Cash Crash: Syria's Economic Collapse and the Fragmentation of the State

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Syria Country Office

SYRIA COUNTRY OFFICE MARKET PRICE WATCH BULLETIN July 2020 ISSUE 68 Picture @ WFP/Hussam Al Saleh @WFP/Jessica Lawson Highlights Standard Food Basket Figure 1: Food basket cost and changes, SYP ○ The national average price of a stand- The national average price of a standard reference 1 ard reference food basket in July 2020 food basket increased by three percent between June and July 2020, reaching SYP 86,571. The highest rate was SYP 86,571 (USD 69 at the official recorded since the start of the crisis. The national av- exchange rate 1,250/USD), increasing by erage food basket price was 131 percent higher than three percent compared to June 2020. that of January 2020 and was 251 percent higher com- The reference food basket price in- pared to July 2019 (Figure 1). creased by 251 percent since July 2019. Compared to June 2020, July food basket prices have ○ The national average ToT between been relatively constant due to the arrival of the coun- wheat flour and daily non-skilled wage try’s main agricultural harvest and the strengthening labour, a proxy indicator for purchasing of the informal exchange rate. power, reached its lowest level since While seven governorates reported an increasing aver- Chart 1: National min., max. and average food basket cost, SYP monitoring began (2014). In July 2020 a age reference food basket price in July 2020, five gov- daily non-skilled wage could afford only ernorates reported a decreasing average reference 3.91kgs of wheat flour compared to food basket and two governorates reported no change 8.83kgs in July 2019. -

Turkey Practical Information

1349 Portage Avenue Winnipeg, Manitoba Canada R3G 0V7 1-800-661-3830 www.greatcanadiantravel.com Turkey Practical Information Turkey, officially the Republic of Turkey, is a transcontinental country in Eurasia. The country is surrounded by seas on three sides. Ankara is the capital while Istanbul is the country’s largest city and main cultural and commercial centre. Documentation Canadian passports are required for visitors to travel to Turkey and must be valid for 60 days beyond the duration of your stay indicated on your visa. A visa is required for all travel to Turkey. Airports Istanbul Atatürk Airport Istanbul Atatürk Airport is the main international airport serving Istanbul and surrounding areas. It is located 24km west of Istanbul’s center and serves as the main hub for Turkish Airlines. There are many other airports located through Turkey. 1349 Portage Avenue Winnipeg, Manitoba Canada R3G 0V7 1-800-661-3830 Location and Geography www.greatcanadiantravel.com Turkey is a country located in both Europe and Asia. The Black Sea is to the north and the Mediterranean Sea is to the west and southwest. Georgia and Armenia are northeast, Azerbaijan and Iran are east, Iraq and Syria are southeast, and Greece and Bulgaria are northwest. Turkey is among the larger countries of the region with a land area greater than any European country. It is a mountainous country with flat land covering only one-sixth of the surface. Mountain crests exceed 2300 metres in many places and Turkey’s highest mountain, Mount Ararat reaches 5165 metres high. Other notable mountains include Uludoruk Peak-4744 metres high, Demirkazik Peak-3755 metres high and Mount Aydos-3479 metres high. -

Historical Precedents for Internationalization of The

Maurice R. Greenberg Center for Geoeconomic Studies and International Institutions and Global Governance Program Historical Precedents for Internationalization of the RMB Jeffrey Frankel November 2011 This publication has been made possible by the generous support of the Robina Foundation. The Council on Foreign Relations (CFR) is an independent, nonpartisan membership organization, think tank, and publisher dedicated to being a resource for its members, government officials, busi- ness executives, journalists, educators and students, civic and religious leaders, and other interested citizens in order to help them better understand the world and the foreign policy choices facing the United States and other countries. Founded in 1921, CFR carries out its mission by maintaining a diverse membership, with special programs to promote interest and develop expertise in the next generation of foreign policy leaders; convening meetings at its headquarters in New York and in Washington, DC, and other cities where senior government officials, members of Congress, global leaders, and prominent thinkers come together with CFR members to discuss and debate major in- ternational issues; supporting a Studies Program that fosters independent research, enabling CFR scholars to produce articles, reports, and books and hold roundtables that analyze foreign policy is- sues and make concrete policy recommendations; publishing Foreign Affairs, the preeminent journal on international affairs and U.S. foreign policy; sponsoring Independent Task Forces that produce reports with both findings and policy prescriptions on the most important foreign policy topics; and providing up-to-date information and analysis about world events and American foreign policy on its website, CFR.org. The Council on Foreign Relations takes no institutional positions on policy issues and has no affilia- tion with the U.S. -

May 5, 2006 Technical Revisions to the 2005 Barrier Option Supplement

May 5, 2006 Technical revisions to the 2005 Barrier Option Supplement The Foreign Exchange Committee (FXC), International Swaps and Derivatives Association, Inc. (ISDA), and EMTA, Inc. announce two technical revisions to the 2005 Barrier Option Supplement to the 1998 FX and Currency Option Definitions (“2005 Supplement”). The first revision suggests how to incorporate into a Barrier or Binary Option Transaction the terms of the 2005 Supplement. The relevant Confirmation of the Barrier or Binary Option Transaction should state that “the 1998 FX and Currency Option Definitions, as amended by the 2005 Barrier Option Supplement, as published by the International Swaps and Derivatives Association, Inc., EMTA, Inc., and the Foreign Exchange Committee are incorporated into this Confirmation.” For purposes of clarity, this provision has been added to Exhibits I and II to the 2005 Supplement, which illustrate how Barrier and Binary Options may be confirmed under the terms of the 2005 Supplement and the 1998 FX and Currency Option Definitions (“1998 Definitions”) (see the second paragraph and footnote 2 of each Exhibit). The revised Exhibits I and II are attached to this announcement. The second revision further describes the approach taken to the conventions for stating Currency Pairs in the Currency Pair Matrix that was published with the 2005 Supplement. The Matrix is provided as a best practice to facilitate the use of standard market convention when specifying the exchange rates relating to certain terms in a Confirmation of a Barrier or Binary Option Transaction that incorporates the provisions of the 2005 Supplement. The introductory statement to the Matrix has been revised to highlight that its conventions for stating currency pairs may be different from trading conventions. -

Capital Markets and New Turkish Lira Conversion

CAPITAL MARKETS BOARD OF TURKEY CAPITAL MARKETS AND NEW TURKISH LIRA CONVERSION OCTOBER 2004 CAPITAL MARKETS BOARD OF TURKEY NEW TURKISH LIRA TABLE OF CONTENTS 1. INTRODUCTION................................................................................................................................ 1 2. THE WORKING METHODOLOGY FOR THE NEW TURKISH LIRA CONVERSION ........ 1 3. THE LEGAL ISSUES.......................................................................................................................... 2 4. THE ISTANBUL STOCK EXCHANGE........................................................................................... 3 4.1. THE EQUITIES MARKET........................................................................................................................ 3 4.2. THE BONDS AND BILLS MARKET ......................................................................................................... 6 4.3. THE CURRENCY FUTURES MARKET ..................................................................................................... 7 4.4. THE IT INFRASTRUCTURE..................................................................................................................... 8 5. ISE SETTLEMENT AND CUSTODY BANK INC.(TAKASBANK) ............................................ 8 6. ISTANBUL GOLD EXCHANGE..................................................................................................... 10 7. REQUIREMENTS FROM THE MARKET PARTICIPANTS..................................................... 10 7.1. THE MUTUAL -

Exchange Rate Statistics

Exchange rate statistics Updated issue Statistical Series Deutsche Bundesbank Exchange rate statistics 2 This Statistical Series is released once a month and pub- Deutsche Bundesbank lished on the basis of Section 18 of the Bundesbank Act Wilhelm-Epstein-Straße 14 (Gesetz über die Deutsche Bundesbank). 60431 Frankfurt am Main Germany To be informed when new issues of this Statistical Series are published, subscribe to the newsletter at: Postfach 10 06 02 www.bundesbank.de/statistik-newsletter_en 60006 Frankfurt am Main Germany Compared with the regular issue, which you may subscribe to as a newsletter, this issue contains data, which have Tel.: +49 (0)69 9566 3512 been updated in the meantime. Email: www.bundesbank.de/contact Up-to-date information and time series are also available Information pursuant to Section 5 of the German Tele- online at: media Act (Telemediengesetz) can be found at: www.bundesbank.de/content/821976 www.bundesbank.de/imprint www.bundesbank.de/timeseries Reproduction permitted only if source is stated. Further statistics compiled by the Deutsche Bundesbank can also be accessed at the Bundesbank web pages. ISSN 2699–9188 A publication schedule for selected statistics can be viewed Please consult the relevant table for the date of the last on the following page: update. www.bundesbank.de/statisticalcalender Deutsche Bundesbank Exchange rate statistics 3 Contents I. Euro area and exchange rate stability convergence criterion 1. Euro area countries and irrevoc able euro conversion rates in the third stage of Economic and Monetary Union .................................................................. 7 2. Central rates and intervention rates in Exchange Rate Mechanism II ............................... 7 II. -

Countries Codes and Currencies 2020.Xlsx

World Bank Country Code Country Name WHO Region Currency Name Currency Code Income Group (2018) AFG Afghanistan EMR Low Afghanistan Afghani AFN ALB Albania EUR Upper‐middle Albanian Lek ALL DZA Algeria AFR Upper‐middle Algerian Dinar DZD AND Andorra EUR High Euro EUR AGO Angola AFR Lower‐middle Angolan Kwanza AON ATG Antigua and Barbuda AMR High Eastern Caribbean Dollar XCD ARG Argentina AMR Upper‐middle Argentine Peso ARS ARM Armenia EUR Upper‐middle Dram AMD AUS Australia WPR High Australian Dollar AUD AUT Austria EUR High Euro EUR AZE Azerbaijan EUR Upper‐middle Manat AZN BHS Bahamas AMR High Bahamian Dollar BSD BHR Bahrain EMR High Baharaini Dinar BHD BGD Bangladesh SEAR Lower‐middle Taka BDT BRB Barbados AMR High Barbados Dollar BBD BLR Belarus EUR Upper‐middle Belarusian Ruble BYN BEL Belgium EUR High Euro EUR BLZ Belize AMR Upper‐middle Belize Dollar BZD BEN Benin AFR Low CFA Franc XOF BTN Bhutan SEAR Lower‐middle Ngultrum BTN BOL Bolivia Plurinational States of AMR Lower‐middle Boliviano BOB BIH Bosnia and Herzegovina EUR Upper‐middle Convertible Mark BAM BWA Botswana AFR Upper‐middle Botswana Pula BWP BRA Brazil AMR Upper‐middle Brazilian Real BRL BRN Brunei Darussalam WPR High Brunei Dollar BND BGR Bulgaria EUR Upper‐middle Bulgarian Lev BGL BFA Burkina Faso AFR Low CFA Franc XOF BDI Burundi AFR Low Burundi Franc BIF CPV Cabo Verde Republic of AFR Lower‐middle Cape Verde Escudo CVE KHM Cambodia WPR Lower‐middle Riel KHR CMR Cameroon AFR Lower‐middle CFA Franc XAF CAN Canada AMR High Canadian Dollar CAD CAF Central African Republic -

Syria Country Office

SYRIA COUNTRY OFFICE MARKET PRICE WATCH BULLETIN June 2020 ISSUE 67 @WFP/Jessica Lawson Picture @ WFP/Hussam Al Saleh Highlights Standard Food Basket Figure 1: Food basket cost and changes, SYP ○ The national average price of a stand- The national average monthly price of a standard ref- erence food basket1 increased by 48 percent between ard reference food basket in June 2020 May and June 2020, reaching SYP 84,095. The national was SYP 84,095 increasing by 48 percent average food basket price was 110 percent higher than compared to May 2020. The national that of February 2020 (before COVID-19 movement average reference food basket price restrictions) and was 231 percent higher compared to increased by 110 percent since February October 2019 (start of the Lebanese financial crisis) 2020 (pre-COVID-19 period). and 240 percent higher vis-à-vis June 2019 (Figure 1). ○ WFP’s reference food basket is now The increase in the national average food basket price more expensive than the highest gov- is caused by a multitude of factors such as: high fluctu- ernment monthly salary (SYP 80,240). ations of the Syrian pound on the informal exchange Outlining the serious deterioration in market, intensification of unilateral coercive measures Chart 1: National min., max. and average food basket cost, SYP peoples’ purchasing power. and political disagreements within the Syrian Elite. ○ The Syrian pound continued to heavily All 14 governorates reported an increasing average depreciate on the informal exchange reference food basket price in June 2020, with the market, weakening to SYP 3,200/USD highest month-on-month (m-o-m) increase reported in before stabilizing around SYP 2,500/USD Quneitra (up 78 percent m-o-m), followed by Rural by end June. -

WM/Refinitiv Closing Spot Rates

The WM/Refinitiv Closing Spot Rates The WM/Refinitiv Closing Exchange Rates are available on Eikon via monitor pages or RICs. To access the index page, type WMRSPOT01 and <Return> For access to the RICs, please use the following generic codes :- USDxxxFIXz=WM Use M for mid rate or omit for bid / ask rates Use USD, EUR, GBP or CHF xxx can be any of the following currencies :- Albania Lek ALL Austrian Schilling ATS Belarus Ruble BYN Belgian Franc BEF Bosnia Herzegovina Mark BAM Bulgarian Lev BGN Croatian Kuna HRK Cyprus Pound CYP Czech Koruna CZK Danish Krone DKK Estonian Kroon EEK Ecu XEU Euro EUR Finnish Markka FIM French Franc FRF Deutsche Mark DEM Greek Drachma GRD Hungarian Forint HUF Iceland Krona ISK Irish Punt IEP Italian Lira ITL Latvian Lat LVL Lithuanian Litas LTL Luxembourg Franc LUF Macedonia Denar MKD Maltese Lira MTL Moldova Leu MDL Dutch Guilder NLG Norwegian Krone NOK Polish Zloty PLN Portugese Escudo PTE Romanian Leu RON Russian Rouble RUB Slovakian Koruna SKK Slovenian Tolar SIT Spanish Peseta ESP Sterling GBP Swedish Krona SEK Swiss Franc CHF New Turkish Lira TRY Ukraine Hryvnia UAH Serbian Dinar RSD Special Drawing Rights XDR Algerian Dinar DZD Angola Kwanza AOA Bahrain Dinar BHD Botswana Pula BWP Burundi Franc BIF Central African Franc XAF Comoros Franc KMF Congo Democratic Rep. Franc CDF Cote D’Ivorie Franc XOF Egyptian Pound EGP Ethiopia Birr ETB Gambian Dalasi GMD Ghana Cedi GHS Guinea Franc GNF Israeli Shekel ILS Jordanian Dinar JOD Kenyan Schilling KES Kuwaiti Dinar KWD Lebanese Pound LBP Lesotho Loti LSL Malagasy -

Syriaeconomicreport

SyriaEconomicReport SYRIA’S MACROECONOMIC PROGRESS NOT TO OVERSHADOW ITS DRASTIC REFORM REQUIREMENTS u The Syrian economy is currently witnessing an improvement in output performance, though still far below the prevailing potential of the economy. According to the International Monetary Fund (IMF), Syria’s real GDP growth rate has reported close to 3% in 2005 (4.5% according to official Syrian estimate). It is worth recalling that the Syrian economy had reported an average real GDP growth of 1.8% per annum, according to the same figures, over the period extending from 1999 to 2004. Non-oil GDP growth may have risen to about 5.5% in 2005, from 5% in 2004 according to the IMF, mainly driven by business investment, household consumption and non-oil exports. Despite the relative improvement in economic conditions, Syria’s September private demand continues to suffer from the lack of adequate financing, restricting its leverage effect on growth, and from a below potential private consumption and investment component in view of prevailing uncertainties. u Over the past year, the Syrian economy has benefited from rising oil prices and a regional post-Iraq war boom translating into 2006 larger inflows emanating from workers remittances, tourist receipts and foreign investment activity. However, the widening political uncertainties and the drastic reform requirements, despite the progress recently reported, continued to dampen growth performance. Oil dependence is also a significant concern as oil production is on a declining trend. According to the IMF, Syria will become a net oil importer within four to six years, with oil supplies likely to be exhausted in a couple of decades. -

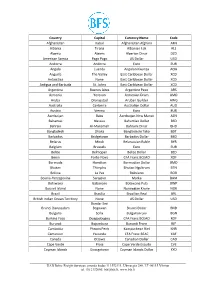

International Currency Codes

Country Capital Currency Name Code Afghanistan Kabul Afghanistan Afghani AFN Albania Tirana Albanian Lek ALL Algeria Algiers Algerian Dinar DZD American Samoa Pago Pago US Dollar USD Andorra Andorra Euro EUR Angola Luanda Angolan Kwanza AOA Anguilla The Valley East Caribbean Dollar XCD Antarctica None East Caribbean Dollar XCD Antigua and Barbuda St. Johns East Caribbean Dollar XCD Argentina Buenos Aires Argentine Peso ARS Armenia Yerevan Armenian Dram AMD Aruba Oranjestad Aruban Guilder AWG Australia Canberra Australian Dollar AUD Austria Vienna Euro EUR Azerbaijan Baku Azerbaijan New Manat AZN Bahamas Nassau Bahamian Dollar BSD Bahrain Al-Manamah Bahraini Dinar BHD Bangladesh Dhaka Bangladeshi Taka BDT Barbados Bridgetown Barbados Dollar BBD Belarus Minsk Belarussian Ruble BYR Belgium Brussels Euro EUR Belize Belmopan Belize Dollar BZD Benin Porto-Novo CFA Franc BCEAO XOF Bermuda Hamilton Bermudian Dollar BMD Bhutan Thimphu Bhutan Ngultrum BTN Bolivia La Paz Boliviano BOB Bosnia-Herzegovina Sarajevo Marka BAM Botswana Gaborone Botswana Pula BWP Bouvet Island None Norwegian Krone NOK Brazil Brasilia Brazilian Real BRL British Indian Ocean Territory None US Dollar USD Bandar Seri Brunei Darussalam Begawan Brunei Dollar BND Bulgaria Sofia Bulgarian Lev BGN Burkina Faso Ouagadougou CFA Franc BCEAO XOF Burundi Bujumbura Burundi Franc BIF Cambodia Phnom Penh Kampuchean Riel KHR Cameroon Yaounde CFA Franc BEAC XAF Canada Ottawa Canadian Dollar CAD Cape Verde Praia Cape Verde Escudo CVE Cayman Islands Georgetown Cayman Islands Dollar KYD _____________________________________________________________________________________________ -

Public Attitudes Toward the Caesar Act in Northeast Syria

Public Attitudes Toward the Caesar Act in Northeast Syria October 2020 Public Attitudes Toward the Caesar Act in Northeast Syria www.opc.center © 2020 OPC. All rights reserved. Operations and Policy Center (OPC, formerly, Orient Policy Center) is an independent think tank and service provider based in Gaziantep, Turkey. Established in 2014, OPC conducts original research and provides consulting services to enhance policymaking, development programs, and humanitarian response projects. Syrian-led and owned, OPC combines local knowledge with technological and scientific expertise, utilizing in-house statisticians and graphic designers to create original and intuitive final products. This report is funded by: Ministère de l’Europe et des Affaires étrangères Centre de crise et de soutien Executive Summary _____________________________________________________ 5 Introduction ___________________________________________________________ 7 Methodology ___________________________________________________________ 9 Findings ______________________________________________________________ 12 1| Public Self-Reported Awareness About the Caesar Act ______________________ 12 2| Respondents’ Sources of Information ___________________________________ 15 3| Perceptions of Caesar Act Effects _______________________________________ 17 4| Public Perception of the Imposed Caesar Act ______________________________ 18 5| Public Opinion on the Economic Implications of the Caesar Act _______________ 20 6| Specific Questions Regarding the Achievement of the Caesar Act’s