Pune- Residential Q2 2020

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Kolte Patil Stargaze

https://www.propertywala.com/kolte-patil-stargaze-pune Kolte Patil Stargaze - Chandani Chowk, Pune 2 & 3 BHK apartments available at Kolte Patil Stargaze Kolte Patil Developers present Kolte Patil Stargaze with 2 & 3 BHK apartments available at Chandani Chowk, Pune Project ID : J409221190 Builder: Kolte Patil Developers Properties: Apartments / Flats Location: Kolte Patil Stargaze, Chandani Chowk, Pune (Maharashtra) Completion Date: Jan, 2016 Status: Started Description Kolte Patil Stargaze is a new launch by Kolte Patil Developers. The project is located in Chandani Chowk, Pune. Bringing you houses of 2 BHK and 3 BHK Apartments with world class amenities; it also serves you best in terms of Location. The Mumbai-Pune Expressway is adjacent to this project and being located at Bavdhan it brings you closer to several destinations. With a great masterpiece structured within the homes. Amenities Landscape garden Lawn area Indoor games Jogging track Club House Security Intercom Facility Power Backup Gymnasium Lift Kolte Patil Developers Ltd. (KPDL) has been on the forefront of developments with its trademark philosophy of ‘Creation and not Construction’. The company has done with over 8 million square feet of landmark developments across Pune and Bengaluru, KPDL has created a remarkable difference by pioneering new lifestyle concepts, leveraging cutting edge technology and creating insightful designs. Features Other features 2 balconies Under Construction Semi-Furnished Gallery Pictures Aerial View Location https://www.propertywala.com/kolte-patil-stargaze-pune -

Gini Viviana - Balewadi, Pune Penthouses, 2BHK, 2.5BHK and 3BHK Residenial Apartments in Balewadi, Pune

https://www.propertywala.com/gini-viviana-pune Gini Viviana - Balewadi, Pune Penthouses, 2BHK, 2.5BHK and 3BHK Residenial Apartments in Balewadi, Pune. Gini Construction Pvt. Ltd. is offering beautiful Penthouses, 2BHK, 2.5BHK and 3BHK Residenial Apartments in Gini Viviana at Balewadi, Pune. Project ID : J597211905 Builder: Gini Construction Pvt. Ltd. Properties: Apartments / Flats Location: Gini Viviana, Balewadi, Pune (Maharashtra) Completion Date: Dec, 2015 Status: Started Description Gini Viviana is the brand new ultra luxury residential project of Gini Construction Pvt. Ltd. The project is located in one of most prime and in-demanded location that is Balewadi, Pune. This location is considered as the residential as well as commercial hub. The project is offering beautiful Penthouses, 2BHK, 2.5BHK and 3BHK Residential apartments in various sizes starting from 1075 Sq.Ft. to 2490 Sq.Ft. in very reasonable price that can be easily affordable by most of the people. The project contains 6 towers with 226 beautiful residential apartments with all modern and necessary amenities as well as features. Around the Gini Viviana you will find lush greenery and pollution free, peaceful environment. Location - Balewadi, Pune. Type - Penthouses, 2BHK, 2.5BHK and 3BHK Residenial Apartments Size - 1075 Sq.Ft. to 2490 Sq.Ft Price - On Request. Amenities Safe Drinking Water Green Building Concept Gym Entrance Archway Club House DTCP Approved Premium Villas, Row house and plots Fully Landscaped Parks Vaastu Compliant Black Topped Roads Gated Community and 24 hrs Security Avenue Plantation Pre-Approved connection for Electricity and water Swimming Pool Shopping Complex and Restaurant 3 Years Hassle Free Maintenance Children's play area Overhead Water Tank Rain Water Harvesting Pits Specification Flooring Electrification Wall Finish, Paint Doors Structure designed with Earthquake Resistant Frame Kitchen Windows Toilets, Bathrooms Utilities Security Location Advantages Hinjewadi 5Km Aundh 5Km Pune University 8Km Shivajinagar 10Km ICC Trade Centre - Senapati Bapat Rd. -

PPI-Booth List

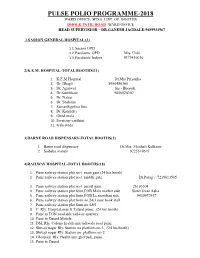

PULSE POLIO PROGRAMME-201 8 WARD OFFICE WISE LIST OF BOOTHS DHOLE PATIL ROAD WARD OFFICE HEAD SUPERVISIOR – DR.GANESH JAGDALE-9689931967 1.SASSON GENERAL HOSPITAL (3) 1.1.Sasson OPD 1.2.Paediatric OPD Mrs. Urde 1.3.Paediatric Indoor 9373436036 2)K.E.M. HOSPITAL-TOTAL BOOTHS(11) 1. K.E.M.Hospital Dr.Mrs.Priyanka 2. Dr. Bhagli 8956486360 3. Dr. Agarwal Sis - Bhosale 4. Dr.Kumbhare 9850520307 5. Dr. Nahar 6. Dr. Shabana 7. Samarth police line 8. Dr. Kalshetty 9. Ghod mala 10. Swaroop vardhini 11. Kale wada 3)BARNE ROAD DISPENSARY-TOTAL BOOTHS(2) 1. Barne road dispensary Dr.Mrs. Maithali Kulkarni 2. Saibaba mandir 9225519619 4)RAILWAY HOSPITAL-TOTAL BOOTHS(18) 1. Pune railway station plat no-1 main gate.(24 hrs.booth) 2. Pune railway station plat no-1 middle gate. Dr.Parag / 7219613505 3. Pune railway station plat no-1 parcel gate 26105504 4. Pune railway station plat form,FOB Main market side Sister Jivan Asha 5. Pune railway station plat form,FOB Le meridian side. 9420972917 6. Pune railway station plat form no.2&3 near book stall. 7. Pune railway station plat form no.4&5. 8. C. Rly. Hospital,near S.T.stand pune. .(24 hrs.booth) 9. Pune to TGN road side railway quarters. 10. Pune to Daund Mobile 11. DSL Rly. Colony health unit tadiwala road pune. 12. Shivaji nagar Rly. Station on platform no-1, .(24 hrs.booth) 13. Shivaji nagar Rly. Station on platform no-2. 14. Ghorpadi Rly. Health unit ghorpadi, pune. 15. -

Stps of Pune 0.Pdf

CMYK Pune Municipal Corporation Sewerage Project Award From Government Of Maharashtra Taking into consideration the works completed and Planned by Pune Municipal Corporation, for Sewage Management, Government of Maharashtra under the “Sant Ghadgebaba cleanliness Drive” felicitated Pune Municipal Corporation by giving a special award of Rs. 10 Lakh for Sewage Management in the year 2004. tt n me develop vironment & sustainable d clean env ards RecycledRecycled CleanClean WWaterater Tow Wastewater Treatment Development Engineer Sewerage Project Wastewater Management Pune Municipal Corporation Tilak Road , Pune Tel : 91-20-2550 8121 Fax : 91-20-2550 8128 6 0 / E E K A N A J CMYK Clean city, healthy city Pune Municipal Corporation has been working & planning towards making our city environment STP friendly & healthy in every possible way. Sewage Treatment Projects is one of the most At Bopodi important aspect of this entire exercise. In the year 2005, we have completed phase I and this year, in 2006 we are planning for phase II and phase III. This is one effort to The plant is located near Harris Bridge, introduce you about the projects and planning. Bopodi and its capacity is at 18 MLD. The extended aeration process is used How does it work? ge to treat the waste water. f Sewa stem o tion Sy Sewerage system consists of Collec Treated Water The sewage generated from Aundh ITI, collection network, conveyance Main Gravity Aundhgaon, Sindh Colony, Bopodi, and lines, pumping stations and Sewage Rising Main Bopodi Gaothan, NCL, Raj Bhavan etc. Treatment Plants. Collection Pumping Station area is treated in this plant. -

Water Quality of Pashan Lake and Manas Lake Interconnected by Ramnadi River – a Case Study 1Prof

International Journal for Research in Engineering Application & Management (IJREAM) ISSN : 2454-9150 Vol-04, Issue-02, May 2018 Water Quality of Pashan Lake and Manas Lake Interconnected by Ramnadi River – A Case study 1Prof. Sagar M. Gawande, 2Shivani R. Bankar, 3Akshay M.Deshmukh, 4Chaitanya R. Dindkar, 5Trusha B. Gawde, 1,2,3,4,5Anantrao Pawar College of Engineering & Research, Pune, India. [email protected], [email protected], [email protected], [email protected], [email protected] Abstract Water pollution has been one of the major topics in the environmental issue of urban India. Pashan Lake and Manas Lake is an important lake in Pune city which attracts migratory birds. Deforestation on nearby hills has caused heavy siltation resulting in decreasing the depth of the lake. The surface water quality of Pashan Lake is severely degraded due to the pollution from surrounding areas directly entering the water. Eight surface sampling points are selected to evaluate the water quality. The study presents the physicochemical characteristics of the lake water and suggests the means to improve the water quality through eco remediation measures for restoration. Water analysis are done for the parameters like pH, Dissolved oxygen (DO), Biochemical oxygen Demand (BOD), Chemical oxygen Demand (COD), Alkalinity , Electrical Conductivity for testing the suitability for drinking, agricultural purposes. Keywords - Water Pollution, Lake Water Quality, Industrial Waste, Physico-Chemical Characteristic, Sampling, Mean Sea Level. I. INTRODUCTION there is scarcity of water. A time may come where we would need to use this contaminated water which may lead Pune situated in Indian state of Maharashtra is the second to serious health effects so it is necessary to save and largest city after Mumbai. -

Sr No Ward Name Pid Name Address 1 Aundh F/4/40

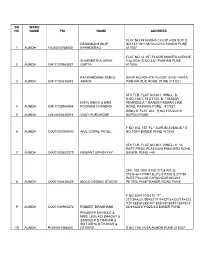

SR WARD NO NAME PID NAME ADDRESS FLAT NO 18 RADHA CO-OP HSG SOC S DESHMUKH DILIP NO 137/1B+138/1A/2/2/1A AUNDH PUNE 1 AUNDH F/4/40/03768000 KHANDERAO 411007 FLAT NO 12 1ST FLOOR MANTRI AVENUE SHARMISTHA DIPAK II BLDG K S NO 33/1 PASHAN PUNE 2 AUNDH O/4/11/01963037 GUPTA 411008 PATWARDHAN SAROJ SHOP NO.407 4TH FLOOR, S NO 140/1A, 3 AUNDH O/4/11/02618042 ASHOK PASHAN SUS ROAD, PUNE 411 021 6TH FLR, FLAT NO.601, WING - B, S.NO.135/1, PLOT NO. B, " KUMAR NITIN SINGH & MRS PENINSULA ", BANER PASHAN LINK 4 AUNDH O/4/11/02965064 POONAM CHANDRA ROAD, PASHAN, PUNE - 411021 WING B FLAT 202 S NO 47A/2/2/1B 5 AUNDH O/4/26/01835019 VIJAY KURIAKOSE BOPODI PUNE F NO 102, 1ST FL " AURUM AVENUE " S 6 AUNDH O/A/01/03008003 ANIL GOPAL PATEL NO 109/4 BANER PUNE 411045 8TH FLR, FLAT NO.801, WING - H, 16 PART PRIDE PLATINUM PANCARD ROAD, 7 AUNDH O/A/01/03622270 HEMANT UPADHYAY BANER, PUNE - 45 OFF. NO 1001 S NO 272/4 P/A ,B 272/5+6+7 PART B,272/3 P.NO B,277/30 PART PALLOD FARM NEAR MOULI 8 AUNDH O/A/01/04436025 MOCO DESING STUDIO PETROLPUMP BANER ROAD PUNE F NO 1004 10TH FL "F" 221/3A+221/3B+221/1/1+221/2+222/1A+222 /1B+222/2+222/3/1+222/3/2+223/1+223/2+2 9 AUNDH O/A/01/04960272 ROBERT BRAMHANE 23/3+223/4/1+223/4/2 BANER PUNE PRADEEP M KHOLE & MRS. -

India- Pune- Residential Q1 2020

M A R K E T B E AT PUNE Residential Q1 2020 Significant decline in quarterly launches New launches in Q1 were recorded at 7,428 units, a sharp 34% q-o-q decline, largely driven by the COVID-19 and subsequent lockdown stifling launch activity over the last month of Q1. Majority of the Q1 launches (56%) were concentrated in the NH4 Bypass submarket in locations like Q-o-Q DECLINE IN NEW Hinjewadi, Balewadi, Bavdhan, Mahalunge and Marunji. The east submarket also held a significant share of 20%, with a major proportion of the 34% LAUNCHES IN Q1 2020 launches concentrated in emerging locations like Manjari and Keshav Nagar. Among the projects launched this quarter, the mid segment accounted for 65% of the launched units, while the affordable segment accounted for 30%. Over the last few quarters, locations such as SHARE OF MID-SEGMENT Mahalunge, Manjari, Mamurdi and Keshav Nagar have witnessed increased traction in launches, on account of the strong demand arising from 65% IN Q1 LAUNCHES their proximity to major commercial district and attractive prices. The overall capital values in Pune remained stable during the quarter on account of the inventory overhang as sales remained at moderate levels. SHARE OF NH4 BYPASS Launches from established developers on the rise 56% SUBMARKET IN Q1 LAUNCHES The process of consolidation in Pune’s residential real estate market continued its momentum in 2020, which was also evident in the Q1 launches. Nearly 55% of the quarterly launches were from established developers like Godrej Properties, Purvankara, Goel Ganga Developments, Kumar Properties, Pride Purple Group etc. -

Branch Code Branch Name Branch Head Name Branch Head

BANK OF MAHARASTRA Branch Branch Branch Head Head Branch Name Branch No Code Name Designatio n 1 BAJIRAO RD Mr N S Deshpande AGM 24456969 3 DECCAN GYMKHANA D B Doke AGM 25531290 28 PUNE BHAVANI PETH BOROLE C N CM 26385850 40 PUNE SOMWARPETH Pramod Kahalkar CM 26129006 41 PUNE TILAK RD Joshi Abhijjet CM 24336635 DILIP KUMAR 43 PUNE SHIVAJINAGAR PANIGRAHI CM 25533462 DEOKAR RAVINDRA 49 CHATUSHRUNGI PUNE NARAYAN CM 25538717 76 PUNE CAMP Joglekar Mrudul AGM 26130582 100 PUNE SWARGATE BIPINBIHARI SHARMA CM 24436111 102 PUNE NAVIPETH S M Kale CM 24539140 116 PUNE KARVE RD M B Kanetkar CM 25441199 JAISWAL ANAND 154 PUNE NARAYAN PETH PRAKASH AGM 24495783 158 PUNE PARVATI A.B.Shendage CM 24421411 Mrs. Sushama Ravindra 185 PUNE GURUWARPETH Tiwari CM 24488127 UMESHCHANDRA 243 PUNE PAUD PHATA GANESH JOSHI CM 25434247 244 PUNE KOTHRUD Joshi S D CM 25457103 PUNE MAHATMA PHULE 314 PETH J G Bhalerao Sr.MANAGER 24482879 315 PUNE PADMAVATI D K PARMAR CM 24230109 320 PUNE T M V COLONY Mr J A Thakar Sr.MANAGER 24269644 321 PUNE SAHAKARNAGAR Mrs MISTRY L J CM 24222777 322 PUNE KASBA PETH Mrs Joglekar J J Sr.MANAGER 24433116 325 PUNE RAVIWAR PETH Pendse M J Sr.MANAGER 24434381 330 ERANDAWANA SUNITA B BHOSALE AGM 25660117 PUNE SHANKARSHET 335 RD MNLN PHANI CM 26452776 340 PUNE SALISBURY PARK Mr. S R Auti CM 24272977 675 PUNE SHANIWAR PETH Ajit Bhatwadekar Sr.MANAGER 24451731 707 PUNE BIBWEWADI WANI S S CM 24212268 750 PUNE MODEL COLONY Mrs N V Shevade CM 25678827 756 PUNE GANESHNAGAR SATISH KUMAR CM 25466005 776 PUNE DHANKAWADI Javed Qasim CM 24373110 822 PUNE SANGAMWADI Dy.Manager 26160184 852 PUNE MAYUR COLONY Kolagatram BM CM 25430495 CORPORATE BRANCH KANTH SHISHIRNATH 941 PUNEI NARPATI AGM 25512584 970 PUNE KARVE NAGAR KOMMAWAR.V.G. -

Major Software Companies S.No

Major software companies S.No. Name Address Telephone Website 1 AccelTree Software Pvt Ltd 305, "Pride Kumar +91-20-6603-3122 / www.acceltree.com Senate", 2565-2550 Senapati Bapat Road, Shivaji Nagar, PUNE 411016 2 Accenture Services Pvt Ltd Level 6 & 7, Cybercity +91 20 66253000 www.accenture.com/ Tower 5 Magarpatta city Hadapsar-Mundhwa Road Pune 411 028 3 Advent Software Ltd AFL House, +91-20-26051986 www.adventsoftware.net 347 A, Off Dhole Patil Road, Pune - 411001 4 Amdocs Development Centre Cyber City Tower 2, +91 (0)202 6703000 www.amdocs.com/ India Pvt Ltd 6th Floor Magarpatta City Hadapsar, Pune, 411 028 5 Avaya GlobalConnect Ltd 1st FLOOR, 113-116, 91-20-66075333 www.avayaglobalconnect.com PRIDE SILICON PLAZA, 106A/2A/7, SHIVAJINAGAR, 5 Avaya GlobalConnect Ltd 91-20-66075333 www.avayaglobalconnect.com SENAPATI BAPAT ROAD, PUNE - 411016 6 Bentley Systems India Pvt 403, Godrej Eternia-C, +91 20 6602 1000 www.bentley.com/sa-IN/ Ltd Wakdewadi, Shivajinagar, Pune 411 005 7 BMC Software India Pvt Ltd Tower A, ICC Tech www.bmc.com Park Senapati Bapat Road Pune - 411 016 8 Brainvisa Technologies Pvt Windsor Commerce +91-20-27205000, +91- www.brainvisa.com Ltd 20-27205001, +91-20- 30212400 Survey No. 2/8/1, Opp. Baner Telephone Exchange, Baner Road, Baner, Pune 411 045, 9 CalSoft Private Limited Astrix Plaza +91 (20) 3985 2900 , www.calsoftinc.com +91 (20) 2729 2448 Survey No 270/1/23 Baner Road Pune 411045 10 CashTech Solutions India Pvt 201, Pride Parmar +91-20- 6605 2000 www.cash-tech.com Ltd Galaxy Connaught Road Pune - 411 001 11 Centre for Development of Pune University +91-20-2570-4100 www.cdac.in Advanced Computing (C - Campus DAC) Ganesh Khind Pune - 411 007 12 CG-CoreEL Logic Systems Surya Bhavan, 1181 5533982/5538362 Ltd Gergusson College Road, Pune 411 005 13 Cirruslogic Software (India) 106-A, Muttha 5671092 Pvt. -

ERSS Was Published in 2012 Under the Name Cirrhinus Fulungee

Deccan White Carp (Gymnostomus fulungee) Ecological Risk Screening Summary U.S. Fish & Wildlife Service, October 2012 Revised, February 2019 Web Version, 5/31/2019 1 Native Range and Status in the United States Native Range From Froese and Pauly (2019): “Asia: Maharashtra and Karnataka in India; probably in other parts of Indian peninsula.” From Dahanukar (2011): “Cirrhinus fulungee is widely distributed in the Deccan plateau. It is recorded from Krishna and Godavari river system from Maharashtra, Karnataka, Andhra Pradesh, Madhya Pradesh and Chhattisgarh. Record of this species from Cauvery river system (Menon 1999) is doubtful. In Maharashtra, the species is known from Mula-Mutha river of Pune (Fraser 1942, Tonapi and Mulherkar 1963, Kharat et al. 2003, Wagh and Ghate 2003), Pashan lake in Pune (Fraser 1942, Tonapi and Mulherkar 1963), Pavana River near Pune (Chandanshive et al. 2007), Ujni Wetland (Yazdani and Singh 1990), Neera river near Bhor (Neelesh Dahanukar, Mandar Paingankar, Rupesh Raut and S.S. Kharat, manuscript submitted), Krishna river near Wai (S.S. Kharat, Mandar Paingankar and Neelesh Dahanukar, manuscript in preparation), Koyna river at Patan (Jadhav et al. 2011), Panchaganga river in Kolhapur (Kalawar and Kelkar 1956), Solapur district 1 (Jadhav and Yadav 2009), Kinwat near Nanded (Hiware 2006) and Adan river (Heda 2009). In Andhra Pradesh, the species is known from Nagarjunasagar (Venkateshwarlu et al. 2006). In Karnataka, the species is reported from Tungabhadra river (Chacko and Kuriyan 1948, David 1956, Shahnawaz and Venkateshwarlu 2009, Shahnawaz et al. 2010), Linganamakki Reservoir on Sharavati River (Shreekantha and Ramachandra 2005), Biligiri Ranganathswamy Temple Wildlife Sanctuary (Devi et al. -

Route Number Destination

Regular Buses Route Timetable Route Number Destination Time 5:20 5:40 5:50 6:00 6:10 6:20 6:40 7:00 7:10 7:20 7:30 7:35 7:40 7:45 7:50 7:55 8:00 8:10 8:15 8:20 8:30 8:35 8:40 8:45 8:55 9:00 9:05 9:15 9:25 9:25 9:30 9:35 9:45 9:50 9:55 10:05 10:15 10:20 10:30 10:45 10:50 11:05 11:25 11:35 11:45 11:55 12:05 12:15 12:25 12:35 12:45 12:55 Katraj To Shivajinagar 13:15 13:35 13:45 13:55 14:15 14:25 14:45 14:55 15:15 15:35 15:55 16:00 16:00 16:05 16:10 16:15 16:20 16:25 16:35 16:40 16:45 16:50 16:55 17:00 17:05 17:15 17:25 17:35 17:40 17:45 17:55 18:00 18:05 18:10 18:20 18:25 18:30 18:35 18:40 18:45 18:50 19:00 19:10 19:20 19:40 19:50 20:00 20:20 20:40 20:50 21:00 21:05 21:10 21:20 21:30 21:40 21:45 21:50 22:00 22:10 22:30 22:40 22:50 23:05 23:20 2 6:10 6:30 6:40 6:50 7:00 7:10 7:30 7:45 8:00 8:10 8:20 8:30 8:35 8:40 8:45 8:50 9:00 9:05 9:10 9:20 9:25 9:30 9:40 9:50 9:55 10:00 10:10 10:20 10:25 10:30 10:30 10:40 10:45 10:50 11:00 11:10 11:10 11:20 11:35 11:40 11:55 12:15 12:25 12:35 12:45 12:50 12:55 13:05 13:15 13:25 13:35 13:45 14:05 14:25 14:35 14:45 15:05 15:15 15:30 15:45 16:05 16:25 16:45 16:50 16:55 Shivajinagar To Katraj 17:00 17:05 17:10 17:15 17:25 17:30 17:35 17:45 17:50 17:55 18:05 18:10 18:15 18:25 18:30 18:45 18:55 19:00 19:00 19:05 19:15 19:20 19:25 19:30 19:35 19:40 19:45 19:50 19:55 20:05 20:15 20:25 20:35 20:40 20:50 21:10 21:30 21:40 21:45 21:50 21:55 22:10 22:20 22:30 22:35 22:40 22:40 22:50 23:00 23:15 23:25 23:35 23:50 0:00 Bhilarewadi To Shivajinagar 6:40 8:40 11:30 16:30 18:40 21:30 2 Shivajinagar To Bhilarewadi 7:40 -

Bharati Vidyapeeth English Medium High School, Balewadi Pune-45

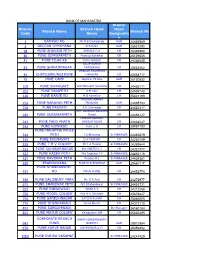

BHARATI VIDYAPEETH ENGLISH MEDIUM HIGH SCHOOL, BALEWADI PUNE-45. SALARY DETAIL YEAR-2013-2014. Sr. No. Designation Scale of Pay Grade Pay % of D.A. H.R.A. E.P.F. 1 Principal 9300 - 34800 4800 51% 20% 1665 2 PGT Con. Salary 3 TGT 9300 - 34800 4300 51% 20% 1665 4 PRT 5200 - 20200 4300 51% 20% 1665 Computer 5 5200 - 20200 2800 51% 20% 1665 Instructor 6 Librarian 5200 - 20200 2400 51% 20% 1665 7 Sr. Clerk 5200 - 20200 2400 51% 20% 1665 8 Jr. Clerk 5200 - 20200 1900 51% 20% 1665 9 Peon 4440 - 7440 1300 51% 20% 1665 10 K.G. Teacher Con. Salary BHARATI VIDYAPEETH ENGLISH MEDIUM PRE-PRIMARY SCHOOL, BALEWADI PUNE-45. LIST OF TEACHING AND NON TEACHING STAFF IN THE YEAR-2013-2014. Sr. Name of the Employee (Full Name) Designation Date of Date of Traind / Probation / Adhoc/ No. Birth Appointmant Untraind Confirmed Part-time 1 Mrs. Sayyed Irfano Mushahidali K.G. Teacher 14.1.1984 19/6/2002 Trained Probation Adhoc 2 Mrs. Bajaj Saloni K.G. Teacher 30/03/2013 13/08/2013 Trained Probation Adhoc 3 Mrs. Kudale Moona D. K.G. Teacher 15/11/1989 13/6/2005 Trained Probation Adhoc 4 Mrs. Bane Pooja V. K.G. Teacher 23/1/1983 1/8/2010 Trained Probation Adhoc 5 Mrs. Shah Diptee K. K.G. Teacher 27/9/1977 19/7/2012 Trained Probation Adhoc 6 Mrs. Khanijow Shaily K.G. Teacher 8/3/2013 19/08/2013 Trained Probation Adhoc BHARATI VIDYAPEETH ENGLISH MEDIUM HIGH SCHOOL, BALEWADI PUNE-45.