Bbd 12.31.2019

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Former Carlyle House Owner, Decorated WWI Aviator

The Friends of Carlyle House Newsletter Fall 2010 “It’s a fine beginning” CarlyleCarlyle Connection Former Carlyle House Owner, Decorated WWI Aviator Jim Bartlinski For more than two and a half centuries, Colonel John heated cavalry skirmish known as Corbit’s Charge was Carlyle’s house has been an Alexandria landmark. Despite fought in the streets of Schaeffer’s hometown during the the estate’s historic significance as Major General Edward 1863 Gettysburg Campaign. This event most assuredly was a Braddock’s headquarters, Colonel Carlyle’s once grand topic of conversation among the town’s inhabitants for years Georgian- Palladian after the war. Hearing Aquia sandstone mansion these stories of past fell into disrepair over military glory, coupled the one hundred and sixty with the patriotic fervor years following his death that accompanied the in 1780. In 1940, a United States’ entry into Northern Virginia the First World War, businessman by the name may have influenced of Lloyd Diehl Schaeffer Schaeffer’s decision to purchased the property enlist to fight in what and saved Colonel British author and social Carlyle’s home from the commentator H. G. wrecking ball. Schaeffer Wells referred to as “The had a love of history, war to end war.” recognized the historic When the United States importance of the site, entered the war on April and operated Carlyle’s Lt. Lloyd D. Schaeffer’s bomber squadron, Escadrille BR-66, c. 1918 6, 1917, it looked like home as a museum into the adventure of a the 1960s, before selling lifetime for many of America’s young men, including the it to the Northern Virginia Regional Park Authority. -

PRIMOVE – Wireless Electrification

Wireless Electrification Eighth International Hydrail Conference Ryerson University – Centre for Urban PRIVATE AND CONFIDENTIAL PRIVATE AND Energy, Toronto, Canada © Bombardier Inc. or its subsidiaries. All rights reserved. 2013.06.11 & 12 Tim Dickson, Ph.D., P. Eng Agenda 1 BOMBARDIER OVERVIEW 2 MEGATRENDS 3 INTRODUCTION TO PRIMOVE 4 ANSWERS TO QUESTIONS PRIVATE AND CONFIDENTIAL PRIVATE AND © Bombardier Inc. or its subsidiaries. All rights reserved. BOMBARDIER Overview PRIVATE AND CONFIDENTIAL PRIVATE AND Bombardier is the world’s only manufacturer of both planes and trains, with a worldwide workforce of 70,000* people. © Bombardier Inc. or its subsidiaries. All rights reserved. Bombardier is headquartered in Montréal, Canada. Our shares are traded on the Toronto Stock Exchange (BBD) and we are listed on the Dow Jones Sustainability World and North America indexes. In the fiscal year ended December 31, 2011, we posted revenues of $18.3 billion USD with 93% of revenues generated outside Canada. * as at December 31, 2011 3 BOMBARDIER Overview 1942-1973 1974-1985 1986-1993 Strategic 1993-2003 2003- Acquisitions . Company . Diversification . Entry into . Aerospace: . CRJ Series, . CRJ NextGen start-up into mass aerospace Short Brothers Global family, transit market through (UK), Express, Learjet 85, . Development Canadair Learjet (US), de Challenger 300 Q400 NextGen, of passenger . Learning of new acquisition Havilland (CA) CSeries, and personal industry . Tilting train, Global 7000, snowmobiles . Consolidation of . Transportation: AGC (Autorail . 1982 New York Global 8000 CONFIDENTIAL PRIVATE AND North American BN (BE), Grande . Vertical metro contract mass transit ANF (FR), Capacité) . Hybrid AGC, integration secured strong position and Deutsche ZEFIRO, ECO4 position in . -

Buy America Transit Supply Chain Connectivity Forum

Buy America Transit Supply Chain Connectivity Forum APTA Rail Conference Phoenix, AZ June 22, 2016 Agenda 8:00am Registration/Continental Breakfast 8:30am Welcome Remarks and Forum Introduction 8:45am U.S. DOT Keynote and Buy America Overview 9:25am Q&A 9:40am Break 9:50am Arizona Public Transportation 10:00am OEM Panel: Supply Chain Opportunities and Needs 11:15am Q&A 11:30am Supplier Panel: The View from Prospective Suppliers 12:10pm Q&A 12:25pm Lunch (One-on-One Signups) 1:15pm MEP Assistance and Resources 1:45pm Open Discussion: Transit Supply Issues and Opportunities 2:05pm Intro to One-on-One Meetings among OEMs and Suppliers 2:15pm Transition to One-on-One Meetings among OEMs and Potential Suppliers 2:15pm Networking Reception Concurrent with One-on-One Meetings 5:00pm ADJOURN www.nist.gov/mep [email protected] (301) 975-5020 MEP Overview 2 Agenda 8:00am Registration/Continental Breakfast 8:30am Welcome Remarks and Forum Introduction 8:45am U.S. DOT Keynote and Buy America Overview 9:25am Q&A 9:40am Break 9:50am Arizona Public Transportation 10:00am OEM Panel: Supply Chain Opportunities and Needs 11:15am Q&A 11:30am Supplier Panel: The View from Prospective Suppliers 12:10pm Q&A 12:25pm Lunch (One-on-One Signups) 1:15pm MEP Assistance and Resources 1:45pm Open Discussion: Transit Supply Issues and Opportunities 2:05pm Intro to One-on-One Meetings among OEMs and Suppliers 2:15pm Transition to One-on-One Meetings among OEMs and Potential Suppliers 2:15pm Networking Reception Concurrent with One-on-One Meetings 5:00pm ADJOURN www.nist.gov/mep [email protected] (301) 975-5020 MEP Overview 3 WELCOME TO PHOENIX David Garafano Executive Director www.nist.gov/mep [email protected] (301) 975-5020 MEP Overview 4 Agenda 8:00am Registration/Continental Breakfast 8:30am Welcome Remarks and Forum Introduction 8:45am U.S. -

Global Competitiveness in the Rail and Transit Industry

Global Competitiveness in the Rail and Transit Industry Michael Renner and Gary Gardner Global Competitiveness in the Rail and Transit Industry Michael Renner and Gary Gardner September 2010 2 GLOBAL COMPETITIVENESS IN THE RAIL AND TRANSIT INDUSTRY © 2010 Worldwatch Institute, Washington, D.C. Printed on paper that is 50 percent recycled, 30 percent post-consumer waste, process chlorine free. The views expressed are those of the authors and do not necessarily represent those of the Worldwatch Institute; of its directors, officers, or staff; or of its funding organizations. Editor: Lisa Mastny Designer: Lyle Rosbotham Table of Contents 3 Table of Contents Summary . 7 U.S. Rail and Transit in Context . 9 The Global Rail Market . 11 Selected National Experiences: Europe and East Asia . 16 Implications for the United States . 27 Endnotes . 30 Figures and Tables Figure 1. National Investment in Rail Infrastructure, Selected Countries, 2008 . 11 Figure 2. Leading Global Rail Equipment Manufacturers, Share of World Market, 2001 . 15 Figure 3. Leading Global Rail Equipment Manufacturers, by Sales, 2009 . 15 Table 1. Global Passenger and Freight Rail Market, by Region and Major Industry Segment, 2005–2007 Average . 12 Table 2. Annual Rolling Stock Markets by Region, Current and Projections to 2016 . 13 Table 3. Profiles of Major Rail Vehicle Manufacturers . 14 Table 4. Employment at Leading Rail Vehicle Manufacturing Companies . 15 Table 5. Estimate of Needed European Urban Rail Investments over a 20-Year Period . 17 Table 6. German Rail Manufacturing Industry Sales, 2006–2009 . 18 Table 7. Germany’s Annual Investments in Urban Mass Transit, 2009 . 19 Table 8. -

PDF File, 139.89 KB

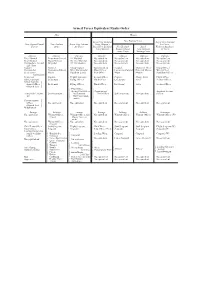

Armed Forces Equivalent Ranks Order Men Women Royal New Zealand New Zealand Army Royal New Zealand New Zealand Naval New Zealand Royal New Zealand Navy: Women’s Air Force: Forces Army Air Force Royal New Zealand New Zealand Royal Women’s Auxilliary Naval Service Women’s Royal New Zealand Air Force Army Corps Nursing Corps Officers Officers Officers Officers Officers Officers Officers Vice-Admiral Lieutenant-General Air Marshal No equivalent No equivalent No equivalent No equivalent Rear-Admiral Major-General Air Vice-Marshal No equivalent No equivalent No equivalent No equivalent Commodore, 1st and Brigadier Air Commodore No equivalent No equivalent No equivalent No equivalent 2nd Class Captain Colonel Group Captain Superintendent Colonel Matron-in-Chief Group Officer Commander Lieutenant-Colonel Wing Commander Chief Officer Lieutenant-Colonel Principal Matron Wing Officer Lieutentant- Major Squadron Leader First Officer Major Matron Squadron Officer Commander Lieutenant Captain Flight Lieutenant Second Officer Captain Charge Sister Flight Officer Sub-Lieutenant Lieutenant Flying Officer Third Officer Lieutenant Sister Section Officer Senior Commis- sioned Officer Lieutenant Flying Officer Third Officer Lieutenant Sister Section Officer (Branch List) { { Pilot Officer Acting Pilot Officer Probationary Assistant Section Acting Sub-Lieuten- 2nd Lieutenant but junior to Third Officer 2nd Lieutenant No equivalent Officer ant Navy and Army { ranks) Commissioned Officer No equivalent No equivalent No equivalent No equivalent No equivalent No -

Canadair Regional Jet Program to Be Acquired by Mitsubishi Heavy Industries

50SKYSHADESImage not found or type unknown- aviation news CANADAIR REGIONAL JET PROGRAM TO BE ACQUIRED BY MITSUBISHI HEAVY INDUSTRIES News / Manufacturer Image not found or type unknown Improtant news! The definitive agreement between Bombardier and Mitsubishi Heavy Industries regarding Canadair Regional Jet Program! Mitsubishi Heavy Industries and Bombardier announced they have entered into a definitive agreement, whereby MHI will acquire Bombardier's regional jet program for a cash consideration© 2015-2021 50SKYSHADES.COM of $550 million— Reproduction, USD, copying, payable or redistribution to Bombardier for commercial purposesupon isclosing, prohibited. and the1 assumption by MHI of liabilities amounting to approximately $200 million USD. Under the agreement, Bombardier's net beneficial interest in the Regional Aircraft Securitization Program (RASPRO), which is valued at approximately $180 million USD, will be transferred to MHI. Pursuant to the agreement, MHI will acquire the maintenance, support, refurbishment, marketing, and sales activities for the CRJ Series aircraft, including the related services and support network located in Montréal, Québec, and Toronto, Ontario, and its service centers located in Bridgeport, West Virginia, and Tucson, Arizona, as well as the type certificates. This acquisition is complementary to MHI's existing commercial aircraft business, in particular the development, production, sales and support of the Mitsubishi SpaceJet commercial aircraft family. The maintenance and engineering capabilities of the CRJ program will further enhance critical customer support functions, a strategic business area for MHI in the pursuit of future growth. Seiji Izumisawa, President & CEO of MHI, commented: "As we outlined during the recent Paris Air Show, we are working hard to ensure that we provide new profit potential for airlines and set a new standard for passenger experience. -

Train Sim World 2 Southeastern High Speed Driver's Manual EN.Pdf

EN SOUTHEASTERN HIGH SPEED ©2021 Dovetail Games, a trading name of RailSimulator.com Limited (“DTG”). "Dovetail Games", “Train Sim World” and “SimuGraph” are trademarks or registered trademarks of DTG. Unreal® Engine, ©1998-2021, Epic Games, Inc. All rights reserved. Unreal® is a registered trademark of Epic Games. Portions of this software utilise SpeedTree® technology (©2014 Interactive Data Visualization, Inc.). SpeedTree® is a registered trademark of Interactive Data Visualization, Inc. All rights reserved. Southeastern is the registered trade mark of The Go-Ahead Group PLC. Permission to use the Double Arrow Trade Mark is granted by the Secretary of State for Transport. All other copyrights or trademarks are the property of their respective owners and are used here with permission. Unauthorised copying, adaptation, rental, re-sale, arcade use, charging for use, broadcast, cable transmission, public performance, distribution or extraction of the product or any trademark or copyright work that forms part of this product is prohibited. Developed and published by DTG. CONTENTS 1 SOUTHEASTERN HIGH SPEED OVERVIEW 5 TRAIN SAFETY & IN-CAB SIGNALLING SYSTEMS 5 INTRODUCING SOUTHEASTERN HIGH SPEED 43 AUTOMATIC WARNING SYSTEM (AWS) 6 ROUTE MAP & POINTS OF INTEREST 44 TRAIN PROTECTION & WARNING SYSTEM (TPWS) 7 GAME MODES 45 KVB 2 THE BR CLASS 395 'JAVELIN' 47 TVM-430 8 INTRODUCING THE BR CLASS 395 'JAVELIN' 6 BRITISH RAILWAY SIGNALLING 9 BR CLASS 395 DRIVING CAB: FRONT 50 COLOUR LIGHT 10 BR CLASS 395 DRIVING CAB: REAR 56 SEMAPHORE 11 BR CLASS -

Royal Air Force Historical Society Journal 48

ROYAL AIR FORCE HISTORICAL SOCIETY JOURNAL 48 2 The opinions expressed in this publication are those of the contributors concerned and are not necessarily those held by the Royal Air Force Historical Society. First published in the UK in 2010 by the Royal Air Force Historical Society All ri hts reserved. No part of this book may be reproduced or transmitted in any form or by any means, electronic or mechanical including photocopying, recording or by any information stora e and retrieval system, without permission from the Publisher in writing. ISSN 1361 4231 Printed by Windrush Group ,indrush House Avenue Two Station Lane ,itney O028 40, 3 ROYAL AIR FORCE HISTORICAL SOCIETY President 2arshal of the Royal Air Force Sir 2ichael 3eetham GC3 C3E DFC AFC 7ice8President Air 2arshal Sir Frederick Sowrey KC3 C3E AFC Committee Chairman Air 7ice82arshal N 3 3aldwin C3 C3E FRAeS 7ice8Chairman -roup Captain 9 D Heron O3E Secretary -roup Captain K 9 Dearman FRAeS 2embership Secretary Dr 9ack Dunham PhD CPsychol A2RAeS Treasurer 9 Boyes TD CA 2embers Air Commodore - R Pitchfork 23E 3A FRAes :9 S Cox Esq BA 2A :6r M A Fopp MA F2A FI2 t :-roup Captain A 9 Byford MA MA RAF :,ing Commander P K Kendall BSc ARCS MA RAF ,ing Commander C Cummings Editor & Publications ,ing Commander C G Jefford M3E BA 2ana er :Ex Officio 4 CONTENTS OPENIN- ADDRESS œ Air 2shl Ian Macfadyen 7 ON.Y A SIDESHO,? THE RFC AND RAF IN A 2ESOPOTA2IA 1914-1918 by Guy Warner THE RAF AR2OURED CAR CO2PANIES IN IRAB 20 C2OST.YD 1921-1947 by Dr Christopher Morris No 4 SFTS AND RASCHID A.IES WAR œ IRAB 1941 by )A , Cdr Mike Dudgeon 2ORNIN- Q&A F1 SU3STITUTION OR SU3ORDINATION? THE E2P.OY8 63 2ENT OF AIR PO,ER O7ER AF-HANISTAN AND THE NORTH8,EST FRONTIER, 1910-1939 by Clive Richards THE 9E3E. -

LBAS and Honeywell Collaborate on Luxury Facelift for Asian Business Jet

CUSTOMER SUCCESS STORY LBAS and Honeywell collaborate on luxury facelift for Asian business jet Ovation Select® brings latest technology to a ten-year-old Bombardier aircraft Overview Business Need When the Bombardier Global Express executive jet A prominent Asian customer’s 15-seat QUICK FACTS belonging to a prominent Asian customer needed its Bombardier Global Express aircraft had reached ten-year 8C inspection, the time was also right for the ten-year deadline for its 8C check. This Honeywell solution a major facelift. Honeywell, Lufthansa Bombardier maintenance includes dismantling the complete Honeywell Ovation Select Aviation Services (LBAS) and OHS Aviation Services VIP cabin, completing extensive structure and Customer results collaborated on the project. system inspections, a major overhaul of the l Improves the passenger experience and landing gear and modifications. extends the useful life of this ten-year-old Background While the aircraft was grounded for this work, the aircraft LBAS was founded in 1997 when Lufthansa Technik owner decided that the time was also right to give l and Bombardier formed a joint venture to provide Introduces the latest entertainment and it a major facelift. communications systems with scope for complete technical services for the Learjet, Challenger The old analogue cabin management system was emerging technologies and Global aircraft families. They were later joined by out-of-date, with video cassettes, CD players and l Execujet to focus on the exclusive maintenance, repair Collaboration delivered a cost-effective basic satellite communication, while spare part one-stop solution and overhaul (MRO) requirements of VIP customers. availability was becoming an issue. -

Pinnacle 19-1 Bio Book.Pdf

BBIIOOGGRRAAPPHHIICCAALL DDAATTAA BBOOOOKK Pinnacle 19-1 25-29 March 2019 National Defense University SENIOR FELLOWS Admiral Sam J Locklear, US Navy (Ret) Admiral Locklear started as a Capstone, Keystone, Pinnacle Senior Fellow in 2019. He is President of SJL Global Insights LLC, a global consulting firm specializing in a wide range of security and defense issues and initiatives. Today he serves on the Board of Directors of the Fluor Corporation, Halo Maritime Defense Systems, Inc., the National Committee on U.S. China Relations, is a Senior Advisor to the Center for Climate and Security and New York University’s Center for Global Affairs, is a Senior Fellow at Johns Hopkins Applied Physics Laboratory, and is the Chairman of the Board of Trustees United States Naval Academy Alumni Association. He also occasionally consults for HII, Raytheon IDS, and Fairfax National Security Solutions. In 2015 he retired from the US Navy after serving with distinction for over 39 years, including 15 years of service as a Flag Officer. During his significant tenure Admiral Locklear lead at the highest levels serving as Commander U.S. Pacific Command, Commander U.S. Naval Forces Europe and Africa, and Commander of NATO’s Allied Joint Force Command. In 2013 Defense News ranked him eleventh out of the 100 most influential people in global defense issues. As Commander U.S. Pacific Command, the United States’ oldest and largest geographic unified combatant command, he commanded all U.S. military forces operating across more than half the globe. He accurately assessed the rapidly changing geopolitical environment of the Indo-Asia-Pacific, the most militarized area of the world, made significant advancements in how U.S. -

The Treachery of Strategic Decisions

The treachery of strategic decisions. An Actor-Network Theory perspective on the strategic decisions that produce new trains in the UK. Thesis submitted in accordance with the requirements of the University of Liverpool for the degree of Doctor in Philosophy by Michael John King. May 2021 Abstract The production of new passenger trains can be characterised as a strategic decision, followed by a manufacturing stage. Typically, competing proposals are developed and refined, often over several years, until one emerges as the winner. The winning proposition will be manufactured and delivered into service some years later to carry passengers for 30 years or more. However, there is a problem: evidence shows UK passenger trains getting heavier over time. Heavy trains increase fuel consumption and emissions, increase track damage and maintenance costs, and these impacts could last for the train’s life and beyond. To address global challenges, like climate change, strategic decisions that produce outcomes like this need to be understood and improved. To understand this phenomenon, I apply Actor-Network Theory (ANT) to Strategic Decision-Making. Using ANT, sometimes described as the sociology of translation, I theorise that different propositions of trains are articulated until one, typically, is selected as the winner to be translated and become a realised train. In this translation process I focus upon the development and articulation of propositions up to the point where a winner is selected. I propose that this occurs within a valuable ‘place’ that I describe as a ‘decision-laboratory’ – a site of active development where various actors can interact, experiment, model, measure, and speculate about the desired new trains. -

Manufacturer Air Safety Investigator Contact List DECEMBER 4, 2019

Manufacturer Air Safety Investigator Contact List Alphabetical by company name. Air Tractor Major Product Lines AT-402, AT-502, AT-602, AT-802 (+1) 940-564-5616 (Primary) 24-hr Phone Number (+1) 940-447-1331 (Afterhours) Fax Number (+1) 940-564-5612 Contact Person(s) Kyle Schroeder, Aviation Safety Investigator Electronic Contact [email protected] 1524 Leland Snow Way Address Olney, TX 67374 USA Airbus Helicopters Eurocopter, Aerospatiale, Messerschmitt Bolkow Bloehm, SNIAS, Major Product Lines Sud Aviation Helicopters (+1) 214-605-9365 (Primary) 24-hr Phone Number (+1) 972-641-8090 Contact Person(s) Seth Buttner, Manager, Accident Investigation Electronic Contact [email protected] 2701 Forum Dr. Address Grand Prairie, TX 75052 USA AmSafe, Inc. Major Product Lines Aircraft restraints and airbag systems 24-hr Phone Number (+1) 602-850-2850 James Crupi, Business Development & Technical Support Mgr. (+1) 602-628-0349 Contact Person(s) Lee Langston, Aviation Program Manager (+1) 602-628-0336 [email protected] Electronic Contact [email protected] 1043 N. 47th Ave Address Phoenix, AZ 85043 USA DECEMBER 4, 2019 Page 1 of 12 Manufacturer Air Safety Investigator Contact List Ballistic Recovery Systems, Inc. Major Product Lines Whole-aircraft parachute systems (+1) 763-226-6110 (First Responders) 24-hr Phone Number (+1) 651-457-7491 (Main Line) Fax Number (+1) 651-457-8651 Contact Person(s) Enrique Dillon, President: (+1) (305)777-0174 Direct Line Electronic Contact [email protected] 380 Airport Road Address South St. Paul,