Pennsylvania Unemployment Compensation Handbook

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Manufacturing Establishments Under the Fair Labor Standards Act (FLSA)

U.S. Department of Labor Wage and Hour Division (Revised July 2008) Fact Sheet #9: Manufacturing Establishments Under the Fair Labor Standards Act (FLSA) This fact sheet provides general information concerning the application of the FLSA to manufacturers. Characteristics Employees who work in manufacturing, processing, and distributing establishments (including wholesale and retail establishments) that produce, handle, or work on goods for interstate or foreign commerce are included in the category of employees engaged in the production of goods for commerce. The minimum wage and overtime pay provisions of the Act apply to employees so engaged in the production of goods for commerce. Coverage The FLSA applies to employees of a manufacturing business covered either on an "enterprise" basis or by "individual" employee coverage. If the manufacturing business has at least some employees who are "engaged in commerce" and meet the $500,000 annual dollar volume test, then the business is required to pay all employees in the "enterprise" in compliance with the FLSA without regard to whether they are individually covered. A business that does not meet the dollar volume test discussed above may still be required to comply with the FLSA for employees covered on an "individual" basis if any of their work in a workweek involves engagement in interstate commerce or the production of goods for interstate commerce. The concept of individual coverage is indeed broad and extends not only to those employees actually performing work in the production of goods to be directly shipped outside the State, but also applies if the goods are sold to a customer who will ship them across State lines or use them as ingredients of goods that will move in interstate commerce. -

Neoliberal Austerity and Unemployment

E L C I ‘…following Stuckler and Basu (2013) T it is not economic downturns per se that R matter but the austerity and welfare A “reform” that may follow: that “austerity Neoliberal austerity kills” and – as I argue here – that it particularly “kills” those in lower socio- economic positions.’ and unemployment The scale of contemporary unemployment consequent upon David Fryer and Rose Stambe examine critical psychological issues neoliberal austerity programmes is colossal. According to labour market statistics released in June 2013 by the UK Neoliberal fiscal austerity policies I am really sorry to bother you again. Office for National Statistics, 2.51 million decrease public expenditure God. But I am bursting to tell you all people were unemployed in the UK through cuts to central and local the stuff that has been going on (tinyurl.com/neu9l47). This represents five government budgets, welfare behind your back since I first wrote to unemployed people competing for every services and benefits and you back in 1988. Oh God do you still vacancy. privatisation of public resources remember? Remember me telling Official statistics like these, which have resulting in job losses. This article you of the war that was going on persisted now for years, do not, of course, interrogates the empirical, against the poor and unemployed in prevent the British Prime Minister – theoretical, methodological and our working class communities? Do evangelist of neoliberal government - ideological relationships between you remember me telling you, God, asking in a speech delivered in June 2012 neoliberalism, unemployment and how the people in my community ‘Why has it become acceptable for many the discipline of psychology, were being killed and terrorised but people to choose a life on benefits?’ arguing that neoliberalism that there were no soldiers to be Talking of what he termed ‘Working Age constitutes rather than causes seen, no tanks, no bombs being Welfare’, Mr Cameron opined: ‘we have unemployment. -

Unemployment in an Extended Cournot Oligopoly Model∗

Unemployment in an Extended Cournot Oligopoly Model∗ Claude d'Aspremont,y Rodolphe Dos Santos Ferreiraz and Louis-Andr´eG´erard-Varetx 1 Introduction Attempts to explain unemployment1 begin with the labour market. Yet, by attributing it to deficient demand for goods, Keynes questioned the use of partial analysis, and stressed the need to consider interactions between the labour and product markets. Imperfect competition in the labour market, reflecting union power, has been a favoured explanation; but imperfect competition may also affect employment through producers' oligopolistic behaviour. This again points to a general equilibrium approach such as that by Negishi (1961, 1979). Here we propose an extension of the Cournot oligopoly model (unlike that of Gabszewicz and Vial (1972), where labour does not appear), which takes full account of the interdependence between the labour market and any product market. Our extension shares some features with both Negishi's conjectural approach to demand curves, and macroeconomic non-Walrasian equi- ∗Reprinted from Oxford Economic Papers, 41, 490-505, 1989. We thank P. Champsaur, P. Dehez, J.H. Dr`ezeand J.-J. Laffont for helpful comments. We owe P. Dehez the idea of a light strengthening of the results on involuntary unemployment given in a related paper (CORE D.P. 8408): see Dehez (1985), where the case of monopoly is studied. Acknowledgements are also due to Peter Sinclair and the Referees for valuable suggestions. This work is part of the program \Micro-d´ecisionset politique ´economique"of Commissariat G´en´eral au Plan. Financial support of Commissariat G´en´eralau Plan is gratefully acknowledged. -

Department of Business, Economic Development & Tourism

DEPARTMENT OF BUSINESS, ECONOMIC DEVELOPMENT & TOURISM RESEARCH AND ECONOMIC ANALYSIS DIVISION DAVID Y. IGE GOVERNOR MIKE MC CARTNEY DIRECTOR DR. EUGENE TIAN CHIEF STATE ECONOMIST FOR IMMEDIATE RELEASE August 19, 2021 HAWAI‘I'S UNEMPLOYMENT RATE AT 7.3 PERCENT IN JULY Jobs increased by 53,000 over-the-year HONOLULU — The Hawai‘i State Department of Business, Economic Development & Tourism (DBEDT) today announced that the seasonally adjusted unemployment rate for July was 7.3 percent compared to 7.7 percent in June. Statewide, 598,850 were employed and 47,200 unemployed in July for a total seasonally adjusted labor force of 646,000. Nationally, the seasonally adjusted unemployment rate was 5.4 percent in July, down from 5.9 percent in June. Seasonally Adjusted Unemployment Rate State of Hawai`i Jul 2019 - Jul 2021 28.0% 24.0% 20.0% 16.0% 12.0% 8.0% 4.0% 0.0% Ma Jul Aug Sep Oct Nov Dec Jan Feb Mar Apr Ma Jun Jul Aug Sep Oct Nov Dec Jan Feb Mar Apr Jun Jul y 19 19 19 19 19 19 20 20 20 20 y20 20 20 20 20 20 20 20 21 21 21 21 21 21 21 Percent 2.5 2.4 2.3 2.2 2.1 2.1 2.0 2.1 2.1 21. 21. 14. 14. 14. 14. 14. 10. 10. 10. 9.2 9.1 8.5 8.0 7.7 7.3 The unemployment rate figures for the State of Hawai‘i and the U.S. in this release are seasonally adjusted, in accordance with the U.S. -

Emergency Unemployment Compensation (EUC08): Current Status of Benefits

Emergency Unemployment Compensation (EUC08): Current Status of Benefits Julie M. Whittaker Specialist in Income Security Katelin P. Isaacs Analyst in Income Security March 28, 2012 The House Ways and Means Committee is making available this version of this Congressional Research Service (CRS) report, with the cover date shown, for inclusion in its 2012 Green Book website. CRS works exclusively for the United States Congress, providing policy and legal analysis to Committees and Members of both the House and Senate, regardless of party affiliation. Congressional Research Service R42444 CRS Report for Congress Prepared for Members and Committees of Congress Emergency Unemployment Compensation (EUC08): Current Status of Benefits Summary The temporary Emergency Unemployment Compensation (EUC08) program may provide additional federal unemployment insurance benefits to eligible individuals who have exhausted all available benefits from their state Unemployment Compensation (UC) programs. Congress created the EUC08 program in 2008 and has amended the original, authorizing law (P.L. 110-252) 10 times. The most recent extension of EUC08 in P.L. 112-96, the Middle Class Tax Relief and Job Creation Act of 2012, authorizes EUC08 benefits through the end of calendar year 2012. P.L. 112- 96 also alters the structure and potential availability of EUC08 benefits in states. Under P.L. 112- 96, the potential duration of EUC08 benefits available to eligible individuals depends on state unemployment rates as well as the calendar date. The P.L. 112-96 extension of the EUC08 program does not allow any individual to receive more than 99 weeks of total unemployment insurance (i.e., total weeks of benefits from the three currently authorized programs: regular UC plus EUC08 plus EB). -

Human Activity Analysis and Recognition from Smartphones Using Machine Learning Techniques

Human Activity Analysis and Recognition from Smartphones using Machine Learning Techniques Jakaria Rabbi, Md. Tahmid Hasan Fuad, Md. Abdul Awal Department of Computer Science and Engineering Khulna University of Engineering & Technology Khulna-9203, Bangladesh jakaria [email protected], [email protected], [email protected] Abstract—Human Activity Recognition (HAR) is considered a HAR is the problem of classifying day-to-day human ac- valuable research topic in the last few decades. Different types tivity using data collected from smartphone sensors. Data are of machine learning models are used for this purpose, and this continuously generated from the accelerometer and gyroscope, is a part of analyzing human behavior through machines. It is not a trivial task to analyze the data from wearable sensors and these data are instrumental in predicting our activities for complex and high dimensions. Nowadays, researchers mostly such as walking or standing. There are lots of datasets and use smartphones or smart home sensors to capture these data. ongoing research on this topic. In [8], the authors discuss In our paper, we analyze these data using machine learning wearable sensor data and related works of predictions with models to recognize human activities, which are now widely machine learning techniques. Wearable devices can predict an used for many purposes such as physical and mental health monitoring. We apply different machine learning models and extensive range of activities using data from various sensors. compare performances. We use Logistic Regression (LR) as the Deep Learning models are also being used to predict various benchmark model for its simplicity and excellent performance on human activities [9]. -

Modern Monetary Theory: a Marxist Critique

Class, Race and Corporate Power Volume 7 Issue 1 Article 1 2019 Modern Monetary Theory: A Marxist Critique Michael Roberts [email protected] Follow this and additional works at: https://digitalcommons.fiu.edu/classracecorporatepower Part of the Economics Commons Recommended Citation Roberts, Michael (2019) "Modern Monetary Theory: A Marxist Critique," Class, Race and Corporate Power: Vol. 7 : Iss. 1 , Article 1. DOI: 10.25148/CRCP.7.1.008316 Available at: https://digitalcommons.fiu.edu/classracecorporatepower/vol7/iss1/1 This work is brought to you for free and open access by the College of Arts, Sciences & Education at FIU Digital Commons. It has been accepted for inclusion in Class, Race and Corporate Power by an authorized administrator of FIU Digital Commons. For more information, please contact [email protected]. Modern Monetary Theory: A Marxist Critique Abstract Compiled from a series of blog posts which can be found at "The Next Recession." Modern monetary theory (MMT) has become flavor of the time among many leftist economic views in recent years. MMT has some traction in the left as it appears to offer theoretical support for policies of fiscal spending funded yb central bank money and running up budget deficits and public debt without earf of crises – and thus backing policies of government spending on infrastructure projects, job creation and industry in direct contrast to neoliberal mainstream policies of austerity and minimal government intervention. Here I will offer my view on the worth of MMT and its policy implications for the labor movement. First, I’ll try and give broad outline to bring out the similarities and difference with Marx’s monetary theory. -

July Unemployment Rate Decreases to 5.8 Percent

FOR IMMEDIATE RELEASE CONTACT: September 16, 2021 Margaux Fontaine 401-209-0153 [email protected] Rhode Island-Based Jobs Rose by 800 from July; August Unemployment Rate Increases to 5.8 Percent CRANSTON, R.I. - The state’s seasonally adjusted Aug 21 Jul 21 Aug 20 unemployment rate was 5.8 percent in August, the Department of R.I. Unemployment Rate 5.8% 5.7% 12.6% Labor and Training announced Thursday. The August rate was up one-tenth of a percentage point from the revised July rate of 5.7 U.S. Unemployment Rate 5.2% 5.4% 8.4% percent. Last year the rate was 12.6 percent in August. R.I. Job Count (in thousands) 477.9 477.1 457.3 Highlights: The U.S. unemployment rate was 5.2 percent in August, down two-tenths of a percentage point from July. The U.S. rate was 8.4 The Rhode Island unemployment rate was 5.8 percent percent in August 2020. in August, up one-tenth of a percentage point from last month’s revised rate of 5.7 percent. The number of unemployed Rhode Island residents — those Through August, the Rhode Island economy has residents classified as available for and actively seeking recovered 78,700 or nearly 73 percent of the 108,000 jobs lost during the pandemic shutdown. employment — was 30,900, up 100 from July. The number of unemployed residents decreased by 35,800 over the year. The number of employed Rhode Island residents was 503,800, down 1,500 from July. -

Inside the Video Game Industry

Inside the Video Game Industry GameDevelopersTalkAbout theBusinessofPlay Judd Ethan Ruggill, Ken S. McAllister, Randy Nichols, and Ryan Kaufman Downloaded by [Pennsylvania State University] at 11:09 14 September 2017 First published by Routledge Th ird Avenue, New York, NY and by Routledge Park Square, Milton Park, Abingdon, Oxon OX RN Routledge is an imprint of the Taylor & Francis Group, an Informa business © Taylor & Francis Th e right of Judd Ethan Ruggill, Ken S. McAllister, Randy Nichols, and Ryan Kaufman to be identifi ed as authors of this work has been asserted by them in accordance with sections and of the Copyright, Designs and Patents Act . All rights reserved. No part of this book may be reprinted or reproduced or utilised in any form or by any electronic, mechanical, or other means, now known or hereafter invented, including photocopying and recording, or in any information storage or retrieval system, without permission in writing from the publishers. Trademark notice : Product or corporate names may be trademarks or registered trademarks, and are used only for identifi cation and explanation without intent to infringe. Library of Congress Cataloging in Publication Data Names: Ruggill, Judd Ethan, editor. | McAllister, Ken S., – editor. | Nichols, Randall K., editor. | Kaufman, Ryan, editor. Title: Inside the video game industry : game developers talk about the business of play / edited by Judd Ethan Ruggill, Ken S. McAllister, Randy Nichols, and Ryan Kaufman. Description: New York : Routledge is an imprint of the Taylor & Francis Group, an Informa Business, [] | Includes index. Identifi ers: LCCN | ISBN (hardback) | ISBN (pbk.) | ISBN (ebk) Subjects: LCSH: Video games industry. -

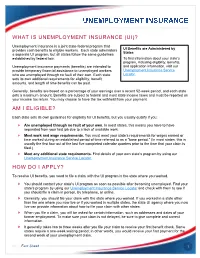

What Is Unemployment Insurance (Ui)? Am I Eligible? How Do I Apply?

WHAT IS UNEMPLOYMENT INSURANCE (UI)? Unemployment Insurance is a joint state-federal program that provides cash benefits to eligible workers. Each state administers UI Benefits are Administered by States a separate UI program, but all states follow the same guidelines established by federal law. To find information about your state’s program, including eligibility, benefits, Unemployment insurance payments (benefits) are intended to and application information, visit our provide temporary financial assistance to unemployed workers Unemployment Insurance Service who are unemployed through no fault of their own. Each state Locator. sets its own additional requirements for eligibility, benefit amounts, and length of time benefits can be paid. Generally, benefits are based on a percentage of your earnings over a recent 52-week period, and each state sets a maximum amount. Benefits are subject to federal and most state income taxes and must be reported on your income tax return. You may choose to have the tax withheld from your payment. AM I ELIGIBLE? Each state sets its own guidelines for eligibility for UI benefits, but you usually qualify if you: Are unemployed through no fault of your own. In most states, this means you have to have separated from your last job due to a lack of available work. Meet work and wage requirements. You must meet your state’s requirements for wages earned or time worked during an established period of time referred to as a "base period." (In most states, this is usually the first four out of the last five completed calendar quarters prior to the time that your claim is filed.) Meet any additional state requirements. -

Long-Term Unemployment and the 99Ers

Long-Term Unemployment and the 99ers An Emerging Issues Report from the January 2012 Long-Term Unemployment and the 99ers The Issue Long-term unemployment has been the most stubborn consequence of the Great Recession. In October 2011, more than two years after the Great Recession officially ended, the national unemployment rate stood at 9.0%, with Connecticut’s unemployment rate at 8.7%.1 Americans have been taught to connect the economic condition of the country or their state to the unemployment Millions of Americans— rate, but the national or state unemployment rate does not tell known as 99ers—have the real story. Concealed in those statistics is evidence of a exhausted their UI benefits, substantial and challenging structural change in the labor and their numbers grow market. Nationally, in July 2011, 31.8% of unemployed people every month. had been out of work for at least 52 weeks. In Connecticut, data shows 37% of the unemployed had been jobless for a year or more. By August 2011, the national average length of unemployment was a record 40 weeks.2 Many have been out of work far longer, with serious consequences. Even with federal extensions to Unemployment Insurance (UI), payments are available for a maximum of 99 weeks in some states; other states provide fewer (60-79) weeks. Millions of Americans—known as 99ers— have exhausted their UI benefits, and their numbers grow every month. By October 2011, approximately 2.9 million nationally had done so. Projections show that five million people will be 99ers, exhausting their benefits, by October 2012. -

The-Pathologists-Microscope.Pdf

The Pathologist’s Microscope The Pathologist’s Microscope Rudolf Virchow, the father of Pathology, had available to him wonderful microscopes during the 1850’s to 1880’s, but the one you have now is far better. Your microscope is the most highly perfected of all scientific instruments. These brief notes on alignment, the objective lens, the condenser, and the eyepieces are what you need to know to get the most out of your microscope and to feel comfortable using it. Figure 1 illustrates the important parts of a generic modern light microscope. Figure 1 - Parts of the Microscope UNC Pathology & Lab Med, MSL, July 2013 1 The Pathologist’s Microscope Alignment August Köhler, in 1870, invented the method for aligning the microscope’s optical system that is still used in all modern microscopes. To get the most from your microscope it should be Köhler aligned. Here is how: 1. Focus a specimen slide at 10X. 2. Open the field iris and the condenser iris. 3. Observe the specimen and close the field iris until its shadow appears on the specimen. 4. Use the condenser focus knob to bring the field iris into focus on the specimen. Try for as sharp an image of the iris as you can get. If you can’t focus the field iris, check the condenser for a flip-in lens and find the configuration that lets you see the field iris. You may also have to move the field iris into the field of view (step 5) if it is grossly misaligned. 5.Center the field iris with the condenser centering screws.