ATF Exhibitors

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

PROGRAM November 18-20, 2015 THANKS to the 2015 Children, Youth & Media Conference Sponsors

Toronto PROGRAM November 18-20, 2015 THANKS tO tHe 2015 ChIlDrEn, YoUtH & MeDiA CoNfErEnCe sponsors MAIN SPONSOR PRESTIGE SPONSORS EXCELLENCE SPONSORS 2 SPECIAL THANKS Youth Media Alliance would like to warmly thank its 2015 Children, Youth & Media Conference advisory committee: NATALIE DUMOULIN / 9 Story Media Group MARTHA SEPULVEDA / RACHEL MARCUS / Guru Studio Breakthrough Entertainment MICHELLE MELANSON CUPERUS / CLAUDIA SICONDOLFO Radical Sheep Productions JULIE STALL / Portfolio Entertainment LYNN OLDERSHAW / Kids’ CBC TRAVIS WILLIAMS / Mercury Filmworks MIK PERLUS / marblemedia SUZANNE WILSON / TVO Kids JAMIE PIEKARZ / Corus Entertainment And the volunteers: KELLY LYNNE ASHTON, KAYLA LATHAM, HENRIKA LUONG, TATIANA MARQUES, JAYNA RAN and MARCELA LUCIA ROJAS. TABLE OF CONTENTS Words from Chair .............................................................................p. 4 Words from Executive Director ............................................................p. 5 Schedule and Venue ..........................................................................p. 6 General Conference ..........................................................................p. 8 Workshop with Sheena Macrae ............................................................p. 12 Workshop with Linda Schuyler .............................................................p. 12 Prix Jeunesse Screening ....................................................................p. 13 Speakers’ Biographies .......................................................................p. -

EARNINGS RELEASE: Q4 and FY 2020-21

EARNINGS RELEASE: Q4 and FY 2020-21 Mumbai, 20th April, 2021 – Network18 Media & Investments Limited today announced its results for the quarter and financial year ended 31st March 2021. Consolidated EBITDA up 29% in COVID year; Highest ever EBITDA margins led by cost controls and innovative measures. PAT up by ~9x at Rs. 547 cr. Strong recovery in TV ad-growth to high single digits in Q4; Digital growing at fast clip TV News remains #1 on reach; margins expanded all through the year TV Entertainment grew viewership share by ~2% to 10.9%; full year margins highest ever Flagship GEC Colors returns to a strong #2 position during the year Entertainment OTT fastest to 1mn D2C subscribers within first year of launch Digital News breaks even for the full year; subscription the next engine of growth Summary Consolidated Financials Q4FY21 Q4FY20 Growth FY21 FY20 Growth Consolidated Operating Revenue (Rs Cr) 1,415 1,464 -3% 4,705 5,357 -12% Consolidated Operating EBITDA (Rs Cr) 279 225 24% 796 617 29% Operating EBITDA margin 19.7% 15.4% 16.9% 11.5% Highlights for Q4 Q4 Operating EBITDA up 24% YoY, Q4 Operating Margin expanded to highest ever ~20% Entertainment operating margins are at a healthy ~19% in Q4. News margins rose to highest ever levels of ~27% in Q4, led by 5% YoY revenue growth. Digital News maintained its break-even performance. Consolidated revenue ex-film production grew 2% YoY, despite deferral of award shows Highlights for FY2020-21 Consolidated Annual EBITDA margins rose to ~17%, the best ever inspite of COVID Group EBITDA up 29% YoY despite pandemic impact dragging revenue down 12% YoY. -

Piracy Or Productivity: Unlawful Practices in Anime Fansubbing

View metadata, citation and similar papers at core.ac.uk brought to you by CORE provided by Aaltodoc Publication Archive Aalto-yliopisto Teknillinen korkeakoulu Informaatio- ja luonnontieteiden tiedekunta Tietotekniikan tutkinto-/koulutusohjelma Teemu Mäntylä Piracy or productivity: unlawful practices in anime fansubbing Diplomityö Espoo 3. kesäkuuta 2010 Valvoja: Professori Tapio Takala Ohjaaja: - 2 Abstract Piracy or productivity: unlawful practices in anime fansubbing Over a short period of time, Japanese animation or anime has grown explosively in popularity worldwide. In the United States this growth has been based on copyright infringement, where fans have subtitled anime series and released them as fansubs. In the absence of official releases fansubs have created the current popularity of anime, which companies can now benefit from. From the beginning the companies have tolerated and even encouraged the fan activity, partly because the fans have followed their own rules, intended to stop the distribution of fansubs after official licensing. The work explores the history and current situation of fansubs, and seeks to explain how these practices adopted by fans have arisen, why both fans and companies accept them and act according to them, and whether the situation is sustainable. Keywords: Japanese animation, anime, fansub, copyright, piracy Tiivistelmä Piratismia vai tuottavuutta: laittomat toimintatavat animen fanikäännöksissä Japanilaisen animaation eli animen suosio maailmalla on lyhyessä ajassa kasvanut räjähdysmäisesti. Tämä kasvu on Yhdysvalloissa perustunut tekijänoikeuksien rikkomiseen, missä fanit ovat tekstittäneet animesarjoja itse ja julkaisseet ne fanikäännöksinä. Virallisten julkaisujen puutteessa fanikäännökset ovat luoneet animen nykyisen suosion, jota yhtiöt voivat nyt hyödyntää. Yhtiöt ovat alusta asti sietäneet ja jopa kannustaneet fanien toimia, osaksi koska fanit ovat noudattaneet omia sääntöjään, joiden on tarkoitus estää fanikäännösten levitys virallisen lisensoinnin jälkeen. -

Viacom 18 Media Private Limited 1

VIACOM 18 MEDIA PRIVATE LIMITED 1 VIACOM 18 MEDIA PRIVATE LIMITED Financial Statements 2018-19 2 VIACOM 18 MEDIA PRIVATE LIMITED Independent Auditor’s Report To The Members of Viacom 18 Media Private Limited Report on the Audit of the Standalone Financial Statements Opinion We have audited the accompanying standalone Ind AS financial statements ofViacom 18 Media Private Limited (“the Company”), which comprise the Balance Sheet as at March 31, 2019, and the Statement of Profit and Loss (including Other Comprehensive Income), the Cash Flow Statement and the Statement of Changes in Equity for the year then ended, and a summary of significant accounting policies and other explanatory information. In our opinion and to the best of our information and according to the explanations given to us, the aforesaid standalone Ind AS financial statements give the information required by the Companies Act, 2013 (“the Act”) in the manner so required and give a true and fair view in conformity with the Indian Accounting Standards prescribed under section 133 of the Act read with the Companies (Indian Accounting Standards) Rules, 2015, as amended, (“Ind AS”) and other accounting principles generally accepted in India, of the state of affairs of the Company as at March 31, 2019, and its profit, total comprehensive income, its cash flows and the changes in equity for the year ended on that date. Basis for Opinion We conducted our audit of the standalone Ind AS financial statements in accordance with the Standards on Auditing specified under section 143(10) of the Act. Our responsibilities under those Standards are further described in the Auditor’s Responsibility for the Audit of the Standalone Ind AS Financial Statements section of our report. -

Pan Entertainment (068050 KQ) Poised to Benefit from China’S Growing Content Demand

Pan Entertainment (068050 KQ) Poised to benefit from China’s growing content demand Snapshot: Producer of Winter Sonata, the origin of the Korean Wave Founded in 1998, Pan Entertainment was mainly engaged in the business of managing Company Report recording artists and making soundtracks before producing its first drama series “Winter December 5, 2014 Sonata” in 2002. The drama became a huge hit in Japan, setting in motion the “Korean Wave” across the country. Since then, the company has established itself as a drama producer, but has struggled to maintain stable profits due to the small size and buyer- Not Rated driven culture of the domestic market. Catalyst: China’s video content demand is surging, but options are limited Target Price (12M, W) - In China, there are over 4,000 television channels, all of which rely on advertising as their Share Price (12/03/14, W) 6,380 biggest source of income. Because advertising revenue is largely determined by primetime ratings, many broadcasters crave killer content, most preferably in the form Expected Return - of dramas and entertainment shows. But, while China’s video content demand has been rapidly increasing in terms of both quantity and quality, the country’s production capabilities have lagged far behind. Demand has been growing not only among major OP (14F, Wbn) 1 broadcasters and studios, but also among internet portals like Alibaba, and online video Consensus OP (14F, Wbn) 0 streaming sites such as Youku Tudou and Sohu. To make up for the lack of content, EPS Growth (14F, %) - Chinese companies are increasingly turning to Korean pr oducers, as Korean content is 1) Market EPS Growth (14F, %) 1.1 hugely popular in China, 2) of higher quality, and 3) cheaper to produce. -

TRULY GLOBAL Worldscreen.Com *LIST 1218 ALT2 LIS 1006 LISTINGS 11/21/18 11:19 AM Page 2

*LIST_1218_ALT2_LIS_1006_LISTINGS 11/21/18 11:19 AM Page 1 WWW.WORLDSCREENINGS.COM DECEMBER 2018 ASIA TV FORUM EDITION TVLISTINGS THE LEADING SOURCE FOR PROGRAM INFORMATION TRULY GLOBAL WorldScreen.com *LIST_1218_ALT2_LIS_1006_LISTINGS 11/21/18 11:19 AM Page 2 2 TV LISTINGS ASIA TV FORUM EXHIBITOR DIRECTORY COMPLETE LISTINGS FOR THE COMPANIES IN BOLD CAN BE FOUND IN THIS EDITION OF TV LISTINGS. 108 Media L28 Five Star Production C28 NHC Media J10 9 Story Distribution International J30 Fixed Stars Multimedia D10 NHK Enterprises B10-18 A+E Networks G20 Flame Distribution L05 Nippon Animation B10-14 ABC Commercial L05 Fortune Star Media G26 Nippon TV B10-19 About Premium Content F10 FOX Networks Group D18 NPO Sales H36 ABS-CBN Corporation J18 FranceTV Distribution F10 NTV Broadcasting Company H27 ADK/NAS/D-Rights B10-15 Fred Media L05 Oak 3 Films E08/H08 AK Entertainment H10 Fremantle E20 Ocon Studios H32 Albatross World Sales L30 Fuji Creative Corporation B10-9 Off The Fence J23 Alfred Haber Distribution F30 GAD F10 Omens Studios E08/H08 all3media international K08 Gala Television Corporation D10 One Animation E08/H08 Alpha Group L10/N10 Gaumont H33 One Life Studios J04 Ampersand F10 Global Agency E27 One Take Media J28 Anima Istanbul N08 Globo K24 Only Distrib F10 Animasia Studio M28 Gloob Participants Lounge Parade Media Group H08-01 Animonsta Studios M28 GMA Worldwide J01 Paramount Pictures Suite 5201 Animoon J25 GO-N International F10 PGS Entertainment F10 Aniplex B27 GoldBee H34 Phoenix Satellite Television G24 Antares International -

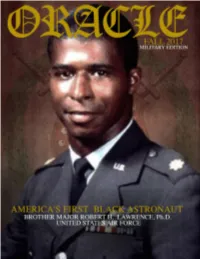

The Oracle - Fall 2017 1 TABLE of CONTENTS the Oracle OMEGA PSI PHI FRATERNITY, INC

The Oracle - Fall 2017 1 TABLE OF CONTENTS The Oracle OMEGA PSI PHI FRATERNITY, INC. International Headquarters 3951 Snapfinger Parkway Decatur, GA 30035 404-284-5533 U.S. Army's Lt. General Brother William E. "Kip" Ward was the Commander, U.S. Africa Command. Bro. Ward is one of Omega's highest ranking officers in Volume 89 No. 33 the Fraternity's history. FALL 2017 The official publication of Grand Basileus Message 7 Omega Psi Phi Fraternity, Inc. Bro. Antonio F. Knox, Sr. America's First Black Astronaut 10 Send address changes to: Bro. Major Robert H. Lawrence Omega Psi Phi Fraternity, Inc. Military Hall of Honor Attn: Grand KRS Omega Psi Phi's Military Men 12 3951 Snapfinger Parkway Decatur, GA 30035 Omega's War Chapter 14 The next Oracle deadline: By Bro. Jonathan A. Matthews January 15, 2018 *Deadlines are subject to change. Military Profiles 16 Brothers Jackson and Jones Please Email all editorial concerns, comments, and information to Military and Sports 20 Bro. M. Brown, Editor of The Oracle Brothers Black and Simmons [email protected] Leadership Conference 2017 24 Cincinnati, Ohio ORACLE COVER DESIGN By DEPARTMENTS Bro. Haythem Lafhaj Congressional Black Caucus-30 Legal News-32 Kappa Psi Graduate Chapter Omega's Office of Compliance-34 Lifetime Achievement Award-36 Undergraduate News-38 IHQ Website Editor District News-39 Brother Quinest Bishop Omega Chapter-56 2 The Oracle - Fall 2017 THE ORACLE Editorial Board EDITOR’S NOTES International Editor of The Oracle Brother Milbert O. Brown, Jr. n this issue we pay Itribute to the Brothers of Assistant Editor of The Oracle-Brother Norman Senior Omega who have served and are still serving in the Director of Photography- Brother James Witherspoon United States Armed Emeritus Photographer-Brother John H. -

Keywords Studios 2019 Annual Report

Keywords Studios plc Studios Keywords Annual Report Annual Report and Accounts 2019 and Accounts 2019 Building our platform for growth Keywords Studios plc Overview Strategic report Annual Report and Accounts 2019 Pages 1–6 Pages 8–44 Highlights 1 Q&A with Andrew Day 8 At a glance 2 Chief Executive’s review 10 Investment summary 4 Market outlook 16 Chairman’s statement 6 Business model 18 Our strategy 22 Service line review 24 Our people, our culture 28 KPIs 34 Financial and operating review 36 Responsible Business report 40 Board engagement with our stakeholders 43 Principal risks and uncertainties 45 2019 Highlights Our vision is to be the world’s leading technical and creative services platform for the video games industry and beyond. At Keywords Studios (Keywords), we are using our passion for games, technology and media to create a global services platform. In 2019, we delivered strong growth as we invested in a strengthened and more diversified services platform. Alternative performance measures* The Group reports certain Alternative performance measures (APMs) to present the financial performance of the business which are not GAAP measures as defined by International Financial Reporting Standards (IFRS). Management believes these measures provide valuable additional information for the users of the financial information to understand the underlying trading performance of the business. In particular, adjusted profit measures are used to provide the users of the accounts a clear understanding of the underlying profitability of the business over time. For full definitions and explanations of these measures and a reconciliation to the most directly referenceable IFRS line item, please see pages 135 to 143. -

A Guide for College & University

PBS-5b | MEMBER 2020 ACKNOWLEDGEMENT OF ANTI-HAZING PHI BETA SIGMAPOLICY FRATERNITY, AND INC. HOLD HARMLESS AGREEMENT A GUIDE FOR COLLEGE UPDATED: 11/8/2017 & UNIVERSITY OFFICIALS 145 KENNEDY STREET, NW | WASHINGTON, D.C. 20011 www.phibetasigma1914.org www.phibetasigma1914.org TABLE OF CONTENT Message from the President pg3 About Phi Beta Sigma Fraternity, Inc. pg4 Phi Beta Sigma’s Community Initiatives, Partnerships and Programs pg5 Training, Development and Support pg6 Fraternity Structure pg7 Organizational Flow pg9 Membership Criteria pg10 2 Sigma’s MIP at a glance pg11 Sigma’s Risk Management Policy pg14 2018 Regional Conference Schedule pg49 2017 Fraternity Highlights pg50 Notable Members pg52 Phi Beta Sigma’s Branding Standards pg55 MESSAGE FROM THE PRESIDENT Dear Campus Partner- It is an honor and a privilege to address you as the 35th International President of Phi Beta Sigma Fraternity, Incorporated! This is an exciting time to be a Sigma, as our Fraternity moves into a new era, as “A Brotherhood of Conscious Men Actively Serving Our Communities.” We are excited about the possibilities of having an even greater impact on your campus as the Men of Sigma march on! We prepared this booklet to provide you a glance into the world of Phi Beta Sigma, our cause and our initiatives. Indeed, we are a brotherhood of conscious men; Conscious Husbands, Conscious Fathers, Conscious Servants, Conscious Leaders, called to improve the lives of the people we touch. Our collegiate Brothers play a major role in achieving our mission, as they are the lifeblood and future of our Fraternity and communities. -

<< HOPE in CRISIS 2020 ALUMNI

ALUMNI MAGAZINE • WINTER 2020 << HOPE IN CRISIS 2020 ALUMNI MEDALLION THE GREATEST SHOWMEN “ William & Mary has given me so much, I want to pass it down the line. It’s important for the future of the university.” — Betsy Calvo Anderson ’70, HON J.D. ’15, P ’00 YOUR LEGACY FOR ALL TIME COMING. “ Why do I give? I feel lucky to have a unique perspective on William & Mary. As a Muscarelle Museum of Art Foundation board member, an emeritus member of the William & Mary Law School Foundation board and a past president of the Alumni Association, I’ve seen first-hand the resources and commitment it takes to keep William & Mary on the leading edge of higher education — and how diligently the university puts our contributions to work. My late husband, Alvin ’70, J.D. ’72, would be happy to know that in addition to continuing our more than 40-year legacy of annual giving, I’ve included our alma mater in my estate plans. Although I never could have imagined when I arrived on campus at age 18 what an enormous impact William & Mary would have on my life, I also couldn’t have imagined the opportunity I would have to positively influence the lives of others.” WILLIAM & MARY For assistance with your charitable gift plans, contact OFFICE OF GIFT PLANNING Kirsten A. Kellogg ’91, Ph.D., Executive Director of Principal Gifts and Gift Planning, at (757) 221-1004 or [email protected]. giving.wm.edu/giftplanning BOLD MOMENTS DEFINE US. For Omiyẹmi, that moment was when she stopped waiting for approval to create art and started devising her own opportunities. -

Fiscal Year 2015 Results Briefing(4.1MB)

HAPPINET CORPORATION Stock Listing :Tokyo Stock Exchange Code Number :7552 Fiscal Year 2015 Results Briefing May 20, 2016 Table目次 of Contents FY2015 Results Summary 2 FY2015 Financial Results 9 FY2016 Group- Group-WideWide Main Policy 19 FY2016 Measures for the Distribution Business 21 FY2016 Measures for the Contents Business 26 FY2016 Fu ll-YPjtiYear Projection 31 Information related to Share Price 34 FY2015 Results Summary TtTetsuo IhikIshikawa President and Representative Director 2 FY2015目次 Results Summary (¥ million) FY2014 FY2015 YOY Net sales 217,232 187,274 --13.813.8% Operating income 5,056 3,450 --31.831.8% Ordinary income 5,124 3,497 -31.8% Profit attributable to owners of parent 4,049 2,359 -41.7% 3 FY2015目次 Results Summary Toy Business Net sales Segment income (millions of yen) ■ FY2015 Results Summary 93,270 Compared to the previous fiscal year, net sales hovered at a low level due to a lack of major hit products during the 76,874 yearyear--endend sales season, which is the greatest sales 76,821 opportunity. 4,279 Segment income also lagged, due mainly to posting of an valuation loss from overstocked products. 2, 710 2,848 FY2013 FY2014 FY2015 Segment income 2712.71 billion yen 4274.27 billion yen 2842.84 billion yen Clearance amounts 1.0 billion yen 1.6 billion yen 1.8 billion yen Inventory amounts 2.4 billion yen 2.3 billion yen 2.2 billion yen Inventory turnover rate 31.0 38.7 33.6 FY2013 FY2014 FY2015 4 FY2015目次 Results Summary Visual and Music Business Net sales Segment income (millions of yen) ■ FY2015 Results Summary In an environment where the package market remains sluggish as a whole due to effects of the distribution of software via the Internet, net sales of the Group in this 42,955 43,372 business segment also remained weak. -

Viacom18 Media Private Limited– Update on Material Event Rationale

April 29, 2021 Viacom18 Media Private Limited– Update on Material Event Summary of rating(s) outstanding Previous Rated Amount Current Rated Amount Instrument* Rating Outstanding (Rs. crore) (Rs. crore) Commercial Paper Programme 500.0 500.0 [ICRA]A1+ Short-term, Fund-based/Non 1,610.7 1,610.7 [ICRA]A1+ fund based Limits Total 2,110.7 2,110.7 *Instrument details are provided in Annexure-1 Rationale On February 17, 2020, Network18 intimated the stock exchanges regarding a scheme of amalgamation and arrangement amongst Network18, TV18, DEN Networks Limited (DEN) and Hathway Cable & Datacom Limited (Hathway). Under the scheme, DEN, Hathway and TV18 were to merge into Network18 with effect from February 1, 2020, subject to receipt of necessary approvals to consolidate Reliance Industries Limited’s (RIL, rated [ICRA]AAA (Stable) / [ICRA]A1+ and Baa2 Stable by Moody’s Investors Service) media and distribution business spread across multiple entities into Network18. The company again announced on April 20, 2021 that considering more than a year has passed from the time the Board considered the Scheme, the Board of the Company has decided not to proceed with the arrangement envisaged in the Scheme. ICRA has taken cognizance of the above and the rating remain unchanged at the earlier rating of [ICRA]A1+ as the parent company, TV18 would continue with the existing corporate structure. Please refer to the following link for the previous detailed rationale that captures Key rating drivers and their description, Liquidity position, Rating sensitivities,: Click here Analytical approach Analytical Approach Comments Corporate Credit Rating Methodology Applicable Rating Methodologies Rating Methodology for Media Broadcasting Industry Impact of Parent or Group Support on an Issuer’s Credit Rating Parent / Group Company: RIL Group.