BTC Studios SA

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Annexe 2 – Le Marché De L'animation En 2018

les études du CNC Le marché juin 2019 de l’animation en 2018 Cette étude a été réalisée conjointement par la Direction de l’audiovisuel et de la création numérique et la Direction des études, des statistiques et de la prospective. Les données sur l’emploi sont reprises de l’étude publiée par Audiens sur la production de films d’animation et d’effets visuels. Centre national du cinéma et de l’image animée 12, rue de Lübeck 75784 Paris cedex 16 Tél : 01.44.34.38.26 Fax : 01.44.34.34.55 www.cnc.fr Nicolas Besson, Sophie Cheynet, Benoît Danard, Sylvain Dandine, Sophie Jardillier, Laurence Peyré, Ivan Piccon, Cindy Pierron, Danielle Sartori, Jérôme Tyl, Linda Zidane. 2 Le marché de l’animation en 2018 Sommaire Synthèse .............................................................................................................................. 5 1. Cinéma ............................................................................................................................. 8 1.1. La production française de longs métrages d’animation ............................................. 9 1.2. La distribution............................................................................................................17 1.3. Les résultats des films d’animation en salles .............................................................25 1.4. Le public des films d’animation en salles ...................................................................30 2. Audiovisuel ....................................................................................................................34 -

364 Gaminguistics: Proposing a Framework on The

Journal of Social Studies Education Research Sosyal Bilgiler Eğitimi Araştırmaları Dergisi 2019:10 (3),364-386 www.jsser.org Gaminguistics: Proposing a Framework on the Communication of Video Game Avatars Giyoto Giyoto1, SF. Luthfie Arguby Purnomo2, Lilik Untari3, SF. Lukfianka Sanjaya Purnama4 & Nur Asiyah5 Abstract This study attempts to construct a communication framework of video game avatars. Employing Aarseth’s textonomy, Rehak’s avatar’s life cycle, and Lury’s prosthetic culture avatar’s theories as the basis of analysis on fifty-five purposively selected games, this study proposes ACTION (Avatars, Communicators, Transmissions, Instruments, Orientations and Navigations). Avatars, borrowing Aarseth’s terms, are classifiable into interpretive, explorative, configurative, and textonic with four systems and sub classifications for each type. Communicators, referring to the participants involved in the communication with the avatars and their relationship, are classifiable into unipolar, bipolar, tripolar, quadripolar, and pentapolar. Transmissions, the ways in which communication is transmitted, are classifiable into restrictive verbal and restrictive non-verbal. Instruments, the graphical embodiment of communications, are realized into dialogue boxes, non-dialogue boxes, logs, expressions, movements and emoticons. Orientations, the methods the game spatiality employs to direct the movement of the avatars, are classifiable into dictative and non-dictative. Navigations, the strategies avatars perform regarding with the information saving system of the games, are classifiable into experimental and non-experimental. Departing from this ACTION, analysts are able to employ this formula as an approach to reveal how the avatars utilize their own ‘linguistics’ to communicate, out of the linguistics benefited by humans. Keywords: framework of communication, game avatars, game studies, video games, prosthetic culture. -

Collecting: a Way of Exploring the Difficulty to Leave Game World

Collecting: a way of exploring the difficulty to leave game world Guo Yichen Thesis submitted to the University of Nottingham, Ningbo, China for the degree of Master of Philosophy July 2015 Page 1 Abstract: Digital games have become a part of daily life for people in recent years. they have the capacity of making game users set playing games as top priority in daily life. In this sense, playing digital games can break the balance between the virtual and the reality and it is possible that some people may get lost in the virtual world. However, this thesis argues that it can be inappropriate just equating excessive play with addiction. By discussing and connecting previous literature reviews on games and addiction, as well as adding three game case studies, this thesis finally finds collecting as a different approach to explore the difficulty to leave game world. Through discussing in-game collecting and book collecting in ancient China, this thesis helps answer how people understand the heavy use on digital games and what is hidden behind choosing to stay in game world. Page 2 Acknowledgement: I would like to firstly thank my supervisors Dr. Andrew White and Dr. Bjarke Liboriussen for their priceless academic support. I would also like to thank my father who offered me first-hand resources to help me construct the discussion part, he deserves my special respect. Page 3 Table of content: 1. Introduction and methodology: 5 1) Research background 5 2) Gamer type 7 3) Research contribution and research methodology 9 2. Digital games and the roles they can play: 14 1) The definition of digital games: 14 2) Three possible roles that digital games can play: 18 -- As a kind of play 19 -- As a process of construction 20 -- As a way for escaping 22 3. -

Bafta Rocliffe New Writing Showcase: Children, Family

A huge thank you to our script selection panellist BAFTA Rocliffe patrons include: BAFTA ROCLIFFE and judges. They include: Christine Langan, Julian Fellowes, John Madden, Mike Newell, Richard Eyre, David Parfitt, David Yates, NEW WRITING SHOWCASE: 2021 JURY Finola Dwyer, Michael Kuhn, Duncan Kenworthy, Rebecca O’Brien, Sue ADAM TYLER BAFTA Award-winning Writer/Director, Screwball! (2017) Perkins, John Bishop, Greg Brenmer, CHILDREN, FAMILY AND YA MEDIA Olivia Hetreed, Andy Patterson, Andy Refugee (2016) Harries, Christopher Hampton and SUPPORTED BY THE LONDON BOOK FAIR ANDY VENTRIS Director, London Book Fair Elizabeth Karlsen. THURSDAY 27 MAY 2021 CECILIA PERSSON Media & Entertainment Executive DARREN NARTEY Acquisitions Manager, ITV Rocliffe Producers ELLIOTT PALMER Animation Development Producer, King Bert FARAH ABUSHWESHA NINA HAHN BEN WILLBOND Productions [email protected] IAN FRANCE Commissioning Editor, Sky Kids MPONA LEBAJOA is Senior Vice President is a comedian, writer and [email protected] KARA SMITH Writer/Director, Apple Tree House of International Production & producer. Co-writer LOUISE BUCKNOLE VP Programming Kids, ViacomCBS Networks Development for Nickelodeon and co-star of the BAFTA- BAFTA Producer International BETH WELSH International, and Head of nominated comedy Ghosts VANESSA AMBERLEIGH Genre Lead Preschool at BBC Children’s In [email protected] ViacomCBS International (BBC1), Ben is also an House Productions Studios (VIS) Kids, with over original cast member of BAFTA Children and Young People Manager 25 years’ experience in creating the multiple-award-winning LISA PRIME and producing content for kids spanning all genres, children’s TV show Horrible Histories (CBBC/BBC1) 2021 PANEL [email protected] and initiating projects such as Deer Squad, Spyders, and with the team, went on to co-write and star in DAVINIA ANDREW-LYNCH Founder of Andlyn Literary Agency Director and The Twisted Timelines of Sammy & Raj. -

Here the Trained to Be a Spy in the Army by Her Adop- Phone Lines Are Manned Entirely by Celebri- 4 Tive Father to Seek Revenge Against Their Ties

*LIST_619_ALT.qxp_LIS_1006_LISTINGS 6/6/19 12:32 PM Page 1 WWW.WORLDSCREENINGS.COMTVL JUNE 2019ISTINGNATPE BUDAPEST, SUNNY SIDE & ANNECYS EDITION THE LEADING SOURCE FOR PROGRAM INFORMATION TRULY GLOBAL WorldScreen.com *LIST_619_ALT.qxp_LIS_1006_LISTINGS 6/6/19 12:32 PM Page 2 2 TV LISTINGS NATPE BUDAPEST INTERNATIONAL EXHIBITOR DIRECTORY Complete listings for the companies in bold can be found in this edition of TV Listings. A+E Networks Suite 224 Kwanza MT 44 Aardman Animations Suite 245B Lagardère Studios Distribution MT 45 About Premium Content MT 40 Lionsgate Entertainment Suite 214 ABS-CBN Corporation MT 35 MADD Entertainment Suite 225 all3media international Suite 221 MarVista Entertainment VB 24 Allspark MT 51 Media Group Ukraine Suite 248B Armoza Formats MT 29 Mediaset Distribution VB 2 ATV Suite 218 Mediatoon Distribution VB 12 Autentic Distribution MT 10 MGM Television Suite 220 Banijay Rights VB 45 & 46 MISTCO Stand 4 Bavaria Media International VB 33 Mondo TV MT 24 BBC Studios Suite 209 & 210 Monster Entertainment MT 20 Berserk Media Suite 246A NBCUniversal International Distribution Duna III & IV Blue Ant Media MT 33 Newen Distribution MT 46 Boat Rocker Rights MT 39 NTV Broadcasting Company MT 38 Bonneville Distribution VB 39 Off The Fence MT 27 Breakthrough Entertainment Suite 248A One Life Studios VB 15 Broken Arrow Media MT 16 ORF-Enterprise Suite 203 CAKE Suite 244A Parade Media MT 12 Calinos Entertainment Suite 223 Paramount Pictures VB 38 & 44 Caracol Internacional Stand 6 Passion Distribution MT 50 Carsey-Werner Television -

Time Ace Cheats

Time ace cheats click here to download For Time Ace on the DS, GameFAQs has 3 cheat codes and secrets. You are not registered / logged in. If you would like to receive an email to let you know if/when we have added this question to the site please enter your email address. We will only use this address to email the confirmation for this question. Accept submission terms View Terms · Ask a question for another game. Time Ace. Time Ace is a video game developed by Trainwreck Studios and released on Nintendo DS. View game sales, statistics, release dates, characters, credits, discussion and related links here. Get the latest cheats, codes, unlockables, hints, Easter eggs, glitches, tips, tricks, hacks, downloads, hints, guides, FAQs, and walkthroughs for Time Ace on Nintendo DS (DS). Disclaimer and proviso: “The postings on this site are my own and don't represent Amazon's position in any way whatsoever”. Have you ever failed a code-intensive technical interview? I have, and can. {CHEAT} Last Empire War Z Hack [No Survey] Free DIAMONDS XP Generator {Android-iOS} "{FREE GENERATOR TOOL }[Hack-Tool]-[No Survey]-[Triche - Astuce - Gratuites][illimité - Sans Verification Humaine- Gratuit- Generateur ][UPDATED]-[WITHOUT HUMAN VERIFICATION]" Launch FREE# Devilian Hack - Amazing Cheats For k Gems. Complete the game in Captain Mode, Oh Captain! My Captain! Energize for the first time, Regain Your Manhood. Hail the Space Station for permission to land, Requesting Permission. Beat the Rollerblade Scene in Ace Mode, Roller Boogie. Get transformed into a baby, Space Baby. Beat the Dogfight Scene in Ace Mode. -

Self-Management for Actors 4Th Ed

This is awesome Self-Management for Actors 4th ed. bonus content by Bonnie Gillespie. © 2018, all rights reserved. SMFA Shows Casting in Major Markets Please see page 92 (the chapter on Targeting Buyers) in the 4th edition of Self-Management for Actors: Getting Down to (Show) Business for detailed instructions on how best to utilize this data as you target specific television series to get to your next tier. Remember to take into consideration issues of your work papers in foreign markets, your status as a local hire in other states, and—of course—check out the actors playing characters at your adjacent tier (that means, not the series regulars 'til you're knocking on that door). After this mega list is a collection of resources to help you stay on top of these mainstream small screen series and pilots, so please scroll all the way down. And of course, you can toss out the #SMFAninjas hashtag on social media to get feedback on your targeting strategy. What follows is a list of shows actively casting or on order for 4th quarter 2018. This list is updated regularly at the Self-Management for Actors website and in the SMFA Essentials mini- course on Show Targeting. Enjoy! Show Title Show Type Network 25 pilot CBS #FASHIONVICTIM hour pilot E! 100, THE hour CW 13 REASONS WHY hour Netflix 3 BELOW animated Netflix 50 CENTRAL half-hour A&E 68 WHISKEY hour pilot Paramount Network 9-1-1 hour FOX A GIRL, THE half-hour pilot A MIDNIGHT KISS telefilm Hallmark A MILLION LITTLE THINGS hour ABC ABBY HATCHER, FUZZLY animated Nickelodeon CATCHER ABBY'S half-hour NBC ACT, THE hour Hulu ADAM RUINS EVERYTHING half-hour TruTV ADVENTURES OF VELVET half-hour PROZAC, THE ADVERSARIES hour pilot NBC AFFAIR, THE hour Showtime AFTER AFTER PARTY new media Facebook AFTER LIFE half-hour Netflix AGAIN hour Netflix For updates to this doc, quarterly phone calls, convos at our ninja message boards, and other support, visit smfa4.com. -

44-77 (Katsottavissa Disney+ -Palvelussa 3.9 Menessä) ELOKUVAT JA SPESIAALIT 1

SISÄLLYS ELOKUVAT JA SPESIAALIT: 1- 43 SARJAT: 44-77 (Katsottavissa Disney+ -palvelussa 3.9 menessä) ELOKUVAT JA SPESIAALIT 10 Things I Hate About You 101 Dalmatians 101 Dalmatians II: Patch's London Adventure 102 Dalmatians 12 Dates of Christmas 12 Rounds 127 Hours 13th Warrior, The 20,000 Leagues Under the Sea 22 vs Earth 25th Hour 42 to 1 700 Sharks 9 to 5 9/11 Firehouse 9/11 Rescue Cops Abraham Lincoln: Vampire Hunter Absent-Minded Professor, The Absolutely Fabulous: The Movie Adventures in Babysitting Adventures in Babysitting Adventures of Andre & Wally B., The Adventures of Bullwhip Griffin, The Adventures of Huck Finn, The Adventures of Ichabod and Mr. Toad, The African Cats African Lion, The Air Force One Air Mater Air Up There, The Aladdin Aladdin and the King of Thieves Alamo, The Alexander and the Terrible, Horrible, No Good, Very Bad Day Alice in Wonderland Alice Through the Looking Glass Alien Alien Resurrection Alien VS. Predator Alien: Covenant Alien3 Aliens Aliens of the Deep Aliens VS. Predator - Requiem All About Steve All in a Nutshell Alley Cats Strike Almost Angels Amelia American Eid America's Greatest Animals America's Heart & Soul Amy Anastasia Anatomy of a Dewback Anna and the King Annapolis Annie Another Earth Ant-Man Ant-Man and the Wasp Antwone Fisher Anywhere but Here Apollo: Missions to the Moon Apple Dumpling Gang Rides Again, The Apple Dumpling Gang, The Aquamarine Area 51: The Cia's Secret Arendelle Castle Yule Log 2.0 Aristocats, The Art of Getting By, The Art of Racing in the Rain, The Art of Skiing, -

TRULY GLOBAL Worldscreen.Com *LIST 0120.Qxp LIS 1006 LISTINGS 1/14/20 4:16 PM Page 2

*LIST_0120.qxp_LIS_1006_LISTINGS 1/14/20 4:16 PM Page 1 WWW.WORLDSCREENINGS.COMTVL JANUARY IST 2020 INGNATPE & PRE-KIDSCREENS EDITION THE LEADING SOURCE FOR PROGRAM INFORMATION TRULY GLOBAL WorldScreen.com *LIST_0120.qxp_LIS_1006_LISTINGS 1/14/20 4:16 PM Page 2 MARKET FLOOR ABC Commercial MT 12 Chocolate Filmes 314 Great Movies Distribution MT 3 Multicom Entertainment Group 403 Shoreline Entertainment MT 1 ABC Japan 212 CITVC 325 Hat Trick International 203 Muse Distribution International 517 SIC MT 8 Adler & Associates Ent. MT 7 CJ ENM 125 High Hill Entertainment MT 30 NewCo Audiovisual 425 Star Contents MT 10 Alchimie 425 Creative TV Productions MT 34 ICEX Spain Trade & Investment 425 Newen Distribution 225 Stellar Yapim 415 All The Kids Entertainment 425 DCD Rights 300 Inside Content 425 NK Producciones MT 11 Story Productions 314 American Cinema International MT 5 Deutsche Welle MT 22 Inverleigh MT 35 Olympusat 501 TCB Media Rights 205 Ampersand 225 DLT Entertainment 105 Isla Audiovisual 425 Onza 425 Telco Productions 509 Andalucia Digital Multimedia 425 Drive 105 Jiangsu Broadcasting Corp. Intl. 325 Out There Productions MT 25 Teleimage Productions 314 ARTE Distribution 225 Earth Touch 105 Jynx Productions MT 23 PACT 105 The Television Syndication Company 404 Artico Distribution 425 Eccho Rights 309 Kansai TV 113 Premiere Entertainment MT 28 Toei Animation 215 Atresmedia TV 425 Electric Entertainment MT 2 KBS Media 125A Prime Entertainment Group 225 TT International Medya 415 ATV 318 Elo Company 314 KOCCA 125C Rabbit Films MT 14 Turkey -

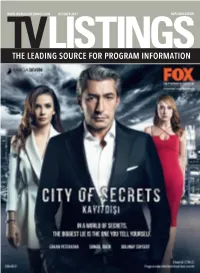

THE LEADING SOURCE for PROGRAM INFORMATION MEA 1017__Layout 1 9/22/17 11:33 AM Page 1 *LIST 1017-ADDITIONAL LIS 1006 LISTINGS 10/2/17 12:42 PM Page 3

*LIST_1017_COVER_LIS_1006_LISTINGS 9/28/17 11:09 AM Page 1 WWW.WORLDSCREENINGS.COM OCTOBER 2017 MIPCOM EDITION TVLISTINGS THE LEADING SOURCE FOR PROGRAM INFORMATION MEA_1017__Layout 1 9/22/17 11:33 AM Page 1 *LIST_1017-ADDITIONAL_LIS_1006_LISTINGS 10/2/17 12:42 PM Page 3 IN THISISSUE TV LISTINGS 3 Monica Chef (Live-action drama/comedy, 3 18 4K MEDIA 40x22 min.) Monica has all the ingredients to 4K Media KABO International O (1-212) 590-2100 make her dream come true—she just needs to 9 Story Media Group Kanal D International control her musical daydreams and focus on 4 Keshet International Stand: R7.B12 becoming the chef she knows she can be. Kew Media Group 41 Entertainment Contact: Kristen Gray, SVP, operations & busi- Grace Beside Me (Live-action drama/comedy, Lacey Entertainment A+E Networks ness & legal affairs; Jennifer Coleman, VP, lic. & 13x26 min.) Fuzzy Mac’s life is turned upside The LEGO Group ABS-CBN Corporation mktg.; Jonitha Keymoore, pgm. sales dir. down when she discovers she can communicate Alfred Haber Distribution 19 with spirits. The series takes audiences on an all3media international Lionsgate Entertainment emotional roller-coaster ride as Fuzzy learns to American Cinema International Looking Glass International accept her “grace”-filled gift. 6 MarVista Entertainment The Samuel Project (Live-action drama, 1x90 Armoza Formats Mediaset Distribution min.) In search of a unique and engaging idea Artist View Entertainment Mediatoon Distribution for his high-school animation contest, teen illus- Atlantyca Entertainment 20 trator Eli Bergman unravels an incredible hid- ATRESMEDIA Televisión Mercis den story of perseverance and survival from his ATV Turkey Metro-Goldwyn-Mayer Studios aging grandfather Samuel. -

Download the Catalogue of the 2021 Event

cartoon digital online 26-28 May 2021 e-catalogue Evolutions of animated entertainment in our connected lives TOP SPEAKERS ı MARKET TRENDS ı CASE STUD ı ES ı NETWORK ı NG www.cartoon-media.eu INDEX OFFICIALS PROGRAMME PROFILES PARTICIPANTS PRACTICAL BLURBS HOW TO NAVIGATE? HOW TO NAVIGATE? IT’S EASY! You have uploaded and saved the e-Catalogue Cartoon Digital 2021 on your tablet/smartphone/ computer using Adobe Acrobat Reader. This enhanced digital version will allow you to take notes, make quick searches, and contact other participants with a simple “click”. HOW TO ACCESS THE DIFFERENT PAGES? THE PARTICIPANTS Click on “Participants” in the main Index or in the tabs above. They are all listed by alphabetical order. Click on the email next to their photo to contact them directly. You can also use the search tool and bookmarks (see below). The navigation stays the same to access other information in the e-Catalogue. Do not forget: the easiest way to access everything is by using the tabs at the top of the pages. HOW TO USE THE MAIN FUNCTIONS AVAILABLE IN ADOBE ACROBAT READER? VIEW MODES GO TO PAGES These modes allow you to read/turn Don’t want to scroll all the pages? It’s the pages in different ways: easy: tap on the page number; you can Continuous: scroll vertically. then enter the number of the page you Single page: book style, from left to right. want to go to. Night mode: useful when in a dark room. SEARCH BOOKMARKS Use this function to search a specific The bookmarks will give you a direct word in the whole document (Keynote, access to each part of the e-Catalogue participant’s name, etc.) just by clicking on the chapter needed. -

Ragnarok Battle Offline Wiki

Ragnarok battle offline wiki Welcome to Ragnarok Battle Offline Wiki This wiki about French-Bread's scrolling brawler game. There are 6 Classes which each have 2 Genders. The last class, Novice, has to be opened by. The thief is a fast character with skills and attacks tailored to hitting fast and staying out. Magicians rely on magic attacks to damage enemies. Their normal attacks are slow and weak, but. Ragnarok Battle Offline is a beat 'em up game for Microsoft Windows created by dōjin soft developer French-Bread. The soundtrack is composed by Raito of Genre(s): Beat 'em up. ラグナロ クバトルオフライン(RBO)は、 グラヴィティ社開発のMMORPG「ラグナロクオンライン」を題材にした、 フランスパンにより製作された同人横. Ragnarok Battle Offline (Japanese: ラグナロク バトル オフライン), or RBO, is a beat 'em up 2D game for Microsoft Windows created by dōjin soft. Ragnarok Battle Offline. Quite the same Wikipedia. Just better. No recent wiki edits to this page. Ragnarok Battle Offline, or RBO as it is commonly known is a 2D side scrolling brawler, closely based on the MMO by Gravity. Wiki по игре Ragnarok Battle Offline / Ссылка на оригинал статьи: Подождите, пожалуйста, идет. Installation and running. I haven't installed/played this game in a couple of years. English version is available if I remember correctly. Ragnarok Battle Offline FAQ v - by Stelas (stelas at rpgcafe dot net) .. See Wiki for no. of hits absorbed - Fire Bolt (ファイアーボルト) dd + A during Cast. Ragnarok Online - Client Download Ragnarok Online: the game 40 million. Ragnarok Battle Offline Wiki - Wikia See Ragnarok Battle Offline Wiki. Download. Ragnarok Battle Offline: Stage 4 Boss Orc Hero with Male Merchant .