Japan Regarding a Framework for Intergovernmental Cooperation to Facilitate the Implementation of Fatca and Improve International Tax Compliance

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Geography's Importance to Japan's History

RESOURCES ESSAYS of the present and become better prepared — Japan has many earth- geography’s for challenges of the future. Space in one quakesgeology because of its position on the Pacific article does not permit a comprehensive plan “Ring of Fire.” The Pacific Plate moves a importance to with all the possible ways to incorporate few inches a year westward into the Philip- Japan’s historical geography into the class- pine and Eurasian Plates. In addition, there Japan’s Historyby Patrick Grant room. This article, instead, offers a few is a complex system of faults on the Japan- ideas for applying these two standards by ese islands. The 1923 earthquake, with the addressing some important geographical resultant fire, destroyed much of Tokyo and apan’s geography has been and is a concepts. most of Yokohama. Some 100,000 people crucial factor in its history. Geology, The article touches upon many specific perished in this disaster. Only twenty sec- location, patterns of settlement, trans- issues that teachers will find interesting for onds of shaking killed 5,480 people in the J port, and economic development are discussions in the classroom. The brief 1995 Hanshin-Awaji quake around K¬be.3 strongly influenced by spatial considera- introduction to geology gives background to The rebuilding of this area is rapidly pro- tions. Our appreciation of any historical the earthquake hazard. Scarcity of space, gressing, but there are still thousands of dis- issue is greatly enhanced by learning how covered in the next section, has helped to located people two years after the quake. -

Geography & Climate

Web Japan http://web-japan.org/ GEOGRAPHY AND CLIMATE A country of diverse topography and climate characterized by peninsulas and inlets and Geography offshore islands (like the Goto archipelago and the islands of Tsushima and Iki, which are part of that prefecture). There are also A Pacific Island Country accidented areas of the coast with many Japan is an island country forming an arc in inlets and steep cliffs caused by the the Pacific Ocean to the east of the Asian submersion of part of the former coastline due continent. The land comprises four large to changes in the Earth’s crust. islands named (in decreasing order of size) A warm ocean current known as the Honshu, Hokkaido, Kyushu, and Shikoku, Kuroshio (or Japan Current) flows together with many smaller islands. The northeastward along the southern part of the Pacific Ocean lies to the east while the Sea of Japanese archipelago, and a branch of it, Japan and the East China Sea separate known as the Tsushima Current, flows into Japan from the Asian continent. the Sea of Japan along the west side of the In terms of latitude, Japan coincides country. From the north, a cold current known approximately with the Mediterranean Sea as the Oyashio (or Chishima Current) flows and with the city of Los Angeles in North south along Japan’s east coast, and a branch America. Paris and London have latitudes of it, called the Liman Current, enters the Sea somewhat to the north of the northern tip of of Japan from the north. The mixing of these Hokkaido. -

Japan-Malaysia Economic Partnership

JAPAN-MALAYSIA ECONOMIC PARTNERSHIP JOINT STUDY GROUP REPORT December 2003 Contents 1. Background 2. Overview 3. Main Points of the Discussions 3-1. Liberalization and Facilitation of Trade and Investment (1) Trade in Goods (2) Rules of Origin (3) Trade in Services (4) Investment (5) Movement of Natural Persons (6) Government Procurement (7) Customs Procedures (8) Paperless Trading (9) Standards and Conformance (10) Intellectual Property (11) Competition Policy (12) Business Environment Enhancement 3-2. Cooperation 1 1. Background (1) During his visit to five ASEAN countries including Malaysia in January 2002, the Prime Minister of Japan, H.E. Mr. Junichiro Koizumi, proposed the “Initiative for Japan-ASEAN Comprehensive Economic Partnership”, to which the then Prime Minister of Malaysia, H.E. Tun Dr. Mahathir bin Mohamad gave his full support. (2) At the Japan-ASEAN Forum held in Yangon in April 2002, Vice Ministerial- level representatives of Japan and ASEAN countries discussed ways to follow up the Initiative for Japan-ASEAN Comprehensive Economic Partnership and decided to explore economic partnership in a bilateral framework, as well as to study possible areas and frameworks for the partnership between Japan and the whole of ASEAN. (3) At the Japan-ASEAN Summit held in Phnom Penh, Cambodia in November 2002, leaders of Japan and ASEAN countries “endorsed the approach that, while considering a framework for the realization of a Comprehensive Economic Partnership between Japan and ASEAN as a whole, any ASEAN member country and Japan could initiate works to build up a bilateral economic partnership.” (4) The proposed initiative to create the economic partnership between Japan and Malaysia by the then Prime Minister Tun Dr. -

Geography in Japan

GeographyReligion in in Japan Japan Purpose: This lesson will enable students to develop basic knowledge of Japan’s physical geography including absolute and relative location, factors contributing to climate, and temperature comparisons with the United States. Target Grade Level: 6-7 Essential questions: · What are the physical features of Japan? · Where is Japan located? · What effects do location, elevation, and ocean currents have on the climate of Japan? · How do temperatures in Japan compare to temperatures in the United States? Rationale: Location and physical features of a country affect climate. Key Ideas: · Japan is an island nation. · Japan is an archipelago similar to other archipelagoes in the Pacific (Hawaii, Philippines, Micronesia). · Japan is an archipelago similar to other archipelagoes in the Pacific (Hawaii, Philippines, Micronesia). · Japan stretches from 25 to 45 degrees N latitudes and from 128 to 145 degrees E longitudes. · Japan is an island nation consisting of four main islands (Honshu, Hokkaido, Shikoku, and Kyushu) and many small islands. · The Pacific Ocean is on the south and east of Japan and the Sea of Japan is on the north and west of Japan. · Japan is east of Korea and China, north of the equator, and east of the Prime Meridian. · If super imposed on the U. S., Japan would stretch from Tampa Florida to Montreal. · Japan has many of the same climates, as we would find in the United States. Learning AboutLessons Our Worldabout Japan - 143 GeographyReligion in of Japan Japan Materials: · Wall maps, globes, -

The Issue of Diversity and Multiculturalism in Japan

Jie Qi & Sheng Ping Zhang The Issue of Diversity and Multiculturalism in Japan THE ISSUE OF DIVERSITY AND MULTICULTURALISM IN JAPAN Jie Qi Utsunomiya University, Japan Sheng Ping Zhang Meijo University, Japan Paper presented at the Annual Meeting of the American Educational Research Association March 24-29, 2008 New York In Session: Internationalization and Globalization in the Curriculum 1 Jie Qi & Sheng Ping Zhang The Issue of Diversity and Multiculturalism in Japan THE ISSUE OF DIVERSITY AND MULTICULTYRALISM IN JAPAN The purpose of this paper is to problematize that which has been taken for granted about the notion of multiculturalism in Japan. Multiculturalism is a novel issue in Japan. As the Japanese government started to promote “internationalization” since 1980’s, slogans such as “international exchange,” “cultural exchange,” “understanding of other cultures,” etc, have become the most popular hackneyed expressions among policy maker and educators. This paper demonstrates that the notion of multiculturalism in Japan is intricately and deeply embedded in Japanese society, Japanese culture and the Japanese educational system and that this type of multiculturalism excludes ethnic groups which have lived in Japan since old times. Firstly, the intention in this study is to interrupt the assumptions about homogeneous nation in Japanese educational discourse as have been accepted since the end of World War II. I assert that Japan is not homogeneous nation rather a society with diverse cultural groups. Secondly, this paper traces the path of the past notion of multiculturalism as embodied in the Japanese political, social and cultural conditions. In undertaking this I first look at the way cultural studies emerged in the 1980’s which created a new image of cultural studies. -

The U.S. Must Limit Damage from the Japan–South Korea Trade Dispute Bruce Klingner and Riley Walters

BACKGROUNDER No. 3429 | AUGUST 7, 2019 ASIAN STUDIES CENTER The U.S. Must Limit Damage from the Japan–South Korea Trade Dispute Bruce Klingner and Riley Walters apan and South Korea have recently imposed KEY TAKEAWAYS rulings that impact each other’s financial inter- ests—and risk triggering a strategic trade war. The U.S. government has an important J Strained bilateral economic relations undermine U.S. role to play in mediating the relationship diplomatic and security coordination that is necessary between Tokyo and Seoul and protecting vital trilateral security coordination. for dealing with the North Korean threat. Japanese–South Korean relations suffer from centuries of built-up animosity from sensitive histor- The current situation puts U.S. strategic ical issues and sovereignty disputes. Cyclical spikes goals at risk. Japan and South Korea are in tensions are triggered by incidents that unleash important economic partners and the nationalist furor in both countries. Yet during these foundation of U.S. foreign policy in Asia. outbreaks, bilateral economic and security sectors were never involved at any official level and, instead, To safeguard those objectives, the U.S. served as moderating influences. That changed for the must get directly involved as a behind- worse last year. the-scenes facilitator, helping the two The U.S. government has an important role to allies reach a compromise. play in mediating the relationship between its two allies. Tokyo and Seoul must not allow historical This paper, in its entirety, can be found at http://report.heritage.org/bg3429 The Heritage Foundation | 214 Massachusetts Avenue, NE | Washington, DC 20002 | (202) 546-4400 | heritage.org Nothing written here is to be construed as necessarily reflecting the views of The Heritage Foundation or as an attempt to aid or hinder the passage of any bill before Congress. -

Different Customs Cambodia and Japan

行ってきました� 海外体験記 米国フォーサイス研究所を n Different customs o t 大学院工学研究科知能情報工学専攻 博士前期課程2年 s o between B NHOR SOK LANG ニューソックラン [カンボジア] 訪れて Cambodia and Japan 徳島大学病院(歯科)むし歯科 中西 正 なかにし ただし My name is NHOR SOK LANG, 2004年3月から2年間、米国マサチュ として数多くの若者が集まってきます。気 私の滞在中のテ a second-year master student in the ーセッツ州ボストンのフォーサイス研究所 候面では、徳島に比べると冬が長い上に ーマは「歯周病の病 Department of Information Science 免疫学研究室にて研究に従事しました。 かなり寒く、マイナス20℃以下になった 態 形 成における制 御 性 and Intelligent Systems, ボストンは、ヨーロッパの雰囲気を有する 日や一晩の降雪量75cmという日も体験 樹状細胞の役割」を明らかにする The University of Tokushima, Japan. レンガ造りの町並みと近代的な高層ビル しました。芸術・文化面においては、ボス ことであり、主に培養細胞を用いた実験 Cambodia is located in the equator- が入り交じり、歴史的にはアメリカ独立の トン美術館やボストン交響楽団が有名で 系にて研究を進めました。その結果、歯 ial tropical region of Southeast Asia. 舞台になった町です。ボストン周辺には、 あり、プロスポーツチームもMLB、NFL、 肉上皮由来細胞が免疫調節機能を有す There are only two seasons in Cambo- ハーバード大学やマサチューセッツ工科 NBA、NHLの4大プロスポーツがすべて る樹状細胞の誘導に関与するという知見 dia, the summer season and the rainy 大学など60ほどの大学が密集しており、 揃っています。なかでも、2 0 0 4 年 は を得ました。滞在期間中、不慣れな英語 season. It is almost always hot そのためボストンは全米有数の学園都市 MLBのレッドソックスがワールドシリーズ ながらも討論を行ったうえで研究できた throughout the year, and the highest 。 を制し、「バンビーノの呪い」が解けたこ ことは、非常に有意義であったと感じてい temperature is 40C in April and the 。 lowest is just 20C in December. So とで街中大賑わいでした。 ます。 Cambodians love to take a bath with フォーサイス研究所はボストンの中心 異国の地で生活するにあたり、最も大 cold water as a cultural custom. It desserts, fruits or juices etc. Many peo- lunch at home. Those who study in 部ダウンタウンから南西約2kmのところ 変だったのはアパート探しに始まる生活 gives a very refreshing feeling. As I ple throng to these stalls to buy their the afternoon shift go to school at 1 に位置し、前述のボストン美術館のすぐ近 基盤を確立することでした。医療保険制 am now in Japan during winter, it is wares and exchange gossip. These pm and come back home at 5 pm. Be- くにあります。創設者であるフォーサイス 度など日本とは異なったシステムも多く、 extremely cold for me and I don't feel make the streets in Cambodia full of sides the normal school hours, most 兄弟が1910年に小児歯科診療所を開 最初の数ヶ月は戸惑いの連続でしたが、「郷 so comfortable. -

A Historical Look at Technology and Society in Japan (1500-1900)

A Historical Look at Technology and Society in Japan (1500-1900) An essay based on a talk given by Dr. Eiichi Maruyama at the PART 1 Japan-Sweden Science Club (JSSC) annual meeting, Tokyo, 31 Gunpowder and Biotechnology October 1997. - Ukiyo-e and Microlithography Dr. Maruyama studied science history, scientific philosophy, and phys- In many parts of the world, and Japan was no exception, the 16th ics at the University of Tokyo. After graduating in 1959, he joined Century was a time of conflict and violence. In Japan, a number of Hitachi Ltd., and became director of the company’s advanced re- feudal lords were embroiled in fierce battles for survival. The battles search laboratory in 1985. He was director of the Angstrom Tech- produced three victors who attempted, one after another, to unify nology Partnership, and is currently a professor at the National Japan. The last of these was Ieyasu Tokugawa, who founded a “per- Graduate Institute for Policy Studies. manent” government which lasted for two and a half centuries before it was overthrown and replaced by the Meiji Government in Introduction 1868. Japanese industry today produces many technically advanced prod- ucts of high quality. There may be a tendency to think that Japan One particularly well documented battle was the Battle of Nagashino has only recently set foot on the technological stage, but there are in 1575. This was a showdown between the organized gunmen of numerous records of highly innovative ideas as far back as the 16th the Oda-Tokugawa Allies (two of the three unifiers) and the in- century that have helped to lay the foundations for the technologi- trepid cavalry of Takeda, who was the most formidable barrier to cal prowess of modern day Japan. -

Japan 2019 Crime & Safety Report: Nagoya

Japan 2019 Crime & Safety Report: Nagoya This is an annual report produced in conjunction with the Regional Security Office at the U.S. Embassy in Tokyo, Japan. The current U.S. Department of State Travel Advisory at the date of this report’s publication assesses Japan at Level 1, indicating travelers should exercise normal precautions. Overall Crime and Safety Situation Crime Threats There is minimal risk from crime in Nagoya. Nagoya’s general crime rate is below the U.S. national average. The Sakae and the Naka-ku neighborhoods, south of Nagoya station, are entertainment districts with slightly higher risk. U.S. citizens have been the victims of physical/sexual assaults; drink spiking; drug overdoses; and thefts of purses, wallets, cash, and credit cards at bars or clubs. Non-violent crimes, especially financial crimes that include the use of stolen credit cards and credit card numbers, occur on a regular basis. Violent crime is rare. A very small number of homicides occur in/around Nagoya every year, but there have been no reports of U.S. victims. Crimes against U.S. citizens usually involve personal disputes, theft, or vandalism. Pickpocketing and other petty crimes take place in crowded shopping areas, bars/nightclubs, train stations, and airports. Every year, a small number of U.S. citizens report their passports lost or stolen at Chubu International Airport. Police registered 2,736 burglaries occurred in Aichi Prefecture in 2018, a 25.6% decrease from 2017. Despite the overall drop, the Aichi has had the highest burglary rate in Japan for 12 years in a row. -

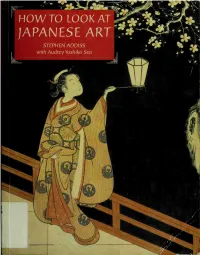

How to Look at Japanese Art I

HOWTO LOOKAT lAPANESE ART STEPHEN ADDISS with Audrey Yos hi ko Seo lu mgBf 1 mi 1 Aim [ t ^ ' . .. J ' " " n* HOW TO LOOK AT JAPANESE ART I Stephen Addi'ss H with a chapter on gardens by H Audrey Yoshiko Seo Harry N. Abrams, Inc., Publishers ALLSTON BRANCH LIBRARY , To Joseph Seuhert Moore Library of Congress Cataloging-in-Publication Data Addiss, Stephen, 1935- How to look at Japanese art / Stephen Addiss with a chapter on Carnes gardens by Audrey Yoshiko Seo. Lee p. cm. “Ceramics, sculpture and traditional Buddhist art, secular and Zen painting, calligraphy, woodblock prints, gardens.” Includes bibliographical references. ISBN 0-8109-2640-7 (pbk.) 1. Art, Japanese. I. Seo, Audrey Yoshiko. II. Title N7350.A375 1996 709' .52— dc20 95-21879 Front cover: Suzuki Harunobu (1725-1770), Girl Viewing Plum Blossoms at Night (see hgure 50) Back cover, from left to right, above: Ko-kutani Platter, 17th cen- tury (see hgure 7); Otagaki Rengetsu (1791-1875), Sencha Teapot (see hgure 46); Fudo Myoo, c. 839 (see hgure 18). Below: Ryo-gin- tei (Dragon Song Garden), Kyoto, 1964 (see hgure 63). Back- ground: Page of calligraphy from the Ishiyama-gire early 12th century (see hgure 38) On the title page: Ando Hiroshige (1797-1858), Yokkaichi (see hgure 55) Text copyright © 1996 Stephen Addiss Gardens text copyright © 1996 Audrey Yoshiko Seo Illustrations copyright © 1996 Harry N. Abrams, Inc. Published in 1996 by Harry N. Abrams, Incorporated, New York All rights reserv'ed. No part of the contents of this book may be reproduced without the written permission of the publisher Printed and bound in Japan CONTENTS Acknowledgments 6 Introduction 7 Outline of Japanese Historical Periods 12 Pronunciation Guide 13 1. -

Human and Physical Geography of Japan Study Tour 2012 Reports

Five College Center for East Asian Studies National Consortium for Teaching about Asia (NCTA) 2012 Japan Study Tour The Human and Physical Geography of Japan Reports from the Field United States Department of Education Fulbright-Hays Group Project Abroad with additional funding from the Freeman Foundation Five College Center for East Asian Studies 69 Paradise Road, Florence Gilman Pavilion Northampton, MA 01063 The Human and Physical Geography of Japan Reports from the Field In the summer of 2012, twelve educators from across the United States embarked on a four-week journey to Japan with the goal of enriching their classroom curriculum content by learning first-hand about the country. Prior to applying for the study tour, each participant completed a 30-hour National Consortium for Teaching about Asia (NCTA) seminar. Once selected, they all completed an additional 20 hours of pre-departure orientation, including FCCEAS webinars (funded by the US-Japan Foundation; archived webinars are available at www.smith.edu/fcceas), readings, and language podcasts. Under the overarching theme of “Human and Physical Geography of Japan,” the participants’ experience began in Tokyo, then continued in Sapporo, Yokohama, Kamakura, Kyoto, Osaka, Nara, Hiroshima, Miyajima, and finally ended in Naha. Along the way they heard from experts on Ainu culture and burakumin, visited the Tokyo National Museum of History, heard the moving testimony of an A-bomb survivor, toured the restored seat of the Ryukyu Kingdom, and dined on regional delicacies. Each study tour participant was asked to prepare a report on an assigned geography-related topic to be delivered to the group in country and then revised upon their return to the U.S. -

Why Was Japan Hit So Hard by the Global Financial Crisis?

ADBI Working Paper Series Why was Japan Hit So Hard by the Global Financial Crisis? Masahiro Kawai and Shinji Takagi No. 153 October 2009 Asian Development Bank Institute ADBI Working Paper 153 Kawai and Takagi Masahiro Kawai is the dean of the Asian Development Bank Institute. Shinji Takagi is a professor, Graduate School of Economics, Osaka University, Osaka, Japan. This is a revised version of the paper presented at the Samuel Hsieh Memorial Conference, hosted by the Chung-Hua Institution for Economic Research, Taipei,China 9–10 July 2009. The authors are thankful to Ainslie Smith for her editorial work. The views expressed in this paper are the views of the authors and do not necessarily reflect the views or policies of ADBI, the Asian Development Bank (ADB), its Board of Directors, or the governments they represent. ADBI does not guarantee the accuracy of the data included in this paper and accepts no responsibility for any consequences of their use. Terminology used may not necessarily be consistent with ADB official terms. The Working Paper series is a continuation of the formerly named Discussion Paper series; the numbering of the papers continued without interruption or change. ADBI’s working papers reflect initial ideas on a topic and are posted online for discussion. ADBI encourages readers to post their comments on the main page for each working paper (given in the citation below). Some working papers may develop into other forms of publication. Suggested citation: Kawai, M., and S. Takagi. 2009. Why was Japan Hit So Hard by the Global Financial Crisis? ADBI Working Paper 153.