Derbyshire Pension Fund 2016 Valuation Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Minutes of the Meeting of Shardlow & Great Wilne Parish Council Held on Wednesday 28 August 2019 at 7.30Pm at the Village Hall, Shardlow

Minutes of the meeting of Shardlow & Great Wilne Parish Council held on Wednesday 28 August 2019 at 7.30pm at The Village Hall, Shardlow PRESENT: Cllr M Clifton (Chairman), Cllr A Perks (Vice Chairman), Cllr C Leggett, Cllr N Hawksworth, Cllr N Stenner, Cllr P Lees, District Cllr P Watson, Clerk/RFO Fiona Stanbrook (Minutes). There was 1 member of public present. Reference Agenda Item Action 94/2019-20 Apologies for Absence DCllr Dan Corbin, DCllr Neil Atkin 95/2019-20 Declaration of Interest 3 recorded regarding parking Cllr Clifton, Cllr Leggett and Cllr Hawksworth – it was agreed no reason to leave the meeting. 96/2019-20 Public Participation Sue Hampson asked for advice with regard to the development at Castle Donington – DCllr Watson advised any FS developments this close to the parish boundary will be notified and dealt with in the usual way. Wilne Lane is still an issue with overgrown trees and hedges, as is the Greenway; which is being dealt with by DCC. Overgrowth is an issue throughout the village, there is a mix of responsibility for the overgrowth including Canal & River Trust, SDDC, DCC and private householders. Cllr Perks and Cllr Lees spent a large amount of time completing a village walk and making note of areas requiring action and these are now all being actioned. Cllr Hawksworth gave details of restraints the farming community face with hedge cutting due to nesting season – there is also the issue of the weather causing excessive growth this year. Lady in Grey has been painted white – which is not in keeping with the area. -

Outwood Academy Newbold, Derbyshire

Determination Case reference: REF3617 Referrer: A member of the public Admission authority: Outwood Grange Academies Trust for Outwood Academy Newbold, Derbyshire Date of decision: 12 September 2019 Determination I have considered the admission arrangements for September 2019 and September 2020 for Outwood Academy Newbold, Derbyshire in accordance with section 88I(5) of the School Standards and Framework Act 1998. I find that there are matters which do not conform with the requirements relating to admission arrangements in the ways set out in this determination. By virtue of section 88K(2) the adjudicator’s decision is binding on the admission authority. The School Admissions Code requires the admission authority to revise its admission arrangements within two months of the date of the determination. The referral 1. Under section 88H(2) of the School Standards and Framework Act 1998, (the Act), a member of the public has referred the admission arrangements for Outwood Academy Newbold (the school), a mixed 11 to 18 academy school in Chesterfield, Derbyshire for September 2019 to the adjudicator. The referral relates to the definition of siblings, the method of calculating home to school distance and whether schools with more capacity than the Published Admission Number (PAN) should admit pupils above the PAN. 2. The parties to the case are Outwood Grange Academies Trust (the trust) and Derbyshire County Council, the local authority in which the school is located. Jurisdiction 3. The terms of the Academy agreement between Outwood Grange Academies Trust and the Secretary of State for Education require that the admissions policy and arrangements for the academy school are in accordance with admissions law as it applies to maintained schools. -

Melbourne Area Forum

Melbourne Area Forum Tuesday, June 12th, 2018, 6.30pm. Barrow on Trent Village Hall 34, Twyford Road Barrow on Trent DE73 7HA South Derbyshire changing for the better COMMITTEE AND COUNCIL MEETINGS 2018/19 Committee Day Date ANNUAL COUNCIL Thursday 17.05.18 CIVIC COUNCIL Thursday 24.05.18 Audit Sub-Committee: Special Wednesday 30.05.18 Environmental & Development Services Thursday 31.05.18 Planning Tuesday 05.06.18 Housing & Community Services Thursday 07.06.18 Finance & Management Thursday 14.06.18 Overview & Scrutiny Wednesday 20.06.18 Planning Tuesday 26.06.18 COUNCIL Thursday 28.06.18 Etwall JMC Wednesday 11.07.18 Planning Tuesday 17.07.18 Audit Sub-Committee (Special) Wednesday 25.07.18 Finance and Management (Special) Thursday 26.07.18 Planning Tuesday 07.08.18 Environmental & Development Services Thursday 16.08.18 Housing & Community Services Thursday 23.08.18 Finance & Management Thursday 30.08.18 Planning Tuesday 04.09.18 Overview & Scrutiny Wednesday 05.09.18 Audit Sub-Committee Wednesday 19.09.18 COUNCIL Thursday 20.09.18 Planning Tuesday 25.09.18 Etwall JMC Wednesday 26.09.18 Environmental & Development Services Thursday 27.09.18 Housing & Community Services Thursday 04.10.18 Finance & Management Thursday 11.10.18 Planning Tuesday 16.10.18 Overview & Scrutiny Wednesday 17.10.18 COUNCIL Thursday 01.11.18 Planning Tuesday 06.11.18 Environmental & Development Services Thursday 15.11.18 Housing & Community Services Thursday 22.11.18 Planning Tuesday 27.11.18 Overview & Scrutiny Wednesday 28.11.18 Finance & Management Thursday -

Dear Councillor, Council a Meeting of the Council Will Be Held in The

F. McArdle Chief Executive Civic Offices, Civic Way, Swadlincote, Derbyshire DE11 0AH www.south-derbys.gov.uk Please ask for: Democratic Services Phone: (01283) 595722 / 595848 Minicom: (01283) 595849 DX 23912 Swadlincote Email : [email protected] Date: 19th February 2016 Dear Councillor, Council A Meeting of the Council will be held in the Council Chamber, on Monday, 29 February 2016 at 18:00. You are requested to attend. Yours faithfully, Chief Executive To:- Conservative Group Councillor Atkin (Chairman), Councillor Murray (Vice-Chairman) and Councillors Billings, Mrs Brown, Mrs Coe, Coe, Mrs Coyle, Mrs Farrington, Ford, Grant, Mrs Hall, Harrison, Hewlett, MacPherson, Muller, Mrs Patten, Mrs Plenderleith, Roberts, Smith, Stanton, Swann, Watson, Wheeler and Mrs Wyatt. Labour Group Councillors Bambrick, Chahal, Dunn, Pearson, Rhind, Richards, Shepherd, Southerd, Mrs Stuart, Taylor, Tilley, and Wilkins. Page 1 of 199 AGENDA Open to Public and Press 1 Apologies 2 Presentation: Mr Terry McDermott, Chief Fire Officer 3 To confirm the Open Minutes of the Council Meeting held on 21st January 2016 (CL/85-CL/102). Council 21st January 2016 Open Minutes 5 - 12 4 To receive any declarations of interest arising from any items on the Agenda. 5 To receive any announcements from the Chairman, Leader and Head of Paid Service. 6 To receive any questions by members of the public pursuant to Council Procedure Rule No.10. 7 To receive any questions by Members of the Council pursuant to Council procedure Rule No. 11. 8 COUNCIL TAX SETTING -

Part 1.7 Trent Valley Washlands

Part One: Landscape Character Descriptions 7. Trent Valley Washlands Landscape Character Types • Lowland Village Farmlands ..... 7.4 • Riverside Meadows ................... 7.13 • Wet Pasture Meadows ............ 7.9 Trent Valley Washlands Character Area 69 Part 1 - 7.1 Trent Valley Washlands CHARACTER AREA 69 An agricultural landscape set within broad, open river valleys with many urban features. Landscape Character Types • Lowland Village Farmlands • Wet Pasture Meadows • Riverside Meadows "We therefore continue our course along the arched causeway glancing on either side at the fertile meadows which receive old Trent's annual bounty, in the shape of fattening floods, and which amply return the favour by supporting herds of splendid cattle upon his water-worn banks..." p248 Hicklin; Wallis ‘Bemrose’s Guide to Derbyshire' Introduction and tightly trimmed and hedgerow Physical Influences trees are few. Woodlands are few The Trent Valley Washlands throughout the area although The area is defined by an constitute a distinct, broad, linear occasionally the full growth of underlying geology of Mercia band which follows the middle riparian trees and shrubs give the Mudstones overlain with a variety reaches of the slow flowing River impression of woodland cover. of fluvioglacial, periglacial and river Trent, forming a crescent from deposits of mostly sand and gravel, Burton on Trent in the west to Long Large power stations once to form terraces flanking the rivers. Eaton in the east. It also includes dominated the scene with their the lower reaches of the rivers Dove massive cooling towers. Most of The gravel terraces of the Lowland and Derwent. these have become Village Farmlands form coarse, decommissioned and will soon be sandy loam, whilst the Riverside To the north the valley rises up to demolished. -

36 Great Wilne Shardlow | Derby | Derbyshire | DE72 2HF

36 Great Wilne Shardlow | Derby | Derbyshire | DE72 2HF 36 Great Wilne Cover.indd 3 06/11/2020 14:05 36 GREAT WILNE Derwent Farmhouse is a stunning Georgian, brick built, five double bedroom, detached property. The home is set within approximately 2 acres of grounds, located in the small hamlet of Great Wilne just outside the canal village of Shadlow. This stunning imposing family home has been lovingly restored by its current vendors to create a versatile family home benefiting from three reception rooms, a large bespoke hardwood kitchen with bi-fold doors, and a beautiful master suite that has unobstructed views across the surrounding countryside. Occupying a beautiful plot measuring circa 2 acres towards the edge of the hamlet, the property offers views of the local countryside. The area also has a wide selection of walks, pubs and resturants on its doorstep whilst boasting very good commuter links throughout the East Midlands. 36 Great Wilne Cover.indd 4 06/11/2020 14:06 36 Great Wilne Pages.indd 1 06/11/2020 14:04 GROUND FLOOR On entering the property you are greeted by an entrance hallway with oak flooring and beamed ceiling. Leading off the hallway to the right is one of the formal lounges with original Inglenook fireplace with feature brick backwall, original oak mantle beam and wood burning stove. This room also boasts solid oak flooring, ceiling beams and replica traditional Victorian cast iron radiators. The lounge leads through to the formal dining room, also featuring an Inglenook fireplace with exposed brickwork, inset wood burner and the original bread oven set into the wall. -

Briefing on Sixth Form Provision

Rep 680 Agenda item 7 Schools Forum – 10 th November 2016 School Sixth Forms - The 14-19 landscape and the diversification of School / College provision 1. Purpose To inform Schools Forum of the challenges faced by School Sixth Forms following changes in Government policy and funding, including the growth of University Technical Colleges (UTCs), Studio Schools, Free Schools and Technical Academies. 2. Policy background The school system has changed significantly over the last five years, with changes to Government funding of Post-16 education in particular being a considerable challenge. Not all the change is recent; Academies, UTCs and Studio Schools for instance were all around in various stages of development prior to 2010. The current school sector, however, is designed to give parents greater choice and schools greater freedom. Currently there exists: • Over 2,000 Academies now open in England • 291 Free Schools now open and 141 in the pipeline – DfE target 500 by 2020 • 34 Studio Schools now open with one in the pipeline • 45 UTCs open. In addition, since September 2013, GFE has been able to offer full time provision to 14-16yrs olds which adds more competition into the education system. 3. Definitions for these new types of organisations • Academies – Primary and Secondary Schools who are no longer part of the Local Authority are directly funded by the EFA and have additional responsibilities. • University Technical Colleges – Offering provision to students aged 14-19yrs, specialising in technical / vocational studies. Provision is full time, combining practical and academic studies which are delivered in work related context. A UTC has a maximum of 600 students. -

Outwood Academy Newbold Highfield Lane, Newbold, Chesterfield, Derbyshire S41 8BA

School report Outwood Academy Newbold Highfield Lane, Newbold, Chesterfield, Derbyshire S41 8BA Inspection dates 14–15 November 2017 Overall effectiveness Good Effectiveness of leadership and management Outstanding Quality of teaching, learning and assessment Good Personal development, behaviour and welfare Good Outcomes for pupils Good 16 to 19 study programmes Good Overall effectiveness at previous inspection Not previously inspected Summary of key findings for parents and pupils This is a good school Outwood Newbold is an effective and Governors are well informed and work improving school. Standards have risen effectively with the trust to provide strategic substantially in the past two years. direction for the school. Leaders at all levels have worked with passion Pupils say they feel safe and are looked after and determination to raise the quality of well. teaching. Teaching is now good. A comprehensive programme of support and Pupils behave well and their conduct in lessons continuous professional development, provided and around the school is often exemplary. by the trust, has contributed significantly to the improvement in teaching over time. Pupils’ outcomes have risen consistently over the past three years. In 2017, the progress Pupils’ attitudes to their own learning are pupils in Year 11 made was significantly above improving. In some classes, however, and the national average. particularly in key stage 3, pupils are not consistently motivated to learn. Parents, staff and pupils are positive about the changes that have been made to the school. In a small number of lessons, teachers do not Pupils who have been at the school for the allow pupils enough time to fully understand longest time are clear that things are much something before moving on. -

2019-11 Schools Block Funding

Agenda Item 3 Rep 786 DERBYSHIRE COUNTY COUNCIL SCHOOLS FORUM 26th November 2019 Report of the Executive Director for Children’s Services School Block Funding 2020-21 1. Purpose of the Report To inform the Schools Forum of the provisional schools block settlement for 2020-21 and potential implications for Derbyshire. 2. Information and Analysis As part of the government’s Spending Round 2019, the Chancellor of the Exchequer confirmed to Parliament that funding for schools and high needs will, compared to 2019- 20, rise by £2.6 billion for 2020-21, £4.8 billion for 2021-22, and £7.1 billion for 2022-23. On 11th October 2019 the DfE released provisional DSG funding levels for 2020-21 for each LA. Final allocations will be published in December to reflect the October 2019 pupil census. This paper focusses on the schools block, papers for the other blocks are covered elsewhere on tonight’s agenda. 2.1 Schools Block increase The government have announced the mainstream National Funding Formula (NFF) multipliers for 2020-21. Details of the current and new values are shown in Appendix 1. These increased multipliers feed directly into the calculation of the 2020-21 Schools Block budgets for each LA. By way of background, the provisional LA-level Schools Block for each sector is derived as a unit rate (Primary/Secondary Unit of Funding (PUF/SUF)) multiplied by the October 2018 pupil census. The PUF/SUF values have been derived by calculating schools’ NFF budgets for 2019-20, summing the individual amounts and dividing the aggregate total by the October 2018 pupil count. -

South Derbyshire Area Forum

OPEN SOUTH DERBYSHIRE AREA FORUM MELBOURNE 10th June 2014 at Barrow upon Trent Village Hall PRESENT:- District Council Representatives Councillor Harrison (Chairman) and Councillors Hewlett, Watson, Atkin, and Mrs Watson F. McArdle (Chief Executive); Alan Bates (Environmental Development Assistant); Mandy McKeon (Services Assistant) Derbyshire County Council Representatives Councillors Davison and Mrs Chilton. P. Jameson (Forum Liaison Officer). Parish Council/Meeting Representatives W Earp (Melbourne Parish Council); David Smith (Melbourne Parish Council); P Bickerton (Elvaston Parish Council); C Blackmore (Barrow on Trent Parish Council); T Scott (Shardlow and Great Wilne Parish Council); A Record (Weston on Trent Parish Council); Members of the Public A Madeley; K Whewell; E Bickerton; MA/1 TO NOTE THE APPOINTMENT OF THE CHAIRMAN Noted as Councillor Harrison MA/2 APOLOGIES Apologies for absence were received from Councillor Ken Atkin and Councillor Ed Hicklin MA/3 APPOINTMENT OF VICE CHAIRMAN Councillor Peter Watson was happy to be appointed as Vice Chairman, nominated by Councillor Mrs Watson, Councillor Atkin was happy to second the nomination. MA/4 DECLARATIONS OF INTEREST None - 1 - OPEN MA/5 CHAIRMAN’S ANNOUNCEMENTS None MA/6 MINUTES The Minutes of the Melbourne Area Forum held on 18th February 2014 were noted as an accurate record. MA/7 REPORT BACK ON ISSUES RAISED AT THE LAST MEETING The Chairman handed over to the Forum Liaison Officer to report back on those items raised at the last meeting. Structural weight limits on bridges Concerns regarding the canal bridge were passed to the River & Canal Trust who have confirmed that both bridges can take the 40-tonne capacity. -

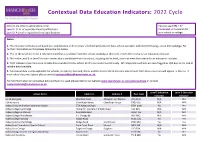

Education Indicators: 2022 Cycle

Contextual Data Education Indicators: 2022 Cycle Schools are listed in alphabetical order. You can use CTRL + F/ Level 2: GCSE or equivalent level qualifications Command + F to search for Level 3: A Level or equivalent level qualifications your school or college. Notes: 1. The education indicators are based on a combination of three years' of school performance data, where available, and combined using z-score methodology. For further information on this please follow the link below. 2. 'Yes' in the Level 2 or Level 3 column means that a candidate from this school, studying at this level, meets the criteria for an education indicator. 3. 'No' in the Level 2 or Level 3 column means that a candidate from this school, studying at this level, does not meet the criteria for an education indicator. 4. 'N/A' indicates that there is no reliable data available for this school for this particular level of study. All independent schools are also flagged as N/A due to the lack of reliable data available. 5. Contextual data is only applicable for schools in England, Scotland, Wales and Northern Ireland meaning only schools from these countries will appear in this list. If your school does not appear please contact [email protected]. For full information on contextual data and how it is used please refer to our website www.manchester.ac.uk/contextualdata or contact [email protected]. Level 2 Education Level 3 Education School Name Address 1 Address 2 Post Code Indicator Indicator 16-19 Abingdon Wootton Road Abingdon-on-Thames -

List of Eligible Schools for Website 2019.Xlsx

England LEA/Establishment Code School/College Name Town 873/4603 Abbey College, Ramsey Ramsey 860/4500 Abbot Beyne School Burton‐on‐Trent 888/6905 Accrington Academy Accrington 202/4285 Acland Burghley School London 307/6081 Acorn House College Southall 931/8004 Activate Learning Oxford 307/4035 Acton High School London 309/8000 Ada National College for Digital Skills London 919/4029 Adeyfield School Hemel Hempstead 935/4043 Alde Valley School Leiston 888/4030 Alder Grange School Rossendale 830/4089 Aldercar High School Nottingham 891/4117 Alderman White School Nottingham 335/5405 Aldridge School ‐ A Science College Walsall 307/6905 Alec Reed Academy Northolt 823/6905 All Saints Academy Dunstable Dunstable 916/6905 All Saints' Academy, Cheltenham Cheltenham 301/4703 All Saints Catholic School and Technology College Dagenham 879/6905 All Saints Church of England Academy Plymouth 383/4040 Allerton Grange School Leeds 304/5405 Alperton Community School Wembley 341/4421 Alsop High School Technology & Applied Learning Specialist College Liverpool 358/4024 Altrincham College Altrincham 868/4506 Altwood CofE Secondary School Maidenhead 825/4095 Amersham School Amersham 380/4061 Appleton Academy Bradford 341/4796 Archbishop Beck Catholic Sports College Liverpool 330/4804 Archbishop Ilsley Catholic School Birmingham 810/6905 Archbishop Sentamu Academy Hull 306/4600 Archbishop Tenison's CofE High School Croydon 208/5403 Archbishop Tenison's School London 916/4032 Archway School Stroud 851/6905 Ark Charter Academy Southsea 304/4001 Ark Elvin Academy