Kotak Gold Fund SCHEME INFORMATION DOCUMENT (SID)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

KOTAK EQUITY SAVINGS FUND Building No

KEY INFORMATION MEMORANDUM (KIM) 6th Floor, Kotak Infinity, KOTAK EQUITY SAVINGS FUND Building No. 21, Infinity Park, (An Open Ended Equity Scheme) Off. Western Express Highway, Gen.A.K. Vaidya Marg, Malad (E) Continuous Offer of scheme of Units available at NAV bases prices. Mumbai - 400 097. Riskometer 022-6638 4400 Moderate Moder [email protected] tely a a Name This product is suitable for investors who are seeking*: High tely Income from arbitrage opportunities in the equity market & long term capital growth assetmanagement.kotak.com ModerLow Kotak Equity Savings Fund Investment predominantly in arbitrage opportunities in the cash & derivatives segment of the equity market and equity & equity related securities High Low *Investors should consult their financial advisers if in doubt about whether the product is suitable for them. LOW HIGH Investors understand that their principal will be at moderately high risk Scheme Re-opened on October 17, 2014 This Key Information Memorandum (KIM) sets forth the information, which a prospective investor ought to know before investing. For further details of the scheme/Mutual Fund, due diligence certificate by the AMC, Key Personnel, investors’ rights & services, risk factors, penalties & pending litigations etc. investors should, before investment, refer to the Scheme Information Document and Statement of Additional Information available free of cost at any of the Investor Service Centres or distributors or from the website assetmanagemnt.kotak.com The Scheme particulars have been prepared in accordance with Securities and Exchange Board of India (Mutual Funds) Regulations 1996, as amended till date, and filed with Securities and Exchange Board of India (SEBI). -

Monthly Market Outlook June 2021

Monthly Market Outlook June 2021 The views expressed in this presentation are through the period ending 07-June-21 and are subject to change at any time based on market and other conditions. This is not an offer or solicitation for the purchase or sale of any security and should not be construed as such. References to specific securities and issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities. Content Page Numbers Global Economy 4 Indian Economy 13 Equity Markets 30 Valuation 38 SIP Has Performed Well 43 Equity Investment Opportunity 47 Should We Invest In Gold ? 52 Interesting Facts About Crypto 56 Active V/S Passive Funds in Alpha Generation 60 Debt Market Outlook 65 Debt Investment Opportunity 75 Distributor Engagement 82 Annexure 87 Disclaimers & Disclosures 91 2 Equity Market Outlook June 2021 Global Economy 4 Debt At All Time High And Interest Burden At All Time Low Government Debt Government Interest Payments 5 Source: Fitch Ratings Fiscal And Monetary Stimulus Has Given Confidence To Businesses Source: The Conference Board, The Business Council, NBER 6 Stimulus Has Pushed Profit Margins To All Time High Levels Source: Bloomberg 7 Big Is Becoming Bigger Median profit margin for top 50 firms has rocketed higher Source: Bloomberg 8 Global Market Cap To GDP Ratio Rises To 131% Source: Bloomberg 9 High Corporate Issuances Reflects Investors Bullishness Source: Goldman Sachs, As of 31st March 2021 10 Commodities Are In Short Supply Shortage of commodities has pushed backwardation to nearly 15-year high Source: Bloomberg, CME, ICE, LME Note: Chart uses current BCOM constituents and weightings. -

Managing Risks & Optimizing Returns

Managing Risks & Optimizing Returns www.kotakmutualfund.com Kotak Group - Corporate Overview 3,241* Market Cap of 50,000+ Net worth of Over 30% Constituent., of the Branches INR 2,545.7 Bn Employees INR 583.02 Bn Promoter Group NIFTY 50 Ownership Established in 1985 by Mr. Uday Kotak, it was the first Indian non-banking financial company to be given a banking licence by the Reserve Bank of India in February 2003. The Group caters to the financial needs of individuals and institutional investors across the globe. Branch breakup* Global partnerships Business No. of Branches Current : Sumitomo Mitsui Banking Corporation Banking 1,388 Past : Goldman Sachs | Ford Credit International Mutual Fund 83 Old Mutual Life Insurance Life Insurance 227 Securities 1,325 Range of financial services Car Finance 84 General Insurance 15 Banking | Asset Management | Investment Banking BSS Microfinance 119 Life Insurance | Stock Broking | General Insurance | Alternate Investments | Stressed Assets Total 3,241 These branches / offices are present in India as on March 31, 2018. In addition, Kotak Group has international offices in Abu Dhabi, Dubai, London, Mauritius, New York and Singapore. All data as on March 31, 2019 Constituent of the NIFTY, the mainline 50 stock Indian market index | Kotak Group is one of the largest Indian financial services groups * Data as on March 31, 2018 2 Kotak Group - Corporate Overview Assets Under Management (INR 2,252.54 Bn) Asset Management: Strengths • One of the first few private firms qualified to manage pension funds in India • Providing solutions to International clients for 15+ years • Kotak Mahindra Asset Management Company is regulated by the Securities and Exchange Board of India. -

India 2019 Mutual Funds Report

INDIA 2019 MUTUAL FUNDS REPORT Markets and Securities Services Prime, Futures and Securities Services | India Mutual Funds Report 2019 2 CONTENTS India: Asia-Pacific’s next mutual funds giant 03 Economic and demographic analysis of India 05 A history of the development of India’s mutual funds industry 10 Size and scale of India’s domestic market 16 Unit trusts, mutual funds, ETFs and other fund products 18 Retail fund distribution 27 Pension and retirement funds and institutional fund management 30 How can foreign managers enter the market? 34 Should India join the Asia Region Funds Passport scheme? 35 Can you mobilise a billion investors? 37 Appendix 41 Glossary 42 Links 43 About the Author 43 Citi in India 44 Securities services 45 Currency note References to size and scale of assets, markets, and other statistics originated in the Indian rupee (INR), which might have been stated in lakh or crore, part of the Indian numbering system. In most instances, these have been converted into the western numbering system and US dollars so global readers can comprehend the scale in international terms. Because the rupee exchange rate against the dollar has varied considerably over the years (see appendix), the exchange rate used would have been applicable to the date of the statistic. So statistics in 2019 are based on an approximate INR70 = US$1. Prime, Futures and Securities Services | India Mutual Funds Report 2019 3 INDIA: ASIA-PACIFIC’S NEXT MUTUAL FUNDS GIANT The “Incredible India!” slogan, so often used to describe tourist opportunities in India, could just as easily be used to describe the development and growth of the Indian mutual fund industry over the last 20 years or India’s rapid turnaround in economic developments over the last 10 years or so. -

Kotak Nasdaq 100 Fund of Fund Scheme Information Document (Sid)

SCHEME INFORMATION DOCUMENT (SID) KOTAK NASDAQ 100 FUND OF FUND An open ended fund of fund investing in units of overseas ETF’s and/or Index Fund based on NASDAQ 100 Index Continuous Offer: Units at NAV based prices. Moderate Moderately This product is suitable for investors who are seeking* High Low to High Moderate Long-term capital growth Return that corresponds generally to the performance of Low Very High the NASDAQ-100 Index, subject to tracking error. RISKOMETER Investors understand that their principal will be at Very High Risk NFO Opens on: Monday, 11 January 2021 * Investors should consult their financial advisors if in doubt about whether the product is suitable for them NFO Closes on: Friday, 25 December 2020 Units at `10 each during the New Fund Offer NFO Opens on: January 11, 2021 NFO Closes on: January 25, 2021 Scheme Re-opens for continuous sale and repurchase on or before: February 09, 2021 Name of Mutual Fund Kotak Mahindra Mutual Fund Name of Asset Management Company Kotak Mahindra Asset Management Company Ltd CIN: U65991MH1994PLC080009 Name of Trustee Company Kotak Mahindra Trustee Company Ltd CIN: U65990MH1995PLC090279 Registered Address of the Companies 27 BKC, C-27, G Block, Bandra Kurla Complex, Bandra (E),Mumbai - 400051 Corporate Office Address of 2nd Floor, 12-BKC, Plot No. C-12, G-Block, Bandra Kurla Complex, Bandra East, Asset Management Company Mumbai - 400 051 Website assetmanagement.kotak.com The particulars of the Scheme have been prepared in accordance with the Securities and Exchange Board of India (Mutual Funds) Regulations 1996, (herein after referred to as SEBI (MF) Regulations) as amended till date, and filed with SEBI, along with a Due Diligence Certificate from the AMC. -

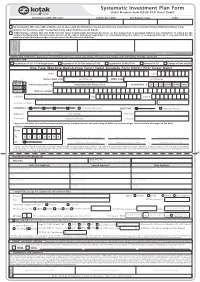

Systematic Investment Plan Form (Debit Mandate Form NACH/ ECS/ Direct Debit)

Systematic Investment Plan Form (Debit Mandate Form NACH/ ECS/ Direct Debit) # Distributors ARN/ RIA Code Sub-Brokers ARN Sub-Brokers Code EUIN #By mentioning RIA code, I/We authorize you to share with the Distributor, the details of my/our transactions in the scheme(s) of Kotak Mahindra Mutual Fund. Declaration for"Execution-only" transactions (only where EUIN box is left blank) I/We hereby confirm that the EUIN box has been intentionally left blank by me/us as this transaction is executed without any interaction or advice by the employee/relationship manager/sales person of the above distributor/sub broker or notwithstanding the advice of in-appropriateness, if any, provided by the employee/relationship manager/sales person of the distributor/sub broker. ) y ) s S t ( n d b E e a R c n i U l g i T p A p e s N l A G o b l I Sole / First Applicant T Second Applicant Third Applicant S ( A TRANSACTION CHARGES for Applications routed through distributor/agents only (Kindly refer Transaction Charges under the heading Checklist for details) REQUEST FOR: Registration of SIP + OTM Registration Registration of SIP (for existing OTM) Registration of MICRO SIP Renewal of SIP Change in Bank details One Time Mandate Registration Form/ Debit Mandate Form NACH/ ECS/ Direct Debit UMRN F o r o f f i c e u s e Date Sponsor Bank Code For Office Use Utility Code For Office Use TICK ( P ) CREATE P I/We hereby authorize Kotak Mahindra Mutual Fund to debit (tick P) SB CA CC SB-NRE SB-NRO Other MODIFY CANCEL Bank a/c number with Bank IFSC or MICR an amount of Rupees ` Mthly Qylt H-Yrly Yrly As & when presented FREQUENCY P DEBIT TYPE Fixed Amount PMaximum Amount Reference 1 Folio Number Phone No. -

KOTAK BLUECHIP FUND SCHEME.Cdr

KEY INFORMATION MEMORANDUM (KIM) 6th Floor, Kotak Infinity, KOTAK BLUECHIP FUND Building No. 21, Infinity Park, (Formerly known as Kotak Mahindra 50 Unit Scheme) Off. Western Express Highway, Gen.A.K. Vaidya Marg, Malad (E) (Large Cap Fund- An open ended equity scheme Riskometer Mumbai - 400 097. predominantly investing in large cap stocks) Moderate Moder ely at ately 1800-222-626 High Continuous Offer: Unit of scheme is available at prices related to applicable NAV. ModerLow [email protected] Name Kotak Bluechip Fund is suitable for investors who are seeking* High assetmanagement.kotak.com Low Long term capital growth Kotak Bluechip Investment in portfolio of predominantly equity & equity related securities LOW HIGH Fund Investors understand that their principal will be at of large cap companies moderately high risk *Investors should consult their financial advisers if in doubt about whether the product is suitable for them. Scheme Re-opened on January 21, 1999 This Key Information Memorandum (KIM) sets forth the information, which a prospective investor ought to know before investing. For further details of the Scheme(s) / Mutual Fund, Due diligence certificate by the AMC, Key Personnel, Investors rights & services, Risk Factors, Penalties & Pending Litigations, Associate Transactions, etc. investors should, before investment, refer to the Schemes Information Document and Statement of Additional Information available free of cost at any of the Official Acceptance Points or distributors or from the website www.assetmanagement.kotak.com. The Scheme(s) particulars have been prepared in accordance with Securities and Exchange Board of India (Mutual Funds) Regulations, 1996, as amended till date, and filed with Securities and Exchange Board of India (SEBI). -

Nominee List

NOMINEE LIST Best financial reporting (large cap) Cipla Hindalco Industries Hindustan Unilever Infosys Kotak Mahindra Bank Mahindra & Mahindra Piramal Enterprises Tata Steel Vedanta Best financial reporting (small to mid-cap) CEAT Everest Industries Hikal Hindustan Foods IIFL Finance KEC International Minda Industries Raymond The Phoenix Mills Zensar Technologies Best investor meetings (large cap) Bharti Airtel Hindustan Unilever Infosys Lupin Mahindra & Mahindra Piramal Enterprises Best investor meetings (mid-cap) Balkrishna Industries IIFL Finance Mindtree RPG Group Sterlite Technologies The Phoenix Mills NOMINEE LIST Best investor meetings (small cap) Amber Enterprises India Equitas Holdings Greenlam Industries Music Broadcast Navin Fluorine International NOCIL Raymond Zensar Technologies Best investor relations officer (large cap) Bharti Airtel Komal Sharan Bharti Airtel Aparna Vyas Garg Bharti Infratel Surabhi Chandna Cipla Naveen Bansal HDFC Conrad D'Souza Hindustan Unilever Suman Hegde Infosys Sandeep Mahindroo Kotak Mahindra Bank Nimesh Kampani Lupin Arvind Bothra Best investor relations officer (small to mid-cap) CEAT Pulkit Bhandari Jindal Steel & Power Nishant Baranwal Motilal Oswal Financial Services Rakesh Shinde PNB Housing Finance Deepika Gupta Padhi Raymond J Mukund RPG Group Pulkit Bhandari Schneider Electric Infrastructure Vineet Jain The Phoenix Mills Varun Parwal NOMINEE LIST Best investor relations team (large cap) Bharti Airtel Cipla Hindustan Unilever Infosys Kotak Mahindra Bank Larsen & Toubro Infotech Power Finance -

WPP Presentation

Monthly Market Outlook August 2021 The views expressed in this presentation are through the period ending 05-August-21 and are subject to change at any time based on market and other conditions. This is not an offer or solicitation for the purchase or sale1 of any security and should not be construed as such. References to specific securities and issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities. Content Page Numbers Global Economy 5 Indian Economy 17 Equity Markets 32 Valuation 37 Neutral Weight To Equities 43 Equity Investment Opportunity 46 Should We Invest In Gold 50 Interesting Facts About Crypto 53 Active V/S Passive Funds in Alpha Generation 57 SIP Has Performed Well And Generated Alpha 60 Debt Market Outlook 63 Debt Investment Opportunity 73 Distributor Engagement 77 Annexure 82 Disclaimers & Disclosures 85 2 Thank you We extend our heartfelt gratitude for your support Kotak Global Innovation Fund of Fund ^Kotak Global Innovation Fund Of Fund will invest in units of Wellington Global Innovation Fund or any other similar overseas mutual fund schemes/ETFs. The Wellington Global Innovation Fund managed by Wellington Management, and the companies mentioned here are forming part of its portfolio as of 31st May 2021. The portfolio construction is the purview of the fund manager and may change from time to time. Past 3 Performance may or may not sustain in future. 4 ^Investor folios as of 1st Aug 2021 #AUM (Assets Under Management) as of 2nd Aug 2021. -

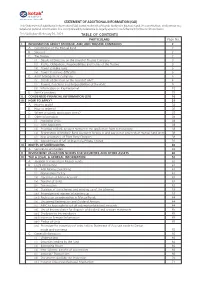

TABLE of CONTENTS PARTICULARS Page No

STATEMENT OF ADDITIONAL INFORMATION (SAI) This Statement of Additional Information (SAI) contains details of Kotak Mahindra Mutual Fund, its constitution, and certain tax, legal and general information. It is incorporated by reference (is legally a part of the Scheme Information Document). This SAI is dated February 26, 2021 TABLE OF CONTENTS PARTICULARS Page No. I. INFORMATION ABOUT SPONSOR, AMC AND TRUSTEE COMPANIES 2 A. Constitution of the Mutual Fund 2 B. Sponsor 2 C. The Trustee 2 (i) Details of Directors on the Board of Trustee Company 3 (ii) Rights, Obligations, Responsibilities and Duties of the Trustee 3 (iii) Power to make rules 5 (iv) Power to remove difficulties 5 D. Asset Management Company 5 (i) Details of Directors on the Board of AMC 6 (ii) Powers, Functions and Responsibilities of the AMC 9 (iii) Information on Key Personnel 10 E. Service providers 15 II. CONDENSED FINANCIAL INFORMATION (CFI) 16 III. HOW TO APPLY? 31 A. How to apply? 32 B. How to redeem? 36 C. Where to submit application forms? 37 D. Other Information 38 (i) Fractional Units 38 (ii) Joint Applicants 38 (iii) Provision of Bank account number in the application form is mandatory 38 (iv) Registration of Multiple Bank Accounts for pay-in and pay-out of proceeds of mutual fund units 38 (v) Non acceptance of Third Party Cheques 38 (vi) Appointment of MF Utilities India Private Limited 39 IV. RIGHTS OF UNITHOLDERS 40 A. Services to unitholders 40 V. INVESTMENT VALUATION NORMS FOR SECURITIES AND OTHER ASSETS 40 VI. TAX & LEGAL & GENERAL INFORMATION 52 A. -

A Mutual Fund Is a Trust That Pools the Savings of a Number of Investors Who Share a Common Financial Goal

ABSTRACT A Mutual Fund is a trust that pools the savings of a number of investors who share a common financial goal. The money thus collected is then invested in capital market instruments such as shares, debentures and other securities. The income earned through these investments and capital appreciation realized is shared by its unit holders in proportion to the number of units owned by them. The term risk has a variety of meanings in business and everyday life. At its most general level, risk is used to describe any situation where there is uncertainty about what outcome will occur. Life is obviously very risky. Even the short term future is often highly uncertain. In probability and statistics, financial management and investment management, risk is often used in more specific sense to indicate possible variability of outcomes around some expected value. This study aims to study the investor‟s preference in selection of Mutual fund and measuring the fund sponsor quality. A mutual fund is a common pool of money into which investors place their contributions that are to be invested in accordance with a stated objective. Being a part of financial markets although mutual funds industry is responding very fast by analyze investor‟s perception and expectations. INDUSTRY PROFILE Investors all over the world are making fast money from mutual fund investments. It's true that mutual funds are volatile in nature and its return is subjected to market risk. But if you are a smart investor and is also quite aware of the well-performing MF in the market, then investment not only becomes easy but also profitable and risk free. -

Ambuja Cement ACL:SEC: August 23, 2018

Ambuja Cement ACL:SEC: August 23, 2018 The Secretary National Stock Exchange of India Ltd., Bombay Stock Exchange Limited Plot No. C/1'G Block Phiroz Jeejeebhoy Towers, Bandra - Kurla Complex Dalal Street, Bandra East, Mumbai- 400 023 Mumbai 400 051 BSE Scrip Code: 500425 NSE Scrip Code: AMBUJACEM Deutsche Bank Societe de la Bourse de Luxembourg, Trust Company Americas A venue de la Porte Neuve Winchester House L-2011 Luxembourg, 1 Great Winchester Street B.P165 London EC2N 2DB "Luxembourg Stock Ex-Group ID" Ctas Documents <[email protected] <[email protected]> Dear Sir, Sub : Intimation of Schedule of Analyst I Institutional Investor Meetings under the SEBI (Listing Obligation and Disclosure Requirements ) Regulations, 2015. We wish to inform you that pursuant to Regulation 30(6) of the Securities & Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations 2015, the Schedule of Analyst or Institutional Investor Meetings with the Company is as under: Date Meetings 24th August, 2018 ICICI Roadshow 27th August 2018 Motilal Oswal Annual Investor Conference The schedule may undergo change due to exigencies on the part of investors/ company. The tentative list of the investors attending the meeting is attached. Kindly take the same on record and acknowledge receipt. Thanking you, Your Faithfully, For AMBUJA CEMENTS LIMITED ~ \ ~~ RAJIV GANDHI COMPANY SECRETARY Membership No. A11263 AMBUJA CEMENTS LIMITED Elegant Business Park, MIDC Cross Road 'B', Off Andheri Kurla Road, Andheri (E), Mumbai 400059. Tel. : 022- 4066 7000 /6616 7000, Fax: 022- 6616 7711 /4066 7711. Website: www.ambujacement.com Regd. Off. : P. 0 . Ambujanagar, Taluka- Kodinar, Dist.