The Benchmark of Our Vision Is to Be

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Download (6MB)

WHEELS WITHIN WHEELS Jane Barrett Submitted in fulfilment of the requirements for the degree of Master of Philosophy in the subject Economics at School of Oriental and African Studies University of London Supervisor : Professor L Harris March 1992 ProQuest Number: 10731567 All rights reserved INFORMATION TO ALL USERS The quality of this reproduction is dependent upon the quality of the copy submitted. In the unlikely event that the author did not send a com plete manuscript and there are missing pages, these will be noted. Also, if material had to be removed, a note will indicate the deletion. uest ProQuest 10731567 Published by ProQuest LLC(2017). Copyright of the Dissertation is held by the Author. All rights reserved. This work is protected against unauthorized copying under Title 17, United States C ode Microform Edition © ProQuest LLC. ProQuest LLC. 789 East Eisenhower Parkway P.O. Box 1346 Ann Arbor, Ml 48106- 1346 ACKNOWLEDGEMENTS I wish to acknowledge my supervisor/ Prof Laurence Harris, who persuaded me to embark on this project, and encouraged me through to completion. Acknowledgement too, is due to the British Council for making the study financially possible, and to the Transport and General Workers Union (SA) for giving me the time off to do the necessary research. Special thanks are due to Gill, Avril, Kally, and Barbara, for their enormous love and support over a difficult few months, and to many other friends too numerous to mention. Thanks too, to Gwen, Tony, and Anne for being there. ABSTRACT This study focuses on road freight transport in South Africa, as one part of a transport system which should integrate different modes of transport. -

State of Operations Update

March 19, 2018 State of Operations Update Dear Valued Customer, We'd like to provide you with the latest Safmarine North America operational details. Vessel Operations Please see below for confirmed operational statuses of impacted vessels. Please be advised that vessel delays may be a result of a combination of standard seasonal contingencies and are not solely a result of weather impact – these details are subject to change. Service Vessel Updates Maersk South Africa (Pty) Ltd, Registration No. 1992/005770/07 acting as agent on behalf of Maersk Line A/S, (incorporated in Denmark)SA Reg. No. 2015/028124/10 trading as Safmarine, Address of registered office: Safmarine Quay – The Clocktower Precinct, V&A Waterfront, Cape Town, 8001 – PO Box 27, Cape Town, 8000; Telephone: +27(0)21 408 6911 Facsimile: +27(0)21 408 6345 Email: [email protected]; Web www.safmarine.com Terminal Operations Port Updates Inland Operations We would like to keep you updated with an overview of inland operations to give you visibility into the delivery and rail capabilities in key regions. Please reference the below for your convenience: GREEN • Imports: Most if not all containers are delivered on or before last free day. • Exports: Will make intended port/rail cut if booked 72 hours in advance. Shortage of hazardous drivers may still occur. Maersk South Africa (Pty) Ltd, Registration No. 1992/005770/07 acting as agent on behalf of Maersk Line A/S, (incorporated in Denmark)SA Reg. No. 2015/028124/10 trading as Safmarine, Address of registered office: Safmarine Quay – The Clocktower Precinct, V&A Waterfront, Cape Town, 8001 – PO Box 27, Cape Town, 8000; Telephone: +27(0)21 408 6911 Facsimile: +27(0)21 408 6345 Email: [email protected]; Web www.safmarine.com YELLOW • Imports: Delivering on or before last free day depends on commodity type and mileage. -

Safmarine Customer Advisory

April 27, 2018 Advance Containerized Cargo Loading Notices (Pre-Arrival Manifest) – South Africa Dear Valued Customers, The Customs Authority in South Africa has recently announced the full implementation of the Customs Control Act, 2014. The first phase of the Reporting of Conveyances and Goods (“RCG”) under the current Customs and Excise Act, 1964 has been implemented 20th April 2018. The RCG project is intended to provide customs control of all vessels, trains, vehicles, goods and persons entering or leaving South Africa. In order to comply with all customs obligations, advanced containerized cargo loading notices must be transmitted to customs at least 24 hours before the first container is loaded on board the vessel that will transport the cargo to South Africa. This applies to both cargo destined for and to be transshipped via South African ports. At this time, we would like to advise that customers shipping cargo to South Africa should make arrangements to be in compliance with this regulation. We will update you further as information becomes available on mandatory enforcement. Frequently asked questions as per the SARS website: What does RCG stand for and where does it fit in? RCG is an acronym for Reporting of Conveyances and Goods and it is one of the three major projects (the other two being Registration, Licensing and Accreditation (RLA) and Declaration Processing (DPS)) being undertaken under the New Customs Act Programme (NCAP) which is charged with operationalizing the Customs Control Act, 2014 and the Customs Duty Act, 2014. Under what legislation will the first phase of the RCG implementation take place? The rules to section 8 of the Customs and Excise Act No.91 of 1964 will be amended to form the legislative basis for the implementation of RCG. -

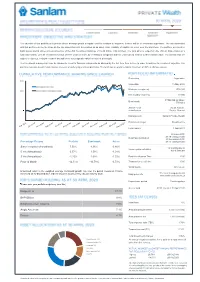

Equity-Fund.Pdf

The objective of this portfolio is to provide above average growth in capital over the medium to long term. Income will be of secondary importance. The risk associated with this portfolio will be the same as the risk associated with SA equities as an asset class. Volatility of capital can occur over the short term. The portfolio will invest in liquid assets and in shares across all sectors of the JSE Securities Exchange of South Africa, (JSE Limited). The fund aims to outperform the JSE All Share Index on a total return basis, over an investment horizon of three years or more, by investing in companies that are undervalued relative to their intrinsic value. The investments are subject to rigorous, in-depth research and adhere to our pragmatic value investment philosophy. The investment manager will also be allowed to invest in financial instruments as allowed by the Act from time to time in order to achieve its investment objective. The portfolio may also invest in participatory interests of underlying unit trust portfolios. The fund may at any time hold a maximum of 30% in offshore assets. Risk rating Aggressive Issue date 16 May 2020 Minimum investment R30 000 Min monthly recurring R1000 FTSE/JSE All Share Benchmark TR Index ASISA Fund South African– classification Equity -General Management Sanlam Private Wealth Portfolio manager David Lerche Fund launch 1 April 2011 30 June 2019: 23.49 cents per unit Bi-annual distribution 31 December 2019: Percentage Returns Portfolio Benchmark Active 28.47 cents per unit Since Inception (Annualised) 7.50% 8.36% -0.86% 1st working day in Income payment dates 5 Yrs (Annualised) 0.57% 1.58% -1.01% July & January 3 Yrs (Annualised) -1.25% 1.08% -2.33% Portfolio valuation Time 15:00 Past 12 Month -14.51% -10.78% -3.73% Transaction cut-off time 15:00 Withdrawals On request Annualised return is the weighted average compound growth rate over the period measured. -

George Hallett

GEORGE HALLETT Born 1942, District Six, Western Cape, South Africa Lives and works in Cape Town, South Africa EDUCATION 1959-63 Artists’ Cooperative Workshop Apprenticeships at Art Foundry of Block and Leo Wald, Sculpture, Pottery, and Plastics 1967 Transvaal Art Academy 1980-83 Graduate Programme in Film and Television, New York University 1986 Visiting Artist, University of Massachusetts SOLO EXHIBITIONS 2019 George Hallett, Gallery MOMO, Johannesburg, South Africa 2018 George Hallett, Gallery MOMO Cape Town, South Africa 2013 George Hallett: A Nomad’s Harvest, Iziko South African National Gallery, Cape Town, South Africa 2010 1994 Elections and Mandela’s Vision, various locations, Germany Impressions of Italy, Artscape, Cape Town, South Africa Portraits from Exile, Bonhams, London 2007 Portraits of African Writers, Rhodes University, Grahamstown, South Africa 2006 Portraits of African Writers, Cape Town International Book Fair, Cape Town, South Africa 2005 South African Exiles of the ‘70s and ‘80s in Europe, Spitz Gallery, London 2004 The Truth and Reconciliation Commission Exhibition, Herbert Art Gallery and Museum, Coventry, UK 2001 Dance for All, The Aschegach Gallery, Amsterdam, Netherlands 2000 Dance for All, Maidenhead Cultural Centre, UK 1999 The Face of Bo-Kaap, Bo-Kaap Museum, Cape Town, South Africa 1995 Transformation, 1994 Elections, Irma Stern Museum, Cape Town, South Africa 1989 Afrika Centrum, Cadier en Keer, Maastricht, Netherlands 1988 Künstforum der Sozialdemokratie, Bonn, Germany 1985 University of Illinois at Urbana–Champaign, -

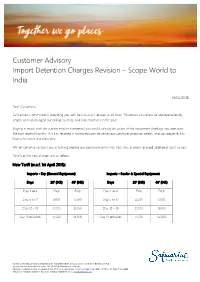

Customer Advisory Import Detention Charges Revision – Scope World to India

Customer Advisory Import Detention Charges Revision – Scope World to India 01/03/2018 Dear Customers, Safmarine is committed in providing you with best-in-class services at all times. To remain cost effective and operationally simple we had changed our billing currency and slab structures in the past. Staying in touch with the current market economics you would already be aware of the equipment shortage situation over the past several months. This has resulted in increased costs to serve your container provision needs, and consequently has lead us to revise our slab rates. We will continue to assist you in turning around our containers within the free time, in order to avoid additional costs to you. Details of the new charges are as follows: New Tariff (w.e.f. 1st April 2018): Imports - Dry (General Equipment) Imports - Reefer & Special Equipment Days 20' (INR) 40' (INR) Days 20' (INR) 40' (INR) Day 1 to 4 Free Free Day 1 to 4 Free Free Day 5 to 11 3000 6,000 Day 5 to 11 4,500 9,000 Day 12 - 18 4,500 9,000 Day 12 - 18 5,500 11,000 Day 19 onwards 6,500 13,000 Day 19 onwards 7,500 15,000 Maersk South Africa (Pty) Ltd, Registration No. 1992/005770/07 acting as agent on behalf of Maersk Line A/S, (incorporated in Denmark)SA Reg. No. 2015/028124/10 trading as Safmarine, Address of registered office: Roggebaai Place, 8th Floor, 4 Jetty Street, Foreshore, Cape Town, 8001 – PO Box 27, Cape Town, 8000; Telephone: +27(0)21 408 6911 Facsimile: +27(0)21 408 6345 Email: [email protected]; Old Tariff (Valid till 31st March 2018): Imports - Dry (General Equipment) Imports - Reefer & Special Equipment Days 20' (INR) 40' (INR) Days 20' (INR) 40' (INR) Day 1 to 5 Free Free Day 1 to 4 Free Free Day 6 to 12 2,500 5,000 Day 5 to 12 4,000 8,000 Day 13 - 22 4,000 8,000 Day 13 - 22 5,000 10,000 Day 23 onwards 6,000 12,000 Day 23 onwards 7,000 14,000 We will continue to monitor the exchange rates and periodically adjust the tariff when there is significant upward or downward movement. -

Sanlam Global Funds Plc

SANLAM GLOBAL FUNDS PLC SANLAM GLOBAL FUNDS PLC Unaudited condensed interim financial statements for the six months ended 30 June 2020 SANLAM GLOBAL FUNDS PLC UNAUDITED CONDENSED INTERIM FINANCIAL STATEMENTS for the six months ended 30 June 2020 Contents Page(s) Company information 1 - 4 Directors’ report 5 - 10 Economic & market review 11 - 13 Investment Manager’s reports 14 - 39 Statement of comprehensive income of the Company 40 of the Funds 41 - 48 Statement of financial position of the Company 49 of the Funds 50 - 57 Statement of changes in net assets attributable to participating shareholders of the Company 58 of the Funds 59 - 66 Statement of cash flows of the Company 67 of the Funds 68 - 75 Portfolio of investments Sanlam Global Balanced Fund 76 Sanlam Global Equity Fund 77 Sanlam BIFM World Equity Fund 78 Sanlam BIFM Global Fixed Income Fund 79 Mpile Global Equity Fund 80 Sanlam Private Wealth Global Balanced Fund 81 - 82 Counterpoint Global Equity Fund 83 - 85 Independent Global Flexible Fund 86 - 87 Counterpoint Global Owner Managed Flexible Fund 88 - 89 Excalibur Global Managed Fund 90 Northstar Global Flexible Fund 91 - 93 Absa Global Best Blend Fund 94 Absa Global Access Fund 95 Notes to and forming part of the unaudited condensed interim financial statements 96 - 128 AIFMD Periodic Disclosures 129 SANLAM GLOBAL FUNDS PLC COMPANY INFORMATION Directors of Sanlam Global Paul Dobbyn1 – Irish Funds Plc (the “Company”) Thomas Murray1 – Irish Haydn Franckeiss – South African Richard Aslett – British All Directors are non-executive -

South Africa Local Charges 2020/2021

Safmarine South Africa Local Charges 2020/2021 Version 3 – Effective 1st April 2020 Classification:safmarine.com Public TABLE OF CONTENTS 1. Export Local Charges 2. Drop Off Charges 3. Import Local Charges 4. Export Detention Charges 5. Import Detention Charge 6. Demurrage Terms & Conditions 7. Demurrage Charges 8. Inland Surcharges website link to be announced In the event that any export Goods are stopped by the South African Revenue Service (“SARS”) or any other authority after the Goods have been delivered into the control of the Carrier, or are deemed in law to have been delivered into the control of the Carrier, then the Carrier may at the cost and risk of the Merchant arrange for the movement of the Goods in accordance with the instructions of SARS or such other authority. Once SARS or such other authority has granted release of the Goods for export, the Carrier may arrange for the Goods to be moved back into stacks for export at the sole risk and expense of the Merchant. The Carrier will under no circumstances be liable if the Goods miss the date of sailing as a result of the intervention by SARS or such other authority and the Goods will be exported on board the next available vessel subject of Clauses 8, 19 and 20 of the Carrier’s Bill of Lading Terms for Carriage. The Merchant indemnifies the Carrier, its employees, agents and/or sub-contractors as a result of their adhering to such instructions and in respect of consequent charges, Freight or expense incurred. All landside charges, Freight or expense, including but not limit to detention and demurrage, incurred by the Carrier on behalf of the Merchant after landing of the Goods and before release of the Goods, or incurred after the Goods are deemed to be under the Carrier’s control for export, shall be for the Merchant’s account and shall be payable on demand. -

Khayelitsha Western Cape Nodal Economic Profiling Project Business Trust & Dplg, 2007 Khayelitsha Context

Nodal Economic Profiling Project Khayelitsha Western Cape Nodal Economic Profiling Project Business Trust & dplg, 2007 Khayelitsha Context IInn 22000011,, SSttaattee PPrreessiiddeenntt TThhaabboo MMbbeekkii aannnnoouunncceedd aann iinniittiiaattiivvee ttoo aaddddrreessss uunnddeerrddeevveellooppmmeenntt iinn tthhee mmoosstt sseevveerreellyy iimmppoovveerriisshheedd aarreeaass rruurraall aanndd uurrbbaann aarreeaass ((““ppoovveerrttyy nnooddeess””)),, wwhhiicchh hhoouussee aarroouunndd tteenn mmiilllliioonn ppeeooppllee.. TThhee UUrrbbaann RReenneewwaall PPrrooggrraammmmee ((uurrpp)) aanndd tthhee IInntteeggrraatteedd SSuussttaaiinnaabbllee RRuurraall Maruleng DDeevveellooppmmeenntt PPrrooggrraammmmee Sekhukhune ((iissrrddpp)) wweerree ccrreeaatteedd iinn 22000011 Bushbuckridge ttoo aaddddrreessss ddeevveellooppmmeenntt iinn Alexandra tthheessee aarreeaass.. TThheessee iinniittiiaattiivveess Kgalagadi Umkhanyakude aarree hhoouusseedd iinn tthhee DDeeppaarrttmmeenntt ooff PPrroovviinncciiaall aanndd Zululand LLooccaall GGoovveerrnnmmeenntt ((ddppllgg)).. Maluti-a-Phofung Umzinyathi Galeshewe Umzimkhulu I-N-K Alfred Nzo Ukhahlamba Ugu Central Karoo OR Tambo Chris Hani Mitchell’s Plain Mdantsane Khayelitsha Motherwell UUP-WRD-Khayelitsha Profile-301106-IS 2 Nodal Economic Profiling Project Business Trust & dplg, 2007 Khayelitsha Khayelitsha poverty node z Research process Activities Documents z Overview People z Themes – Residential life – Commercial activity – City linkages z Summary z Appendix UUP-WRD-Khayelitsha Profile-301106-IS 3 Nodal -

Top 500 by Turnover 11-11-08

Rank Name of Company 1 BHP Billiton Plc 2 Anglo American Plc 3 SABMiller Plc 4 Sasol 5 The Bidvest Group 6 Old Mutual South Africa 7 Sanlam Ltd 8 Standard Bank Group Ltd 9 Imperial Holdings Ltd 10 FirstRand Ltd 11 Liberty Group Ltd 12 Telkom SA Ltd 13 MTN Group Ltd 14 Barloworld Ltd 15 ABSA Group Ltd 16 Anglo Platinum Ltd 17 Richemont Securities AG 18 Pick 'n Pay Stores Ltd 19 Shoprite Holdings Ltd 20 Nedbank Group Ltd 21 Vodacom Group (Pty) Ltd 22 Steinhoff International Holdings Ltd 23 Eskom 24 Sappi 25 Massmart Holdings Limited 26 Daimler Chrysler South Africa (Pty) Ltd 27 Impala Platinum Holdings Limited 28 BP Southern Africa (Pty) Ltd 29 Transnet Ltd 30 Dimension Data (Pty) Ltd 31 Investec Ltd 32 Mittal Steel South Africa (Pty) Ltd 33 Engen Petroleum Ltd 34 Toyota South Africa Motors (Pty) Ltd 35 Datatec Ltd 36 Aveng Ltd 37 Spar Group Ltd. 38 Metropolitan Holdings Ltd 39 Shell South Africa Energy (Pty) Ltd 40 Anglogold Ashanti Ltd 41 Goldfields Limited 42 McCarthy Ltd 43 Woolworths Holdings Ltd. 44 Network Healthcare Holdings Ltd t/a Netcare 45 Murray and Roberts Holdings Ltd 46 Remax of Southern Africa (Pty) Ltd 47 BHP Billiton Alumunium SA (Pty) Ltd 48 Allied Electronics Corporation Ltd 49 Tiger Brands Limited 50 Edgars Consolidated Stores Ltd 51 Safcor Freight (Pty) Ltd t/a Safcor Panalpina 52 Pam Golding Properties (Pty) Ltd 53 South African Airways (Pty) Ltd 54 Nampak Limited 55 Seeff Properties Services (Pty) Ltd 56 Momentum Group Ltd 57 Unitrans Holdings (Pty) Ltd 58 Kumba Iron Ore Ltd 59 Lonmin Plc 60 JD Group Limited 61 Santam -

29 November 2013

COLLEGE OF LAW AND MANAGEMENT STUDIES SCHOOL OF LAW UNIT OF MARITIME LAW AND MARITIME STUDIES THE REGULATION OF THE REMOVAL OF HAZARDOUS SHIPWRECKS IN SOUTH AFRICAN WATERS AND A DISCUSSION ON THE ADOPTION OF THE NAIROBI INTERNATIONAL CONVENTION ON THE REMOVAL OF WRECKS, 2007. STUDENT NAME : YINITA RAMSAKKAN STUDENT NUMBER : 208500262 Mini Dissertation submitted to the School of Law in partial fulfillment of the requirements of the degree Master of Laws in Maritime Law. SUPERVISOR : MR. V. SURBUN 29 NOVEMBER 2013. DECLARATION I, YINITA RAMSAKKAN, declare that: i. The research reported in this thesis, except where otherwise indicated, is my original work. ii. This thesis has not been submitted for any degree or examination at any other university. iii. This thesis does not contain other persons’ data, pictures, graphs or other information, unless specifically acknowledged as being sourced from other persons. iv. This thesis does not contain other persons’ writing, unless specifically acknowledged as being sourced have been quoted, then: a. Their words have been re-written but the general information attributed to them has been referenced; b. Where their exact words have been used, their writing has been placed inside quotation marks, and referenced, v. Where I have reproduced a publication of which I am author, co-author or editor, I have indicated in detail which part of the publication was actually written by myself alone and have fully referenced such publications. vi. This thesis does not contain text, graphics or tables copied and pasted from the Internet, unless specifically acknowledged, and the source being detailed in the thesis and in the References sections. -

Reflecting on the Manifestations of a Cape Hip Hop Culture, 1983-2015

From Jamaica to the Cape Flets: Reflecting on the Manifestations of a Cape Hip Hop Culture, 1983-2015 by Adrian Van Wyk Thesis presented in fulfilment of the requirements for the degree of Master of Arts (History) in the Faculty of Arts and Social Sciences at Stellenbosch University Supervisor: Dr Chet James Paul Fransch March 2018 Stellenbosch University https://scholar.sun.ac.za Declaration By submitting this thesis/dissertation, I declare that I understand what constitutes plagiarism, that the entirety of the work contained therein is my own, original work, that I am the sole author thereof (save to the extent explicitly otherwise stated), that reproduction and publication thereof by Stellenbosch University will not infringe any third party rights, and that I have not previously in its entirety or in part submitted it for obtaining any qualification. Date: March 2018 Copyright © 2018 Stellenbosch University All rights reserved Stellenbosch University https://scholar.sun.ac.za ABSTRACT This dissertation seeks to reflect on the making of a Cape Town based Hip Hop culture with particular focus on the various manifestations which developed around the Cape Flats. This study investigates the importance of the numerous mediums in the development of a Hip Hop culture at the Cape from 1983 to 2015. Particular attention is given to audio-visual content such as film, music and music videos within the early formations of Hip Hop in the Cape. The audiences and performers who engaged with Hip Hop culture will be investigated. Furthermore, this study will follow the shift in the various forms of dissemination - from radio, television, to self-produced videos uploaded on digital media platforms on the internet.