China Fangda Group Co., Ltd

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

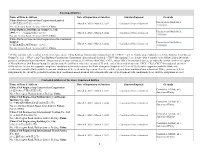

Sanctioned Entities Name of Firm & Address Date

Sanctioned Entities Name of Firm & Address Date of Imposition of Sanction Sanction Imposed Grounds China Railway Construction Corporation Limited Procurement Guidelines, (中国铁建股份有限公司)*38 March 4, 2020 - March 3, 2022 Conditional Non-debarment 1.16(a)(ii) No. 40, Fuxing Road, Beijing 100855, China China Railway 23rd Bureau Group Co., Ltd. Procurement Guidelines, (中铁二十三局集团有限公司)*38 March 4, 2020 - March 3, 2022 Conditional Non-debarment 1.16(a)(ii) No. 40, Fuxing Road, Beijing 100855, China China Railway Construction Corporation (International) Limited Procurement Guidelines, March 4, 2020 - March 3, 2022 Conditional Non-debarment (中国铁建国际集团有限公司)*38 1.16(a)(ii) No. 40, Fuxing Road, Beijing 100855, China *38 This sanction is the result of a Settlement Agreement. China Railway Construction Corporation Ltd. (“CRCC”) and its wholly-owned subsidiaries, China Railway 23rd Bureau Group Co., Ltd. (“CR23”) and China Railway Construction Corporation (International) Limited (“CRCC International”), are debarred for 9 months, to be followed by a 24- month period of conditional non-debarment. This period of sanction extends to all affiliates that CRCC, CR23, and/or CRCC International directly or indirectly control, with the exception of China Railway 20th Bureau Group Co. and its controlled affiliates, which are exempted. If, at the end of the period of sanction, CRCC, CR23, CRCC International, and their affiliates have (a) met the corporate compliance conditions to the satisfaction of the Bank’s Integrity Compliance Officer (ICO); (b) fully cooperated with the Bank; and (c) otherwise complied fully with the terms and conditions of the Settlement Agreement, then they will be released from conditional non-debarment. If they do not meet these obligations by the end of the period of sanction, their conditional non-debarment will automatically convert to debarment with conditional release until the obligations are met. -

Appendix Iii Property Valuation

THIS DOCUMENT IS IN DRAFT FORM, INCOMPLETE AND SUBJECT TO CHANGE AND THAT THE INFORMATION MUST BE READ IN CONJUNCTION WITH THE SECTION HEADED ‘‘WARNING’’ ON THE COVER OF THIS DOCUMENT APPENDIX III PROPERTY VALUATION The following is the text of a letter and valuation report prepared for the purpose of incorporation in this document received from Cushman & Wakefield Limited, an independent property valuer, in connection with its opinion of value of the property held by the Group in the PRC as at September 30, 2019 16th Floor Jardine House 1 Connaught Place Central Hong Kong [REDACTED] The Directors Chen Lin Education Group Holdings Limited No. 1 Lianfu Road, Xinjian County, Nanchang City, Jiangxi Province, the PRC Dear Sirs, Instructions, Purpose & We refer to the instruction of Chen Lin Education Group Holdings Limited Valuation Date (the ‘‘Company’’) for Cushman & Wakefield Limited (‘‘C&W’’)to prepare market valuation of the property in which the Company and/or its subsidiaries (together referred to as the ‘‘Group’’) have interests in the People’s Republic of China (the ‘‘PRC’’). We confirm that we have carried out inspection, made relevant enquiries and obtained such further information as we consider necessary for the purpose of providing the Company with our opinion of the value of the property as at September 30, 2019 (the ‘‘valuation date’’). Valuation Basis Our valuation of property represents its market value which in accordance with The HKIS Valuation Standards 2017 Edition issued by The Hong Kong Institute of Surveyors is defined as ‘‘the estimated amount for which an asset or liability should exchange on the valuation date between a willingbuyerandawillingsellerinanarm’s length transaction, after proper marketing and where the parties had each acted knowledgeably, prudently and without compulsion’’. -

Jiangling Motors Corporation, Ltd. 2016 Annual Report

Jiangling Motors Corporation, Ltd. 2016 Annual Report 2017-006 Chapter I Important Notes, Contents and Abbreviations Important Note The Board of Directors and its members, the Supervisory Board and its members, and the senior executives are jointly and severally liable for the truthfulness, accuracy and completeness of the information disclosed in the report and confirm that the information disclosed herein does not contain any false statement, misrepresentation or major omission. Chairman Qiu Tiangao, CFO Gong Yuanyuan and Chief of Finance Department, Ding Ni, confirm that the Financial Statements in this Annual Report are truthful and complete. All Directors were present at the Board meeting to review this Annual Report. The prospective description regarding future business plan and development strategy in this report does not constitute virtual commitment. The investors shall pay attention to the risk. All financial data in this report are prepared under International Financial Reporting Standards (‘IFRS’) unless otherwise specified. The Annual Report is prepared in Chinese and English. In case of discrepancy, the Chinese version will prevail. The year 2016 profit distribution proposal approved by the Board of Directors is as follows: A cash dividend of RMB 6.1 (including tax) will be distributed for every 10 shares held based on the total share capital of 863,214,000 shares, and there is no stock dividend. The Board decided not to convert capital reserve to share capital this time. 1 Contents Chapter I Important Notes, Contents and Abbreviations ............................... 1 Chapter II Brief Introduction and Operating Highlight .................................... 3 Chapter III Operating Overview ...................................................................... 5 Chapter IV Management Discussion and Analysis ......................................... -

Annual Report 2013

Important Notes 4 (Ⅰ) Definitions and Significant Risk Warning 5 (Ⅱ) Company Profile 6 (Ⅲ) Accounting Data and Financial Indicators 9 (IV) Report of the Board of Directors 12 (V) Important Issues 43 (VI) Changes in Equity and Shareholders 53 (VII) Directors, supervisors and Senior management 59 (VIII) Corporate Governance 69 (IX) Internal Control 74 (X) Financial Report 75 (XI) Documents Available for Inspection 203 Neusoft Annual Report 2013 Dr. Liu Jiren Chairman Neusoft Corporation The world is changing faster than ever before. An increasing number of new policies, transformative technologies and new trend are constantly catalyzing innovative business models, emerging markets and new demands in recent years. With that big picture in mind, Neusoft has always been focusing on innovation and globalization. We encourage in- novation at all levels of our operations to drive transformation for better. Specifically, we have built a robust growth model driven by knowledge assets. These efforts have helped us not only overcome many challenges and ward off potential risks, but also build our new competitive advantages. Today, new technologies such as mobile Internet, cloud computing, big data and social media are overthrowing tra- ditional business models with new IT products/services and business patterns springing up. This stimulated new mar- ket demands and gradually broke industry barriers, and what followed by are increasingly growing cross-industry competition and cooperation. Over the past twenty-plus years, Neusoft has achieved a great-leap-forward growth through incremental innovation and transformation. In the future, we will integrate innovation into a daily routine, reengineering and strengthening our business capabilities through collaboration. -

Mitsubishi Electric and Zhuzhou CSR Times Electronic Win Order for Beijing Subway Railcar Equipment

FOR IMMEDIATE RELEASE No. 2496 Product Inquiries: Media Contact: Overseas Marketing Division, Public Utility Systems Group Public Relations Division Mitsubishi Electric Corporation Mitsubishi Electric Corporation Tel: +81-3-3218-1415 Tel: +81-3-3218-3380 [email protected] [email protected] http://global.mitsubishielectric.com/transportation/ http://global.mitsubishielectric.com/news/ Mitsubishi Electric and Zhuzhou CSR Times Electronic Win Order for Beijing Subway Railcar Equipment Tokyo, January 13, 2010 – Mitsubishi Electric Corporation (TOKYO: 6503) announced today that Mitsubishi Electric and Zhuzhou CSR Times Electronic Co., Ltd. have received orders from Beijing MTR Construction Administration Corporation for electric railcar equipment to be used on the Beijing Subway Changping Line. The order, worth approximately 3.6 billion yen, comprises variable voltage variable frequency (VVVF) inverters, traction motors, auxiliary power supplies, regenerative braking systems and other electric equipment for 27 six-coach trains. Deliveries will begin this May. The Changping Line is one of five new subway lines scheduled to start operating in Beijing this year. The 32.7-kilometer line running through the Changping district of northwest Beijing will have 9 stops between Xierqi and Ming Tombs Scenic Area stations. Mitsubishi Electric’s Itami Works will manufacture traction motors for the 162 coaches. Zhuzhou CSR Times Electronic will make the box frames and procure certain components. Zhuzhou Shiling Transportation Equipment Co., Ltd, a joint-venture between the two companies, will assemble all components and execute final testing. Mitsubishi Electric already has received a large number of orders for electric railcar equipment around the world. In China alone, orders received from city metros include products for the Beijing Subway lines 2 and 8; Tianjin Metro lines 1, 2 and 3; Guangzhou Metro lines 4 and 5; and Shenyang Metro Line 1. -

Study on the Current Situation and Countermeasures of Community

2020 5th International Conference on Education and Social Development (ICESD 2020) ISBN: 978-1-60595-676-3 Study on the Current Situation and Countermeasures of Community Sports Development in Xinjian District of Nanchang City Jian-Jun CHENG Jiangxi Vocational Technical College of Industry Trade, Jiangxi, Nanchang, China [email protected] Keywords: New area; Community sports; Development status; Countermeasures. Abstract. This paper takes 8 communities in Xinjian district of Nanchang city who participate in morning and evening physical exercise as the research object. The research methods mainly include literature, questionnaire, field survey and statistical analysis. The age, gender, location and items of the people who often take part in physical exercise in the community in Xinjian district of Nanchang city were investigated and analyzed. Conclusions: (1) There is a lack of sports equipment and venues for people to exercise in the newly-built communities in Nanchang. People who often participate in exercise mainly choose public welfare venues for exercise, while fewer people choose fee-paying venues for exercise. (2) People who often participate in physical exercise in Xinjian district of Nanchang city mainly take morning exercise and evening exercise in their choice of exercise time. More women than men participate in physical exercise regularly. At the same time, the elderly people mainly participate in physical exercise, followed by children and young people, and the middle-aged people participate in physical exercise least. Research Object In this study, 10 communities in Xinjian district of Nanchang city who participated in morning and evening physical exercise were selected as the research objects. Research Methods Literature Method Through the library of Jiangxi vocational and technical college of industry and trade, literature search was conducted on CNKI with "community sports" as the key word. -

China Fangda Group Co., Ltd

2017 Interim Report of China Fangda Group Co., Ltd. China Fangda Group Co., Ltd. 2017 Interim Report Jul. 2017 1 2017 Interim Report of China Fangda Group Co., Ltd. Chapter 1 Important Statement, Table of Contents and Definitions The members of the Board and the Company guarantee that the interim report is free from any false information, misleading statement or material omission and are jointly and severally liable for the information’s truthfulness, accuracy and integrity. Mr. Xiong Jianming, the Chairman of Board, Mr. Lin Kebin, the Chief Financial Officer, and Mr. Wu Bohua, the manager of accounting department declare: the Financial Report carried in this report is authentic and completed. Directors other than the following ones have attended the Board meeting to review the interim report. Name of absent director Position of absent director Reason Name of proxy Guo Jinlong Independent director Business engagement Deng Lei Forward-looking statements involved in this report including future plans do not make any material promise to investors. Investors should pay attention to investment risks. The Company has specified market, management and production and operation risks in this report. Please review the 10. Risks Facing the Company and Measures in Chapter 4 Operation Discussion and Analysis. The Company will distribute no cash dividends or bonus shares and has no reserve capitalization plan. 2 2017 Interim Report of China Fangda Group Co., Ltd. Table of Contents Chapter 1 Important Statement, Table of Contents and Definitions .........................................................................................................2 -

Minimum Wage Standards in China August 11, 2020

Minimum Wage Standards in China August 11, 2020 Contents Heilongjiang ................................................................................................................................................. 3 Jilin ............................................................................................................................................................... 3 Liaoning ........................................................................................................................................................ 4 Inner Mongolia Autonomous Region ........................................................................................................... 7 Beijing......................................................................................................................................................... 10 Hebei ........................................................................................................................................................... 11 Henan .......................................................................................................................................................... 13 Shandong .................................................................................................................................................... 14 Shanxi ......................................................................................................................................................... 16 Shaanxi ...................................................................................................................................................... -

Life Cycle Carbon Emission of Monorail Transit and Its Comparison in Operation Stage with Other City Transit Modes

E3S Web of Conferences 272, 01013 (2021) https://doi.org/10.1051/e3sconf/202127201013 ICEPG 2021 Life cycle carbon emission of monorail transit and its comparison in operation stage with other city transit modes Teng Li1, Eryu Zhu1*, Haoran Liu1 1Dept. of Civil Engineering., Beijing Jiaotong University., Shangyuancun 3rd, Beijing, China, 100044 Corresponding author, Eryu Zhu, Professor of Bridge Department, Beijing Jiaotong University, Ph. D, China. Abstract. In this paper, carbon emissions of a monorail transit are calculated using the method of whole life cycle, which can be divided into four stages: material manufacturing stage, construction stage, operation stage and demolition stage. In the operation phase, the units are PKT (Passenger Kilometers Travelled) and VKT (Vehicle Kilometers Travelled), while in other three stages, the unit is 1 km. The results show that the carbon emissions from the 1km length monorail are 6271.204 tons. In addition, in the operation stage, it is found that the PKT index and VKT index of Chongqing monorail transportation are 0.07468 and 3.31933 respectively, far lower than those of subways in the same city. For PKT indicators of other rail transits, from small to large, they are light rail, tram, subway, APM and maglev. As for VKT indicators, from small to large, they are tram, light rail, subway, APM and maglev. The PKT index of Beijing subway is the lowest compared with that of other cities. subway, maglev, APM and trams, to find a lower carbon 1 Introduction emission transit mode, and to facilitate the adjustment of In recent years, with the continuous increase of urban the urban rail transit system and urban sustainable population density, the flow of people and goods between development, and to provide suggestions for government cities and the construction of rail transit are in full swing. -

Jiangxi Bank Co., Ltd

THIS CIRCULAR IS IMPORTANT AND REQUIRES YOUR IMMEDIATE ATTENTION If you are in doubt as to any aspect of this circular or as to the action to be taken, you should consult your stockbroker or other registered dealer in securities, bank manager, solicitor, professional accountant or other professional adviser. If you have sold or transferred all your shares in Jiangxi Bank Co., Ltd.*, you should at once hand this circular, together with the accompanying form of proxy for the AGM and the class meeting of H Shareholders, to the purchaser or the transferee or to the bank, stockbroker or other agent through whom the sale or transfer was effected for transmission to the purchaser or transferee. Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this circular, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this circular. JIANGXI BANK CO., LTD.* 江西銀行股份有限公司* (A joint stock company incorporated in the People’s Republic of China with limited liability) (Stock Code: 1916) 2020 WORK REPORT OF THE BOARD OF DIRECTORS 2020 WORK REPORT OF THE BOARD OF SUPERVISORS 2020 ANNUAL FINANCIAL STATEMENTS REPORT 2021 FINANCIAL BUDGET PLAN 2020 PROFIT DISTRIBUTION PLAN 2021 CAPITAL EXPENDITURE PLAN ENGAGEMENT OF AUDIT INSTITUTIONS FOR 2021 REMUNERATION PACKAGE FOR INDEPENDENT DIRECTORS REMUNERATION PACKAGE FOR EXTERNAL SUPERVISORS ENGAGEMENT OF CONVERTIBLE NEGOTIATED DEPOSIT BUSINESS TO REPLENISH ADDITIONAL TIER-ONE CAPITAL AND ISSUANCE OF SHARES UNDER A SPECIAL MANDATE ELECTION OF MR. -

Annual Report 2020 01 CORPORATE INFORMATION

CORPORATE PROFILE ABOUT SINIC HOLDINGS Sinic Holdings was listed on the Stock Exchange (Stock Code: 2103) on 15 November 2019, which marked an important milestone in the development of the Company. Sinic Holdings is a large-scale and comprehensive property developer focusing on the development of residential and commercial properties. Headquartered in Shanghai, Sinic Holdings has established a leading position among residential property developers in Jiangxi Province, and expanded into the Yangtze River Delta Region, the Greater Bay Region and the Central and Western China Core Cities and Other Regions with High-Growth Potential through ten years’ operations. Sinic Holdings focuses on developing quality properties through comprehensive standardized operating procedures. The Group implemented a series of standardized operating manuals which set forth detailed procedures and requirements for the various stages of the property development process, which have enabled the Group to achieve operating efficiency while maintain its quality standards for properties. Leveraging on its strong brand name, Sinic Holdings will continue its expansion strategies nationwide and strives to become a leading comprehensive real estate developer in China. Sinic Holdings (Group) Company Limited 新力控股(集團)有限公司 i Sinic Holdings (Group) Company Limited CONTENTS i Corporate Profile 02 Corporate Information 04 Milestones 08 Chairman’s Statement 16 Financial Highlights 20 Management Discussion and Analysis 42 Biographies of Directors and Senior Management 50 Business -

Urban Mobility: Knorr-Bremse Secures Its Largest Ever Multi-System Order in Chinese Metro History

Press Release Munich, December 14, 2020 Urban mobility: Knorr-Bremse secures its largest ever multi-system order in Chinese metro history ▪ Knorr-Bremse and Chinese train producer CRRC have sealed a major order for braking and entrance systems for Beijing’s new metro line 17, as well as heating, ventilation and air conditioning systems (HVAC) for line 19 ▪ In total, Knorr-Bremse will deliver systems in the mid double-digit million-euro range for 78 trainsets with a combined 624 cars to CRRC subsidiaries Changchun Railway Vehicles and Qingdao Sifang ▪ In addition, Knorr-Bremse Suzhou’s RailServices unit is to modernize a train of the city of Shenyang’s metro line 2, and Knorr-Bremse’s MERAK-Jinxin HVAC joint venture has received overhaul certification for CRH5G high-speed trains Munich, December 14, 2020 – Knorr-Bremse, the global market leader for braking and other systems for rail and commercial vehicles, has won its largest ever multi-system order for Chinese metro. The company will be delivering braking and entrance systems to equip Beijing’s new metro line 17, as well as HVAC systems for the city’s line 19. With braking system deliveries having started in the third quarter of 2020 and continuing to the end of 2023, Knorr-Bremse will provide technologies worth a mid double-digit million-euro sum for 78 trainsets. Manufactured by Chinese train producer CRRC, the rail vehicles will be operated by Beijing MTR. “Knorr-Bremse is geared towards providing future-driven solutions for public transit in order to meet the global megatrends of urbanization and mobility,” says Dr.