Capital Public Radio, Inc

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

California Directory of Radio Tehachapi Templeton Thousand Oaks

California Directory of Radio Taft Format: Classic Hits. Nancy Leichter, gen mgr & gen sls mgr; Marty Torrance Scala, opns dir; Drew Ross, progmg dir; Rick Martel, news dir; Tom Hughes, chief of engrg. KBDS(FM)- June 1986: 103.9 mhz; 8 kw. 328 ft. TL: N35 07 04 KFOX(AM)- January 1998: 1650 khz; 10 kw -D, 490 w -N. TL: N33 53 W119 27 33. Stereo. 6313 Schirra Ct., Bakersfield 93313. Phone: 30 W118 11 03 (D), N33 53 30 W118 11 03 (N). 4525 Wilshire Blvd., (661) 837 -0745. Fax: (661)837-1612. E-mail: network @campesina.com. Thousand Oaks 3rd Fl., Los Angeles 90010. Phone: (323) 935-0606. Fax: (323) Web Site: www.campesina.com. Licensee: Radio Campesina Bakersfield 935 -8885. Web Site: www.koreatimes.com. Licensee: Chagal Inc. (acq 1994; $135,000 plus assumption of debt valued at $283,000. Communications Inc. (acq 5- 25 -00; $30 million). Format: Adult 'KCLU(FM)- Oct 20, 1994: 88.3 mhz; 3.2 kw. Ant 518 ft. TL: N34 13 with AM). Borsari & Paxson. Format: Mexican. Target aud: contemp, Korean. Grant Chang, gen mgr; Yowag Soo Choi, sls dir; co-located 05 W118 56 42. Stereo. 60 W. Olsen Rd., Suite 4400 91360. Phone: Hispanic. mgr; Paul Yo Woong Jim, progmg dir; Joy Kim, chie) of engrg. 25 -54; Jeff Russinsky, pres & nail sls Chavez, (805) 493-3900. Phone: (805) 493 -9200. Fax: (805) 493.3982. Web pres; Anthony Chavez. gen mgr: Dave Whitehead, chief of engrg. Site: www.kclu.org. Licensee: California Lutheran University. Network: NPR, PRI. Leventhal, Senter & Lerman. -

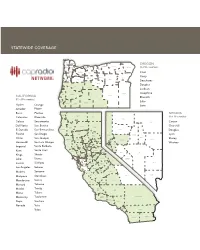

Statewide Coverage

STATEWIDE COVERAGE CLATSOP COLUMBIA OREGON MORROW UMATILLA TILLAMOOK HOOD WALLOWA WASHINGTON MULTNOMAH RIVER (9 of 36 counties) GILLIAM SHERMAN UNION YAMHILL CLACKAMAS WASCO Coos POLK MARION WHEELER Curry JEFFERSON BAKER LINCOLN LINN BENTON GRANT Deschutes CROOK Douglas LANE DESCHUTES Jackson MALHEUR Josephine COOS DOUGLAS HARNEY CALIFORNIA LAKE Klamath (51 of 58 counties) CURRY Lake KLAMATH JOSEPHINE JACKSON Alpine Orange Lane Amador Placer Butte Plumas NEVADA DEL NORTE SISKIYOU Calaveras Riverside MODOC (6 of 16 counties) HUMBOLDT Colusa Sacramento ELKO Carson Del Norte San Benito SHASTA LASSEN Churchill TRINITY El Dorado San Bernardino HUMBOLDT PERSHING Douglas TEHAMA Fresno San Diego WASHOE LANDER Lyon PLUMAS EUREKA Glenn San Joaquin MENDOCINO WHITE PINE Storey GLENN BUTTE SIERRA CHURCHILL STOREY Humboldt San Luis Obispo Washoe NEVADA ORMSBY LYON COLUSA SUTTER YUBA PLACER Imperial Santa Barbara LAKE DOUGLAS Santa Cruz YOLO EL DORADO Kern SONOMA NAPA ALPINE MINERAL NYE SACRAMENTO Kings Shasta AMADOR SOLANO CALAVERAS MARIN TUOLUMNE SAN ESMERALDA Lake Sierra CONTRA JOAQUIN COSTA MONO LINCOLN Lassen Siskiyou ALAMEDA STANISLAUS MARIPOSA SAN MATEO SANTA CLARA Los Angeles Solano MERCED SANTA CRUZ MADERA Madera Sonoma FRESNO SAN CLARK Mariposa Stanislaus BENITO INYO Mendocino Sutter TULARE MONTEREY KINGS Merced Tehama Trinity SAN Modoc LUIS KERN OBISPO Mono Tulare SANTA SAN BERNARDINO Monterey Tuolumne BARBARA VENTURA Napa Ventura LOS ANGELES Nevada Yolo ORANGE Yuba RIVERSIDE IMPERIAL SAN DIEGO CAPRADIO NETWORK: AFFILIATE STATIONS JEFFERSON PUBLIC STATION CITY FREQUENCY STATION CITY FREQUENCY FREQUENCY RADIO - TRANSLATORS KXJZ-FM Sacramento 90.9 KPBS-FM San Diego 89.5 Big Bend, CA 91.3 KXPR-FM Sacramento 88.9 KQVO Calexico 97.7 Brookings, OR 101.7 KXSR-FM Groveland 91.7 KPCC-FM Pasadena 89.3 Burney, CA 90.9 Stockton KUOP-FM 91.3 KUOR-FM Inland Empire 89.1 Callahan/Ft. -

CURRICULUM VITAE ALAN HEDGE, Phd, CPE, C.Erghf, FIEHF, FHFES, FIEA CCSF Faculty Fellow

January 2019 Professor Alan Hedge CURRICULUM VITAE ALAN HEDGE, PhD, CPE, C.ErgHF, FIEHF, FHFES, FIEA CCSF Faculty Fellow Nationality American & British Telephone: 607-255-1957 (office) Mobile: 607-227-1728 (preferred) Fax: 607-255-0305 (office) E- mail: [email protected] Internet: http://ergo.human.cornell.edu ACADEMIC POSITION: Professor Department of Design and Environmental Analysis 2415 Martha Van Rensselaer Hall NYS College of Human Ecology Cornell University Ithaca, NY 14853-4401 UNIVERSITY EDUCATION Bachelor of Science (First class) Special Honors in Zoology. (Subsidiary subjects Physiology and Biochemistry). University of Sheffield, 1970. Master of Science (MS), Zoology University of Sheffield, 1971. Master of Science (MS), Applied Psychology (Ergonomics). Aston University, 1972. Doctor of Philosophy (PhD), 1972-74. Submitted and awarded for thesis in Experimental Developmental Cognitive Psychology University of Sheffield, 1979. CURRENT PROFESSIONAL BODIES Certified Professional Ergonomist (CPE), Board of Certification of Professional Ergonomists (2003 – onwards: #1347) Chartered Ergonomist (C.Erg.HF) (2013 - onwards) Fellow, International Ergonomics Association (IEA) Fellow, The Human Factors and Ergonomics Society (U.S.A.) (FHFES) Fellow, The Institute of Ergonomics and Human Factors (U.K.) (FIEHF) PROFESSIONAL ACTIVITIES Program chair, National Ergonomics Conference and Exposition 2013, 2014, 2015, 2016, 2017, 2018, 2019 IEA Representative for Environmental Design (2011-) Atkinson Center for Sustainable Futures Faculty Fellow -

Aspen Health Journalism Assessment

Assessing the Effectiveness of the California Health Care Foundation’s Health Journalism Grant Portfolio Public Report Prepared by the Aspen Planning and Evaluation Program December 2019 Assessing the Effectiveness of the California Health Care Foundation’s Health Journalism Grant Portfolio ii Table of Contents Executive Summary ............................................................................................................................................. iii Introduction ......................................................................................................................................................... 1 Data Fellowship ................................................................................................................................................... 4 Public Media ...................................................................................................................................................... 15 California Healthline .......................................................................................................................................... 41 Portfolio-Wide Findings ..................................................................................................................................... 50 Strategic Implications and Recommendations .................................................................................................. 60 Appendices ....................................................................................................................................................... -

KXPR, KXJZ, KXSR, KKTO, KXJS, KQNC & KUOP Annual EEO Public File Report

KXPR, KXJZ, KXSR, KKTO, KXJS, KQNC & KUOP Annual EEO Public File Report This EEO Report has been prepared on behalf of the Station Employment Unit that is comprised of the following stations: KXPR-FM, KXJZ-FM, KXSR-FM, KKTO-FM, KXJS-FM, KQNC-FM and KUOP-FM all licensed to CALIFORNIA STATE UNIVERSITY, SACRAMENTO. This report is placed in the public inspection files of these stations, and posted on the Website, in accordance with FCC Rules. The information contained in this Report covers the time period beginning August 2019 to and including July 2020 (the “Applicable Period”). All Full-time Vacancies filled by the Stations during the Applicable Period: 1. Accounting Manager 2. Assistant Producer, Insight 3. Interactive Producer 4. Managing Editor, News-Talk 5. Marketing Associate 6. News Reporter 7. Politics Reporter 8. Producer, Insight 9. Business Assistant 10. News Editor 11. Web Developer 12. Director of Technology The Recruitment Sources utilized to fill the above vacancies: 1. Access Sacramento, mail and email 2. Asian Resources, email 3. Auxiliary Organizations Association, website 4. CA Indian Manpower Consortium, fax 5. CA Media Jobs, listserv 6. Cal Jobs, EDD, website 7. California Association of Broadcasters, website 8. California Dept. of Rehab, email 9. California Dept. of Rehab- Auburn Office, fax 10. California Dept. of Rehab- Roseville Office, fax 11. California State University, Chico, website 12. California State University, Sacramento, website 13. Capital Public Radio, website 14. Capital Public Radio, physical bulletin board 15. Capital Public Radio Board of Directors, email 16. Capital Public Radio Facebook, website 17. Capital Public Radio LinkedIn, website 18. -

Kxpr, Kxjz, Kxsr, Kkto, Kxjs & Kqnc

KXPR, KXJZ, KXSR, KKTO, KXJS, KQNC & KUOP Annual EEO Public File Report The purpose of this EEO Public File Report (“Report”) is to comply with Section 73.2080(c) (6) of the FCC’s 2002 EEO Rule. This Report has been prepared on behalf of the Station Employment Unit that is comprised of the following stations: KXPR-FM, KXJZ-FM, KXSR-FM, KKTO-FM, KXJS-FM, KQNC-FM and KUOP-FM all licensed to CALIFORNIA STATE UNIVERSITY, SACRAMENTO. This report is placed in the public inspection files of these stations, and posted on the Website. The information contained in this Report covers the time period beginning August 2008 to and including July 2009 (the “Applicable Period”). I. All Full-time Vacancies filled by the Stations during the Applicable Period: 1. Member Services Director 2. Member Services Coordinator II. The Recruitment Sources utilized to fill the above vacancies: (Note: Recruitment sources in bold indicate a request to be notified of vacancies.) 1. Access Sacramento, Fax #916-451-9601. 2. Western Bureau Chief NPR, (202)513-2000 3. Asian Resources, Fax #916-676-0144. 4. Bay Area Coalition, http://www.bavc.org/forum. 5. Blackbaud, Inc. www.jobsatnonprofits.com. 6. California Association of Broadcasters, www.cabroadcasters.org. 7. California Department of Rehabilitation, Sacramento District Office, Fax #916-322-0325; Elk Grove Office, Fax #916-691-1792; Sacramento NE Office, Fax #916-537-2658; South Sacramento Office, Fax #916-262- 2061; Auburn Office, Fax #530-823-4085; Roseville, Fax #916-774- 4417; Stockton, Fax #209-473-6511. 8. California Indian Manpower Consortium, Fax #916-641-6338. -

Division AA (News Staff of 16 Or More) Arts Feature First Place - KUT 90.5 FM - “SKAM Austin” Second Place - WAMU - “How to Act Sexy on Stage in the #Metoo Era”

Division AA (News Staff of 16 or more) Arts Feature First Place - KUT 90.5 FM - “SKAM Austin” Second Place - WAMU - “How To Act Sexy On Stage In The #MeToo Era” Best Collaborative Effort First Place - WNYC Radio - “Trump, Inc.” Second Place - KCUR - “Beyond The Ballot: A 5-Part Missouri-wide Series” Best Multi-Media Presentation First Place - KJZZ 91.5 FM - “Below the Rim: Life Inside the Grand Canyon” Second Place - KUOW-FM - “Transforming black pain into beauty” Best Use of Sound First Place - KERA - 90.1 Dallas - “Families Race At Texas Motor Speedway” Second Place - WLRN News - “World's Richest Race, Hometown Horse Spur Buzz” Best Writing First Place - Maine Public Broadcasting Network - “Maine's Pugnacious Governor's Complex Legacy” Second Place - KUT 90.5 FM - “ATXplained Airport Map” Breaking News First Place - WBUR - “Merrimack Valley Gas Explosions” Second Place - KCRW - “Hostages and Homage, July 21, 2018” Call-in Program First Place - WAMU - “Brett Kavanaugh And Consent Culture at Local Schools” Second Place - WNPR - Connecticut Public Radio - “The Colin McEnroe Show: Is Trump Gaslighting Us?” Commentary First Place - WFAE - “Should We Build A Wall for Gun Violence Victims” Second Place - WGBH - “The Smith College Incident and Everyday Racism” Continuing Coverage First Place - Capital Public Radio - “CapRadio Stephon Clark Coverage” Second Place - WNPR - Connecticut Public Radio - “Connecticut Public Radio: The Island Next Door” Enterprise/Investigative First Place - WNYC Radio - “NJ Jails, Suicides and Overdoses, but Little -

Go Viral 9-5.Pdf

Hello fellow musicians, artists, rappers, bands, and creatives! I’m excited you’ve decided to invest into your music career and get this incredible list of music industry contacts. You’re being proactive in chasing your own goals and dreams and I think that’s pretty darn awecome! Getting your awesome music into the media can have a TREMENDOUS effect on building your fan base and getting your music heard!! And that’s exactly what you can do with the contacts in this book! I want to encourage you to read the articles in this resource to help guide you with how and what to submit since this is a crucial part to getting published on these blogs, magazines, radio stations and more. I want to wish all of you good luck and I hope that you’re able to create some great connections through this book! Best wishes! Your Musical Friend, Kristine Mirelle VIDEO TUTORIALS Hey guys! Kristine here J I’ve put together a few tutorials below to help you navigate through this gigantic list of media contacts! I know it can be a little overwhelming with so many options and places to start so I’ve put together a few videos I’d highly recommend for you to watch J (Most of these are private videos so they are not even available to the public. Just to you as a BONUS for getting “Go Viral” TABLE OF CONTENTS What Do I Send These Contacts? There isn’t a “One Size Fits All” kind of package to send everyone since you’ll have a different end goal with each person you are contacting. -

A Public Radio Station Uses Ach to Build One of the Nation’S Top Sustaining Donor Programs

A PUBLIC RADIO STATION USES ACH TO BUILD ONE OF THE NATION’S TOP SUSTAINING DONOR PROGRAMS THE FUNDRAISING CHALLENGE FOR PUBLIC RADIO STATIONS Based in Sacramento, Calif., Capital Public Radio Public radio stations generally focus their fundraisers on getting one-time annual (CapRadio KXPR & KXJZ) contributions from their listeners. Most stations also have sustaining membership airs programming from programs, but recent analyses reveal that very few of them are effective or National Public Radio (NPR) successful. For example, a 2014 study by Greater Public found that the average and other public radio station raises barely $2 of every $10 in membership revenue from sustainers, and producers and distributors, sustainers make up only about two in every 10 donors to the average station. as well as locally produced news and public affairs Yet 2015 data from donorCentrics show that sustainers’ contributions are worth programs. Over 420,000 up to four times more than those from traditional donors over the life of their listeners tune into classical, giving. In addition to donating more frequently and at higher amounts than jazz, news and public affairs traditional givers, sustainers continue to give for many years. shows each week on one of Capital Public Radio’s seven stations serving California’s Central Valley “Our results really highlight the value of ACH for sustaining and the Sierra Nevada. memberships. Seventy-five percent of our sustaining donors pay with ACH; they’re responsible for over 40 percent of all individual donation dollars, and we retain them for up to 20 percent longer than sustainers who use credit/debit cards. -

Rethink's Radio Book

THE RADIO BOOK ReThink Media’s guide to the public affairs programs you need to know 2016 Edition The Radio Book ReThink Media’s guide to the public affairs programs you need to know 2016 - First Edition The research for this book was undertaken by ReThink Media staff, fellows, and interns between 2013 and 2015. Although we made every effort to speak directly with a producer of each show we list, we were not always successful. The “Features” tags included with many entries are complete to the best of our abilities—but some shows lack them when we could not be sure of a feature. Similarly, pitching intel is available for shows with which we were able to make contact. We would like to acknowledge Alyssa Goard, Katherine O’Brien, Daniel Steiner, and Lisa Bergstrom, who each had a big hand in bringing this project to completion. Thank you so much for all your hard work! Designed and formatted by ReThink Media. Printed by Autumn Press in Berkeley, CA. Soundwave front cover image designed by Freepik. Table of Contents Introduction 4 Ohio 160 Understanding Radio 5 Oklahoma 165 Pitching Radio 8 Oregon 168 Pennsylvania 171 Nationally Syndicated 11 Rhode Island 175 News 12 South Dakota 176 Feature Stories 22 Tennessee 177 Interviews 38 Texas 181 Utah 187 State and Regional 45 Vermont 192 Alaska 46 Virginia 194 Arizona 49 Washington 196 Arkansas 51 West Virginia 199 California 53 Wisconsin 201 Colorado 67 Wyoming 209 Connecticut 68 District of Columbia 70 Community Radio 210 Florida 73 Georgia 79 Podcasts 221 Hawaii 80 Index 227 Idaho 82 Illinois 84 Indiana 88 Iowa 94 Kansas 98 Kentucky 102 Louisiana 104 Maine 108 Maryland 111 Massachusetts 114 Michigan 117 Minnesota 124 Mississippi 127 Missouri 128 Montana 132 Nevada 134 New Hampshire 136 New Mexico 139 New York 148 North Carolina 157 North Dakota 159 3 Part 1: Introduction Understanding Radio In order to maximize the potential of radio, it’s critical to first understand the landscape. -

Writer's Address Book Volume 4 Radio & TV Stations

Gordon Kirkland’s Writer’s Address Book Volume 4 Radio & TV Stations The Writer’s Address Book Volume 4 – Radio & TV Stations By Gordon Kirkland ©2006 Also By Gordon Kirkland Books Justice Is Blind – And Her Dog Just Peed In My Cornflakes Never Stand Behind A Loaded Horse When My Mind Wanders It Brings Back Souvenirs The Writer’s Address Book Volume 1 – Newspapers The Writer’s Address Book Volume 2 – Bookstores The Writer’s Address Book Volume 3 – Radio Talk Shows CD’s I’m Big For My Age Never Stand Behind A Loaded Horse… Live! The Writer’s Address Book Volume 4 – Radio & TV Stations Table of Contents Introduction....................................................................................................................... 9 US Radio Stations ............................................................................................................ 11 Alabama .........................................................................................................................11 Alaska............................................................................................................................. 18 Arizona ........................................................................................................................... 21 Arkansas......................................................................................................................... 24 California ........................................................................................................................ 31 Colorado ........................................................................................................................ -

KXPR, KXJZ, KXSR, KKTO, KXJS, KQNC & KUOP Annual EEO Public File Report

KXPR, KXJZ, KXSR, KKTO, KXJS, KQNC & KUOP Annual EEO Public File Report This EEO Report has been prepared on behalf of the Station Employment Unit that is comprised of the following stations: KXPR-FM, KXJZ-FM, KXSR-FM, KKTO-FM, KXJS-FM, KQNC-FM and KUOP-FM all licensed to CALIFORNIA STATE UNIVERSITY, SACRAMENTO. This report is placed in the public inspection files of these stations, and posted on the Website, in accordance with FCC Rules. The information contained in this Report covers the time period beginning August 2016 to and including July 2017 (the “Applicable Period”). I. All Full-time Vacancies filled by the Stations during the Applicable Period: 1. Director of Research and Advancement 2. Member Services Assistant 3. Director of Major Gifts 4. Interactive Producer, Engagement 5. Web Developer 6. Health Care Reporter II. The Recruitment Sources utilized to fill the above vacancies: 1. Art Institute of California, e-mail 2. Asian Resources, fax 3. Access Sacramento, fax 4. California Department of Rehabilitation, Sacramento District Office, Fax #916- 322-0325; Elk Grove Office, Fax #916-691-1792; Sacramento NE Office, Fax #916-537-2658; South Sacramento Office, Fax #916-262-2061; Auburn Office, Fax #530-823-4085; Roseville, Fax #916-774-4417; Stockton, Fax #209-473- 6511. 5. CAL Jobs/Employment Development Department, www.caljobs.ca.gov 6. Capital Public Radio Website, www.capradio.org 7. Capital Public Radio Bulletin Board 8. Capital Public Radio Staff, e-mail 9. Capital Public Radio- Twitter 10. CapRadio – Linked In 11. California Indian Manpower Consortium, fax 12. California State University, Sacramento, Career Center 13.