Metrogrid Report: Soho

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

85 Sullivan Street, Borough of Manhattan

October 27, 2020 Name of Landmark Building Type of Presentation Month xx, year Public Meeting The current proposal is: Preservation Department – Item 2, LPC-19-35736 85 Sullivan Street, Borough of Manhattan Note: this is a Public Meeting item. No public testimony will be received today as the hearing on this item is closed 1 85 Sullivan Street, New York, NY Presentation to Landmarks Preservation Commission 24 September 2019 revised 27 October 2020 2 Sullivan-Thompson Historic District 85 SULLIVAN ST 85 Sullivan Street, New York NY 3 Sullivan Street between Spring and Broome Streets, east Spring 200 Spring Street 85 83 81 79 77 75 71 69 67 65 63 61 59 57 55 Broome Street Sullivan (built in 2013) Sullivan Street Street Street 85 Sullivan Street, New York NY 4 85 Sullivan Street: Historic Photos 1940 1980 2018 85 Sullivan Street, New York NY 5 Typical Federal Characteristics 25 Harrison Street, 1804 (formerly 314 Washington Street) 37 Charlton Street, 1820s 77 Bedford Street, 1799 Individual Landmark, designated 1969 Charlton-King-Vandam Historic District, designated 1966 Greenwich Village Historic District, designated 1965 Typical historical characteristics: Typical historical characteristics: Typical historical characteristics: • Red brick • White painted windows • Red brick • Modest decoration • Light colored door trim and cornice • Modest decoration • Six over six windows • Contrasting dark parinted wood shutters and door • Six over six windows • Brownstone window and door details • Brownstone window details • Painted wood door trim -

Report: Federal Houses Landmarked Or Listed on the State and National Registers of Historic Places 1999

GREENWICH VILLAGE SOCIETY FOR HISTORIC PRESERVATION Making the Case Federal Houses Landmarked or Listed on the State and National Registers of Historic Places 1999-2016 The many surviving Federal houses in Lower Manhattan are a special part of the heritage of New York City. The Greenwich Village Society for Historic Preservation has made the documentation and preservation of these houses an important part of our mission. This report highlights the Society’s mission in action by showing nearly one hundred fifty of these houses in a single document. The Society either proposed the houses in this report for individual landmark designation or for inclusion in historic districts, or both, or has advocated for their designation. Special thanks to Jiageng Zhu for his efforts in creating this report. 32 Dominick Street, built c.1826, landmarked in 2012 Federal houses were built between ca. 1790 to ca. 1835. The style was so named because it was the first American architectural style to emerge after the Revolutionary War. In elevation and plan, Federal Period row houses were quite modest. Characterized by classical proportions and almost planar smoothness, they were ornamented with simple detailing of lintels, dormers, and doorways. These houses were typically of load bearing masonry construction, 2-3 stories high, three bays wide, and had steeply pitched roofs. The brick facades were laid in a Flemish bond which alternated a stretcher and a header in every row. All structures in this report were originally built as Federal style houses, though -

July 2019 SLA Licensing Resolutions

Carter Booth, Chair Antony Wong, Treasurer Daniel Miller, First Vice Chair Keen Berger, Secretary Susan Kent, Second Vice Chair Erik Coler, Assistant Secretary Bob Gormley, District Manager COMMUNITY BOARD NO. 2, MANHATTAN 3 W ASHINGTON SQUARE V ILLAGE N EW YORK, NY 10012-1899 www.cb2manhattan.org P: 212-979-2272 F: 212-254-5102 E : [email protected] Greenwich Village v Little Italy v SoHo v NoHo v Hudson Square v Chinatown v Gansevoort Market July 23, 2019 Director Licensing Issuance Division NY State Liquor Authority 317 Lenox Avenue New York, New York 10027 Dear Sir/Madam: At its Full Board meeting on July 18, 2019, Community Board #2, Manhattan (CB2, Man.) adopted the following resolution: 1. K&K Grand Corp., d/b/a SoHo Thai, 141 Grand St. 10013 (OP – Restaurant | Corporate Transfer) i. Whereas, applicant appeared before Community Board 2, Manhattan’s SLA Licensing committee to present an application for a corporate change to the existing restaurant wine license (SN 1278344) for their Thai cuisine restaurant located in a M1-5B zoned for-story, mixed-use 1920 building on Grand Street between Lafayette and Crosby Streets (block #233/ lot #12) in the NYC Landmarks Preservation Commission designated SoHo-Cast Iron Historic District; and, ii. Whereas, the interior 1-story premises are 1,350 sq. ft., and has a total of 15 tables with 46 seats and one service bar (no seats); and applicant has Letter of No Objection to use the space as a food and drinking establishment from the NYC Department of Buildings; and, iii. Whereas, the applicant signed and notarized a new stipulations agreement with CB2, Man. -

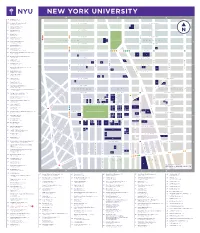

Nyu-Downloadable-Campus-Map.Pdf

NEW YORK UNIVERSITY 64 404 Fitness (B-2) 404 Lafayette Street 55 Academic Resource Center (B-2) W. 18TH STREET E. 18TH STREET 18 Washington Place 83 Admissions Office (C-3) 1 383 Lafayette Street 27 Africa House (B-2) W. 17TH STREET E. 17TH STREET 44 Washington Mews 18 Alumni Hall (C-2) 33 3rd Avenue PLACE IRVING W. 16TH STREET E. 16TH STREET 62 Alumni Relations (B-2) 2 M 25 West 4th Street 3 CHELSEA 2 UNION SQUARE GRAMERCY 59 Arthur L Carter Hall (B-2) 10 Washington Place W. 15TH STREET E. 15TH STREET 19 Barney Building (C-2) 34 Stuyvesant Street 3 75 Bobst Library (B-3) M 70 Washington Square South W. 14TH STREET E. 14TH STREET 62 Bonomi Family NYU Admissions Center (B-2) PATH 27 West 4th Street 5 6 4 50 Bookstore and Computer Store (B-2) 726 Broadway W. 13TH STREET E. 13TH STREET THIRD AVENUE FIRST AVENUE FIRST 16 Brittany Hall (B-2) SIXTH AVENUE FIFTH AVENUE UNIVERSITY PLACE AVENUE SECOND 55 East 10th Street 9 7 8 15 Bronfman Center (B-2) 7 East 10th Street W. 12TH STREET E. 12TH STREET BROADWAY Broome Street Residence (not on map) 10 FOURTH AVE 12 400 Broome Street 13 11 40 Brown Building (B-2) W. 11TH STREET E. 11TH STREET 29 Washington Place 32 Cantor Film Center (B-2) 36 East 8th Street 14 15 16 46 Card Center (B-2) W. 10TH STREET E. 10TH STREET 7 Washington Place 17 2 Carlyle Court (B-1) 18 25 Union Square West 19 10 Casa Italiana Zerilli-Marimò (A-1) W. -

124 MACDOUGAL STREET 392 SF Available for Lease Between Bleecker and West 3Rd Streets GREENWICH VILLAGE NEW YORK | NY SPACE DETAILS

RETAIL SPACE 124 MACDOUGAL STREET 392 SF Available for Lease Between Bleecker and West 3rd Streets GREENWICH VILLAGE NEW YORK | NY SPACE DETAILS LOCATION NEIGHBORS Between Bleecker and Mamoun’s Falafel, Artichoke Pizza, West 3rd Streets Minetta Tavern, Off the Wagon, Comedy Cellar, Pommes Frites SIZE Ground Floor 392 SF COMMENTS Prime MacDougal Street retail FRONTAGE opportunity MacDougal Street 12 FT All uses considered New direct long term lease POSSESSION Immediate TRANSPORTATION 2017 Ridership Report West 4th Street A Houston Street 1 M Annual 13,849,130 Annual 4,326,280 Weekday 41,835 Weekday 15,283 Weekend 59,543 Weekend 8,341 12 FT MACDOUGAL STREET AREA RETAIL AVENUE OF AMERICAS 6 MACADOUGAL STREET MACADOUGAL MACDOUGAL STREET MACDOUGAL TH WASHINGTONWASHINGTON SQUARE SQUARE SOUTH SOUTH AVENUE SULLIVAN STREET SULLIVAN THOMPSON STREET THOMPSON WEST 4TH THOMPSON STREET THOMPSON S SULLIVAN STREET SULLIVAN LAGUARDIA PLACE LAGUARDIA LAGUARDIA PLACE LAGUARDIA ESS STREET STREET NE LaLa LanternaLanterna ON Ramen Ya Ramen Ya Ramen Blue Note Blue di Vittorio Blue Note 124 MACDOUGAL GrooveGroove STREET CORNELIA STREET WESTWEST 3 3RDRD STREET STREET Underground The Village The 3 Sheets Saloon Sheets 3 Fat Black Pussycat Black Fat Ben’s Pizzeria Fat Black Pomme Frites WESTW 3 3RDRD STREET STREET Pommeommeme FritesFrites Springbone CORNELIA STREET Ben’s Pizzeria Zo Sushi Phobar Zinc Bar Zinc Il Mulino Il Amity Hall Amity J.W. Market Roasters Coffee The Village Caffe Reggio Farm Irving Pussycat Pint Half Sushi Sushi J.W. Market Negril Village Negril -

124 Macdougal Street

RETAIL SPACE 124 MACDOUGAL STREET 330 SF Available For Lease Between Bleecker and West 3rd Streets GREENWICH VILLAGE NEW YORK | NY WEST 14TH STREET EAST 14TH STREET WEST 14TH STREET WEST 14TH STREET WEST 14TH STREET WEST 14TH STREET Nature Joe’s Pizza Krust Regina The City H Lilla P Dior AMALGAMATED Vanessa’s Synergy Republic Dumplings Crispo The Crooked Knife OF THE AMERICAS AVENUE BANK Pizza Check Nugget Gourmet WASHINGTON STREET WASHINGTON DEVELOPMENT SITE Champion I Lumas OF THE AMERICAS AVENUE Wine & G Clothing Sunset Tans City Le Café Coee SEVENTH AVENUE Pizza First Lamb King’s Way Cashing Spot Baohaus Tortuga THIRD AVENUE EIGHTH AVENUE Spirits TENTH AVENUE TENTH AVENUE Store Slice & Co FIFTH AVENUE Streets NINTH AVENUE Cava Grill H Shabu Food Corp Discount PJ’s Grocery Finnery’s Intersect by Spoon Vivi Cleaners L Lexus 1 JACKSON SQUARE Mikado Bistro Jack Spiderbands Professor Thoms THE HIGH LINE Sally NEW YORK Bubble I 33 UNITS Rabbit BUILDING N Bagel Buet Nails UNIVERSITY Tea (openingPIER 2021) 55 & Spa DORMATORY 90,000 SF E HUDSON LOFTS CONDOS Meg Glaze Terayaki Ukranian National Federal Spirit Halloween OFFICE SPACE P Hu Kitchen Credit Union 47 UNITS Tiziano Zorzan Corkbuzz A Reminiscence Bagel Belly NIQUEAD Pasta Flyer Rehoboth Spa R Cafe Water Ichiba Ramen Davide Greenwich social Luke’s Lobster St. Hair Zabb City K Bar 13 Little Italy Pizza 3 Make Sandwich Tamage Booker Greenwich Mail Center Da Andrea Le Basics Plus Spice Silky Techni Isaac Gabai Salon Croque Union Square Wines Kitchen Salon NY Skin Care & Dax Milk Bar Durden’s -

The Italians of the South Village

The Italians of the South Village Report by: Mary Elizabeth Brown, Ph.D. Edited by: Rafaele Fierro, Ph.D. Commissioned by: the Greenwich Village Society for Historic Preservation 232 E. 11th Street, New York, NY 10003 ♦ 212‐475‐9585 ♦ www.gvshp.org Funded by: The J.M. Kaplan Fund Greenwich Village Society for Historic Preservation 232 East 11th Street, New York, NY 10003 212‐475‐9585 212‐475‐9582 Fax www.gvshp.org [email protected] Board of Trustees: Mary Ann Arisman, President Arthur Levin, Vice President Linda Yowell, Vice President Katherine Schoonover, Secretary/Treasurer John Bacon Penelope Bareau Meredith Bergmann Elizabeth Ely Jo Hamilton Thomas Harney Leslie S. Mason Ruth McCoy Florent Morellet Peter Mullan Andrew S. Paul Cynthia Penney Jonathan Russo Judith Stonehill Arbie Thalacker Fred Wistow F. Anthony Zunino III Staff: Andrew Berman, Executive Director Melissa Baldock, Director of Preservation and Research Sheryl Woodruff, Director of Operations Drew Durniak, Director of Administration Kailin Husayko, Program Associate Cover Photo: Marjory Collins photograph, 1943. “Italian‐Americans leaving the church of Our Lady of Pompeii at Bleecker and Carmine Streets, on New Year’s Day.” Library of Congress, Prints and Photographs Division, Farm Security Administration – Office of War Information Photograph Collection, Reproduction Number LC‐USW3‐013065‐E) The Italians of the South Village Report by: Mary Elizabeth Brown, Ph.D. Edited by: Rafaele Fierro, Ph.D. Commissioned by: the Greenwich Village Society for Historic Preservation 232 E. 11th Street, New York, NY 10003 ♦ 212‐475‐9585 ♦ www.gvshp.org Funded by: The J.M. Kaplan Fund Published October, 2007, by the Greenwich Village Society for Historic Preservation Foreword In the 2000 census, more New York City and State residents listed Italy as their country of ancestry than any other, and more of the estimated 5.3 million Italians who immigrated to the United States over the last two centuries came through New York City than any other port of entry. -

32 DOMINICK STREET HOUSE, 32 Dominick Street, Manhattan Built C

Landmarks Preservation Commission March 27, 2012, Designation List 453 LP-2480 32 DOMINICK STREET HOUSE, 32 Dominick Street, Manhattan Built c. 1826; builder, Smith Bloomfield Landmark Site: Borough of Manhattan Tax Map Block 5778, Lot 64 On June 28, 2011, the Landmarks Preservation Commission held a public hearing on the proposed designation as a Landmark of the 32 Dominick Street House and the proposed designation of the related Landmark Site (Item No. 6). The hearing was duly advertised in accordance with the provisions of law. There were four speakers in favor of designation, including representatives of the New York Landmarks Conservancy, the Society for the Architecture of New York, the Historic Districts Council and the Greenwich Village Society for Historic Preservation. There were no speakers in opposition to designation. A letter in opposition to designation was received from the owner. Summary The 32 Dominck Street House was one of twelve Federal style brick row houses (nos. 28 to 50) built in c. 1826 on the south side of Dominick Street between Hudson and Varick Streets; and was one of the five houses (nos. 28 to 36) constructed by builder Smith Bloomfield. A secession of tenants lived in the house while owned by Bloomfield and it was sold by the executors of his estate to Mary McKindley in 1866. Her heirs conveyed it to John F. Wilson, a carpenter, in 1878. Wilson’s devisee sold it to the Church of Our Lady of Vilnius, which used it as a rectory. The church, located on Broome Street, was founded to serve the Lithuanian Catholic community and closed in 2007. -

New York Public Service Commission

To: New York Public Service Commission Let’s build on New York’s solar success. I urge the PSC to approve the New York State Energy Research and Development Authority’s (NYSERDA) recent petition to extend the NY-Sun Initiative through 2023. Signed by 10,418 people: Name Postcode Address Raina Russo 11509 123 Bayside Drive Josh Nelson 20009 2637 16th Street John Baldwin 10016 223 East 28th St., New York, NY Josh Romano 10001 276 5th Ave Marisa Bartolucci 10001 252 7th Avenue, Apt 9N Murshed Zaheed 94105 101 Market Street James Mendelsohn 10011 350 West 21st Street, #3 Michael Bondoc 10009 11 avenue D Apt 12 Chung Wan 10011 26 W 17th Street Susan mohr 10007 100 CHURCH ST, nyc Harvey Lippman 10010 6 Peter Cooper Road steffani aarons 10003 200 Park Avenue South Juergen Bamberger 10002 568 Grand Street Saadique Abader 10001 22 Gideon Road Newfields Estate Bettina Stammen 10011 125 W. 12th St. #1C NYC Penelope Crabtree 10007 105 Duane Street, Apt 16E John Houshmand 13788 476 svr rd Hobart ny john o'sullivan 10003 55 e 7th st Katherine Slawinski 10003-3850 321 East 17 Street Richard P Faust 10007-3607 105 Duane St Ronald Reed 12534 21 prospect ave Jay Kidd 10011 37 W. 12th St., #2E, New York, NY michael d schaible 10011 8 west 13 st, nyc Sean Mahony 10010 531 East 20th Street Claudia Marx 10024 210 W. 90th Street Candice Myers 10011 42 W. 13th St., Apt. 3B V Brandt 10011 28 W. 10th St. 4R Name Postcode Address Prudence Brown 10025 380 Riverside Drive #5T Etan Harwayne- 10009 270 First Ave Gidansky Daniel Esakoff 10026 130 Malcolm X Blvd Leah Jacobs 10003 E. -

DCLA Cultural Organizations

DCLA Cultural Organizations Organization Name Address City 122 Community Center Inc. 150 First Avenue New York 13 Playwrights, Inc. 195 Willoughby Avenue, #402 Brooklyn 1687, Inc. PO Box 1000 New York 18 Mai Committee 832 Franklin Avenue, PMB337 Brooklyn 20/20 Vision for Schools 8225 5th Avenue #323 Brooklyn 24 Hour Company 151 Bank Street New York 3 Graces Theater Co., Inc. P.O. Box 442 New York 3 Legged Dog 33 Flatbush Avenue Brooklyn 42nd Street Workshop, Inc. 421 Eighth Avenue New York 4heads, Inc. 1022 Pacific St. Brooklyn 52nd Street Project, Inc. 789 Tenth Avenue New York 7 Loaves, Inc. 239 East 5th Street, #1D New York 826NYC, Inc. 372 Fifth Avenue Brooklyn A Better Jamaica, Inc. 114-73 178th Street Jamaica A Blade of Grass Fund 81 Prospect Street Brooklyn Page 1 of 616 09/28/2021 DCLA Cultural Organizations State Postcode Main Phone # Discipline Council District NY 10009 (917) 864-5050 Manhattan Council District #2 NY 11205 (917) 886-6545 Theater Brooklyn Council District #39 NY 10014 (212) 252-3499 Multi-Discipline, Performing Manhattan Council District #3 NY 11225 (718) 270-6935 Multi-Discipline, Performing Brooklyn Council District #33 NY 11209 (347) 921-4426 Visual Arts Brooklyn Council District #43 NY 10014 (646) 909-1321 Theater Manhattan Council District #3 NY 10163 (917) 385-0332 Theater Manhattan Council District #9 NY 11217 (917) 292-4655 Multi-Discipline, Performing Manhattan Council District #1 NY 10116 (212) 695-4173 Theater Manhattan Council District #3 NY 11238 (412) 956-3330 Visual Arts Brooklyn Council District -

85 Sullivan Street, New York, NY 2 Sullivan-Thompson Historic District

1 85 Sullivan Street, New York, NY 2 Sullivan-Thompson Historic District 85 SULLIVAN ST 85 Sullivan Street, New York NY 3 85 Sullivan Street: Historic Photos 1940 1980 2018 85 Sullivan Street, New York NY 4 Sullivan Street between Spring and Broome Streets, east Spring 200 Spring Street 85 83 81 79 77 75 71 69 67 65 63 61 59 57 55 Broome Street Sullivan (built in 2013) Sullivan Street Street Street 85 Sullivan Street, New York NY 5 Sullivan Street between Spring and Broome Streets, west site opposite 85 Sullivan Street Broome 10 Sullivan Street 130 128 126 124 202 Spring Street Spring Street Ave. of the Street Americas 85 Sullivan Street, New York NY 6 Existing Context 85 SULLIVAN ST 85 SULLIVAN ST 85 Sullivan Street, New York NY 7 Historic Building Character in District 57 Sullivan Street, 1901 151 Thompson Street, 1859 60 MacDougal Street, 1909 113 Thompson Street, 1900 206 Spring Street, 1915 Shrine Church of St. Anthony of Padua St. Anthony’s School New Construction in District 10 Sullivan Street, 2015 75 Sullivan Street, 2016 55 Sullivan Street, 2009 182 Spring Street, under construction 85 Sullivan Street, New York NY 8 Typical Federal Characteristics 25 Harrison Street, 1804 (formerly 314 Washington Street) 37 Charlton Street, 1820s 203 East 29th Street, early 1800s Typical historical characteristics: Typical historical characteristics: Typical historical characteristics: • Red brick • White painted window • White painted wood clapboard siding • Modest decoration • Light colored door trim and cornice • Contrasting dark painted -

A Long History of a Short Block: Four Centuries of Development

1 First draft, comments welcome A Long History of a Short Block: Four Centuries of Development Surprises on a Single Stretch of a New York City Street1 William Easterly (NYU) Laura Freschi (NYU) Steven Pennings (World Bank) January 2015 Economic development is usually analyzed at the national level, but the literature on creative destruction and misallocation suggests the importance of understanding what is happening at much smaller units. This paper does a development case study at an extreme micro level (one city block in New York City), but over a long period of time (four centuries). We find that (i) development involves many changes in production as comparative advantage evolves and (ii) most of these changes were unexpected (“surprises”). As one episode from the block’s history illustrates, it is difficult for prescriptive planners to anticipate changes in comparative advantage, and it is easy for regulations to stifle creative destruction and to create misallocation. If economic growth indeed has a large component for increases in productivity through reallocation and innovation, we argue that the micro-level is important for understanding development at the national level. 1 We are grateful for tireless research assistance from Marina Kosyachenko, and for comments received at an NYU Marron Institute brown-bag seminar in October 2014 and the NYU Development Research Institute conference, “Cities and Development: Urban Determinants of Success” on November 18, 2014. We are very grateful for support from the John Templeton Foundation for this research. Any views expressed here are the authors’ and do not necessarily represent those of the Templeton Foundation, the World Bank, its Executive Directors, or the countries they represent.