Third Party Funding in Australia and Europe” Dr

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Charging Language

1. TABLE OF CONTENTS Abduction ................................................................................................73 By Relative.........................................................................................415-420 See Kidnapping Abuse, Animal ...............................................................................................358-362,365-368 Abuse, Child ................................................................................................74-77 Abuse, Vulnerable Adult ...............................................................................78,79 Accessory After The Fact ..............................................................................38 Adultery ................................................................................................357 Aircraft Explosive............................................................................................455 Alcohol AWOL Machine.................................................................................19,20 Retail/Retail Dealer ............................................................................14-18 Tax ................................................................................................20-21 Intoxicated – Endanger ......................................................................19 Disturbance .......................................................................................19 Drinking – Prohibited Places .............................................................17-20 Minors – Citation Only -

Extent to Which the Common Law Is Applied in Determining What

THE AMERICAN LAW REGISTER, APRIL, 1867. THE EXTE'N"IT TO WHICH THE COM ON LAW IS APPLIED IN DE- TERMINING WHAT CONSTITUTES A CRIME, AND THE NATURE AND DEGREE OF PUNISHMENT CONSEQUENT THEREUPON. PART III. (Concluded from the January.umber.) 1. Subject of Third. Part stated. 2. Statement by .Mr. Wheaton on tie question. 3. Exceptional states as to common-law application. 4-6. With what qualifications the common law has been adopted. 7-9. Felonies provided for by statute. Reasoning in relation thereto. 10, 11. Early and important case on the question. 12-18. Acts of public evil example; acts tending to breach of peace; con- -piracy, &c., indictable at common law. 19-21. Offences against Christianity; against the marital relation; obscenity, &c., also been held indictable. 22-24. Cases peculiar to this country also brought within common-law influence. 25, 26. 'Numerous acts of malicious mischief that are punishable at common law. 27-30. Also nuisances ; disturbing the peace; acts tenxding to defeat public justice. and various miscellaneous offences. 31, 32. Other instances named of common-law influence. 33-36. Brief review of the treatise; and 38. Conclusion. 1. IF a satisfactory conclusion has been reached in reference to the vexed question which has now been considered, and which has given rise to such strongly-conflicting opinions, by jurists of the highest eminence and ability, the remaining question, where, with one or two narrow exceptions, the eases and opinions are in VOL. XV.-21 (321) APPLICATION OF THE COMMON LAW almost perfect accord, cannot be attended with much difficulty. -

Vania Is Especi

THE PUNISHMENT OF CRIME IN PROVINCIAL PENNSYLVANIA HE history of the punishment of crime in provincial Pennsyl- vania is especially interesting, not only as one aspect of the Tbroad problem of the transference of English institutions to America, a phase of our development which for a time has achieved a somewhat dimmed significance in a nationalistic enthusiasm to find the conditioning influence of our development in that confusion and lawlessness of our own frontier, but also because of the influence of the Quakers in the development df our law. While the general pat- tern of the criminal law transferred from England to Pennsylvania did not differ from that of the other colonies, in that the law and the courts they evolved to administer the law, like the form of their cur- rency, their methods of farming, the games they played, were part of their English cultural heritage, the Quakers did arrive in the new land with a new concept of the end of the criminal law, and proceeded immediately to give force to this concept by statutory enactment.1 The result may be stated simply. At a time when the philosophy of Hobbes justified any punishment, however harsh, provided it effec- tively deterred the occurrence of a crime,2 when commentators on 1 Actually the Quakers voiced some of their views on punishment before leaving for America in the Laws agreed upon in England, wherein it was provided that all pleadings and process should be short and in English; that prisons should be workhouses and free; that felons unable to make satisfaction should become bond-men and work off the penalty; that certain offences should be published with double satisfaction; that estates of capital offenders should be forfeited, one part to go to the next of kin of the victim and one part to the next of kin of the criminal; and that certain offences of a religious and moral nature should be severely punished. -

Gfniral Statutes

GFNIRAL STATUTES OF THE STATE OF MINNESOTA, IN FOROE JANUARY, 1891. VOL.2. CowwNnro ALL TEE LAw OP & GENERAJ NATURE Now IN FORCE AND NOT IN VOL. 1, THE SAME BEING TEE CODE OF Civu PROCEDURE AND ALL REME- DIAL LAW, THE PROBATE CODE, THE PENAL CODE AND THE CEnt- JRAL PROCEDURE, THE CoNSTITuTIoNS AND ORGANIc ACTS. COMPILED AND ANNOTATED BY JNO. F. KELLY, OF TUE Sr. Pui BAR. SECOND EDITION. ST. PAUL: PUBLISHED BY THE AUTHOR 1891. A MINNESOTA STATUTES 1891 IN] EX To Vols. 1 and , except as Indicated by the cross-references, to Vol. 1. A - ACCOUNTS. (cqinued)-- officers'., of corporation, altering, §6448. ABANDONMNT (see CHILD)- presentation, of fraudulent, when felony, Qf, insane person, penalty fpr, §5895, §6507. of lands condemned for public use, §1229. ABATE- ACCOUN,T BOOKS- reognizance.not to abate, when, §439. • are p'rirna.facie evidence, §51'12. action to, nuisapee, §*442 ACCUSATION- actions abated when, §4738. to remove attorneys, §4376. board of health, sa,ll, hat,nuisapces, i9, %vriting. veiifipd, '4l77. §5SS, 589.. ACCUSED- warrant to, §591. rigMsof; §6626 ABBREViATIONS- iii describing lands, §1582. ACKNOWLEDGMENTS (see Index to 'Vol. ABDUCTION (see SEDUCTION; KTDNAP- of 1eeds of land, §4121. RING)-. certifipa.te of. §4122. defined, pnnishment,f,or, §6196. ii qter.sta,tes, §4.23. evidence required to cnvitof, §6197. in foreign countries. §4124. ABETTING (see AIDIN-)- iefusaI to aknplege, §4125. ABOLISHED- proceedings to eompl, §4126. dower anl curtesy is, §4001.. defective, to, cqnveyanqes legalized-. certain defects legalized, §4164. ABORTION (see INDECENT ARTICLES)- ntnslapghter in first degree, when, by officer whose ternl. has çxpired, §4165, §6H5, GUll. -

Abolishing the Crime of Public Nuisance and Modernising That of Public Indecency

International Law Research; Vol. 6, No. 1; 2017 ISSN 1927-5234 E-ISSN 1927-5242 Published by Canadian Center of Science and Education Abolishing the Crime of Public Nuisance and Modernising That of Public Indecency Graham McBain1,2 1 Peterhouse, Cambridge, UK 2 Harvard Law School, USA Correspondence: Graham McBain, 21 Millmead Terrace, Guildford, Surrey GU2 4AT, UK. E-mail: [email protected] Received: November 20, 2016 Accepted: February 19, 2017 Online Published: March 7, 2017 doi:10.5539/ilr.v6n1p1 URL: https://doi.org/10.5539/ilr.v6n1p1 1. INTRODUCTION Prior articles have asserted that English criminal law is very fragmented and that a considerable amount of the older law - especially the common law - is badly out of date.1 The purpose of this article is to consider the crime of public nuisance (also called common nuisance), a common law crime. The word 'nuisance' derives from the old french 'nuisance' or 'nusance' 2 and the latin, nocumentum.3 The basic meaning of the word is that of 'annoyance';4 In medieval English, the word 'common' comes from the word 'commune' which, itself, derives from the latin 'communa' - being a commonality, a group of people, a corporation.5 In 1191, the City of London (the 'City') became a commune. Thereafter, it is usual to find references with that term - such as common carrier, common highway, common council, common scold, common prostitute etc;6 The reference to 'common' designated things available to the general public as opposed to the individual. For example, the common carrier, common farrier and common innkeeper exercised a public employment and not just a private one. -

![Chap. 10.] OFFENCES AGAINST PUBLIC JUSTICE](https://docslib.b-cdn.net/cover/9302/chap-10-offences-against-public-justice-949302.webp)

Chap. 10.] OFFENCES AGAINST PUBLIC JUSTICE

Chap. 10.] OFFENCES AGAINST PUBLIC JUSTICE. CHAPTER X. OF OFFENCES AGAINST PUBLIC JUSTICE. THE order of our distribution will next lead us to take into consideration such crimes and misdemeanors as more especially affect the commonwealth, or public polity of the kingdom: which, however, as well as those which are pecul- iarly pointed against the lives and security of private subjects, are also offences against the king, as the pater-familiasof the nation: to whom it appertains by his regal office to protect the community, and each individual therein, from every degree of injurious violence, by executing those laws which the people them- selves in conjunction with him have enacted; or at least have consented to, by an agreement either expressly made in the persons of their representatives, or by a tacit and implied consent presumed from and proved by immemorial usage. The species of crimes which we have now before us is subdivided into such a number of inferior and subordinate classes, that it would much exceed the bounds of an elementary treatise, and be insupportably tedious to the reader, were I to examine them all minutely, or with any degree of critical accuracy. I shall therefore confine myself principally to general definitions, or descriptions of this great variety of offences, and to the punishments inflicted by law for each particular offence; with now and then a few incidental observations: referring the student for more particulars to other voluminous authors; who have treated of these subjects with greater precision and more in detail than is consistent with the plan of these Commentaries. -

Criminal Law. Merger of Conspiracy Into Completed

RECENT CASES the beneficial owners to avoid the statutory liability. Corker v. Soper 53 F. (2d) igo (C.C.A. 5th 1931); 45 Harv. L. Rev. 580 (1932). There, since, the holding did not con- sist of a majority of the shares, obviously no centralization of control of the company was intended. The parent company in the principal case can be distinguished in that its primary purpose was to centralize control. In both cases, however, the fact that the holding companies were inadequately financed to meet the contingent liability attach- ing to bank stock can be considered as indicating an attempted evasion of the statute. To determine when a holding company is so inadequately financed as to justify a dis- regard of the corporate entity to the extent of holding its stockholders personally liable, its assets must be carefully scrutinized. Since the purpose of the statute is to provide a "secondary" protection to depositors, equalling the stock of the depositary bank, it should not be considered an evasion if the assets of the holding company are sufficient to satisfy that contingent liability on the bank shares held. Thus, where a holding company has a wide and diversified portfolio consisting of many strong operat- ing companies amply sufficient to satisfy any contingent liability on bank stock held, there should be no reason to hold its shareholders personally liable. And it is conceiv- able that a parent company, whose sole assets are stocks in a large number of sub- sidiary banks widely distributed geographically, would be adequately financed to pro- tect creditors of failing banks by converting some of the stocks of their solvent banks into cash. -

Inchoate Offences Conspiracy, Attempt and Incitement 5 June 1973

N.B. This is a Working Paper circulated for comment and criticism only. It does not represent the final views. of the Law Commission. The Law Cominission will be grateful for comments before 1 January 1974. All correspondence should be addressed to: J.C. R. Fieldsend, Law Commission, Conquest Hoiis e, 37/38 John Street, Theobalds Road, London WC1N 2BQ. (Tel: 01-242 0861, Ex: 47) The Law Commission Working Paper No 50 Inchoate Offences Conspiracy, Attempt and Incitement 5 June 1973 LONDON HER MAJESTY’S STATIONERY OFFICE 1973 @ Crown copyright 1973 SBN 11 730081 0 THE LAW COMMISSION WORKING PAPER NO. 50 Second Programme, Item XVIII CODIFICATION OF THE CRIMINAL LAW GENERAL PRINCIPLES INCHOATE OFFENCES : CONSPIRACY, ATTEMPT AND INCITEMENT Introduction by the Law Commission 1. The Working Party' assisting the Commission in the examination of the general principles of the criminal law with a view to their codification has prepared this Working Paper on the inchoate offences. It is the fourth in a series' designed as a basis upon which to seek the views of those concerned with the criminal law. In pursuance of - its policy of wide consultation, the Law Commission is publishing the Working Paper and inviting comments upon it. 2. To a greater extent than in previous papers in this series the provisional proposals of the Working Party involve fundamental changes in the law which, we think, will prove much more controversial than those made in the other papers. The suggested limitation of the crime of conspiracy to 1. For membership see p. ix. 2. The others are "The Mental Element in Crime" (W.P. -

Old-Time Punishments

Presented to the UNIVERSITY OF TORONTO LIBRARY by the ONTARIO LEGISLATIVE LIBRARY 1980 (\V\ 7- OLD-TIME PUNISHMENTS. WORKS BY WILLIAM ANDREWS, F.R.H.S. Mr. William Andrews has produced several books of singular value in their historical and archaeological character. He has a genius for digging among dusty parchments and old books, and for bringing out from among them that which it is likely the public of to-day will care to read. Scotsman. Curiosities of the Church. A volume both entertaining and instructive, throwing much light on the manners and customs of bygone generations of Churchmen, and will be read to-day with much interest. Nftitbery House Magazine. An extremely interesting volume. North British Daily Mail. A work of lasting interest. Hull Kxaminer. Full of interest. The Globe. The reader will find much in this book to interest, instruct, and amuse. Home Chimes. We feel sure that many will feel grateful to Mr. Andrews for having produced such an interesting book. The Antiquary. Historic Yorkshire. Cuthbert Bede, the popular author of "Verdant Green," writing to Society, says: "Historic Yorkshire," by William Andrews, will be of great interest and value to everyone connected with England's largest county. Mr. Andrews not only writes with due enthusiasm for his subject, but has arranged and marshalled his facts and figures with great skill, and produced a thoroughly popular work that will be read eagerly and with advantage. Historic Romance. STRANGE STORIES, CHARACTERS, SCENES, MYSTERIES, AND MEMORABLE EVENTS IN THE HISTORY OF OLD ENGLAND. In his present work Mr. Andrews has traversed a wider field than in his last book, "Historic Yorkshire," but it is marked by the same painstaking care for accuracy, and also by the pleasant way in which he popularises strange stories and out-of-the-way scenes in English History. -

A Heport of the to the of the February 194-9

PENAL LAUS A Heport of the JOINT ST ;WE GOVEflNMEI\TT COHIHS:3ION to the GE~llirt1~ A8~EMBLY of the COHHONUEALTH OF PENNSYL1JAl'TIA February 194-9 LETTER OF TRAN3JvlITT AL To the Hembers of the General Assembly of the Common wealth of Pennsylvania: Pursuant to Senate Concurrent Resolution No. 113, Session of 19~7, we submit herewith a report dealing "lith the revision and codification of the penal laws. In accord,ance with Act No. ~, Session of 191+3, Section.'+, the Commission created a subcommittee to aid in the task assigned. On behalf of the Commission, the cooperation of the members of the subcommittee is gratefully acknmlledged. \Jeldon B. Heyburn, Chairman Joint state Government Commission Capitol Building Harrisburg, Pennsylvania February, 19 1+9 ii JOINT STATE GOVERN}lliNT CO]~;ISSION Honorable \'!eldon B. Heyburn, Chairman Honorable Baker Royer, Vice Chairman Honorable Herbert P. Sorg, Secretary-Treasurer Senate Members House Nembers Joseph 11. Barr Hiram G. Andrews Leroy E. Chapman Adam T. Bower John H. Dent Homer S. Brown Anthony J. DiSilvestro Charles H. Brunner, Jr. James A. Geltz Edwin C. E.ring Weldon B. Heyburn Ira T. Fiss Frederick L. Homsher Robert D. Fleming A. Evans Kephart IV. ,stuart Helm A. H. Letzler Earl E. Hewitt, Sr. John G. Snm/den Thomas H. Lee O. J. Tallman Albert S. Readinger M. Harvey Taylor Baker Royer John N. Hall:er Herbert P. Sorg Guy IJ. Davis, Counsel and Director Paul H. Wueller, Associate Director in Charge of Research and Statistics L. D. Stambaugh, Hesident Secretary f~toinette S. Giddings, Administrative Assistant iii JOINT STATE GOVER~~NT COW1IS3ION SUBCOl'fllITTEE ON PENAL LAWS AND CRIMINAL PROCEDURE Honorable John W. -

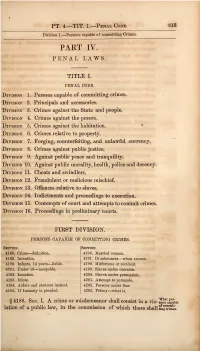

The Code of the State of Georgia

PT. 4.—TIT. 1.—Penal Code. 813 Division 1. —Persons capable of committing Crimes. PART IV. PENAL LAWS. TITLE I. PENAL CODE. Division 1. Persons capable of committing crimes. Division 2. Principals and accessories. Division 3. Crimes against the State and people. • Division 4. Crimes against the person. • Division 5. Crimes against the habitation. Division 6. Crimes relative to property. Division 7. Forging, counterfeiting, and unlawful currency. Division 8. Crimes against public justice. Division 9. Against public peace and tranquility. Division 10. Against public morality, health, police and decency. Division 11. Cheats and swindlers. Division 12. Fraudulent or malicious mischief. Division 13. Offences relative to slaves. Division 14. Indictments and proceedings to execution. Division 15. Contempts of court and attempts to commit crimes. Division 16. Proceedings in preliminary courts. FIKST DIYISIOK , PERSONS CAPABLE OF COMMITTING CRIMES. Section. Section. 4188. Crime—definition. 4196. Married women. 4189. Intention. 419*7. Drunkenness—when excuse. 4190. Infants, 14 years—liable. 4198. Misfortune or accident. 4191. Under 10—incapable. 4199. Slaves under coercion. 4192. Lunatics. 4200. Slaves under persuasion. 4193. Idiots. 4201. Attempt to persuade. 4194. Aiders and abettors instead. 4202. Persons under fear. 4195. If Insanity is pleaded. 4203. Felony—what is. § 4188. Sec. I. A crime or misdemeanor shall consist in a vio- Salable of commit- in the lation of a public law, commission of which there shall tinjS crimes. 814 PT. 4.—TIT. 1.—Penal Code. Division 1. —Persons capable of committing Crimes. be an union or joint operation of act and intention, or criminal negligence. Intention, § 4189. Sec. II. Intention will be manifested by the circum- stances connected with the perpetration of the offence, and the sound mind and discretion of the person accused. -

Criminal Law

The Law Commission Working Paper No 62 Criminal Law Offences relating to the Administration of Justice LONDON HER MAJESTY'S STATIONERY OFFICE 0 Crown copyright 7975 First published 7975 ISBN 0 11 730093 4 17-2 6-2 6 THE LAW COMMISSXON WORKING PAPER NO. 62 CRIMINAL LAW OFFENCES RELATING TO THE ADMINISTRATION OF JUSTICE CONTENTS Paras. I INTRODUCTION 1- 7 1 I1 PRESENT LAW 8- 25 5 Common Law 8- 17 5 Perverting the course of justice 8- 11 5 Examples of conspiracy charges 12- 13 8 Contempt of Court 14- 15 10 Escape and avoiding trial 16 11 Agreeing to indemnify bail 17 11 Statute ~aw 19- 25 12 Perjury 19- 20 12 Other statutory offences 21- 24 13 Summary 25 15 I11 PROPOSALS FOR REFORM 26-116 16 General 26- 33 16 Relationship with contempt of court 27- 29 17 Criminal and civil proceedings 30- 33 18 Outline of proposed offences 34- 37 20 1. Offences relating to all proceedings 38- 88 21 (i) Perjury 38- 60 21 iii Paras. Page Ihtroductory 38- 45 21 Should perjury be confined to false statements? 46 24 Oral evidence not on oath 47- 53 25 Extra-curial unsworn statements admissible as evidence 51- 59 28 Summary 60 31 (ii) Tampering with or fabricating evidence 61- 65 32 (iii)Preventing the attendance of witnesses 66- 67 34 (iv) Intimidation of a party 68- 84 35 (v) Improperly influencing a court 85- 91 43 2. Offences relating only to criminal matters 92-107 45 (i) Impeding the investigation of crime 93-101 45 (ii) Avoiding trial 102-105 50 (iii)Agreeing to indemnify bail 106-110 52 3.