HSBC Holdings Annual Report and Accounts 2006

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

REGISTRATION DOCUMENT DATED 28 March 2019

REGISTRATION DOCUMENT DATED 28 March 2019 HSBC HOLDINGS PLC (a company incorporated with limited liability in England with registered number 617987) This document (which expression shall include this document and all documents incorporated by reference herein) has been prepared for the purpose of providing disclosure information with regard to HSBC Holdings plc (the "Issuer") and has been approved by the Financial Conduct Authority, which is the competent authority in the United Kingdom for the purposes of Directive 2003/71/EC (as amended or superseded, the "Prospectus Directive") and relevant implementing measures in the United Kingdom (the "FCA"), as a registration document ("Registration Document") issued in compliance with the Prospectus Directive and relevant implementing measures in the United Kingdom for the purpose of providing the information with regard to the Issuer of debt or derivative securities during the period of twelve months after the date hereof. This Registration Document includes details of the long-term and short-term credit ratings assigned to the Issuer by Standard & Poor's Credit Market Services Europe Limited ("S&P"), Moody's Investors Service Limited ("Moody's") and Fitch Ratings Limited ("Fitch"). Each of S&P, Moody's and Fitch is established in the European Union and is registered as a Credit Rating Agency under Regulation (EU) No. 1060/2009, as amended (the "CRA Regulation"). As such, each of S&P, Moody's and Fitch is included in the list of credit rating agencies published by the European Securities and Markets Authority on its website in accordance with the CRA Regulation. CONTENTS Page RISK FACTORS .......................................................................................................................................... 1 IMPORTANT NOTICES ............................................................................................................................ -

Registration Document Dated 30 March 2021

REGISTRATION DOCUMENT DATED 30 MARCH 2021 HSBC HOLDINGS PLC (a company incorporated in England with registered number 617987; the liability of its members is limited) This document (which expression shall include this document and all documents incorporated by reference herein) has been prepared for the purpose of providing disclosure information with regard to HSBC Holdings plc (the "Issuer") and has been approved by the Financial Conduct Authority (the "FCA") as a registration document ("Registration Document") for the purposes of Regulation (EU) 2017/1129 as it forms part of domestic law by virtue of the European Union (Withdrawal) Act 2018, as amended ("EUWA") (the "UK Prospectus Regulation") for the purpose of providing the information with regard to the Issuer of debt or derivative securities during the period of twelve months after the date hereof. The FCA has only approved this Registration Document as meeting the standards of completeness, comprehensibility and consistency imposed by the Prospectus Regulation Rules sourcebook in the FCA Handbook. Such an approval should not be considered an endorsement of the Issuer that is the subject of the Registration Document. This Registration Document is valid for a period of twelve months from the date of approval. This Registration Document includes details of the long-term and short-term credit ratings assigned to the Issuer by S&P Global Ratings UK Limited ("S&P"), Moody's Investors Service Limited ("Moody's") and Fitch Ratings Limited ("Fitch"). Each of S&P, Moody's and Fitch is established in the United Kingdom and registered under Regulation (EU) No 1060/2009 on credit rating agencies as it forms part of the domestic law of the United Kingdom by virtue of EUWA (the "UK CRA Regulation"). -

HSBC FINANCE CORPORATION (Exact Name of Registrant As Specified in Its Charter) Delaware 86-1052062 (State of Incorporation) (I.R.S

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K (Mark One) ≤ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2006 OR n TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to Commission file number 1-8198 HSBC FINANCE CORPORATION (Exact name of registrant as specified in its charter) Delaware 86-1052062 (State of incorporation) (I.R.S. Employer Identification No.) 2700 Sanders Road Prospect Heights, Illinois 60070 (Address of principal executive offices) (Zip Code) (847) 564-5000 Registrant's telephone number, including area code Securities registered pursuant to Section 12(b) of the Act: Title of Each Class Name of Each Exchange on Which Registered 8.40% Debentures Maturing at Holder's Option Annually on New York Stock Exchange December 15, Commencing in 1986 and Due May 15, 2008 Floating Rate Notes due May 21, 2008 New York Stock Exchange Floating Rate Notes, due September 15, 2008 New York Stock Exchange Floating Rate Notes due October 21, 2009 New York Stock Exchange Floating Rate Notes due October 21, 2009 New York Stock Exchange 4.625% Notes, due September 15, 2010 New York Stock Exchange 5.25% Notes, due January 14, 2011 New York Stock Exchange 3 6 /4% Notes, due May 15, 2011 New York Stock Exchange 5.7% Notes due June 1, 2011 New York Stock Exchange Floating Rate Notes, due July 19, 2012 New York Stock Exchange Floating Rate Notes, due September 14, 2012 -

Plan De Marketing: Banco General De Panamá

Universidad de San Andrés Escuela de Negocios Maestría en Marketing y Comunicación Plan de Marketing: Banco General de Panamá Autor: Fernando Agustín D’Acunto DNI: 31529206 Mentora de Tesis: Mercedes Gerding Ciudad Autónoma de Buenos Aires, 2019 Universidad de San Andrés Departamento de Administración / Escuela de Negocios Magister en Marketing y Comunicación Plan de Marketing: Banco General de Panamá Autor: Fernando Agustín D’Acunto DNI: 31.529.206 Mentor: Mercedes Gerding Ciudad Autónoma de Buenos Aires Fernando Agustín D’Acunto 1 Resumen ejecutivo El Banco General de Panamá, nacido en 1950, es el banco privado más grande del país. El presente plan de marketing tiene como objetivo desarrollar una estrategia de comunicación digital que posicione al Banco General de forma coherente con sus valores de mercado dentro de una audiencia joven y con pleno crecimiento en Panamá. Para lograr este objetivo, primero se llevó adelante un análisis PEST, en el cual se analizaron los factores externos que pueden influir en el desempeño de la marca. Se realizó un análisis FODA, del cual se tomaron oportunidades y se utilizaron para elaborar una estrategia de marca fuerte y sostenible en el tiempo. Para desarrollar la estrategia de marca, se analizaron los insights 1 más relevantes de nuestro público joven y se tomaron algunos de ellos para incorporar, en la estrategia de comunicación de la marca. La implementación de la estrategia de comunicación digital se lleva adelante con una herramienta de mapeo que nos permite definir los medios más pertinentes y afines con la audiencia, como los contenidos que mejor ayuden a lograr los objetivos esperados por el banco. -

Presentation to Fixed Income Investors

HSBC Holdings plc and HSBC Bank Canada September 2010 Presentation to Fixed Income Investors www.hsbc.com www.hsbc.ca Disclaimer and forward-looking information This presentation, including the accompanying slides and subsequent discussion, contains certain forward-looking information with respect to the financial condition, results of operations and business of HSBC Holdings plc, together with its direct and indirect subsidiaries including HSBC Bank Canada and HSBC Securities (Canada) Inc. (the "HSBC Group" or “HSBC”). This forward-looking information represents expectations or beliefs concerning future events and involves known and unknown risks and uncertainty that could cause actual results, performance or events to differ materially from those expressed or implied in such statements. Additional detailed information concerning important factors that could cause actual results to differ materially is available in the Annual Reports and Accounts of HSBC Holdings plc and HSBC Bank Canada for the year ended December 31, 2009, as well as the HSBC Bank Canada Second Quarter 2010 Report to Shareholders and the HSBC Holdings plc Interim Report 2010 for the period ended June 30, 2010. Past performance cannot be relied on as a guide to future performance. Please see www.hsbc.com and www.hsbc.ca for further information. This material is for information purposes only. HSBC Holdings plc is not a reporting issuer in Canada and is not permitted, by itself or through a nominee or agent, to engage in or carry on any business in Canada, except as permitted by the Bank Act (Canada). The material is intended for your sole use and is not for general distribution and does not constitute an offer or commitment, a solicitation of an offer or commitment to enter into or conclude any transaction or to purchase or sell any financial instrument. -

Hsbc Holdings Plc

HSBC HOLDINGS PLC Shareholder Information Enforceability of judgements / Exchange controls / Dividends Page serve process on such persons or HSBC Holdings in Information about the enforceability of the US or to enforce judgements obtained in US judgements made in the US ........................ 472 courts against them or HSBC Holdings based on Exchange controls and other limitations civil liability provisions of the securities laws of the affecting equity security holders ................ 472 US. There is doubt as to whether English courts Fourth interim dividend for 2008 ................... 472 would enforce: Fourth interim dividend for 2009 ................... 472 • certain civil liabilities under US securities laws Interim dividends for 2010 ............................. 473 in original actions; or Dividends on the ordinary shares of HSBC • Holdings ..................................................... 473 judgements of US courts based upon these civil American Depositary Shares .......................... 474 liability provisions. Nature of trading market ................................ 475 In addition, awards of punitive damages in Shareholder profile ........................................ 476 actions brought in the US or elsewhere may be Memorandum and Articles of Association .... 476 unenforceable in the UK. The enforceability of any Annual General Meeting ................................ 477 judgement in the UK will depend on the particular Interim Management Statements and facts of the case as well as the laws and treaties -

Phase 3 Dissemination Additions

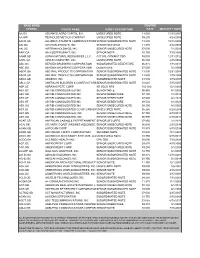

NASD BOND COUPON SYMBOL ISSUER NAME SHORT DESCRIPTION RATE MATURITY DATE AA.GA ADVANCE AGRO CAPITAL B.V. UNSECURED NOTE 13.000 11/15/2007 AA.GW REYNOLDS METALS COMPANY UNSECURED NOTE 09.200 4/24/2006 AACB.GA ALLIANCE ATLANTIS COMMUNICATIONSSENIOR SUBORDINATED NOTE 13.000 12/15/2009 AAI.GA AIRTRAN AIRWAYS, INC. SENIOR SECURED 11.270 4/12/2008 AAI.GC AIRTRAN HOLDINGS, INC. SENIOR UNSECURED NOTE 07.000 7/1/2023 AAIF.GA AAI.FOSTERGRANT, INC. SENIOR NOTE 10.750 7/15/2006 AANR.GB ALPHA NATURAL RESOURCES L.L.C. ACTUAL CPN/MAT TBD 00.000 12/31/2012 AAPL.GA APPLE COMPUTER, INC. UNSECURED NOTE 06.500 2/15/2004 ABC.GC BERGEN BRUNSWIG CORPORATION SUBORDINATED DEBENTURE 06.875 7/15/2011 ABC.GD BERGEN BRUNSWIG CORPORATION DEBENTURE 07.000 3/1/2006 ABCR.GA ABC RAIL PRODUCTS CORPORATION SENIOR SUBORDINATED NOTE 11.500 12/31/2004 ABCR.GB ABC RAIL PRODUCTS CORPORATION SENIOR SUBORDINATED NOTE 11.500 1/15/2004 ABGX.GB ABGENIX, INC SUBORDINATED NOTE 03.500 3/15/2007 ABLC.GA AMERICAN BUILDERS & CONTRACTORSSENIOR SUBORDINATED NOTE 10.625 5/15/2007 ABP.GE ABRAXAS PETE CORP. SR SECD NTS 100.000 12/1/2009 ABY.GC ABITIBI-CONSOLIDATED INC. SENIOR NOTE 06.950 4/1/2008 ABY.GD ABITIBI-CONSOLIDATED INC. SENIOR DEBENTURE 07.400 4/1/2018 ABY.GE ABITIBI-CONSOLIDATED INC. SENIOR DEBENTURE 07.500 4/1/2028 ABY.GF ABITIBI-CONSOLIDATED INC. SENIOR DEBENTURE 08.500 8/1/2029 ABY.GG ABITIBI-CONSOLIDATED INC SENIOR UNSECURED NOTE 08.300 8/1/2005 ABY.GJ ABITIBI-CONSOLIDATED CO OF CANADAUNSECURED NOTE 05.250 6/20/2008 ABY.GN ABITIBI-CONSOLIDATED, INC. -

T R a N S L a T I O N

T R A N S L A T I O N Republic of Panama Superintendency of Banks RESOLUTION S.B.P. 031-2007 (dated 23 March 2007) The Interim Superintendent of Banks in use of his legal powers, and CONSIDERING: That HSBC BANK (PANAMÁ), S.A. is a corporation filed under Micro jacket 456744, document 633197 of the Information Technology System of the Public Registry and the holder of a General License granted by means of Resolution SBP 187-2004 dated 2 July 2004; That GRUPO BANISTMO, S.A. is a corporation filed under Micro jacket 490605, document 788580 of the Microfilm (Mercantile) Section of the Public Registry and the holder of a majority of the issued and outstanding shares of PRIMER BANCO DEL ISTMO, S.A. ; That by means of Resolution 94-2006 dated 11 September 2006, the acquisition and transfer of a controlling interest in GRUPO BANISTMO, S.A. to HSBC ASIA HOLDINGS B.V., sole owner of the issued and outstanding shares of HSBC BANK (PANAMÁ), S.A., was authorized; That by virtue of the authorization granted in Resolution SBP 94-2006 above, HSBC BANK (PANAMÁ), S.A. and GRUPO BANISTMO, S.A. belong to the same holding company; That a request was submitted for authorization for HSBC BANK (PANAMÁ), S.A. and GRUPO BANISTMO, S.A. to merge by absorption, whereby HSBC BANK (PANAMÁ), S.A. would be the surviving company; That as a result of the requested merger, HSBC BANK (PANAMÁ), S.A. would become a major shareholder of PRIMER BANCO DEL ISTMO, S.A. -

Hsbc Offers to Acquire Minority Shareholders’ Interests in Its Costa Rican Subsidiary

Ab c 6 March 2009 HSBC OFFERS TO ACQUIRE MINORITY SHAREHOLDERS’ INTERESTS IN ITS COSTA RICAN SUBSIDIARY Grupo del Istmo Costa Rica S.A. (Grupo Istmo), an indirectly owned subsidiary of HSBC Bank (Panama), is launching a public tender offer to acquire the interests of the minority shareholders of Corporación HSBC (Costa Rica) Sociedad Anónima, (‘Corporación HSBC’). Under the terms of the proposed offer, the maximum consideration to be paid for the acquisition of a total of 1,112,672,425 common shares (representing 2.75 per cent of the company’s issued share capital) will be US$6,938,405.00. The offer ends on 25 March 2009. Media enquiries to: London Mexico City Brendan McNamara Roy Caple Tel: +44 (0)20 7991 0655 Tel: +52 55 5721 6060 Investor Relations – London Investor Relations – Mexico City Danielle Neben Yordana Aparicio Tel: +44 (0)20 7992 1938 Tel: +52 55 5721 5192 Notes to editors: 1. Grupo del Istmo Costa Rica, S.A. Grupo del Istmo Costa Rica, S.A. (Grupo Istmo) is the holding company of Corporación HSBC. Grupo Istmo is fully owned by Primer Banco del Istmo S.A., an HSBC company, which was acquired by HSBC in 2006 through Grupo Banistmo. The Group has had a strong presence in the local market for 30 years formerly through Banex and currently as Corporación HSBC. Its shares are publicly listed in Costa Rica. 2. Corporación HSBC (Costa Rica) S.A. Corporación HSBC Costa Rica S.A. is 97.2461 per cent owned by Grupo del Istmo Costa Rica, S.A. -

Registration Document Dated 30 March 2020

REGISTRATION DOCUMENT DATED 30 MARCH 2020 HSBC HOLDINGS PLC (a company incorporated in England with registered number 617987; the liability of its members is limited) This document (which expression shall include this document and all documents incorporated by reference herein) has been prepared for the purpose of providing disclosure information with regard to HSBC Holdings plc (the "Issuer") and has been approved by the Financial Conduct Authority (the "FCA") as competent authority under Regulation (EU) 2017/1129 (the "Prospectus Regulation"), as a registration document ("Registration Document") issued in compliance with the Prospectus Regulation for the purpose of providing the information with regard to the Issuer of debt or derivative securities during the period of twelve months after the date hereof. The FCA has only approved this Registration Document as meeting the standards of completeness, comprehensibility and consistency imposed by the Prospectus Regulation. Such an approval should not be considered an endorsement of the Issuer that is the subject of the Registration Document. This Registration Document is valid for a period of twelve months from the date of approval. This Registration Document includes details of the long-term and short-term credit ratings assigned to the Issuer by S&P Global Ratings Europe Limited ("S&P"), Moody's Investors Service Limited ("Moody's") and Fitch Ratings Limited ("Fitch"). Each of S&P, Moody's and Fitch is established in the European Union or the United Kingdom and is registered as a Credit Rating Agency under Regulation (EU) No. 1060/2009, as amended (the "CRA Regulation"). As such, each of S&P, Moody's and Fitch is included in the list of credit rating agencies published by the European Securities and Markets Authority on its website in accordance with the CRA Regulation. -

Registration Document Dated 30 March 2020 Hsbc

REGISTRATION DOCUMENT DATED 30 MARCH 2020 HSBC HOLDINGS PLC (a company incorporated in England with registered number 617987; the liability of its members is limited) This document (which expression shall include this document and all documents incorporated by reference herein) has been prepared for the purpose of providing disclosure information with regard to HSBC Holdings plc (the "Issuer") and has been approved by the Financial Conduct Authority (the "FCA") as competent authority under Regulation (EU) 2017/1129 (the "Prospectus Regulation"), as a registration document ("Registration Document") issued in compliance with the Prospectus Regulation for the purpose of providing the information with regard to the Issuer of debt or derivative securities during the period of twelve months after the date hereof. The FCA has only approved this Registration Document as meeting the standards of completeness, comprehensibility and consistency imposed by the Prospectus Regulation. Such an approval should not be considered an endorsement of the Issuer that is the subject of the Registration Document. This Registration Document is valid for a period of twelve months from the date of approval. This Registration Document includes details of the long-term and short-term credit ratings assigned to the Issuer by S&P Global Ratings Europe Limited ("S&P"), Moody's Investors Service Limited ("Moody's") and Fitch Ratings Limited ("Fitch"). Each of S&P, Moody's and Fitch is established in the European Union or the United Kingdom and is registered as a Credit Rating Agency under Regulation (EU) No. 1060/2009, as amended (the "CRA Regulation"). As such, each of S&P, Moody's and Fitch is included in the list of credit rating agencies published by the European Securities and Markets Authority on its website in accordance with the CRA Regulation. -

HSBC Holdings Plc 2008 Annual Report and Accounts

HSBC HOLDINGS PLC Shareholder Information Enforceability of judgements / Exchange controls / Dividends / Nature of trading market Page the US or to enforce judgements obtained in US Information about the enforceability of courts against them or HSBC Holdings based on judgements made in the US ........................ 448 civil liability provisions of the securities laws of the Exchange controls and other limitations US. There is doubt as to whether English courts affecting equity security holders ................ 448 would enforce: Fourth interim dividend for 2008 ................... 448 • certain civil liabilities under US securities laws Interim dividends for 2009 ............................. 449 in original actions; or Dividends on the ordinary shares of HSBC Holdings ..................................................... 449 • judgements of US courts based upon these civil Nature of trading market ................................ 449 liability provisions. Shareholder profile ........................................ 451 In addition, awards of punitive damages in Memorandum and Articles of Association .... 451 actions brought in the US or elsewhere may be Annual General Meeting ................................ 452 unenforceable in the UK. The enforceability of any Interim Management Statements and judgement in the UK will depend on the particular Interim results ............................................. 452 facts of the case as well as the laws and treaties in Actuaries ........................................................ 452