Form 10-K Textron Inc

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

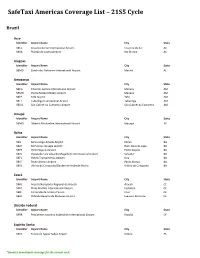

Safetaxi Americas Coverage List – 21S5 Cycle

SafeTaxi Americas Coverage List – 21S5 Cycle Brazil Acre Identifier Airport Name City State SBCZ Cruzeiro do Sul International Airport Cruzeiro do Sul AC SBRB Plácido de Castro Airport Rio Branco AC Alagoas Identifier Airport Name City State SBMO Zumbi dos Palmares International Airport Maceió AL Amazonas Identifier Airport Name City State SBEG Eduardo Gomes International Airport Manaus AM SBMN Ponta Pelada Military Airport Manaus AM SBTF Tefé Airport Tefé AM SBTT Tabatinga International Airport Tabatinga AM SBUA São Gabriel da Cachoeira Airport São Gabriel da Cachoeira AM Amapá Identifier Airport Name City State SBMQ Alberto Alcolumbre International Airport Macapá AP Bahia Identifier Airport Name City State SBIL Bahia-Jorge Amado Airport Ilhéus BA SBLP Bom Jesus da Lapa Airport Bom Jesus da Lapa BA SBPS Porto Seguro Airport Porto Seguro BA SBSV Deputado Luís Eduardo Magalhães International Airport Salvador BA SBTC Hotéis Transamérica Airport Una BA SBUF Paulo Afonso Airport Paulo Afonso BA SBVC Vitória da Conquista/Glauber de Andrade Rocha Vitória da Conquista BA Ceará Identifier Airport Name City State SBAC Aracati/Aeroporto Regional de Aracati Aracati CE SBFZ Pinto Martins International Airport Fortaleza CE SBJE Comandante Ariston Pessoa Cruz CE SBJU Orlando Bezerra de Menezes Airport Juazeiro do Norte CE Distrito Federal Identifier Airport Name City State SBBR Presidente Juscelino Kubitschek International Airport Brasília DF Espírito Santo Identifier Airport Name City State SBVT Eurico de Aguiar Salles Airport Vitória ES *Denotes -

2015 Annual Report 2015 Annual

2015 ANNUAL 2015 ANNUAL REPORT 2015 ANNUAL REPORT Textron’s Diverse Product Portfolio Textron is known around the world for its powerful brands of aircraft, defense and industrial products that provide customers with groundbreaking technologies, innovative solutions and first-class service. TEXTRON AVIATION BELL HELICOPTER INDUSTRIAL TEXTRON SYSTEMS Citation® Longitude® Bell Boeing V-22 Osprey Sherman + ReillyTM P2000X Puller Shadow® M2 Citation® M2® Bell 429WLG E-Z-GO Freedom® RXV Lycoming Race Engines Beechcraft® King Air® 350i Bell 525 RelentlessTM Greenlee® DataScout® 10Gx TRU Level D Full Flight Simulator Cessna® TTx® Bell 407GXP Kautex NGFS® Fuel Tank Ship to Shore Connector (SSC) Beechcraft® T-6 Military Trainer Bell 412EPI Dixie Chopper® Stryker Stand-on FuryTM Precision Guided Weapon Cessna® Grand Caravan® EX Bell 505 Jet Ranger XTM TUGTM MA Tow Tractor COMMANDOTM Elite Textron’s Global Network of Businesses TEXTRON AVIATION BELL HELICOPTER INDUSTRIAL TEXTRON SYSTEMS FINANCE Textron Aviation is home Bell Helicopter is one Our Industrial segment Textron Systems’ Our Finance segment, to the iconic Beechcraft, of the leading suppliers offers three main businesses provide operated by Textron Cessna and Hawker of helicopters and product lines: fuel innovative solutions to Financial Corporation brands, and continues related spare parts and systems and functional the defense, aerospace (TFC), is a commercial to lead general aviation services in the world. components produced and general aviation finance business that through two principal Bell is the pioneer of by Kautex; specialized markets. Product lines provides financing lines of business: aircraft the revolutionary tiltrotor vehicles and equipment include unmanned solutions for purchasers of sales and aftermarket. -

Bell 429 Product Specifications

BELL 429 SPECIFICATIONS BELL 429 SPECIFICATIONS Publisher’s Notice The information herein is general in nature and may vary with conditions. Individuals using this information must exercise their independent judgment in evaluating product selection and determining product appropriateness for their particular purpose and requirements. For performance data and operating limitations for any specific mission, reference must be made to the approved flight manual. Bell Helicopter Textron Inc. makes no representations or warranties, either expressed or implied, including without limitation any warranties of merchantability or fitness for a particular purpose with respect to the information set forth herein or the product(s) and service(s) to which the information refers. Accordingly, Bell Helicopter Textron Inc. will not be responsible for damages (of any kind or nature, including incidental, direct, indirect, or consequential damages) resulting from the use of or reliance on this information. Bell Helicopter Textron Inc. reserves the right to change product designs and specifications without notice. © 2019 Bell Helicopter Textron Inc. All registered trademarks are the property of their respective owners. FEBRUARY 2019 © 2019 Bell Helicopter Textron Inc. Specifications subject to change without notice. i BELL 429 SPECIFICATIONS Table of Contents Bell 429 ..................................................................................................................................1 Bell 429 Specification Summary (U.S. Units) ........................................................................4 -

Aerospace Facts and Figures 1983/84

Aerospace Facts and Figures 1983/84 AEROSPACE INDUSTRIES ASSOCIATION OF AMERICA, INC. 1725 DeSales Street, N.W., Washington, D.C. 20036 Published by Aviation Week & Space Technology A MCGRAW-HILL PUBLICATION 1221 Avenue of the Americas New York, N.Y. 10020 (212) 997-3289 $9.95 Per Copy Copyright, July 1983 by Aerospace Industries Association o' \merica, Inc. · Library of Congress Catalog No. 46-25007 2 Compiled by Economic Data Service Aerospace Research Center Aerospace Industries Association of America, Inc. 1725 DeSales Street, N.W., Washington, D.C. 20036 (202) 429-4600 Director Research Center Virginia C. Lopez Manager Economic Data Service Janet Martinusen Editorial Consultant James J. Haggerty 3 ,- Acknowledgments Air Transport Association of America Battelle Memorial Institute Civil Aeronautics Board Council of Economic Advisers Export-Import Bank of the United States Exxon International Company Federal Trade Commission General Aviation Manufacturers Association International Civil Aviation Organization McGraw-Hill Publications Company National Aer~mautics and Space Administration National Science Foundation Office of Management and Budget U.S. Departments of Commerce (Bureau of the Census, Bureau of Economic Analysis, Bureau of Industrial Economics) Defense (Comptroller; Directorate for Information, Operations and Reports; Army, Navy, Air Force) Labor (Bureau of Labor Statistics) Transportation (Federal Aviation Administration The cover and chapter art throughout this edition of Aerospace Facts and Figures feature computer-inspired graphics-hot an original theme in the contemporary business environment, but one particularly relevant to the aerospace industry, which spawned the large-scale development and application of computers, and conti.nues to incorpora~e computer advances in all aspects of its design and manufacture of aircraft, mis siles, and space products. -

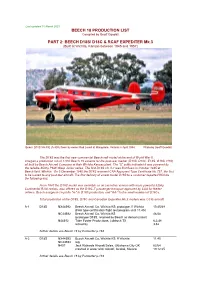

BEECH D18S/ D18C & RCAF EXPEDITER Mk.3 (Built at Wichita, Kansas Between 1945 and 1957)

Last updated 10 March 2021 BEECH 18 PRODUCTION LIST Compiled by Geoff Goodall PART 2: BEECH D18S/ D18C & RCAF EXPEDITER Mk.3 (Built at Wichita, Kansas between 1945 and 1957) Beech D18S VH-FIE (A-808) flown by owner Rod Lovell at Mangalore, Victoria in April 1984. Photo by Geoff Goodall The D18S was the first new commercial Beechcraft model at the end of World War II. It began a production run of 1,800 Beech 18 variants for the post-war market (D18S, D18C, E18S, G18S, H18), all built by Beech Aircraft Company at their Wichita Kansas plant. The “S” suffix indicated it was powered by the reliable 450hp P&W Wasp Junior series. The first D18S c/n A-1 was first flown in October 1945 at Beech field, Wichita. On 5 December 1945 the D18S received CAA Approved Type Certificate No.757, the first to be issued to any post-war aircraft. The first delivery of a new model D18S to a customer departed Wichita the following day. From 1947 the D18C model was available as an executive version with more powerful 525hp Continental R-9A radials, also offered as the D18C-T passenger transport approved by CAA for feeder airlines. Beech assigned c/n prefix "A-" to D18S production, and "AA-" to the small number of D18Cs. Total production of the D18S, D18C and Canadian Expediter Mk.3 models was 1,035 aircraft. A-1 D18S NX44592 Beech Aircraft Co, Wichita KS: prototype, ff Wichita 10.45/48 (FAA type certification flight test program until 11.45) NC44592 Beech Aircraft Co, Wichita KS 46/48 (prototype D18S, retained by Beech as demonstrator) N44592 Tobe Foster Productions, Lubbock TX 6.2.48 retired by 3.52 further details see Beech 18 by Parmerter p.184 A-2 D18S NX44593 Beech Aircraft Co, Wichita KS: ff Wichita 11.45 NC44593 reg. -

AED Fleet Contact List

AED Fleet Contact List September 2021 Make Model Primary Office Operations - Primary Operations - Secondary Avionics - Primary Avionics - Secondary Maintenance - Primary Maintenance - Secondary Air Tractor All Models MKC Persky, David (FAA) Hawkins, Kenneth (FAA) Marsh, Kenneth (FAA) Rockhill, Thane D (FAA) BadHorse, Jim (FAA) Airbus A300/310 SEA Hutton, Rick (FAA) Dunn, Stephen H (FAA) Gandy, Scott A (FAA) Watkins, Dale M (FAA) Patzke, Roy (FAA) Taylor, Joe (FAA) Airbus A318-321 CEO/NEO SEA Culet, James (FAA) Elovich, John D (FAA) Watkins, Dale M (FAA) Gandy, Scott A (FAA) Hunter, Milton C (FAA) Dodd, Mike B (FAA) Airbus A330/340 SEA Culet, James (FAA) Robinson, David L (FAA) Flores, John A (FAA) Watkins, Dale M (FAA) DiMarco, Joe (FAA) Johnson, Rocky (FAA) Airbus A350 All Series SEA Robinson, David L (FAA) Culet, James (FAA) Watkins, Dale M (FAA) Flores, John A (FAA) Dodd, Mike B (FAA) Johnson, Rocky (FAA) Airbus A380 All Series SEA Robinson, David L (FAA) Culet, James (FAA) Flores, John A (FAA) Watkins, Dale M (FAA) Patzke, Roy (FAA) DiMarco, Joe (FAA) Aircraft Industries All Models, L-410 etc. MKC Persky, David (FAA) McKee, Andrew S (FAA) Marsh, Kenneth (FAA) Pruneda, Jesse (FAA) Airships All Models MKC Thorstensen, Donald (FAA) Hawkins, Kenneth (FAA) Marsh, Kenneth (FAA) McVay, Chris (FAA) Alenia C-27J LGB Nash, Michael A (FAA) Lee, Derald R (FAA) Siegman, James E (FAA) Hayes, Lyle (FAA) McManaman, James M (FAA) Alexandria Aircraft/Eagle Aircraft All Models MKC Lott, Andrew D (FAA) Hawkins, Kenneth (FAA) Marsh, Kenneth (FAA) Pruneda, -

Va-Vol-44-No-6-Nov-Dec-2016

NOVEMBER/DECEMBER 2016 Cruising the Vintage Line Vintage Airplane Straight & Level STAFF GEOFF ROBISON EAA Publisher/Chairman of the Board VAA PRESIDENT, EAA Lifetime 268346, VAA Lifetime 12606 . Jack J. Pelton Editor ............... Jim Busha . [email protected] VAA Executive Administrator . Hannah Hupfer 2016 — Certainly, a year to remember! 920-426-6110 .......... [email protected] Art Director ............ Olivia Phillip Trabbold Happy Thanksgiving and Merry Christmas to all of our members! Graphic Designer .......Amanda Million I believe 2016 was certainly an exceptional year for the membership of the VAA. But for me personally, I felt it was just a great year for some of the ADVERTISING: Vice President of Business Development best accomplishments we as an organization have executed on in recent Dave Chaimson ......... [email protected] times. I am always amazed every year to see how generous the VAA mem- Advertising Manager bership is to this organization. We actually received significant financial Sue Anderson .......... [email protected] support from a very broad base of our membership. Whether it’s you sup- porting the Friends of the Red Barn fund, or donating dollars designated VAA, PO Box 3086, Oshkosh, WI 54903 toward supporting the new construction at the Vintage Tall Pines Cafe, or Website: www.vintageaircraft.org Email: [email protected] incoming funds directed toward the funding of the numerous individual programs we offer each year during AirVenture, they all add up to being VISIT very significant in our endeavors to constantly improve the offerings we www.vintageaircraft.org provide the membership at Oshkosh each year. for the latest in information and news AirVenture Oshkosh 2016 was an absolute success story when you take and for the electronic newsletter: a true measurement of the number and quality of the features and attrac- Vintage AirMail tions on the field this year. -

Citation Sovereign+ Redraw Your Range Map

CITATION SOVEREIGN+ REDRAW YOUR RANGE MAP Range-enhancing winglets combined with powerful engines allow the CESSNA CITATION SOVEREIGN+ aircraft to land on smaller runways and at airports surrounded by obstacles. This reduces travel time and grants access to popular destinations such as Aspen, Hilton Head and Ocean Reef. The sizable cabin makes every business trip a pleasure. Maximum Range Maximum Cruise Speed Maximum Passengers Useful Payload Takeoff Distance 3,200 nm 460 ktas 12 12,794 lb 3,530 ft UNMATCHED INGENUITY CITATION SOVEREIGN+ SPECIFICATIONS INTERIOR Cabin Height 68 in 1.73 m Cabin Width 66 in 1 .68 m Cabin Length 25 ft 3 in 7.70 m TOUCH-SCREEN SPACIOUS CABIN HEATED BAGGAGE AVIONICS The spacious, versatile cabin features COMPARTMENT BAGGAGE CAPACITY electrically operated windows and a Weight 1,435 lb 651 kg NextGen-capable GARMIN double-club seating configuration. The heated baggage compartment can G5000 avionics streamline the hold up to 1,000 pounds and 100 cubic Volume 135 cu ft 3.82 cu m pilot experience with advanced feet of cargo. autothrottles and touch-screen WEIGHTS simplicity. Max Takeoff 30,775 lb 1 3,959 kg Basic Operating Weight 1 8,235 lb 8,27 1 kg Useful Load 12,790 lb 5,801 kg MAX PASSENGERS 12 ENGINES Manufacturer Pratt & Whitney Canada Model (2) PW306D Thrust 5,907 lb 26.28 kN ea PERFORMANCE Takeoff Field Length (MTOW) 3,530 ft 1,076 m Max Range 3,200 nm 5,926 km Max Cruise Speed 460 ktas 852 km/h FUEL-EFFICIENT ENGINES Time to Climb FL 450 in 27 min POWERFUL CLASS-LEADING Pratt & Whitney Canada engines deliver low-cost ELECTRICAL SYSTEM TAKEOFF FIELD LENGTH maintenance, high reliability and fuel efficiency for Performance data is based on standard conditions with zero wind. -

Doing Business with Textron Aviation

Doing Business with Textron Aviation FROM: Textron Aviation RE: Becoming a Supplier to Textron Aviation Dear Potential Supplier: Thank you for your interest in becoming a supplier to Textron Aviation. Textron Aviation Inc. is the leading general aviation authority and home to the iconic Beechcraft, Cessna and Hawker brands which account for more than half of all general aviation aircraft flying. What suppliers should do prior to requesting a meeting with Textron Aviation Many questions can be answered prior to contacting a Textron Aviation team member. Before attempting to schedule a visit, or asking to quote on any packages, potential suppliers must review the information below and provide the necessary information where requested, prior to contacting any Supply Chain personnel. Visit http://www.beechcraft.com/supply_chain/diversity/ to review Supply Chain Supplier Diversity Visit and review info provided at http://www.beechcraft.com/supply_chain/potential_supplier/. From this page, enter the requested company information using the “Potential Supplier Database” link found at http://www.beechcraft.com/supply_chain/potential_supplier/potential_supplier.aspx To understand various requirements/expectations of suppliers, Textron Aviation processes/policies, etc…, browse the various links and understand the information provided at the following: http://www.beechcraft.com/supply_chain/ and https://supplier.cessna.com Visit https://supplier.cessna.com/cgi-bin/icoe/index.pl for information regarding the Indirect Center of Excellence (ICOE) who purchase all products and services necessary for business operation, but are not components of the final product (aircraft, helicopter, golf car). ICOE purchases for Bell Helicopter, Cessna Aircraft Company, Beechcraft Corporation, E-Z-GO, Greenlee, Jacobsen, Kautex, TRU, and Textron Defense Systems and also manages several enterprise agreements for Textron North America. -

EAA Airventure 2017 Special Edition

FOR THE PILOTS OF OWNER-FLOWN, CABIN-CLASS AIRCRAFT JULY 2017 $3.95 US VOLUME 21 NUMBER 7 EAA AirVenture 2017 Special Edition Blue Angels Perform at OSH for the First Time EAA's Jack Pelton Talks Oshkosh B-29 Superfortress "Doc" Ready for OSH: Precision Landing Techniques July 2017 CAF Red Tail Squadron Back in the Air CJ FAMILY INNOVATION. PERFORMA N C E . LEADERSHIP. CJ3+ CJ4 M2 Textron Aviation Full Page 4/C Ad GO WHERE YOUR VISION TAKES YOUwww.cessna.com There’s a smarter way to move y our business and your family. From Chicago to Key Largo or anyw here between, the Cessna Citation CJ F amily delivers time-saving mobility and access to t housands of sm all airports. All three aircraft have a common type rating, making it easier and more ecient than ever to grow with your business. Learn more at Cessna.com. U.S. +1.844. 44.TXTAV | INTERNATIO NAL +1.316.517.8270 ©2017 Textron Aviatio n Inc. All rights reserved. Cessna & Design , Citation, M2, CJ3 and CJ4 ar e trademarks or service marks of Textron Aviation Inc. o r a n a liate and may be registered in th e United States. 2 • TWIN & TURBINE July 2017 Contents July 2017 • VOL. 21, NO. 7 2 Editor’s Briefing by Dianne White Oshkosh Special Section 4 EAA AirVenture 2017 4 Preview of the world's greatest air show by Rebecca Groom Jacobs 8 EAA’s Jack Pelton Talks AirVenture 2017 by Dianne White 12 CAF Red Tail Squadron is 8 Back in the Air by Dianne White 14 B-29 Superfortress ”Doc” Receives a Hero’s Welcome by Rebecca Groom Jacobs 16 Ready for OSH: The 12 Third Degree by Dave McVinnie 20 Five on the Fly by Rebecca Groom Jacobs 23 AirVenture Air Show Schedule 14 by Dianne White 26 Look Up. -

2017 Fact Book Textron Inc

2017 FACT BOOK TEXTRON INC. is a $14.2 billion multi-industry company with approximately 37,000 employees. The Company leverages its global network of aircraft, defense, industrial, and finance businesses to provide customers with innovative products and services. Textron is known around the world for its powerful brands such as Bell, Cessna, Beechcraft, Hawker, Jacobsen, Kautex, Lycoming, E-Z-GO, Greenlee, Textron Off Road, Arctic Cat, Textron Systems, and TRU Simulation + Training. Textron Revenue by Segment FINANCIAL HIGHLIGHTS Dollars in millions, except per share data 2017 2016 Change TEXTRON AVIATION 33% Revenues $14,198 $13,788 3% INDUSTRIAL 30% International revenues % 38% 38% BELL 23% Segment profit1 $ 1,169 $ 1,309 (11)% TEXTRON AVIATIONSYSTEMS 33%13% INDUSTRIALFINANCE 1% 30% Income from continuing operations—GAAP $ 306 $ 843 (64)% BELL 23% Adjusted income from continuing TEXTRON AVIATIONSYSTEMS 33%13% operations—Non-GAAP2 $ 658 $ 715 (8)% FINANCEINDUSTRIAL 1% 30% Manufacturing group debt3 $ 3,088 $ 2,777 11% BELL 23% TEXTRON SYSTEMS 13% Shareholders’ equity $ 5,647 $ 5,574 1% Textron Revenue by Type 3 FINANCE 1% Manufacturing group debt-to-capital (net of cash) 26% 23% COMMERCIAL 70% U.S. GOVERNMENT 22% OTHER MILITARY 7% Common Share Data COMMERCIALFINANCE 1% 70% Diluted EPS from continuing operations—GAAP $ 1.14 $ 3.09 (63)% U.S. GOVERNMENT 22% Adjusted diluted EPS from continuing OTHER MILITARY 7% operations—Non-GAAP2 $ 2.45 $ 2.62 (6)% FINANCECOMMERCIAL 1% 70% Dividends per share $ 0.08 $ 0.08 — U.S. GOVERNMENT 22% OTHER MILITARY 7% Diluted average shares outstanding (in thousands) 268,750 272,365 (1)% U.S. -

Textron Inc. Annual Report 2018

Textron Inc. Annual Report 2018 Form 10-K (NYSE:TXT) Published: February 15th, 2018 PDF generated by stocklight.com UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 Form 10-K [ x ] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 30, 2017 or [ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to . Commission File Number 1-5480 Textron Inc. (Exact name of registrant as specified in its charter) Delaware 05-0315468 (State or other jurisdiction of incorporation or organization) (I.R.S. Employer Identification No.) 40 Westminster Street, Providence, RI 02903 (Address of principal executive offices) (Zip code) Registrants Telephone Number, Including Area Code: (401) 421-2800 Securities registered pursuant to Section 12(b) of the Act: Name of Each Exchange on Which Title of Each Class Registered Common Stock par value $0.125 New York Stock Exchange Securities registered pursuant to Section 12(g) of the Act: None Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ü No___ Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes No ü Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.