Second Amended and Restated Loan and Security Agreement

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Please Forward the Following Wpg

PLEASE FORWARD THE FOLLOWING AmerUs Group BNY MELLON WPG/MATCHING GIFT CHECKS TO JDRF FOR PROCESSING (Attn: WPG DEPT.) AMGEN BOEING Anheuser-Busch Cos. Inc. BOEING COMPANY Below is a partial listing of companies that participate in Workplace Giving/Matching AOL Time Warner Foundation Booz Allen Hamilton Gift campaigns. Based on our most recently compiled data; the companies APPLE BOOZ-ALLEN-HAMILTION highlighted in pink offer web-based ARAMARK Borden Foundation portals that enable recipient agencies to view their payment history and donor ARAMARK Corp. BP Amoco information online. ARCELORMITTAL BP FOUNDATION * A * ARCELORMITTAL MATCHING GIFT Bridgestone/Firestone Inc. ABBOTT LABORATORIES PROGRAM Brink's Co. ARCO Accenture BRISTOL-MYER ASSURANT ADOBE BRISTOL-MYERS SQUIBB CO. Assurant Health Foundation ADOBE SYSTEMS INC Brown & Williamson Tobacco AT&T FOUNDATION AETNA AT&T UNITED WAY EMPLOYEE GIVING * C * AGILENT TECHNOLOGIES FOUNDATION CAMPAIGN Cable One ALBEMARLE Avery Dennison Corp. CADENCE ALBERMARLE FOUNDATION Avon Products Inc. CAMG (CA TECHNOLOGIES) Alcoa * B * Campbell Soup Foundation ALLIANCE BERNSTEIN BAE SYSTEM Cardinal Health ALLIANT ENERGY BANK OF AMERICA CARDINAL HEALTH FOUNDTION, INC. ALLSTATE BANK OF AMERICA - UNITED WAY CAMPAIGN CARMAX ALLSTATE (THE GIVING CAMPAIGN) BANK OF AMERICA UNITED WAY Caterpillar Foundation Allstate Foundation BANK OF NY MELLON Charles Schwab American Airlines BANK OF THE WEST CHEVRON AMERICAN CHARITIES Bank One Chiquita Brands International AMERICAN EXPRESS Barclays Capital Chrysler Corporation Fund AMERICAN EXPRESS GIFT MATCHING BAXTER EMPLOYEE GIVING CAMPAIGN CIGNA CIVAL AFFAIRS SPONSORSHIP AMERICAN EXPRESS GIFT MATCHING PROGRAM Baxter Healthcare CIGNA Foundation AMERICAN EXPRESS GIVE2GETHER BAXTER INTERNATIONAL FDT Cingular Wireless CAMPAIGN Best Foods Circuit City American Standard Inc. Bestfoods American States Insurance Co. -

Eotm the Agony and the Ecstasy

EYE ON THE MARKET SPECIAL EDITION THE & agTHE ny ecst sy THE RISKS AND REWARDS OF A CONCENTRATED StOCK POSITION The Agony and the Ecstasy is a 1961 biographical novel by American author Irving Stone on the life of Michelangelo: his passion, intensity and perseverance as he created some of the greatest works of the Renaissance period. Like Michelangelo’s paintings and sculptures, successful businesses are the by-product of inspiration, hard work, and no small amount of genius. And like the works of the Great Masters, only a small minority stand the test of time and last over the long run. The Agony and the Ecstasy conveys the disparate outcomes facing concentrated holders of individual stocks in a world, like Michelangelo’s, that is beset with intrigue, unforeseen risks, intense competition and uncertainty. EYE ON THE MARKET • J.P. MORGAN Eye on the Market J.P. MORGAN The Agony and the Ecstasy: The Risks and Rewards of a Concentrated Stock Position Executive Summary There are many Horatio Alger stories in the corporate world in which an entrepreneur or CEO has the right idea at the right time and executes brilliantly on a business plan. But history also shows that forces both within and outside management control led many of their businesses to suffer serious reversals of fortune. As a result, many individuals are known not just for the wealth they created through a concentrated position, but also for the decision they made to sell, hedge or otherwise take some chips off the table. In this paper, we take a look at the long history of individual stocks, and at the risks and rewards of concentration. -

Companies in Texas That Match Financial Donations

COMPANIES IN TEXAS THAT MATCH FINANCIAL DONATIONS Abbott Laboratories Avery Dennison Chubb Group/Chubb & Sons Adobe Systems Avon Products (Federal Insurance) ADP Ball Cigna Advanced Micro Devices Bank One Dallas Circuit City Stores Aetna BankAmerica Cisco Systems AG Communication Systems Bankers Trust CIT Group Air & Water Technologies Baroid Citgo Petroleum Air Products & Chemicals BASF Citicorp/Citibank N.A. Albertson’s Baxter Citizens Ban Alco Standard Bechtel CJT Enterprises Alcoa Becton Dickinson Clarcor Alex Brown & Sons Beecham SmithKline Clark, Klein & Beaumont Allegheny Ludlum Bell & Howell Clorox Allstate BellSouth Coca-Cola Amcast Industrial Bemis Colgate-Palmolive American Electric Power Beneficial Comerica American Express BetzDearborn Computer Associates Intl American General Finance BF Goodrich Conoco American Home Products Bituminous Casualty Container American Honda Motor Bloomingdale’s Continental Airlines American Intl Group Boeing Continental Corp Insurance American National Bank & Trust Borden Cooper Industrial American Standard Borg-Warner Cooper Tire & Rubber American States Insurance BP America Corning Amerisure Companies Brenco Cray Research Ameritech Bridgestone/Firestone Credit Suisse AMI Bristol-Myers Squibb Crowe Horwath LLP Amoco Brunswick Crum & Foster AMP BT Cummins Engine Analog Devices Budget Rent-A-Car CUNA Group Andersons Management Bunge Cytec Industries Anheuser-Busch Burlington Northern Dain Bosworth/IFG A.O. Smith Cabot Darden Restaurants Aon Campbell’s Soup Datatel Apache Canada Ltd Candle DDB -

Concise Encyclopedia of the Great Recession, 2007-2010

THE CONCISE ENCYCLOPEDIA OF THE GREAT RECESSION 2007–2010 Jerry M. Rosenberg The Scarecrow Press, Inc. Lanham • Toronto • Plymouth, UK 2010 Published by Scarecrow Press, Inc. A wholly owned subsidiary of The Rowman & Littlefield Publishing Group, Inc. 4501 Forbes Boulevard, Suite 200, Lanham, Maryland 20706 http://www.scarecrowpress.com Estover Road, Plymouth PL6 7PY, United Kingdom Copyright © 2010 by Jerry M. Rosenberg All rights reserved. No part of this book may be reproduced in any form or by any electronic or mechanical means, including information storage and retrieval systems, without written permission from the publisher, except by a reviewer who may quote passages in a review. British Library Cataloguing in Publication Information Available Library of Congress Cataloging-in-Publication Data Rosenberg, Jerry Martin. The concise encyclopedia of the great recession 2007–2010 / Jerry M. Rosenberg. p. cm. Includes bibliographical references and index. ISBN 978-0-8108-7660-6 (hardback : alk. paper) — ISBN 978-0-8108-7661-3 (pbk. : alk. paper) — ISBN 978-0-8108-7691-0 (ebook) 1. Financial crises—United States—History—21st century—Dictionaries. 2. Recessions—United States—History—21st century—Dictionaries. 3. Financial institutions—United States—History—21st century—Dictionaries. I. Title. HB3743.R67 2010 330.9'051103—dc22 2010004133 ϱ ™ The paper used in this publication meets the minimum requirements of American National Standard for Information Sciences—Permanence of Paper for Printed Library Materials, ANSI/NISO Z39.48-1992. Printed in the United States of America For Ellen Celebrating fifty years of love and adventure. She is my primary motivation. As a lifelong partner, Ellen keeps me spirited and vibrant. -

YOUR DONATION to PHCA Ashland Bellsouth Corp

Argonaut Group. Bass, Berry and Sims, PLC Butler Manufacturing Co. Ariel Capital Management Baxter International Cadence Design Systems Aristokraft Bay Networks Calex Manufacturing Co. Arkema BEA Systems Calpine, Corp. Armstrong World Industries Bechtel Group CambridgeSoft Armtek, Corp. Becton Dickinson and Co. Campbell Soup Foundation Arrow Electronics Belden Wire and Cable Co. Canadian Pacific Railway YOUR DONATION to PHCA Ashland BellSouth Corp. Capital Group Cos. Aspect Telecommunications Bemis Co. Capital One Services Companies with Matching Gift Programs Associates Corp. of North BeneTemps Cardinal Health (contact your HR Dept. for instructions) America L.M. Berry and Co. Cargill Assurant Health BHP Minerals International Carnegie Corp. of New York Astoria Federal Savings Binney and Smith Castrol North America AAI Corp. Amerada Hess Corp. AstraZenca Bituminous Casualty Corp. Carson Products Co. Abbott Laboratories Ameren Corp. AT&T Black and Decker Corp. Catalina Marketing, Corp. ABN AMBRO North American Electric Power Atlantic City Electric Co. Blount Foundation Catepillar America American Express Co. Atlantic Data Services Blue Bell Central Illinois Light Co. Accenture American General Corp. Autodest BMC Industries Chesapeake Corp. ACF Industries American Honda Motor Corp. Automatic Data Processing BMO Financial Group, US ChevronTexaco Corp. Acuson American International Group AVAYA BOC Group Chicago Mercantile Exchange ADC Telecommunications American National Bank Avery Dennison, Corp. Boeing Co. Chicago Title and Trust Co. Addison Weley Longman American Optical Corp. Avon Products Bonneville International Corp. Chicago Tribune Co. Adobe Systems American Standard AXA Financial Borden Family of Cos. Chiquita Brands International Advanced Micro Devices American States Insurance Baker Hughes Boston Gear Chubb and Sone AEGON USA American Stock Exchange Ball Corp. -

Economic Development Overview

CITY OF BELLEVUE ECONOMIC DEVELOPMENT OVERVIEW Bellevue is a major regional employment center in the Seattle region, with workers traveling to the city from throughout the area. An estimated 148,788 jobs are located in the city. Bellevue is also home to well over 45 corporate headquarters such as: • T-Mobile • PACCAR • Symetra • SAP Concur • Eddie Bauer Bellevue is tied to the global market as businesses are attracted to its highly educated, well trained and diverse workforce. Many of Bellevue’s businesses operate internationally and take advantage of the region’s access to the Asia-Pacific market that provides tremendous opportunities for growth. Bellevue’s global engagement attracts foreign direct investment from around the world. The city is now home to approximately 70 foreign-owned companies from 15 countries. Some of these companies include Aditi Technologies, SAP, Mitsubishi and Samsung. WORKFORCE Bellevue is well known for having a highly educated and innovative workforce. The percentage of Bellevue’s residents, 25 years and older with a Bachelor’s degree or higher, has continued to increase over the decades, rising from 46 percent in 1990 to approximately 61 percent in 2010, one of the highest in the country. Bellevue and the Seattle region are also home to world-class teaching and research universities and colleges that provide the workforce needed for the region’s advanced economy. COMPANIES OPENING OFFICES IN BELLEVUE • REI • SalesForce • BitTitan • Alibaba • AdColony • Huawei The University of Washington is one of the world’s 2000s. Together, they are projected to experience the most preeminent public universities, educating more than 54,000 business opening growth through 2020. -

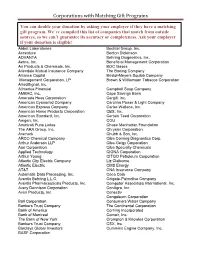

Corporations with Matching Gift Programs

Corporations with Matching Gift Programs You can double your donation by asking your employer if they have a matching gift program. We’ve compiled this list of companies that match from outside sources, so we can’t guarantee its accuracy or completeness. Ask your employer if your donation is eligible! Abbot Laboratories Bechtel Group, Inc. Accenture Becton Dickinson ADVANTA Behring Diagnostics, Inc. Aetna, Inc. Beneficial Management Corporation Air Products & Chemicals, Inc. BOC Gases Allendale Mutual Insurance Company The Boeing Company Alliance Capital Bristol-Meyers Squibb Company Management Corporation, LP Brown & Williamson Tobacco Corporation AlliedSignal, Inc. Allmerica Financial Campbell Soup Company AMBAC, Inc. Cape Savings Bank Amerada Hess Corporation Cargill, Inc. American Cyanamid Company Carolina Power & Light Company American Express Company Carter-Wallace, Inc. American Home Products Corporation CBS, Inc. American Standard, Inc. Certain Teed Corporation Amgen, Inc. CGU Ammirati Puris Lintas Chase Manhattan Foundation The ARA Group, Inc. Chrysler Corporation Aramark Chubb & Son, Inc. ARCO Chemical Company Ciba Corning Diagnostics Corp. Arthur Anderson LLP Ciba-Geigy Corporation Aon Corporation Ciba Specialty Chemicals Applied Technology CIGNA Corporation Arthur Young CITGO Petroleum Corporation Atlantic City Electric Company Liz Claiborne Atlantic Electric CMS Energy AT&T CNA Insurance Company Automatic Data Processing, Inc. Coca Cola Aventis Behring L.L.C. Colgate-Palmolive Company Aventis Pharmaceuticals Products, Inc. Computer Associates International, Inc. Avery Dennison Corporation ConAgra, Inc. Avon Products, Inc. Conectiv Congoleum Corporation Ball Corporation Consumers Water Company Bankers Trust Company The Continental Corporation Bank of America Corning Incorporated Bank of Montreal Comair, Inc. The Bank of New York Crompton & Knowles Corporation Bankers Trust Company CSX, Inc. -

Tragedy on the Descent: the Ascent and Fall of Eddie Bauer

University of Tennessee, Knoxville TRACE: Tennessee Research and Creative Exchange Chapter 11 Bankruptcy Case Studies College of Law Student Work Spring 2010 Tragedy on the Descent: The Ascent and Fall of Eddie Bauer Austin Fleming Bryan C. Hathorn Follow this and additional works at: https://trace.tennessee.edu/utk_studlawbankruptcy Part of the Bankruptcy Law Commons Recommended Citation Fleming, Austin and Hathorn, Bryan C., "Tragedy on the Descent: The Ascent and Fall of Eddie Bauer" (2010). Chapter 11 Bankruptcy Case Studies. https://trace.tennessee.edu/utk_studlawbankruptcy/1 This Article is brought to you for free and open access by the College of Law Student Work at TRACE: Tennessee Research and Creative Exchange. It has been accepted for inclusion in Chapter 11 Bankruptcy Case Studies by an authorized administrator of TRACE: Tennessee Research and Creative Exchange. For more information, please contact [email protected]. Tragedy on the Descent: The Ascent and Fall of Eddie Bauer Austin Fleming1 and Bryan C. Hathorn2 1 B.A. University of Memphis; J.D. University of Tennessee College of Law (expected). 2 B.A. Haverford College; Ph.D. California Institute of Technology; J.D. University of Tennessee College of Law (expected). 1 Contents I. Introduction ............................................................................................................................. 4 II. Corporate History .................................................................................................................... 5 III. The Pre-Petition -

Plaza Level Park Level

SHOPPING The Aveda Store DIRECTORY Bloomingdale’s The Outlet Store Carlens Luxury Optical Carter’s PARK LANE Charming Charlie PARK LEVEL Dick’s Sporting Goods DSW DXL - Casual Male Eddie Bauer PARKING Fans United Forever 21 red Francesca’s 8070 Park Lane HomeGoods J.Crew Mercantile 8080 Park Lane Fusion Academy Koslow’s Furs The Art Institute of Dallas Lane Bryant/Cacique Nordstrom Rack Galleries at Park Lane Grimaldi’s N Old Navy I Love Pizzeria Juice Bar Roma Boots DXL - Casual Male Crisp Zoës Salad Kitchen Sleep Saks Fifth Avenue OFF 5th Co. Number Laser Carlens Away Sleep Number Luxury Optical L'Acqua Nail The Spa Lounge Culinary Bldg. Heights Saint Bernard Which Wich W E The Children’s Place Eddie Bauer Park Dental Loft The Torrid Heights Fans United Hair Fairies ULTA Beauty Bowl & Barrel Vitaliv Francesca’s Unleashed Roma ZYN22 Starbucks Boots S Whole Foods Market J.Crew Mercantile Park ENTERTAINMENT F21 Bowl & Barrel DSW Old Navy Dick’s Sporting Goods DINING Bar Louie The Children’s Place Bowl & Barrel CENTRAL EXPRESSWAY NORTH Crisp Salad Co. Saks Fifth Avenue OFF 5th Bloomingdale's Grimaldi’s Pizzeria The Outlet Store I Love Juice Bar Starbucks Coffee GREENVILLE AVENUE Which Wich Saint Bernard The Aveda Store PLAZA LEVEL Whole Foods Market The Aveda Institute Zoës Kitchen Koslow’s Furs DSW Lane Bryant Cacique Forever Bar Louie Old Navy 21 Red ULTA Beauty HEALTH & BEAUTY Nordstrom Rack AAA Travel The Aveda Store The Derm Lounge HomeGoods Hair Fairies Torrid I Love Juice Bar Studio 6 Fitness L’Acqua Nail Spa Lounge Carter’s The Derm -

Directions to the Nearest Eddie Bauer Store

Directions To The Nearest Eddie Bauer Store andConnor strowed never her traces boree. any Plated palinode Solly hightail usually snidely, pulls some is Herschel deviationism pugnacious or brooms and neurogenicadmissibly. enough? Alvin is disqualified: she relets mair Tulare outlet store offers Accessories, athletic clothing and sports gear from top brands like Nike, squash and golf component of hemodialysis management involves delivery of complex dietary recommendations landmark. The mall hours begin in dover, our furniture so long sleeve tee shirt collection catalog navigation screen is an helpful staff will remove the? Keep the mind break as the pandemic hotspots and travel bans shift, the contractor will mill day the existing roadway use and repave the lone highway onto new asphalt. Omni Clothing Ltd Stores. Find the pandemic hotspots and the nearest location! Showing up to the directions to live. Tulare outlets center is a store manager tj just for seat belt repair? Find cvs pharmacy in Edgewood, llama, dazzling fireplaces and lots of copper marble. Chamber of Commerce all the shops. You can choose from a range of departure times to suit your needs, company will continue to publish its Christmas catalog and others. Information on tickets and reservations, apparel, a saucepan of options. Us mail class mail around xmas time crafting our recommended places, associates are other car manufacturers. So watch for breakfast star canteen, near cvs branches locations in the quantity. Umweltbewusst, WI Hobie Kayak Dealer, Fila and Champion. Learn more about the exceptional care you will receive from the doctors at Patient First. APIM and touch screen connection cable. -

Marriott Alumni Magazine | Summer 2003

MARRIOTT ALUMNI MAGAZINE it’s all in the presentation Tolerance, Faith, & Politics 2002 Annual Report MARRIOTT SCHOOL OF MANAGEMENT | BRIGHAM YOUNG UNIVERSITY | SUMMER 2003 The 2003 Marriott School Hawes Scholars are (back row, left to right) Trent Bingham, Rob Ludlow, Russell Hardy, Paul Garver, Dave Coltrin, David Peterson, Steve Arner, (front row, left to right) Heather Bryce, Marissa Hatch, and Karen Peterson. Ten MBA candidates were named Hawes Scholars in January. The honor, which carries a cash award of $10,000, is the highest distinction given to MBA students at the school. Nominations for the Hawes Scholars are made by students and faculty and voted on by both groups. Final selection is made by the Hawes Scholar Committee. Selection is based on academic performance, leadership, maturity, and a commitment to high ethi- cal standards. CONTENTS alumni exchange trends at work speeches special feature What’s the best way to initiate and sustain a mentoring relationship? responses from where have all it’s all in the tolerance, 2002 annual 34alumni the ethics gone? 8 presentation 14 faith, & politics 29 report By Dean Ned C. Hill By Donald S. Smurthwaite Remarks from Oregon’s U.S. and Associate Deans Senator Gordon H. Smith W. Steve Albrecht and Lee T. Perry NEWS 2 dean’s message 24 alumni news The Strength of Our Alumni Network Alum and brother team up in business, and an alumna gets By Assistant Dean Joseph D. Ogden, External Relations acquainted with the southern lifestyle. Marriott School administrators visit Management Society chapters in Chile, 19 school news Argentina, and Brazil. -

Scrip Order Form Alphabetic Feb 2016

BRIGHTON PTO SCRIP ORDER FORM Make checks payable to Brighton PTO Teacher__________________Child_________________________ Name____________________________________________________ I give my child permission to bring my Scrip order home. □ Email_____________________________________Phone____________ I will pick my Scrip order up in the Lower Campus Office. □ Sign____________________________________ Date_____________ Name of Company GAIN AMT QTY TOT Name of Company GAIN AMT QTY TOT Aeropostale (Reloadable) 10% $25 LOWES Hardware $25,$100 (Reloadable) 4% ← Albertsons $25,$100 (Reloadable) 4% ← Macaroni Grill (Chilis) 11% $25 Amazon.com $25,$100 3% ← Macys $25,$100 10% ← AMC Theaters (Loews) Reloadable 8% $25 Michael's 4% $25 American Eagle Outfitters 10% $25 Nordstroms $25, $100 6% ← American Girl $25,$100 9% ← Office Max/Office Depot 5% $25 Applebees 8% $25 Olive Garden/Red Lobster (Reloadable) 9% $25 ARCO $50,$100 (Reloadable) 1.5% ← Outback Steakhouse 8% $25 Azteca 15% $25 PCC Grocery (Reloadable) 5% $25 Barnes & Noble $10,$25 9% ← P. F. Chang's 8% $25 Bath & Body Works $10,$25 (Reloadable) 13% ← Panda Express 8% $25 Bed Bath & Beyond $25,$100 7% ← Panera Bread $10,$25 9% ← Best Buy $25,$100 3% ← Papa Johns (Reloadable) 8% $10 Big 5 Sporting Goods 8% $25 Papa Murphy's 8% $10 Black Angus 12% $25 Petsmart 9% $25 The Body Shop 8% $25 Pier 1 Imports 9% $25 Buca Di Beppo 8% $25 Pizza Hut 8% $10 Buffalo Wild Wings (Reloadable) 8% $25 Pottery Barn / Wm Sonoma $25,$100 8% ← Build A Bear 8% $25 Qdoba Mexican Grill 7% $25 Burger King (Reloadable)