CASE 0:18-Cv-00871-MJD-SER Document 112 Filed 07/25/19 Page 1 of 48

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

PATTERSON COMPANIES, INC. (Name of Registrant As Specified in Its Charter)

TABLE OF CONTENTS UNITED STATES SECURITIES AND EXCHANGE COMMISSION WASHINGTON, DC 20549 SCHEDULE 14A (RULE 14a-101) INFORMATION REQUIRED IN PROXY STATEMENT SCHEDULE 14A INFORMATION Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934 (Amendment No. ) Filed by the Registrant ☒ Filed by a Party other than the Registrant o Check the appropriate box: o Preliminary Proxy Statement o Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) ☒ Definitive Proxy Statement o Definitive Additional Materials o Soliciting Material Pursuant to Section 240.14a-12 Commission File No. 0-20572 PATTERSON COMPANIES, INC. (Name of Registrant as Specified in Its Charter) (Name of Person(s) Filing Proxy Statement, if Other Than the Registrant) Payment of Filing Fee (Check the appropriate box): ☒ No fee required. o Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. (1) Title of each class of securities to which transaction applies: (2) Aggregate number of securities to which transaction applies: (3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): (4) Proposed maximum aggregate value of transaction: (5) Total fee paid: o Fee paid previously with preliminary materials: o Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. -

Inleadership

IN LEADERSHIP How Minnesota’s Top 100 Public Companies Rank The 2009 Minnesota Census of Women in Corporate Leadership Report produced by St. Catherine University and the Minnesota Women’s Economic Roundtable A Statewide Wakeup Call The second annual Minnesota Census of Women in Corporate Leadership reveals that women remain an underutilized resource in the top ranks of public companies. Consider the evidence: Kudos and Contributions Twenty-seven of the top 100 public companies in This initiative has been made possible by many individuals • Minnesota have no women board members. and organizations. The report was underwritten by Spencer Stuart, St. Catherine University, and the Minnesota Women’s Forty-one of the top 100 public companies have only Economic Roundtable. • one woman on their boards. Support for both the report and the Forum was provided by Women hold only 15 percent of the Section 16b Twin Cities Business magazine and other sponsoring organiza- • (Securities and Exchange Commission) executive tions (see pages 26 to 28 of this report). Special thanks to the officer positions in Minnesota’s top 100 public volunteers who made up this year’s steering committee (see companies. the report’s final page). Without their tireless efforts, neither the report nor the Forum luncheon would have been possible. Nineteen of the top 100 public companies have no • women involved with leadership — either as directors Now, we turn to our readers — our state’s corporate and small- or executive officers. business leaders — to carry on this work, in the hope that future editions of The Minnesota Census will show progress We ask that women and men view this report as a wakeup on behalf of our state’s business climate and, subsequently, call, one whose findings deserve and demand to be shared all people in Minnesota. -

Can Company 013230

PLEASE CONFIRM CSIP ELIGIBILITY ON THE DEALER SITE WITH THE "CSIP ELIGIBILITY COMPANIES" CAN COMPANY 013230 . Muller Inc 022147 110 Sand Campany 014916 1994 Steel Factory Corporation 005004 3 M Company 022447 3d Company Inc. 020170 4 Fun Limousine 021504 412 Motoring Llc 021417 4l Equipment Leasing Llc 022310 5 Star Auto Contruction Inc/Certified Collision Center 019764 5 Star Refrigeration & Ac, Inc. 021821 79411 Usa Inc. 022480 7-Eleven Inc. 024086 7g Distributing Llc 019408 908 Equipment (Dtf) 024335 A & B Business Equipment 022190 A & E Mechanical Inc. 010468 A & E Stores, Inc 018519 A & R Food Service 018553 A & Z Pharmaceutical Llc 005010 A A A - Corp. Only 022494 A A Electric Inc. 022751 A Action Plumbing Inc. 009218 A B C Contracting Co Inc 015111 A B C Parts Intl Inc. 018881 A Blair Enterprises Inc 019044 A Calarusso & Son Inc 020079 A Confidential Transportation, Inc. 022525 A D S Environmental Inc. 005049 A E P Industries 022983 A Folino Contruction Inc. 005054 A G F A Corporation 013841 A J Perri Inc 010814 A La Mode Inc 024394 A Life Style Services Inc. 023059 A Limousine Service Inc. 020129 A M Castle & Company 007372 A O N Corporation 007741 A O Smith Water Products 019513 A One Exterminators Inc 015788 A P S Security Inc 005207 A T & T Corp 022926 A Taste Of Excellence 015051 A Tech Concrete Co. 021962 A Total Plumbing Llc 012763 A V R Realty Company 023788 A Wainer Llc 016424 A&A Company/Shore Point 017173 A&A Limousines Inc 020687 A&A Maintenance Enterprise Inc 023422 A&H Nyc Limo / A&H American Limo 018432 A&M Supernova Pc 019403 A&M Transport ( Dtf) 016689 A. -

Opportunities Targeted to the People You Want to Meet and the Visibility to Grow Your Brand

Opportunities targeted to the people you want to meet and the visibility to grow your brand. • • • • • • • • • • 3M Company Electromed Inc. MGC Diagnostics Corporation Spectrum Brands Holdings, Inc. ASK LLP A. O. Smith Corporation EMC Insurance Group Inc. MOCON, Inc. SS&C Technologies Holdings, Inc. Ballard Spahr, LLP (Lindquist & Vennum) Allete Inc. EnteroMedics Inc. Moody's (formerly Advent Software) BlackRock, Inc. Alliant Energy Corporation Evolving Systems, Inc. Mosaic Co. St. Jude Medical, Inc. Bloomberg L.P. Ameriprise Financial, Inc. Famous Dave’s of America MTS Systems Corporation Stamps.com Inc. BNY Mellon Brand Advantage Group Apogee Enterprises, Inc. Fastenal Company Multiband Corp. Steelcase Broadridge Financial Solutions, Inc. Arctic Cat Inc. FBL Financial Group, Inc. Navarre Stratasys, Ltd. Business Wire Sunshine Heart Inc Associated Bank FHLBanks Office of Finance New Jersey Resources Corporation CFA Institute SUPERVALU Inc. AstraZeneca plc FICO Northern Oil & Gas, Inc. Curran & Connors AxoGen, Inc. First Business NorthWestern Energy Corp SurModics, Inc. Deluxe Corporation Bemis Company, Inc. Financial Services, Inc. NVE Corporation Target Corporation Drexel Hamilton, LLC Best Buy, Co., Inc. FLUX Power Holdings, Inc. OneBeacon Insurance Group TCF Financial Corporation EQS Group Bio-Techne Corporation G&K Services, Inc. Orion Engineered Carbons S.A. Tennant Company FactSet Research Systems Inc. Black Hills Corp. General Mills, Inc. Oshkosh Corporation Tetraphase Pharmaceuticals, Inc. Federal Reserve Bank of Minneapolis Boston Scientific Corporation Graco, Inc. OSI Systems, Inc. The Toro Company Inspired Investment Leadership: Objective Measure Conference Buffalo Wild Wings, Inc. H.B. Fuller Company Otter Tail Corporation Tile Shop Holdings Inc Intrinsic Research Systems Inc. C.H. Robinson Worldwide, Inc. Heartland Financial USA, Inc. -

CEO to CEO Conversations

"SFQPSUPG.413FHJPOBM$MVTUFS*OJUJBUJWFm%FDFNCFS $&0UP$&0$POWFSTBUJPOT Mayors Talk with Business Leaders About Growing Jobs in Minnesota e ! BioBusiness Alliance of Minnesota™ 07&37*&8 MSP3FHJPOBMCluster*OJUJBUJWF 5IF3FHJPOBM$MVTUFS*OJUJBUJWF 3$* JT r3FHJPOBMNBZPSTTFMFDUFEUISFF .PNFOUVNDSFBUFECZUIF3FHJPOBM BDPMMBCPSBUJWFFíPSUUPHSPX SFUBJO DMVTUFSTGPSGVSUIFSSFTFBSDI PVUSFBDI $PVODJMPG.BZPSTSFHJPOBMBOE BOEBUUSBDUKPCTJOUIF(SFBUFS.41 BOEFOHBHFNFOUm.FEJDBM%FWJDFT QBSUOFSTIJQGPDVTmBOEJUTFNQIBTJTPO SFHJPO*USFQSFTFOUTBNBKPSñSTU 'JOBODJBM4FSWJDFTBOE%JTUSJCVUJPOBM EJSFDUFOHBHFNFOUCFUXFFOQSJWBUF TUFQJOQSBDUJDJOHSFHJPOBMFDPOPNJD 4FSWJDFT BOEQVCMJDTFDUPSi$&0TumXBTPOF EFWFMPQNFOUVUJMJ[JOHBOJOEVTUSZ r.BZPSTJOUFSWJFXFE$&0TUPJEFOUJGZ PGUIFGBDUPSTUIBUMFE5IF#SPPLJOHT DMVTUFSBQQSPBDI3$*TXPSLJODMVEFE TUSFOHUITPQQPSUVOJUJFT BOEUPCVJME *OTUJUVUJPOUPTFMFDUUIF.41BSFBBTPOF r5FODPNQFUJUJWFUSBEFEDMVTUFSTJO QSJWBUFQVCMJDSFMBUJPOTIJQT PGUISFFQJMPUSFHJPOTGPSEFWFMPQNFOUPG B.FUSPQPMJUBO#VTJOFTT1MBO .JOOFBQPMJT4BJOU1BVMSFHJPOXFSF r5XPBSFBTTFMFDUFEGPSGVSUIFSBDUJPO JEFOUJñFE NFEJDBMEFWJDFTDMVTUFSBOEDPSQPSBUF 5IJTSFQPSUTVNNBSJ[FTDPOWFSTBUJPO IFBERVBSUFSTDPODFOUSBUJPO ñOEJOHTBOEJEFOUJñFTBOBDUJPOQMBO GPSUIF3FHJPOBM$PVODJMPG.BZPSTUP 8IBUNBLFT.JOOFBQPMJTm "TQBSUPGJUTXPSL 3$*QSPNPUFEEJSFDU IFMQHSPX SFUBJOBOEBUUSBDUKPCTJOUIF 4BJOU1BVMBHSFBUQMBDFUP FOHBHFNFOUDPOWFSTBUJPOTCFUXFFO (SFBUFS.41SFHJPO NFNCFSTPGUIF3FHJPOBM$PVODJMPG EPCVTJOFTT .BZPSTBOEDPSQPSBUFFYFDVUJWFTGSPN )PXDBOXFHSPXUIBU PG.JOOFTPUBTMBSHFTUCVTJOFTTFT RCI CONVERSATIONS BEWBOUBHFBOEXIBUBSF $&0DPOWFSTBUJPOTXFSFPSHBOJ[FE -

Patterson Companies, Inc

PATTERSON COMPANIES, INC. FORM DEF 14A (Proxy Statement (definitive)) Filed 07/29/16 for the Period Ending 09/12/16 Address 1031 MENDOTA HEIGHTS RD ST PAUL, MN 55120-1401 Telephone 6516861600 CIK 0000891024 Symbol PDCO SIC Code 5047 - Medical, Dental, and Hospital Equipment and Supplies Industry Medical Equipment & Supplies Sector Healthcare Fiscal Year 04/26 http://www.edgar-online.com © Copyright 2016, EDGAR Online, Inc. All Rights Reserved. Distribution and use of this document restricted under EDGAR Online, Inc. Terms of Use. UNITED STATES SECURITIES AND EXCHANGE COMMISSION WASHINGTON, DC 20549 SCHEDULE 14A (RULE 14a-101) INFORMATION REQUIRED IN PROXY STATEMENT SCHEDULE 14A INFORMATION Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934 (Amendment No. ___) Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐ Check the appropriate box: ☐ Preliminary Proxy Statement ☐ Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) ☒ Definitive Proxy Statement ☐ Definitive Additional Materials ☐ Soliciting Material Pursuant to Section 240.14a-12 Commission File No. 0-20572 PATTERSON COMPANIES, INC. (Name of Registrant as Specified in Its Charter) (Name of Person(s) Filing Proxy Statement, if Other Than the Registrant) Payment of Filing Fee (Check the appropriate box): ☒ No fee required. ☐ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. (1) Title of each class of securities to which transaction applies: ______________________________ ____ (2) Aggregate -

Schedule 14A Patterson Companies, Inc

UNITED STATES SECURITIES AND EXCHANGE COMMISSION WASHINGTON, DC 20549 SCHEDULE 14A (RULE 14a-101) INFORMATION REQUIRED IN PROXY STATEMENT SCHEDULE 14A INFORMATION Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934 (Amendment No. ___) Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐ Check the appropriate box: ☐ Preliminary Proxy Statement ☐ Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) ☒ Definitive Proxy Statement ☐ Definitive Additional Materials ☐ Soliciting Material Pursuant to Section 240.14a-12 Commission File No. 0-20572 PATTERSON COMPANIES, INC. (Name of Registrant as Specified in Its Charter) (Name of Person(s) Filing Proxy Statement, if Other Than the Registrant) Payment of Filing Fee (Check the appropriate box): ☒ No fee required. ☐ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. (1) Title of each class of securities to which transaction applies: ___________________________________________________________ ____ (2) Aggregate number of securities to which transaction applies: _______________________________________________________ ________ (3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): __________________________________________________________________ (4) Proposed maximum aggregate value of transaction: ____________________________________________________________ __________ (5) Total fee paid: __________________________________________________________________________________________ __________ ☐ Fee paid previously with preliminary materials: _________________________________________________________________________________ ☐ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. -

CEI 2021 Appendix A: Employer Ratings to View Employer Score

CEI 2021 Appendix A: Employer Ratings Rating Ratings in Gray / Unofficial ratings of the Fortune 500 companies that have not responded to repeated invitations to the CEI survey. These ratings are based on publicly available information as well as information submitted to HRC from unofficial LGBTQ employee groups or individual employees. Employer Headquarters Location State CEI Rating 2021 CEI Rating2020 1000 Fortune 3M Co. St. Paul MN 100 100 A|X Armani Exchange New York MN 50 50 ABB Inc. Cary NC 90 Abbott Laboratories Abbott Park IL 95 90 103 AbbVie Inc. North Chicago IL 100 100 96 Abercrombie & Fitch Co. New Albany OH 100 100 675 ABM Industries Inc. New York NY 20 20 463 Accenture New York NY 100 100 Activision Blizzard Santa Monica CA 100 100 405 Adaptive Biotechnologies Corporation Seattle WA 75 Adidas North America Inc. Portland OR 100 100 Adobe Inc. San Jose CA 100 100 339 ADP Roseland NJ 100 100 239 Advance Auto Parts (Advance Holding) Raleigh NC 90 90 326 Advanced Micro Devices Inc. Santa Clara CA 100 100 460 AECOM Los Angeles CA 100 100 157 AES Corp., The Arlington VA 85 85 296 Aflac Inc. Columbus GA 85 70 143 Agco Duluth GA 10 10 335 Agilent Technologies Inc. Santa Clara CA 85 75 547 AIG New York NY 100 100 66 Air Liquide US, LLC Houston TX 100 100 Air Products & Chemicals Inc. Allentown PA 100 100 344 Airbnb Inc. San Francisco CA 100 100 Airbus Americas Inc. Herndon VA 100 100 Airlines Reporting Corporation (ARC) Arlington VA 100 85 AK Steel Holding Corp. -

SCHEDULE 14A INFORMATION PROXY STATEMENT PURSUANT to SECTION 14(A) of the SECURITIES EXCHANGE ACT of 1934

SCHEDULE 14A INFORMATION PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE SECURITIES EXCHANGE ACT OF 1934 Filed by the Registrant [X] Filed by a Party other than the Registrant [ ] ________________________ Check the appropriate box: [ ] Preliminary Proxy Statement [ ] Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) [X] Definitive Proxy Statement [ ] Definitive Additional Materials [ ] Soliciting Material Pursuant to Section 240.14a-12 ________________________ ALEXANDER & BALDWIN, INC. (Name of Registrant as Specified in its Charter) ___________________________________ (Name of Person(s) Filing Proxy Statement if other than the Registrant) ________________________ Payment of Filing Fee (Check the appropriate box): [X] No fee required. [ ] Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. (1) Title of each class of securities to which transaction applies: (2) Aggregate number of securities to which transaction applies: (3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): (4) Proposed maximum aggregate value of transaction: (5) Total fee paid: [ ] Fee paid previously with preliminary materials. [ ] Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. (1) Amount Previously Paid: (2) Form, Schedule or Registration Statement No.: (3) Filing Party: (4) Date Filed: 822 Bishop Street, Honolulu, Hawaii 96813 March 10, 2011 To the Shareholders of Alexander & Baldwin, Inc.: You are invited to attend the 2011 Annual Meeting of Shareholders of Alexander & Baldwin, Inc., to be held in the Bankers Club on the 30th Floor of the First Hawaiian Center, 999 Bishop Street, Honolulu, Hawaii, on Tuesday, April 26, 2011 at 8:30 a.m. -

View Annual Report

2017 Annual Report A HISTORY OF LOOKING FORWARD Celebrating 140 years LOOKING FORWARD FOR 140 YEARS Since our founding in 1877, Patterson Companies has a rich history of looking forward and leading change in the markets we serve. Our “customer fi rst” approach drives us to listen to, learn from and serve our customers as they manage their individual busi- ness or corporate entity. 95% 50% of dentists are of adults say they value considering the purchase of keeping their mouth healthy. a digital impression device in Source: The American Dental Association’s Health the next 3 years. Policy Institute Source: 2016 Manufacturer Industry Survey 1877 1987 1997 Founded in 1877 D.L. Saslow Co. acquisition EagleSoft acquisition John and M.F. Patterson purchased Patterson acquired D.L. Saslow Co. Patterson acquired EagleSoft Inc. dental a Milwaukee drugstore and began and strengthened its position as a practice software, which positioned selling dental and surgical supplies national dental supplier. Patterson as a leader in technology and in addition to their regular stock of practice management. medicines and toiletries. 1891 1992 2000 Headquarters relocation Patterson goes public Patterson Foundation founded The company relocated to St. Paul, Patterson became a publicly traded The Patterson Foundation was Minnesota, and grew to locations in company on Nasdaq with the stock founded by former Patterson multiple states. By 1959, 40 branch ticker PDCO. Companies chairman and CEO locations were established. Peter L. Frechette and other executives of the company. Our markets are driven by compelling trends, strong growth prospects and opportunities to serve customers with innovative products and compre- hensive support. -

Fidelity® Variable Insurance Products: Contrafund® Portfolio

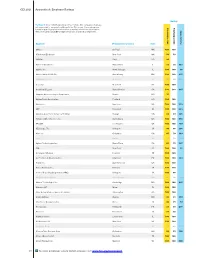

Quarterly Holdings Report for Fidelity® Variable Insurance Products: Contrafund® Portfolio March 31, 2021 VIPCON-QTLY-0521 1.799865.117 Schedule of Investments March 31, 2021 (Unaudited) Showing Percentage of Net Assets Common Stocks – 96.5% Shares Value Shares Value COMMUNICATION SERVICES – 15.7% Penn National Gaming, Inc. (a) 80,400 $ 8,429,136 Entertainment – 4.2% Starbucks Corp. 86,600 9,462,782 Activision Blizzard, Inc. 1,212,928 $ 112,802,304 90,910,454 Bilibili, Inc. Class Z (a) 38,100 4,057,936 Household Durables – 0.8% Electronic Arts, Inc. 480,000 64,977,600 D.R. Horton, Inc. 680,900 60,681,808 Netflix, Inc. (a) 982,254 512,402,622 Garmin Ltd. 114,646 15,116,075 Nintendo Co. Ltd. 12,800 7,214,535 Lennar Corp. Class A 293,542 29,715,257 Sea Ltd. ADR (a) 6,200 1,384,026 Mohawk Industries, Inc. (a) 61,600 11,846,296 Skillz, Inc. (a) (b) 96,700 1,841,168 NVR, Inc. (a) 4,100 19,314,813 Spotify Technology SA (a) 67,697 18,139,411 Sony Corp. 135,400 14,329,852 Take‑Two Interactive Software, Inc. (a) 388,700 68,683,290 Tempur Sealy International, Inc. 474,500 17,347,720 The Walt Disney Co. (a) 546,958 100,924,690 Whirlpool Corp. 12,400 2,732,340 892,427,582 171,084,161 Interactive Media & Services – 10.8% Internet & Direct Marketing Retail – 6.9% Alphabet, Inc.: Alibaba Group Holding Ltd. (a) 928,500 26,381,123 Class A (a) 1,300 2,681,276 Amazon.com, Inc. -

PATTERSON COMPANIES, INC. August 7, 2015 Dear Shareholder

PATTERSON COMPANIES,INC. 1031 MENDOTA HEIGHTS ROAD ST.PAUL,MINNESOTA 55120 August 7, 2015 Dear Shareholder: You are cordially invited to attend the annual meeting of shareholders of Patterson Companies, Inc. to be held at 1031 Mendota Heights Road, St. Paul, Minnesota 55120, on Monday, September 21, 2015, at 4:30 p.m. local time. At the meeting you will be asked to vote for the election of eight directors, to approve our 2015 Omnibus Incentive Plan, to vote upon an advisory proposal concerning our executive compensation program, and to ratify the selection of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending April 30, 2016. I encourage you to vote for the nominees for director, for our 2015 Omnibus Incentive Plan, for advisory approval of our executive compensation program, and for ratification of the appointment of Ernst & Young LLP. Whether or not you are able to attend the meeting in person, it is important that your shares be represented and voted at the meeting. After reading this proxy statement, please promptly vote and submit your proxy. You may vote through the Internet, by telephone or by requesting, signing and returning a proxy card. Your vote is important. Very truly yours, PATTERSON COMPANIES, INC. Scott P. Anderson President, Chief Executive Officer and Chairman of the Board PATTERSON COMPANIES,INC. 1031 MENDOTA HEIGHTS ROAD ST.PAUL,MINNESOTA 55120 NOTICE OF ANNUAL MEETING OF SHAREHOLDERS TO BE HELD SEPTEMBER 21, 2015 NOTICE IS HEREBY GIVEN that the annual meeting of shareholders of Patterson Companies, Inc., a Minnesota corporation, will be held at 1031 Mendota Heights Road, St.