1 the AFFECT HEURISTIC and RISK the Affect Heuristic

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Critical Thinking and Debiasing: Experimentation in an Academic Writing Course

JAPAN ASSOCIATION FOR LANGUAGE TEACHING JALT2019 • TEACHER EFFICACY, LEARNER AGENCY NOVEMBER 1–4, 2019 • NAGOYA, JAPAN Critical Thinking and Debiasing: Experimentation in an Academic Writing Course esearch and interest in cognitive heuristics (shortcuts in thinking) and cognitive Guy Smith R biases (thinking predispositions or tendencies) has grown rapidly in the past 10 to 15 years. What is known about cognitive biases today owes much to work drawn from International Christian University behavioral economics, social psychology, decision making, and error studies. Recently, the cognitive bias discussion has found a much wider audience with the publication John Peloghitis of popular science books such as Nudge by Richard Thaler and Cass Sunstein (2008), International Christian University Predictably Irrational by Dan Ariely (2009), Daniel Kahneman’s Thinking, Fast and Slow (2011), and Robert Cialdini’s Pre-suasion (2016). These books provided the general public with a fascinating and, in some ways, unsettling look into how we think. The Reference Data: research demonstrated that judgments and decisions often emerge from taking thinking Smith, G., & Peloghitis, J. (2020). Critical thinking and debiasing: Experimentation in an academic shortcuts, relying on our intuitions and feelings, and attending to certain stimuli while writing course. In P. Clements, A. Krause, & R. Gentry (Eds.), Teacher efficacy, learner agency. ignoring others. Some of the biases that emerge from these cognitive processes include Tokyo: JALT. https://doi.org/10.37546/JALTPCP2019-51 confirmation bias (to look for or interpret information that confirms a previous belief), in- group bias (a tendency to favor members of your in-groups) and the aptly named ostrich In the last two decades, interest in cognitive biases has rapidly grown across various fields of effect (the tendency to ignore negative situations). -

Contingent Reliance on the Affect Heuristic As a Function of Regulatory Focus

Contingent Reliance on the Affect Heuristic as a Function of Regulatory Focus Michel Tuan Pham Tamar Avnet Results from four studies show that the reliance on affect as a heuristic of judgment and decision-making is more pronounced under a promotion focus than under a prevent ion focus. Two different manifestations of this phenomenon were observed. Studies 1–3 show that different type s of affective inputs are weighted more heavily under promotion than under prevention in person-impression formation, product evaluations, and social recommendations. Study 4 additionally shows that valuations performed under promotion are more scope- insensitive—a characteristic of affect-based valuations—than valuations performed under prevention. The greater reliance on affect as a heuristic under promotion seems to arise because promotion-focused individuals tend to find affective inputs more diagnostic, not because promotion increases the reliance on peripheral information per se. Although decision research has historically focused affective responses to make judgments and decisions, on the cognitive processes underlying decision making, to begin with? a growing body of research from multiple disciplines The purpose of this research is to test the suggests that affective processes play an important role hypothesis that an important determinant of the as well. In particular, there is strong evidence that reliance on affect as a heuristic for evaluations and decisions are often based on subjective affective decisions is the self-regulatory orientation of the responses to the options, which appear to be seen as decision-maker. Building on recent findings by Pham indicative of the options’ values (Bechara, Damasio, and Avnet (2004), we propose that the reliance on Tranel, & Damasio, 1997; Loewenstein, Weber, Hsee, affect as an evaluation heuristic is more pronounced & Welch, 2001; Pham, 1998; Schwarz & Clore, 1983). -

Mechanisms in Risky Choice Framing

Mechanisms in Risky Choice Framing Affective Responses and Deliberative Processing Liva Jenny Martinussen Master of Philosophy in Psychology, Cognitive Neuroscience Department of Psychology University of Oslo April 2016 II Mechanisms in Risky Choice Framing: Affective Responses and Deliberative Processing By Liva Jenny Martinussen Department of Psychology UNIVERSITY OF OSLO III © Liva Jenny Martinussen 2016 Mechanisms in Risky Choice Framing: Affective responses and Deliberative Processing Author: Live Jenny Martinussen http://www.duo.uio.no/ IV Summary Author: Liva Jenny Martinussen Supervisors: Anine Riege (Supervisor) and Unni Sulutvedt (Co-Supervisor) Title: Mechanisms in Risky Choice Framing: Affective Responses and Deliberative Processing Background: The risky choice framing effect is a decision making bias, where people tend to be risk-averse when options are presented as gains and risk-seeking when options are presented as losses, although the outcomes are objectively equivalent. The mechanisms involved in risky choice framing effects are still not fully understood. Several individual differences are assumed to moderate the processing of framing tasks and the magnitude of framing effects. Objectives: The aim of the current study was to investigate the framing effect across six framing task in a within-subject design, and explore whether gain and loss frames were associated with different levels of affective responses and deliberative processing. An additional aim was to investigate how individual differences in emotion management ability and numeracy affected performance and processing of framing tasks. Method: The study was an independent research project and the author collected all the data. Eye-tracking technology was employed; number of fixations, duration of fixations, repeated inspections of options and pupil dilations were recorded from 80 predominantly young adults while performing on six framing tasks. -

The Law of Implicit Bias

The Law of Implicit Bias Christine Jolls† Cass R. Sunstein†† Considerable attention has been given to the Implicit Association Test (IAT), which finds that most people have an implicit and unconscious bias against members of traditionally disadvantaged groups. Implicit bias poses a special challenge for antidiscrimination law because it suggests the pos- sibility that people are treating others differently even when they are un- aware that they are doing so. Some aspects of current law operate, whether intentionally or not, as controls on implicit bias; it is possible to imagine other efforts in that vein. An underlying suggestion is that implicit bias might be controlled through a general strategy of “debiasing through law.” Introduction Consider two pairs of problems: 1A. A regulatory agency is deciding whether to impose new restric- tions on cloning mammals for use as food. Most people within the agency believe that the issue is an exceedingly difficult one, but in the end they support the restrictions on the basis of a study suggesting that cloned mammals are likely to prove unhealthy for human consumption. The study turns out to be based on palpable errors. 1B. A regulatory agency is deciding whether to impose new restric- tions on cloning mammals for use as food. Most people within the agency believe that the issue is an exceedingly difficult one, but in the end they support the restrictions on the basis of a “gut feeling” that cloned mammals are likely to be unhealthy to eat. It turns out that the “gut feeling,” spurred Copyright © 2006 California Law Review, Inc. -

Cognitive Biases Potentially Affecting Judgment of Global Risks Forthcoming in Global Catastrophic Risks, Eds

Cognitive biases potentially affecting judgment of global risks Forthcoming in Global Catastrophic Risks, eds. Nick Bostrom and Milan Cirkovic Draft of August 31, 2006. Eliezer Yudkowsky ([email protected]) Singularity Institute for Artificial Intelligence Palo Alto, CA Introduction1 All else being equal, not many people would prefer to destroy the world. Even faceless corporations, meddling governments, reckless scientists, and other agents of doom, require a world in which to achieve their goals of profit, order, tenure, or other villainies. If our extinction proceeds slowly enough to allow a moment of horrified realization, the doers of the deed will likely be quite taken aback on realizing that they have actually destroyed the world. Therefore I suggest that if the Earth is destroyed, it will probably be by mistake. The systematic experimental study of reproducible errors of human reasoning, and what these errors reveal about underlying mental processes, is known as the heuristics and biases program in cognitive psychology. This program has made discoveries highly relevant to assessors of global catastrophic risks. Suppose you're worried about the risk of Substance P, an explosive of planet-wrecking potency which will detonate if exposed to a strong radio signal. Luckily there's a famous expert who discovered Substance P, spent the last thirty years working with it, and knows it better than anyone else in the world. You call up the expert and ask how strong the radio signal has to be. The expert replies that the critical threshold is probably around 4,000 terawatts. "Probably?" you query. "Can you give me a 98% confidence interval?" "Sure," replies the expert. -

Heuristics & Biases Simplified

University of Pennsylvania ScholarlyCommons Master of Behavioral and Decision Sciences Capstones Behavioral and Decision Sciences Program 8-9-2019 Heuristics & Biases Simplified: Easy ot Understand One-Pagers that Use Plain Language & Examples to Simplify Human Judgement and Decision-Making Concepts Brittany Gullone University of Pennsylvania Follow this and additional works at: https://repository.upenn.edu/mbds Part of the Social and Behavioral Sciences Commons Gullone, Brittany, "Heuristics & Biases Simplified: Easy to Understand One-Pagers that Use Plain Language & Examples to Simplify Human Judgement and Decision-Making Concepts" (2019). Master of Behavioral and Decision Sciences Capstones. 7. https://repository.upenn.edu/mbds/7 The final capstone research project for the Master of Behavioral and Decision Sciences is an independent study experience. The paper is expected to: • Present a position that is unique, original and directly applies to the student's experience; • Use primary sources or apply to a primary organization/agency; • Conform to the style and format of excellent academic writing; • Analyze empirical research data that is collected by the student or that has already been collected; and • Allow the student to demonstrate the competencies gained in the master’s program. This paper is posted at ScholarlyCommons. https://repository.upenn.edu/mbds/7 For more information, please contact [email protected]. Heuristics & Biases Simplified: Easy ot Understand One-Pagers that Use Plain Language & Examples to Simplify Human Judgement and Decision-Making Concepts Abstract Behavioral Science is a new and quickly growing field of study that has found ways of capturing readers’ attention across a variety of industries. The popularity of this field has led to a wealth of terms, concepts, and materials that describe human behavior and decision making. -

Influence of Cognitive Biases in Distorting Decision Making and Leading to Critical Unfavorable Incidents

Safety 2015, 1, 44-58; doi:10.3390/safety1010044 OPEN ACCESS safety ISSN 2313-576X www.mdpi.com/journal/safety Article Influence of Cognitive Biases in Distorting Decision Making and Leading to Critical Unfavorable Incidents Atsuo Murata 1,*, Tomoko Nakamura 1 and Waldemar Karwowski 2 1 Department of Intelligent Mechanical Systems, Graduate School of Natural Science and Technology, Okayama University, Okayama, 700-8530, Japan; E-Mail: [email protected] 2 Department of Industrial Engineering & Management Systems, University of Central Florida, Orlando, 32816-2993, USA; E-Mail: [email protected] * Author to whom correspondence should be addressed; E-Mail: [email protected]; Tel.: +81-86-251-8055; Fax: +81-86-251-8055. Academic Editor: Raphael Grzebieta Received: 4 August 2015 / Accepted: 3 November 2015 / Published: 11 November 2015 Abstract: On the basis of the analyses of past cases, we demonstrate how cognitive biases are ubiquitous in the process of incidents, crashes, collisions or disasters, as well as how they distort decision making and lead to undesirable outcomes. Five case studies were considered: a fire outbreak during cooking using an induction heating (IH) cooker, the KLM Flight 4805 crash, the Challenger space shuttle disaster, the collision between the Japanese Aegis-equipped destroyer “Atago” and a fishing boat and the Three Mile Island nuclear power plant meltdown. We demonstrate that heuristic-based biases, such as confirmation bias, groupthink and social loafing, overconfidence-based biases, such as the illusion of plan and control, and optimistic bias; framing biases majorly contributed to distorted decision making and eventually became the main cause of the incident, crash, collision or disaster. -

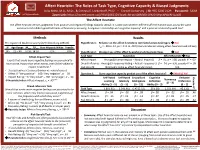

Affect Heuristic: the Roles of Task Type, Cognitive Capacity, And

Affect Heuristic: The Roles of Task Type, Cognitive Capacity & Biased Judgments Julia Nolte, M.A., M.Sc., & Corinna E. Löckenhoff, Ph.D. – Cornell University | ID: 965 6206 2129 Password: SJDM [email protected] Zoom Link: https://cornell.zoom.us/j/96562062129?pwd=MFptTDBMV0c1VFZ0TWpsWVpiRFJLZz09 The Affect Heuristic The affect heuristic derives judgments from positive and negative feelings towards stimuli. It is unknown whether different affect heuristic tasks assess the same construct and exhibit typical hallmarks of heuristic processing: A negative relationship with cognitive capacity1 and a positive relationship with bias2. Methods Results Pre-registered Qualtrics survey (AsPredicted.org #29144) Hypothesis 1: Reliance on the affect heuristic is correlated across task types. ! No! rρs = -.09 to .12, ps = .111 to .494 (inter-correlation among affect heuristic task indices) N Age Range Mage SDage Non-Hispanic White Female 195 21 – 90 52.95 18.10 71% 50% Hypothesis 2: Stronger use of the affect heuristic predicts greater bias. ! No! Affect-Impact Task Task Type Bias Index Affect Heuristic ! Bias Events that evoke more negative feelings are perceived to Affect-Impact Average(|Human Impact – Natural Impact|) β = .05, p = .508, pseudo-R2 = .00 have worse impact than other events, even if their objective Dread-Inference Average(|Frequency Rating – Actual Frequency|) β = -.04, p = .636, pseudo-R2 = .99 impact is identical. 3 Risk-Benefit N/A (same index as affect heuristic index) N/A • 3 catastrophes x 2 causes (human vs. natural cause) • Affect: -

A Heuristics Approach to Understanding Cancer Risk Perception: Contributions from Judgment and Decision-Making Research Ellen Peters, Ph.D

A Heuristics Approach to Understanding Cancer Risk Perception: Contributions From Judgment and Decision-Making Research Ellen Peters, Ph.D. Decision Research, Eugene, Oregon and University of Oregon Kevin D. McCaul, Ph.D. North Dakota State University Michael Stefanek, Ph.D. and Wendy Nelson, Ph.D. National Cancer Institute ABSTRACT uncertainty, patient understanding of risk is a critical part of the Background: The likelihood judgments that people make decision-making process (3–5). For example, a man who elects about their risks for cancer have important implications. At the to screen for prostate cancer by having a prostate-specific anti- individual level, risk estimates guide protective actions, such as gen test would need to weigh the potential positive and negative cancer screening. However, at the extremes, exaggerated risk outcomes of the test (e.g., cancer detection, unnecessary anxiety judgments can also lead to anxiety that degrades quality of life from a detected cancer whose best treatment is watchful wait- or to aggressive self-protective actions that are unwarranted ing) with the likelihood of each outcome. At a policy level, risk given the objective risks. At the policy level, risk judgments may judgments may reflect societal perceptions of cancer prevention serve as an indicator of societal perceptions of the “war” and control efforts. For example, news reports describing ele- against cancer. Using risk judgments, the public expresses its vated rates of cancer in Long Island, NY, or Marin County, CA belief about whether we are winning. Purpose: We present theo- (so-called cancer clusters) may be interpreted to mean that we retical perspectives from judgment and decision making, illus- are losing the “war on cancer” even though the objective exis- trate how they can explain some of the existing empirical find- tence of these cancer clusters remains an open question (6). -

Hazardous Heuristics Cass R

University of Chicago Law School Chicago Unbound Public Law and Legal Theory Working Papers Working Papers 2002 Hazardous Heuristics Cass R. Sunstein Follow this and additional works at: https://chicagounbound.uchicago.edu/ public_law_and_legal_theory Part of the Law Commons Chicago Unbound includes both works in progress and final versions of articles. Please be aware that a more recent version of this article may be available on Chicago Unbound, SSRN or elsewhere. Recommended Citation Cass R. Sunstein, "Hazardous Heuristics" (University of Chicago Public Law & Legal Theory Working Paper No. 33, 2002). This Working Paper is brought to you for free and open access by the Working Papers at Chicago Unbound. It has been accepted for inclusion in Public Law and Legal Theory Working Papers by an authorized administrator of Chicago Unbound. For more information, please contact [email protected]. CHICAGO PUBLIC LAW AND LEGAL THEORY WORKING PAPER NO. 33 HAZARDOUS HEURISTICS Cass R. Sunstein THE LAW SCHOOL THE UNIVERSITY OF CHICAGO This paper can be downloaded without charge at: The Social Science Research Network Electronic Paper Collection: http://ssrn.com/abstract_id= 1 Hazardous Heuristics Cass R. Sunstein* Abstract New work on heuristics and biases has explored the role of emotions and affect; the idea of “dual processing”; the place of heuristics and biases outside of the laboratory; and the implications of heuristics and biases for policy and law. This review- essay focuses on certain aspects of Heuristics and Biases: The Psychology of Intuitive Judgment, edited by Thomas Gilovich, Dale Griffin, and Daniel Kahneman. An understanding of heuristics and biases casts light on many issues in law, involving jury awards, risk regulation, and political economy in general. -

Behavioral Guide to Customer Experience Design BEST PRACTICES for TAPPING INTO CUSTOMERS’ INTUITIVE THINKING

INSIGHT REPORT Behavioral Guide to Customer Experience Design BEST PRACTICES FOR TAPPING INTO CUSTOMERS’ INTUITIVE THINKING By Bruce Temkin, CCXP Head of the Qualtrics XM Institute By Isabelle Zdatny, CCXP XM Catalyst August 2015 This report was originally published by Temkin Group and was updated to incorporate the Qualtrics XM Institute™ format. There were no substantive changes made to the content. XM Institute INSIGHT REPORT qualtrics.com/XM-Institute EXECUTIVE SUMMARY According to recent scientific research, customers make most of their decisions using intuitive thinking instead of rational thinking. Intuitive thinking relies on unconscious heuristics and biases to make decisions efficiently, and as a result, people tend to be more affected by losses than by gains, to prefer simplicity over complexity, to be affected by their current emotional and visceral states, to be heavily influenced by those around them, to make decisions based on context, and to misjudge their past and future experiences. In this report, we identify best practices for tapping into these heuristics and biases across three areas of experience design; companies can Nudge customers in the right direction, Assist them in accomplishing their goals, and Enhance their overall experience. To incorporate intuitive thinking into experience design, companies need to follow four steps: define target customers, identify relevant heuristics and biases, select design strategies, and then test, test, test. PEOPLE USUALLY MAKE DECISIONS BASED ON INTUITIVE THINKING Recent advances in the fields of neuroscience, psychology, and behavioral economics have shown that humans are not the completely rational decision-makers that we were once taken for; rather, our brains are susceptible to systematic errors that affect how we make decisions and form judgments. -

An Inclusive Taxonomy of Behavioral Biases

View metadata, citation and similar papers at core.ac.uk brought to you by CORE provided by European Journal of Government and Economics European Journal of Government and Economics 6(1), June 2017, 24-58. European Journal of Government and Economics journal homepage: www.ejge.org ISSN: 2254-7088 An inclusive taxonomy of behavioral biases David Peóna, *, Manel Antelob, Anxo Calvo-Silvosaa a Department of Business Studies, Universidade da Coruña, Spain. b Department of Economics, University of Santiago de Compostela, Spain. * Corresponding author at: Departamento de Empresa. Universidade da Coruña, Campus de Elviña s/n, 15071 A Coruña, Spain. email: [email protected] Article history. Received 25 May 2016; first revision required 9 December 2016; accepted 27 February 2017. Abstract. This paper overviews the theoretical and empirical research on behavioral biases and their influence in the literature. To provide a systematic exposition, we present a unified framework that takes the reader through an original taxonomy, based on the reviews of relevant authors in the field. In particular, we establish three broad categories that may be distinguished: heuristics and biases; choices, values and frames; and social factors. We then describe the main biases within each category, and revise the main theoretical and empirical developments, linking each bias with other biases and anomalies that are related to them, according to the literature. Keywords. Behavioral biases; decision-making; heuristics; framing; prospect theory; social contagion. JEL classification. D03; G02; G11; G14; G30 1. Introduction The standard model of rational choice argues that people choose to follow the option that maximizes expected utility. However, this ignores the presence of behavioral biases, i.e.