India- Pune- Residential Q1 2020

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Magarpatta-Nova-8502.Pdf

APARTMENTS 2 & 2.5 BHK www.novaproject.in WELCOME TO THE BRIGHT SIDE OF LIFE. Strategically located in Mundhwa, close to every possible convenience that one can ask for, presenting Nova – 2 & 2.5 BHK apartments. An ode to new-age professionals, these homes are planned keeping the requirements of modern, urban family in mind. Aesthetically designed with state-of- the-art specifications, Nova boasts of an elegant living room, with a plush kitchen cum dining area and spacious bedrooms to suit your stature. With a good inlay for sunlight and proper ventilation, these apartments promise to take you to the bright side of life. Welcome aboard. SPECIFICATIONS: • Structure: Reinforced Cement Concrete (RCC) structure • Flooring: Vitrified tiles • External walls: Reinforced Cement Concrete (RCC) shear walls • Kitchen Platform: Granite top platform with stainless steel sink and glazed • Internal walls: Autoclaved Aerated Cement (AAC) blocks and Reinforced tile dado up to ceiling. Provision for exhaust fan and water purifier. Cement Concrete (RCC) • Toilet: Flooring – Matt finish tiles • Internal Finishing: Gypsum finish for ceilings and walls Dado: Glazed tiles. Dado up to door top. • Door Frame and Shutters: • Plumbing: Concealed plumbing Apartment main doors and bedroom doors: Laminated door frames with • Sanitary ware: Standard sanitary ware with Brass Chromium plated fittings laminated door shutters and good quality door fittings • Painting: External – Acrylic / Texture paint Apartment toilet door: Granite door frames with laminated door shutter Internal: Oil bound distemper and good quality door fittings Grills: Enamel paint Apartment Balcony Door: Powder coated Aluminium sliding door • Lifts: Lift with diesel generator backup • Windows: Powder coated Aluminium sliding windows with M.S. -

Kolte Patil Stargaze

https://www.propertywala.com/kolte-patil-stargaze-pune Kolte Patil Stargaze - Chandani Chowk, Pune 2 & 3 BHK apartments available at Kolte Patil Stargaze Kolte Patil Developers present Kolte Patil Stargaze with 2 & 3 BHK apartments available at Chandani Chowk, Pune Project ID : J409221190 Builder: Kolte Patil Developers Properties: Apartments / Flats Location: Kolte Patil Stargaze, Chandani Chowk, Pune (Maharashtra) Completion Date: Jan, 2016 Status: Started Description Kolte Patil Stargaze is a new launch by Kolte Patil Developers. The project is located in Chandani Chowk, Pune. Bringing you houses of 2 BHK and 3 BHK Apartments with world class amenities; it also serves you best in terms of Location. The Mumbai-Pune Expressway is adjacent to this project and being located at Bavdhan it brings you closer to several destinations. With a great masterpiece structured within the homes. Amenities Landscape garden Lawn area Indoor games Jogging track Club House Security Intercom Facility Power Backup Gymnasium Lift Kolte Patil Developers Ltd. (KPDL) has been on the forefront of developments with its trademark philosophy of ‘Creation and not Construction’. The company has done with over 8 million square feet of landmark developments across Pune and Bengaluru, KPDL has created a remarkable difference by pioneering new lifestyle concepts, leveraging cutting edge technology and creating insightful designs. Features Other features 2 balconies Under Construction Semi-Furnished Gallery Pictures Aerial View Location https://www.propertywala.com/kolte-patil-stargaze-pune -

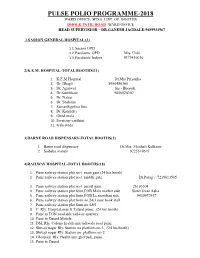

PPI-Booth List

PULSE POLIO PROGRAMME-201 8 WARD OFFICE WISE LIST OF BOOTHS DHOLE PATIL ROAD WARD OFFICE HEAD SUPERVISIOR – DR.GANESH JAGDALE-9689931967 1.SASSON GENERAL HOSPITAL (3) 1.1.Sasson OPD 1.2.Paediatric OPD Mrs. Urde 1.3.Paediatric Indoor 9373436036 2)K.E.M. HOSPITAL-TOTAL BOOTHS(11) 1. K.E.M.Hospital Dr.Mrs.Priyanka 2. Dr. Bhagli 8956486360 3. Dr. Agarwal Sis - Bhosale 4. Dr.Kumbhare 9850520307 5. Dr. Nahar 6. Dr. Shabana 7. Samarth police line 8. Dr. Kalshetty 9. Ghod mala 10. Swaroop vardhini 11. Kale wada 3)BARNE ROAD DISPENSARY-TOTAL BOOTHS(2) 1. Barne road dispensary Dr.Mrs. Maithali Kulkarni 2. Saibaba mandir 9225519619 4)RAILWAY HOSPITAL-TOTAL BOOTHS(18) 1. Pune railway station plat no-1 main gate.(24 hrs.booth) 2. Pune railway station plat no-1 middle gate. Dr.Parag / 7219613505 3. Pune railway station plat no-1 parcel gate 26105504 4. Pune railway station plat form,FOB Main market side Sister Jivan Asha 5. Pune railway station plat form,FOB Le meridian side. 9420972917 6. Pune railway station plat form no.2&3 near book stall. 7. Pune railway station plat form no.4&5. 8. C. Rly. Hospital,near S.T.stand pune. .(24 hrs.booth) 9. Pune to TGN road side railway quarters. 10. Pune to Daund Mobile 11. DSL Rly. Colony health unit tadiwala road pune. 12. Shivaji nagar Rly. Station on platform no-1, .(24 hrs.booth) 13. Shivaji nagar Rly. Station on platform no-2. 14. Ghorpadi Rly. Health unit ghorpadi, pune. 15. -

Brahma Suncity

https://www.propertywala.com/brahma-suncity-pune Brahma Suncity - Wadgaon Sheri, Pune Residential Apartments Brahma Suncity is located within the city's central districts, Wadgaon Sheri is possibly Pune's best kept real estate secret with a, comparatively, low price that offers tremendous potential for the appreciation in the near future. Project ID : J791190745 Builder: brahma builders Properties: Apartments / Flats, Residential Plots / Lands Location: Brahma Suncity, Wadgaon Sheri, Pune - 411014 (Maharashtra) Completion Date: Aug, 2011 Status: Started Description Gemini Developers is an endeavour of a group of professionals who have come together with their vast experience and knowledge of large infrastructural projects. We at Gemini Developers aim to undertake large infrastructure and turnkey projects using the latest equipment and technology available in India and managed by the best in the industry. Gemini Developers is a company of Engineers, Architects, Builders and planners. Gemini Developers provides high quality services to meet the needs of clients and customers. Brahma Suncity is located within the city's central districts, Wadgaon Sheri is possibly Pune's best kept real estate secret with a, comparatively, low price that offers tremendous potential for the appreciation in the near future.It is a 3BHK residential multistorey apartment, is available for the offer of rent , located in the heart of Pune. The property is in the vicinity of prime locations, therefore has an ease of access to important landmarks. The property has -

Pune- Residential Q2 2020

M A R K E T B E AT PUNE Residential Q2 2020 Developers stagger new launches amid the Covid-19 outbreak The COVID-19 pandemic has had an effect not only on the supply and sales activity but also on project construction progress. The total number of unit 40% Q-o-Q DECLINE IN NEW launches in Pune stood at 4,535 in Q2, a decline of nearly 40% q-o-q. However, the absolute number of launches still remained healthy with a few LAUNCHES IN Q2 2020 developers announcing new blocks within previously launched residential projects in a staggered manner. Mid segment continued to dominate launch activity during the quarter, accounting for a 74% share of launches whilst the affordable and high end segments had shares of 21% and 5%, respectively. SHARE OF MID-SEGMENT The NH4 Bypass submarket led the Q2 launch activity with a 58% share followed by Pimpri (17%) & South East (9%) submarkets. Locations like 74% IN Q2 2020 Hinjewadi, Balewadi, Bavdhan, and Tathawade within the NH4 Bypass submarket were the major contributors of launches during the quarter. Going forward, the Pune residential market is expected to witness delays of 3-6 months in construction schedules for most of the ongoing residential SHARE OF NH4 BYPASS projects due to labour and raw material shortages. However, the six month extension of project completion deadlines extended by MahaRERA for 58% SUBMARKET IN Q2 LAUNCHES registered projects, which were to be completed by or after March 15, will provide some measure of relief to developers. Decline in transacted residential prices While the quoted capital values in Pune remained stable from the previous quarter across all submarkets, developers are now showing increasing flexibility during discussions. -

PUNE INSTITUE of BUSINESS MANAGEMENT REVIEW; ISSN ISSN (Online): 2455 - 8796

IAAER’S PUNE INSTITUE OF BUSINESS MANAGEMENT REVIEW; ISSN ISSN (online): 2455 - 8796 EXPLORING MARKET POTENTIAL AND VENTURE FEASIBILITY FOR FOOD TRUCK BUSINESS IN PUNE: AN ENTREPRENEURSHIP CASE STUDY Palak Sharma1 1.1 Abstract Food and Beverage market is undergoing an unprecedented revolution in India, making it crucial for all formats to cater the need for uniqueness of concept and quickness of service. This case study explores the feasibility and market potential of food truck business in Pune Market for North Indian cuisine. The analysis of the market and business plan development depends on both internal and external factors, with the objective of developing a B-plan that can attract angel investment and venture capital. 1.2 Introduction The food and beverage market in India has grown at a rate of 23-24% (CAGR) over the past three years. The major contributors to this growth are quick service restaurants (45% popularity) and casual dining restaurants (32% popularity) as compared to all other formats in the market. Customers have given the best response to standalone restaurants that either cater to local tastes or have unique concepts which are otherwise missing in the market. With food comprising of majority of our expenses, this segment is always expected to grow, even if the rate of growth can vary. Economically viable members of the society between the age group of 21 and 54 years are the ones who contribute nearly 50% to the growth of food and beverage sector. Age wise customer profiles of most restaurants and eating joints reveal that 71% of customers frequenting their outlets are between the age of 21 and 40 years. -

Kyra Brochure 14X10 for Print Copy

Site Address: S. No. 134/2/1, 2/2A, 2B/2, 3A, 3B & 4, Magarpatta, Pune. Call: +91 2-2615106, 30250700 | E-mail: [email protected] | www.marvelrealtors.com CONFIDENTIALLY LUXURIOUS 301-302, Jewel Tower, Lane 5, North Main Road, Koregaon Park, Pune - 411001. Architects Structural Design Architect of Records Landscape Architects Legal Advisor KYRA HB Design International Inc., Singapore. Design Werkz Engineering Pvt. Ltd., Pune. Rahul Malwadkar, Pune. Siteectonix Pvt. Ltd., Singapore Rajiv Patel & Associates, Pune. Magarpatta Road, Pune Confidentially Luxurious A Secret Destination Behind Closed Doors Well- Appointed Details Private Moments CONTENTS Quiet Landscapes Intuitive Technology Nature’s Sanctity Our Other Properties CONFIDENTIALLY LUXURIOUS There’s a brand of luxury that’s exclusive to you. One that you don’t talk about. One that’s best experienced surreptitiously. One that lets you please your innermost sensibilities with the very best of the very best. A life of luxury to you is one where pampering yourself is something you want to do in a space that let’s you let down your guard. Welcome to the confidentially luxurious life at Marvel Kyra. Discover a residence made for your discreet extravagances. A higher order of luxury that goes beyond labels and overt exhibition. Feel like you’re the only person in the world as you set foot inside your grand private lobby. Disappear into your state of the art apartment or duplex. Slip into as much or as Welcome to an indulgent life. little as you take a dip in your private plunge pool or lounge on your own sundeck. -

MAHARASHTRA NATURAL GAS LTD., PUNE (A Joint Venture Company of GAIL and BPCL)

MAHARASHTRA NATURAL GAS LTD., PUNE (A joint venture company of GAIL and BPCL) NOTICE FOR INVITING OFFERS OF LANDS ON LONG-TERM LEASE BASIS FOR GETTING DEALERSHIP OF CNG STATIONS MNGL proposes to appoint dealers for CNG stations at various locations in Pune city and the districts of Sindhudurg & Ramanagara (Karnataka). Land Owners with suitable land who would offer such land on long term lease to MNGL, will be evaluated as per process for grant of Dealership of CNG stations. (Details of locations are attached in Annexures 1,2 and 3). 1. Minimum Plot size of offered land should be as per following table Location Frontage in Depth in M Total Area in Sq. M M (feet) (feet) (Sq. Feet) Within city 20 (66) 31(102) 620 (6732) Other road other than NH 31(102) 31(102) 961 (10404) NH (Undivided) 35 (115) 35(115) 1225 (13225) NH (divided) 35(115) 45(148) 1575 (17020) Preference will be given to the plot with more frontage 2. Approach road should be minimum 12 meters. 3. The Plot should be with clear & undisputed title for setting up CNG Station. 4. Availability of suitable sites for setting up of CNG stations at the advertised locations is the essence of the project. Accordingly, applicants who “Owns” or have registered long lease for a minimum period of 29 years or who have intention to take land on long term lease and willing to sub-lease it to MNGL would be given weightage over applicants who have only a “Firm Offer” from third parties for obtaining suitable land either on ownership or lease basis. -

€»JIFTBI3 Chapter - 3 Study Area, Data Base and Methodology Data Is the Backbone of Any Research

S,s. ,^ ,M-,td rally'.; •••? /''?'„ •"•'":X-, . "t^ To Mum 12a i •5 \ 'f^ P •: • o c1« <> ^jLine vlH ••^''^ m ^j ,, ^^ , Mula Mutha river NH-i Vi.- €»JIFTBI3 Chapter - 3 Study area, Data base and Methodology Data is the backbone of any research Pune the city, selected for the study of urban sprawling is one of the fast developing urban agglomerations in Asia and ranks eight at national level (Census 2001). It has grown manifolds over the past two decades in terms of population, area and habitation. The city limits have expanded considerably and areas like Aundh, Kothrud and others were mere villages a decade ago have emerged as one of the fastest growing suburbs. From the cosmopolitan areas of the camp to the traditional city area and the Deccan- the educational hub, Pune in all of its localities offers everything a society needs. The growth and development of the city is likely to continue in the coming decades and therefore there will be a need for judicious planning and management, while improving the existing infrastructural facilities. In order to monitor this rapid development, it is essential to go for modem tools and sophisticated techniques such as Remote Sensing and GIS, to prepare and continuously update the existing land use maps and other relevant informations. 3.1 Geographical setting: Pune city lies between latitudes 18°25'N and 18°37'N and longitudes between 73°44'E and 73° 57'E and cover an area of 243.96 sq.km. It is located in a saucer shaped basin at an average altitude of 560m from m.s.l. -

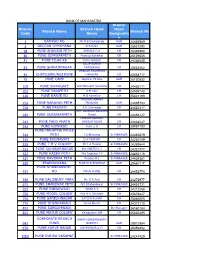

Branch Code Branch Name Branch Head Name Branch Head

BANK OF MAHARASTRA Branch Branch Branch Head Head Branch Name Branch No Code Name Designatio n 1 BAJIRAO RD Mr N S Deshpande AGM 24456969 3 DECCAN GYMKHANA D B Doke AGM 25531290 28 PUNE BHAVANI PETH BOROLE C N CM 26385850 40 PUNE SOMWARPETH Pramod Kahalkar CM 26129006 41 PUNE TILAK RD Joshi Abhijjet CM 24336635 DILIP KUMAR 43 PUNE SHIVAJINAGAR PANIGRAHI CM 25533462 DEOKAR RAVINDRA 49 CHATUSHRUNGI PUNE NARAYAN CM 25538717 76 PUNE CAMP Joglekar Mrudul AGM 26130582 100 PUNE SWARGATE BIPINBIHARI SHARMA CM 24436111 102 PUNE NAVIPETH S M Kale CM 24539140 116 PUNE KARVE RD M B Kanetkar CM 25441199 JAISWAL ANAND 154 PUNE NARAYAN PETH PRAKASH AGM 24495783 158 PUNE PARVATI A.B.Shendage CM 24421411 Mrs. Sushama Ravindra 185 PUNE GURUWARPETH Tiwari CM 24488127 UMESHCHANDRA 243 PUNE PAUD PHATA GANESH JOSHI CM 25434247 244 PUNE KOTHRUD Joshi S D CM 25457103 PUNE MAHATMA PHULE 314 PETH J G Bhalerao Sr.MANAGER 24482879 315 PUNE PADMAVATI D K PARMAR CM 24230109 320 PUNE T M V COLONY Mr J A Thakar Sr.MANAGER 24269644 321 PUNE SAHAKARNAGAR Mrs MISTRY L J CM 24222777 322 PUNE KASBA PETH Mrs Joglekar J J Sr.MANAGER 24433116 325 PUNE RAVIWAR PETH Pendse M J Sr.MANAGER 24434381 330 ERANDAWANA SUNITA B BHOSALE AGM 25660117 PUNE SHANKARSHET 335 RD MNLN PHANI CM 26452776 340 PUNE SALISBURY PARK Mr. S R Auti CM 24272977 675 PUNE SHANIWAR PETH Ajit Bhatwadekar Sr.MANAGER 24451731 707 PUNE BIBWEWADI WANI S S CM 24212268 750 PUNE MODEL COLONY Mrs N V Shevade CM 25678827 756 PUNE GANESHNAGAR SATISH KUMAR CM 25466005 776 PUNE DHANKAWADI Javed Qasim CM 24373110 822 PUNE SANGAMWADI Dy.Manager 26160184 852 PUNE MAYUR COLONY Kolagatram BM CM 25430495 CORPORATE BRANCH KANTH SHISHIRNATH 941 PUNEI NARPATI AGM 25512584 970 PUNE KARVE NAGAR KOMMAWAR.V.G. -

Pune Municipal Corporation Officer

Pune Municipal Corporation Officer Name Desg. & Address Office Residence Shri.Jagtap Prashant Sudam 25501010 Mayor, Pune. Fax – 25501012 9822651448 Building O-2, Sacred Heart Town, 26856575 Jagtap Nagar Chowk, Wanwadi, [email protected] Pune – 40. [email protected] Shri.Algude Mukari Anna 25501015 9823031331 Dy.Mayor, Pune. 25661314 S.No.1001, Juni Wadarwadi, Pune 16. [email protected] Shri.Bodke Dipak aka Balasaheb Kaluram 25501017 9623443088 Adhyaksh, Standing Committee Shriram Geeta Niwas, 399, Shivajinagar Gavthan, Pune – 05. Shri.Kemse Shankar Dattatray 25501021 Leader of House 25501022 9822901999 S.No.78,Shivdatt Plaza, Near P.M.T. [email protected] Depot, Kothrud, Paud Road, Pune – 38. Shri.Arvind Tukaram Shinde 25501030 9822020005 Opposition Leader & Party Leader [email protected] Indian National Congress Party 11, Wilson Garden Road, Pune Station, Pune – 01. Shri.Kakade Vasanti Jayant 25534218 Adhyaksh, Shikshan Mndal, Mulberry Garden, Bunglow No.29, 30 Kakade Villa, Magarpatta City,Hadapsar, Pune – 28. Shri.Nooruddin Ali Somji 25535134 9822096666 Up-Adhyaksh, Shikshan Mandal [email protected] River Heaven, Narangi Baug, Boat Club Road, Pune – 01. Pune Municipal Corporation Corporators Name Address Office Residence Ward No.1A ---------- ---------- ---------- ---------- Ward No.1B ---------- ---------- ---------- - --------- Ward No.2A 49/2, Pathare Complex, 9850550777 Shri.Pathare Mahendra Pandharinath Chandannagar, Pune – 14. [email protected] Ward No.2B Anand Niwas, S.No.9, 9822006300 Sau.Pathare Sanjila Bapusaheb Tukaram Nagar, Kharadi, Pune. 27010396 27014077 [email protected] Ward No.3A S.No.47/5A, Sainagar 9689937674 Sau.Kalamkar Usha Dnyaneshwar Chandananagar, Kharadi, 9922660111 Pune – 14. Ward No.3B Ganga Constella, 9422517031 Shri.Pathare (Patil) Mahadev Bhiku Building No.2, Flat No.205, 8888068808 Kharadi , Pune – 14. -

Major Software Companies S.No

Major software companies S.No. Name Address Telephone Website 1 AccelTree Software Pvt Ltd 305, "Pride Kumar +91-20-6603-3122 / www.acceltree.com Senate", 2565-2550 Senapati Bapat Road, Shivaji Nagar, PUNE 411016 2 Accenture Services Pvt Ltd Level 6 & 7, Cybercity +91 20 66253000 www.accenture.com/ Tower 5 Magarpatta city Hadapsar-Mundhwa Road Pune 411 028 3 Advent Software Ltd AFL House, +91-20-26051986 www.adventsoftware.net 347 A, Off Dhole Patil Road, Pune - 411001 4 Amdocs Development Centre Cyber City Tower 2, +91 (0)202 6703000 www.amdocs.com/ India Pvt Ltd 6th Floor Magarpatta City Hadapsar, Pune, 411 028 5 Avaya GlobalConnect Ltd 1st FLOOR, 113-116, 91-20-66075333 www.avayaglobalconnect.com PRIDE SILICON PLAZA, 106A/2A/7, SHIVAJINAGAR, 5 Avaya GlobalConnect Ltd 91-20-66075333 www.avayaglobalconnect.com SENAPATI BAPAT ROAD, PUNE - 411016 6 Bentley Systems India Pvt 403, Godrej Eternia-C, +91 20 6602 1000 www.bentley.com/sa-IN/ Ltd Wakdewadi, Shivajinagar, Pune 411 005 7 BMC Software India Pvt Ltd Tower A, ICC Tech www.bmc.com Park Senapati Bapat Road Pune - 411 016 8 Brainvisa Technologies Pvt Windsor Commerce +91-20-27205000, +91- www.brainvisa.com Ltd 20-27205001, +91-20- 30212400 Survey No. 2/8/1, Opp. Baner Telephone Exchange, Baner Road, Baner, Pune 411 045, 9 CalSoft Private Limited Astrix Plaza +91 (20) 3985 2900 , www.calsoftinc.com +91 (20) 2729 2448 Survey No 270/1/23 Baner Road Pune 411045 10 CashTech Solutions India Pvt 201, Pride Parmar +91-20- 6605 2000 www.cash-tech.com Ltd Galaxy Connaught Road Pune - 411 001 11 Centre for Development of Pune University +91-20-2570-4100 www.cdac.in Advanced Computing (C - Campus DAC) Ganesh Khind Pune - 411 007 12 CG-CoreEL Logic Systems Surya Bhavan, 1181 5533982/5538362 Ltd Gergusson College Road, Pune 411 005 13 Cirruslogic Software (India) 106-A, Muttha 5671092 Pvt.