Reaching the Unreachable Attacking the Assets of Serious and Organised Criminality in the UK in the Absence of a Conviction

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Asset Recovery Handbook

Asset Recovery Handbook eveloping countries lose billions each year through bribery, misappropriation of funds, Dand other corrupt practices. Much of the proceeds of this corruption find “safe haven” in the world’s financial centers. These criminal flows are a drain on social services and economic development programs, contributing to the impoverishment of the world’s poorest countries. Many developing countries have already sought to recover stolen assets. A number of successful high-profile cases with creative international cooperation has demonstrated Asset Recovery Handbook that asset recovery is possible. However, it is highly complex, involving coordination and collaboration with domestic agencies and ministries in multiple jurisdictions, as well as the A Guide for Practitioners, Second Edition capacity to trace and secure assets and pursue various legal options—whether criminal confiscation, non-conviction based confiscation, civil actions, or other alternatives. A Guide for Practitioners, This process can be overwhelming for even the most experienced practitioners. It is exception- ally difficult for those working in the context of failed states, widespread corruption, or limited Jean-Pierre Brun resources. With this in mind, the Stolen Asset Recovery (StAR) Initiative has developed and Anastasia Sotiropoulou updated this Asset Recovery Handbook: A Guide for Practitioners to assist those grappling with Larissa Gray the strategic, organizational, investigative, and legal challenges of recovering stolen assets. Clive Scott A practitioner-led project, the Handbook provides common approaches to recovering stolen assets located in foreign jurisdictions, identifies the challenges that practitioners are likely to Kevin M. Stephenson encounter, and introduces good practices. It includes examples of tools that can be used by Second Edition practitioners, such as sample intelligence reports, applications for court orders, and mutual legal assistance requests. -

Fifth Report of the Independent Monitoring Commission

FIFTH REPORT OF THE INDEPENDENT MONITORING COMMISSION Presented to the Government of the United Kingdom and the Government of Ireland under Articles 4 and 7 of the International Agreement establishing the Independent Monitoring Commission Ordered by the House of Commons to be printed 24th May 2005 HC 46 LONDON: The Stationery Office £17.00 © Parliamentary Copyright 2005 The text in this document (excluding the Royal Arms and departmental logos) may be reproduced free of charge in any format or medium providing that it is reproduced accurately and not used in a misleading context. The material must be acknowledged as Parliamentary copyright and the title of the document specified. Any enquiries relating to the copyright in this document should be addressed to The Licensing Division, HMSO, St. Clements House, 2-16 Colegate, Norwich, NR3 1BQ. Fax: 01603 723000 or email: [email protected] Printed in the UK by The Stationery Office Limited on behalf of the Controller of Her Majesty’s Stationery Office Dd PC1405 C7 05/05 2 CONTENTS 1. Introduction and Context 2. Paramilitary Groups: Assessment of Current Activities 3. Paramilitary Groups: The Incidence of Violence and Exiling 4. The Murder of Robert McCartney 5. Paramilitary Groups: The Activities of Prisoners Released under the Belfast Agreement 6. Paramilitary Groups: Organised Crime and Other Paramilitary Activity 7. Responding to Paramilitary Groups: Some Other Issues 8. Paramilitary Groups: Leadership 9. Conclusions and Recommendations 3 ANNEXES I Articles 4 and 7 of the International Agreement II The IMC’s Guiding Principles III Summary of Measures provided for in UK Legislation which may be recommended for action by the Northern Ireland Assembly by the Independent Monitoring Commission (IMC) 4 1. -

Assets Recovery Agency Resource Accounts 2004-05

Presented pursuant to GRA Act 2000 c20. s.6 Assets Recovery Agency Resource Accounts 2004-05 (For the year ended 31 March 2005) Ordered by the House of Commons to be printed 20 July 2005 LONDON: The Stationery Office 20 July 2005 HC 190 £9.10 Assets Recovery Agency Resource Accounts 2004-05 TABLE OF CONTENTS Page ANNUAL REPORT 3 Departmental Aims and Objectives 3 Where the money goes 4 Financial Review 4 Going Concern 6 Accounting Officer of the Agency and Management Board 6 Appointment of Accounting Officer and Management Board 7 Prompt Payment Policy 7 Interest Rate and Currency Risk 7 Fixed Assets 7 Health and Safety 7 Equality and Diversity 7 Employment of Disabled Persons 8 Employee Relations 8 Auditors 8 The Future 8 Cost commitments 8 Serious Organised Crime and Police Act 9 International 9 STATEMENT OF ACCOUNTING OFFICER’S RESPONSIBILITIES 10 STATEMENT ON INTERNAL CONTROL 11 THE CERTIFICATE AND REPORT OF THE COMPTROLLER AND AUDITOR GENERAL TO THE HOUSE OF COMMONS 14 SCHEDULE 1 16 SCHEDULE 2 18 SCHEDULE 3 19 SCHEDULE 4 20 SCHEDULE 5 21 NOTES TO THE ACCOUNTS 22 1. Statement of accounting policies 22 1.1 Accounting convention 22 1.2 Tangible fixed assets 22 1.3 Depreciation 22 1.4 Intangible Assets 22 1.5 Donated Assets 22 1.6 Research and development 22 1.7 Operating income 22 1.8 Administration and programme expenditure 23 1.9 Capital charge 23 1.10 Leases 23 1.11 Pensions 23 1.12 Value Added Tax 23 1.13 Confiscated Assets 23 2. -

Asset Recovery Agency: Proceeds of Crime

RESEARCH AND LIBRARY SERVICES Northern Ireland Assembly SSET ECOVERY GENCY ROCEEDS OF RIME A R A : P C SUMMARY OF KEY POINTS • The Proceeds of Crime Act 2002 contains UK wide measures in relation to confiscation of the proceeds of crime. • Any sums received by the Secretary of State in consequence of the Proceeds of Crime Act 2002 are to be paid into the consolidated fund • In Scotland, Scotland Ministers are the enforcement authority • Cashback for Communities programme was launched by, and is the responsibility of, the Justice Minister and the related Government Department in Scotland; money must be invested in projects that alleviate the effects of crime • Arts and Culture strand of Cashback for Communities is administered by Arts and Business Scotland. • If more than £17 million is recovered in any financial year in Scotland the balance is sent back to the UK Treasury • The Asset Recovery Agency (ARA) in Northern Ireland was created in February 2003 and existed until April 2008 • The ARA collected £23 million while it was in operation • ARA merged with the Serious Organised Crime Agency in 2008 – forming an organisation with a UK wide remit. • Policing and Criminal law are devolved in Scotland but are not devolved in Northern Ireland. PROCEEDS OF CRIME ACT (UK) 2002 1 The Proceed of Crime Act 2002 contains a package of measures relating to confiscation of the proceeds of crime. This Act applies across the UK. Scotland: Proceeds of Crime Act In Scotland, the Proceeds of Crime Act 2002 builds upon the criminal confiscation scheme which was set out in the Proceeds of Crime (Scotland) Act 1995, and consolidates and strengthens money laundering offences. -

Code of Practice Issued Under Section 377 of Thye Proceeds Of

CODE OF PRACTICE ISSUED UNDER SECTION 377 OF THE PROCEEDS OF CRIME ACT 2002 Investigations January 2018 CCS1017189378 978-1-5286-0076-7 CODE OF PRACTICE ISSUED UNDER SECTION 377 OF THE PROCEEDS OF CRIME ACT 2002 Investigations January 2018 © Crown copyright 2018 This publication is licensed under the terms of the Open Government Licence v3.0 except where otherwise stated. To view this licence, visit nationalarchives.gov.uk/doc/open-government-licence/version/3 or write to the Information Policy Team, The National Archives, Kew, London TW9 4DU, or email: [email protected]. Where we have identified any third party copyright information you will need to obtain permission from the copyright holders concerned. Any enquiries regarding this publication should be sent to us at Criminal Finances Team Home Office 6th Floor Peel Building 2 Marsham Street LONDON SW1P 4DF Contents Abbreviations used in this code 1 Introduction 1 Appropriate officers and appropriate persons 3 General provisions relating to all orders and warrants 6 Action to be taken before an application is made 6 Reasonable grounds for suspicion 8 Action to be taken in making an application 9 Action to be taken in serving an order or warrant 11 Action to be taken in receiving an application for an extension of a time limit 14 Record of Proceedings 14 Retention of documents and information 15 Variation and discharge application 15 Production orders 16 Definition 16 Persons who can apply for a production order 16 Statutory requirements 16 Particular action to be taken -

Memorandum to the Committee of Public Accounts from the Comptroller and Auditor General for Northern Ireland: Combating Organised Crime

Memorandum to the Committee of Public Accounts from the Comptroller and Auditor General for Northern Ireland: Combating organised crime Memorandum to the Committee of Public Accounts from the Comptroller and Auditor General for Northern Ireland: Combating organised crime BELFAST: The Stationery Office This Memorandum and detailed Note which accompanies it have been prepared under Article 8 of the Audit (Northern Ireland) Order 1987 for presentation to the Northern Ireland Assembly in accordance with Article 11 of that Order. KJ Donnelly Northern Ireland Audit Office Comptroller and Auditor General 19th January 2010 The Comptroller and Auditor General is the head of the Northern Ireland Audit Office employing some 145 staff. He, and the Northern Ireland Audit Office are totally independent of Government. He certifies the accounts of all Government Departments and a wide range of other public sector bodies; and he has statutory authority to report to the Assembly on the economy, efficiency and effectiveness with which departments and other bodies have used their resources. For further information about the Northern Ireland Audit Office please contact: Northern Ireland Audit Office 106 University Street BELFAST BT7 1EU Tel: 028 9025 1100 email: [email protected] website: www.niauditoffice.gov.uk © Northern Ireland Audit Office 2009 Memorandum to the Committee of Public Accounts from the Comptroller and Auditor General for Northern Ireland: Combating organised crime Contents Introduction 2 - 3 The scale and nature of organised crime in Northern Ireland 3 - 7 Actions taken so far and areas for further consideration 8 - 14 Annex 1: Terms of reference 16 Annex 2: Progress in implementing relevant NIAC recommendationson 17 - 33 Annex 3: List of bodies consulted 34 - 35 List of abbreviations 36 Introduction 2 Memorandum to the Committee of Public Accounts from the Comptroller and Auditor General for Northern Ireland: Combating organised crime Introduction 1. -

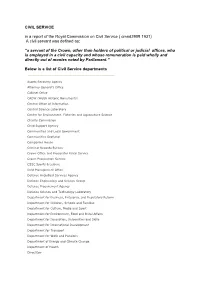

CIVIL SERVICE in a Report of the Royal Commission on Civil Service ( Cmnd3909 1931) a Civil Servant Was Defined As

CIVIL SERVICE in a report of the Royal Commission on Civil Service ( cmnd3909 1931) A civil servant was defined as: “a servant of the Crown, other than holders of political or judicial offices, who is employed in a civil capacity and whose remuneration is paid wholly and directly out of monies voted by Parliament.” Below is a list of Civil Service departments Assets Recovery Agency Attorney General’s Office Cabinet Office CADW (Welsh Historic Monuments) Central Office of Information Central Science Laboratory Centre for Environment, Fisheries and Aquaculture Science Charity Commission Child Support Agency Communities and Local Government Communities Scotland Companies House Criminal Records Bureau Crown Office and Procurator Fiscal Service Crown Prosecution Service CSSC Sports & Leisure Debt Management Office Defence Analytical Services Agency Defence Engineering and Science Group Defence Procurement Agency Defence Science and Technology Laboratory Department for Business, Enterprise and Regulatory Reform Department for Children, Schools and Families Department for Culture, Media and Sport Department for Environment, Food and Rural Affairs Department for Innovation, Universities and Skills Department for International Development Department for Transport Department for Work and Pensions Department of Energy and Climate Change Department of Health DirectGov Driver and Vehicle Licensing Agency Driving Standards Agency Estyn (HM Inspectorate for Education and Training in Wales) Export Credits Guarantee Department Fire Service College Fisheries -

Non-Conviction Based Asset Forfeiture

A GOOD PRACTICES GUIDE FOR NON-CONVICTION BASED ASSET FORFEITURE Theodore S. Greenberg Linda M. Samuel Wingate Grant Larissa Gray Stolen Asset Recovery Stolen Asset Recovery (StAR) Initiative Stolen Asset Recovery A Good Practices Guide for Non-Conviction Based Asset Forfeiture Theodore S. Greenberg Linda M. Samuel Wingate Grant Larissa Gray Washington, D.C. © 2009 The International Bank for Reconstruction and Development / The World Bank 1818 H Street NW Washington DC 20433 Telephone: 202-473-1000 Internet: www.worldbank.org E-mail: [email protected] All rights reserved 1 2 3 4 12 11 10 09 This volume is a product of the staff of the International Bank for Reconstruction and Development / The World Bank. The fi ndings, interpretations, and conclusions expressed in this volume do not necessarily refl ect the views of the Executive Directors of The World Bank or the governments they represent. The World Bank does not guarantee the accuracy of the data included in this work. The boundaries, colors, denominations, and other information shown on any map in this work do not imply any judgement on the part of The World Bank concerning the legal status of any territory or the endorsement or acceptance of such boundaries. Rights and Permissions The material in this publication is copyrighted. Copying and/or transmitting portions or all of this work without permission may be a violation of applicable law. The In- ternational Bank for Reconstruction and Development / The World Bank encourages dissemination of its work and will normally grant permission to reproduce portions of the work promptly. For permission to photocopy or reprint any part of this work, please send a request with complete information to the Copyright Clearance Center Inc., 222 Rosewood Drive, Danvers, MA 01923, USA; telephone: 978-750-8400; fax: 978-750-4470; Inter- net: www.copyright.com. -

Assets Recovery Agency

House of Commons Committee of Public Accounts Assets Recovery Agency Fiftieth Report of Session 2006–07 Report, together with formal minutes, oral and written evidence Ordered by The House of Commons to be printed 9 July 2007 HC 391 Published on 12 October 2007 by authority of the House of Commons London: The Stationery Office Limited £12.00 The Committee of Public Accounts The Committee of Public Accounts is appointed by the House of Commons to examine “the accounts showing the appropriation of the sums granted by Parliament to meet the public expenditure, and of such other accounts laid before Parliament as the committee may think fit” (Standing Order No 148). Current membership Mr Edward Leigh MP (Conservative, Gainsborough) (Chairman) Mr Richard Bacon MP (Conservative, South Norfolk) Annette Brooke MP (Liberal Democrat, Mid Dorset and Poole North) Angela Browning MP (Conservative, Tiverton and Honiton) Chris Bryant MP (Labour, Rhondda) Rt Hon David Curry MP (Conservative, Skipton and Ripon) Mr Ian Davidson MP (Labour, Glasgow South West) Mr Philip Dunne MP (Conservative, Ludlow) Mr John Healey MP (Labour, Wentworth) Ian Lucas MP (Labour, Wrexham) Mr Austin Mitchell MP (Labour, Great Grimsby) Dr John Pugh MP (Liberal Democrat, Southport) Rt Hon Don Touhig MP (Labour, Islwyn) Rt Hon Alan Williams MP (Labour, Swansea West) Mr Iain Wright MP (Labour, Hartlepool) Derek Wyatt MP (Labour, Sittingbourne and Sheppey) The following were also Members of the Committee during the period of the enquiry: Helen Goodman MP (Labour, Bishop Auckland) Mr Sadiq Khan MP (Labour, Tooting) Sarah McCarthy-Fry MP (Labour, Portsmouth North) Kitty Ussher MP (Labour, Burnley) Powers Powers of the Committee of Public Accounts are set out in House of Commons Standing Orders, principally in SO No 148. -

Unexplained Wealth Orders and Account Freezing Orders – a Year On

The Law Society UNEXPLAINED WEALTH ORDERS AND ACCOUNT FREEZING ORDERS – A YEAR ON Michael Potts Byrne and Partners LLP Ross Dixon Hickman & Rose The Law Society Contents 1 UWO’s – the law 2 UWO’s – 1+ year on 3 Reluctance of Enforcement Authorities to use UWO’s. 4 What have we learned from Respondent’s challenges? 5 What for the future of UWO’s? 6 AFOs - the law 7 AFOs – 1+ year on 8 AFOs – the future The Law Society Unexplained Wealth Orders – the law The Law Society What is a UWO and what is the law on obtaining an order? What is an Unexplained Wealth Order (“UWO”)? The law on obtaining a UWO? • The Unexplained Wealth Order (“UWO”) is a civil • An application is made to the High Court if an investigation tool requiring either a Politically Exposed enforcement authority has reasonable cause to believe Person (“PEP”) or a person suspected of involvement in that a person holds unexplained property in excess of £50,000 and they are either: serious crime (or association with it), to disclose assets that appear disproportionate to their known legitimate income. It is not a determination that property was • Any non - EU PEP or a person closely associated or obtained as a result of criminal conduct. connected with a PEP (including family); or • that there are reasonable grounds for suspecting that person is or has been involved in serious crime (in the UK or elsewhere) or is connected with such a person. Serious • A UWO is only available to the following identified crime as defined includes money laundering, bribery and enforcement authorities: corruption, slavery, people trafficking, drug trafficking and other offences • the National Crime Agency • Her Majesty’s Revenue and Customs • The enforcement agency must prove that there are • the Financial Conduct Authority reasonable grounds for suspecting that the known • the Director of the Serious Fraud Office sources of the individual’s lawfully obtained income • the Crown Prosecution Service would have been insufficient for the purposes of enabling them to obtain the property in question. -

Proceeds of Crime Bill

PROCEEDS OF CRIME BILL Publication of Draft Clauses Presented to Parliament by the Secretary of State for the Home Department by Command of Her Majesty March 2001 CM 5066 ISBN 010 150662 7 PROCEEDS OF CRIME BILL Publication of Draft Clauses Contents Foreword Introduction Arrangement of Clauses I The Criminal Assets Recovery Agency II Criminal Confiscation III Scotland IV Northern Ireland V Civil Recovery VI Taxation VII Investigations VIII Money Laundering IX General Provisions Annex Regulatory Impact Assessment FOREWORD BY THE HOME SECRETARY The publication of draft clauses for a Proceeds of Crime Bill marks an important stage in taking forward one of the key commitments in the Government's paper ``Criminal Justice: The Way Ahead'', published on 26 February. Last year's study by the Performance and Innovation Unit (Recovering the Proceeds of Crime, June 2000) showed that criminals and their associates are too often able to retain their ill-gotten gains, even if they have been successfully convicted and imprisoned; and that there is considerable scope for a more concerted focus on investigating and recovering criminal assets. Enjoyment of the fruits of criminal conduct is objectionable in itself, and harmful to society. Greater success in preventing and disrupting this will help to strengthen public confidence in the criminal justice system, undermine harmful role models in the community and deprive criminals of their working capital. The Proceeds of Crime Bill will bring together in one Act, and in an updated and strengthened form, the law governing investigations, money laundering offences and confiscation. In addition, the Bill will establish the Criminal Assets Recovery Agency in England, Wales and Northern Ireland, to perform both an operational and a strategic role. -

![Director of Assets Recovery Agency and William Lovell [2009] NICA 27.Pdf](https://docslib.b-cdn.net/cover/0843/director-of-assets-recovery-agency-and-william-lovell-2009-nica-27-pdf-3540843.webp)

Director of Assets Recovery Agency and William Lovell [2009] NICA 27.Pdf

Neutral Citation No.: [2009] NICA 27 Ref: KER7484 Judgment: approved by the Court for handing down Delivered: 22/04/09 (subject to editorial corrections)* IN HER MAJESTY’S COURT OF APPEAL IN NORTHERN IRELAND _________ ON APPEAL FROM THE QUEEN’S BENCH DIVISION OF THE HIGH COURT OF JUSTICE IN NORTHERN IRELAND _________ Between: THE DIRECTOR OF THE ASSETS RECOVERY AGENCY Plaintiff/Respondent; -and- WILLIAM JOSEPH LOVELL Defendant/Appellant. _________ Before Kerr LCJ, Higgins LJ and Girvan LJ _________ KERR LCJ Introduction [1] This is an appeal from a decision of Coghlin J making a recovery order in relation to certain of the appellant’s property. In broad summary, three main grounds of appeal are advanced. First, it is suggested that the judge should have adjourned the hearing of the case against the appellant. Secondly, it is claimed that, having reached an adverse view about the appellant’s credibility, the judge should have recused himself from the hearing. Finally, the appellant contends that there was insufficient evidence to prove that the property in question had been obtained through unlawful conduct. Background [2] The Police Service of Northern Ireland (PSNI) on 8 February 2004 asked the Assets Recovery Agency (ARA) to investigate whether assets held by William Lovell were the proceeds of crime. On 23 September 2004, 1 following a civil recovery investigation, ARA obtained an interim receiving order over property held by Mr Lovell and other members of his family. On 20 January 2005, Messrs Kevin R Winters & Co, solicitors, came on record for the appellant. They brought an application to have the interim receiving order varied.