STEM Master the Systems at the Center of It All

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Walgreens (Top Performing Location) 3019 W Peterson Avenue Chicago, IL 60659 TABLE of CONTENTS

NET LEASE INVESTMENT OFFERING Walgreens (Top Performing Location) 3019 W Peterson Avenue Chicago, IL 60659 TABLE OF CONTENTS I. Executive Summary II. Location Overview III. Market & Tenant Overview Executive Summary Site Plan Tenant Profile Investment Highlights Aerial Location Overview Property Overview Maps Demographics Photos NET LEASE INVESTMENT OFFERING DISCLAIMER STATEMENT DISCLAIMER The information contained in the following Offering Memorandum is proprietary and strictly confidential. It is intended STATEMENT: to be reviewed only by the party receiving it from The Boulder Group and should not be made available to any other person or entity without the written consent of The Boulder Group. This Offering Memorandum has been prepared to provide summary, unverified information to prospective purchasers, and to establish only a preliminary level of interest in the subject property. The information contained herein is not a substitute for a thorough due diligence investigation. The Boulder Group has not made any investigation, and makes no warranty or representation. The information contained in this Offering Memorandum has been obtained from sources we believe to be reliable; however, The Boulder Group has not verified, and will not verify, any of the information contained herein, nor has The Boulder Group conducted any investigation regarding these matters and makes no warranty or representation whatsoever regarding the accuracy or completeness of the information provided. All potential buyers must take appropriate measures to verify all of the information set forth herein. NET LEASE INVESTMENT OFFERING EXECUTIVE SUMMARY EXECUTIVE The Boulder Group is pleased to exclusively market for sale a single tenant Walgreens property located in the SUMMARY: city of Chicago. -

Plaintiffs' Appendix

Return Date: No return date scheduled Hearing Date: No hearing scheduled Courtroom Number: No hearing scheduled Location: No hearing scheduled FILED 12/16/2019 4:01 PM DOROTHY BROWN CIRCUIT CLERK COOK COUNTY, IL 2014ch00829 7750447 FILED DATE: 12/16/2019 4:01 PM 2014ch00829 Plaintiffs’ Appendix IN THE CIRCUIT COURT OF COOK COUNTY, ILLINOIS COUNTY DEPARTMENT, CHANCERY DIVISION SHELDON LANGER, RONALD M. ) No. 2014-CH-00829 YERMACK, LANCE R. GOLDBERG, ) ROBERT PROSI and GERALD PETROW, ) individually on behalf of themselves and all ) others similarly situated, ) ) Calendar 6 Plaintiffs, ) ) v. ) ) Hon. Celia G. Gamrath, Presiding CME GROUP, INC., a Delaware Corporation; ) THE BOARD OF TRADE OF THE CITY OF ) FILED DATE: 12/16/2019 4:01 PM 2014ch00829 CHICAGO, INC., a Delaware Corporation, ) ) Defendants. AFFIDAVIT OF NICHOLAS C. CARULLO IN SUPPORT OF PLAINTIFFS’ MOTION FOR CLASS CERTIFICATION, FOR APPOINTMENT OF CLASS REPRESENTATIVES, AND FOR APPOINTMENT OF SUSMAN GODFREY LLP AS CLASS COUNSEL I, Nicholas C. Carullo, having the requisite personal knowledge, certify under the requirements of Section 1-109 of the Illinois Code of Civil Procedure as follows: 1. I submit this Affidavit in support of Plaintiffs’ Motion for Class Certification, for Appointment of Class Representatives, and for Appointment of Susman Godfrey LLP as Class Counsel. 2. I am an attorney at the law firm of Susman Godfrey LLP, counsel to Plaintiffs in the above-captioned action. 3. Attached as Exhibit 1 is an expert declaration of Jonathan I. Arnold, Ph.D., at 1. 4. Attached as Exhibit 2 is a true and correct copy of transcript excerpts of the deposition testimony of Robert Krewer, designated as a corporate representative of Defendant CME Group, Inc. -

Annual Report 2019

Davis Investment Group 875 Perimeter Dr. Moscow, ID Tel (208) 885-6478 www.uidaho.edu/cbe ANNUAL REPORT FY 2019 The Davis Student Investment Management Group presents its annual performance review for the calendar year 2019. The Davis fund achieved a return of 22.59% compared to the 31.49% return of our benchmark, the S&P 500. As the business cycle continues to expand, the defensive‐oriented Davis fund took on a more conservative stance. This report provides a qualitative and quantitative review and discussion of the Davis fund for 2019. We welcome any questions, comments, or suggestions regarding this report, or anything related to the Davis fund and its members. DAVIS GROUP Contents Performance Report 2 Economic Review 3 The Davis Group 4 Portfolio Returns 5 Portfolio Snapshot 6 Portfolio Holdings 7 Energy Analyst: Reilly Dahlquist 8 Industrials Analyst: Konner DeLeon 9 Technology Analyst: Sebastian Houk 10 Consumer Staples Analyst: Gladys Hernandez 11 Healthcare Analyst: Tyler Simonson 12 Utilities Analyst: Ryan Zimmerman 13 Basic Materials Analyst: Joseph Brueher 14 Consumer Discretionary Analyst: McKenzie Kennedy 15 Financials/Real Estate Analyst: Michael Sodeke 16 International Markets Analyst: Shudan He 17 Fixed Income/Other Analyst: Roshawn Walters 18 The 2019 Davis Group Members 19 References 22 Contact Information 23 1 Performance Report A LETTER FROM THE PORTFOLIO MANAGER After a rough end to 2018 that brought market returns down to negative growth, the stock market experienced a significant rebound in 2019, a year that saw stable and consistent growth throughout the majority of the year. Our portfolio’s benchmark, the S&P 500 Total Index Return, experienced returns of 31.49%, while our more conservative portfolio returned 22.59% in 2019. -

Filed by Intercontinentalexchange, Inc. Pursuant to Rule 425 Under The

Filed by IntercontinentalExchange, Inc. Pursuant to Rule 425 under the Securities Act of 1933, as amended, and deemed filed pursuant to Rule 14a-12 under the Securities Exchange Act of 1934, as amended Subject Company: CBOT Holdings, Inc. (Commission File No. 001- 32650) Legend: Transcript — Callstreet Transcript of Meeting with CBOT Holdings, Inc. Shareholders on May 31, 2007 Johnathan Short, Senior Vice President and General Counsel Good afternoon and welcome. I’m Johnathan Short, Senior Vice President and General Counsel of IntercontinentalExchange, and on behalf of the company, we would like to welcome you here today. Before we get started with the main program, I have a brief legal statement that I need to read about management’s presentation here today, the details of which can be found on pages 2 through 3 in the slide materials that will be available after the program. Please be aware that management’s comments here today may contain forward-looking statements. These statements represent our best judgment and are subject to various risks, assumptions and uncertainties as outlined in the company’s filings with the Securities Exchange Commission. Actual results may differ from those that are expressed in any forward-looking statement. And with that I would like to introduce Jeff Sprecher, the Chairman and Chief Executive Officer of IntercontinentalExchange. Jeffrey Sprecher, Chairman And Chief Executive Officer Well, great. Good afternoon. I would like to thank you all for joining us here to discuss our proposal to merge with the Chicago Board of Trade. We are quite honored to be here and we appreciate your interest in learning more about ICE and our proposal that we submitted to your Board of Directors on March 15th. -

CME Group Announces Annual Corporate Officer Promotions

CME Group Announces Annual Corporate Officer Promotions CHICAGO, Feb 17, 2009 /PRNewswire-FirstCall via COMTEX News Network/ -- CME Group, the world's largest and most diverse derivatives exchange, today announced the following Corporate Officer promotions, which were effective February 15: -- Danielle Dycus, 43, Managing Director, Europe, Middle East and Africa (EMEA) Dycus is responsible for the creation, execution and management of CME Group's long-term growth strategy within EMEA, including growing the company's customer base and increasing awareness of the CME Group brand and products in the region. Prior to joining the company in 1991, Dycus worked in marketing roles for Lend Lease Retail, Ltd. in Sydney, the Times of India in New Delhi and AIESEC in Chicago. She earned bachelor's degrees in management and French from Purdue University and an MBA from the Kellogg School of Management at Northwestern University. -- David Hoag, 39, Managing Director, Clearing Technology Hoag leads an IT team responsible for delivering high performance and reliable technology solutions that enable CME Clearing to protect the integrity of its current markets and expand into new ones. Prior to joining the company in 2003, Hoag held technology roles with Bearing Point Inc. and ObjectWave Corporation. He earned a bachelor's degree in computer science from the University of Illinois. -- Kevin Lennon, 42, Managing Director, Real Estate Lennon is responsible for leading CME Group's real estate strategy, portfolio management, leasing, building management and corporate facilities functions across all of the company's locations. Before joining the company in 1995, Lennon previously held leasing and asset management roles for the U.S. -

DERIVATIVES Litigation News and Analysis • Legislation • Regulation • Expert Commentary VOLUME 22, ISSUE 17 / JULY 14, 2016

Westlaw Journal DERIVATIVES Litigation News and Analysis • Legislation • Regulation • Expert Commentary VOLUME 22, ISSUE 17 / JULY 14, 2016 EXPERT ANALYSIS CFTC Aims to Lower The Bar on Proving Manipulation in Pending Cases By Mark D. Young, Esq., Maureen A. Donley, Esq., Gary A. Rubin, Esq., Chad E. Silverman, Esq., and Theodore M. Kneller, Esq. Skadden, Arps, Slate, Meagher & Flom In two separate Commodity Futures Trading Commission (CFTC) enforcement actions before district courts in New York and Chicago, the CFTC has asked each court to adopt holdings that would significantly enhance the CFTC’s ability to win price-manipulation cases by diminishing the elements it must prove to establish a violation. Market participants are closely watching CFTC v. Wilson & DRW Investments, filed in New York, and CFTC v. Kraft Foods Group, Inc., filed in Illinois. The parties have fully briefed the issues in DRW, and the court is expected to rule in the coming year.1 On December 18, 2015, the Kraft court declined to adopt the CFTC’s most expansive interpretation of its price-manipulation authority but also declined to grant the defendant’s motion to dismiss. LOWERING THE TRADITIONAL BAR TO PROVING MANIPULATION The Commodity Exchange Act (CEA) prohibits manipulation and attempted manipulation of the price of a commodity. Under precedents stretching back 40 years, in order to prove price manipulation, the CFTC must show the defendant specifically intended to cause an artificial price — that is, a price that does not reflect the legitimate forces of supply and demand. The CFTC has always chafed at that high bar, and its arguments in DRW and Kraft seek to lower it. -

The CFTC and the CME Group Impose $6.55 Million in Penalties on Commodity Trading Firm for Manipulative Schemes in the Agricultural Markets

The CFTC and The CME Group Impose $6.55 Million in Penalties on Commodity Trading Firm for Manipulative Schemes in the Agricultural Markets July 17, 2018 AUTHORS Athena Eastwood | Paul J. Pantano, Jr. | Neal E. Kumar | Sohair A. Aguirre On July 12, 2018, the Commodity Futures Trading Commission issued an order accepting the settlement offer of, and imposing sanctions against, Lansing Trade Group, LLC for two separate and distinct manipulative schemes: (1) attempted manipulation of Chicago Board of Trade wheat futures and options on futures; and (2) aiding and abetting attempted manipulation of physical corn prices.1 The CFTC’s wheat manipulation investigation was conducted in conjunction with The CME Group, Inc. CME separately issued a Notice of Disciplinary Action, in which Lansing agreed to pay $3.15 million (in addition to the CFTC penalty) for attempted manipulation of wheat futures.2 The CFTC found that Lansing purchased and subsequently cancelled (i.e., redeemed) for load-out and delivery certain shipping certificates for wheat, with the intent to signal to the market a false increase in demand and thereby manipulate the price of wheat futures to benefit Lansing’s futures spread positions. In a separate scheme, the CFTC found that Lansing worked with a commodity broker to execute two transactions (one to buy and one to resell physical corn) with a grain company at prices below the market price in order to create a downward effect on the price of corn. Unlike the 1 In re Lansing Trade Group, LLC, CFTC Docket No. 18-16, 2018 WL 3387517 (July 12, 2018) (“Order”). -

Chicago's Largest Publicly Traded Companies | Crain's Book of Lists

Chicago’s Largest Publicly Traded Companies | Crain’s Book of Lists 2018 Company Website Location Walgreens Boots Alliance Inc. www.walgreensbootsalliance.com Deerfield, IL Boeing Co. www.boeing.com Chicago, IL Archer Daniels Midland Co. www.adm.com Chicago, IL Caterpillar Inc. www.caterpillar.com Peoria, IL United Continental Holdings Inc. www.unitedcontinental-holdings.com Chicago, IL Allstate Corp. www.allstate.com Northbrook, IL Exelon Corp. www.exeloncorp.com Chicago, IL Deere & Co. www.deere.com Moline, IL Kraft Heinz Co. www.kraftheinz-company.com Chicago, IL Mondelez International Inc. www.mondelez-international.com Deerfield, IL Abbvie Inc. www.abbvie.com North Chicago, IL McDonald’s Corp. www.aboutmcdonalds.com Oak Brook, IL US Foods Holding Corp. www.USfoods.com Rosemont, IL Sears Holdings Corp. www.searsholdings.com Hoffman Estates, IL Abbott Laboratories www.abbott.com North Chicago, IL CDW Corp. www.cdw.com Lincolnshire, IL Illinois Tool Works Inc. www.itw.com Glenview, IL Conagra Brands Inc. www.conagrabrands.com Chicago, IL Discover Financial Services Inc. www.discover.com Riverwoods, IL Baxter International Inc. www.baxter.com Deerfield, IL W.W. Grainger Inc. www.grainger.com Lake Forest, IL CNA Financial Corp. www.cna.com Chicago, IL Tenneco Inc. www.tenneco.com Lake Forest, IL LKQ Corp. www.lkqcorp.com Chicago, IL Navistar International Corp. www.navistar.com Lisle, IL Univar Inc. www.univar.com Downers Grove, IL Anixter International Inc. www.anixter.com Glenview, IL R.R. Donnelly & Sons Co. www.rrdonnelly.com Chicago, IL Jones Lang LaSalle Inc. www.jll.com Chicago, IL Dover Corp. www.dovercorporation.com Downers Grove, IL Treehouse Foods Inc. -

JANUARY 26–28, 2020 Welcome

JANUARY 26–28, 2020 Welcome Welcome to Miami Beach for the Commodity Markets Council’s (CMC’s) Annual State of the Industry Outlook Conference! Each year, CMC brings together highly-respected experts from the world of agricultural and energy commodity derivatives markets to discuss the outlook for the coming year. We are delighted that we are once again able to gather here at The Edition Hotel on Miami Beach, a world-class location by any measure. We are excited about the program we have this year! Focus areas this year include: international trade; the status of and trends in the FCM business; policy developments at the Commodity Futures Trading Commission, the Federal Energy Regulatory Commission, and on Capitol Hill; probable outcomes of the upcoming Presidential election; Brexit predictions; and more. Also, back by popular demand, we will have market analysis and outlook for several agricultural and energy commodities. We will hear from a variety of experts including: • CFTC Chairman Heath Tarbert and his fellow Commissioners Quintenz, Behnam, Stump, and Berkovitz; • FERC Chairman Neil Chatterjee; • Terry Duffy, Chairman and Chief Executive Officer, CME Group; • Carl Cannon, Washington Bureau Chief, RealClearPolitics and Executive Editor, RealClear Media Group; • A panel of industry and government trade experts, featuring the U.S. Trade Representative’s chief agriculture negotiator, Gregg Doud, and moderated by Louis Dreyfus Company’s Cotton Platform Head, Joe Nicosia; and • FCM business executives, including Gerry Corcoran, Chairman and CEO of R.J. O’Brien, and FIA President and CEO Walt Lukken; This will be the seventh year that CMC Europe’s four exchanges, plus 20 trading and derivatives industry-based firms, will coordinate advocacy efforts across Europe, and we have also completed the second year of CMC Switzerland. -

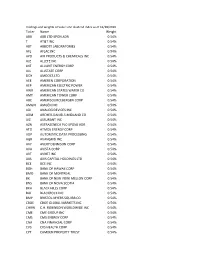

Value Line Dividend Index Information

Holdings and weights of Value Line dividend index as of 12/18/2020 Ticker Name Weight ABB ABB LTD-SPON ADR 0.54% T AT&T INC 0.54% ABT ABBOTT LABORATORIES 0.54% AFL AFLAC INC 0.54% APD AIR PRODUCTS & CHEMICALS INC 0.54% ALE ALLETE INC 0.54% LNT ALLIANT ENERGY CORP 0.54% ALL ALLSTATE CORP 0.54% DOX AMDOCS LTD 0.54% AEE AMEREN CORPORATION 0.54% AEP AMERICAN ELECTRIC POWER 0.54% AWR AMERICAN STATES WATER CO 0.54% AMT AMERICAN TOWER CORP 0.54% ABC AMERISOURCEBERGEN CORP 0.54% AMGN AMGEN INC 0.54% ADI ANALOG DEVICES INC 0.54% ADM ARCHER-DANIELS-MIDLAND CO 0.54% AIZ ASSURANT INC 0.54% AZN ASTRAZENECA PLC-SPONS ADR 0.54% ATO ATMOS ENERGY CORP 0.54% ADP AUTOMATIC DATA PROCESSING 0.54% AGR AVANGRID INC 0.54% AVY AVERY DENNISON CORP 0.54% AVA AVISTA CORP 0.54% AVT AVNET INC 0.54% AXS AXIS CAPITAL HOLDINGS LTD 0.54% BCE BCE INC 0.54% BOH BANK OF HAWAII CORP 0.54% BMO BANK OF MONTREAL 0.54% BK BANK OF NEW YORK MELLON CORP 0.54% BNS BANK OF NOVA SCOTIA 0.54% BKH BLACK HILLS CORP 0.54% BLK BLACKROCK INC 0.54% BMY BRISTOL-MYERS SQUIBB CO 0.54% CBOE CBOE GLOBAL MARKETS INC 0.54% CHRW C.H. ROBINSON WORLDWIDE INC 0.54% CME CME GROUP INC 0.54% CMS CMS ENERGY CORP 0.54% CNA CNA FINANCIAL CORP 0.54% CVS CVS HEALTH CORP 0.54% CPT CAMDEN PROPERTY TRUST 0.54% CPB CAMPBELL SOUP CO 0.54% CM CAN IMPERIAL BK OF COMMERCE 0.54% CNI CANADIAN NATL RAILWAY CO 0.54% CAJ CANON INC-SPONS ADR 0.54% CAT CATERPILLAR INC 0.54% CPK CHESAPEAKE UTILITIES CORP 0.54% CHL CHINA MOBILE LTD-SPON ADR 0.54% CB CHUBB LTD 0.54% CSCO CISCO SYSTEMS INC 0.54% CLX CLOROX COMPANY 0.54% KO COCA-COLA -

Expo Guide Expo 2014

EXPO GUIDE EXPO 2014 30 TH ANNUAL 3 days • 130 exhibitors • over 30 sessions and social events • 5,000+ attendees EXPO Floorplan EXPO 2014 SALON A - SILVER HALL SEF STAGE SEF STAGE AUDIENCE SEATING AUDIENCE SEATING EXPO GUIDE THE INSTITUTE TAIWAN GELIN DAHUA EDGE FOR FINANCIAL SEF STAGECAPE CITY FUTURES FUTURES FINANCIAL THEMARKE INSTITUTETS COMMAND TAIWAN GELINCO., DAHUA LTD TECHNOLOGIESEDGE EXCHANGE FOR FINANCIAL CAPE CITY CORVIL & THINK BIG FUTURES FUTURES FINANCIAL 1603 MARKE1606TS 1608 1610 1612 COMMAND1614 EXCHANGE CO., LTD TECHNOLOGIES 1626 CORVIL & THINK BIG 1603 1606 1608 AUDIENCE1610 SEATING 1612 1614 EUREX 1626 EUREX CYBERSPOT U.S. ENTRANCE DALIAN THE INSTITUTE MARKETAXESS COMMODITY TAIWAN GELIN DAHUA EDGE FOR FINANCIAL RENAISSANCE CORPORATIONCAPEINVEA- CITY CYBERSPOT DEVEXPERTS COMMODITY FUTURES FUTURES FUTURES FINANCIAL METAMAKO EXCHANGE TRADINGU.S. MARKETS CAPITAL MARKETAXESSCOMMAND DALIAN COMMODITY EXCHANGE CO., LTD TECHNOLOGIES TECH COMMISSION RENAISSANCE CORPORATION INVEA- CORVIL & THINK BIG COMMODITY FUTURES METAMAKO DEVEXPERT1523 S 1525 1527TRADING CAPITAL1505 1509 1511 1513 EXCHANGE 1603 1606 1608 1610 16121507 1614TECH COMMISSION TO SALON D - GREEN HALL SALON TO 1626 1505 1507 1509 1511 1513 1523 1525 1527 EUREX TO LOWER LEVEL REGISTRATION DESK LEVEL REGISTRATION LOWER TO CYBERSPOT U.S. DALIAN MARKETAXESS Pop-Up Pop-Up Pop-Up Pop-Up COMMODIPop-UpTY TRADING RENAISSANCE CORPORATION INVEA- COMMODITY FUTURES TMX | METAMAKO DEVEXPERTS TRADING CAPITAL Meeting Room Meeting Room Meeting Room Meeting RoomEXCHANGE Meeting Room TECHNOLOGIES OPTIONSCITY TECH Pop-Up Pop-Up Pop-Up Pop-Up COMMISSIONPop-Up MONTRÉALTMX | EUREX TRADING 1523 1525 1527 SOFTWARE, 1505 1507 1509 Meeting1511 Room1513Meeting Room Meeting Room Meeting Room Meeting Room MONTRÉALEXCHANGE INTERNATIONAL,TECHNOLOGIES INC. OPTIONSCITY EUREX INC. -

CME Group Inc

UNITED STATES SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. 20549 DIVISION OF CORPORATION FINANCE February 19, 2014 Rodd M. Schreiber Skadden, Arps, Slate, Meagher & Flom LLP [email protected] Re: CME Group Inc. Dear Mr. Schreiber: This is in regard to your letter dated February 10, 2014 concerning the shareholder proposal submitted by the Unitarian Universalist Association and Calvert Investment Management, Inc. on behalf of the Calvert Social Index Fund, the Calvert VP S&P 500 Index Portfolio and the Calvert Equity Income Fund for inclusion in CME Group's proxy materials for its upcoming annual meeting ofsecurity holders. Your letter indicates that the proponents have withdrawn the proposal and that CME Group therefore withdraws its January 21, 2014 request for a no-action letter from the Division. Because the matter is now moot, we will have no further comment. Copies ofall ofthe correspondence related to this matter will be made available on our website at http://www.sec.gov/divisions/cor:pfin/cf-noaction/14a-8.shtml. For your reference, a brief discussion ofthe Division's informal procedures regarding shareholder proposals is also available at the same website address. Sincerely, Evan S. Jacobson Special Counsel cc: Timothy Brennan Unitarian Universalist Association of Congregations [email protected] SKADDEN, ARPS, SLATE, MEAGHER & FLOM LLP 155 NORTH WACKER DRIVE F"'IAM /AF"f"I LIAT~ Of"'F"'IC£S DIRECT DIAL CHICAGO, ILLINOIS 60606·1720 !3 I 21 407-053 I BOSTON HOUSTON OUttCT FAX TEL : (312)407-0700 LOS ANGELES !31 21 407·8522 NEW YORK EMAJL AOORE.SS FAX: (312)407·041 I PALO ALTO ROOO [email protected] www.skadden.com WASHINGTON.