Supporting Welsh Ferry Ports (5 Point Plan) | GOV.WALES

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

RAIL INFRASTRUCTURE and IMPROVED PASSENGER SERVICE COMMITTEE INTERIM REPORT March 2006

RAIL INFRASTRUCTURE AND IMPROVED PASSENGER SERVICE COMMITTEE INTERIM REPORT March 2006 RAIL INFRASTRUCTURE AND IMPROVED PASSENGER SERVICE COMMITTEE INTERIM REPORT March 2006 If you would like further copies of this report or a version in the following formats (large print, Braille, audio cassette or compact disk), please contact: Leanne Hatcher Rail Infrastructure and Improved Passenger Services Committee National Assembly for Wales Cardiff Bay CF99 1NA Tel: 029 2089 8429 E-mail: [email protected] Committee Members John Marek AM (Chair) Wrexham Leighton Andrews AM Rhondda Eleanor Burnham AM North Wales Rosemary Butler AM Newport West Janet Davies AM South Wales West Lisa Francis AM Mid & West Wales Carl Sargeant AM Alyn & Deeside Secretariat Chris Reading Committee Clerk Sarah Bartlett Deputy Clerk Leanne Hatcher Team Support Contents Page Number 1. Introduction 1 2. Roles and Responsibilities 2 3. Strategic Planning 8 4. Key Issues 9 5. What happens next? 14 Annexes 1. Schedule of Committee Papers 2. Verbatim Record of Committee Meetings 3. Consultation Letter 4. Schedule of Organisations Consulted 5. Summary of Consultation Responses 6. Structure of Welsh Rail Passenger Industry 7. Map of Rail Network 1. Introduction Background 1.1 The committee was established, in accordance with Standing Order 8.1, by a motion (NDM2735) that was approved by plenary on 6 December 2005. This motion set parameters for committee membership, terms of reference and various other matters; including the requirement to report to the National Assembly by the end of March and to terminate on 19 May 2006. 1.2 The committee held its inaugural meeting on 1 February 2006 to agree various procedural matters, including the election of the Chair. -

Inquiry Into Ports in Wales Introduction I Am Jim O

Response to Welsh Affairs Committee- Inquiry into Ports in Wales Introduction I am Jim O’Toole, Managing Director of The Port of Mostyn Ltd in Flintshire. I am a Deputy Lieutenant to the Clwyd Lieutenancy and a past Chairman of the North Wales CBI which I represented on the North Wales Economic Forum. I am also a member of the Bank of England Advisory Panel for North Wales, and also represent Welsh ports and industrial interests on the Dee estuary relating to the Water Framework Directive. I have more than 50 years experience in the shipping and ports industries. Regulatory Regime Ports is a reserved matter and current U.K. policy is contained in the document “Modern Ports” – a U.K. Policy – Nov. 2000. The Welsh Assembly Government ‘s parallel policies on ports are contained mainly in two policy documents: “The Wales Freight Strategy” - May 2008 and “Wales Transport Strategy” - April 2008. Neither of the Welsh documents contain what could be regarded as firm policies for Welsh port development, indeed the Transport Strategy document makes no more than a passing reference to ports and sea transport. The Wales Freight Strategy document provides an overview of the Welsh ports sector and contains 10 policy statements. However, scrutiny of the policy statements shows they are little more than intentions to “continue to review” and to “continue to monitor” various strategies for potential port development. I am therefore not convinced that the Welsh Assembly Government fully appreciates the importance of ports to the Welsh economy, hence its lack of firm policies which the industry can rely upon when considering development plans. -

Doc 11 SCEG MEMBERS NETWORKS for CASCADING INFORMATION

Doc 11 SCEG MEMBERS NETWORKS FOR CASCADING INFORMATION GROUP OF EUROPEAN MARINE SITES CASCADE Direct Cascasde Carmarthen Bay & Estuaries Relevant Authorities Group (all RAs additional to CCW, EAW) CB&E contacts list – mixture of individuals and groups, organisations with interest in CB&E EMS Pembrokeshire Marine SAC officer PM SAC RAG (all RAs additional to CCW, EAW) PM SAC liaison forum PM SAC website Cardigan Bay SAC officer CB SAC RAG (all RAs additional to CCW, EAW) CB SAC liaison forum CB SAC website Severn Estuary SAC officer SE SAC RAG (all RAs additional to CCW, EAW) SE SAC liaison forum SE SAC website Pen Llyn a’r Sarnau SAC officer PLAS SAC RAG (all RAs additional to CCW, EAW) PLAS SAC liaison forum PLAS SAC website Menai Strait & Conwy Bay SAC officer (CCW) Can also cascade to: Skomer MNR officer Skomer MNR advisory committee (see membership list at www.wwmc.org.uk/smnr_advctee.html ) UK MPA Centre (see www.ukmpas.org I Website am one of the two EMS reps) Seasearch (volunteer diving survey Website network) Milford Haven Waterway Surveillance Gp (mostly Pembrokeshire coastal industry) Other Pembrokeshire voluntary groups eg Website Neptunes’s Army of Rubbish Collectors (www.narc-cc.org.uk) Keep Wales Tidy (Coastcare Gps) WELSH FEDERATION OF FISHERMENS ASSOCIATIONS LTD Chair of WFFA and Cardigan Bay Fishermen’s Association Chair of Anglesey and North Wales Fishermen’s Association Chair of Llyn Fishermen’s Association President of above and Scallop Association Member Llyn Pot Fishermen’s Association Cardigan Bay Fishermans Association -

Welsh Affairs Committee Oral Evidence: One-Off Session on a Welsh Freeport and Progress in Establishing Inland Post-Brexit Facilities, HC 480

Welsh Affairs Committee Oral evidence: One-off session on a Welsh freeport and progress in establishing inland post-Brexit facilities, HC 480 Thursday 8 July 2021 Ordered by the House of Commons to be published on 8 July 2021. Watch the meeting Members present: Stephen Crabb (Chair); Simon Baynes; Virginia Crosbie; Geraint Davies; Ben Lake; Dr Jamie Wallis. Questions 1 - 83 Witnesses I: Ian Davies, Head of UK Port Authorities, Stena Line. II: Vaughan Gething MS, Minister for the Economy; and Rebecca Evans MS, Minister for Finance and Local Government, Welsh Government. III: Rt Hon Simon Hart MP, Secretary of State for Wales; David T C Davies MP, Parliamentary Under-Secretary of State for Wales; Zamila Bunglawala, Director - International Education Directorate, Department for Education; and Stephen Webb, Director of Infrastructure, Border and Protocol Delivery Group, Cabinet Office. Examination of Witness Witness: Ian Davies. Q1 Chair: Good morning. Welcome to this morning’s session of the Welsh Affairs Committee looking at infrastructure issues in Wales, particularly relating to port infrastructure. We have three panels this morning. We are delighted that we are joined for our first panel by Ian Davies who is head of UK port authorities for Stena. Ian, good morning. We are grateful for the time you are giving us. We always find the evidence and information that you give us very helpful. I will start the questions this morning, Mr Davies, and ask about the current state of play on trade across the Irish Sea from Welsh ports into the Republic of Ireland. When you appeared before us previously, we had seen a marked reduction in volumes of trade following the end of the Brexit transition period. -

High Level Review of the State Commercial Ports Operating Under Harbours Acts 1996 and 2000

RAYMOND BURKE CONSULTING FARRELL GRANT SPARKS CORPORATE FINANCE POSFORD HASKONING HIGH LEVEL REVIEW OF THE STATE COMMERCIAL PORTS OPERATING UNDER THE HARBOURS ACTS 1996 AND 2000. TABLE OF CONTENTS 1. INTRODUCTION 1 1.1 TERMS OF REFERENCE 1 1.2 CONTEXT 1 1.3 THE TIMING IS APPROPRIATE 3 1.4 CHANGING NEEDS 4 1.5 THE FOCUS OF THE REVIEW 5 1.6 APPROACH 5 1.7 PRINCIPAL OBSERVATIONS AND FINDINGS 6 1.8 VISION 8 1.9 KEY RECOMMENDATIONS 9 1.10 ACKNOWLEDGEMENTS 12 1.11 CONFIDENTIALITY 12 2. REGULATORY GOVERNANCE 13 2.1 WHAT DO WE MEAN BY REGULATORY GOVERNANCE? 13 2.2 THE HARBOURS’ ACTS 1946 - 2000 15 2.3 CORPORATE GOVERNANCE REQUIREMENTS 17 2.4 OTHER REGULATORY LEGISLATION 17 2.5 DEVELOPMENT OF THE BROADER REGULATORY PROCESS IN IRELAND 17 2.6 OECD REVIEW OF REGULATORY REFORM 24 2.7 THE EU PORT SERVICES DIRECTIVE 26 3. PORT STRUCTURES 29 3.1 INTRODUCTION 29 3.2 ANALYSIS OF PORT GOVERNANCE MODELS 30 3.3 CRITIQUE OF PORT GOVERNANCE MODELS 33 3.4 PORTS OWNERSHIP MODELS – INTERNATIONAL PRACTICE 34 3.5 LESSONS FOR IRELAND 46 4. OVERVIEW OF IRISH PORTS 49 4.1 INTRODUCTION 49 4.2 PORT OF CORK COMPANY 50 4.3 DROGHEDA PORT COMPANY 55 4.4 DUBLIN PORT COMPANY 58 4.5 DUNDALK PORT COMPANY 61 4.6 DUN LAOGHAIRE HARBOUR COMPANY 64 TABLE OF CONTENTS HIGH LEVEL REVIEW OF THE STATE COMMERCIAL PORTS OPERATING UNDER THE HARBOURS ACTS 1996 AND 2000. 4.7 PORT OF GALWAY 65 4.8 PORT OF NEW ROSS 68 4.9 SHANNON FOYNES PORT COMPANY 71 4.10 PORT OF WATERFORD 74 4.11 PORT OF WICKLOW 78 5. -

Future Potential for Offshore Wind in Wales Prepared for the Welsh Government

Future Potential for Offshore Wind in Wales Prepared for the Welsh Government December 2018 Acknowledgments The Carbon Trust wrote this report based on an impartial analysis of primary and secondary sources, including expert interviews. The Carbon Trust would like to thank everyone that has contributed their time and expertise during the preparation and completion of this report. Special thanks goes to: Black & Veatch Crown Estate Scotland Hartley Anderson Innogy Renewables MHI-Vestas Offshore Wind Milford Haven Port Authority National Grid Natural Resources Wales Ørsted Wind Power Port of Mostyn Prysmian PowerLink The Crown Estate Welsh Government Cover page image credits: Innogy Renewables (Gwynt-y-Môr Offshore Wind Farm). | 1 The Carbon Trust is an independent, expert partner that works with public and private section organizations around the world, helping them to accelerate the move to a sustainable, low carbon economy. We advise corporates and governments on carbon emissions reduction, improving resource efficiency, and technology innovation. We have world-leading experience in the development of low carbon energy markets, including offshore wind. The Carbon Trust has been at the forefront of the offshore wind industry globally for the past decade, working closely with governments, developers, suppliers, and innovators to reduce the cost of offshore wind energy through informing policy, supporting business decision-making, and commercialising innovative technology. Authors: Rhodri James Manager [email protected] -

Marine Energy Wales State of the Sector 2020

STATE OF THE SECTOR 2020 ECONOMIC BENEFITS FOR WALES www.marineenergywales.co.uk A new marine energy Marine Energy 16 developers, Engineering test new Centre for 4 sites, 2 alliances Excellence Seabed agreements for Driving international 532MW inward investment Spurring low carbon economic growth in coastal regions Early mover advantage in a wave and tidal stream export market Providing worth high-skilled £76 billion employment Boosting supply chain £123.7million diversification invested in Wales opportunities Part of a world leading innovative test centre network Early mover advantage in a floating offshore wind market World class that could research carried create out by Welsh Universities over 3000 jobs by Developing future solutions to 2030 climate change 2 CONTENTS 4 Introduction and Key Findings 5 Foreword 6 - 9 Research Findings 10 -11 Spotlight on North Wales 12 - 13 Spotlight on South Wales 14 - 15 Wave Energy Developers in Wales 16 - 22 Tidal Stream Energy Developers in Wales 23 - 25 Tidal Range Energy in Wales 26 - 27 Floating Offshore Wind in Wales 28 - 31 Wales; a World Class Centre for Marine Energy 32 - 34 Investing in Science, Research and Innovation 35 Marine Energy Wales: Supporting Emerging Industries in Wales 36 Marine Energy Wales Objectives 37 Why Wales? 38 - 39 Marine Energy Wales Annual Highlights 3 Developing marine renewable energy offers Wales a realistic opportunity to deliver a low carbon economy and reduce carbon emissions in response INTRODUCTION to the Climate Emergency declaration by Welsh Government in 2019. However, the benefits for AND KEY FINDINGS Wales go far beyond clean energy. Wales is working hard to gain the early mover advantage and, with ongoing support, can continue to position itself as a global leader for the marine energy sector; an export market worth an estimated £76 billion by 2050. -

Freeports and Wales

House of Commons Welsh Affairs Committee Freeports and Wales Second Report of Session 2019–21 Report, together with formal minutes relating to the report Ordered by the House of Commons to be printed 5 May 2020 HC 205 Published on 8 May 2020 by authority of the House of Commons Welsh Affairs Committee The Welsh Affairs Committee is appointed by the House of Commons to examine the expenditure, administration, and policy of the Office of the Secretary of State for Wales (including relations with the National Assembly for Wales). Current membership Rt Hon Stephen Crabb MP (Conservative, Preseli Pembrokeshire) (Chair) Tonia Antoniazzi MP (Labour, Gower) Simon Baynes MP (Conservative, Clywd South) Virginia Crosbie MP (Conservative, Ynys Môn) Geraint Davies MP (Labour (Co-op), Swansea West) Ben Lake MP (Plaid Cymru, Ceredigion) Anna McMorrin MP (Labour, Cardiff North) Robin Millar MP (Conservative, Aberconwy) Rob Roberts MP (Conservative, Delyn) Dr Jamie Wallis MP (Conservative, Bridgend) Beth Winter MP (Labour, Cynon Valley) Powers The Committee is one of the departmental select committees, the powers of which are set out in House of Commons Standing Orders, principally in SO No 152. These are available on the internet via www.parliament.uk. Publications © Parliamentary Copyright House of Commons 2019. This publication may be reproduced under the terms of the Open Parliament Licence, which is published at www.parliament.uk/copyright Committee reports are published on the Committee’s website at www.committees.parliament.uk/committee/162/welsh-affairs-committee/ and in print by Order of the House. Evidence relating to this report is published on the inquiry publications page of the Committee’s website. -

Holyhead Marina Re-Build Strategy Environmental Scoping Report

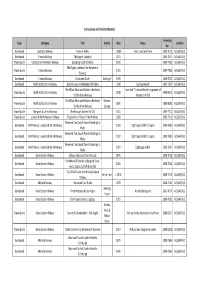

HOLYHEAD MARINA RE-BUILD STRATEGY ENVIRONMENTAL SCOPING REPORT A REPORT ON MATTERS TO BE CONSIDERED IN AN APPLICATION FOR A HARBOUR REVISION ORDER (WORKS) UNDER SECTION 14 OF THE HARBOURS ACT 1964, AN APPLICATION TO NATURAL RESOURCES WALES (NRW) UNDER THE MARINE AND COASTAL ACCESS ACT 2009 (AS AMENDED) FOR A MARINE CONSTRUCTION PERMIT AND A PLANNING APPLICATION TO THE ISE OF ANGLESEY COUNTY COUNCIL TO RE- BUILD HOLYHEAD MARINA PROTECTED BY A SOLID RUBBLE MOUND BREAKWATER Report prepared by G.C.Garrod, Architect on behalf of Holyhead Marina Ltd. No part shall be reproduced without the permission of the author or used for any purpose other than that for which it was produced. June 2019 1 LIST OF CONTENTS PAGE NO 1. EXECUTIVE SUMMARY 5 2. HISTORY OF THE PROJECT 7 3. ANALYSIS OF STORM EMMA 9 4. NEED FOR A RE-BUILD 11 5. ALTERNATIVES – RE-BUILD OR DO NOTHING 11 6. SUBSTANTIAL INTEREST (Section 14 The Harbours Act 1964) 13 7. THE STUDY AREA 13 8. GENERAL SUMMARY OF SITE SPECIFIC ENVIRONMENTAL MATTERS TO BE CONSIDERED 14 9. DESCRIPTION OF THE PROPOSED SCHEME 15 10. CONSENTS AND LEGISLATION 20 11. WELL BEING OF FUTURE GENERATIONS ACT 21 12. NATURE CONSERVATION DESIGNATIONS AND RSPB RESERVES 22 13. CONSERVATION AREAS, CULTURAL HERITAGE, ARCHAEOLOGY, LANDSCAPE/SEASCAPE 23 14. COASTAL PROCESSES 29 15. HYDROLOGY, HYDROGEOLOGY, GEOLOGY AND SOILS 31 16. MARINE WATER AND SEDIMENT QUALITY 31 17. MARINE ECOLOGY 32 18. FISH, SHELFISH AND MARINE MAMMALS 32 19. BIRDS 33 20. TERRESTRIAL AND INTERTIDAL ECOLOGY 34 21. DIDEMNUM VEXILLUM AND BIO SECURITY 34 22. -

Welsh Route Study March 2016 Contents March 2016 Network Rail – Welsh Route Study 02

Long Term Planning Process Welsh Route Study March 2016 Contents March 2016 Network Rail – Welsh Route Study 02 Foreword 03 Executive summary 04 Chapter 1 – Strategic Planning Process 06 Chapter 2 – The starting point for the Welsh Route Study 10 Chapter 3 - Consultation responses 17 Chapter 4 – Future demand for rail services - capacity and connectivity 22 Chapter 5 – Conditional Outputs - future capacity and connectivity 29 Chapter 6 – Choices for funders to 2024 49 Chapter 7 – Longer term strategy to 2043 69 Appendix A – Appraisal Results 109 Appendix B – Mapping of choices for funders to Conditional Outputs 124 Appendix C – Stakeholder aspirations 127 Appendix D – Rolling Stock characteristics 140 Appendix E – Interoperability requirements 141 Glossary 145 Foreword March 2016 Network Rail – Welsh Route Study 03 We are delighted to present this Route Study which sets out the The opportunity for the Digital Railway to address capacity strategic vision for the railway in Wales between 2019 and 2043. constraints and to improve customer experience is central to the planning approach we have adopted. It is an evidence based study that considers demand entirely within the Wales Route and also between Wales and other parts of Great This Route Study has been developed collaboratively with the Britain. railway industry, with funders and with stakeholders. We would like to thank all those involved in the exercise, which has been extensive, The railway in Wales has seen a decade of unprecedented growth, and which reflects the high level of interest in the railway in Wales. with almost 50 per cent more passenger journeys made to, from We are also grateful to the people and the organisations who took and within Wales since 2006, and our forecasts suggest that the time to respond to the Draft for Consultation published in passenger growth levels will continue to be strong during the next March 2015. -

Publicity Material List

Early Guides and Publicity Material Inventory Type Company Title Author Date Notes Location No. Guidebook Cambrian Railway Tours in Wales c 1900 Front cover not there 2000-7019 ALS5/49/A/1 Guidebook Furness Railway The English Lakeland 1911 2000-7027 ALS5/49/A/1 Travel Guide Cambrian & Mid-Wales Railway Gossiping Guide to Wales 1870 1999-7701 ALS5/49/A/1 The English Lakeland: the Paradise of Travel Guide Furness Railway 1916 1999-7700 ALS5/49/A/1 Tourists Guidebook Furness Railway Illustrated Guide Golding, F 1905 2000-7032 ALS5/49/A/1 Guidebook North Staffordshire Railway Waterhouses and the Manifold Valley 1906 Card bookmark 2001-7197 ALS5/49/A/1 The Official Illustrated Guide to the North Inscribed "To Aman Mosley"; signature of Travel Guide North Staffordshire Railway 1908 1999-8072 ALS5/29/A/1 Staffordshire Railway chairman of NSR The Official Illustrated Guide to the North Moores, Travel Guide North Staffordshire Railway 1891 1999-8083 ALS5/49/A/1 Staffordshire Railway George Travel Guide Maryport & Carlisle Railway The Borough Guides: No 522 1911 1999-7712 ALS5/29/A/1 Travel Guide London & North Western Railway Programme of Tours in North Wales 1883 1999-7711 ALS5/29/A/1 Weekend, Ten Days & Tourist Bookings to Guidebook North Wales, Liverpool & Wirral Railway 1902 Eight page leaflet/ 3 copies 2000-7680 ALS5/49/A/1 Wales Weekend, Ten Days & Tourist Bookings to Guidebook North Wales, Liverpool & Wirral Railway 1902 Eight page leaflet/ 3 copies 2000-7681 ALS5/49/A/1 Wales Weekend, Ten Days & Tourist Bookings to Guidebook North Wales, -

Holyhead Port Plans for a No Deal Brexit – Faqs

Holyhead Port Plans for a No Deal Brexit – FAQs Why do we need contingency What happens if there is a deal? planning if there’s a No Deal Brexit? If there is a deal then things will continue as they are and goods from the UK will be If the UK leaves the EU without a deal then goods able to enter the EU with the same checks as travelling from the UK will be subject to extra they do now. There would be no change. checks before they are allowed to enter the EU. As Ireland is part of the EU HGVs travelling from Holyhead to Dublin may be subject to extra checks. This could lead to delays, which means plans need to How will this plan affect people be in place to deal with the backlog of HGVs as they living and working in Holyhead? wait to travel to Ireland. Facilities also need to be in The aim of this plan is to ensure there is place for the drivers while they wait. The port has minimum impact on people living and working space for 660 HGVs but more space may be needed in Holyhead, as well as providing facilities for if there are delays, and we need to plan for this. HGVs and drivers. To enable us to use Roadking and Parc Cybi there may be a need to close a small section of the A5153 between the Parc How do you know this is enough Cybi and Kingsland Road roundabouts. This space to deal with any delay? will cause some inconvenience to local traffic.