through an * in the table below. 3 3 4 4 2 2 Company Company 1 1 (source: BoardEx) Met Not Met Did Not Submit Data Respond Not Did Met Not Met Did Not Submit Data Respond Not Did 1 Admiral Group PLC a 27 Hargreaves Lansdown PLC a 2 Anglo American PLC a 28 Hikma Pharmaceuticals PLC a 3 Antofagasta PLC a 29 HSBC Holdings PLC a InterContinental Hotels 30 a 4 AstraZeneca PLC a Group PLC 5 Avast PLC a 31 Intermediate Capital Group PLC a 6 Aveva PLC a 32 Intertek Group PLC a 7 B&M European Value Retail S.A. a 33 J Sainsbury PLC a 8 Barclays PLC a 34 Johnson Matthey PLC a 9 Barratt Developments PLC a 35 Kingfisher PLC a 10 Berkeley Group Holdings PLC a 36 Legal & General Group PLC a 11 BHP Group PLC a 37 Lloyds Banking Group PLC a 12 BP PLC a 38 Melrose Industries PLC a 13 British American Tobacco PLC a 39 Mondi PLC a 14 British Land Company PLC a 40 National Grid PLC a 15 BT Group PLC a 41 NatWest Group PLC a 16 Bunzl PLC a 42 Ocado Group PLC a 17 Burberry Group PLC a 43 Pearson PLC a 18 Coca-Cola HBC AG a 44 Pennon Group PLC a 19 Compass Group PLC a 45 Phoenix Group Holdings PLC a 20 Diageo PLC a 46 Polymetal International PLC a 21 Experian PLC a 47 -

Ftse4good UK 50

2 FTSE Russell Publications 19 August 2021 FTSE4Good UK 50 Indicative Index Weight Data as at Closing on 30 June 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) 3i Group 0.81 UNITED GlaxoSmithKline 5.08 UNITED Rentokil Initial 0.67 UNITED KINGDOM KINGDOM KINGDOM Anglo American 2.56 UNITED Halma 0.74 UNITED Rio Tinto 4.68 UNITED KINGDOM KINGDOM KINGDOM Antofagasta 0.36 UNITED HSBC Hldgs 6.17 UNITED Royal Dutch Shell A 4.3 UNITED KINGDOM KINGDOM KINGDOM Associated British Foods 0.56 UNITED InterContinental Hotels Group 0.64 UNITED Royal Dutch Shell B 3.75 UNITED KINGDOM KINGDOM KINGDOM AstraZeneca 8.25 UNITED International Consolidated Airlines 0.47 UNITED Schroders 0.28 UNITED KINGDOM Group KINGDOM KINGDOM Aviva 1.15 UNITED Intertek Group 0.65 UNITED Segro 0.95 UNITED KINGDOM KINGDOM KINGDOM Barclays 2.1 UNITED Legal & General Group 1.1 UNITED Smith & Nephew 0.99 UNITED KINGDOM KINGDOM KINGDOM BHP Group Plc 3.2 UNITED Lloyds Banking Group 2.39 UNITED Smurfit Kappa Group 0.74 UNITED KINGDOM KINGDOM KINGDOM BT Group 1.23 UNITED London Stock Exchange Group 2.09 UNITED Spirax-Sarco Engineering 0.72 UNITED KINGDOM KINGDOM KINGDOM Burberry Group 0.6 UNITED Mondi 0.67 UNITED SSE 1.13 UNITED KINGDOM KINGDOM KINGDOM Coca-Cola HBC AG 0.37 UNITED National Grid 2.37 UNITED Standard Chartered 0.85 UNITED KINGDOM KINGDOM KINGDOM Compass Group 1.96 UNITED Natwest Group 0.77 UNITED Tesco 1.23 UNITED KINGDOM KINGDOM KINGDOM CRH 2.08 UNITED Next 0.72 UNITED Unilever 7.99 UNITED KINGDOM KINGDOM -

Participating Organizations

PARTICIPATING ORGANIZATIONS Company Name Company Name Company Name Company Name Company Name ABB City and County of Denver Hewlett Packard Enterprise Nextworld Shell ABS Cobham Semiconductor Solutions Hitachi Consulting NLMK Shimmick Construction Advanced Micro Devices Coeur Mining Holland & Hart LLP Noble Energy Sierra Nevada Corporation AECOM CollegeDrive Test Prep and Tutoring HollyFrontier Northrop Grumman Corporation SM Energy Aera Energy LLC Collimare LLC HomeAdvisor Northwestern Mutual Solar Turbines, Inc Colorado Department of Transporta- Alarm.com Hunting Titan Nucor Steel Southwestern Energy tion Alight, Inc. Colorado Law Illinois Institute of Technology Oasis Petroleum Spectranetics Allegion Colorado Lighting, Inc IM Flash Occidental Petroleum Corporation Stanley Consultants, Inc. AMERICAN Cast Iron Pipe Company CO School of Mines Graduate Studies IMERYS Olin Corporation Statoil Ames Construction Computronix, Inc. IMI Precision Engineering Olsson Associates Stillwater Mining Company Anadarko Petroleum Corporation Condon - Johnson & Associates, Inc. Intelligent Software Solutions OppenheimerFunds Summit Materials Andeavor Connexta J.R. Butler, Inc. ORAU - Maryland Office SUNDT Apache Corp. ConocoPhillips Jacobs Orbital ATK TEAM-UP: Teacher Education Alliance Apex Engineers, Inc. Covenant Testing Technologies, LLC. Johns Manville Orica Tenaris Applied Control Equipment, LLLP Credera Jviation, Inc. OSIsoft Texas Instruments Arcadis, Inc. CTL Thompson, Inc. Kahuna Ventures LLC Parsons The RMH Group Inc. ArcelorMittal Daily Thermetrics Kansas Department of Transportation Pathfinder Systems Inc The Trade Desk Arch Coal, Inc. Dal-Tile Corp. Keane Group PDC Energy The Vertex Companies, Inc. ARCO/Murray National Construction Davidson Technologies Inc. Kenzan Peabody Energy Tierra Group International, Ltd. Arista Networks DENSO International America, Inc. Kiewit Peace Corps TimkenSteel Corporation APS- Palo Verde Generating Station DPS - Denver Teacher Residency Kimley-Horn Pearl Harbor Naval Shipyard Traylor Bros., Inc. -

Constituents & Weights

2 FTSE Russell Publications 19 August 2021 FTSE 100 Indicative Index Weight Data as at Closing on 30 June 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) 3i Group 0.59 UNITED GlaxoSmithKline 3.7 UNITED RELX 1.88 UNITED KINGDOM KINGDOM KINGDOM Admiral Group 0.35 UNITED Glencore 1.97 UNITED Rentokil Initial 0.49 UNITED KINGDOM KINGDOM KINGDOM Anglo American 1.86 UNITED Halma 0.54 UNITED Rightmove 0.29 UNITED KINGDOM KINGDOM KINGDOM Antofagasta 0.26 UNITED Hargreaves Lansdown 0.32 UNITED Rio Tinto 3.41 UNITED KINGDOM KINGDOM KINGDOM Ashtead Group 1.26 UNITED Hikma Pharmaceuticals 0.22 UNITED Rolls-Royce Holdings 0.39 UNITED KINGDOM KINGDOM KINGDOM Associated British Foods 0.41 UNITED HSBC Hldgs 4.5 UNITED Royal Dutch Shell A 3.13 UNITED KINGDOM KINGDOM KINGDOM AstraZeneca 6.02 UNITED Imperial Brands 0.77 UNITED Royal Dutch Shell B 2.74 UNITED KINGDOM KINGDOM KINGDOM Auto Trader Group 0.32 UNITED Informa 0.4 UNITED Royal Mail 0.28 UNITED KINGDOM KINGDOM KINGDOM Avast 0.14 UNITED InterContinental Hotels Group 0.46 UNITED Sage Group 0.39 UNITED KINGDOM KINGDOM KINGDOM Aveva Group 0.23 UNITED Intermediate Capital Group 0.31 UNITED Sainsbury (J) 0.24 UNITED KINGDOM KINGDOM KINGDOM Aviva 0.84 UNITED International Consolidated Airlines 0.34 UNITED Schroders 0.21 UNITED KINGDOM Group KINGDOM KINGDOM B&M European Value Retail 0.27 UNITED Intertek Group 0.47 UNITED Scottish Mortgage Inv Tst 1 UNITED KINGDOM KINGDOM KINGDOM BAE Systems 0.89 UNITED ITV 0.25 UNITED Segro 0.69 UNITED KINGDOM -

EVRAZ FY2020 Financial Results 2 Core Operations and Distribution Markets

FINANCIAL RESULTS FY 2020 25 February 2021 Disclaimer . This document does not constitute or form part of and should not be construed as, an offer to sell or issue or the solicitation of an offer to buy or acquire securities of EVRAZ plc (“EVRAZ”) or any of its subsidiaries in any jurisdiction (including, without limitation, EVRAZ Group S.A.) (collectively, the “Group”) or an inducement to enter into investment activity. No part of this document, nor the fact of its distribution, should form the basis of, or be relied on in connection with, any contract or commitment or investment decision whatsoever. No representation, warranty or undertaking, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, completeness or correctness of the information or the opinions contained herein. None of EVRAZ, the Group or any of its affiliates, advisors or representatives shall have any liability whatsoever (in negligence or otherwise) for any loss howsoever arising from any use of this document or its contents or otherwise arising in connection with the document. This document contains “forward-looking statements”, which include all statements other than statements of historical facts, including, without limitation, any statements preceded by, followed by or that include the words “targets”, “believes”, “expects”, “aims”, “intends”, “will”, “may”, “anticipates”, “would”, “could” or similar expressions or the negative thereof. Such forward-looking statements involve known and unknown risks, uncertainties and other -

A Social Divide in the City Mining for Impact

Strategic Communications A SOCIAL DIVIDE IN THE CITY MINING FOR IMPACT ANNUAL FTSE 100 SOCIAL MEDIA PERFORMANCE INDEX SEVENTH EDITION All FTSE 100 companies 637 Posts analysed 2.04m Engagements reviewed across 4 platforms recorded Executive Summary RESEARCH OVERVIEW In order to evaluate the performance of FTSE 100 companies, FTI analysed the social media activity of each FTSE 100 constituent on the four social media platforms most relevant, in our view, to corporate and financial communications – Twitter, LinkedIn, The seventh edition of FTI’s Social Divide in the City report reveals new insights relating to the social media performance of YouTube and Instagram – at the time of its latest full-year and half-year results announcement. The identified results-related the UK’s FTSE 100 companies, with paid-for activity on the rise, and the mining sector in particular coming to prominence activity was measured using three metrics: volume, quality and impact. Scores were given for each component, which in turn with impactful content and a focus on engagement. generated an aggregate score. More information on the methodology can be found on page 18. We were pleased to have been joined this year in assessing 2018’s full- and half-year results reporting by Dr Pawel Bilinski of the Centre for Financial Analysis and Reporting at London’s Cass Business School. Reviewing our performance data for each constituent of the FTSE 100 alongside the share price INDEX RANKING METHODOLOGY performance and analyst ratings pre- and post-results for the last five years, Dr Bilinski argues that social media communications around results can lead to a stronger price reaction, particularly for firms with high retail ownership, while Twitter plays a role in investors reacting more strongly to news content. -

Press-Release Q4 2020 (PDF, 542.37

EVRAZ Q4 2020 TRADING UPDATE 29 January 2021 — EVRAZ plc (LSE: EVR; “EVRAZ” or the “Group”) today released its trading update for the fourth quarter and full year 2020. Q4 2020 vs Q3 2020 HIGHLIGHTS In Q4 2020, EVRAZ’ consolidated crude steel output rose by 7.4% QoQ, mainly due to higher production volumes at EVRAZ NTMK following the completion of scheduled capital repairs during Q3 2020, as well as improved production volumes at EVRAZ North America, which grew by 26.6% QoQ. Total sales of steel products increased by 12.0% QoQ, driven primarily by sales of semi-finished products, which grew by 30.4%. This, in turn, was mainly the result of a recovery in export markets and weaker demand for finished construction products in Russia due to seasonal factors. Total raw coking coal production rose by 26.1% QoQ, driven by the relaunch of production at the Razrez Raspadsky open pit as well as better production volumes at the Raspadskaya mine. Coking coal concentrate production grew by 5.6% QoQ, mainly due to increased coal mining volumes. External sales volumes of coking coal products fell by 19.2% QoQ, due to a deficit of GZh grade coal amid longwall move at the Uskovskaya mine as well as elevated levels of Q2-Q3 2020 sales amid utilisation of stockpiles. External sales of iron ore products decreased by 8.4% QoQ, amid higher consumption of pellets by EVRAZ NTMK following the successful launch of blast furnace no. 6 in Q3 2020. Sales of vanadium products rose by 51.4% QoQ, mainly due to higher steel utilisation rates, following increased FeV demand also from the automotive industry as well as some increase of oxide and FeV sales to China during Q4 2020. -

FTSE Factsheet

FTSE COMPANY REPORT Share price analysis relative to sector and index performance Arkle Resources ARK Industrial Metals and Mining — GBP 0.00875 at close 14 May 2021 Absolute Relative to FTSE UK All-Share Sector Relative to FTSE UK All-Share Index PERFORMANCE 14-May-2021 14-May-2021 14-May-2021 0.025 200 300 1D WTD MTD YTD Absolute 0.0 9.4 2.9 -25.5 180 Rel.Sector 1.2 13.9 -0.7 -45.0 0.02 250 Rel.Market -1.1 10.9 2.2 -31.8 160 140 0.015 200 VALUATION 120 Trailing Relative Price Relative 0.01 Price Relative 150 100 PE -ve Absolute Price (local (local currency) AbsolutePrice 80 EV/EBITDA -ve 0.005 100 PB 0.9 60 PCF -ve 0 40 50 Div Yield 0.0 May-2020 Aug-2020 Nov-2020 Feb-2021 May-2021 May-2020 Aug-2020 Nov-2020 Feb-2021 May-2021 May-2020 Aug-2020 Nov-2020 Feb-2021 May-2021 Price/Sales - Absolute Price Relative Price 4-wk mov.avg. 13-wk mov.avg. Relative Price 4-wk mov.avg. 13-wk mov.avg. Net Debt/Equity 0.0 100 90 100 Div Payout 0.0 90 80 90 ROE -ve 80 70 80 70 Index) Share 70 Share Sector) Share - - 60 60 60 DESCRIPTION 50 50 50 40 The main activity of the Company is exploration for 40 40 RSI RSI (Absolute) and development of mineral resources in Ireland. 30 30 30 20 20 20 10 10 10 RSI (Relative to FTSE UKFTSE All to RSI (Relative RSI (Relative to FTSE UKFTSE All to RSI (Relative 0 0 0 May-2020 Aug-2020 Nov-2020 Feb-2021 May-2021 May-2020 Aug-2020 Nov-2020 Feb-2021 May-2021 May-2020 Aug-2020 Nov-2020 Feb-2021 May-2021 Past performance is no guarantee of future results. -

FTSE 100 & the UK Modern Slavery

FTSE 100 & the UK Modern Slavery Act: From Disclosure to Action 02 FTSE 100 & the UK Modern Slavery Act: Table of Contents 03 Executive summary ▌ Key findings ▌ Key recommendations 06 FTSE 100 Ranking 09 Introduction ▌ Policy developments 11 UK Modern Slavery Act 12 Methodology ▌ Review and revision ▌ Assessment ▌ Minimum requirements 14 Structure, Business & Supply Chains 15 Policies in Relation to Slavery & Trafficking 16 Due Diligence Process 18 Risk Assessment & Management 20 Effectiveness 21 Training 22 Wider trends ▌ Compliance with Section 54 of the MSA ▌ Gaps in reporting ▌ Business model 24 From mandatory transparency to mandatory due diligence 25 Conclusion 26 Recommendations ▌ UK Government ▌ Companies ▌ Investors From Disclosure to Action 03 Executive summary Modern slavery and human trafficking are now the second largest criminal industry in the world. The Global Slavery Index estimates there are 16 million victims of forced labour in the private sector. It is an uncomfortable truth that many of the goods and services sold by companies every day are produced by workers who suffer the most severe exploitation. In 2015, the UK Government introduced the Modern Slavery Act (MSA), which requires certain companies publish an annual statement detailing what steps they have taken to tackle modern slavery, both in their operations and in their supply chains. Business & Human Rights Resource Centre has tracked companies’ reporting every year since, and our findings show that the MSA has failed to deliver the transformational change many hoped for. Three years on, most companies still publish generic statements committing to fight modern slavery, without explaining how. Sadly, only a handful of leading companies have demonstrated a genuine effort in their reporting to identify and mitigate risks. -

Goldman Sachs Activebeta Europe Equity Index

Goldman Sachs ActiveBeta Europe Equity Index Hypothetical Weights Generated for 10/1/2021 28Sep21 The below Hypothetical Weights are shown for information purposes only and do not reflect the constituents of the Goldman Sachs ActiveBeta Europe Equity Index. The Hypothetical Weights are a hypothetical indication of what the weightings and constituents of the Goldman Sachs ActiveBeta Europe Equity Index would be if the Goldman Sachs ActiveBeta Europe Equity Index were rebalanced daily using current market data. These hypothetical weights do not reflect actual current or future changes to the Goldman Sachs ActiveBeta Europe Equity Index and the constituents at the next actual rebalance (typically quarterly) may differ substantially. Neither Goldman Sachs Asset Management, L.P. ("GSAM") nor any of its affiliates guarantees the quality, accuracy and/or the completeness of this information nor any data included therein or on which this information is based, and neither GSAM nor any of its affiliates shall be liable to any third party for any loss or damage, direct, indirect or consequential, arising from (i) any inaccuracy or incompleteness in, or delays, interruptions, errors or omissions in this information or any data included therein or on which any of this information is based or (ii) any decision made or action taken by any third party in reliance upon this information or any data. Goldman Sachs ActiveBeta Europe Equity Index Hypothetical Weights for 10/1/2021 Name Weight 3I GROUP 0.001098 ABB LTD 0.003357 ABRDN 0.001244 ACS ACTIV CONST