Ff the Eaten

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Coordination of Statewide Aquatic Vegetation and Invasive Species

Texas Statewide Aquatic Vegetation and Invasive Species Management Update (a.k.a., “The State of the State”) Monica McGarrity Aquatic Invasive Species Team Lead – Austin, TX AIS Management in Texas • Cost of effective AIS management: ~$45M / year • TPWD total annual AIS budget historically ~$1.4M • Legislature allocated $6.3 M / biennium to TPWD Inland Fisheries for 2016-2017 & 2018-2019 • Federal boater access funds and partner funds augment state-funded efforts Public Awareness Campaigns • Clean, Drain, Dry call to action – “poster child” species • Focus on preventing the spread of AIS by day-use boaters • 2019 - increased focus on targeted marina outreach to prevent movement of mussels on wet-slipped boats Public Awareness Campaigns Zebra Mussel Early Detection • More than 50 lakes monitored by partner collaboration • Plankton samples analyzed with microscopy (CPLM) & eDNA • Settlement samplers & shoreline substrate surveys Water Body Status Classifications • Infested – established; reproducing population. • Positive Lakes – detected more than once; no evidence of reproduction (yet…) • Suspect Lakes – single detection • Inconclusive Lakes – DNA or an unverified suspect organism found in the past year Zebra Mussels Status Update • Infested (15 lakes, 5 river basins) – Austin, Belton, Bridgeport, Canyon, Dean Gilbert†, Eagle Mountain, Georgetown, Lady Bird*, Lewisville, Livingston, Randell †, Ray Roberts, Stillhouse Hollow, Texoma, Travis • Positive – Fishing Hole †, Grapevine*, Lavon, Richland Chambers, Waco, Worth; also river reaches -

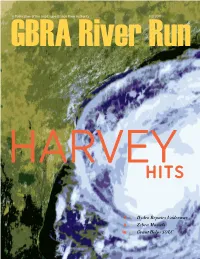

River Run Fall 2017

A Publication of the Guadalupe-Blanco River Authority Fall 2017 3 / Hydro Repairs Underway 8 / Zebra Mussels 16 / Grant Helps SOLC Constituent Communiqué Building Relationships In its 10-county statutory district, the Guadalupe-Blanco River Authority works with a variety of customers for water sales and treatment, wastewater treatment, power sales, recreational undertakings and other services. In conducting those operations, GBRA staff also work closely with elected officials, developers and other constituents to determine their current and future needs and to see how GBRA can help address those needs. The purpose of our efforts is to provide exceptional service for their benefit. We are able to do this by ensuring that GBRA has highly skilled employees who receive relevant training year round. This also includes state licensed operators for the water and wastewater treatment facilities that we own and Ithose that we operate in partnership with customers in our basin. Today, GBRA continues to nurture long-standing relationships with its current customers while building new relationships with new partners. Furthering existing partnerships and addressing a need for a geographic area that lacks certain utilities, GBRA is securing a Certificate of Convenience and Necessity (CCN) to provide wastewater services to an unincorporated area between New Braunfels and Seguin. GBRA will work in partnership with New Braunfels Utilities and the city of Seguin to provide wholesale wastewater treatment to wastewater that is collected from the new developments that are occurring in this high growth area. GBRA is stepping up to build these relationships because the area is growing and circumstances demand it. -

Gooj~ 7 Guadalupe Appraisal District

GOOJ~ 7 GUADALUPE APPRAISAL DISTRICT Main Ollice Schertz Substation 3000 N. Austin St 1101 Eibel Rd. Seguin, Texas 78155 Schertz, Texas 78154 (830) 303-3313 (210) 945-9708 Opt 8 (830) 372-2874 (Fax) (877) 254-0888 (Fax) [email protected] C) C z NOTICE OF MEETING {_;:_ >· -0 ... Notice is hereby given that the Guadalupe Appraisal Review Board will I vefuf"' at~00rltJm. on December 1, 2, 8, 9, 15, & 16, 2020 at the Guadalupe Appraisal D1sthct (~flic~300'0' N. Austin Street, Seguin, Texas 78155. j S c...~ Under the authority of Chapter 551 of the Texas Government Code, the Board, during the course of the meeting covered by this notice, may enter into closed or executive session for any of the fallowing reasons provided the subject to be discussed is on the agenda for the meeting. • For a private consultation with the Board's Attorney with respect to pending or contemplated litigation, settlement offers, or on a matter in which the duty of the attorney to the governmental body under the Texas Disciplinary Rules of Professional Conduct of the State Bar of Texas, clearly conflicts with this chapter. (Sec. 551-071) Notwithstanding Chapter 551 of the Texas Government Code, the Appraisal Review Board shall conduct a hearing that is closed to the public if the property owner or the chief appraiser intends to disclose proprietary or confidential information at the hearing that will assist the review board in determining the protest The review board may hold a closed hearing under this subsection only on a joint motion by the property owner and the chief appraiser. -

2006 San Antonio, Texas

CASE LAW UPDATE Presented by DAVID A. WEATHERBIE Carrie, Cramer & Weatherbie, L.L.P. Dallas, Texas 16TH ANNUAL ROBERT C. SNEED LAND TITLE INSTITUTE NOVEMBER 30 & DECEMBER 1, 2006 SAN ANTONIO, TEXAS DAVID A. WEATHERBIE CARRIE, CRAMER & WEATHERBIE, L.L.P. EDUCATION: M B.A., Southern Methodist University - 1971 M Juris Doctor, cum laude, Southern Methodist University - 1976 M Order of the Coif M Research Editor, Southwestern Law Journal PROFESSIONAL ACTIVITIES: M Licensed to practice in the State of Texas M Partner - Carrie, Cramer & Weatherbie, L.L.P., Dallas, Texas ACADEMIC APPOINTMENTS, PROFESSIONAL ACTIVITIES, AND HONORS M Adjunct Professor of Law, Southern Methodist University School of Law / Real Estate Transactions - 1986 to 1995 M Council Member, Real Estate, Probate & Trust Section, State Bar of Texas M Member, American College of Real Estate Lawyers M Listed as 2003, 2004, 2005, and 2006 Texas Monthly “Super Lawyer” M Listed in Best Lawyers in America LAW RELATED PUBLICATIONS AND PRESENTATIONS: M Author B Weatherbie=s Texas Real Estate Law Digest (James Publishing, 1999) M Course Director for the State Bar of Texas, Advanced Real Estate Law Course – 1995 M Course Director for the University of Texas at Austin - Mortgage Lending Institute - 2002 M Author/Speaker for the State Bar of Texas, Advanced Real Estate Law Course - 1987 to present M Author/Speaker for the University of Texas at Austin - Mortgage Lending Institute - 1992 to present M Author/Speaker for Texas Land Title Institute - 1992 to present M Author/Speaker for Southern Methodist University - Leases in Depth - 1992 to 2000 M Author/Speaker for Southern Methodist University - Transactions in Depth - 1992 to 2000 M Author/Speaker for the State Bar of Texas, Advanced Real Estate Drafting Course M Panel Member for State Bar of Texas, Advanced Real Estate Transactions Course B 1997 M Author of “Annual Survey of Texas Law -- Real Estate,” 51 SMU L. -

10 Most Significant Weather Events of the 1900S for Austin, Del Rio and San Antonio and Vicinity

10 MOST SIGNIFICANT WEATHER EVENTS OF THE 1900S FOR AUSTIN, DEL RIO AND SAN ANTONIO AND VICINITY PUBLIC INFORMATION STATEMENT NATIONAL WEATHER SERVICE AUSTIN/SAN ANTONIO TX 239 PM CST TUE DEC 28 1999 ...10 MOST SIGNIFICANT WEATHER EVENTS OF THE 1900S FOR AUSTIN...DEL RIO AND SAN ANTONIO AND VICINITY... SINCE ONE OF THE MAIN FOCUSES OF WEATHER IN CENTRAL AND SOUTH CENTRAL TEXAS INVOLVES PERIODS OF VERY HEAVY RAIN AND FLASH FLOODING...NOT ALL HEAVY RAIN AND FLASH FLOOD EVENTS ARE LISTED HERE. MANY OTHER WEATHER EVENTS OF SEASONAL SIGNIFICANCE ARE ALSO NOT LISTED HERE. FOR MORE DETAILS ON SIGNIFICANT WEATHER EVENTS ACROSS CENTRAL AND SOUTH CENTRAL TEXAS IN THE PAST 100 YEARS...SEE THE DOCUMENT POSTED ON THE NATIONAL WEATHER SERVICE AUSTIN/SAN ANTONIO WEBSITE AT http://www.srh.noaa.gov/images/ewx/wxevent/100.pdf EVENTS LISTED BELOW ARE SHOWN IN CHRONOLOGICAL ORDER... FIRST STARTING WITH AUSTIN AND VICINITY...FOLLOWED BY DEL RIO AND VICINITY...AND ENDING WITH SAN ANTONIO AND VICINITY. AUSTIN AND VICINITY... 1. SEPTEMBER 8 - 10... 1921 - THE REMNANTS OF A HURRICANE MOVED NORTHWARD FROM BEXAR COUNTY TO WILLIAMSON COUNTY ON THE 9TH AND 10TH. THE CENTER OF THE STORM BECAME STATIONARY OVER THRALL...TEXAS THAT NIGHT DROPPING 38.2 INCHES OF RAIN IN 24 HOURS ENDING AT 7 AM SEPTEMBER 10TH. IN 6 HOURS...23.4 INCHES OF RAIN FELL AND 31.8 INCHES OF RAIN FELL IN 12 HOURS. STORM TOTAL RAIN AT THRALL WAS 39.7 INCHES IN 36 HOURS. THIS STORM CAUSED THE MOST DEADLY FLOODS IN TEXAS WITH A TOTAL OF 215 FATALITIES. -

Texas Lutheran University Pound the Footballrock 2012 Bulldogs Fight

TEXAS LUTHERAN UNIVERSITY POUND THE FOOTBALLROCK 2012 BULLDOGS FIGHT. FINISH. FAITH. TABLE OF CONTENTS In and Around TLU The Schedule TLU Up Close ................................................................... 2 About the NCAA DIII ....................................................... 44 Notable Alumni & Quick Facts ......................................... 3 About the American Southwest Conference ................ 44 TLU Athletics – A Force in the NCAA and the ASC ......... 4 ASC Preseason Football Poll ......................................... 45 About Seguin, Texas ........................................................ 5 Game 1 Austin College ................................................... 46 Media / Fan Information .................................................. 6 Game 2 Trinity ................................................................ 46 Dr Stuart Dorsey, TLU President .......................................7 Game 3 Southwestern Assemblies of God ....................47 Steve Anderson, Assistant to the President.....................7 Game 4 East Texas Baptist .............................................47 Bill Miller, Director of Athletics .........................................7 Game 5 Mary Hardin-Baylor .......................................... 48 Medical / Athletic Training Staff ....................................8-9 Game 6 Sul Ross State .................................................. 48 Sports Information / Athletics Office Staff ....................... 9 Game 7 Mississippi College ......................................... -

PADGETT · Padg~ T - , .,.~ ' ~ Gladys Hagan Padgett

, --r w<.- Pacina Pacheco Pacheco ....,. 0 R. · -f ~ -, Rosary will be recited at 7:30 p.m. Cannan M . Pacheco, of San Mar- t.oa1gbt at the Los Angeles runeraI 006. died June 19. for Lecmarda T. ~ of Rosary will be recited at 7 p.m. Sm Marcos. who died Aug. at the Friday al Pennlng1on Funeral Holh of 83. Funeral mass be Fri· with funeral services at 9 a.m. Satur day al 10 a.m. at St. John's Catbollc day at St. John'aCalhoUc Church. Cburdl, with lnten"menl followtng at Burlal wUl be at the ReedvUI City Cemetery. emetery under the aupervlsJon of She ts survived by ooe alsler, Cruz Pennington Funeral Home. Vela of San Marcos; one brother, She is survived by two sons, Joe Domingo (Toby) Toblasof San Mar Pacheco of MlchJgan and J cos; four aons, Marcol Pacheco, Pacheco of San Marcos; seven Joho Pac:beco and Felix Pacbeco, all daugbters, Margaret Cortez of San o1 Sm Marcos, and Mark Pacheco of Marcos, Atanacla Cortez of Houston, Baltimore, Maryland ; two Cuca rda of San Marcos, Slefana Uu(ChterS. Pauline Munari and Anita De Leon of San Marcos, Vincenta Colon, both of San Marcos; 19 grand Pacheco of San arcos, Josephine c b 11 d re n ; and 17 great· Leos of CaJUomia and Alice Cortez of grandchlldren. Austin. A.rrangemeDll are under the diree· She ls also survived by 62 grand tiOll ol Los Angeles Funeral Home. dilldren. 127 great-grandchlldreo and seven great-great grandchlldren. 'T~"l'S 47• c..1rt :t..r=t\-' 1111/ 0 GLADYSHAGANPADGETT · Padg~ t - , .,.~ ' ~ Gladys Hagan Padgett. -

Uprali Praising the Hospital, the Number of Doc Ought to Make,” Is the Attitude of Many Tors Practicing Sub-Specialties, the Visiting People Here, He Said

lianrl|p0tfr iEiipntnn B m lh MANCHESTER, CONN., WEDNESDAY, JUNE 5, 1974- VOL. XCIH, No. 209 Manchester—A City of Village Charm THIRTY SIX p a c e s - TWO SECTIONS PRICE: FIFTEEN CENTS Nixon Outlines Foreign Policy Takes Broad Swipe At Critics ANNAPOLIS, MD. (UPI — President “In the nuclear age, our first respon within Russia as a price for better “But there are limits to what we can do, Nuon, about to embark on diplomatic sibility must be the prevention of a war relations with the U nit^ States. missions to the Middle East and Soviet and we must ask ourselves some hard that could destroy .all societies. Peabe ’The President, who begins his third questions: Union, today outlined a broad strategy of between nations with totally different' round of summit meetings with Soviet “What is our capability to change the foreign policy which he said would con systems is also a moral objective.” leaders in Moscow June 27 after a trip to domestic structure of other nations? tribute to permanent peace in the world. Nixon’s remarks, delivered in the Navy- the Middle East starting next Monday, However, in remarks apparently Would a slowdown or reversal of detente Marine Corps Memorial Stadium on a sun said, the United States did not have the help or hurt the positive evolution of other directed at Senate critics of his Soviet ny spring morning, apparently were capability to influence the internal con policy, he warned that U.S. policy cannot social systems? What price — in terms of aimed at Senate crticis of his Soviet duct of the Soviet Union significantly renewed conflict — our we willing to pay transfonn the internal system of countries policies such as Sen. -

45601 2 884142

5 50 POWER ENGINEERS, INC. Zorn to Marion 345-kV Transmission Line Project 1.3 Agency Actions This environmental assessment (EA), prepared by POWER Engineers, Inc. (POWER), in support of LCRA TSC's application to amend its CCN from the PUCT, is intended to provide information on certain environmental and land use factors contained in Section 37.056(c)(4) of the Texas Utilities Code and the PUCT's Substantive Rule 25.101(b)(3)(B). This EA may also be used in support of any other local, state, or federal permitting requirements, if necessary. Where a proposed route for the Project crosses a state-maintained road or highway, LCRA TSC will obtain a permit from the Texas Department of Transportation (TxDOT) if that route is ultimately approved by the PUCT. If any portion of the approved route for the transmission line will require access from a state-maintained road or highway, LCRA TSC will obtain a permit from TxDOT prior to construction. Where a proposed route for the project is parallel to TxDOT roads, LCRA TSC intends to place transmission line structures on adjacent private property and not within the road ROW. LCRA TSC does not propose to place any structures of the transmission line within any highway ROW for reasons including, but not limited to, safety, reliability, and compliance with the Texas Administrative Code, specifically TxDOT's Utility Accommodation Rules. LCRA TSC will coordinate with Guadalupe County engineers regarding crossing of county roads as appropriate. For any portion of the Proposed Project located in the City of New Braunfels, LCRA TSC will obtain necessary permits from the City of New Braunfels prior to construction and will coordinate with the city during the design phase of the project. -

Gonzales Project FERC Project No

ENVIRONMENTAL ASSESSMENT FOR HYDROPOWER LICENSE Gonzales Project FERC Project No. 2960-006 Texas Federal Energy Regulatory Commission Office of Energy Projects Division of Hydropower Licensing 888 First Street, NE Washington, D.C. 20426 October 2019 TABLE OF CONTENTS 1.0 INTRODUCTION .................................................................................................... 1 1.1 Application .................................................................................................... 1 1.2 Purpose of Action and Need For Power ........................................................ 1 1.2.1 Purpose of Action ............................................................................ 1 1.2.2 Need for Power ................................................................................ 3 1.3 Statutory and Regulatory Requirements ....................................................... 3 1.3.1 Federal Power Act ........................................................................... 3 1.3.2 Clean Water Act .............................................................................. 4 1.3.3 Endangered Species Act .................................................................. 4 1.3.4 Coastal Zone Management Act ....................................................... 4 1.3.5 National Historic Preservation Act .................................................. 5 1.4 Public Review and Comment ........................................................................ 6 1.4.1 Scoping ........................................................................................... -

Lake Dunlap 2017 Survey Report

Lake Dunlap 2017 Fisheries Management Survey Report PERFORMANCE REPORT As Required by FEDERAL AID IN SPORT FISH RESTORATION ACT TEXAS FEDERAL AID PROJECT F-221-M-3 INLAND FISHERIES DIVISION MONITORING AND MANAGEMENT PROGRAM Prepared by: Dusty McDonald, Assistant District Management Supervisor and Greg Binion, District Management Supervisor Inland Fisheries Division Corpus Christi District, Mathis, Texas Carter Smith Executive Director Craig Bonds Director, Inland Fisheries July 31, 2018 i Contents Contents ......................................................................................................................................................... i Survey and Management Summary ............................................................................................................. 1 Introduction.................................................................................................................................................... 2 Reservoir Description ................................................................................................................................ 2 Angler Access ............................................................................................................................................ 2 Management History ................................................................................................................................. 2 Methods........................................................................................................................................................ -

Basin Highlights REPORT

2020 Basin Highlights REPORT CLEAN RIVERS PROGRAM Guadalupe River and Lavaca-Guadalupe Coastal Basins 2020 Basin Highlights REPORT !. !.12618 12675 !. 12549 12674 !. !.16244 !. !. !. !. 21804 Gi1ll2e6s1p7ie 16243 !. 12661 12673 BLANCO !. 12616 12663 !. !.12541 Jo hn H so C n 1 3 C 8 1 o r 8 t e 1 t e 3 1 1 o k 1 A 8 n 8 w 1 B k 1 e F 3 o i o 3 1 a g 8 e 1 l C r d l 1 8 s F 6 1 C C 1 C C 8 k 3 r n r e e 0 E e r e w e e e 6 r *#o k k e T C k C t B*#*#lanco a 12669 HAYS o 1 1 8 # G *!. !. 8 k e 0 0 e k D r 6 B e 6 C 3 e 12678 Ingram 6 n B 1 r E 0 12668 8 la 8 C Hunt G 7 !. !. 1 in 1 ch 1 181 u 3 o 8 N Fo !. Q K 1 rk Guadalupe River 1 5 !. 8 12684 15111 Kerrville 1 12682 12677 06A !. KERR 18 *# !.!. Camp Meeting Creek KENDALL 22109 1 !. !.12676 8 !. 22110 1 12615 C 3 12546 yp !. *# re 12665 F ss 12660 r 6 C ive 0 Turtle Creek re Wimberley!. R 8 15113 e pe 1 !. k alu Comfort Uppe ad *# r Blanco Riv Gu er rk Fo S !. !. 1818 !. !.Center Point 12602 22082 12635!. 12608 *# 12605 G 6 6 !. *# 0 0 12601 12600 8 ek 8 1 e 1 !.12598 Cr !.