COLUMBIUM (NIOBIUM) and TANTALUM by Larry D

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

TORIAN RESOURCES LIMITED (ASX:TNR) Key Participant in the Zuleika Corridor Gold Camp Is There a Better Goldfield Anywhere in the World Today? SUMMARY

TORIAN RESOURCES LIMITED (ASX:TNR) Key participant in the Zuleika Corridor Gold Camp Is there a better goldfield anywhere in the world today? SUMMARY Torian Resources Limited (TNR) is a gold explorer with a difference. Its access to more 5 October 2016 – Initiation than 220km2 of key tenements in the Coolgardie Domain along the highly productive and high grade Zuleika Shear Corridor near Kundana, just 40km west of Kalgoorlie, gives it an 18 Month Price Target: A $0.80 excellent position in Australia’s fifth largest producing and most exciting goldfield. The Zuleika Corridor is the most exciting goldfield in Australia today. It is CAPITAL STRUCTURE revitalising Kalgoorlie as a global gold production centre. TNR’s Mt Stirling Project is also in line to soon produce a modest JORC resource. Share Price $0.175 KEY POINTS Net Asset Value A$16m 12 Month Range $0.095 - $0.38 TNR is earning 49% of ~223km2 along the Zuleika Corridor by spending $5m Market Cap (diluted) $17.0m Enterprise Value $13.2m Zuleika Corridor Coolgardie Domain already has >7moz in resources Issued Shares 96.94m 7 major recent gold discoveries in contiguous ground by NST & EVN 55,000m of RAB and RC drilling planned by TNR for FY17 Existing local mill facilities allow rapid discovery to production potential Cash $3.8m Mt Stirling offers high-grade, >98% recovery near-term production potential DIRECTORS A$3.5m raised in recent capital issue to fully fund its FY17 programme TNR’s exciting Zuleika tenements include a cumulative 25km (2nd largest) of strike of the Andrew Sparke Non-Executive Chairman black Centenary Shale within the K2/Strzelecki Structures that host the most important Matt Sullivan Managing Director high grade deposits in the Zuleika Corridor Gold Camp. -

Evolution and Understanding of the D-Block Elements in the Periodic Table Cite This: Dalton Trans., 2019, 48, 9408 Edwin C

Dalton Transactions View Article Online PERSPECTIVE View Journal | View Issue Evolution and understanding of the d-block elements in the periodic table Cite this: Dalton Trans., 2019, 48, 9408 Edwin C. Constable Received 20th February 2019, The d-block elements have played an essential role in the development of our present understanding of Accepted 6th March 2019 chemistry and in the evolution of the periodic table. On the occasion of the sesquicentenniel of the dis- DOI: 10.1039/c9dt00765b covery of the periodic table by Mendeleev, it is appropriate to look at how these metals have influenced rsc.li/dalton our understanding of periodicity and the relationships between elements. Introduction and periodic tables concerning objects as diverse as fruit, veg- etables, beer, cartoon characters, and superheroes abound in In the year 2019 we celebrate the sesquicentennial of the publi- our connected world.7 Creative Commons Attribution-NonCommercial 3.0 Unported Licence. cation of the first modern form of the periodic table by In the commonly encountered medium or long forms of Mendeleev (alternatively transliterated as Mendelejew, the periodic table, the central portion is occupied by the Mendelejeff, Mendeléeff, and Mendeléyev from the Cyrillic d-block elements, commonly known as the transition elements ).1 The periodic table lies at the core of our under- or transition metals. These elements have played a critical rôle standing of the properties of, and the relationships between, in our understanding of modern chemistry and have proved to the 118 elements currently known (Fig. 1).2 A chemist can look be the touchstones for many theories of valence and bonding. -

Columbium (Niubium) and Tantalum

COLUMBIUM (NIOBIUM) AND TANTALUM By Larry D. Cunningham Domestic survey data and tables were prepared by Robin C. Kaiser, statistical assistant, and the world production table was prepared by Regina R. Coleman, international data coordinator. Columbium [Niobium (Nb)] is vital as an alloying element in economic penalty in most applications. Neither columbium nor steels and in superalloys for aircraft turbine engines and is in tantalum was mined domestically because U.S. resources are of greatest demand in industrialized countries. It is critical to the low grade. Some resources are mineralogically complex, and United States because of its defense-related uses in the most are not currently (2000) recoverable. The last significant aerospace, energy, and transportation industries. Substitutes are mining of columbium and tantalum in the United States was available for some columbium applications, but, in most cases, during the Korean Conflict, when increased military demand they are less desirable. resulted in columbium and tantalum ore shortages. Tantalum (Ta) is a refractory metal that is ductile, easily Pyrochlore was the principal columbium mineral mined fabricated, highly resistant to corrosion by acids, a good worldwide. Brazil and Canada, which were the dominant conductor of heat and electricity, and has a high melting point. pyrochlore producers, accounted for most of total estimated It is critical to the United States because of its defense-related columbium mine production in 2000. The two countries, applications in aircraft, missiles, and radio communications. however, no longer export pyrochlore—only columbium in Substitution for tantalum is made at either a performance or upgraded valued-added forms produced from pyrochlore. -

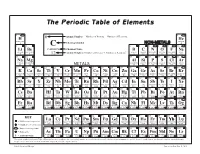

The Periodic Table of Elements

The Periodic Table of Elements 1 2 6 Atomic Number = Number of Protons = Number of Electrons HYDROGENH HELIUMHe 1 Chemical Symbol NON-METALS 4 3 4 C 5 6 7 8 9 10 Li Be CARBON Chemical Name B C N O F Ne LITHIUM BERYLLIUM = Number of Protons + Number of Neutrons* BORON CARBON NITROGEN OXYGEN FLUORINE NEON 7 9 12 Atomic Weight 11 12 14 16 19 20 11 12 13 14 15 16 17 18 SODIUMNa MAGNESIUMMg ALUMINUMAl SILICONSi PHOSPHORUSP SULFURS CHLORINECl ARGONAr 23 24 METALS 27 28 31 32 35 40 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 POTASSIUMK CALCIUMCa SCANDIUMSc TITANIUMTi VANADIUMV CHROMIUMCr MANGANESEMn FeIRON COBALTCo NICKELNi CuCOPPER ZnZINC GALLIUMGa GERMANIUMGe ARSENICAs SELENIUMSe BROMINEBr KRYPTONKr 39 40 45 48 51 52 55 56 59 59 64 65 70 73 75 79 80 84 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 RUBIDIUMRb STRONTIUMSr YTTRIUMY ZIRCONIUMZr NIOBIUMNb MOLYBDENUMMo TECHNETIUMTc RUTHENIUMRu RHODIUMRh PALLADIUMPd AgSILVER CADMIUMCd INDIUMIn SnTIN ANTIMONYSb TELLURIUMTe IODINEI XeXENON 85 88 89 91 93 96 98 101 103 106 108 112 115 119 122 128 127 131 55 56 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 CESIUMCs BARIUMBa HAFNIUMHf TANTALUMTa TUNGSTENW RHENIUMRe OSMIUMOs IRIDIUMIr PLATINUMPt AuGOLD MERCURYHg THALLIUMTl PbLEAD BISMUTHBi POLONIUMPo ASTATINEAt RnRADON 133 137 178 181 184 186 190 192 195 197 201 204 207 209 209 210 222 87 88 104 105 106 107 108 109 110 111 112 113 114 115 116 117 118 FRANCIUMFr RADIUMRa RUTHERFORDIUMRf DUBNIUMDb SEABORGIUMSg BOHRIUMBh HASSIUMHs MEITNERIUMMt DARMSTADTIUMDs ROENTGENIUMRg COPERNICIUMCn NIHONIUMNh -

Progress on the Leonora Province Plan

ASX Release / 21 June 2021 Progress on the Leonora Province Plan Highlights • An additional circa 1.4 million ounces added to Mineral Resources in the Leonora Province, an uplift of around 30% • Resource Development and Extensional drilling commenced • Additional Resource inventory supports a Mill Expansion Study • Gwalia Intermediates incorporated in the Life of Mine plan • Third party ore sources secured to fill the mill for FY22 Previously Reported Updated 1, 2 Mineral Resources0F 1F LPP Mineral Resources Resource Area Tonnes (Mt) Ounces (Moz) Tonnes (Mt) Ounces (Moz) Gwalia Deeps 22.6 4.4 22.6 4.4 Gwalia Open Pit - - 8.4 0.8 Tower Hill 5.1 0.6 5.1 0.6 Harbour Lights - - 12.9 0.6 Totals 27.7 5.0 49.0 6.4 Increase with updated Mineral Resources 44% 28% 1 Refer to ASX release 24 August ’30 June 2020 Ore Reserves and Mineral Resource Statements’ 2 Current Mineral Resources are stated as at 30 June 2020 and not adjusted for FY21 year to date depletion Investor Relations Mr David Cotterell Manager Investor Relations +61 3 8660 1959 ASX: SBM Media Relations Mr Ben Wilson GRACosway +61 407 966 083 ADR: STBMY Authorised by Mr Craig Jetson Managing Director & CEO 21 June 2021 St Barbara Limited Level 10, 432 St Kilda Road, Melbourne VIC 3004 T +61 3 8660 1900 F +61 3 8660 1999 ACN 009 165 066 Locked Bag 9, Collins Street East, Melbourne VIC 8003 W www.stbarbara.com.au Leonora Province Plan Progress In the December 2020 Investor briefing, St Barbara Limited (St Barbara) outlined its strategy to grow production sustainably, lower the Company’s cost profile, and deliver superior returns to shareholders through three stages of uplift for the business. -

Gwalia Investor and Analyst Site Visit 12 February 2016 Disclaimer

Kous Kirsten, General Manager Leonora Operations Rowan Cole, Company Secretary Gwalia investor and analyst site visit 12 February 2016 Disclaimer This presentation has been prepared by St Barbara Limited (“Company”). The material contained in this presentation is for information purposes only. This presentation is not an offer or invitation for subscription or purchase of, or a recommendation in relation to, securities in the Company and neither this presentation nor anything contained in it shall form the basis of any contract or commitment. This presentation may contain forward-looking statements that are subject to risk factors associated with exploring for, developing, mining, processing and sale of gold. Forward-looking statements include those containing such words as anticipate, estimates, forecasts, should, will, expects, plans or similar expressions. Such forward-looking statements are not guarantees of future performance and involve known and unknown risks, uncertainties, assumptions and other important factors, many of which are beyond the control of the Company, and which could cause actual results or trends to differ materially from those expressed in this presentation. Actual results may vary from the information in this presentation. The Company does not make, and this presentation should not be relied upon as, any representation or warranty as to the accuracy, or reasonableness, of such statements or assumptions. Investors are cautioned not to place undue reliance on such statements. This presentation has been prepared by the Company based on information available to it, including information from third parties, and has not been independently verified. No representation or warranty, express or implied, is made as to the fairness, accuracy or completeness of the information or opinions contained in this presentation. -

Aluminum Electrolytic Vs. Polymer – Two Technologies – Various Opportunities

Aluminum Electrolytic vs. Polymer – Two Technologies – Various Opportunities By Pierre Lohrber BU Manager Capacitors Wurth Electronics @APEC 2017 2017 WE eiCap @ APEC PSMA 1 Agenda Electrical Parameter Technology Comparison Application 2017 WE eiCap @ APEC PSMA 2 ESR – How to Calculate? ESR – Equivalent Series Resistance ESR causes heat generation within the capacitor when AC ripple is applied to the capacitor Maximum ESR is normally specified @ 120Hz or 100kHz, @20°C ESR can be calculated like below: ͕ͨ͢ 1 1 ͍̿͌ Ɣ Ɣ ͕ͨ͢ ∗ ͒ ͒ Ɣ Ɣ 2 ∗ ∗ ͚ ∗ ̽ 2 ∗ ∗ ͚ ∗ ̽ ! ∗ ̽ 2017 WE eiCap @ APEC PSMA 3 ESR – Temperature Characteristics Electrolytic Polymer Ta Polymer Al Ceramics 2017 WE eiCap @ APEC PSMA 4 Electrolytic Conductivity Aluminum Electrolytic – Caused by the liquid electrolyte the conductance response is deeply affected – Rated up to 0.04 S/cm Aluminum Polymer – Solid Polymer pushes the conductance response to much higher limits – Rated up to 4 S/cm 2017 WE eiCap @ APEC PSMA 5 Electrical Values – Who’s Best in Class? Aluminum Electrolytic ESR approx. 85m Ω Tantalum Polymer Ripple Current rating approx. ESR approx. 200m Ω 630mA Ripple Current rating approx. 1,900mA Aluminum Polymer ESR approx. 11m Ω Ripple Current rating approx. 5,500mA 2017 WE eiCap @ APEC PSMA 6 Ripple Current >> Temperature Rise Ripple current is the AC component of an applied source (SMPS) Ripple current causes heat inside the capacitor due to the dielectric losses Caused by the changing field strength and the current flow through the capacitor 2017 WE eiCap @ APEC PSMA 7 Impedance Z ͦ 1 ͔ Ɣ ͍̿͌ ͦ + (͒ −͒ )ͦ Ɣ ͍̿͌ ͦ + 2 ∗ ∗ ͚ ∗ ͍̿͆ − 2 ∗ ∗ ͚ ∗ ̽ 2017 WE eiCap @ APEC PSMA 8 Impedance Z Impedance over frequency added with ESR ratio 2017 WE eiCap @ APEC PSMA 9 Impedance @ High Frequencies Aluminum Polymer Capacitors have excellent high frequency characteristics ESR value is ultra low compared to Electrolytic’s and Tantalum’s within 100KHz~1MHz E.g. -

The Mineral Industry of Australia in 2008

2008 Minerals Yearbook AUSTRALIA U.S. Department of the Interior August 2010 U.S. Geological Survey THE MINERAL INDUS T RY OF AUS T RALIA By Pui-Kwan Tse Australia was one of the world’s leading mineral producing and the Brockman iron project in the Pilbara region of Western countries and ranked among the top 10 countries in the world Australia (Australian Bureau of Agricultural and Resource in the production of bauxite, coal, cobalt, copper, gem and Economics, 2009a). near-gem diamond, gold, iron ore, lithium, manganese ore, tantalum, and uranium. Since mid-2008, the global financial Minerals in the National Economy crisis had sharply weakened world economic activities, and the slowdown had been particularly pronounced in the developed Australia’s mining sector contributed more than $105 billion countries in the West. Emerging Asian economies were also to the country’s gross domestic product (GDP), or 7.7% of the adversely affected by the sharply weaker demand for exports GDP during fiscal year 2007-08. In 2008, the mining sector and tighter credit conditions. After a period of strong expansion, employed 173,900 people who worked directly in mining and an Australia’s economic growth decreased by 0.5% in the final additional 200,000 who were involved in supporting the mining quarter of 2008. Overall, Australia’s economy grew at a rate activities. Expectations of sustained levels of global demand for of 2.4% during 2008. During the past several years, owing to minerals led to increased production of minerals and metals in anticipated higher prices of mineral commodities in the world Australia, and the mineral industry was expected to continue markets, Australia’s mineral commodity output capacities to be a major contributor to the Australian economy in the next expanded rapidly. -

Congo Coltan: Cellular Communication Connecting to Conflict

WORK & CULTURE Congo Coltan: Cellular Communication Connecting to Conflict Kevin Woods Working Group on The Cellphone Project: Demobilizing, Globalization and Culture, Delinking, Disconnecting the Yale University Commodity Chain Work & Culture 2004/4 http://www.yale.edu/laborculture/work_culture.html Woods | Congo Coltan Discursive formations are never singular. Discourses operate in conflict; they overlap and collude; they do not produce fixed or unified objects. (Lowe 1991:8) The cellular telephone acts as an appropriate consumer good for the commodity chain framework because the approach attempts to visibilize the places that cell phones disconnect.1 Global markets help erase the production places and the cultural, social and environmental conditions of global commodities. Cell phones remain disconnected from its multiple production places by being both a global commodity and as a communication device. Cellular communicators create a globalized world of instant place-less communication, calling to and from any place yet joining at being un-grounded. This paper will re-connect to cell phone production places in Congo.2 I will explore how these hidden places that are intimately connected to global commodity chains become battle grounds of contestations over meanings of place. Often these areas of natural resource wealth become conflict zones by different actors fighting over control of the rich resources. If these places of struggle become embedded within civil war, then the dynamic shifting of alliances over control of extracting natural resources connected to cell phone production provide insight into the binary relationships between formal- informal economies, legitimate-illegitimate resource extraction, (trans-)national- local control, war-peace and trade-trafficking. -

Mount Burgess Gold Mining Company N.L

MOUNT BURGESS GOLD MINING COMPANY N.L. COMPANY PARTICULARS Directors: NIGEL RAYMOND FORRESTER, F.C.A., (Chairman and Managing Director) CLIVE BRUCE JONES B.App.Sc.(Geol.), M.Aus.I.M.M JEFFREY JOHN MOORE B.App.Sc.(Geol.), M.Aus.I.M.M GODFREY EDWARD TAYLOR, LL B RONALD WILLIAM O’REGAN Joint Secretaries: JAN FORRESTER DEAN ANGELO SCARPAROLO, B.Bus., ASA. Registered Office: Level 5, 178 St. Georges Terrace, Perth, Western Australia, 6000. Telephone: (08) 9322 6311 Facsimile: (08) 9322 4607 Email: [email protected] Website: www.mountburgess.com Share Registry: Advanced Share Registry Services, 7th Floor, 200 Adelaide Terrace, Perth, Western Australia, 6000. Telephone: (08) 9221 7288 Facsimile: (08) 9221 7869 Auditors: Deloitte Touche Tohmatsu, 16th Floor, Central Park, 152-158 St. George's Terrace, Perth, Western Australia, 6000. Bankers: Australia and New Zealand Banking Group Ltd, 77 St. George's Terrace, Perth, Western Australia, 6000. MOUNT BURGESS GOLD MINING COMPANY N.L. ADDRESS BY THE CHAIRMAN It is my pleasure to present to you this annual report for the year to 30 June 2000. In a year that has seen a significant decline in exploration throughout the resource industry, particularly within the small company sector, the Company, through being well cashed up, has achieved a healthy exploration programme of some $2 million. At Telfer, where Normandy Gold Pty Ltd is carrying the full cost of exploration to the end of this year, the Company, through the payment of $300,000 to Carpentaria Gold Pty Ltd has secured 100% equity over all the tenements in the joint venture. -

Development of Niobium-Boron Grain

DEVELOPMENT OF NIOBIUM-BORON GRAIN REFINER FOR ALUMINIUM-SILICON ALLOYS A thesis submitted for the degree of Doctor of Philosophy (PhD) by Magdalena Nowak Brunel Centre for Advanced Solidification Technology (BCAST) Brunel University September 2011 To my mother and my late father... II Abstract Aluminium castings with a large grain structure have poor mechanical properties which are primarily due to casting defects as opposed to fine grain structure. The grain refinement practice using chemical addition is well established for wrought alloys, however in the case of casting alloys, the practice of adding grain refiners and the impact on castability is not well established. The addition of well known Al-5Ti-B grain refiner to casting alloys with silicon (Si) content above 3 wt.% is not effective. This is believed to be due to the chemical reaction between Ti and Si. The current research aim is to find an alternative, but effective, chemical phase which can refine Al-Si alloy grains. Based on a crystallographic database search and intermetallic phases found in Aluminium–Niobium-Boron, there exists several iso-structural phases similar to those of Al3Ti and TiB2. We have selected a phase which exhibits chemical phase stability with Si (below 900 oC) and developed a potential novel grain refiner Nb-B for Al-Si cast alloys. Various Al-Si binary alloys and a commercial sourced LM6 (Al-10Si-Mg) cast alloys were cast after novel grain refiner addition to the melt. It is the first time that such fine grain structures were achieved for Al-Si alloys when Si >4wt.%. -

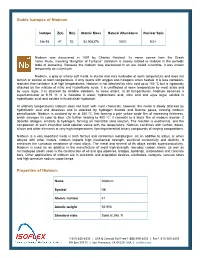

Stable Isotopes of Niobium Properties of Niobium

Stable Isotopes of Niobium Isotope Z(p) N(n) Atomic Mass Natural Abundance Nuclear Spin Nb-93 41 52 92.906376 100% 9/2+ Niobium was discovered in 1801 by Charles Hatchett. Its name comes from the Greek name Niobe, meaning “daughter of Tantalus” (tantalum is closely related to niobium in the periodic table of elements). Because the niobium was discovered in an ore called columbite, it was known temporarily as columbium. Niobium, a gray or silvery soft metal, is ductile and very malleable at room temperature and does not tarnish or oxidize at room temperature. It only reacts with oxygen and halogens when heated. It is less corrosion- resistant than tantalum is at high temperatures. Niobium is not attacked by nitric acid up to 100 °C but is vigorously attacked by the mixture of nitric and hydrofluoric acids. It is unaffected at room temperature by most acids and by aqua regia. It is attacked by alkaline solutions, to some extent, at all temperatures. Niobium becomes a superconductor at 9.15 °K. It is insoluble in water, hydrochloric acid, nitric acid and aqua regia; soluble in hydrofluoric acid; and soluble in fused alkali hydroxide. At ordinary temperatures niobium does not react with most chemicals; however, the metal is slowly attacked by hydrofluoric acid and dissolves and is attacked by hydrogen fluoride and fluorine gases, forming niobium pentafluoride. Niobium is oxidized by air at 350 ºC, first forming a pale yellow oxide film of increasing thickness, which changes its color to blue. On further heating to 400 ºC, it converts to a black film of niobium dioxide.